|

시장보고서

상품코드

1432645

레토르트 포장 시장 : 점유율 분석, 산업 동향, 성장 예측(2024-2029년)Retort Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

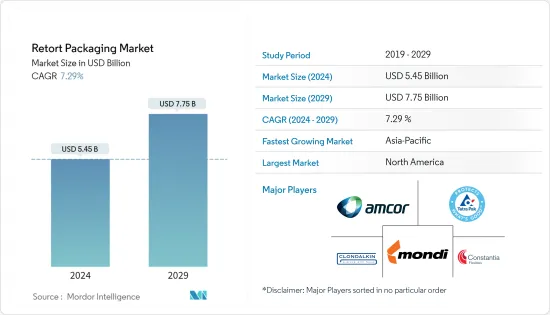

레토르트 포장(Retort Packaging) 시장 규모는 2024년에 54억 5,000만 달러로 추정되며, 2029년까지 77억 5,000만 달러에 이를 것으로 예측 되며, 예측 기간(2024-2029년) 동안 7.29%의 CAGR로 성장할 전망입니다.

주요 하이라이트

- 라이프스타일의 변화, 장시간 근무, 도시화 등 다양한 원인으로 인해 즉석식품에 대한 수요가 증가하고 있습니다. 많은 고객이 맛이나 품질에 타협하지 않으면서도 단 몇 분 만에 만들 수 있는 빠르고 간편한 식사 옵션을 찾고 있습니다. 바쁘고 시간과 노력을 절약하고자 하는 소비자들에게 간편식은 쉽고 간단한 해답을 제공합니다. 많은 소비자가 이동 중 섭취를 위해 포장 옵션을 선택함에 따라 파우치 및 트레이에 담긴 제품으로 인해 레토르트 포장이 확장되었습니다. 연포장협회에 따르면 레토르트 지갑과 가방은 전 세계 식품 포장의 약 60%를 차지합니다.

- 미국 인구조사국에 따르면 2022년 9월부터 2022년 12월까지 미국 내 식음료의 월별 소매 판매량이 증가했습니다. 2022년 9월의 판매액은 78,216만 달러였습니다. 2022년 12월에는 무려 88,432백만 달러에 달했습니다. 앞으로도 이러한 추세는 계속될 것으로 예상됩니다. 따라서 레토르트 포장 수요는 시장의 점진적인 소매 판매 수요 증가로 인해 예측 기간 동안 확대될 것으로 예상됩니다.

- 반려동물에 대한 과도한 지출에 대한 소비자들의 초기 망설임은 점차 반려동물 인간화 및 감성화와 같은 추세로 바뀌고 있으며, 이는 입양률의 급격한 증가에서 분명하게 드러납니다. 소매, 제약, 식음료, 반려동물 사료 등 다양한 분야에서 연포장 기술의 사용이 확대됨에 따라 전 세계적으로 레토르트 파우치의 인기가 점점 더 높아지고 있습니다.

- 하지만 레토르트 포장 산업에서 가장 큰 어려움은 레토르트 포장재 제조 비용이 높다는 점입니다. 레토르트 포장은 플라스틱, 알루미늄 및 기타 재료로 구성되어 있기 때문에 강도가 높고 고온에서도 견딜 수 있습니다. 그러나 이러한 재료의 가격과 이를 만들기 위한 특수 기계 및 생산 방법이 필요하기 때문에 제조 가격이 상승합니다. 레토르트 포장의 높은 비용으로 인해 자원이 부족한 소규모 기업에서는 이 기술을 채택하기가 어려울 수 있습니다. 제조업체는 비용 문제를 해결하기 위해 레토르트 포장 공정의 효율성과 경제성을 개선할 방법을 모색하고 있습니다.

