|

시장보고서

상품코드

1639527

PH 센서 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)PH Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

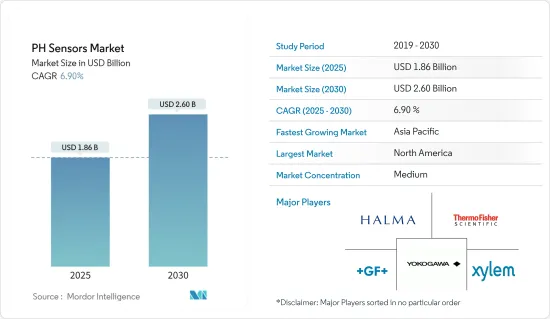

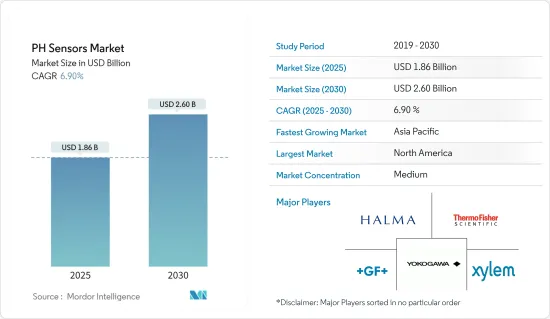

PH 센서 시장 규모는 2025년에 18억 6,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 6.9%의 CAGR로 2030년에는 26억 달러에 달할 것으로 예상됩니다.

시장 성장의 원동력은 물, 폐수, 크롬, 양식업의 처리 플랜트에서 pH 센서 및 분석기 사용이 급증하고 있으며, pH 센서는 약물 효율을 모니터링하고 의약품 제조에 최적의 pH 수준을 제공하여 시장을 더욱 견인하고 있습니다.

주요 하이라이트

- 또한, 전 세계적으로 산업 자동화에 대한 요구가 증가하고 있는 것도 pH 센서 시장 개척을 촉진하는 중요한 요소 중 하나입니다. 또한, 인도 정부는 중요 출발 원료(KSM)/의약품 중간체 및 기능성 의약품 원료(API)를 위한 16개 공장에 대한 PLI 계획을 승인했습니다. 이 16개 공장 설치에 4,701만 달러가 투자될 예정입니다. 이들 공장의 상업적 개발은 2023년 4월까지 시작될 예정입니다. 또한 정부는 최근 전자 및 IT 하드웨어 제조 업그레이드에 3억 6,232만 달러, 인도 내 하이브리드 및 전기자동차의 신속한 도입 및 제조(FAME-India)에 1억 4,250만 달러의 예산을 배정했습니다.

- ZVEI(독일전기전자산업협회)는 이러한 상황이 계측 프로세스 자동화 산업에 유리한 비즈니스 환경을 조성하는 동시에 pH 센서, 분석기 등 프로세스 분석 기기에 대한 수요를 증가시키고 있다고 지적했습니다.

- 또한, 산업 폐수 및 도시 폐수처리에 대한 정부의 엄격한 규제는 재활용 및 재사용 시스템에서 수처리 기술의 진화를 촉진하고 있으며, 이는 예측 기간 동안 조사된 시장을 더욱 활성화할 수 있습니다.

- NITI Aayog에 따르면, 인도의 폐수처리 플랜트 시장은 전국 지자체 및 하수 처리 시설에 대한 수요 증가로 인해 2025년까지 43억 달러 규모로 확대될 것으로 예상됩니다.

- 또한, 세계 각국은 물 인프라 및 담수화 프로젝트에 상당한 투자를 하고 있습니다. 예를 들어, 칠레 중앙 정부는 향후 몇 년 동안 물 인프라에 2억 8,000만 달러의 자금을 투입할 예정입니다. 또한, 각국은 수처리 및 폐수처리를 촉진하기 위한 장려책을 전 세계적으로 시행하고 있으며, 이는 pH 센서 및 분석기 시장을 촉진할 것으로 예상됩니다.

- 그러나 비용의 제약과 확립된 표준의 필요성이 시장 성장을 억제하고 있습니다. 조합 pH 센서, 차동 pH 센서, 실험실용 pH 센서, 공정용 pH 센서 등 많은 pH 센서가 활용되고 있으며, 높은 상업적 수용성을 보이고 있습니다. 그러나 그 동작에 관한 표준은 제한적입니다. 이러한 기술은 서로 다르고 호환되지 않습니다. 낮은 인지도, 낮은 수용성, 이들 센서가 제공하는 불합리한 품질 기준도 시장 성장의 걸림돌이 될 수 있습니다.

pH 센서 시장 동향

상하수도 분야가 큰 폭의 성장세 기록

- 상하수도 산업은 환경 기관의 인식과 환경 상황의 증가로 인해 개별 시장에서 가장 큰 수직적 부문을 차지하고 있습니다. 크롬 폐수처리 및 양식업과 같은 표준 응용 분야는 필요한 안전 표준을 제공하기 위해 정확한 pH 및 ORP 측정에 크게 의존하고 있으며, 이는 시장에 일정한 수요를 가져옵니다.

- 북미, 유럽, 아시아태평양 등의 지역에서는 지속가능한 에너지 프로젝트가 크게 성장하고 있습니다. 수처리 및 해수 담수화와 같은 수처리 노력은 지자체 및 산업 부문에서 빠르게 확산되고 있으며, pH 센서에 대한 요구가 증가하고 있습니다.

- Thames Water에 따르면, 회사는 2022년 3월 회계 연도에 매일 46억 리터의 폐수를 처리했으며, 버크셔 주 레딩에 설립되어 353 개의 하수 처리 시설을 보유하고 있습니다. 또한 런던과 템스 밸리 지역의 1,500만 명 이상의 고객에게 매일 25억 리터의 식수를 공급하고 있습니다.

- 전 세계적으로 수처리 플랜트의 증가와 물 부족 상황이 해수담수화 분야에서 pH 센서의 필요성을 불러일으키고 있습니다. 물의 pH는 해수담수화 시스템의 처리 시스템을 제어하기 위한 중요한 데이터입니다. 예를 들어, 2022년 11월, 수처리 솔루션 제공업체인 Daiki Axis Japan은 인도 할리야나주에 제2공장을 설립할 예정이며, 투자금액은 20억 인도 루피입니다.

- 또한, 화학, 물, 폐수 산업의 투자도 증가할 것으로 예상됩니다. 예를 들어, 2022년 7월 미국 농무부(The U.S. Department of Agriculture, USDA)는 농촌 지역의 물 인프라에 대한 접근성을 개발하고 식민지, 농촌, 부족 사회에 살고 일하는 사람들을 위한 경제적 기회를 마련하기 위해 1,300만 달러를 투자했습니다. 이 투자에는 900만 달러가 포함되어 있으며, 사회적으로 취약한 지역사회에 거주하는 약 14,000명을 지원할 예정입니다.

- 또한, 2022년 8월, 바이든-해리스 행정부는 EPA-USDA Partnership to deliver Wastewater Sanitation to Underserved Rural America를 발표하였습니다.

아시아태평양이 큰 폭의 시장 성장을 이룰 것입니다.

- 아시아태평양은 신흥 경제, 기술 발전에 대한 인식 증가, 제약 및 생명공학 산업의 발전, 제조업에 대한 인식 증가, 자금 조달을 위한 정부 이니셔티브 증가로 인해 향후 몇 년 동안 PH 센서 시장이 유리하게 성장할 것으로 예상됩니다.

- IBEF에 따르면 인도 정부는 2024년까지 3억 5,000만 인도 루피(465억 달러)를 투자하여 해안 지역에 다양한 처리 시설과 해수 담수화 플랜트를 설치하여 현재 수원을 강화하는 'Jal Jeevan' 계획에 투자할 예정입니다. 이 임무는 또한 기존 물 공급과 연결이 작동하고, 수질이 유지되고, 지속가능한 농업이 달성되기를 희망하고 있습니다.

- 또한 2022년 2월, 에너지 자원 연구소(TERI)가 보고한 자료에 따르면, 2022년까지 물 수요는 1,180BCM으로 확대될 것으로 예상됩니다. 폐수처리에서 이러한 물의 확대는 향후 조사 대상 시장의 성장을 더욱 촉진할 수 있습니다.

- 또한 중국에서는 인프라 프로젝트가 증가함에 따라 많은 물 재이용 및 폐수처리 대책이 pH 센서와 분석기를 필요로 하고 있습니다. 예를 들어, 국제 물 협회의 통계에 따르면, 중화인민공화국의 수도인 베이징에서는 생활 폐수의 4분의 1을 재사용하고, 산업 폐수의 85%까지 처리를 강화하고 있습니다.

- IBEF에 따르면, 2022년 5월 ONGC는 인도에서 탐사 활동을 확대하기 위해 22-25년 동안 40억 달러를 투자할 계획을 발표했으며, 석유 및 가스 프로젝트에 대한 투자 증가는 이 지역의 pH 측정 수요를 더욱 증가시켰습니다.

- 또한 2022년 3월, Oil India 이사회는 Numaligarh 석유화학 프로젝트에 655억 5,000만 인도 루피(8억 3,949만 달러)를 투자하는 것을 승인했습니다. 또한, 석유 부문의 잠정적인 정유소 설치 용량은 2억 4,921만 톤으로, IOC는 7,005만 톤의 용량을 가진 국내 최대 정유소가 되었습니다.

pH 센서 산업 개요

pH 센서 시장은 Halma PLC, Thermo Fisher Scientific Inc., Xylem Inc. Systems Ltd.와 같은 소수의 중요한 진입 기업이 존재합니다. 시장 점유율 우위를 유지하고 있는 주요 기업들은 해외 국가에서의 고객 기반 확대에 주력하고 있습니다. 이들 기업은 시장 점유율과 수익성을 높이기 위해 전략적 제휴 이니셔티브를 활용하고 있습니다. 또한, 시장 선도 기업들은 pH 센서 개발 스타트업들을 인수하여 제품 역량을 강화하는 데 주력하고 있습니다.

- 2023년 2월 - Rajguru Electronics는 모든 액체의 수소 전위(pH)를 계산하는 센서인 ADIY pH 센서 모듈을 출시했습니다. 이 센서는 수용액 내 수소 이온 활성을 정확하게 측정할 수 있는 저비용 센서입니다. 또한, pH 지시약 용액이나 리트머스 검사보다 정확도가 높습니다. 이 센서는 Raspberry Pi나 Arduino와 쉽게 통합할 수 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 역학

- 시장 성장 촉진요인

- 정부 규제 증가

- 산업 설비의 안전성에 대한 관심 상승

- 시장 성장 억제요인

- pH 센서 디바이스 비용과 표준화의 결여

제6장 시장 세분화

- 유형별

- 벤치톱형 분석기

- 휴대용 분석기

- 프로세스 애널라이저

- 용도별

- 상하수도

- 의료

- 석유 및 가스

- 식품 및 음료

- 산업용

- 기타

- 지역별

- 북미

- 유럽

- 아시아

- 호주·뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 개요

- Halma Plc.

- Thermo Fisher Scientific Inc.

- Xylem Inc.

- Yokogawa Electric Corporation

- Georg Fischer Piping Systems Ltd

- Honeywell International Inc.

- KOBOLD Messring GmbH

- Emerson Electric Co.

- Schneider Electric SE(Foxboro)

- ABB Ltd

- Hach Company Inc.(Danaher Corporation)

- Endress+Hauser AG

- Mettler-Toledo International Inc.

제8장 투자 분석

제9장 시장 전망

ksm 25.02.10The PH Sensors Market size is estimated at USD 1.86 billion in 2025, and is expected to reach USD 2.60 billion by 2030, at a CAGR of 6.9% during the forecast period (2025-2030).

The market growth is driven by the surge in the usage of pH sensors and analyzers in water, wastewater, chromium, and aquaculture treatment plants for formulating precise readings of the oxidation-reduction potential and pH levels. pH sensors monitor drug efficiency and provide optimal pH levels for pharmaceutical manufacturing, further driving the market.

Key Highlights

- Further, the growth in the need for industrial automation around the globe is one of the essential elements driving the development of the pH sensors market. Additionally, the government of India sanctioned a PLI scheme for 16 plants for critical starting materials (KSM)/drug intermediates and functional pharmaceutical ingredients (APIs). Installing these 16 plants would result in a total investment of USD 47.01 million. The commercial development of these plants is anticipated to begin by April 2023. Furthermore, the government lately allocated USD 362.32 million to upgrade electronics and IT hardware manufacturing and USD 104.25 million for the Faster Adoption & Manufacturing of Hybrid and Electric automobiles in India (FAME - India).

- ZVEI (German Electrical and Electronic Manufacturers' Association) specified that these circumstances created a favorable business environment for the measurement and process automation industry while raising the need for process analytics instruments, such as pH sensors and analyzers.

- In addition, Stringent government rules over industrial and municipal wastewater disposal are driving the water treatment technology need evolution in recycling and reuse systems which may provide further momentum to create the market studied during the forecast period.

- Furthermore, Municipal authorities widely use wastewater technology in different cities across India for municipal wastewater treatment. According to NITI Aayog, India's market for wastewater treatment plants is expected to rise to USD 4.3 billion by 2025 due to growing demand for municipal and sewage water therapy facilities nationwide.

- Further, countries worldwide have made considerable investments in water infrastructure and desalination projects. For instance, the central government in Chile plans to fund USD 280 million in water infrastructure over the coming years. Countries have also developed to present incentives to promote water and wastewater treatment around the globe, which is anticipated to push the market for pH sensors & analyzers market.

- However, cost constraints and a need for established standards restrain market growth. Many pH sensors, like combination, differential, laboratory, and process pH sensors, are utilized and notice high commercial acceptance. However, there are only so many specified standards for their operation. These technologies are different from each other and lack compatibility. Lack of awareness, less acceptability, and the unjust quality standard these sensors offer could also hinder the market growth.

pH Sensors Market Trends

Water and Wastewater Application to Register Significant Growth

- The water and Wastewater Industry" accounts for the biggest vertical segment in the individual market due to environmental agencies' growth in awareness and environmental situation. Standard applications, like chromium wastewater treatment and aquaculture, largely dependent on precise pH and ORP measurements to provide needed safety standards, are providing constant demand in the market.

- Regions like North America, Europe, and Asia-Pacific, have noticed a significant growth in sustainable energy projects. Water treatment initiatives, like water treatment and desalination activities, are rapidly gaining popularity among municipalities and industrial sectors, developing a substantial need for pH sensors.

- According to Thames Water, the company treated 4.6 billion liters of wastewater daily for the year ending March 2022. Thames Water is established in Reading, Berkshire, with 353 sewage treatment works. It also delivers 2.5 billion liters of drinking water daily to more than 15 million customers in London and the Thames Valley region.

- Globally, growing water treatment plants and situations regarding water scarcity fuel the need for pH sensors from the desalination sector. Water pH gives crucial data for controlling the treatment system for desalination systems. For instance, in November 2022, Daiki Axis Japan, a Water treatment solutions provider, intended to set up its second plant in Haryana, India, with an investment of INR 200 crore, with the plant capacity to produce 1,000 sewage treatment units with Japanese "Johkasou" technology.

- Furthermore, investments from the chemical, water, and wastewater industries are anticipated to increase. For instance, in July 2022, The U.S. Department of Agriculture (USDA) invested USD 13 million to develop access to rural water infrastructure and assemble economic opportunities for people who live and work in colonies or rural and Tribal communities. The investments contain over USD 9 million to help nearly 14,000 people in socially vulnerable communities.

- Further, in August 2022, Biden-Harris Administration introduced EPA-USDA Partnership to deliver Wastewater Sanitation to Underserved Rural America, as such developments will further drive market growth.

Asia Pacific to Experience Significant Market Growth

- Asia-Pacific is anticipated to experience lucrative growth in the ph sensors market over the coming years due to the emerging economy, rising awareness of technological advancements, advances in the pharmaceutical and biotechnology industries, growing awareness in the manufacturing sector, and an increase in government initiatives for funding.

- According to IBEF, the Indian government is expected to spend INR 3.50 lakh crore (USD 46.5 billion) for the "Jal Jeevan" program, which strives to reinforce the current water sources to set up different treatment plants and desalination plants in the coastal regions by 2024. The mission also desires that the existing water supply and connections are functional, water quality is maintained, and sustainable agriculture is achieved.

- Further, in February 2022, According to the data reported by The Energy and Resources Institute (TERI), the country's water demand is anticipated to grow to 1180 BCM by 2050. Such expansion in water in wastewater treatment may further drive the studied market growth in the future.

- In addition, with growing infrastructure projects in China, many water reuse and wastewater treatment policies are demanding pH sensors and analyzers in the country. For example, the statistics from the International Water Association indicate that Beijing, the capital of the People's Republic of China, recycled a quarter of its domestic wastewater and enhanced the treatment of up to 85 percent of industrial wastewater discharge.

- Moreover, growing investments in oil and gas projects further drive the demand for pH measurements in the region. According to IBEF, in May 2022, ONGC announced plans to invest USD 4 billion from FY22-25 to expand its exploration efforts in India.

- Furthermore, in March 2022, the Board of Oil India approved an investment of INR 6,555 crore (USD 839.49 million) for the Numaligarh petrochemical project. In addition, the oil sector's aggregate installed provisional refinery capacity stood at 249.21 MMT, and IOC appeared as the largest domestic refiner with a capacity of 70.05 MMT.

pH Sensors Industry Overview

The pH sensors market is moderately concentrated with the presence of several major players. A few significant players such as Halma PLC, Thermo Fisher Scientific Inc., Xylem Inc., Yokogawa Electric Corporation, and George Fischer Piping Systems Ltd. currently dominate the market in terms of market share. With a prominent market share, these major players focus on expanding their customer bases in various foreign countries. These companies leverage strategic collaborative initiatives to improve their market shares and profitability. The players performing in the market are also acquiring startups working on pH sensors to intensify their product capabilities.

- February 2023 - Rajguru Electronics released the ADIY pH sensor module, a sensor for calculating the potential of hydrogen (pH) in any liquid. It is a low-cost sensor that can precisely measure the hydrogen-ion activity in water-based solutions. Also, it provides better accuracy than pH Indicator solutions and litmus tests. These sensors can easily be integrated with Raspberry Pi and Arduino.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness- Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Government Regulations

- 5.1.2 Rising Safety Concerns in Industrial Setups

- 5.2 Market Restraints

- 5.2.1 Cost and Absence of Standardization of pH Sensor Devices

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Benchtop Analyzers

- 6.1.2 Portable Analyzers

- 6.1.3 Process Analyzers

- 6.2 By Application

- 6.2.1 Water and Wastewater

- 6.2.2 Medical

- 6.2.3 Oil and Gas

- 6.2.4 Food and Beverages

- 6.2.5 Industrial

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Halma Plc.

- 7.1.2 Thermo Fisher Scientific Inc.

- 7.1.3 Xylem Inc.

- 7.1.4 Yokogawa Electric Corporation

- 7.1.5 Georg Fischer Piping Systems Ltd

- 7.1.6 Honeywell International Inc.

- 7.1.7 KOBOLD Messring GmbH

- 7.1.8 Emerson Electric Co.

- 7.1.9 Schneider Electric SE (Foxboro)

- 7.1.10 ABB Ltd

- 7.1.11 Hach Company Inc. (Danaher Corporation)

- 7.1.12 Endress+Hauser AG

- 7.1.13 Mettler-Toledo International Inc.