|

시장보고서

상품코드

1906917

머신 비전 시스템(MVS) : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2026-2031년)Machine Vision Systems (MVS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

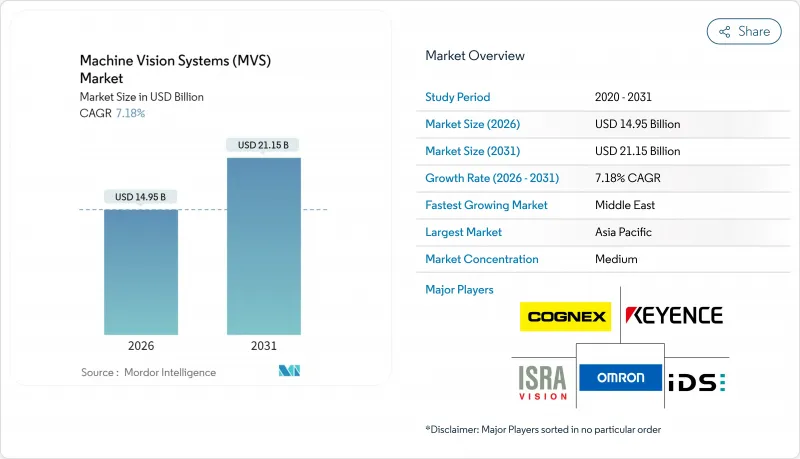

머신 비전 시스템(MVS) 시장은 2025년 139억 5,000만 달러로 평가되었고, 2026년에 149억 5,000만 달러로 성장할 것으로 보입니다. 2026-2031년에 걸쳐 CAGR 7.18%의 성장이 예상되며, 2031년까지 211억 5,000만 달러에 이를 것으로 예측됩니다.

이러한 가속화는 무결점 생산에 대한 수요 증가, 인공지능과 산업용 이미징의 융합, 그리고 자동차, 반도체, 물류, 의료 운영 전반에 걸친 사용 사례 확장을 반영합니다. 한때 하드웨어 사양으로 경쟁하던 공급업체들은 이제 딥러닝 소프트웨어, 클라우드 연결성, 구독형 가격 정책을 통해 차별화를 꾀하고 있으며, 기업들은 보증 위험을 제한하기 위해 종단간 품질 보증을 추구하고 있습니다. 아직 소수인 클라우드 기반 전개는 확장 가능한 처리 및 원격 관리의 이점을 제공하여 공급업체들이 사이버 보안 및 데이터 거버넌스 프레임워크를 강화하도록 촉진하고 있습니다. 지역별 성장 패턴을 보면 아시아태평양 지역은 제조업 우위를 유지하고 있으며, 중동 지역은 신규 자동화 프로젝트를 확대하고, 북미 및 유럽 지역은 인증된 비전 아키텍처를 선호하는 더 엄격한 책임 규정을 시행하고 있습니다.

세계의 머신 비전 시스템(MVS) 시장 동향 및 인사이트

무결점 제조에 대한 수요 증가

자동차 배터리 제조 및 첨단 전자 부품 조립은 단일 지점 결점을 용납할 수 없어, 생산자들이 통계적 샘플링을 포기하고 100% 인라인 검사를 선호하게 되었습니다. 하이퍼스펙트럼 카메라를 장착한 머신 비전 시스템은 서브밀리미터 해상도로 재료 또는 구조적 이상을 식별하여 비용이 많이 드는 리콜 및 보증 책임을 방지합니다. 유럽연합의 규제 개정은 재정적 책임을 강화하여 고해상도 센서 및 AI 분류기에 대한 투자를 촉진합니다. 클라우드 연동 대시보드는 공장 관리자에게 실시간 결점 지도를 제공하여 근본 원인 조사 시간을 단축합니다. 무결점 프로그램이 성숙해짐에 따라 턴키 분석, 엣지 추론 및 강화된 산업용 하드웨어를 제공하는 벤더들이 머신 비전 시스템 시장 내 점유율을 점진적으로 확대하고 있습니다.

비전 가이드형 로봇 채택 확대

로봇 장착 카메라가 이제 무작위 부품 방향에서도 그리퍼를 안내하여, 기존에는 라인 작업자가 담당하던 빈 피킹, 키팅, 조립 작업을 가능하게 합니다. 코그넥스(Cognex)는 고객사가 AI 기반 비전을 활용해 자동차 생산 전환 시간을 수 시간에서 수 분으로 단축했다고 보고하며 생산성 향상을 입증했습니다. 카메라 내장 엣지 프로세서는 실시간 그랩스 플래닝을 지원하며, 충돌 방지 알고리즘은 불량률을 감소시킵니다. 창고에서는 재고 위치를 파악하고 포장 상태를 캡처하는 비전 유도 모바일 로봇을 통합하여 무인 물류 허브의 핵심을 형성합니다. 노동력 부족이 지속되는 가운데, 비전 유도 로봇은 유연한 생산 능력을 추가하고 개별 제조 및 물류 부문 전반에 걸쳐 머신 비전 시스템 시장 성장을 가속화합니다.

숙련된 머신 비전 통합 기술자 부족

복잡한 비전 시스템 구축은 광학, 조명, 이미지 처리, 신경망 튜닝, 산업용 네트워킹 등 다양한 기술을 아우르는데, 이러한 기술들을 단일 학문으로 가르치는 공학 프로그램은 거의 없습니다. 중소기업들은 프로젝트를 외주화하지만, 시스템 통합업체들의 수주량이 과도하게 많아 납기 기간과 총비용이 증가하고 있습니다. 공급업체 인증 체계가 분산되어 인재 이동성이 제한되고 신흥 시장의 인력 풀이 축소됩니다. 출시 지연은 특히 가격 민감형 애플리케이션에서 투자 수익률 달성 시기를 늦춰 성장 경제권의 머신 비전 시스템 시장 확대를 제약합니다. 교육과정을 표준화하기 위한 학계-산업계 협력 관계가 형성 중이지만, 중기적으로 공급이 수요를 따라가지 못할 전망입니다.

부문 분석

하드웨어는 2025년 머신 비전 시스템 시장 점유율 60.15%를 유지하며 산업 환경 전반에서 이미지 캡처의 핵심 역할을 재확인했습니다. 카메라, 렌즈, 조명, 프레임 그래버는 자본 집약적 기반을 형성하지만, 상품화 압박과 표준 인터페이스로 인해 마진이 압박받고 있습니다. 연평균 복합 성장률(CAGR) 7.42%로 성장 중인 소프트웨어는 딥러닝 추론, 데이터셋 관리, 로우코드 애플리케이션 빌더를 통해 가치를 창출합니다. Zebra Technologies의 Aurora 소프트웨어는 2024년 사전 훈련된 신경망을 추가하여 진입 장벽을 낮추고 반복 수익을 창출했습니다. OEM 업체들은 점점 더 엣지 하드웨어와 평생 소프트웨어 구독을 패키지화하며, 머신 비전 시스템 시장 내 수익 구조를 재편하는 연금형 모델로 전환하고 있습니다.

이러한 변화는 클라우드 오케스트레이션, 모델 버전 관리, 사이버보안을 기업 구매 기준으로 부각시킵니다. 통합 소프트웨어 스택을 제공하는 통합업체들은 하드웨어 중심 경쟁사들을 대체할 수 있는 입지를 확보하는 반면, 센서 공급업체들은 AI 프레임워크와 협력하여 경쟁력을 유지하고 있습니다. 최종 사용자가 플릿 전체 분석을 추구함에 따라 소프트웨어는 이종 카메라 환경을 통제하는 제어 평면이 되어, 부품 판매에서 기능 제공으로의 전환을 가속화하고 있습니다.

2025년 머신 비전 시스템 시장 규모에서 PC 기반 설치는 57.35%를 차지했으며, 이는 컴퓨팅 집약적 알고리즘과 다중 카메라 오케스트레이션에 유리하기 때문입니다. 그러나 광학, 조명, 처리를 견고한 모듈로 압축한 스마트 카메라가 7.24%의 가장 빠른 연평균 성장률(CAGR)을 기록 중입니다. Hailo-10H와 같은 자동차 등급 엣지 가속기는 카메라 포드에 트랜스포머 네트워크와 생성형 AI를 도입해 캐비닛 설치 공간을 축소합니다. 창고 운영사는 바코드 해독, 체적 측정, 손상 감지를 위해 플러그 앤 플레이 방식의 스마트 카메라를 도입해 외부 PC를 우회합니다. 스마트 카메라 공급업체들은 브라우저 기반 구성 기능을 패키지화하여 전개 기간을 며칠에서 몇 시간으로 단축함으로써 머신 비전 시스템 시장 전반의 소형 폼팩터 애플리케이션에 대한 영향력을 강화하고 있습니다.