- COVID-19 공급망 문제와 조기 봉쇄 조치로 인해 전 세계적으로 종이 판지를 구하기가 점점 더 어려워지고 있습니다. 이에 따라 2020년부터 종이 포장재 가격 인상이 시작되어 현재까지도 시행되고 있습니다. 그 이후로 이러한 문제는 더욱 악화되었고, 우크라이나 사태에 대한 러시아의 간섭으로 인해 원자재 가격이 기록적인 수준으로 상승했습니다. 러시아와 우크라이나 간의 전쟁으로 인해 여러 국가가 러시아에 부과한 경제 제재로 인해 원자재 가격이 상승하고 공급망이 중단되었으며, 여러 세계 시장에 영향을 미쳤습니다. 러시아와 우크라이나 간의 분쟁은 사람들의 생활과 생계 수단에 큰 영향을 미쳤을 뿐만 아니라 무역 패턴에도 큰 변화를 가져왔습니다. 에너지 비용과 유가 상승으로 인해 전 세계 공급망 전반에서 플라스틱 수지 가격이 상승하고 있습니다. 그러나 폴리머 산업은 2022년 러시아의 우크라이나 침공으로 인해 큰 타격을 입었습니다. 석유 및 가스 가격 변동에 따른 국내 시장의 원자재 가격 변동은 시장 공급업체의 주요 과제입니다.

레토르트 포장 시장 동향

음료의 상당한 성장률

- 레토르트 포장과 같은 유연한 포장 솔루션은 폐기물을 줄이는 데 중요한 역할을 하며 온라인 브랜드가 포장을 혁신하여 이커머스 경험을 향상시킬 수 있게 해줍니다. 취급의 용이성, 생산 및 배송 비용 절감 등의 요인으로 인해 음료 부문에서 레토르트 포장에 대한 수요가 높습니다.

- 내열성 라미네이트 플라스틱으로 제작된 레토르트 파우치 포장은 연포장재의 일종으로 음료 및 제품 폐기물을 줄이는 동시에 온라인 브랜드가 포장을 혁신하여 이커머스 경험을 향상시키는 데 중요한 역할을 합니다.

- 가벼운 포장재는 음료, 특히 파우치 포장에 필수적입니다. 파우치 디자인이 개선되면서 과일 음료, 건강기능식품, 식사 대용 셰이크, 섬유질 보충제, 콜드 프레스 주스 등을 구매하는 소비자가 늘어나면서 파우치의 활용도가 높아졌습니다.

- 그러나 음료의 품질은 pH, 보관 온도, 압력, 오염 물질의 존재 여부에 따라 영향을 받습니다. 레토르트 파우치 포장은 방부제를 사용하지 않고도 4.0-7.0의 pH로 음료 제품의 품질과 안전성을 유지하여 음료를 살균합니다. 기업들은 열, 습기, 박테리아에 대한 차단성 및 산화 가능성 제거와 같은 특성을 가진 포장 제품을 점점 더 많이 사용하고 있습니다.

- 소비자는 건강과 웰빙에 대한 의식이 점점 더 높아지고 있습니다. 아침에 마시는 주스부터 에너지 음료까지, 소비자들은 이제 웰빙 트렌드에 부합하는 다과를 제공하는 제품에 더 많은 비용을 지출하고 있습니다. 이로 인해 음료 부문에서 비용 효율적인 포장 솔루션에 대한 수요가 높아지고 있습니다.

- 영국 통계청에 따르면 2022년 1분기에 식품 및 무알코올 음료에 대한 소비자 지출은 290억 파운드(352억 6천만 달러)를 넘어섰습니다. 2019년 1분기에 가정에서 지출한 금액은 약 270억 파운드(미화 328억 달러)였습니다. 레토르트 음료의 판매 및 제조 증가는 소비자 지출 증가로 인해 포장재에 대한 필요성이 증가할 수 있습니다. 이 업계의 기업들은 레토르트 음료 포장재에 대한 수요 증가로 인해 제조 역량을 강화하고 최첨단 포장 솔루션을 생산할 수 있습니다.

북미는 상당한 시장 점유율을 유지할 것으로 예상

- 도시 인구 증가, 바쁜 직장 생활, 1인 가구 증가, 소비력 증가로 인해 일반적으로 스탠드형 레토르트 파우치에 포장되는 레토르트 식품의 성장이 촉진되어 레토르트 파우치 산업 성장의 주요 동력으로 작용하고 있습니다.

- 레토르트 포장은 매우 편리하고 휴대하기 좋은 포장 솔루션으로 빠르게 인기를 얻고 있습니다. 국내의 많은 쇼핑객들은 기존의 딱딱한 포장재보다 유연한 스탠드형 파우치를 선호합니다. 스낵 식품, 음료, 이유식, 산업용 오일 및 윤활유 등 지난 10년간 소비자들은 스탠드업 파우치에 대한 수요를 기하급수적으로 증가시켰습니다.

- 미국에서는 보건복지부가 사람과 동물이 섭취하는 식품, 의약품, 건강기능식품을 규제하고 있습니다. 이는 미국 식품의약국(FDA) 또는 미국 농무부(USDA)를 통해 이루어집니다. 레토르트 포장에 사용되는 규정은 최고 온도에서 상당히 까다로우며 FDA 규정 21 CFR 177.1390에 따라 재료와 공정이 나열되어야 합니다.

- 소매, 제약, 식음료, 반려동물 사료 등 다양한 산업 분야에서 연포장 기술의 채택이 증가함에 따라 캐나다에서는 레토르트 파우치 사용이 증가하고 있습니다.

- 캐나다에서는 식품 공급의 약 75%가 포장된 가공 식품에서 나옵니다. 또한 식습관의 변화로 인해 일반적으로 지방, 설탕, 나트륨 함량이 높고 에너지 밀도가 높은 초가공, 즉석식품의 소비가 증가하고 있습니다. 이러한 식품은 대부분 레토르트 파우치에 포장되는데, 이는 유통기한을 연장해야 하는 식품을 포장하는 데 효과적인 기술이기 때문입니다.

레토르트 포장 산업 개요

레토르트 포장 시장은 경쟁이 심하고 여러 선도 기업으로 구성되어 있습니다. 시장 점유율 측면에서 현재 시장을 독점하는 대기업은 거의 없습니다. 그러나 혁신적이고 지속 가능한 패키징으로 많은 기업들이 새로운 계약을 획득하고 새로운 시장을 개척함으로써 시장에서 존재감을 높이고 있습니다.

2022년 6월, Stora Enso와 Tetra Pak은 음료용지 팩의 재활용 솔루션으로 제휴했습니다. Stora Enso의 벨기에 랭거 브뤼헤 거점에 위치한 재활용 플랜트의 설계는 공동 실현 가능성 조사의 일부입니다. 베네룩스 3국 시장은 연간 약 75,000톤의 음료용지 팩을 제공합니다. 이 중 70% 이상이 이미 재활용을 위해 회수되었습니다.

2022년 4월, ProAmpac은 특징적인 ProActive PCR 레토르트 파우치를 출시했습니다. ProActive PCR 레토르트 파우치는 반려동물과 인간의 식품을 포장하기 위해 만들어졌으며, 레토르트 용도의 식품 접촉과 관련하여 FDA와 EU 모두에서 승인되었습니다. 패키징에서 버진 레진의 사용량을 줄이기 위해 ProActive PCR 레토르트 파우치에는 30 중량% 이상의 PCR 함량이 포함되어 있습니다. 또한, 본 발명의 파우치는 영국(UK)의 플라스틱 포장세(PPT)를 준수합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사 전제 조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- COVID-19가 업계에 미치는 영향

- 시장 성장 촉진 요인

- 가볍고 컴팩트한 포장재에 대한 수요 증가

- 포장 식품 산업의 지속적인 성장

- 시장 과제

- 설비 투자 증가와 원료 재활용 문제

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 포장 유형별

- 파우치

- 판지

- 트레이

- 기타 유형

- 재료별

- 폴리프로필렌

- 폴리에스테르

- 알루미늄박

- 판지

- 나일론

- 식품용 캐스트 폴리프로필렌

- 기타 소재

- 최종 사용자 재료별

- 식품

- 음료

- 기타 최종 사용자 산업

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아 태평양

- 중국

- 일본

- 인도

- 호주

- 기타 아시아 태평양

- 남미

- 멕시코

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 기업 개요

- Amcor PLC

- Constantia Flexibles

- Clifton Packaging Group Limited

- Clondalkin Industries BV

- Coveris Holdings SA

- Flair Flexible Packaging Corporation

- Mondi PLC

- Tetra Pak International SA

- Proampac LLC

- Sonoco Product Company

- Winpak Ltd

- Sealed Air Corporation

제7장 투자 분석

제8장 시장 전망

LYJThe Retort Packaging Market size is estimated at USD 5.45 billion in 2024, and is expected to reach USD 7.75 billion by 2029, growing at a CAGR of 7.29% during the forecast period (2024-2029).

Key Highlights

- There is a rising demand for ready-to-eat meals as a result of a number of causes, including changing lifestyles, long workdays, and increased urbanization. Many customers are searching for quick and simple meal options that can be made in a matter of minutes without compromising on taste or quality. For consumers who are busy and want to save time and effort, ready meals provide an easy, simple answer. Retort packaging has expanded due to products in pouches and trays since many consumers choose packaging options for on-the-go consumption. Retorting purses and bags makeup about 60% of all food packaging worldwide, according to the Flexible Packaging Association.

- The US Census Bureau reports that from September 2022 to December 2022, there was a rise in the monthly retail sales of food and drink in the US. In September 2022, the sale was valued at USD 78,216 million. In December 2022, it was worth an astounding USD 88,432 million. In the coming years, it is anticipated that this tendency will continue. Retort packaging demand is therefore anticipated to expand during the projection period as a result of the market's progressive increase in retail sales demand.

- Consumers' initial hesitation of overpaying for pets is progressively giving way to trends like pet humanization and sensitization, which are clearly shown in the sharp increase in adoption rates. Retort pouches are becoming more and more popular all over the world as a result of the expanding use of flexible packaging techniques in a variety of sectors, including retail, pharmaceutical, food and beverage, and pet food.

- However, one key difficulty in the retort packaging industry is the high cost of manufacturing retort packaging materials. Retort packaging is strong and able to survive high temperatures since it is comprised of plastic, aluminium, and other materials. However, the price of these materials and the need for specialized machinery and production methods to create them drive up manufacturing prices. Adopting this technique may be challenging for small enterprises with tight resources due to the high cost of retort packing. Manufacturers are searching for ways to improve the efficiency and cost-effectiveness of the retort packaging process to meet cost issues.

- Due to COVID-19 supply chain issues and earlier lockdowns, finding paper boards has grown increasingly challenging on a global scale. In light of this, a hike in the price of paper packaging began in 2020 and is still in force today. Since then, these problems have gotten worse, and because of Russia's interference in the Ukrainian situation, the price of raw paper materials has increased to record levels. Economic sanctions imposed on Russia by a number of countries have caused a rise in commodity prices, interruptions in the supply chain, and effects on several global markets as a result of the war between Russia and Ukraine. The conflict between Russia and Ukraine has had a profound effect on people's life and means of subsistence, as well as greatly altered trade patterns. The price of plastic resins is increasing across the whole global supply chain as a result of rising energy costs and oil prices. However, the polymer industry was dominated by Russia's invasion of Ukraine in 2022. A major challenge for market vendors is the varying cost of raw materials on the domestic market as a result of fluctuations in the price of oil and gas.

Retort Packaging Market Trends

Beverages to Witness Significant Growth Rate

- Flexible packaging solutions, such as retort packaging, play a crucial role in reducing waste and allows online brands to innovate their packaging to enhance the e-commerce experience. There is a high demand for retort packaging in the beverage sector due to factors such as ease of handling and reduced production and shipment costs.

- Made from heat-resistant laminated plastic, retort pouch packaging, a form of flexible packaging, plays a crucial role in ensuring the reduction of beverage and product waste while allowing online brands to innovate their packaging to enhance the e-commerce experience simultaneously.

- Lightweight packaging material is essential for beverages, particularly in pouches. The improving designs of pouches increased their applications, attracting more consumers to purchase fruit drinks, nutraceuticals, meal replacement shakes, fibre supplements, and cold-pressed juices.

- However, the quality of beverages is affected by pH, storage temperature, pressure, and contaminants' presence. Retort pouch packaging sterilizes beverages by preserving the quality and safety of beverage products with pH levels between 4.0 and 7.0 without using preservatives. Companies are increasingly employing packaging products with properties such as barrier resistance (to heat, moisture, and bacteria) and to eliminate possible oxidation.

- Consumers are becoming increasingly conscious of health and wellness. From juice in the morning to energy drinks, consumers now are spending more on products that provide refreshments that are well within the wellness trend. This has created a high demand for cost-effective packaging solutions in the beverage segment.

- In the first quarter of 2022, consumer spending on food and non-alcoholic drinks amounted to over GBP 29 billion (USD 35.26 billion), according to the Office for National Statistics (UK). The amount of money spent by households in the first quarter of 2019 was around GBP 27 billion (USD 32.8 billion). Increased sales and manufacturing of retort drinks might result from rising consumer expenditure, which would increase the need for packaging materials. Companies in this industry may be able to boost their manufacturing capabilities and produce cutting-edge packaging solutions as a result of the rising demand for retort beverage packaging.

North America is Expected to Hold Significant Market Share

- Increased urban population, busy work life, growing single households, and increasing spending power of the population have boosted the growth of readymade, which are normally packaged in stand-up retort pouches, thereby also acting as key drivers for the growth of the retort pouch industry.

- Retort packaging has been rapidly gaining popularity, as it is a highly convenient and portable packaging solution. Many shoppers in the country prefer flexible, stand-up pouches over traditional, rigid packaging. Consumers have driven demand for stand-up pouches exponentially over the past decade, whether for snack food, beverage, baby food, or industrial oils and lubricants.

- In the United States, the Department of Health and Human Services regulates food, pharmaceutical, and nutraceutical products consumed by humans and animals. This is done through either the Food and Drug Administration (FDA) or the US Department of Agriculture (USDA). The regulation used for retort packages is quite demanding under the highest temperatures and requires the materials and processes to be listed under FDA regulation 21 CFR 177.1390.

- The growing adoption of flexible packaging techniques across numerous industries, including retail, pharmaceutical, food and beverage, and pet food, is propelling the use of retort pouches in Canada.

- In the country, about 75% of the food supply comes from packaged, processed food items. Also, there is a change in eating habits, and the country is witnessing an increase in consumption of ultra-processed, ready-to-consume foods, which are typically energy-dense with high fat, sugar, and sodium content. These food are mostly packed in retort pouches as it provides an effective technique for packaging food products that require extended shelf life.

Retort Packaging Industry Overview

The retort packaging market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many companies are increasing their market presence by securing new contracts and by tapping new markets.

In June 2022, Stora Enso and Tetra Pak joined forces on a beverage carton recycling solution. A design for a recycling plant at Stora Enso's Langerbrugge location in Belgium is part of the joint feasibility study. The Benelux market receives around 75,000 tonnes of beverage cartons annually. More than 70% of these have already been collected for recycling.

In April 2022, ProAmpac introduced its distinctive ProActive PCR Retort pouches. ProActive PCR Retort pouches are made for packaging pet and human food, and they are both FDA and EU-approved for food contact in retort applications. In order to reduce the usage of virgin resins in the packaging, ProActive PCR Retort pouches have a 30-weight percentage or higher PCR content. Additionally, these inventive pouches are Plastics Packaging Tax (PPT) compliant for the United Kingdom (UK).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growing Demand for Lightweight and Compact Packaging Materials

- 4.3.2 Sustained Growth in the Packaged Food Industry

- 4.4 Market Challenges

- 4.4.1 Higher Capital Investments and Raw Material Recycling Issues

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Packaging Type

- 5.1.1 Pouches

- 5.1.2 Cartons

- 5.1.3 Trays

- 5.1.4 Other Types

- 5.2 By Material

- 5.2.1 Polypropylene

- 5.2.2 Polyester

- 5.2.3 Aluminum Foil

- 5.2.4 Paper Board

- 5.2.5 Nylon

- 5.2.6 Food Grade Cast Polypropylene

- 5.2.7 Other Materials

- 5.3 By End-User Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Other End-User Industry

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Italy

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Argentina

- 5.4.4.4 Rest of Latin America

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Constantia Flexibles

- 6.1.3 Clifton Packaging Group Limited

- 6.1.4 Clondalkin Industries BV

- 6.1.5 Coveris Holdings SA

- 6.1.6 Flair Flexible Packaging Corporation

- 6.1.7 Mondi PLC

- 6.1.8 Tetra Pak International SA

- 6.1.9 Proampac LLC

- 6.1.10 Sonoco Product Company

- 6.1.11 Winpak Ltd

- 6.1.12 Sealed Air Corporation