|

시장보고서

상품코드

1850243

과산화수소 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Hydrogen Peroxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

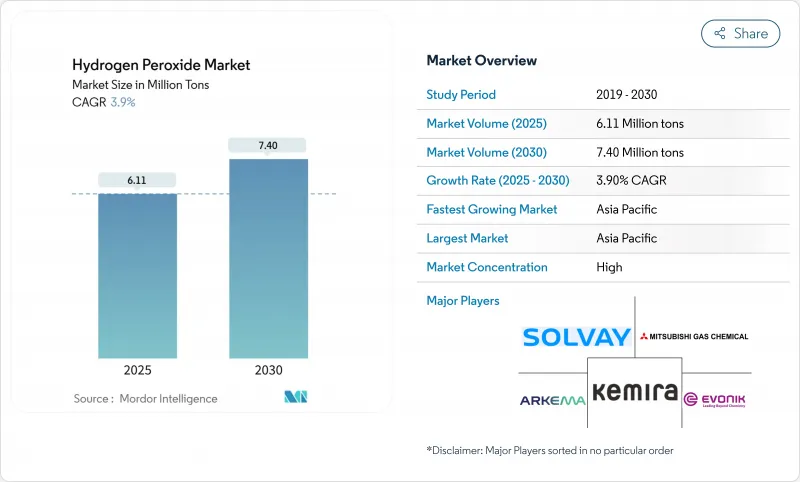

과산화수소 시장은 2025년에 611만 톤으로 평가되었고, 2030년에는 CAGR은 3.9%를 나타낼 것으로 예측되며, 740만 톤에 달할 전망입니다.

펄프 및 제지 표백 분야에서 모멘텀이 지속되고 있으나, 반도체 제조, 첨단 폐수 처리, 친환경 항공우주 추진제 등이 새로운 수요 계층을 형성하며 평균 판매 가격을 끌어올리고 있습니다. 아시아태평양 지역의 생산 능력 확대, 유럽의 저탄소 제품 출시, 그리고 전 세계적으로 강화된 위생 규정은 원료 가격 변동과 강화된 위험 등급 분류로 인해 이익 마진이 다소 위축되더라도 안정적인 성장 기반을 공고히 하고 있습니다. 주요 공급업체들은 초순수 생산 라인을 확장하고, 현장 생산 기술에 투자하며, 전자 제품 고객사와의 공급 계약을 체결하여 과산화수소 시장에서 장기적인 물량 확보에 나서고 있습니다.

세계의 과산화수소 시장 동향 및 인사이트

반도체 습식 공정 세척에서 고순도 등급 수요 증가

초고순도 과산화수소는 현재 5nm 미만 반도체 생산에 필수적입니다. 불순물 허용 기준이 트리???? 분의 일(ppb) 수준으로 강화되었으며, 솔베이의 INTEROX PicoPlus는 양이온 오염물질을 0.01ppb 미만으로 유지하여 해당 사양을 충족합니다. 대만, 한국, 미국, 독일의 신규 반도체 공장은 수년간의 공급 계약을 체결하여 구매 물량을 확보함으로써 과산화수소 시장을 뒷받침하고 있습니다. 장비 제조사들도 금속 잔류물을 줄이는 과산화수소 함량이 높은 고급 세정제를 채택하여 웨이퍼당 소비량을 더욱 확대하고 있습니다. 에보닉(Evonik)과 쓰촨(四川)의 푸화통다(Fuhua Tongda)가 발표한 생산 능력 증설은 중기적 낙관 전망을 강조합니다.

식품 접촉 포장 규제 강화가 유럽 식품 등급 과산화수소 주도

EU 식품안전 지침은 무균 카톤 및 PET 병에 대한 더 엄격한 살균을 요구합니다. 과산화수소는 물과 산소로 신속 분해되는 특성 덕분에 여전히 선호되는 살균제입니다. 유럽식품안전청(EFSA)은 2024년 안전성을 재확인했습니다. 가금류 가공 시 항균제 사용에 대한 FDA 승인은 글로벌 가공업체들이 프로토콜을 통일하도록 영향을 미치고 있습니다. 이러한 정책으로 포장 라인에 기화 과산화수소 장치가 도입되기 시작했으며, 특히 유제품 및 주스 공장에서 식품 등급 용액 수요가 증가하고 있습니다. 과산화수소 시장은 단기적으로 이러한 규제 호재의 혜택을 볼 전망입니다.

EU CLP 및 REACH에 따른 건강 유해성 표시로 인한 규정 준수 비용 발생

과산화수소 생산사는 유럽의 통합된 유해성 표기를 충족하기 위해 방대한 안전 데이터 시트를 유지하고 밀폐형 충전 시스템에 투자해야 합니다. 유럽화학물질청(ECHA)은 과산화수소를 여러 물리적 및 건강 위험 범주에 포함시켰습니다. 규정 준수를 위해서는 주기적인 독성학 업데이트, 직원 교육, 포장 개선이 필요하여 유럽연합 수출업체의 간접비가 증가합니다. 소규모 공급업체는 불균형적인 비용 부담에 직면하여 신규 진입이 제한되고 전체 성장세가 다소 둔화됩니다.

부문 분석

2024년 과산화수소 시장의 61%를 표백 응용 분야가 차지했으며, 이는 염소 없는 표백으로 밝기 향상을 중시하는 펄프 및 제지 공장의 수요에 기반합니다. 과산화수소로 원소 이산화염소를 대체하면 배출수 품질이 개선되어 서구 인쇄용지 수요 감소에도 기초 수요가 유지됩니다. 밝기 목표가 제품 사양에 명시되어 있어 수요 탄력성은 제한적입니다.

소독 분야는 4.37%의 가장 높은 연평균 복합 성장률(CAGR)을 기록했으며, 병원, 식품 공장, 대중교통 허브의 강화된 위생 기준 유지로 지속적인 성장 전망입니다. TOMI Environmental Solutions는 2025년 1분기 이온화 과산화수소 장치 매출이 42% 급증했다고 보고했습니다. 연속 미스트 공급 시스템은 적용 사례를 확대하고 평균 가격을 끌어올려 기존 물량을 넘어 과산화수소 시장을 확장하고 있습니다.

산업용 등급 부문은 2024년 41% 점유율을 기록했으며, 여전히 섬유, 광업, 기초 화학 분야의 주력 제품입니다. 비용 경쟁력과 공급망 밀집도는 대부분의 대량 응용 분야에서 산업용 등급을 선호하게 합니다.

반도체 제조사들이 ppb 미만의 금속 함량을 요구함에 따라 고순도 소재 부문이 연평균 5.23% 성장률로 가장 빠르게 확대되고 있습니다. 태양닛폰산소는 이 틈새 시장을 공략하기 위해 'BRUTE 과산화수소'를 출시했습니다. 300mm 팹 한 곳만으로도 연간 수 킬로톤을 소비할 수 있어, 신규 시설마다 고순도 제품 시장의 규모에 실질적인 물량을 추가합니다.

지역 분석

아시아태평양 지역은 2024년 과산화수소 시장의 53%를 점유했으며 4.27%의 연평균 복합 성장률(CAGR)로 성장하고 있습니다. 중국과 인도의 생산 능력 증가는 국내 제지 및 전자 산업 부문에 공급됩니다. 엔그로 폴리머 앤드 케미컬스(Engro Polymer and Chemicals)는 2026년 가동을 목표로 파키스탄에 신규 공장에 120억 파키스탄 루피를 투자했습니다. 지역 공급업체들은 마진을 보호하는 운송비 이점을 누리고 있습니다.

북미는 과산화수소 시장에서 상당한 비중을 차지합니다. 폐수 규제와 친환경 추진 연구가 고농도(90% 이상) 등급의 신규 응용 분야를 촉진하고 있습니다. 벤치마크 스페이스 시스템즈는 고농도 과산화수소를 사용한 22N 이원 추진 스러스터를 시연했으며, 290초의 비추력을 달성했습니다. 이러한 항공우주 시험은 프리미엄 수요를 촉진하고 국내 소비를 촉진합니다.

유럽은 성숙한 시장 규모를 보이지만 지속가능성 혁신을 주도합니다. 에보닉의 탄소중립 과산화수소(Way to GO2 프로그램 인증)는 고객의 범주 3 배출량 감축을 지원합니다. 강화된 포장 규정은 식품 등급 주문 증가를 이끌고, REACH 규정 준수 비용은 소규모 수입업체를 제약합니다. 유럽의 과산화수소 시장 규모는 2030년까지 완만하지만 꾸준히 성장할 전망입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 반도체 습식 공정 세정에 있어서의 고순도 등급 수요 증가

- 유럽에서 식품 접촉 포장 규제의 강화로 인한 식품 등급 과산화수소 수요 증가

- 아시아태평양 지역 통합 제지 공장에서의 화학 펄프 생산 능력 확대

- 산업 폐수 고급 산화를 위한 현장 H₂O₂ 생성 증가

- 북미 항공우주 산업의 HTP(>90% w/w) 사용 친환경 추진제로의 전환

- 시장 성장 억제요인

- EU CLP 및 REACH에 따른 건강 유해성 표시로 인한 규정 준수 비용 발생

- 원료 가격 변동

- 환경규제와 폐기 과제

- 밸류체인 분석

- 규제 전망

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

- 가격 분석

- 무역 분석

- 공급 시나리오

제5장 시장 규모와 성장 예측

- 제품 기능별

- 소독제

- 표백제

- 산화제

- 기타 제품 기능(세정제 등)

- 등급별

- 표준 등급(35% w/w 미만)

- 산업용 등급(35-50%)

- 고순도 등급(50% 이상)

- 농도/형태별

- 수용액(70% 이하)

- 무수(90% 이상)

- 분말/입상 부가물(과붕산염, 과탄산염 등)

- 최종 사용자 업계별

- 펄프 및 제지

- 화학 합성

- 폐수 처리

- 광업

- 식품 및 음료

- 화장품 및 헬스케어

- 섬유

- 기타 최종 사용자 업계(전자 기기 및 반도체, 수송, 무균 포장, 로켓)

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 노르딕

- 튀르키예

- 러시아

- 기타 유럽

- 중동 및 아프리카

- 사우디아라비아

- 카타르

- 아랍에미리트(UAE)

- 남아프리카

- 이집트

- 나이지리아

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Arkema

- BASF

- Chang Chun Group

- Dow

- EnGro Corporation Limited

- Evonik Industries AG

- FMC Corporation

- Guangdong Zhongcheng Chemicals Inc.

- Gujarat Alkalies and Chemicals Limited

- Hodogaya Chemical Co., Ltd.

- Indian Peroxide Ltd.

- Kemira Oyj

- Kingboard Holdings Limited

- Luxi Chemical Group

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- National Peroxide Limited.

- NIPPON PAPER INDUSTRIES CO., LTD.

- Nouryon

- OCI ALABAMA

- PQ Corporation

- Qingdao LaSheng Co. Ltd.

- Sichuan Hebang Biotechnology Co. Ltd.

- Solvay

제7장 시장 기회와 장래의 전망

HBR 25.11.17The hydrogen peroxide market stands at 6.11 million tons in 2025 and is projected to reach 7.40 million tons by 2030, registering a 3.9% CAGR.

Momentum continues to come from pulp and paper bleaching, but semiconductor fabrication, advanced wastewater treatment, and green aerospace propellants are adding new demand layers that lift average selling prices. Capacity additions in Asia-Pacific, low-carbon product launches in Europe, and stricter global hygiene protocols are reinforcing a stable growth runway even as feedstock price swings and tighter hazard classifications temper profit margins. Leading suppliers are enlarging ultra-pure production lines, investing in on-site generation technologies, and signing offtake agreements with electronics customers to secure long-term volumes in the hydrogen peroxide market.

Global Hydrogen Peroxide Market Trends and Insights

Growing Demand for High-Purity Grades in Semiconductor Wet-Process Cleaning

Ultra-high-purity hydrogen peroxide is now indispensable in sub-5 nm semiconductor production. Impurity thresholds have tightened to parts-per-trillion levels, and Solvay's INTEROX PicoPlus meets those specifications with cationic contaminants below 0.01 ppb. New fabs in Taiwan, South Korea, the United States, and Germany are signing multi-year supply agreements that lock in offtake volumes, underpinning the hydrogen peroxide market. Equipment makers are also adopting peroxide-rich advanced cleans that reduce metallic residues, further expanding per-wafer consumption. Capacity additions announced by Evonik and Fuhua Tongda in Sichuan underscore the bullish medium-term outlook.

Stricter Food-Contact Packaging Regulations Driving Food-Grade H2O2 in Europe

EU food-safety directives now require more rigorous sterilization of aseptic cartons and PET bottles. Hydrogen peroxide remains the preferred agent thanks to rapid decomposition into water and oxygen. The European Food Safety Authority reaffirmed its safety in 2024. FDA approvals for antimicrobial use in poultry processing are influencing global processors to harmonize protocols. As a result of these policies, packaging lines have begun integrating vaporized hydrogen peroxide units, driving increased demand for food-grade solutions, particularly in dairies and juice plants.The hydrogen peroxide market benefits from this regulatory tail-wind in the near term.

Health-Hazard Labelling under EU CLP and REACH Creating Compliance Costs

Peroxide producers must maintain extensive safety data sheets and invest in closed loading systems to meet Europe's harmonized hazard statements. The European Chemicals Agency lists hydrogen peroxide under several physical and health hazard categories. Compliance requires periodic toxicology updates, employee training, and upgraded packaging, adding overhead for exporters into the bloc. Smaller suppliers face disproportionate cost burdens, limiting new entrants and marginally slowing overall growth.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Chemical Pulp Capacity in APAC Integrated Mills

- Increasing On-Site H2O2 Generation for Advanced Oxidation in Industrial Wastewater

- Volatility of Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bleaching applications accounted for 61% of the hydrogen peroxide market in 2024, anchored by pulp and paper mills that value chlorine-free brightness gains. Replacement of elemental chlorine dioxide with peroxide improves effluent profiles, sustaining baseline demand even as Western print paper declines. Demand elasticity is modest because brightness targets are codified in product specifications.

Disinfection posted the fastest 4.37% CAGR and is forecast to keep climbing as hospitals, food plants, and mass-transit hubs maintain heightened sanitation standards. TOMI Environmental Solutions reported a 42% sales jump in Q1 2025 for ionized peroxide devices. Continuous-mist delivery systems broaden use cases and lift average prices, expanding the hydrogen peroxide market beyond legacy volumes.

The industrial grade segment delivered 41% share in 2024 and remains the workhorse for textiles, mining, and basic chemicals. Cost competitiveness and supply chain density favor industrial grade in most bulk applications.

High-purity material is scaling fastest at 5.23% CAGR as chipmakers specify sub-ppb metal levels. Taiyo Nippon Sanso launched BRUTE Peroxide to serve this niche. A single 300 mm fab can offtake several kilotons annually, so each new facility adds tangible volume to the hydrogen peroxide market size for high-purity products.

The Hydrogen Peroxide Market Report Segments the Industry by Product Function (Disinfectant, Bleaching, Oxidant, and More), Grade (Standard Grade, Industrial Grade, and More), Concentration/Form (Aqueous Solution, Anhydrous, and More), End-User Industry (Pulp and Paper, Chemical Synthesis, Mining, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific controlled 53% of the hydrogen peroxide market 2024 and is rising at a 4.27% CAGR. Capacity additions in China and India feed the domestic paper and electronics sectors. Engro Polymer and Chemicals invested PKR 12 billion in a new Pakistani plant scheduled for 2026 start-up. Regional suppliers enjoy freight advantages that safeguard margins.

North America holds a significant slice of the hydrogen peroxide market. Wastewater regulations and green propulsion research spur new endpoints for concentrated (more than 90%) grades. Benchmark Space Systems demonstrated a 22 N bipropellant thruster using high-test peroxide that reached a 290-second specific impulse. These aerospace trials anchor premium demand and boost domestic consumption.

Europe exhibits mature volumes but leads sustainability innovation. Evonik's carbon-neutral peroxide, certified under the Way to GO2 program, helps customers cut Scope 3 emissions. Stricter packaging rules raise food-grade orders, while REACH compliance costs restrain smaller importers. The hydrogen peroxide market size for Europe is projected to move modestly yet steadily through 2030.

- Arkema

- BASF

- Chang Chun Group

- Dow

- EnGro Corporation Limited

- Evonik Industries AG

- FMC Corporation

- Guangdong Zhongcheng Chemicals Inc.

- Gujarat Alkalies and Chemicals Limited

- Hodogaya Chemical Co., Ltd.

- Indian Peroxide Ltd.

- Kemira Oyj

- Kingboard Holdings Limited

- Luxi Chemical Group

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- National Peroxide Limited.

- NIPPON PAPER INDUSTRIES CO., LTD.

- Nouryon

- OCI ALABAMA

- PQ Corporation

- Qingdao LaSheng Co. Ltd.

- Sichuan Hebang Biotechnology Co. Ltd.

- Solvay

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for High-Purity Grades in Semiconductor Wet-Process Cleaning

- 4.2.2 Stricter Food-Contact Packaging Regulations Driving Food-Grade H2O2 in the Europe

- 4.2.3 Expansion of Chemical Pulp Capacity in APAC Integrated Mills

- 4.2.4 Increasing On-Site H2O2 Generation for Advanced Oxidation in Industrial Wastewater

- 4.2.5 Aerospace Shift toward Green Propellants Using HTP (>90 % w/w) in North America

- 4.3 Market Restraints

- 4.3.1 Health-Hazard Labelling under EU CLP and REACH Creating Compliance Costs

- 4.3.2 Volatility of Feedstock Prices

- 4.3.3 Environmental Regulations and Disposal Challenges

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Pricing Analysis

- 4.8 Trade Analysis

- 4.9 Supply Scenerio

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Function

- 5.1.1 Disinfectant

- 5.1.2 Bleaching

- 5.1.3 Oxidant

- 5.1.4 Other Product Function (Cleaning Agent, etc.)

- 5.2 By Grade

- 5.2.1 Standard Grade (less than 35 % w/w)

- 5.2.2 Industrial Grade (35-50 %)

- 5.2.3 High-Purity Grade (more than 50 %)

- 5.3 By Concentration / Form

- 5.3.1 Aqueous Solution (less than or equal to 70 %)

- 5.3.2 Anhydrous (more than 90 %)

- 5.3.3 Powder / Granular Adducts (e.g., Perborate, Percarbonate)

- 5.4 By End-user Industry

- 5.4.1 Pulp and Paper

- 5.4.2 Chemical Synthesis

- 5.4.3 Wastewater Treatment

- 5.4.4 Mining

- 5.4.5 Food and Beverage

- 5.4.6 Cosmetics and Healthcare

- 5.4.7 Textiles

- 5.4.8 Other End-user Industries (Electronics and Semiconductors, Transportation, Aseptic Packaging, Rocketry)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Malaysia

- 5.5.1.6 Thailand

- 5.5.1.7 Indonesia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Argentina

- 5.5.3.3 Colombia

- 5.5.3.4 Rest of South America

- 5.5.4 Europe

- 5.5.4.1 Germany

- 5.5.4.2 United Kingdom

- 5.5.4.3 France

- 5.5.4.4 Italy

- 5.5.4.5 Spain

- 5.5.4.6 Nordic

- 5.5.4.7 Turkey

- 5.5.4.8 Russia

- 5.5.4.9 Rest of Europe

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 Qatar

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 South Africa

- 5.5.5.5 Egypt

- 5.5.5.6 Nigeria

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Arkema

- 6.4.2 BASF

- 6.4.3 Chang Chun Group

- 6.4.4 Dow

- 6.4.5 EnGro Corporation Limited

- 6.4.6 Evonik Industries AG

- 6.4.7 FMC Corporation

- 6.4.8 Guangdong Zhongcheng Chemicals Inc.

- 6.4.9 Gujarat Alkalies and Chemicals Limited

- 6.4.10 Hodogaya Chemical Co., Ltd.

- 6.4.11 Indian Peroxide Ltd.

- 6.4.12 Kemira Oyj

- 6.4.13 Kingboard Holdings Limited

- 6.4.14 Luxi Chemical Group

- 6.4.15 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.16 National Peroxide Limited.

- 6.4.17 NIPPON PAPER INDUSTRIES CO., LTD.

- 6.4.18 Nouryon

- 6.4.19 OCI ALABAMA

- 6.4.20 PQ Corporation

- 6.4.21 Qingdao LaSheng Co. Ltd.

- 6.4.22 Sichuan Hebang Biotechnology Co. Ltd.

- 6.4.23 Solvay

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Newer Opportunities for Hydrogen Peroxide in Wastewater Treatment