엣지 컴퓨팅의 발전에도 불구하고, 테라바이트 단위의 처리량이 필요한 연구실, 반도체 공장, 다중 스펙트럼 설비에서는 PC 기반 백엔드가 여전히 필수적입니다. 스마트 카메라가 초기 추론을 수행하고 PC가 심층 분석을 통합하는 하이브리드 아키텍처가 등장하며, 이는 완전한 대체가 아닌 공존을 보여줍니다.

머신 비전 시스템(MVS) 보고서는 컴포넌트별(하드웨어, 소프트웨어), 제품 유형별(PC 기반, 스마트 카메라 기반), 촬상 유형별(2D, 3D, 하이퍼 스펙트럼 및 멀티 스펙트럼), 도입 모드별(온프레미스, 엣지/임베디드, 클라우드 기반), 최종 사용자 산업(일렉트로믹스 및 반도체, 식품 및 음료, 물류 및 소매 등), 지역별로 분류 시장 예측은 금액 기준(달러)으로 제공됩니다.

지역별 분석

아시아태평양 지역은 2025년 매출의 40.25%를 차지했으며, 이는 중국의 전자제품 조립 능력, 일본의 로봇 기술 전문성, 한국의 메모리 칩 생산 시설에 기반을 두고 있습니다. 지역 정부들은 스마트 공장 업그레이드에 자금을 지원하며, 계약 제조업체들은 엄격한 수출 품질 기준을 충족하기 위해 비전 시스템을 도입합니다. 인도는 글로벌 핸드셋 및 배터리 제조업체를 유치하는 생산 연계 인센티브로 혜택을 보며, 인라인 검사 수요를 촉진합니다. 동남아시아 국가들은 자동차 배선 및 칩 패키징 분야에서 틈새 시장을 개척하며 비전 시스템 보급률을 높이고 공급망 생태계를 강화합니다.

북미는 전기차 및 반도체 공장 유치를 위한 리쇼어링 정책과 인센티브를 활용합니다. 미국 FDA와 NHTSA의 규제 감독은 감사 추적이 가능한 검증된 비전 라인 투자를 촉진합니다. 캐나다 온타리오와 퀘벡의 첨단 제조 클러스터는 노동력 제약을 상쇄하기 위해 AI 비전과 로봇공학을 통합하며, 멕시코 자동차 산업 벨트는 OEM 승인을 유지하기 위해 경제적인 스마트 카메라 라인을 도입합니다.

유럽은 품질에 집착하는 중견 제조업체와 엄격한 책임 법규를 결합해 꾸준한 도입을 유지합니다. 독일과 이탈리아는 비전, 로봇공학, MES 통합을 융합한 인더스트리 4.0 프로그램을 정교화합니다. 중동은 사우디아라비아와 아랍에미리트가 주권 부를 식품 가공, 소비재, 재생에너지 등 비석유 제조업에 투자하며 8.22%의 가장 빠른 연평균 성장률(CAGR)을 기록합니다. 터키의 자동차 수출과 이집트의 포장 공장이 지역 내 설비 확장을 주도합니다.

남미는 수출형 농업 비즈니스 및 차량 생산과 연계된 산발적 도입을 보이나, 거시경제적 변동성이 물량 증가를 제한합니다. 아프리카는 여전히 초기 단계이지만, 남아프리카공화국의 자동차 허브와 모로코의 전자제품 조립 공장이 확장 중인 머신 비전 시스템 시장에서 공급업체들의 발판을 제공합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 무결점 제조에 대한 수요 증가

- 비전 기반 로봇공학의 확산

- 전자 기기의 소형화에 수반하는 3D 비전 수요 확대

- 식품 및 의약품에 대한 엄격한 품질 기준

- 온디바이스 AI 추론 칩의 급증

- VaaS(Vision-as-a-Service) 구독 모델의 대두

- 시장 성장 억제요인

- 숙련된 머신 비전 통합자의 부족

- 고해상도 및 하이퍼스펙트럼 카메라의 높은 비용

- 클라우드 연결형 비전 시스템의 사이버 보안 위험

- 이미지 센서 반도체 공급망 변동성

- 업계 생태계 분석

- 거시경제 요인의 영향

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 컴포넌트별

- 하드웨어

- 비전 시스템

- 카메라

- 광학 및 조명 시스템

- 프레임 그래버

- 기타 하드웨어

- 소프트웨어

- 하드웨어

- 제품 유형별

- PC 기반

- 스마트 카메라 기반

- 화상 유형별

- 2D 이미징

- 3D 이미징

- 하이퍼스펙트럼 및 멀티스펙트럼 이미징

- 전개 모드별

- 온프레미스

- 엣지/내장

- 클라우드 기반

- 최종 사용자 산업별

- 자동차

- 전자기기, 반도체

- 식품, 음료

- 의료 및 의약품

- 물류 및 소매

- 기타 최종 사용자 산업

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 중동

- 튀르키예

- 사우디아라비아

- 아랍에미리트(UAE)

- 아프리카

- 남아프리카

- 이집트

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Cognex Corporation

- Keyence Corporation

- Omron Corporation

- Teledyne Technologies Incorporated

- Sony Group Corporation

- Atlas Copco AB(ISRA Vision)

- IDS Imaging Development Systems GmbH

- National Instruments Corporation

- MVTec Software GmbH

- Basler AG

- Allied Vision Technologies GmbH

- TKH Group NV(LMI Technologies)

- FLIR Systems Inc(Teledyne)

- Intel Corporation

- Qualcomm Technologies Inc

- Sick AG

- Panasonic Holdings Corporation

- Stemmer Imaging AG

- Zebra Technologies Corporation

- Hitachi Ltd

제7장 시장 기회와 장래의 전망

HBR 26.02.04The machine vision systems market is expected to grow from USD 13.95 billion in 2025 to USD 14.95 billion in 2026 and is forecast to reach USD 21.15 billion by 2031 at 7.18% CAGR over 2026-2031.

The acceleration reflects rising demand for zero-defect production, the fusion of artificial intelligence with industrial imaging, and expanding use cases across automotive, semiconductor, logistics, and healthcare operations. Vendors that once competed on hardware specifications now differentiate through deep-learning software, cloud connectivity, and subscription pricing, while enterprises pursue end-to-end quality assurance to limit warranty exposure. Cloud-based deployment, still a minority, benefits from scalable processing and remote management, pushing vendors to harden cybersecurity and data-governance frameworks. Regional growth patterns show Asia-Pacific retaining manufacturing primacy, the Middle East scaling greenfield automation projects, and North America and Europe enforcing tighter liability rules that favor certified vision architectures.

Global Machine Vision Systems (MVS) Market Trends and Insights

Rising Need for Zero-Defect Manufacturing

Automotive battery manufacturing and advanced electronics assemblies cannot tolerate single-point defects, leading producers to abandon statistical sampling in favor of 100% inline inspection. Machine vision systems equipped with hyperspectral cameras identify material or structural anomalies at sub-millimeter resolution, preventing costly recalls and warranty liabilities. Regulatory amendments in the European Union reinforce financial accountability, motivating investment in higher-resolution sensors and AI classifiers. Cloud-linked dashboards give plant managers real-time defect maps that shorten root-cause investigations. As zero-defect programs mature, vendors that deliver turnkey analytics, edge inference, and hardened industrial hardware capture incremental share within the machine vision systems market.

Increasing Adoption of Vision-Guided Robotics

Robot-mounted cameras now guide grippers through random part orientations, enabling bin-picking, kitting, and assembly tasks once reserved for line workers. Cognex reported customers trimming automotive changeover time from hours to minutes using AI-enabled vision, strengthening the productivity case. Edge processors inside the camera support real-time grasp planning, while collision-avoidance algorithms reduce scrap. Warehouses integrate vision-guided mobile robots that localize inventory and capture package condition, forming the backbone of lights-out fulfillment hubs. As labor scarcity persists, vision-guided robotics adds flexible capacity and accelerates the machine vision systems market across discrete and logistics sectors.

Lack of Skilled Machine Vision Integrators

Complex vision deployments span optics, lighting, image processing, neural-network tuning, and industrial networking, skills that engineering programs seldom teach as a single discipline. Small and medium enterprises outsource projects, yet system integrators remain over-booked, raising lead times and total cost. Vendor certification tracks are fragmented, making talent portability difficult and limiting labor pools in emerging markets. Delayed rollouts widen the return-on-investment horizon, especially for price-sensitive applications, constraining uptake of the machine vision systems market in growth economies. Academic-industry partnerships are forming to standardize curricula, but supply will lag demand through the medium term.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for 3D Vision in Electronics Miniaturization

- Stringent Quality Rules for Food and Pharmaceuticals

- High Cost of High-Resolution and Hyperspectral Cameras

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware retained a 60.15% machine vision systems market share in 2025, underscoring its foundational role in capturing images across industrial environments. Cameras, lenses, lighting, and frame grabbers form a capital-intensive base, but commoditization pressures and standard interfaces squeeze margins. Software, advancing at a 7.42% CAGR, captures value through deep-learning inference, dataset management, and low-code application builders. Aurora software from Zebra Technologies added ready-trained neural networks in 2024, lowering entry barriers and pushing recurring revenue. OEMs increasingly package lifetime software subscriptions with edge hardware, pivoting to an annuity model that reshapes profit pools within the machine vision systems market.

The shift elevates cloud orchestration, model versioning, and cybersecurity as corporate procurement criteria. Integrators that offer unified software stacks stand to displace hardware-centric competitors, while sensor vendors partner with AI frameworks to remain relevant. As end users pursue fleet-wide analytics, software becomes the control plane over heterogeneous camera footprints, accelerating the transition from component sales to capability delivery.

PC-based installations represented 57.35% of the machine vision systems market size in 2025, favored for compute-intensive algorithms and multi-camera orchestration. However, smart cameras, compressing optics, lighting, and processing into a rugged module, record the fastest 7.24% CAGR. Automotive-qualified edge accelerators such as Hailo-10H bring transformer networks and generative AI to the camera pod, shrinking cabinet footprints. Warehouse operators adopt plug-and-play smart cameras for barcode decoding, volumetric measurement, and damage detection, bypassing external PCs. Smart-camera vendors package browser-based configuration that cuts deployment days to hours, tightening their grip on small-form-factor applications across the machine vision systems market.

Despite edge advances, PC back-ends remain indispensable in research labs, semiconductor fabs, and multi-spectral setups requiring terabytes of throughput. Hybrid architectures emerge in which smart cameras perform preliminary inference while PCs aggregate deeper analytics, illustrating coexistence rather than outright displacement.

The Machine Vision Systems Report is Segmented by Component (Hardware, and Software), Product Type (PC-Based, and Smart Camera-Based), Imaging Type (2D, 3D, and Hyperspectral and Multispectral), Deployment Mode (On-Premise, Edge/Embedded, and Cloud-Based), End-User Industry (Electronics and Semiconductors, Food and Beverage, Logistics and Retail, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 40.25% of 2025 revenue, anchored by China's electronics assembly capacity, Japan's robotics expertise, and South Korea's memory-chip fabs. Regional governments fund smart-factory upgrades, while contract manufacturers embed vision to meet stringent export quality criteria. India benefits from production-linked incentives that draw global handset and battery makers, boosting local demand for inline inspection. Southeast Asian nations carve out niches in automotive wiring and chip packaging, raising vision penetration and deepening supplier ecosystems.

North America leverages reshoring policies and incentives for electric-vehicle and semiconductor plants. Regulatory oversight by the U.S. FDA and NHTSA spurs investments in validated vision lines that generate audit trails. Canada's advanced-manufacturing clusters in Ontario and Quebec integrate AI vision with robotics to offset labor constraints, while Mexico's automotive corridor deploys affordable smart-camera lines to maintain OEM approvals.

Europe combines quality-obsessed midsize manufacturers with rigorous liability statutes, sustaining steady uptake. Germany and Italy refine Industrie 4.0 programs that merge vision, robotics, and MES integration. The Middle East delivers the fastest 8.22% CAGR as Saudi Arabia and United Arab Emirates channel sovereign wealth into non-oil manufacturing, including food processing, consumer goods, and renewables. Turkey's automotive exports and Egypt's packaging plants widen regional installations.

South America shows sporadic adoption tied to export agribusiness and vehicle production, though macroeconomic volatility tempers volume. Africa remains nascent, but South Africa's automotive hubs and Morocco's electronics assemblies offer footholds for suppliers in the expanding machine vision systems market.

- Cognex Corporation

- Keyence Corporation

- Omron Corporation

- Teledyne Technologies Incorporated

- Sony Group Corporation

- Atlas Copco AB (ISRA Vision)

- IDS Imaging Development Systems GmbH

- National Instruments Corporation

- MVTec Software GmbH

- Basler AG

- Allied Vision Technologies GmbH

- TKH Group NV (LMI Technologies)

- FLIR Systems Inc (Teledyne)

- Intel Corporation

- Qualcomm Technologies Inc

- Sick AG

- Panasonic Holdings Corporation

- Stemmer Imaging AG

- Zebra Technologies Corporation

- Hitachi Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Need for Zero-Defect Manufacturing

- 4.2.2 Increasing Adoption of Vision-Guided Robotics

- 4.2.3 Growing Demand for 3D Vision in Electronics Miniaturisation

- 4.2.4 Stringent Quality Rules for Food and Pharmaceuticals

- 4.2.5 Surge in On-Device AI Inference Chips

- 4.2.6 Emergence of Vision-as-a-Service Subscription Models

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Machine Vision Integrators

- 4.3.2 High Cost of High-Resolution and Hyperspectral Cameras

- 4.3.3 Cybersecurity Risks in Cloud-Connected Vision Systems

- 4.3.4 Supply Chain Volatility of Image Sensor Semiconductors

- 4.4 Industry Ecosystem Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Vision Systems

- 5.1.1.2 Cameras

- 5.1.1.3 Optics and Illumination Systems

- 5.1.1.4 Frame Grabbers

- 5.1.1.5 Other Hardwares

- 5.1.2 Software

- 5.1.1 Hardware

- 5.2 By Product Type

- 5.2.1 PC-Based

- 5.2.2 Smart Camera-Based

- 5.3 By Imaging Type

- 5.3.1 2D Imaging

- 5.3.2 3D Imaging

- 5.3.3 Hyperspectral and Multispectral Imaging

- 5.4 By Deployment Mode

- 5.4.1 On-Premise

- 5.4.2 Edge/Embedded

- 5.4.3 Cloud-Based

- 5.5 By End-User Industry

- 5.5.1 Automotive

- 5.5.2 Electronics and Semiconductors

- 5.5.3 Food and Beverage

- 5.5.4 Healthcare and Pharmaceutical

- 5.5.5 Logistics and Retail

- 5.5.6 Other End-User Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Mexico

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.5 Middle East

- 5.6.5.1 Turkey

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cognex Corporation

- 6.4.2 Keyence Corporation

- 6.4.3 Omron Corporation

- 6.4.4 Teledyne Technologies Incorporated

- 6.4.5 Sony Group Corporation

- 6.4.6 Atlas Copco AB (ISRA Vision)

- 6.4.7 IDS Imaging Development Systems GmbH

- 6.4.8 National Instruments Corporation

- 6.4.9 MVTec Software GmbH

- 6.4.10 Basler AG

- 6.4.11 Allied Vision Technologies GmbH

- 6.4.12 TKH Group NV (LMI Technologies)

- 6.4.13 FLIR Systems Inc (Teledyne)

- 6.4.14 Intel Corporation

- 6.4.15 Qualcomm Technologies Inc

- 6.4.16 Sick AG

- 6.4.17 Panasonic Holdings Corporation

- 6.4.18 Stemmer Imaging AG

- 6.4.19 Zebra Technologies Corporation

- 6.4.20 Hitachi Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment