|

시장보고서

상품코드

1851535

자동 창고(AS/RS) : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Automated Storage And Retrieval System (ASRS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

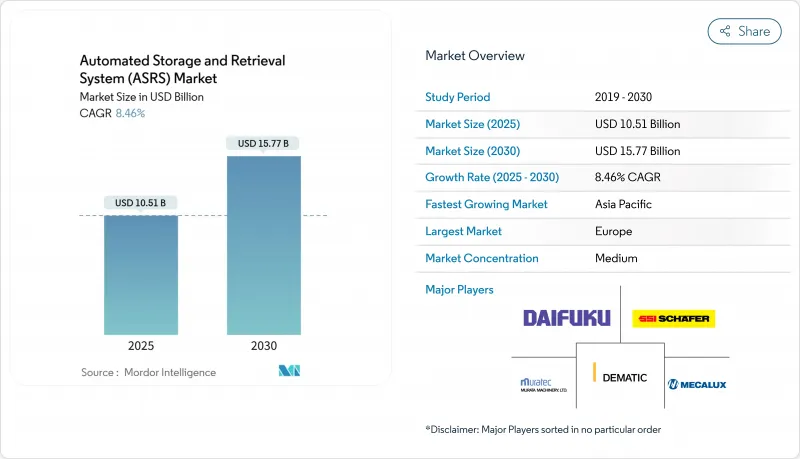

자동 창고(AS/RS) 시장 규모는 2025년에 105억 1,000만 달러로 평가되고, 2030년에는 157억 7,000만 달러에 이를 것으로 예측됩니다.

이는 지능형 자동화가 창고 운영자에게 선택적 업그레이드에서 전략적 필요로 전환됨을 강조하는 견고한 CAGR을 반영합니다.

전자상거래량 증가, 만성적인 노동력 부족, 부동산 비용의 상승이 함께 자동 창고(AS/RS) 시장의 전개가 스루풋, 정밀도, 스페이스 이용에 있어서 측정 가능한 이익을 가져오는 전환점을 창출하고 있습니다. 물류 업무에서 연간 5-7%의 임금 상승에 직면한 기업은 자본 집약적인 자동화 프로젝트를 운영비 상승의 헤지로 취급하는 반면, 에너지 효율적인 큐브 및 셔틀 솔루션은 기업의 지속가능성 의무에 부합하고 있습니다. 기술 융합이 솔루션 설계를 재구성하고 있습니다. 최신 플랫폼은 로봇 엔지니어링, AI 라우팅 알고리즘 및 예측 보전 애널리틱스를 통합하여 예기치 않은 다운타임을 최대 30% 절감합니다. 조기 채용 기업에서는 다품종 주문 프로파일의 사이클 타임이 40% 단축되었다는 보고도 있어 자동 창고(AS/RS) 시장에 대한 투자는 옴니채널·플루필먼트 전략의 기반으로 자리매김하고 있습니다.

세계의 자동 창고(AS/RS) 시장 동향 및 인사이트

전자상거래 완성에 대한 압력

2025년 중반까지, 아마존이 100만대의 로봇을 도입한 것은 수작업에 의한 피킹에서는 시간당 300행에 육박하는 오더 프로파일을 유지할 수 없다는 것이 눈에 띄는 증명이 되었습니다. 동업소매기업은 주문의 사이클 타임을 수시간에서 수분으로 단축하는 큐브 셔틀 프로젝트를 신속하게 진행함으로써 이에 대응하여 자동 창고(AS/RS) 시장의 예약을 가속화했습니다. 의류와 전자 기기에서 반품률이 증가함에 따라 정밀도가 중요해졌습니다. AI를 강화한 그리퍼는 현재 99% 이상의 품목 인식 정확도를 달성하여 비용이 많이 드는 재발송을 줄이고 있습니다. 또한 Fullfilment 오퍼레이터는 로보틱스가 지게차의 움직임과 조명의 필요성을 제한함으로써 주문당 에너지 비용을 8% 절감할 수 있다는 것을 발견했습니다.

상승하는 인건비와 안전의무

2024년 지게차 사고는 창고에서 사망 사고의 대부분을 차지했으며 미국 전체에서 1주일의 부상 보험금 청구에 8,400만 달러가 지출되었습니다. 2025년에 발행된 OSHA의 새로운 가이드라인은 고용주의 책임을 전환시키고, 길거리 통로에서 인간을 배제하는 물품 대인 셀로의 전환을 가속화했습니다. 2028년까지 기술자가 20% 부족할 것으로 예측되는 자동차 정비 공장에서는 미니 로드 시스템을 채용해 부족한 노동력을 검색에서 진단 역할로 돌렸습니다. 이러한 역학을 종합하면 중기적인 자동 창고(AS/RS) 시장의 성장에 2포인트 이상의 플러스 요인이 됩니다.

높은 초기 CAPEX와 장기 투자 회수 기간

7만 달러에서 300만 달러까지의 턴키 프로젝트는 비용 절감 가능성이 입증되었음에도 불구하고 많은 소규모 판매업체의 발판이 되고 있습니다. TCO 모델은 소프트웨어, 시운전, 트레이닝이 본체 가격에 추가로 40% 상승하는 경우가 많으며, 매크로적으로 불투명한 시기에는 CFO의 쾌적 영역을 넘어 투자 회수 기간이 늘어나는 것이 밝혀졌습니다. 구독 기반 '페이 퍼 픽' 모델은 선행 비용을 줄이기 위해 시작되었지만 현재 사용 가능한 일부 대량 생산 이용 사례로 제한됩니다.

부문 분석

고정식 통로 크레인의 설치는 2024년에도 세계 매출의 38.2%를 차지하고 예측 가능한 흐름이 높은 랙 구조를 정당화하는 자동차 공장과 대량 소비재 공장에 축족을 두었습니다. 이러한 설비는 역사적으로 자동 창고(AS/RS) 시장의 설계 템플릿을 설정해 왔지만 사용자를 특정 통로 폭과 처리량 천장에 고정시킵니다. 큐브 기반 그리드와 로봇 스토리지 라인은 스토리지 밀도를 60% 향상시키고, 검색 시간을 70초 미만으로 단축함으로써 기세를 늘리고, 10년 말까지 수익 믹스를 이동시키는 12.1%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다. AutoStore 및 DSV와 같은 인기 있는 3PL은 9개국에서 큐브 배포를 확장하고 다목적 적응성을 강조했습니다. 셔틀 기반 시스템은 중간 위치를 차지합니다. 모듈식 셔틀 레인을 통해 기업은 대규모 건물을 개조하지 않고도 단계적으로 확장할 수 있습니다. 이러한 유연성은 자동 창고(AS/RS) 시장에 대한 투자를 연간 수요 변동에 맞추고자 하는 급성장하는 소매업체에게 매력적입니다.

수직 리프트 모듈(VLM)과 회전 목마 솔루션은 수익 점유율이 10% 미만으로 틈새 시장으로 변하지는 않지만 바닥 면적이 부족하고 부품 무결성이 가장 중요하게 보일 때 중요한 가치를 추가합니다. 예를 들어, 의료기기 조립업체는 99.9% 이상의 픽 정확도를 달성하면서 오염으로부터 마이크로기계 부품을 보호하기 위해 VLM을 사용합니다. 하이브리드 장비는 크레인, 셔틀, 큐브를 혼합하는 경우가 많습니다. 이 아키텍처는 자동 창고(AS/RS) 시장이 단일 기술 베팅이 아닌 맞춤형 생태계로 진화했음을 보여줍니다. Kardex와 Berkshire Grey와의 협업은 AI 비전 픽셀을 VLM 라인에 통합하여 99.99%의 정확성을 달성하고 현대 창고 설계를 형성하는 상호 수분 동향을 강화했습니다.

유닛 로드 팔레트 시스템은 2024년 매출의 42.5%를 차지했으며, 자동차 서브어셈블리, 음료 팔레타이징, 각 보관 장소에 균질한 아이템이 보관되는 기타 벌크 플로우가 원동력이 되었습니다. 그러나 전자상거래에서 SKU의 폭발적인 증가는 유니트 로드 크레인에서 비용 효율적으로 충족할 수 없는 토트 레벨 검색 속도를 촉진하고 미니 로드 시스템 수요가 11.3%인 CAGR로 증가하고 있습니다. 미니 적재 토트 솔루션의 자동 창고(AS/RS) 시장 규모는 1개당 온라인 주문이 평균 35건인 옴니채널 식료품에서 더욱 빠르게 확대될 것으로 예측됩니다. 하나의 미니로드 통로에서 시간당 최대 1,200개의 토트 사이클을 처리할 수 있기 때문에 한 실적를 통해 매장을 보충하고 클릭 및 수집을 완료할 수 있습니다.

팔레트 셔틀 서브시스템은 높은 처리량 팔레트 저장과 선택적 액세스 요청을 가로질러 밀도와 속도를 균형있게 설정할 수 있는 깊이를 허용합니다. 미드로드 용도는 적은 수의 전자 기기 및 애프터마켓 자동차 부품의 까다로운 중형 부품을 처리합니다. WMS가 경직된 사일로화된 영역이 아니라 실시간 이동당 비용을 기반으로 픽을 지시하도록 운영자는 통합 소프트웨어 플랫폼에서 부하 유형을 점점 더 블렌딩하고 자동 창고(AS/RS) 시장의 미묘한 성숙을 보여줍니다.

자동 창고(AS/RS) 시장 보고서는 제품 유형(고정 아일 크레인 시스템, 셔틀 기반 시스템, 수직 리프트 모듈(VLM), 기타), 로드 유형(유닛 로드, 팔레트 로드 셔틀, 미니 로드, 미드로드, 토트/판지 등), 용도(보관 및 버퍼링, 상품 대 개인 주문 피킹, 키팅 및 순서 지정, 기타), 최종 사용자 산업(제조업)

지역 분석

유럽이 2024년 세계 매출의 33.8%를 차지하고 지역별 기여도로 최대를 유지했습니다. 시급 28달러를 넘는 높은 인건비와 엄격한 근로자 안전법제가 자동화를 재정적으로 설득력 있는 것으로 하고 EU의 지속가능성 규칙이 고밀도 큐브 그리드를 건물의 에너지 실적를 저감하는 길로 인정했습니다. 독일의 하이테크 전략 2025는 로봇 연구 개발에 3억 6,920만 달러를 기록하여 솔루션 공급자를 육성하는 상업 생태계를 강화했습니다. 스칸디나비아의 소매업체는 6개의 기존 창고를 1개의 자동화 시설로 압축하여 배송되는 주문 1건당 CO2를 35% 줄였습니다.

아시아태평양은 CAGR 11.9%로 가장 빠른 성장을 이루었습니다. 중국의 1조 위안 규모의 로봇 메가 프로젝트는 공장 자동화에 대한 국가 수준의 헌신을 보여주었고, 일본은 오사카와 도쿄를 연결하는 500킬로미터의 벨트 컨베이어 네트워크를 제안하여 높은 처리량의 소테이션 노드에 대한 수요를 창출했습니다. 한국의 정책 우대 조치는 스마트 팩토리 전개를 위해 1억 2,800만 달러의 보조금을 추가해, 인도는 다이후크의 2025년 공장 개설에 이어 생산 거점이 되어, 지역 고객의 리드 타임을 단축했습니다. 따라서 아시아태평양의 자동 창고(AS/RS) 시장은 내수와 현지 생산 능력 모두에서 혜택을 누리고 있습니다.

북미는 여전히 혁신의 중심지이며 세계 벤치마크가 되는 하이퍼스케일 전자상거래 실증 실험장이 있습니다. 아마존은 AI 기반 모델을 도입하여 그룹 로봇의 경로를 변경하여 에너지 효율을 향상시키면서 시간당 피킹 수를 증가시켰습니다. 뉴햄프셔 주에 있는 AutoStore의 신본사에는 기술자를 양성하는 아카데미가 있으며, 스킬 갭의 억제에 임함과 동시에 2026년 후반까지 지역별 설치 대수가 300대를 돌파한다는 동사의 예측을 뒷받침하고 있습니다. 사우디아라비아의 의약품 판매회사는 2024년에 반자동 필필먼트를 시험적으로 도입했으며, 브라질의 3PL은 자본재에 대한 감세조치의 혜택을 받아 양 지역을 향후 5년간의 성장 여지에 자리잡고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- E-Commerce·플루필먼트에의 압력

- 인건비 상승과 직장 안전 의무화

- 마이크로 플루필먼트/도시형 DC로의 변화(잠재적)

- 콜드체인을 위한 냉동 창고 자동화(잠재적)

- ROI를 높이는 예측 유지관리 분석(잠재적)

- APAC와 유럽의 산업 정책 인센티브

- 시장 성장 억제요인

- 높은 초기 투자액과 긴 투자 회수 기간

- ASRS 숙련 기술자의 부족

- 레거시 WMS와의 통합 복잡성

- 커넥티드 ASRS(잠재적)의 사이버 보안 취약성

- 중요한 규제 틀의 평가

- 밸류체인 분석

- 기술의 전망

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 주요 이해관계자의 영향 평가

- 주요 이용 사례와 사례 연구

- 시장의 거시경제 요인에 미치는 영향

- 투자분석

제5장 시장 세분화

- 제품 유형별

- 고정 통로 크레인 시스템

- 셔틀 기반 시스템

- 수직 리프트 모듈(VLM)

- 캐러셀 모듈(세로형, 수평형)

- 큐브형/로봇형 큐브 저장

- 적재 유형별

- 단위 적재

- 팔레트 적재 셔틀

- 소형 적재

- 중간 적재

- 토트/카톤 및 기타

- 용도별

- 저장 및 버퍼링

- 상품-인(goods-to-Person) 주문 피킹

- 키팅 및 시퀀싱

- 조립/생산 지원

- 냉장 및 초저온 취급

- 최종 사용자 업계별

- 제조

- 자동차

- 음식

- 의약품 및 생명과학

- 일렉트로닉스 및 반도체

- 금속 및 기계

- 비제조업

- 전자상거래 및 소매

- 제3자물류(3PL) 및 창고업

- 공항 및 수하물 처리

- 방위 및 정부 물자 저장소

- 제조

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- ASEAN

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Daifuku Co., Ltd.

- Schaefer Systems International GmbH(SSI SCHAEFER)

- Dematic Corp.(KION Group AG)

- Murata Machinery, Ltd.

- Mecalux, SA

- Honeywell Intelligrated, Inc.

- KUKA AG

- KNAPP AG

- Kardex Holding AG

- Toyota Industries Corporation

- Viastore Systems GmbH

- AutoStore Holdings Ltd.

- Swisslog Holding AG

- Vanderlande Industries BV

- Bastian Solutions LLC

- System Logistics SpA

- Hanel Storage Systems

- Modula SpA

- TGW Logistics Group GmbH

- BEUMER Group GmbH & Co. KG

- Stocklin Logistik AG

- Godrej Korber Supply Chain Ltd.

- Westfalia Technologies, Inc.

- Shanghai Jingxing Logistics Equipment Engineering Co., Ltd.

- Unitechnik Systems GmbH

제7장 시장 기회와 향후 전망

KTH 25.11.13The automated storage and retrieval system market size was valued at USD 10.51billion in 2025 and is forecast to reach USD 15.77 billion by 2030, reflecting a robust 8.46% CAGR that underscores how intelligent automation has shifted from optional upgrade to strategic necessity for warehouse operators.

Growing e-commerce volumes, chronic labor shortages, and escalating real-estate costs have combined to create a tipping point at which automated storage and retrieval system market deployments deliver measurable gains in throughput, accuracy, and space utilization. Companies facing 5%-7% annual wage inflation in logistics roles have treated capital-intensive automation projects as a hedge against rising operating expenses, while energy-efficient cube and shuttle solutions align with corporate sustainability mandates. Technology convergence is reshaping solution design; modern platforms integrate robotics, AI routing algorithms, and predictive maintenance analytics that cut unplanned downtime by up to 30%. Early adopters report cycle-time reductions of 40% for high-mix order profiles, positioning automated storage and retrieval system market investments as a foundation for omnichannel fulfillment strategies.

Global Automated Storage And Retrieval System (ASRS) Market Trends and Insights

E-commerce fulfillment pressure

By mid-2025, Amazon's deployment of 1 million robots served as visible proof that manual picking cannot sustain order profiles approaching 300 lines per hour. Peer retailers responded by fast-tracking cube and shuttle projects that shrink order cycle times from hours to minutes, driving accelerated bookings for the automated storage and retrieval system market. Higher return rates in apparel and electronics sharpened the focus on accuracy; AI-enhanced grippers now achieve item recognition accuracy above 99%, cutting costly reships. Fulfillment operators also discovered that robotics lowered energy cost per order by 8% by limiting forklift movements and lighting requirements.

Rising labor costs and safety mandates

Forklift incidents accounted for most fatal warehouse accidents in 2024, costing USD 84 million in weekly injury claims across the United States. New OSHA guidelines issued in 2025 shifted employer liability, prompting accelerated conversion to goods-to-person cells that remove humans from high-traffic aisles. Automotive maintenance depots suffering a projected 20% technician shortfall by 2028 adopted mini-load systems to reassign scarce labor from retrieval to diagnostic roles. Collectively, these dynamics add more than two percentage points to automated storage and retrieval system market growth over the mid-term.

High initial CAPEX and extended payback periods

Turnkey projects ranging from USD 70,000 to USD 3 million deterred many small distributors despite demonstrable cost-out potential. TCO models reveal software, commissioning, and training often add another 40% to sticker price, stretching payback beyond CFO comfort zones during periods of macro uncertainty. Subscription-based "pay-per-pick" models started to mitigate upfront expense, though current availability is limited to select high-volume use cases.

Other drivers and restraints analyzed in the detailed report include:

- Shift toward micro-fulfillment centers

- Deep-freeze warehouse automation

- Cyber-security vulnerabilities threaten connected ASRS operations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fixed-aisle crane installations still delivered 38.2% of global revenue in 2024, anchored in automotive and bulk consumer-goods plants where predictable flows justify tall rack structures. These installations historically set the design template for the automated storage and retrieval system market, yet they lock users into specific aisle widths and throughput ceilings. Cube-based grids and robotic storage lines gained momentum by raising storage density 60% and slashing retrieval times to under 70 seconds, driving a 12.1% CAGR that will shift the revenue mix before decade-end. AutoStore and populous 3PLs such as DSV scaled cube deployments across nine countries, underscoring multipurpose adaptability. Shuttle-based systems occupy a middle ground; modular shuttle lanes allow firms to expand incrementally without major building retrofits. That flexibility appeals to fast-growing retailers who want automated storage and retrieval system market investments aligned with year-to-year demand swings.

Vertical lift modules (VLMs) and carousel solutions remain niche at under 10% revenue share, yet they add critical value where floor area is scarce and parts integrity is paramount. Medical-device assemblers, for example, use VLMs to protect micro-mechanical parts from contamination while achieving pick accuracies above 99.9%. Hybrid facilities increasingly mix cranes, shuttles, and cubes, an architecture that exemplifies how the automated storage and retrieval system market evolved toward tailored ecosystems rather than single-technology bets. Kardex's collaboration with Berkshire Grey incorporated AI vision pick cells into VLM lines, attaining 99.99% accuracy and reinforcing the cross-pollination trend shaping modern warehouse design.

Unit-load pallet systems captured 42.5% of 2024 revenue, powered by automotive subassemblies, beverage palletizing, and other bulk flows where each storage location houses homogenous items. Yet the SKU explosion in e-commerce drove tote-level retrieval rates that unit-load cranes cannot satisfy cost-effectively, opening demand for mini-load systems advancing at 11.3% CAGR. The automated storage and retrieval system market size for mini-load tote solutions is projected to expand even faster in omnichannel grocery, where online order lines per basket average 35. A single mini-load aisle can process up to 1,200 tote cycles per hour, enabling store replenishment and click-and-collect fulfillment from one footprint.

Pallet shuttle subsystems bridge high-throughput pallet storage with selective access demands, permitting configurable depth that balances density and speed. Mid-load applications, though smaller in headline numbers, handle awkward medium-sized components in electronics and aftermarket auto parts, functions often overlooked in project scoping yet critical to end-to-end flow. Operators increasingly blend load types inside unified software platforms so that WMS directs picks based on real-time cost per move, rather than rigid siloed zones, signaling a nuanced maturity within the automated storage and retrieval system market.

The ASRS Market Report Segments the Industry Into by Product Type (Fixed-Aisle Crane Systems, Shuttle-Based Systems, Vertical Lift Modules (VLM), and More), Load Type (Unit Load, Pallet Load Shuttle, Mini Load, Mid Load, and Tote / Carton and Others), Application (Storage and Buffering, Goods-To-Person Order Picking, Kitting and Sequencing, and More), End-User Industry (Manufacturing, and Non-Manufacturing), and Geography.

Geography Analysis

Europe retained the largest regional contribution at 33.8% of 2024 global revenue. High labor costs exceeding USD 28 per hour and stringent worker-safety legislation made automation financially compelling, while EU sustainability rules recognized high-density cube grids as a path to lower building energy footprint. Germany's High-Tech Strategy 2025 earmarked USD 369.2 million for robotics R&D, reinforcing commercial ecosystems that nurture solution providers. Scandinavian retailers compressed six conventional warehouses into a single automated facility and cut CO2 per shipped order by 35%.

Asia-Pacific delivered the fastest growth at 11.9% CAGR. China's trillion-yuan robotics megaproject signaled state-level commitment to factory automation, while Japan proposed a 500-kilometer conveyor belt network linking Osaka and Tokyo, creating demand for high-throughput sortation nodes. Korean policy incentives added USD 128 million in grants for smart-factory deployments, and India became a production hub following Daifuku's 2025 plant opening that lowers lead times for regional customers. The automated storage and retrieval system market in Asia-Pacific therefore benefits from both domestic demand and localized manufacturing capacity.

North America remains innovation center, with hyperscale e-commerce proving grounds that set global benchmarks. Amazon introduced AI foundation models to re-route swarm robots, improving energy efficiency while increasing picks per hour, which directly influences design specifications adopted by peers. AutoStore's new headquarters in New Hampshire houses an academy that trains technicians, addressing the skill-gap restraint and underscoring the company's forecast to surpass 300 regional installations by late-2026. Latin America and Middle East and Africa are emerging corridors; Saudi pharmaceutical distributors piloted semi-automated fulfillment in 2024, and Brazilian 3PLs benefitted from tax breaks on capital goods, positioning both regions as growth white space over the next five years.

- Daifuku Co., Ltd.

- Schaefer Systems International GmbH (SSI SCHAEFER)

- Dematic Corp. (KION Group AG)

- Murata Machinery, Ltd.

- Mecalux, S.A.

- Honeywell Intelligrated, Inc.

- KUKA AG

- KNAPP AG

- Kardex Holding AG

- Toyota Industries Corporation

- Viastore Systems GmbH

- AutoStore Holdings Ltd.

- Swisslog Holding AG

- Vanderlande Industries B.V.

- Bastian Solutions LLC

- System Logistics S.p.A.

- Hanel Storage Systems

- Modula S.p.A.

- TGW Logistics Group GmbH

- BEUMER Group GmbH & Co. KG

- Stocklin Logistik AG

- Godrej Korber Supply Chain Ltd.

- Westfalia Technologies, Inc.

- Shanghai Jingxing Logistics Equipment Engineering Co., Ltd.

- Unitechnik Systems GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce fulfillment pressure

- 4.2.2 Rising labor-cost and workplace-safety mandates

- 4.2.3 Shift toward micro-fulfillment / urban DCs (under-the-radar)

- 4.2.4 Deep-freeze warehouse automation for cold-chain (under-the-radar)

- 4.2.5 Predictive-maintenance analytics boosting ROI (under-the-radar)

- 4.2.6 Industrial-policy incentives in APAC and Europe

- 4.3 Market Restraints

- 4.3.1 High initial CAPEX and long pay-back

- 4.3.2 Scarcity of ASRS-skilled technicians

- 4.3.3 Integration complexity with legacy WMS

- 4.3.4 Cyber-security vulnerabilities in connected ASRS (under-the-radar)

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Fixed-Aisle Crane Systems

- 5.1.2 Shuttle-Based Systems

- 5.1.3 Vertical Lift Modules (VLM)

- 5.1.4 Carousel Modules (Vertical and Horizontal)

- 5.1.5 Cube-Based / Robotic Cube Storage

- 5.2 By Load Type

- 5.2.1 Unit Load

- 5.2.2 Pallet Load Shuttle

- 5.2.3 Mini Load

- 5.2.4 Mid Load

- 5.2.5 Tote / Carton and Others

- 5.3 By Application

- 5.3.1 Storage and Buffering

- 5.3.2 Goods-to-Person Order Picking

- 5.3.3 Kitting and Sequencing

- 5.3.4 Assembly / Production Support

- 5.3.5 Cold-Storage and Deep-Freeze Handling

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.1.1 Automotive

- 5.4.1.2 Food and Beverages

- 5.4.1.3 Pharmaceuticals and Life Sciences

- 5.4.1.4 Electronics and Semiconductor

- 5.4.1.5 Metals and Machinery

- 5.4.2 Non-manufacturing

- 5.4.2.1 E-commerce and Retail

- 5.4.2.2 Third-Party Logistics (3PL) and Warehousing

- 5.4.2.3 Airports and Baggage Handling

- 5.4.2.4 Defense and Government Stores

- 5.4.1 Manufacturing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Daifuku Co., Ltd.

- 6.4.2 Schaefer Systems International GmbH (SSI SCHAEFER)

- 6.4.3 Dematic Corp. (KION Group AG)

- 6.4.4 Murata Machinery, Ltd.

- 6.4.5 Mecalux, S.A.

- 6.4.6 Honeywell Intelligrated, Inc.

- 6.4.7 KUKA AG

- 6.4.8 KNAPP AG

- 6.4.9 Kardex Holding AG

- 6.4.10 Toyota Industries Corporation

- 6.4.11 Viastore Systems GmbH

- 6.4.12 AutoStore Holdings Ltd.

- 6.4.13 Swisslog Holding AG

- 6.4.14 Vanderlande Industries B.V.

- 6.4.15 Bastian Solutions LLC

- 6.4.16 System Logistics S.p.A.

- 6.4.17 Hanel Storage Systems

- 6.4.18 Modula S.p.A.

- 6.4.19 TGW Logistics Group GmbH

- 6.4.20 BEUMER Group GmbH & Co. KG

- 6.4.21 Stocklin Logistik AG

- 6.4.22 Godrej Korber Supply Chain Ltd.

- 6.4.23 Westfalia Technologies, Inc.

- 6.4.24 Shanghai Jingxing Logistics Equipment Engineering Co., Ltd.

- 6.4.25 Unitechnik Systems GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment