|

시장보고서

상품코드

1640515

금속 캡 및 마개 시장 전망 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Metal Caps & Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

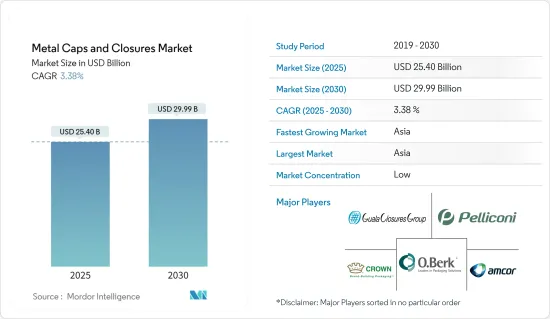

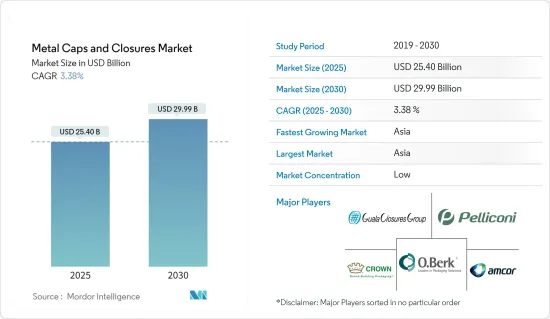

금속 캡 및 마개 시장 규모는 2025년에 254억 달러로 예측되어 예측 기간 중(2025-2030년)의 연평균 성장율(CAGR)은 3.38%로, 2030년에는 299억 9,000만 달러에 달할 것으로 예측됩니다.

금속 캡 및 마개 시장은 식음료에 대한 수요 증가로 인해 예측 기간 동안 빠르게 확장 될 것으로 예상됩니다. 알코올 음료, 맥주, 빵, 가금류 및 생선, 즉석식품, 유제품 등에 대한 수요가 증가하고 있습니다. 또한 플라스틱 규제로 인해 청량음료 포장 공급업체는 음료 포장에 금속 크라운 캡을 선호하여 시장 성장을 주도하고 있습니다.

주요 하이라이트

- 친환경 제품 사용에 대한 관심이 높아지면서 금속 캡과 마개의 채택이 증가하고 있습니다. 플라스틱 기반 캡은 금속 캡에 높은 위협을 가하고 있지만 플라스틱 캡 시장은 환경 문제에 대한 높은 위협을 목격하고 있습니다. 이는 금속 캡과 마개에 대한 기회를 창출하고 있습니다. 최근 몇 년 동안 여러 회사에서 플라스틱 기반 캡과 마개를 금속으로 교체하고 있습니다.

- 또한 금속 캡과 마개에는 로고나 기타 디자인으로 브랜딩할 수 있어 고유한 브랜드를 홍보함으로써 수요를 늘릴 수 있습니다. 또한, 적응형 크라운 캡은 나사산 병마개와 결합할 때 최적의 착용감을 제공하는 독특한 금속으로 구성되어 있습니다. 크라운 캡은 합리적인 가격, 뛰어난 기능, 간편한 사용, 빠른 적용, 변조 방지 기능을 제공합니다.

- 금속 캡과 마개는 멸균 처리되고 일반적으로 다층 재질로 만들어지기 때문에 제약 산업에서도 자주 사용됩니다. 업계에서 가장 일반적으로 사용되는 금속 캡은 강철과 알루미늄으로 구성됩니다.

- 또한 알루미늄은 일반 또는 엠보싱, 컬러 또는 내추럴 등 다양한 형태로 제작됩니다. 따라서 소비자 수요에 따라 제약 포장을 제공할 수 있습니다.

- 어린이 보호용, 부가가치 및 노인 친화적 마개 시장은 빠르게 성장하는 제약 산업과 규제 개혁으로 인해 제조업체가 우수한 품질의 캡과 마개를 생산하도록 장려함으로써 주도될 것으로 예상됩니다.

- 그러나 플라스틱, 목재 등으로 만들어진 다른 마개 시스템의 존재는 예측 기간 동안 금속 마개 시장의 성장을 제한하고 도전하는 요인으로 작용할 것으로 예상됩니다.

금속 캡 및 마개 시장 동향

의약품 용도가 성장 가능성을 제공

- 금속 캡과 마개는 멸균 처리되어 있고 일반적으로 겹겹이 쌓인 재질로 구성되어 있기 때문에 제약 분야에서 주로 사용됩니다. 이 분야에서는 강철과 알루미늄으로 만든 금속 캡이 주로 사용됩니다. 또한 알루미늄은 내추럴 또는 컬러, 일반 또는 엠보싱 등 다양한 맞춤화가 가능합니다. 따라서 소비자의 요구에 따라 제약 포장을 공급할 수 있습니다.

- 빠르게 성장하는 제약 판매 및 생산과 규제 변화는 어린이 보호, 부가가치 및 노인 친화적 인 마개를 더욱 선호하며, 이는 예측 된 기간 동안 시장을 주도 할 것으로 예상됩니다. 세계보건기구(WHO)는 전 세계에서 판매되는 모든 의약품의 3분의 1이 불법 의약품이라고 추정했습니다. 위조 의약품으로 인한 위험이 증가함에 따라 효율적인 위조 방지 솔루션에 대한 필요성이 커지면서 위조 방지 마개 채택이 증가하고 있습니다.

- 고무 마개는 약품을 오염시키는 경향이 있기 때문에 제약 업계에서 알루미늄 마개 채택이 증가하고 있습니다. 오염은 엘라스토머 용기 마개 구성 요소로 인해 발생합니다. 가능한 오염 물질로는 미생물, 내독소, 화학물질 등이 있습니다. 2022 회계연도에는 166개 제조 현장에서 912건의 의약품 리콜이 발생하여 지난 5년 동안 가장 많은 리콜 건수를 기록했습니다.

- 데이터에 따르면 이러한 리콜의 가장 큰 결함 그룹은 지난 해 CDER에서 보고한 바와 같이 여전히 현행 우수 제조 관리 기준(CGMP) 위반인 것으로 나타났습니다. 리콜된 제품의 대부분은 온도 관리 및 창고 보관 문제로 인해 리콜되었습니다. 이 보고서는 이러한 조건이 제품의 품질 저하를 유발하여 유통기한, 안전성 또는 효과에 부정적인 영향을 미칠 수 있다는 사실을 강조합니다.

- 또한 금속 캡과 마개에 대한 수요는 시럽병 부문의 사용 규정으로 인해 몇 가지 어려움을 겪을 수 있습니다. 약초 제품(HMP)은 최근 그 중요성이 커지고 있으며 다양한 질병을 예방하고 치료하는 데 광범위하게 사용되고 있습니다.

가장 빠른 성장을 보일 아시아태평양 지역

- 아시아 태평양 지역은 중국과 인도라는 인구가 많은 두 국가가 존재하기 때문에 가장 빠른 성장을 보일 것으로 예상됩니다. 이 두 국가에서는 가처분 소득의 증가가 금속 캡 및 마개 시장의 성장을 보완 할 것입니다.

- 주류로 구성된 인도 음료 부문은 가장 다양한 분야 중 하나입니다. 이 산업은 날씨와 관련된 인도의 광활한 지형에 큰 영향을 받습니다. 따라서 음료를 담고 운송을 가능하게 하며 기계적 스트레스와 재료 손실로부터 음료를 보호하는 포장 기능이 필수적입니다. 방코 두 노르데스테(Banco do Nordeste)의 연구에 따르면 2020년 인도의 알코올 소비량은 48억 6,600만 리터였습니다. 2024년에는 소비량이 62억 1,000만 리터에 달할 것으로 예상됩니다.

- 중국의 주류 시장은 지속적으로 확대되고 있으며, 이에 따라 포장 솔루션에 대한 수요도 증가하고 있습니다. 이러한 매출은 중국 음료 패키징 분야의 국내 생산업체에게 엄청난 기회를 의미합니다. 외국 투자자들은 이러한 시장 부문의 엄청난 잠재력을 인식하고 있습니다. 또한 중국산 주류의 수입액이 증가함에 따라 음료용 뚜껑 및 마개 시장도 성장했습니다. 2022년 10월에 발표된 중국 세관 데이터에 따르면 중국은 7월부터 9월까지 약 300만 달러의 와인과 주류를 북한에 수출한 것으로 나타났습니다.

- 동남아시아에서는 지속 가능성에 대한 소비자의 인식이 높아지고 다양한 이해관계자들의 관심이 높아지면서 지속 가능한 음료 포장에 대한 트렌드가 가속화되고 있으며, 정부는 순환 경제로의 전환을 장려하고 제조업체는 재활용, 포장재 감소 및 보다 지속 가능한 포장 대체품 채택에 주력하고 있습니다. 일부 제조업체는 플라스틱을 보다 지속 가능한 소재로 대체하고 있습니다.

- 포장된 식음료에 대한 수요가 크게 증가하고 포장된 소모품을 장기간 신선하게 유지하는 데 있어 뚜껑과 마개의 역할이 중요해짐에 따라 이 지역의 시장이 활성화될 것으로 보입니다.

금속 캡 및 마개 산업 개요

세계의 금속 캡 및 클로저 시장은 국제 공급업체의 존재로 인해 매우 세분화되고 경쟁이 치열합니다. 이 시장의 주요 기업으로는 Crown Holdings, O. Berk Company, Guala Closures SPA, Amcor PLC 등이 있습니다. 제품 차별화, 포트폴리오 및 가격 측면에서 치열한 경쟁이 시장에서 우세합니다. 부가가치가 높은 마개와 변조 방지 특성에 대한 수요가 증가함에 따라 주로 제약 및 음료 등 다양한 부문에서 금속 캡과 마개의 사용이 증가할 것입니다.

2022년 7월, 다양한 종류의 병 마개를 생산하던 Guala Closures는 비첸차에 본사를 둔 고급 마개 전문업체인 Labrenta를 인수했습니다. 이 인수는 럭셔리 부문으로 사업 영역을 확장하여 업계를 선도하는 기업으로 성장하는 데 큰 도움이 되었기 때문에 Guala Closures에게 매우 중요한 일이었습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 역학

- 시장 성장 촉진요인

- 지속 가능한 포장 재료에 대한 요구가 증가함에 따라 음료 소비 증가

- 기타 마개 재료에 비해 뛰어난 특성

- 시장 성장 억제요인

- 기타 유형의 마개 재료의 높은 채택율

제6장 시장 세분화

- 재료 유형별

- 알루미늄

- 스틸

- 주석

- 클로저 유형별

- 크라운 캡

- 스크류 캡

- 트위스트 메탈 캡

- 기타 캡(이지 오픈 엔드, ROPP 메탈 캡)

- 최종 사용자 산업별

- 식품

- 음료

- 알코올 음료

- 비알코올

- 의약품

- 퍼스널케어

- 기타

- 지역별

- 북미

- 유럽

- 아시아

- 호주 및 뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Crown Holdings Inc.

- O.Berk Company

- Guala Closures SPA

- Pelliconi & C. SpA

- Nippon Closures Co. Ltd

- Silgan White Cap LLC

- Sks Bottle & Packaging Inc.

- Amcor PLC

- Qorpak(Berlin Packaging)

- Alameda Packaging LLC

- Closure Systems International Inc(CSI)

제8장 투자 분석

제9장 시장의 미래

HBR 25.02.13The Metal Caps & Closures Market size is estimated at USD 25.40 billion in 2025, and is expected to reach USD 29.99 billion by 2030, at a CAGR of 3.38% during the forecast period (2025-2030).

The market for metal caps and closures is predicted to expand rapidly during the forecast period due to the increased demand for food and beverages. There is a rising demand for alcoholic drinks, beer, bread, poultry and fish, ready-to-eat meals, dairy goods, etc. Moreover, due to plastic regulations, soft drink packaging vendors prefer metal crown caps for beverage packaging, driving the market growth.

Key Highlights

- The growing concerns regarding the usage of environment-friendly products have boosted the adoption of metal caps and closures. Though plastic-based caps pose a high threat to metal caps, the plastic caps market is witnessing high threats regarding environmental problems. This has been creating the opportunity for metal caps and closures. Several companies in recent years have been replacing their plastic-based caps and closures with metal.

- Further, metal caps and closures can be branded with logos or other designs, increasing demand for them by promoting the distinctive brand. Moreover, the adaptable crown caps are composed of a unique metal that gives the optimum fit when combined with a threaded bottleneck. Crown caps are reasonably priced, very functional, simple to use, allow for high-speed application, and provide genuine tamper protection.

- Metal caps and closures are also often utilized in the pharmaceutical industry since they are sterile and typically made of multilayer materials. The most common metal caps used in the industry are comprised of steel and aluminum.

- Additionally, aluminum is made in various variations, including plain or embossed, colored, or natural. As a result, pharmaceutical packaging may be provided in accordance with consumer demand.

- The market for child-resistant, value-added, and senior-friendly closures is expected to be driven by the rapidly expanding pharmaceutical industry as well as regulatory reforms, which have encouraged manufacturers to produce superior-quality caps and closures.

- However, the presence of other closure systems made of plastics, wood, etc., is expected to act as a restraint and challenge the growth of the metal closures market over the forecast period.

Metal Caps and Closures Market Trends

Pharmaceutical Application Offers Potential Growth

- Metal caps and closures are predominantly used in the pharmaceutical sector as they are sterile and are generally composed of layered material. Metals caps made of steel and aluminum are mostly used in the sector. Besides, aluminum can be highly customizable: natural or colored, plain or embossed. Thus, pharmaceutical packaging can be supplied according to the consumers' needs.

- The rapidly growing pharmaceutical sales and production and the regulatory changes further favor child-resistant, value-added, and senior-friendly closures, which are anticipated to drive the market in the foreseen period. The World Health Organization (WHO) estimated that one-third of all medicines sold worldwide are illegitimate. The increasing risks from falsified drugs are creating the need for efficient anti-counterfeiting solutions, boosting the adoption of anti-counterfeiting closures.

- The adaptation of aluminum closures in the pharmaceutical industry is on the rise, as its rubber counterparts tend to contaminate the drugs. The contamination is attributable to elastomeric container closure components. Possible contaminants include microorganisms, endotoxins, and chemicals. In the fiscal year 2022, 912 drug recalls were generated by 166 manufacturing sites, marking the highest number of recalls in the past five years.

- The data indicates that the largest defect group for these recalls remains current good manufacturing practice (CGMP) deviations, as reported in previous years by CDER. The majority of the products were recalled due to issues with temperature control and storage in warehouses. The report highlights the fact that these conditions can cause degradation of the product, leading to a negative impact on its shelf-life, safety, or effectiveness.

- Further, the demand for metal caps and closures may witness a few challenges in the syrup bottle sector owing to the regulations prevailing in their usage. Herbal medicinal products (HMP) have recently gained importance and are extensively used to prevent and treat various ailments.

Asia-Pacific to Witness the Fastest Growth

- Asia-Pacific is expected to witness the fastest growth because of the presence of two highly populated countries, i.e., China and India. In these two countries, the increase in disposable income will supplement the growth of the metal caps and closures market.

- The Indian beverage sector, consisting of alcohol, is one of the most diverse sectors. The industry is highly influenced by the country's vast geography associated with the weather. With it comes the imperative of packaging function to contain beverages, enabling transportation, and protecting beverages against mechanical stress and material loss. According to a study performed by Banco do Nordeste, alcohol consumption in India was 4.86 billion liters in 2020. The consumption is expected to reach 6.21 billion liters in 2024.

- China's spirits market is expanding continuously, leading to a high demand for packaging solutions. Such turnover represents an enormous opportunity for domestic producers in Chinese beverage packaging. Foreign investors have recognized the huge potential of such a market segment. Moreover, the growing import value of alcoholic drinks from China has boosted the market for caps and closures for beverages. Recent data published in October 2022 showed that China exported nearly USD 3 million of wine and liquor to North Korea from July to September, according to Chinese customs data.

- The trend for sustainable beverage packaging is accelerating in Southeast Asia, buoyed by greater consumer awareness of sustainability and increased focus by various stakeholders, with governments incentivizing a shift towards a circular economy and manufacturers focusing on recycling, packaging reduction, and the adoption of more sustainable packaging alternatives. Some manufacturers are opting to replace plastics with more sustainable materials.

- The vast rise in the demand for packaged foods and beverages and the critical role played by caps and closures in keeping packaged consumables fresh for extended periods are likely to boost the market in these regions.

Metal Caps and Closures Industry Overview

The global metal caps and closures market is highly fragmented and competitive due to the presence of international vendors. Some of the key players in this market are Crown Holdings, O.Berk Company, Guala Closures S.P.A., and Amcor P.L.C., amongst others. Intense competition prevails in the market in terms of product differentiation, portfolio, and pricing. The rising demand for value-added closures and tamper resistance properties will augment the usage of metal caps and closures in various segments, primarily pharmaceuticals and beverages.

In July 2022, Guala Closures, a company that produced closures for various types of bottles, acquired Labrenta, a high-end closure specialist based in Vicenza. This acquisition was crucial for Guala Closures as it helped the company expand its reach in the luxury segment, thus making it a world leader in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Beverages with a Rising Need for Sustainable Packaging Materials

- 5.1.2 Superior Properties Compared to Other Closure Materials

- 5.2 Market Restraints

- 5.2.1 High Adoption Rate of Other Types of Closure Materials

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminium

- 6.1.2 Steel

- 6.1.3 Tin

- 6.2 By Closures Type

- 6.2.1 Crown Caps

- 6.2.2 Screw Caps

- 6.2.3 Twist Metal Caps

- 6.2.4 Other Closures Types (Easy Open Ends, ROPP Metal Caps)

- 6.3 By End-User Industry

- 6.3.1 Food

- 6.3.2 Beverages

- 6.3.2.1 Alcoholic

- 6.3.2.2 Non-Alcoholic

- 6.3.3 Pharmaceuticals

- 6.3.4 Personal Care

- 6.3.5 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Crown Holdings Inc.

- 7.1.2 O.Berk Company

- 7.1.3 Guala Closures S.P.A.

- 7.1.4 Pelliconi & C. SpA

- 7.1.5 Nippon Closures Co. Ltd

- 7.1.6 Silgan White Cap LLC

- 7.1.7 Sks Bottle & Packaging Inc.

- 7.1.8 Amcor PLC

- 7.1.9 Qorpak (Berlin Packaging)

- 7.1.10 Alameda Packaging LLC

- 7.1.11 Closure Systems International Inc (CSI)