|

시장보고서

상품코드

1851379

블리스터 포장 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Blister Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

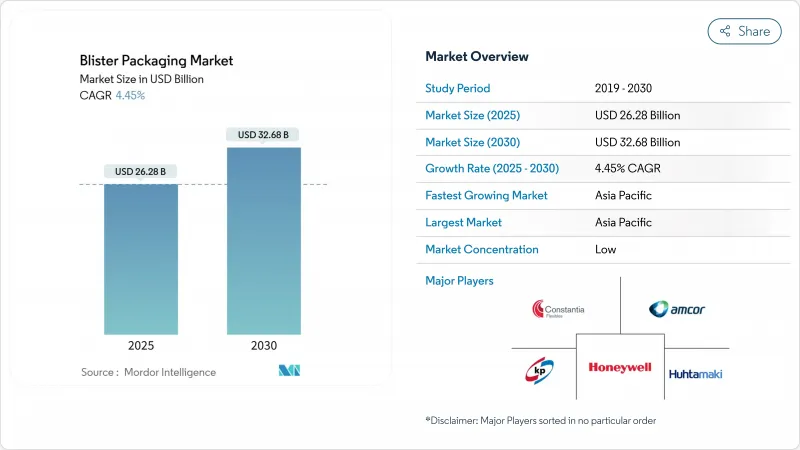

블리스터 포장 시장 규모는 2025년에 262억 8,000만 달러로 추정되고, 2030년에는 326억 8,000만 달러로 확대될 전망이며, 예측 기간 중 CAGR 4.45%로 성장할 전망입니다.

의료용 의약품, 일반용 의약품, 복잡화하는 생물 제제의 왕성한 수요가 이 성장을 지원하는 한편, 병원, 장기 간호, 소매의 각 채널에서는 유닛 도즈 포맷이 벌크 병에 옮겨 대체하고 있습니다. 규제압력, 특히 2030년까지 완전한 재활용을 의무화하는 유럽연합(EU)의 규칙 2025/40과 미국 FDA에 의한 변조 방지 규칙의 강화는 컴플라이언스 주도의 기술 혁신의 물결에 불을 붙여 원재료비가 변동하는 가운데도, 비싼 가격설정과 금리 확보를 요구하고 있습니다. 아시아태평양은 중국과 인도의 제조 규모에 따라 세계적인 수요를 이끌고 있으며 북미와 유럽은 직렬화, 스마트 팩 및 지속가능성 업그레이드로 고가치 틈새 시장을 형성하고 있습니다. 한편, Amcor의 84억 3,000만 달러의 Berry Global 인수로 대표되는 업계 재편은 다국적 제약 기업의 고객을 수용할 수 있는 유연하고, 견고하며, 지능적인 통합 솔루션에 대한 축족을 보여줍니다.

세계의 블리스터 포장 시장 동향 및 인사이트

노인 인구 증가 및 만성 질환의 만연

세계의 60세 이상 인구는 2030년까지 56% 급증할 전망이며, 변조 방지 기능을 갖추면서 복약 준수를 향상시키는 사용하기 쉬운 블리스터 팩에 대한 수요가 높아집니다. Drug Plastics Group과 같은 컨버터는 고령자를 위한 디자인(큰 인쇄, 색 분할, 개봉력이 낮음)을 상품화하고 있으며, 그 팝&클릭 클로저는 필요한 손의 힘을 약 1/4로 줄입니다. 당뇨병 및 심혈관 질환과 같은 만성 질환은 복잡한 처방전의 명확한 시각적 신호를 가능하게 하고 블리스터 전문가에게 프리미엄 가격의 실현을 강화함으로써 멀티 도즈 팩의 채택을 더욱 촉진하고 있습니다.

단위 용량 및 환자 어드히어런스 팩에 대한 수요

병원, 약국 및 재택치료 제공업체는 점점 어드히어런스 지표와 상환을 연관시키고 있으며, 블리스터 기반 단위 용량 팩의 역할이 높아지고 있습니다. 파라타의 자동화 장치는 전자 차트 플랫폼과 직접 통합되어 제제 실수를 줄이는 동시에 리팩 작업을 간소화합니다. FDA가 구강내 붕괴형 OTC 제제의 1회분 용기를 의무화하는 제안을 한 것은 1회분 단위의 안전성 이점에 대한 규제 당국의 잉크 첨부를 강조하는 것입니다. 의약품 브랜드는 또한 차별화를 위해 유닛 도즈 블리스터를 활용하고 있으며, 브랜드의 시인성과 병에서는 재현할 수 없는 변조 방지를 겸비하고 있습니다.

불안정한 PVC 및 알루미늄 가격

중국이 2025년 PVC 수입관세를 1%에서 5.5%로 끌어올려 다운스트림 컨버터의 수지 비용이 상승하고 정책전환에 대한 취약성이 부각되었습니다. 인도의 컨버터는 PVC 원료의 60%를 해외에서 조달하고 있기 때문에 헤지와 후방 통합이 리스크 관리의 중심이 되어 여전히 리스크에 노출되어 있습니다. 알루미늄박 가격도 에너지 시장과 함께 변동하기 때문에 다년간 계약을 체결할 규모를 갖지 않는 중소 블리스터 기업에는 부담이 듭니다.

부문 분석

열성형은 2024년 세계 매출의 64.33%를 차지했으며, 연간 5.67%의 성장이 예상됩니다. 이는 금형 비용이 낮고, 라인 속도가 빠르며, 다양한 필름 기재와의 호환성이 의약품 제조업체에 의해 지원되기 때문입니다. 브라운 머신의 Quad-Series 열성형기는 에너지 사용량을 약 4분의 1로 줄이면서 시간당 최대 25만 개의 뚜껑을 성형할 수 있게 되어 위탁 포장업자에게 생산성 향상을 가져와, 블리스터 포장 시장의 기세를 지속시키고 있습니다. GEA가 도입한 모듈식 기계로 소규모 연구소에 접근할 수 있게 되었으며, 대기업의 다국적 기업 이외에도 공급업체 기반이 넓어지고 있습니다.

콜드 폼 호일은 소수 점유율이지만 습기와 빛에 민감한 분자에 필수적입니다. 의약품 제조업체는 안정성 시험에서 수증기 투과율이 0에 가깝게 요구되는 경우 알루미늄 알루미늄 구조를 지정하는 경우가 많습니다. 생물 제제 및 높은 역가의 활성 물질이 늘어남에 따라, 콜드 폼의 설치 베이스는 확대되고, 배리어성을 손상시키지 않고 중량을 삭감하는 보다 얇은 호일이나 하이브리드 라미네이트의 연구 개발이 강화되고 있습니다. 이러한 진보가 상반되고 기술의 폭이 넓어지며, 블리스터 포장 시장은 대량 생산의 제네릭 의약품과 틈새 특수 의약품 모두에 대응하는 범용성이 높은 플랫폼으로 강화되고 있습니다.

PVC, PET, PP로 대표되는 플라스틱 필름은 성숙한 공급망과 용이한 열성형성으로 2024년 블리스터 매출의 68.26%를 차지했습니다. 그러나 화석 유래의 소재에 대한 감시의 눈은 엄격하고 종이 기반 솔루션에 급속한 성장을 가속하고 있으며, 2030년까지 CAGR 7.34%로 성장할 전망입니다. TekniPlex는 현재 재활용률이 30%인 투명 재활용 가능한 미드 배리어 PET 블리스터를 제공하고 있으며, 컨버터가 순환성을 추진하면서 약전 컴플라이언스를 유지하는 방법을 보여줍니다.

롤러의 EcoVolve-30과 같은 판지 진출기업은 섬유와 기능성 코팅을 사용하여 라인 성형 온도를 견디고 습기에 강한 정제를 보호합니다. 습기에 민감하기 때문에 광범위한 대체품에는 한계가 있지만 브랜드 소유자는 비타민, 영양 보충제 및 유통 기한이 짧은 SKU에 종이를 사용하여 생태를 강화하고 있습니다. 시간이 지남에 따라 재료 과학의 혁신은 하이브리드 섬유 폴리머 라미네이트가 더 높은 장벽 범주를 확보하고, 블리스터 포장 시장 규모의 궤적을 강화하며, 규제에 따른 재활용 함량의 의무화에 부합할 것으로 예측됩니다.

지역 분석

아시아태평양은 2024년 매출의 41.34%를 차지하였고, 중국과 인도가 의약품 유효 성분의 생산량을 확대하고 구미의 품질 기준에 맞추기 위해 CAGR 7.56%로 전 지역을 웃도는 것으로 보입니다. WuXi STA의 태흥 API 신거점과 싱가포르의 확장 계획은 이 지역의 제조 거점 증강의 한 예이며, 적합 블리스터 라인에 대한 현지 수요를 직접적으로 인상하고 있습니다. 중국 수입 PVC 관세의 5.5%로 인상하면 동아시아 블리스터 포장 시장을 지원하는 공급망의 현지화를 강화하고 국내 필름 압출을 더욱 촉진합니다.

북미는 여전히 기술적인 견인 역할입니다. 엄격한 FDA 직렬화 및 변조 방지 규칙은 지능형 형식의 프리미엄 마진을 유지하면서 생물학적 제제의 충전 마감 수요를 예상하여 기계 설비 투자가 확대됩니다. PMMI는 2027년까지 포장 기계 판매가 과거 최고를 기록했고 의약품 용도가 식음료를 능가할 것으로 예상했습니다. Amcor의 Berry Global 인수는 유연성과 리지드 기능을 단일 플랫폼으로 통합하여 북미의 소규모 컨버터에서 굉장히 굳을 수 없는 규모 및 수직 도달 범위를 보장합니다.

유럽은 가장 적극적인 지속가능성에 관한 법규제에 직면하고 있습니다. 2025/40 규칙은 2030년까지 PET 팩의 재활용 가능성과 재활용률 30%를 의무화하는 것으로, 서큘러 대응 설계에 대한 투자를 촉진하고 있습니다. TekniPlex의 투명 재활용 가능한 미드 배리어 블리스터 쇼케이스는 EMA의 엄격한 배리어 사양을 충족하는 컴플라이언스 경로를 보여줍니다. 임상시험용 팩도 EU 536/2014에 적합하기 때문에 캐터런트사는 일본의 시가현에 있는 거점에 고속 블리스터 라인을 설치해, 범 지역적인 시험에 대응하는 것과 동시에, 컴플라이언스 주도 수요가 세계한 것임을 강조하고 있습니다. 그 결과, 유럽에서의 블리스터 포장 시장 점유율은 재료의 선택이 진화해도 견조하게 추이하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 고령자 인구 증가 및 만성 질환 만연

- 단위 용량 및 환자 어드히어런스 팩 수요

- 변조 방지 포맷의 규제 강화

- 추적을 위한 NFC/QR 부착 스마트 블리스터 팩

- 맞춤형 의료용 소분 블리스터 라인

- 지속가능성이 견인하는 PVC에서 PE로의 개수 수요

- 시장 성장 억제요인

- 불안정한 PVC 및 알루미늄 가격

- PVC 폐기 및 재활용 규제 강화

- PVDC 수지 공급의 병목

- OTC 스틱 팩 및 파우치의 대체

- 밸류체인 및 공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁의 격렬함

제5장 시장 규모 및 성장 예측

- 프로세스별

- 열성형

- 냉간 성형

- 재료별

- 플라스틱 필름(PVC, PET, PP, PE, rPET, COP, 기타)

- 알루미늄(ALU-ALU, PTP박)

- 종이 및 판지

- 제품 유형별

- 카드들이 및 페이스 씰 블리스터

- 클램쉘 블리스터

- 트랩 및 풀카드 블리스터

- 어린이 저항 및 고령자 친화적인 팩

- 최종 사용자 업계별

- 의약품

- 영양보조식품

- 소비자 일렉트로닉스 및 하드웨어

- 퍼스널케어 및 화장품

- 기타 최종 사용자 업계

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주, 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 이집트

- 기타 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Amcor plc

- WestRock Company

- Constantia Flexibles GmbH

- Klockner Pentaplast Group

- Sonoco Products Company

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- Tekni-Plex, Inc.

- Dow Inc.

- Uflex Ltd.

- Huhtamaki Oyj

- Winpak Ltd.

- Bilcare Ltd.

- Bemis Company LLC(Amcor)

- Lotte Aluminium Co., Ltd.

- Toyo Aluminium KK

- Pharma Packaging Solutions

- R-Pharm Germany GmbH

- FormPaks Ltd.

- Zhejiang Hualian Pharmaceutical Co.

제7장 시장 기회 및 향후 전망

AJY 25.11.21The blister packaging market size stands at USD 26.28 billion in 2025 and is set to climb to USD 32.68 billion by 2030, translating into a steady 4.45% CAGR over the forecast horizon.

Robust demand from prescription drugs, over-the-counter medications, and increasingly complex biologics underpins this growth, while unit-dose formats continue to displace bulk bottles across hospital, long-term-care, and retail channels. Regulatory pressure-most notably the European Union's Regulation 2025/40 mandating full recyclability by 2030 and the U.S. FDA's strengthened tamper-evident rules-has sparked a wave of compliance-driven innovation that commands premium pricing and protects margins even as raw-material costs fluctuate. Asia-Pacific leads global demand thanks to China and India's manufacturing scale, while North America and Europe shape high-value niches through serialization, smart packs, and sustainability upgrades. Meanwhile, industry consolidation-typified by Amcor's USD 8.43 billion purchase of Berry Global-signals a pivot toward integrated flexible, rigid, and intelligent solutions that can serve multinational pharmaceutical clients.

Global Blister Packaging Market Trends and Insights

Growing Geriatric Population and Chronic-Disease Prevalence

The global cohort aged 60 and above will surge 56% by 2030, intensifying demand for user-friendly blister packs that improve medication adherence while offering tamper evidence. Senior-centric designs-larger print, color coding, and low opening force-are being commercialized by converters such as Drug Plastics Group, whose Pop & Click closure reduces required hand pressure by roughly a quarter. Chronic conditions like diabetes and cardiovascular disease further amplify multi-dose pack adoption, enabling clear visual cues for complex regimes and reinforcing premium price realization for blister specialists.

Demand for Unit-Dose and Patient-Adherence Packs

Hospitals, pharmacies, and home-health providers increasingly link reimbursement to adherence metrics, elevating the role of blister-based unit-dose packs. Automated equipment from Parata now integrates directly with electronic health-record platforms, cutting dispensing errors while simplifying repack operations. The FDA's proposal to require single-unit containers for orally disintegrating OTC forms underscores regulatory endorsement of unit-dose safety benefits. Pharmaceutical brands also leverage unit-dose blisters for differentiation, combining brand visibility with tamper-evidence that bottles cannot replicate.

Volatile PVC and Aluminium Prices

China's jump in PVC import tariffs from 1% to 5.5% in 2025 lifted resin costs for downstream converters, spotlighting vulnerability to policy shifts. Indian converters remain exposed since 60% of their PVC feedstock is sourced abroad, making hedging and backward integration central to risk management. Aluminium foil prices also swing with energy markets, straining smaller blister firms that lack the scale to lock in multi-year contracts.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Tamper-Evident Formats

- Smart Blister Packs with NFC/QR for Track-and-Trace

- Tightening PVC Disposal/Recycling Legislation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermoforming commanded 64.33% of global revenues in 2024 and will grow 5.67% a year as drug makers favor its low tooling cost, fast line speeds, and compatibility with diverse film substrates. Brown Machine's Quad-Series thermoformers now deliver up to 250,000 lids per hour while trimming energy use by roughly one-quarter, giving contract packers productivity gains that sustain the blister packaging market's momentum. Smaller laboratories gain access through modular machines introduced by GEA, broadening supplier bases beyond large multinationals.

Cold-form foil, though a minority share, is indispensable for moisture- or light-sensitive molecules. Drug makers often specify aluminium-aluminium structures when stability studies demand near-zero water vapor transmission. As biologics and high-potency actives proliferate, cold form's installed base expands, intensifying R&D into thinner foils and hybrid lamination that cut weight without compromising barrier. Together, these advances widen the technology palette, reinforcing the blister packaging market as a versatile platform for both mass-production generics and niche specialty drugs.

Plastic films, led by PVC, PET, and PP, accounted for 68.26% of blister revenues in 2024 thanks to mature supply chains and easy thermoformability. Yet heightened scrutiny of fossil-based materials is spurring rapid incremental gains for paper-based solutions, which log a 7.34% CAGR through 2030. TekniPlex now offers transparent recyclable mid-barrier PET blisters containing 30% recycled content, illustrating how converters preserve pharmacopoeial compliance while advancing circularity.

Paperboard entrants such as Rohrer's EcoVolve-30 use fiber plus functional coatings to withstand line forming temperatures and protect moisture-tolerant tablets. Although moisture sensitivity limits broad substitution, brand owners deploy paper variants in vitamins, nutraceuticals, and short shelf-life SKUs, bolstering eco-credentials. Over time, material science breakthroughs are expected to let hybrid fiber-polymer laminates secure higher-barrier categories, reinforcing the blister packaging market size trajectory and aligning with regulatory recycled-content mandates.

The Blister Packaging Market Report is Segmented by Process (Thermoforming, Cold Forming), Material (Plastic Films, Aluminium, Paper and Paperboard), Product Type (Carded/Face-Seal Blisters, Clamshell Blisters, Trapped and Full-Card Blisters, and More), End-User Industry (Pharmaceuticals, Nutraceuticals and Dietary Supplements, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 41.34% of 2024 revenue and will outpace all regions at 7.56% CAGR as China and India scale active-pharmaceutical-ingredient output and align with Western quality standards. WuXi STA's new Taixing API site and proposed Singapore expansion exemplify regional manufacturing build-out, directly lifting local demand for compliant blister lines. China's tariff hike on imported PVC to 5.5% further encourages domestic film extrusion, reinforcing supply-chain localization that underpins the blister packaging market in East Asia.

North America remains a technological bellwether. Stringent FDA serialization plus tamper-evidence rules sustain premium margins for intelligent formats, while machinery capex expands in anticipation of biologic fill-finish demand. PMMI projects packaging-machinery sales will hit record highs by 2027, with pharmaceutical applications outperforming food and beverage. Amcor's Berry Global acquisition consolidates flexible and rigid capabilities inside a single platform, ensuring scale and vertical reach that smaller North American converters will find hard to match.

Europe confronts the most aggressive sustainability legislation. Regulation 2025/40 enforces recyclability and 30% recycled content in PET packs by 2030, directing investment into circular-ready designs. TekniPlex's showcase of transparent recyclable mid-barrier blisters demonstrates compliance pathways that still satisfy stringent EMA barrier specifications. Clinical-trial packs also adapt to EU 536/2014, prompting Catalent to equip its Shiga, Japan, site with high-speed blister lines that serve pan-regional studies and underscore the global nature of compliance-driven demand. Consequently, the blister packaging market share in Europe remains resilient even as material choices evolve.

- Amcor plc

- WestRock Company

- Constantia Flexibles GmbH

- Klockner Pentaplast Group

- Sonoco Products Company

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- Tekni-Plex, Inc.

- Dow Inc.

- Uflex Ltd.

- Huhtamaki Oyj

- Winpak Ltd.

- Bilcare Ltd.

- Bemis Company LLC (Amcor)

- Lotte Aluminium Co., Ltd.

- Toyo Aluminium K.K.

- Pharma Packaging Solutions

- R-Pharm Germany GmbH

- FormPaks Ltd.

- Zhejiang Hualian Pharmaceutical Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing geriatric population and chronic-disease prevalence

- 4.2.2 Demand for unit-dose and patient-adherence packs

- 4.2.3 Regulatory push for tamper-evident formats

- 4.2.4 Smart blister packs with NFC / QR for track-and-trace

- 4.2.5 Personalized-medicine small-batch blister lines

- 4.2.6 PVC-to-PE retrofit demand driven by sustainability

- 4.3 Market Restraints

- 4.3.1 Volatile PVC and aluminium prices

- 4.3.2 Tightening PVC disposal / recycling legislation

- 4.3.3 PVDC-resin supply bottlenecks

- 4.3.4 OTC stick-pack and sachet substitution

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Process

- 5.1.1 Thermoforming

- 5.1.2 Cold Forming

- 5.2 By Material

- 5.2.1 Plastic Films (PVC, PET, PP, PE, rPET, COP, others)

- 5.2.2 Aluminium (ALU-ALU, PTP foil)

- 5.2.3 Paper and Paperboard

- 5.3 By Product Type

- 5.3.1 Carded / Face-Seal Blisters

- 5.3.2 Clamshell Blisters

- 5.3.3 Trapped and Full-Card Blisters

- 5.3.4 Child-Resistant / Senior-Friendly Packs

- 5.4 By End-User Industry

- 5.4.1 Pharmaceuticals

- 5.4.2 Nutraceuticals and Dietary Supplements

- 5.4.3 Consumer Electronics and Hardware

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Other End-user Industry

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 WestRock Company

- 6.4.3 Constantia Flexibles GmbH

- 6.4.4 Klockner Pentaplast Group

- 6.4.5 Sonoco Products Company

- 6.4.6 DuPont de Nemours, Inc.

- 6.4.7 Honeywell International Inc.

- 6.4.8 Tekni-Plex, Inc.

- 6.4.9 Dow Inc.

- 6.4.10 Uflex Ltd.

- 6.4.11 Huhtamaki Oyj

- 6.4.12 Winpak Ltd.

- 6.4.13 Bilcare Ltd.

- 6.4.14 Bemis Company LLC (Amcor)

- 6.4.15 Lotte Aluminium Co., Ltd.

- 6.4.16 Toyo Aluminium K.K.

- 6.4.17 Pharma Packaging Solutions

- 6.4.18 R-Pharm Germany GmbH

- 6.4.19 FormPaks Ltd.

- 6.4.20 Zhejiang Hualian Pharmaceutical Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment