|

시장보고서

상품코드

1686654

제조업의 디지털 전환 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Digital Transformation In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

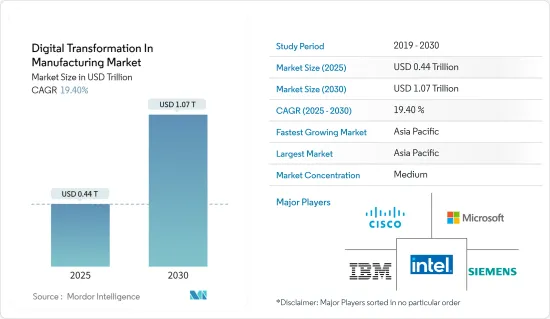

제조업의 디지털 전환 시장 규모는 2025년에 4,400억 달러로 추정되고, 2030년에는 1조700억 달러에 달할 것으로 예측되며, 예측 기간 중(2025-2030년) CAGR은 19.4%를 나타낼 전망입니다.

주요 하이라이트

- 제조 부문의 디지털화는 운영과 공급망의 모든 측면에 영향을 미칩니다.

- 또한 사물 인터넷(IoT) 디바이스의 광범위한 사용은 산업 프로세스를 전환하고 생산성을 높이고 있습니다.

- 이러한 도구의 도움으로 이해관계자, 시스템, 기계가 보다 쉽게 소통하고 협력하여 프로세스를 간소화하고 다운타임을 줄일 수 있습니다. 제조업체는 IoT 디바이스를 통합함으로써 품질 관리를 개선하고 실시간으로 재고를 관리하며 공급망 가시성을 향상시킬 수 있습니다.

- 하지만 디지털 전환에는 상당한 초기 비용이 소요됩니다. IoT 기기 및 자동화 시스템을 포함한 새로운 기술을 구현하려면 하드웨어, 교육, 소프트웨어, 인프라에 막대한 비용을 지출해야 하는 경우가 많으며, 이는 특정 비즈니스에 재정적 어려움을 초래하여 시장 확장에 걸림돌이 될 수 있습니다.

- 코로나19는 제조업의 디지털 전환을 가속화했습니다. 공급망과 근로자의 가용성이 중단되면서 기업들은 위험을 줄이고 운영 효율성을 개선할 수 있는 기술적 솔루션을 모색했습니다. 자동화, 원격 모니터링, 데이터 분석은 제조 절차를 간소화하고 재고를 관리하며 작업자의 안전을 보장하는 데 필수적이었습니다. 제조업체는 실시간 데이터 분석, 원격 협업, 예측 유지보수를 용이하게 하는 복원력과 민첩성을 강화하는 동시에 다가오는 도전에 맞서 클라우드 기반 플랫폼, IoT 기기, 인공 지능을 구현했습니다.

제조업의 디지털 전환 시장 동향

주요 시장 점유율을 차지할 사물 인터넷(IoT)

- 사물 인터넷은 물리적 장치와 센서를 인터넷에 연결하여 스마트하고 연결된 시스템을 만드는 디지털 전환의 핵심 동력입니다.

- 제조업은 디지털 전환을 강화하고 운영 효율성을 높일 수 있는 중요한 원동력으로서 IoT에 집중하고 있습니다.

- 사물 인터넷은 새로운 투자 기회를 창출하고, 고객 경험을 개선하고, 생산성을 높이고, 운영 비용과 효율성을 낮추고, 비즈니스 모델을 강화함으로써 조직의 디지털 전환에 영향을 미칩니다.

- 전반적으로 제조업체는 IoT 기술을 활용하여 프로세스를 최적화하고 생산성을 개선하며 비용을 절감하고 있습니다.

가장 빠른 성장을 기록한 아시아태평양 지역

- 중국의 제조업은 최근 몇 년 동안 디지털 혁명을 경험했습니다.

- 중국은 스마트 제조를 위해 로봇 공학, IoT, 빅데이터 분석, AI, 클라우드 컴퓨팅 기술과 같은 혁신 기술에 상당한 투자를 했습니다.

- 일본은 로봇 공학 및 자동화의 주요 공급국이며, 디지털 전환으로 인해 로봇 도입이 더욱 촉진되고 있습니다.

- 또한 일본은 최근 몇 년 동안 디지털 트윈 기술 개발 및 적용 분야에서 글로벌 리더가 되었습니다. 디지털 트윈은 분석, 시뮬레이션 및 최적화에 사용할 수 있는 실제 사물, 시스템 또는 절차의 가상 표현입니다.

- 인도 정부는 제조업 부문의 디지털 전환을 장려하기 위해 '메이크 인 인디아'와 '디지털 인디아'를 도입했습니다. 이는 사업을 더 쉽게 하고, 인프라 및 기술 투자를 촉진하며, 제조업에서 디지털 기술 사용을 촉진하기 위한 입법 지원과 인센티브를 제공하고자 합니다. 또한 인도 제조업 부문에서 IIoT 도입이 가속화되고 있습니다.

- 아시아태평양에서는 로봇 공학 및 자동화 기술이 제조 업계에 빠르게 도입되고 있습니다.

제조의 디지털 전환 개요

많은 솔루션 제공업체와 업계의 기술 발전으로 인해 디지털 전환의 경쟁은 상당히 치열합니다. 특히, 기업들은 시장 점유율을 유지하고 신규 및 기존 소비자를 유지하기 위해 가격 책정 방식을 조정하여 다른 기업에 가격 압박을 가하고 시장 경쟁력을 강화하는 경우가 많습니다. 또한 기업들은 경쟁력 있는 가격으로 새로운 제품을 생산하고 인수하는 등의 기술을 지속적으로 추구하고 있어 기업 간 경쟁이 치열해지고 있습니다.

- 2023년 3월, Mitsubishi Electric은 iOS와 안드로이드 플랫폼을 위한 무료 모바일 애플리케이션를 발표했습니다.

- 2023년 2월, Oracle은 빠르게 증가하는 클라우드 서비스 수요를 충족하기 위해 특히 사우디아라비아에 세 번째 퍼블릭 클라우드 리전을 개설할 계획을 발표했습니다. 이 새로운 클라우드 리전은 사우디아라비아의 전반적인 클라우드 인프라 역량을 확장하기 위해 Oracle이 계획 중인 15억 달러 투자 계획의 일부가 될 것입니다. Oracle 클라우드는 머신러닝, AI, IoT와 같은 핵심 기술 분야에서 선구적인 혁신을 제공합니다. 이는 사우디 비전 2030의 필수 요소인 경제 성장과 디지털 전환을 촉진하는 데 도움이 될 것입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 밸류체인 분석

- 기술 스냅샷

제5장 시장 역학

- 시장 성장 촉진요인

- 비용 효율적인 프로세스를 향한 제조업체의 성향

- IoT의 확산

- 시장 성장 억제요인

- 기술 전문성 부족

제6장 시장 세분화

- 기술별

- 로봇 공학

- IoT

- 3D 프린팅 및 적층 제조

- 사이버 보안

- 기타 기술

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Cisco Systems Inc.

- Microsoft Corporation

- Intel Corporation

- IBM Corporation

- Siemens AG

- SAP SE

- Nortonlifelock Inc.

- Oracle Corporation

- Schneider Electric SE

- Mitsubishi Electric Corporation

- General Electric Company

- ABB Ltd

제8장 투자 분석

제9장 시장의 미래

HBR 25.05.02The Digital Transformation In Manufacturing Market size is estimated at USD 0.44 trillion in 2025, and is expected to reach USD 1.07 trillion by 2030, at a CAGR of 19.4% during the forecast period (2025-2030).

Key Highlights

- The digitalization of the manufacturing sector impacts every aspect of operations and the supply chain. It begins with the design of the equipment and continues with the product design, production process development, and, finally, the monitoring and improvement of the end-user experience. Through cross-border collaboration, digital transformation is revolutionizing how manufacturers communicate and maintain product and engineering design specifications on the cloud.

- In addition, the widespread use of Internet of Things (IoT) devices is transforming industrial processes and increasing productivity. IoT devices enable real-time monitoring, gathering, and analyzing data on various industrial processes. It enables preventative maintenance, reduces energy use, and boosts overall productivity.

- With the help of these tools, stakeholders, systems, and machines can communicate and work together more easily, streamlining processes and decreasing downtime. By integrating IoT devices, manufacturers can improve quality control, manage inventories in real-time, and improve supply chain visibility.

- However, there are significant up-front expenses related to digital transformation. Implementing new technologies, including IoT gadgets and automation systems, frequently necessitates large expenditures in hardware, training, software, and infrastructure, which can be financially challenging for certain businesses, impeding market expansion.

- The COVID-19 outbreak expedited the manufacturing industry's digital transition. As supply chains and worker availability were disrupted, businesses sought technological solutions to reduce risks and improve operational effectiveness. Automation, remote monitoring, and data analytics were essential for streamlining manufacturing procedures, controlling inventory, and guaranteeing worker safety. Along with enhancing resilience and agility to facilitate real-time data analysis, remote collaboration, and predictive maintenance, manufacturers implemented cloud-based platforms, IoT gadgets, and artificial intelligence in the face of upcoming challenges. This rapid digitization also cleared the way for smarter, more integrated factories to boost efficiency and creativity in the post-pandemic period.

Digital Transformation in Manufacturing Market Trends

Internet-of-Things (IoT) to Hold Major Market Share

- The Internet of Things is a key driver of digital transformation that connects physical devices and sensors to the Internet, creating smart and connected systems. This connection enables real-time data collection and analysis, improving operational efficiency, better decision-making, new business models, and increased automation across various industries.

- Manufacturing businesses are concentrating on IoT as the critical enabler to augment digital transformation and unlock operational efficiencies. It facilitates the collection and analysis of real-time data, enabling organizations to make informed decisions and optimize manufacturing and related processes.

- The Internet of Things impacts organizations' digital transformation by creating new investment opportunities, improving customer experience, increasing productivity, lowering operational costs and efficiency, and empowering business models. It became essential for industries, including healthcare, government and education, security, communication, and others, owing to numerous benefits that could act as a competitive factor in the coming years.

- The market is expanding positively as IoT technology is increasingly used in manufacturing. The Internet of Things (IoT) is driving the next industrial revolution of intelligent connectivity as the traditional manufacturing sector transforms digitally. It is transforming how businesses handle the increasingly complex systems and machines they use to increase productivity and minimize downtime. According to Ericsson, ioT connections are anticipated to increase from USD 13.20 billion in 2022 to USD 34.70 billion by 2028 at a CAGR of over 18%.

- Overall, manufacturers are optimizing processes, improving productivity, and reducing costs by leveraging IoT technologies. It is to gain a competitive edge in the rapidly involving manufacturing industry across the globe and driving digital transformation in the manufacturing sectors. The market's growth is likely to continue with the development of the manufacturing industry and the adoption of IoT over the forecast period.

Asia-Pacific to Register Fastest Growth

- China's manufacturing sector saw a digital revolution in recent years. The Chinese government actively supports digital technologies in traditional manufacturing processes to increase production, efficiency, and innovation.

- China invested significantly in innovative technologies like robotics, IoT, Big Data Analytics, AI, and cloud computing technologies for smart manufacturing. With the help of these technologies, industrial processes can become optimized, and preventative maintenance is made possible. It significantly boosts productivity and lowers costs, boosting the market's growth opportunities.

- Japan is a significant provider of robotics and automation, and digital transformation is further driving their adoption. Advanced robots are used in various manufacturing processes for packaging, assembly, and material handling tasks. Automation helps improve efficiency, reduce errors, and enhance workplace safety.

- Moreover, Japan became a global leader in digital twin technologies creation and application in recent years. Digital twins are virtual representations of actual things, systems, or procedures that can be used for analysis, simulation, and optimization. They can enhance product design, lower costs, and boost manufacturing effectiveness. This technique is used in many industries in Japan, including manufacturing.

- The Indian government introduced "Make in India" and "Digital India" to encourage the manufacturing sector's digital transformation. These initiatives seek to make doing business easier, promote infrastructure and technology investments, and offer legislative support and incentives to hasten the use of digital technologies in manufacturing. Also, IIoT adoption is accelerating in the Indian manufacturing sector. IIoT offers real-time data collection, remote monitoring, and predictive maintenance by integrating machines, sensors, and devices. It aids producers in streamlining operations, decreasing downtime, and enhancing overall equipment performance.

- In the Asia-Pacific region, robotics and automation technologies are rapidly being widely adopted in the manufacturing industry. Advanced robots are increasingly used in assembly lines, material handling, and other repetitive operations to increase efficiency, productivity, and product quality. Automation enables industries to respond rapidly to shifting market demands while lowering labor costs and improving precision.

Digital Transformation in Manufacturing Industry Overview

The competition in digital transformation is considerable due to the availability of many solution providers and technological improvements in the industry. Notably, firms often adjust their pricing methods to maintain market share and retain new and existing consumers, placing pricing pressure on other companies and boosting market competitiveness. Furthermore, firms are continually pursuing techniques such as acquisitions and the production of new goods at competitive prices, increasing competition among organizations. Some significant players in the market are Cisco Systems Inc., Microsoft Corporation, Intel Corporation, IBM Corporation, and Siemens AG.

- In March 2023, Mitsubishi Electric launched a free mobile application for iOS and Android platforms. It is for searching and comparing its factory automation products to make it easier to identify relevant products to aid digital manufacturers quickly.

- In February 2023, Oracle declared plans to open a third public cloud region, especially in Saudi Arabia, to fulfill the rapidly growing demand for its cloud services. Located in Riyadh, the new cloud region will be part of a planned USD 1.5 billion investment by Oracle to expand its overall cloud infrastructure capabilities in the Kingdom. Oracle Cloud delivers pioneering innovation in key technologies like Machine Learning, AI, and IoT. It will help fuel economic growth and digital transformation, an integral part of Saudi Vision 2030.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Inclination of Manufacturers Toward Cost-efficient Processes

- 5.1.2 Proliferation of IoT

- 5.2 Market Restraints

- 5.2.1 Lack of Technical Expertise

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Robotics

- 6.1.2 IoT

- 6.1.3 3D Printing and Additive Manufacturing

- 6.1.4 Cybersecurity

- 6.1.5 Other Technologies

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United kingdom

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 Intel Corporation

- 7.1.4 IBM Corporation

- 7.1.5 Siemens AG

- 7.1.6 SAP SE

- 7.1.7 Nortonlifelock Inc.

- 7.1.8 Oracle Corporation

- 7.1.9 Schneider Electric SE

- 7.1.10 Mitsubishi Electric Corporation

- 7.1.11 General Electric Company

- 7.1.12 ABB Ltd