|

시장보고서

상품코드

1851395

세계의 연포장 산업 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Flexible Packaging Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

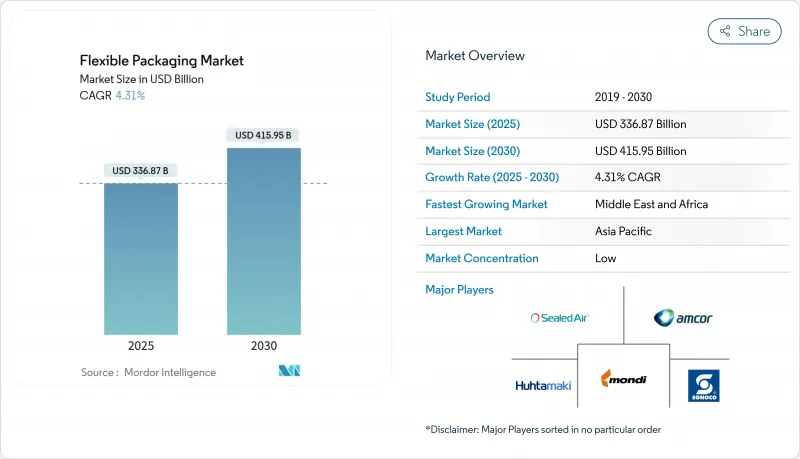

세계의 연포장 시장 규모는 2025년 3,368억 7,000만 달러로, 2030년에는 4,159억 5,000만 달러에 이르고, CAGR 4.31%로 성장할 것으로 예측되고 있습니다.

지속가능성의 의무화, 전자상거래의 급속한 확대, 경량, 장벽성이 높은 형식에 대한 브랜드 수요 증가가 연포장 시장의 기회를 넓히고 있습니다. 재료 과학의 비약적 진보, 특히 단일 재료 구조에서의 진보는 매립 처분의 압력을 감소시키고 컨버터에게 새로운 순환형 수익원을 끌어내고 있습니다. 디지털 인쇄는 틈새 제품의 출시 주기를 단축하고 저스트 인 타임 워크플로우는 폴리올레핀의 가격 변동으로 인한 수익 변동을 완화합니다. 지역별로는 아시아태평양의 중간층 확대와 제조 규모의 확대가 아시아태평양의 리더십을 지지하고 있는 반면 중동 및 아프리카에서는 패키징 인프라의 붐이 추진을 가속화하고 있습니다.

세계 연포장 산업시장 동향과 통찰

경량 보호 메일러에 대한 전자상거래 수요 급증

북미의 온라인 판매는 2024년 15.4% 확대해, 소매업체는 치수 중량 요금을 최대 30% 삭감하는 유연한 버블 메일러의 채용을 추진했습니다. Amazon이 인도에서 9,100톤의 플라스틱을 철거하고 재활용 가능한 종이 패딩 가방을 광범위하게 전개한 것은 기업의 탄소 서약이 섬유와 필름의 하이브리드 조달에 어떻게 방향타를 절단하고 있는지를 보여줍니다. 또한 크기 조정의 의무화가 강화됨에 따라 수량은 유럽으로도 확산되고 아시아 소포 네트워크는 이러한 비용 효율적인 형식을 복제합니다. 순효과는 폴리코티드 메일러 수요의 지속적인 증가로 기존의 FMCG 최종 용도를 넘어 연포장 시장을 끌어올리고 있습니다.

아시아의 FMCG 브랜드를 재활용 가능한 단일 소재 필름으로 이동

2025년 인도의 플라스틱 폐기물 관리 규칙에서 브랜드 소유자는 포장 실적의 정량적 재활용을 입증해야 하며, 주요 식품 및 구강 관리 제조업체는 다층 라미네이트를 폴리올레핀 필름으로 대체해야 합니다. Wipf AG의 PP 기반 WICOFILM과 같은 솔루션은 산소와 향기 장벽을 유지하면서 기존 재활용 흐름을 원활하게 흐릅니다. ASEAN의 퍼스널케어 브랜드는 이러한 전환에 호응해, 단소재의 파우치를 활용하는 것으로, 소매점의 인수 제도를 채우면서, 선반에 대한 어필을 확보하고 있습니다. 공급측의 기술 혁신은 아시아태평양 전역에 퍼져 있으며, 아시아태평양은 연포장 시장에서 45.24%의 점유율을 강화하는 데 도움이 됩니다. 대부분의 EPR 요금이 매년 인상되는 가운데, 단일 소재의 생산 능력을 확대하는 컨버터는 프리미엄 계약과 마진의 회복력을 확보하는 입장에 있습니다.

불안정한 폴리올레핀 가격이 컨버터 마진을 압박

원료 가격 변동은 2024년에는 2자리 스프레드에 이르며 분기별 가격 계약을 맺은 컨버터의 EBITDA를 침식합니다. 아시아의 PE와 PP 공급과잉과 출하의 혼란이 변동을 증폭시키고 있습니다. 주요 컨버터 각 회사는 마진 충격의 둔화를 위해 얇은 게이지 필름을 채택하고 재고 계획을 디지털화하고 위험 노출을 분산시키기 위해 바이오 매스 기반 나프타 계약을 모색하고 있습니다. 이러한 시장 성장 억제요인은 일시적이지만 가격 안정성과 재활용 가능한 소재로의 이동을 가속화하고 간접적으로 연포장 시장공급 기반을 현대화하고 있습니다.

부문 분석

폴리에틸렌은 2024년 연포장 시장 점유율의 34.71%를 지원하는 저비용과 습기 장벽의 특성을 활용하여 핵심 식품 용도를 지원했습니다. 폴리에틸렌은 폭넓은 수지가 입수 가능하고, 재활용의 흐름도 확립되어 있기 때문에 시리얼 라이너, 냉동 식품 필름, 세제용 파우치 등에서는 항상 폴리에틸렌이 선택되고 있습니다. 그러나 생분해성 폴리머와 퇴비화 가능한 폴리머는 소매업체가 가정에서 퇴비화할 수 있는 프라이빗 라벨 라인을 도입하고 지자체가 유기 폐기물 프로그램을 개선함에 따라 2025-2030년의 CAGR이 가장 빠른 7.76%가 됩니다. 이 기세는 연구 개발 예산을 LDPE의 강인성을 모방하면서도 공업적인 퇴비화 사이클에서 분해하는 PLA나 PHA 기반의 공압출 수지에 돌려보냅니다. 종이 라미네이트도 수증기에 대한 요구가 적당한 경우에 부활하고, 알루미늄 포일은 산소 투과율이 거의 0인 것이 요구되는 틈새 역할을 지키고 있습니다. EVOH는 마이크로 레이어 형태로 사용되지만 무균 국물이나 영양 보충제 젤에는 여전히 중요합니다. 전반적으로 소재 포트폴리오는 기계 가공성을 희생하지 않고 범위 3 배출량을 줄이는 솔루션으로 축발을 옮기고 연포장 시장의 순환형으로 축발을 강화하고 있습니다.

생분해성 재료의 연포장 시장 규모는 2025년 324억 달러에서 2030년 472억 달러로 증가할 것으로 예측되며, FMCG의 탈탄소화 로드맵과 매립지 전용료가 그 원동력이 되고 있습니다. 폴리에틸렌은 여전히 양적 우위를 유지하지만, 소비자 범주가 재활용 함량의 최저 기준을 부과함에 따라 그 우위성은 떨어질 것으로 예측됩니다. BOPP의 투명성과 강성은 스낵 과자의 존재감을 유지하고, CPP의 히트 씰의 신뢰성은 레토르트 팩이나 트위스트랩 팩에서의 채용을 확실히 하고 있습니다. 수지 제조업체는 PP 및 PE 단량체를 회수하기 위한 화학 재활용에 투자하여 재료 성능을 유지하는 진정한 고분자 대 고분자 루프를 가능하게 합니다. 이러한 이니셔티브가 확대됨에 따라 컨버터는 기계적, 화학적, 생물학적 분해 경로가 공존하고 각각이 연포장 시장 내의 다른 채널의 요구에 대응하는 혼합 포트폴리오를 예측합니다.

파우치는 2024년 매출액의 46.74%를 차지하고 유리병과 캔을 대체하는 70% 경량화된 포맷으로 화물 배출량을 삭감하는 능력에 스포트라이트를 맞추고 있습니다. 스탠드업 파우치는 광고 공간을 강화하고 조미료와 반려동물 먹이의 충동 구매를 촉진합니다. 고해상도 잉크젯 인쇄기의 출현은 인쇄 준비 낭비를 줄이고, 계절 풍미에 대응하는 SKU의 확산을 가능하게 하며, D2C 브랜드와 개인 라벨의 리프레시를 지원합니다. 필름과 랩은 선반 위에서는 그다지 눈에 띄지 않지만, 내천자성을 희생하지 않고 게이지의 두께를 얇게 함으로써 CAGR이 가장 날카로운 5.72%를 기록했습니다. 나노클레이와 산화규소의 배리어 코팅이 알루미늄층을 대체하여 선별성과 재활용성이 향상되었습니다.

한편, 가방과 색 연포장 시장 규모는 비료, 시멘트, 개밥 수요에 힘입어 견조하게 추이하고 있습니다. 작은 가방과 스틱 팩은 특히 온 더 고 소비가 증가하는 동남아시아에서 싱글 서브 영양 보조 식품과 인스턴트 음료에 계속 침투하고 있습니다. 향후 5년간 디지털 인쇄기의 가동 시간, 무용제 라미네이션, 전자빔 경화의 상호작용에 의해 리드 타임은 수주에서 며칠로 단축될 것으로 예상되며, 컨버터는 공장 레이아웃의 재검토를 강요받을 것입니다. 최종 결과는 후드 서비스를 위한 긴 로트와 인플루엔서와의 협업을 위한 마이크로 배치를 전환할 수 있는 민첩한 작업을 보상하는 제품 믹스입니다.

연포장 시장 보고서는 재료 유형(플라스틱, 종이, 알루미늄 포일, 생분해성 재료), 제품 유형(파우치, 가방, 필름 등), 최종 이용 산업(식품, 음려, 의약품, 화장품, 산업용 등), 유통 채널(직접, 간접), 지역(북미, 유럽, 아시아태평양, 남미, MEA)으로 구분됩니다. 시장 예측은 금액(달러)로 제공됩니다.

지역별 분석

아시아태평양은 도시화, 가처분 소득 증가, 제조 촉진 정책에 따라 2024년 연포장 시장에서 45.24%의 압도적 점유율을 유지했습니다. 중국의 스마트 팩토리 투자와 인도의 식품 가공용 생산 연동 장려금 제도가 국내 수지와 필름의 생산 능력을 지원하고 있습니다. UFlex는 폴리에스터 칩의 생산량을 두배로 늘리고 소비자 유래의 원료를 통합하는 PCR 플랜트를 가동시켜 순환형 공급 제안을 강화했습니다. 현지의 컨버터 각사는 가까이 다가온 EPR 요금에 대응하기 위해, 단일 소재의 전개에도 선편을 붙여, 이 지역의 궤도를 강화하고 있습니다. 한편 동남아시아 국가들은 면세 무역 클러스터를 활용하여 스탠드업 파우치를 수출하고 역내 무역의 흐름을 활발하게 하고 있습니다.

북미는 전자상거래 메일러의 채용과 의약품의 콜드체인 성장으로 2위의 노드가 되고 있습니다. 소매업체는 How2Recycle 인증 파우치를 찾고 PE 필름의 재활용성 업그레이드를 촉구하고 있습니다. OEM은 FDA 등급의 추적성을 보장하기 위해 디지털 검사를 통합하여 시장 무결성을 강화합니다. 유럽은 EU PPWR의 전략을 축으로, 화학 리사이클 파일럿 플랜트와 섬유 기반의 플렉서블 제품에 자금을 투입. 몬디와 하프타마키는 재활용 가능한 레토르트 라인과 블루 루프 포트폴리오를 각각 확대하여 디자인 포 리사이클링 원칙을 대규모로 통합합니다.

중동 및 아프리카는 사우디아라비아와 이집트에서 FDI의 지원을 받은 식품 허브에 의해 2030년까지 연평균 복합 성장률(CAGR)이 가장 빠른 6.16%가 될 것으로 예측됩니다. 아프리카 패키징 부문은 2030년까지 545억 4,000만 달러에 이르는 추세이며, 그 중 플렉서블 형식은 2032년까지 32억 6,000만 달러를 초과할 수 있습니다. 현대적인 소매 체인은 건조한 기후에 대응하는 장기 보존 가능한 파우치를 필요로 하며, 높은 장벽 필름의 수입을 자극합니다. 남미의 스페셜티 커피 붐은 탈기 밸브 파우치 수요를 강화하고, 환율 변동은 경질 유리나 금속보다 경량인 연포장 시장의 매력을 높이고 있습니다. 각 지역에서 공통적인 것은 규제 주도의 재활용 목표이며, 이것이 단일 소재를 향한 컨버터의 연구 개발 로드맵을 통일하고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 북미의 경량 보호 메일러의 전자상거래 수요 급증

- 아시아의 FMCG 브랜드는 EPR 의무에 대응하기 위해 단일 소재의 리사이클 가능한 필름으로 전환

- 유럽에서의 레토르트 식품의 급속한 보급

- 남미의 커피와 스페셜티 음료 브랜드에서 하이 배리어 필름으로의 전환

- 화장품 팩의 매스커스터마이제이션을 가능하게 하는 디지털 인쇄에 대한 투자

- 콜드체인 생물 제제의 물집 수요의 성장이 의약품 연포장을 견인

- 시장 성장 억제요인

- 불안정한 폴리올레핀 가격이 컨버터의 마진을 압박

- EU와 미국에서의 다층 라미네이트의 재활용 인프라의 단편화

- 주요 신흥국(예: 인도, 케냐)에서 일회용 플라스틱 금지 강화

- 중동 CSD 분야에서 스탠드 업 파우치의 침투를 막는 경질 PET 병

- 공급망 분석

- 규제 전망

- 기술의 전망

- 무역 시나리오(관련 HS 코드 아래)

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 재활용과 지속가능성의 상황

제5장 시장 규모와 성장 예측

- 소재 유형별

- 플라스틱

- 폴리에틸렌

- 2축 연신 폴리프로필렌(BOPP)

- 캐스트 폴리프로필렌(CPP)

- 폴리염화비닐(PVC)

- 에틸렌비닐알코올(EVOH)

- 기타 플렉서블 플라스틱

- 종이

- 알루미늄박

- 생분해성 소재와 퇴비화 가능 소재

- 플라스틱

- 제품 유형별

- 파우치

- 가방 및 색

- 필름 및 랩

- 기타 제품 유형

- 최종 이용 산업별

- 식품

- 냉동식품

- 유제품

- 고기 및 해산물

- 제과 및 과자류

- 신선 식품

- 기타 식품

- 음료

- 주스 및 넥터

- 유제품 음료

- 기타 음료

- 의약품

- 화장품 및 퍼스널케어

- 산업용

- 기타 최종 이용 산업

- 식품

- 유통 채널별

- 직접 판매 채널

- 간접 판매 채널

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 아시아태평양

- 중국

- 일본

- 인도

- ASEAN

- 한국

- 호주

- 뉴질랜드

- 남미

- 브라질

- 아르헨티나

- 칠레

- 중동 및 아프리카

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 케냐

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Amcor plc

- Sealed Air Corporation

- Mondi plc

- Huhtamaki Oyj

- Constantia Flexibles Group GmbH

- Sonoco Products Company

- ProAmpac LLC

- Coveris Management GmbH

- Uflex Ltd.

- Sigma Plastics Group

- Schur Flexibles Holding

- Wipf AG

- Glenroy Inc.

- Printpack Inc.

- Clondalkin Flexible Packaging

- American Packaging Corporation

- FlexPak Services LLC

- Arabian Flexible Packaging LLC

- Gulf East Paper & Plastic Industries LLC

- Plastipak Packaging Inc.

제7장 시장 기회와 장래의 전망

JHS 25.11.13The flexible packaging market size stands at USD 336.87 billion in 2025 and is forecast to reach USD 415.95 billion by 2030, advancing at a 4.31% CAGR.

Rising sustainability mandates, rapid e-commerce expansion, and brand demand for lightweight, high-barrier formats are widening the flexible packaging market opportunity. Material science breakthroughs, particularly in mono-material structures, are reducing landfill pressure and unlocking new circular revenue streams for converters. Digital printing is compressing launch cycles for niche products, while just-in-time workflows mitigate the earnings volatility caused by polyolefin price swings. Regionally, Asia Pacific's expanding middle class and manufacturing scale underpin its leadership, whereas the Middle East and Africa's packaging infrastructure boom is accelerating its catch-up growth.

Global Flexible Packaging Industry Market Trends and Insights

Surge in e-commerce demand for lightweight protective mailers

North American online sales expanded by 15.4% in 2024, pushing retailers to adopt flexible bubble mailers that cut dimensional-weight fees up to 30%. Amazon's removal of 9,100 metric tons of plastic in India and its wider rollout of recyclable paper padded bags illustrate how corporate carbon pledges are steering procurement toward fiber-and-film hybridsConverter order books now favor curbside-recyclable mailers with high recycled-content films, spawning capacity additions across the United States and Mexico. Volumes are also spilling into Europe as right-sizing mandates tighten, while Asian parcel networks replicate these cost-efficient formats. The net effect is a sustained uplift in poly-coated mailer demand that lifts the flexible packaging market beyond traditional FMCG end uses.

Shift of Asian FMCG brands toward mono-material recyclable films

India's Plastic Waste Management Rules in FY 2025 require brand owners to demonstrate quantifiable recycling of their packaging footprints, compelling leading food and oral-care players to replace multilayer laminates with polyolefin-only films. Solutions such as PP-based WICOFILM from Wipf AG preserve oxygen and aroma barriers yet flow seamlessly through existing recycling streams. ASEAN personal-care brands echo this switch, leveraging mono-material pouches to secure shelf appeal while satisfying retailer take-back schemes. Supply-side innovation is spreading across Asia Pacific, helping the region reinforce its 45.24% hold on the flexible packaging market. With most EPR fees escalating annually, converters that scale mono-material capacity are positioned to secure premium contracts and margin resilience.

Volatile polyolefin prices squeezing converter margins

Feedstock volatility reached double-digit spreads in 2024, eroding EBITDA for converters locked into quarterly price agreements. Asian PE and PP oversupply and shipping disruptions amplify the swings. To blunt margin shocks, leading converters deploy thinner gauge films, digitalize inventory planning, and explore biomass-based naphtha contracts to diversify risk exposure. This restraint remains transitory yet accelerates the shift toward materials that provide price stability and recycled content, indirectly modernizing the flexible packaging market supply base.

Other drivers and restraints analyzed in the detailed report include:

- Rapid adoption of retort pouches for ready-to-eat meals

- Coffee and specialty-drink brands' switch to high-barrier films

- Fragmented recycling infrastructure for multilayer laminates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene underpinned 34.71% of flexible packaging market share in 2024, leveraging its low cost and moisture barrier attributes to anchor core food applications. Its wide resin availability and established recycling streams keep it the default choice for cereal liners, frozen food films, and detergent pouches. However, biodegradable and compostable polymers exhibit the fastest 7.76% CAGR from 2025-2030 as retailers introduce home-compostable private-label lines and municipalities upgrade organic waste programs. This momentum realigns R&D budgets toward PLA- and PHA-based coextrusions that mimic LDPE toughness yet break down within industrial composting cycles. Paper laminates also resurge where water vapor requirements are moderate, while aluminum foil defends niche roles that demand near-zero oxygen transmission. EVOH, albeit used in microlayer form, remains critical for aseptic broths and nutraceutical gels. Collectively, the material portfolio is pivoting toward solutions that reduce Scope 3 emissions without forfeiting machinability, reinforcing the flexible packaging market's pivot to circularity.

The flexible packaging market size for biodegradable materials is projected to climb from USD 32.4 billion in 2025 to USD 47.2 billion in 2030, fueled by FMCG decarbonization roadmaps and landfill diversion fees. Polyethylene still commands the volume crown, yet its dominance is expected to edge down as consumer-facing categories impose minimum recycled-content thresholds. BOPP's clarity and stiffness uphold its presence in snack foods, while CPP's heat-seal reliability ensures its inclusion in retort and twist-wrap packs. Resin makers are investing in chemical recycling to recapture PP and PE monomers, enabling true polymer-to-polymer loops that preserve material performance. As these initiatives scale, converters foresee a blended portfolio where mechanical, chemical, and bio-degradation pathways coexist, each serving distinct channel needs within the flexible packaging market.

Pouches generated 46.74% of 2024 revenue, spotlighting their ability to replace glass jars and tins with 70% lighter formats that lower freight emissions. Stand-up pouches enhance billboard space, driving impulse purchases in condiments and pet food. The advent of high-definition inkjet presses slashes make-ready waste and enables SKU proliferation for seasonal flavors, supporting D2C brands and private-label refreshes. Films and wraps, while less visible on shelf, register the sharpest 5.72% CAGR by trimming gauge thicknesses without sacrificing puncture resistance. Nanoclay and silicon oxide barrier coatings now substitute aluminum layers, improving sortability and stream recyclability.

Meanwhile, the flexible packaging market size for bags and sacks holds steady, buoyed by fertilizer, cement, and dog-food demand. Sachets and stick packs continue to penetrate single-serve nutraceuticals and instant beverages, particularly in Southeast Asia where on-the-go consumption is rising. Over the next five years the interplay between digital press uptime, solvent-less lamination, and e-beam curing is expected to compress lead times from weeks to days, pushing converters to rethink plant layouts. The end result is a product mix that rewards agile operations able to toggle between long food-service runs and micro batches for influencer collaborations.

The Flexible Packaging Market Report is Segmented by Material Type (Plastic, Paper, Aluminum Foil, Biodegradable Materials), Product Type (Pouches, Bags, Films, Others), End-Use Industry (Food, Beverage, Pharmaceutical, Cosmetics, Industrial, Others), Distribution Channels (Direct, Indirect), and Geography (North America, Europe, Asia Pacific, South America, MEA). Market Forecasts are in Value (USD).

Geography Analysis

Asia Pacific retained a commanding 45.24% share of the flexible packaging market in 2024 due to urbanization, rising disposable incomes, and pro-manufacturing policies. China's smart-factory investments and India's Production Linked Incentive scheme for food processing underpin domestic resin and film capacity. UFlex doubled polyester chip output and commissioned a PCR plant to integrate post-consumer feedstock, fortifying a circular supply proposition. Local converters also spearhead mono-material rollouts to comply with forthcoming EPR fees, reinforcing the region's trajectory. Meanwhile, Southeast Asian nations leverage duty-free trade clusters to export stand-up pouches, lifting intraregional trade flows.

North America is the second-largest node, propelled by e-commerce mailer adoption and pharmaceutical cold-chain growth. Retailers press for How2Recycle-certified pouches, prompting PE film recyclability upgrades. OEMs integrate digital inspection to guarantee FDA-grade traceability, reinforcing market integrity. Europe anchors its strategy around the EU PPWR, channeling funds into chemical-recycling pilot plants and fiber-based flexibles. Mondi and Huhtamaki expand recyclable retort lines and blueloop portfolios, respectively, embedding design-for-recycling principles at scale.

The Middle East & Africa is forecast to post the fastest 6.16% CAGR to 2030, aided by FDI-backed food hubs in Saudi Arabia and Egypt. Africa's packaging sector is on course to hit USD 54.54 billion by 2030, of which flexible formats could surpass USD 3.26 billion by 2032. Modern retail chains require extended-shelf-life pouches for arid climates, stimulating imports of high-barrier films. South America's specialty coffee boom strengthens demand for degassing valve pouches, while currency volatility makes the lighter flexible packaging market more attractive than rigid glass or metal. Across regions, a common thread is regulatory-driven recycling targets that unify converter R&D roadmaps toward mono-materials.

- Amcor plc

- Sealed Air Corporation

- Mondi plc

- Huhtamaki Oyj

- Constantia Flexibles Group GmbH

- Sonoco Products Company

- ProAmpac LLC

- Coveris Management GmbH

- Uflex Ltd.

- Sigma Plastics Group

- Schur Flexibles Holding

- Wipf AG

- Glenroy Inc.

- Printpack Inc.

- Clondalkin Flexible Packaging

- American Packaging Corporation

- FlexPak Services LLC

- Arabian Flexible Packaging LLC

- Gulf East Paper & Plastic Industries LLC

- Plastipak Packaging Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in e-commerce demand for lightweight protective mailers in North America

- 4.2.2 Shift of Asian FMCG brands toward mono-material recyclable films to meet EPR mandates

- 4.2.3 Rapid adoption of retort pouches for ready-to-eat meals in Europe

- 4.2.4 Coffee and specialty-drink brands' switch to high-barrier films in South America

- 4.2.5 Investments in digital printing enabling mass customization for cosmetics packs

- 4.2.6 Growth in cold-chain biologics blister demand boosting pharma flexible packaging

- 4.3 Market Restraints

- 4.3.1 Volatile polyolefin prices squeezing converter margins

- 4.3.2 Fragmented recycling infrastructure for multilayer laminates in EU and US

- 4.3.3 Stricter single-use plastic bans in key emerging economies (e.g., India, Kenya)

- 4.3.4 Rigid PET bottles limiting stand-up pouch penetration in Middle-East CSD segment

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Trade Scenario (Under Relevant HS Code)

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Recycling and Sustainability Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Biaxially Oriented Polypropylene (BOPP)

- 5.1.1.3 Cast Polypropylene (CPP)

- 5.1.1.4 Polyvinyl Chloride (PVC)

- 5.1.1.5 Ethylene-Vinyl Alcohol (EVOH)

- 5.1.1.6 Other Flexible Plastic

- 5.1.2 Paper

- 5.1.3 Aluminum Foil

- 5.1.4 Biodegradable and Compostable Materials

- 5.1.1 Plastic

- 5.2 By Product Type

- 5.2.1 Pouches

- 5.2.2 Bags and Sacks

- 5.2.3 Films and Wraps

- 5.2.4 Other Product Types

- 5.3 By End-use Industry

- 5.3.1 Food

- 5.3.1.1 Frozen Food

- 5.3.1.2 Dairy Based Products

- 5.3.1.3 Meat and Seafood

- 5.3.1.4 Baked Snacks and Confectionery

- 5.3.1.5 Fresh Produce

- 5.3.1.6 Other Food Products

- 5.3.2 Beverage

- 5.3.2.1 Juice and Nectare

- 5.3.2.2 Dairy Based Drinks

- 5.3.2.3 Other Beverages

- 5.3.3 Pharmaceutical

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Industrial

- 5.3.6 Other End -Use Industry

- 5.3.1 Food

- 5.4 By Distribution Channels

- 5.4.1 Direct Sales Channel

- 5.4.2 Indirect Sales Channel

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Nordics

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 ASEAN

- 5.5.3.5 South Korea

- 5.5.3.6 Australia

- 5.5.3.7 New Zealand

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 Amcor plc

- 6.3.2 Sealed Air Corporation

- 6.3.3 Mondi plc

- 6.3.4 Huhtamaki Oyj

- 6.3.5 Constantia Flexibles Group GmbH

- 6.3.6 Sonoco Products Company

- 6.3.7 ProAmpac LLC

- 6.3.8 Coveris Management GmbH

- 6.3.9 Uflex Ltd.

- 6.3.10 Sigma Plastics Group

- 6.3.11 Schur Flexibles Holding

- 6.3.12 Wipf AG

- 6.3.13 Glenroy Inc.

- 6.3.14 Printpack Inc.

- 6.3.15 Clondalkin Flexible Packaging

- 6.3.16 American Packaging Corporation

- 6.3.17 FlexPak Services LLC

- 6.3.18 Arabian Flexible Packaging LLC

- 6.3.19 Gulf East Paper & Plastic Industries LLC

- 6.3.20 Plastipak Packaging Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment