|

시장보고서

상품코드

1849970

클라우드 보안 소프트웨어 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Cloud Security Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

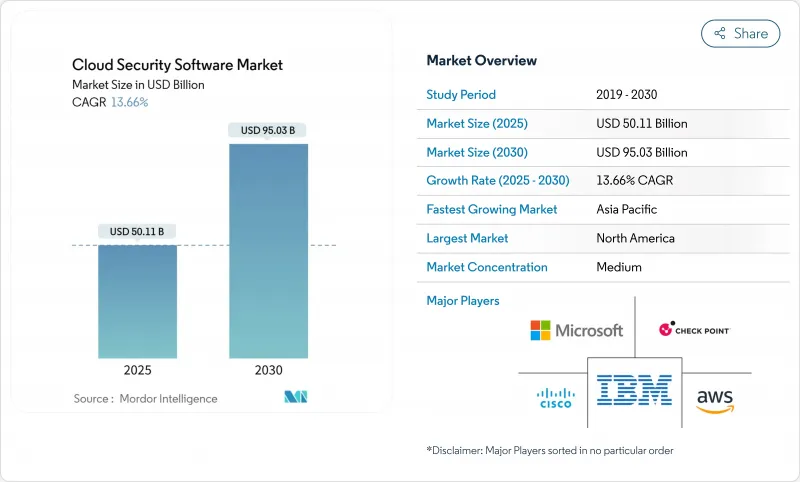

클라우드 보안 소프트웨어 시장은 현재 501억 1,000만 달러로 평가되었고, 2030년에 950억 3,000만 달러에 이를 것으로 예측되며, CAGR은 13.7%를 나타낼 전망입니다.

이러한 성장 추세는 규제 산업의 디지털 인프라 현대화 경쟁, 제로 트러스트 프레임워크의 확산, 생성형 AI 기반 위협의 출현에 의해 형성된 강력한 클라우드 보안 소프트웨어 시장 규모를 입증합니다. 강화된 규정 준수 의무, 주권 클라우드 정책, 하이퍼스케일러의 자본 지출은 멀티 클라우드 전개 전반에 걸친 통합 보안 오케스트레이션 수요를 증폭시켰습니다. 기업들이 핵심 워크로드를 퍼블릭 클라우드로 이전함에 따라, 위험 관리를 간소화하고 비즈니스 속도를 유지하기 위해 신원 관리, 런타임 보호, 자동화된 규정 준수 보고를 우선시하고 있습니다. 공급업체 간 경쟁은 이제 플랫폼 통합과 다양한 클라우드 환경 전반에 걸쳐 더 빠른 탐지, 낮은 오탐률, 원활한 통합을 약속하는 네이티브 AI 기능에 집중되고 있습니다.

세계의 클라우드 보안 소프트웨어 시장 동향 및 인사이트

규제 산업에서 퍼블릭 클라우드의 급속한 보급

규제 대상 기업들은 감독 기관의 클라우드 가이드라인 업데이트에 따라 레거시 아키텍처를 재구축하고 있습니다. 연방 금융기관 검사 위원회(FFIEC)는 실시간 제3자 위험 모니터링을 강조하며, 은행과 보험사가 규정 준수 증거를 지속적으로 검증하는 자동화된 통제 수단을 도입하도록 촉구하고 있습니다. 의료 서비스 제공자들도 마찬가지로 단순한 규제 요건 충족을 넘어 경쟁적 이점을 제공하는 보안 인증과 현대화 계획을 연계하고 있습니다. 연방 위험 및 승인 관리 프로그램(FedRAMP) 개혁은 클라우드 마이그레이션을 더욱 합법화하여 계약업체와 공급업체 전반에 걸쳐 도입 기대감을 확산시키고 있습니다. 벤더들은 사전 패키지화된 규정 준수 템플릿으로 대응하여 온보딩 시간을 단축하고, 정책을 멀티 클라우드 환경 전반에 걸친 프로그램적 가이드레일로 전환합니다.

멀티클라우드와 하이브리드 클라우드의 복잡성 급증

기업들은 일반적으로 3.2개 클라우드 공급자에서 워크로드를 운영하며, 이는 정책 사일로를 증대시키고 통합 부채를 가중시킵니다. 상이한 API와 가변적 보안 모델은 기반 인프라와 무관하게 통제 수단을 표준화할 수 있는 중앙 집중식 오케스트레이션 수요를 촉진합니다. 이에 따라 클라우드 네이티브 애플리케이션 보호 플랫폼은 컨테이너와 서버리스 함수 전반의 오구성 및 런타임 이상 현상을 탐지함으로써 선호도를 얻습니다. 기업들은 원래 다각화를 위해 멀티클라우드를 추구했으나, 이제는 비용, 성능, 관할권 요구사항이 상이해짐에 따라 운영 지속성을 유지하기 위해 오케스트레이션에 의존합니다.

기존 보안 스택과의 통합 부채

보안 리더들은 클라우드 제어 기능이 온프레미스 투자 위에 중첩되면서 중복된 도구와 일관성 없는 정책으로 고군분투합니다. 병렬 환경은 공격 경로를 모호하게 하고 운영 비용을 부풀리며, 특히 조직이 허브 앤 스포크 네트워크에 제로 트러스트 모델을 개조 적용할 때 더욱 그렇습니다. 통합된 텔레메트리 없이는 위협 인텔리전스가 사일로화되고, 대응 주기가 길어져 보안 지출 대비 수익률을 저해합니다.

부문 분석

클라우드 ID 및 접근 관리(CIAM)는 2024년 클라우드 보안 소프트웨어 시장의 34.8% 점유율을 기록하며 제로 트러스트 도입의 핵심 역할을 반영했습니다. 조직들이 측면 이동 위험 완화를 위해 최소 권한 정책을 우선시함에 따라, 이 부문의 확고한 지위는 클라우드 보안 소프트웨어 시장 전반을 뒷받침합니다. 동시에 클라우드 네이티브 애플리케이션 보호 플랫폼(CNAP)과 클라우드 워크로드 보호 플랫폼(CWPP)은 2030년까지 연평균 복합 성장률(CAGR) 14.5%를 달성할 전망입니다. 이는 런타임 보호가 필요한 컨테이너화된 워크로드의 확산을 반영합니다. 이들의 성장은 DevSecOps 파이프라인에 통합되어 개발 및 운영 전반에 걸쳐 지속적인 평가를 제공하는 클라우드 액세스 보안 브로커(CASB) 및 취약점 스캐너와 함께합니다.

통합 로깅 수요는 보안 정보 및 이벤트 관리(SIEM) 현대화를 주도하며, 머신러닝을 활용해 클라우드 규모의 텔레메트리 데이터를 분석하고 평균 탐지 시간(MTD)을 단축하는 플랫폼이 등장합니다. SEALSQ의 Crystal Kyber 및 Crystal Dilithium 쇼케이스에서 입증된 바와 같이, 공급업체들은 양자 저항 알고리즘 실험을 확대하며 암호화 경계의 장기적 진화를 예고합니다. 이러한 혁신들은 종합적으로 카테고리 경계를 재편하며, 플랫폼 벤더들이 인접 기능을 통합된 제품군에 포함시켜 구매 및 운영을 간소화하도록 장려하고 있습니다.

퍼블릭 클라우드는 2025년 2,150억 달러에 달하는 하이퍼스케일러 투자의 지지를 받아 2024년 클라우드 보안 소프트웨어 시장 규모에서 65.4%의 점유율을 유지했습니다. 아마존만 해도 750억 달러 이상을 투자해 네이티브 보안 서비스와 지리적 중복성을 강화했습니다. 퍼블릭 클라우드의 규모 이점에도 불구하고, 기업들이 워크로드 이동성, 데이터 거주지 보장, 비용 최적화를 추구함에 따라 하이브리드 및 멀티 클라우드 환경이 15.2%의 가장 빠른 연평균 성장률(CAGR)을 기록하고 있습니다.

하이브리드 환경의 복잡성은 정책 추상화 필요성을 증폭시켜, 보안 공급업체들이 쿠버네티스 클러스터, SaaS 애플리케이션, 온프레미스 자산을 아우르는 통일된 규칙을 적용하는 중앙 집중식 대시보드를 제공하도록 촉진하고 있습니다. 민감한 지적 재산권이나 지연 시간이 중요한 워크로드를 보유한 산업군에서는 프라이빗 클라우드 채택이 지속되고 있으나, 많은 기업들이 규정 준수 장벽이 완화되면 더 광범위한 퍼블릭 클라우드 채택을 위한 과도기적 단계로 프라이빗 환경을 활용하고 있습니다.

클라우드 보안 소프트웨어 시장 보고서는 소프트웨어(클라우드 IAM, CASB, CNAPP/CWPP 등), 전개 형태(퍼블릭 클라우드, 프라이빗 클라우드, 하이브리드/멀티클라우드), 조직 규모(대기업 및 중소기업), 최종 사용자 업계(은행, 금융서비스 및 보험(BFSI), IT 및 통신, 헬스케어 및 생명 과학 등), 지역별로 분류됩니다.

지역 분석

북미는 2024년 매출 점유율 41.3%를 유지하며 클라우드 보안 소프트웨어 시장에서 가장 큰 지역적 비중을 차지했습니다. 연방 위험 및 승인 관리 프로그램(FedRAMP) 현대화는 민간 기관, 계약업체 및 규제 강도 높은 산업 전반에 걸쳐 클라우드 통제에 대한 신뢰도를 높입니다. 동시에 미국 법무부 데이터 보안 프로그램은 해외 데이터 트래픽을 처리하는 통신사에 새로운 규정 준수 계층을 도입하여 중복된 규칙 세트를 조정하는 자동화된 정책 매핑 도구에 대한 기회를 창출하고 있습니다.

아시아태평양 지역은 주권 클라우드 지침, 5G 도입, 대규모 디지털화를 바탕으로 2030년까지 연평균 14.7%의 성장률을 기록하며 가장 빠르게 성장하는 지역입니다. 그러나 심각한 인재 부족이 실행 일정을 위협하고 있습니다. 일본의 기술력 격차는 교육의 시급성을 부각시키며, 대학, 클라우드 공급업체, 보안 벤더 간의 협력을 촉진해 인증 접근성을 확대하고 있습니다. 중국은 주권 요구사항을 충족하기 위해 국내 개발 보안 스택을 발전시키는 반면, 인도는 다양한 기업 기반을 지원하기 위해 저비용 확장형 솔루션을 강조합니다. 호주, 뉴질랜드, 한국은 선진 네트워크 인프라를 활용해 금융 거래 및 스마트 공장 환경에 저지연 보호를 보장하는 실시간 위협 탐지 플랫폼을 도입하고 있습니다.

유럽은 혁신과 주권 사이의 미묘한 균형을 모색 중입니다. 일반 데이터 보호 규정(GDPR)과 진화하는 네트워크 및 정보 보안 지침(NIS Directive)은 데이터 현지화 옵션과 투명한 감사 추적을 제공하는 공급업체를 선호하는 조달 기준을 형성합니다. 독일은 제조업 분야 도입을 선도하는 반면, 프랑스는 국가 호스팅 클라우드 존에 투자하여 핵심 인프라 프로젝트를 뒷받침합니다. 브렉시트 이후 영국은 자체 데이터 보안 입장을 수립하면서도 국경 간 전송을 용이하게 할 만큼 충분히 조율하고 있습니다. 지역적 조화 노력은 공급업체 진입을 단순화하지만, 지침 이행에 대한 국가별 상이한 일정은 여전히 통일된 출시 전략을 복잡하게 만듭니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 규제 산업에서 퍼블릭 클라우드 도입이 급증

- 멀티클라우드와 하이브리드 클라우드 복잡성 급증

- 제로 트러스트 아키텍처 의무화

- 생성형 AI 기반 위협 벡터

- 사이버 보험료 인센티브

- EU 및 APAC 지역의 주권 클라우드 이니셔티브

- 시장 성장 억제요인

- 기존 보안 스택과의 통합 부채

- 클라우드 네이티브 기술 인력 부족

- 관할권 간 규정 준수 충돌

- 지속되는 섀도우 IT 및 BYOD(개인 기기 업무 사용) 행위

- 밸류체인 분석

- 규제와 규정 준수의 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 소프트웨어별

- 클라우드 IAM

- CASB

- CNAPP/CWPP

- 취약성 및 리스크 관리

- 웹, 메일, DNS 보안

- SIEM과 로그 관리

- 전개 모드별

- 퍼블릭 클라우드

- 프라이빗 클라우드

- 하이브리드/멀티클라우드

- 조직 규모별

- 대기업

- 중소기업

- 최종 사용자 업계별

- BFSI

- IT 및 통신

- 헬스케어 및 생명과학

- 소매 및 소비재

- 제조업

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Palo Alto Networks

- Cisco Systems

- Fortinet

- Zscaler

- Check Point Software

- IBM

- Broadcom(CA Technologies)

- Microsoft

- Trend Micro

- Okta

- CrowdStrike

- Rapid7

- Amazon Web Services(Security services)

- Google Cloud Security

- HPE(Aruba)

- Proofpoint

- Sophos

- Imperva

- Netskope

- Qualys

- F5 Networks

제7장 시장 기회와 장래의 전망

HBR 25.11.14The cloud security software market currently generates USD 50.11 billion and is projected to reach USD 95.03 billion by 2030, advancing at a 13.7% CAGR.

This growth trajectory confirms a robust cloud security software market size that is shaped by regulated industries racing to modernize digital infrastructure, the embrace of zero-trust frameworks, and the emergence of generative-AI-driven threats. Heightened compliance obligations, sovereign-cloud policies, and capital spending by hyperscalers have amplified demand for unified security orchestration across multi-cloud deployments. As enterprises shift critical workloads to the public cloud, they prioritize identity management, runtime protection, and automated compliance reporting to streamline risk management and sustain business velocity. Vendor competition now centers on platform consolidation and native AI capabilities that promise faster detection, lower false-positive rates, and seamless integration across diverse cloud environments.

Global Cloud Security Software Market Trends and Insights

Fast-growing Public-cloud Adoption Among Regulated Industries

Regulated enterprises are re-tooling legacy architectures as supervisory bodies update cloud guidance. The Federal Financial Institutions Examination Council now stresses real-time third-party risk monitoring, prompting banks and insurers to adopt automated controls that verify compliance evidence continuously. Healthcare providers likewise align modernization plans with security certifications that deliver competitive benefit rather than mere regulatory box-ticking. Federal Risk and Authorization Management Program reforms further legitimize cloud migrations, cascading adoption expectations across contractors and suppliers. Vendors respond with pre-packaged compliance templates that shorten onboarding times and translate policy into programmatic guardrails across multi-cloud estates.

Surge in Multi-cloud and Hybrid-cloud Complexity

Enterprises typically run workloads on 3.2 cloud providers, multiplying policy silos and integration debt. Disparate APIs and variable security models fuel demand for centralized orchestration able to normalize controls independent of underlying infrastructure. Cloud-native application protection platforms thus gain favor by detecting misconfigurations and runtime anomalies across containers and serverless functions. Organizations originally pursued multi-cloud for diversification but now rely on orchestration to maintain operational viability as cost, performance, and jurisdictional requirements diverge.

Integration Debt with Legacy Security Stacks

Security leaders grapple with duplicated tooling and inconsistent policies as cloud controls overlay on-premises investments. Parallel environments obscure attack paths and inflate operating costs, especially when organizations retrofit zero-trust models onto hub-and-spoke networks. Without unified telemetry, threat intelligence remains siloed, and remediation cycles extend, undermining return on security spend.

Other drivers and restraints analyzed in the detailed report include:

- Zero-trust Architecture Mandates

- Generative-AI-driven Threat Vectors

- Cloud-native Skills Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud Identity and Access Management accounted for a 34.8% cloud security software market share in 2024, reflecting its cornerstone role in zero-trust rollouts. The segment's entrenched status underpins the broader cloud security software market as organizations prioritize least-privilege policies to mitigate lateral movement risks. Simultaneously, Cloud-Native Application Protection Platforms and Cloud Workload Protection Platforms achieve a 14.5% CAGR through 2030, mirroring the proliferation of containerized workloads that require runtime safeguards. Their ascent joins Cloud Access Security Brokers and vulnerability scanners that integrate within DevSecOps pipelines, offering continuous assessment across development and production.

Demand for unified logging drives Security Information and Event Management modernization, with platforms leveraging machine learning to parse cloud-scale telemetry and accelerate mean-time-to-detect. Vendors further experiment with quantum-resistant algorithms, as demonstrated by SEALSQ's Crystal Kyber and Crystal Dilithium showcase, signaling the long-term evolution of encryption boundaries. These innovations collectively reshape category borders, encouraging platform vendors to fold adjacent capabilities into consolidated suites for simplified procurement and operations.

Public cloud retained 65.4% share of the cloud security software market size in 2024, buoyed by hyperscaler investments that reached USD 215 billion in 2025. Amazon alone allocated more than USD 75 billion, augmenting native security services and geographic redundancy. Despite public cloud scale advantages, hybrid and multi-cloud environments post the fastest 15.2% CAGR as enterprises seek workload portability, data residency assurance, and cost optimization.

Hybrid complexity magnifies the need for policy abstraction, prompting security providers to offer central dashboards that push uniform rules across Kubernetes clusters, SaaS applications, and on-premises assets. Private cloud adoption persists among industries with sensitive intellectual property or latency-critical workloads, though many treat private environments as transitional waypoints toward broader public adoption once compliance hurdles ease.

The Cloud Security Software Market Report is Segmented by Software (Cloud IAM, CASB, CNAPP / CWPP, and More), Deployment Mode (Public Cloud, Private Cloud, and Hybrid / Multi-Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End-User Industry (BFSI, IT and Telecom, Healthcare and Life-Sciences, and More), and Geography.

Geography Analysis

North America retained a 41.3% revenue share in 2024, signifying the largest regional slice of the cloud security software market. Federal Risk and Authorization Management Program modernization boosts confidence in cloud controls across civilian agencies, contractors, and heavily regulated industries. Concurrently, the U.S. Department of Justice Data Security Program introduces fresh compliance layers for telecommunications firms handling foreign data traffic, generating opportunities for automated policy-mapping tools that reconcile overlapping rule sets.

Asia-Pacific is the fastest-growing territory with a 14.7% CAGR through 2030, underpinned by sovereign-cloud directives, 5G rollout, and broad-scale digitization. Yet acute talent shortages threaten execution timelines. Japan's skills deficit underscores the training imperative, spurring partnerships between universities, cloud providers, and security vendors to expand certification access. China advances domestically sourced security stacks to meet sovereignty mandates, whereas India emphasizes low-cost, scalable solutions to service a diverse enterprise base. Australia, New Zealand, and South Korea leverage advanced network infrastructure to adopt real-time threat detection platforms that ensure low-latency protection for financial trading and smart-factory environments.

Europe navigates the delicate balance between innovation and sovereignty. General Data Protection Regulation and the evolving Network and Information Security Directive shape procurement criteria that favor providers offering data-localization options and transparent audit trails. Germany leads adoption in manufacturing, while France invests in nationally hosted cloud zones to underpin critical infrastructure projects. Post-Brexit, the United Kingdom crafts its own data security stance yet aligns closely enough to facilitate cross-border transfers. Regional harmonization efforts simplify vendor entry, although divergent national timelines for directive transposition continue to complicate uniform rollout strategies.

- Palo Alto Networks

- Cisco Systems

- Fortinet

- Zscaler

- Check Point Software

- IBM

- Broadcom (CA Technologies)

- Microsoft

- Trend Micro

- Okta

- CrowdStrike

- Rapid7

- Amazon Web Services (Security services)

- Google Cloud Security

- HPE (Aruba)

- Proofpoint

- Sophos

- Imperva

- Netskope

- Qualys

- F5 Networks

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Fast-growing public-cloud adoption among regulated industries

- 4.2.2 Surge in multi-cloud and hybrid-cloud complexity

- 4.2.3 Zero-trust architecture mandates

- 4.2.4 Generative-AI-driven threat vectors

- 4.2.5 Cyber-insurance premium incentives

- 4.2.6 Sovereign-cloud initiatives in EU and APAC

- 4.3 Market Restraints

- 4.3.1 Integration debt with legacy security stacks

- 4.3.2 Cloud-native skills shortage

- 4.3.3 Compliance conflicts across jurisdictions

- 4.3.4 Persistent shadow-IT and BYOD behaviour

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Compliance Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Software

- 5.1.1 Cloud IAM

- 5.1.2 CASB

- 5.1.3 CNAPP / CWPP

- 5.1.4 Vulnerability and Risk Management

- 5.1.5 Web, Email and DNS Security

- 5.1.6 SIEM and Log Management

- 5.2 By Deployment Mode

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid / Multi-Cloud

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 IT and Telecom

- 5.4.3 Healthcare and Life-Sciences

- 5.4.4 Retail and Consumer Goods

- 5.4.5 Manufacturing

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Palo Alto Networks

- 6.4.2 Cisco Systems

- 6.4.3 Fortinet

- 6.4.4 Zscaler

- 6.4.5 Check Point Software

- 6.4.6 IBM

- 6.4.7 Broadcom (CA Technologies)

- 6.4.8 Microsoft

- 6.4.9 Trend Micro

- 6.4.10 Okta

- 6.4.11 CrowdStrike

- 6.4.12 Rapid7

- 6.4.13 Amazon Web Services (Security services)

- 6.4.14 Google Cloud Security

- 6.4.15 HPE (Aruba)

- 6.4.16 Proofpoint

- 6.4.17 Sophos

- 6.4.18 Imperva

- 6.4.19 Netskope

- 6.4.20 Qualys

- 6.4.21 F5 Networks

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment