|

시장보고서

상품코드

1907247

멜라민 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Melamine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

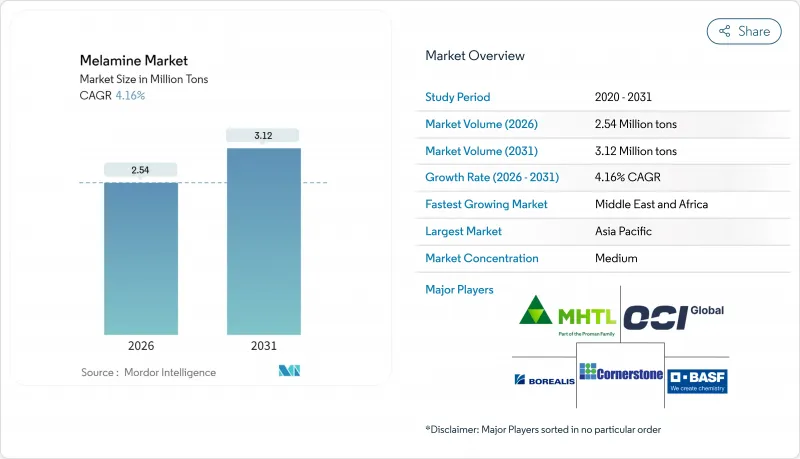

멜라민 시장의 규모는 2026년에는 254만 톤으로 추정되고 있으며, 2025년 244만 톤에서 성장할 전망입니다.

2031년 예측은 312만 톤에 이르며 2026년부터 2031년까지 연평균 복합 성장률(CAGR) 4.16%로 성장할 것으로 전망되고 있습니다.

아시아태평양에서의 활발한 건설 활동, 북미 및 유럽에서의 견조한 리모델링 및 개보수에 대한 투자, 복수의 플랜트 감산에 수반하는 세계적인 공급 핍박이 가격 실현과 확대를 지속적으로 뒷받침하고 있습니다. 신흥국에서의 라미네이트 바닥재의 급속한 보급, 초저포름알데히드 방출 수지를 가능하게 하는 기술 진보, 유럽에서의 바이오물질 수지 등급의 고부가가치 도입이 수요를 더욱 밀어 올리고 있습니다. 공급면에서는 카타르와 중국에서의 생산능력 증강이 유럽에서의 영구적인 가동 정지를 일부 상쇄하고 있지만, 에너지 가격의 변동이 지속되고 있는 것과 우레아 원료 가격의 급등에 의해 재고 사이클은 단축되고, 스팟 가격은 상승하고 있습니다. 우레아의 소급적 통합과 탄소 절감 로드맵을 결합한 공급업체는 구조적 비용 우위와 규제 준수의 우위를 확보하고 있으며, 멜라민 시장 전체에서 지역의 자급자족 전략과 병목 해소를 목적으로 한 투자가 촉진되고 있습니다.

세계의 멜라민 시장의 동향 및 인사이트

신흥국에서의 라미네이트 바닥재 및 가구 생산 급증

중국, 인도, 베트남, 인도네시아의 도시화와 중산층의 소비 확대는 장식용 라미네이트 재료와 가구의 업그레이드 수요를 자극하고 있습니다. 중국의 2024년 국가경제계획에서는 석유화학 최적화와 다운스트림 통합이 우선시되어 멜라민 수지에 대한 국내 투자가 촉진되고 있습니다. 생산 능력의 증강에 의해 원료 공급이 확보되어 패널 제조업체는 요소 포름알데히드계에서 내습성이 뛰어난 멜라민 요소 포름알데히드계로의 이행이 가능해집니다. 인도에서는 화학산업의 적극적인 확충에 의해 신규 비료 복합시설과 파생 멜라민 공장이 제휴해, 패널 제조업체의 리드 타임 단축을 도모하고 있습니다. 파티클 보드의 생산량은 증가 추세에 있으며, 오리나무나 자작나무 등 기존에 사용 빈도가 낮았던 수종에서는 접착 기준을 충족시키기 위해 고성능 수지가 필요합니다. 이러한 요인들이 더하여 멜라민 시장의 꾸준한 수량 증가를 뒷받침합니다.

미국 및 유럽연합에서의 건설업 회복이 목공용 접착제 수요를 견인

양 지역에서 주택 착공 건수는 2024년에 안정화되었으며 2026년까지 완만한 증가가 전망되고 있습니다. 따라서 멜라민 강화 접착제를 필요로 하는 OSB(배향성 스트랜드보드) 및 MDF(중밀도 섬유판)의 소비가 회복될 전망입니다. EU의 건설업자는 2026년 8월 시행 예정인 REACH규제에서 포름알데히드 배출량 제한(0.062mg/m3)을 충족하는 패널 등급도 요구하고 있습니다. 북미의 생산자는 EPA TSCA 타이틀 VI를 준수하며 저배출형 멜라민 요소 포름알데히드 수지에 대한 대안을 추진하고 있습니다. 유럽의 고객은 바이오물질 수지의 도입을 확대하고 있으며, Finsa사 등의 조기 도입 기업은 OCI의 바이오멜라민 등급을 통합하고 있습니다. 이로 인해 기존 수입품과 비교하여 제품의 탄소발자국을 약 50% 줄이고 있습니다.

EU 및 북미에서의 포름알데히드 배출 규제 강화

EU의 0.062 mg/m3 제한과 이에 따른 EPA TSCA Title VI 임계값은 고가의 인증 획득, 실험실 테스트 및 공급망 문서화를 의무화하고 있습니다. 새로운 기준을 충족하지 못하는 생산자는 시장에서 퇴출될 위험에 직면합니다. 멜라민 포름알데히드 수지는 보통 요소 포름알데히드 수지보다 낮은 배출성을 보이지만, 적합 증명을 위한 추가 비용이 이익률을 압박하고 중소 컨버터를 기피하도록 하고 있습니다. 스웨덴은 한 걸음 더 나아가 0.124 mg/m3의 한계를 설정했으며, 이는 곧 다른 북유럽 시장에서 벤치마크가 될 수 있습니다.

부문 분석

멜라민 수지는 2025년에도 멜라민 시장 점유율의 64.70%를 유지했으며, 장식용 라미네이트, 파티클 보드용 오버레이, 고압 라미네이트의 기간 재료로서 기능하고 있습니다. 아시아태평양의 견조한 바닥재 교환 사이클과 유럽의 포름알데히드 규제 대응 압력은 2031년까지 수지 시장의 성장을 뒷받침할 전망입니다. 병행하여 발포체용 멜라민 시장의 규모는 항공우주, EV, 철도분야가 초경량 방음재를 우선시하기 때문에 기반은 작지만, 4.72%의 연평균 복합 성장률(CAGR)로 확대될 것으로 전망됩니다. 폼 제조업체는 인테리어 트리밍용 대형 패널공급을 위해 연속 블록 및 번스톡 생산의 규모 확대를 추진하고 있습니다. BASF사의 'EcoBalanced' 도입 사례는 재생 가능 전력과 바이오매스 원료에 의해 재인증이 필요 없는 제품으로 탄소발자국을 최대 50% 줄일 수 있음을 실증하고 있으며, 넷 제로를 목표로 하는 OEM 제조업체에 있어서 경쟁상의 차별화 요인이 됩니다.

수지 배합 제조업체는 포름알데히드 배출량을 0.05mg/m3 미만으로 줄이는 초저몰비 시스템에 주력하고 있으며 이는 EU용 패널 수출을 보호하고 있습니다. 우레아 회수 설비와 멜라민 반응기를 보유한 통합 제조업체는 원료의 안정 공급을 확보하고 요소 가격의 변동이 심한 시기에도 규모의 경제성을 활용해 이익률을 보호하고 있습니다. 2024년 글루파 아조티의 일시적 가동 중단은 상업용 우레아와 고비용 가스에 의존하는 플랜트의 취약성을 드러냈습니다.

멜라민 시장의 보고서는 제품 형태(멜라민 결정, 멜라민 수지, 멜라민 폼 등), 용도(라미네이트, 목공용 접착제, 기타), 최종 사용자 산업(건설 및 인프라, 가구 및 목공, 기타), 지역(아시아태평양, 북미, 유럽, 남미, 중동 및 아프리카)별로 분류되어 있습니다. 시장 예측은 수량(톤) 단위로 제공됩니다.

지역별 분석

2025년 아시아태평양은 멜라민 시장 점유율의 51.05%를 차지했습니다. 이는 중국의 방대한 수지화 능력과 장식용 패널에 대한 인도의 안정적인 수요에 의해 뒷받침되었습니다. 산동성과 내몽골 자치구의 통합형 암모니아, 우레아, 멜라민 복합시설은 석탄 또는 저비용 가스 원료의 혜택을 받으며, 지역의 가격 주도권을 강화하고 있습니다. 일본과 한국에서는 반도체 산업과 조선업에서 사용되는 고순도 성형 컴파운드와 흡음 폼에 대한 프리미엄 틈새 수요가 유지되고 있습니다. 동남아시아에서는 가구 수출의 급성장에 따라 수지 투자가 증가하고 있으며 수입 멜라민 결정에 대한 의존에도 불구하고 지역의 자급률 향상에 기여하고 있습니다.

북미는 중요한 시장이지만 구조적으로 공급 부족이 지속되고 있으며 국내 단일 생산자에 의존하고 있습니다. 허리케인 관련 가동 정지 및 유지 보수로 인한 가동 중지 시간은 패널 및 바닥재 제조업체를 공급 혼란의 위험에 노출시킵니다. 독일, 카타르, 트리니다드 토바고 및 인도의 제품에 대한 상쇄 관세로 수입 의존도가 억제되었습니다. 한편 건설업체는 완화된 대출 금리와 인프라 지출을 활용하여 패널 소비를 유지함으로써 안정적인 수지 수요를 지원하고 있습니다.

유럽은 가장 엄격한 배출규제에 직면하는 한편, 바이오물질 수지 멜라민 분야에서는 선행 지역의 우위를 누리고 있습니다. 중동 및 아프리카의 시장은 현 시점에서는 소규모이지만, 카타르에너지 및 그 계열사가 풍부한 저비용 가스 원료를 기반으로 한 멜라민 생산 능력을 확대하고 있기 때문에 4.28%라는 최고 성장률을 나타내고 있습니다. 라스라판의 새로운 석유화학 회랑은 아시아 및 유럽의 인수처로의 공급을 목표로 하고 있지만, 미국의 관세가 북미로의 직접 접근을 제약하고 있습니다. 남미는 여전히 기회가 존재하며 재정 거래가 가능한 경우 트리니다드 토바고와 유럽의 스팟 화물을 유치하고 있습니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 신흥 경제국에서의 라미네이트 바닥재 및 가구 생산 급증

- 미국 및 유럽연합에서의 건설업 회복이 목재용 접착제 수요를 견인

- 아시아태평양의 산업 확대가 HPL 및 성형 컴파운드를 견인

- 항공기 및 철도 음향용 경량 내열 멜라민 폼

- 저탄소 요소에서 멜라민으로의 프로세스 혁신

- 억제요인

- 유럽연합 및 북미에서의 포름알데히드 배출규제 강화

- 바이오 베이스 접착제 대체품(대두, 리그닌, 액상화 목재)

- 비료시장의 혼란에 따른 우레아 가격의 변동성

- 밸류체인 분석

- 규제 상황

- Porter's Five Forces

- 공급자의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

- 원료 분석 및 동향

- 생산 공정

- 수출입 동향

- 가격 동향

- 특허 분석

제5장 시장 규모 및 성장 예측

- 제품 형태별

- 멜라민 결정

- 멜라민 수지(HPL, LPL, 함침지)

- 멜라민 폼

- 기타(함침 장식지, 난연성 조성)

- 용도별

- 라미네이트재

- 목공용 접착제

- 성형용 컴파운드

- 페인트 및 코팅

- 난연제 및 섬유용 수지

- 최종 사용자 업계별

- 건설 및 인프라

- 가구 및 목공

- 자동차 및 운송

- 화학제품 및 코팅

- 가전 및 전기기기

- 기타

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%) 및 순위 분석

- 기업 프로파일

- BASF SE

- Borealis AG

- Cornerstone Chemical Company

- EuroChem Group

- Fushun Huaxing Petroleum Chemical Co., Ltd

- Grupa Azoty

- Gujarat State Fertilizers & Chemicals Ltd(GSFC)

- Henan Xinlianxin Chemicals Group Co. Ltd

- Hexion Inc.

- Methanol Holdings(Trinidad) Ltd(MHTL)

- Mitsui Chemicals Inc.

- Nissan Chemical Corporation

- OCI NV

- Prefere Resins Holding GmbH

- Qatar Melamine Company

- Sichuan Chemical Works Group Ltd

제7장 시장 기회 및 미래 전망

CSM 26.01.23Melamine Market size in 2026 is estimated at 2.54 million tons, growing from 2025 value of 2.44 million tons with 2031 projections showing 3.12 million tons, growing at 4.16% CAGR over 2026-2031.

Strong construction activity in the Asia-Pacific region, resilient repair-and-remodel investment in North America and Europe, and tight global supply following multiple plant curtailments continue to support price realization and reinforce expansion. Demand is further boosted by the rapid adoption of laminated flooring in emerging economies, technological advancements that enable ultra-low formaldehyde-emission resins, and the premium adoption of biomass-balanced grades in Europe. On the supply side, capacity additions in Qatar and China partially offset permanent shutdowns in Europe, yet lingering energy volatility and urea feedstock spikes keep inventory cycles short and spot prices elevated. Suppliers that combine backward urea integration with carbon-reduction road maps gain a structural cost and regulatory compliance edge, encouraging regional self-sufficiency strategies and targeted debottlenecking investments across the melamine market.

Global Melamine Market Trends and Insights

Surge in laminated flooring and furniture production in emerging economies

Urbanization and growing middle-class spending in China, India, Vietnam, and Indonesia are stimulating a boom in decorative laminates and furniture upgrades. China's 2024 national economic plan prioritizes petrochemical optimization and downstream integration, which favors local investments in melamine resin. Capacity additions ensure feedstock availability, enabling panel producers to transition from urea-formaldehyde to melamine-urea-formaldehyde systems, which offer improved moisture resistance. India's aggressive chemical build-out couples new fertilizer complexes with derivative melamine plants, shortening lead times to panel firms. Particleboard output is growing, and lesser-used species, such as alder and birch, will require higher-performance resins to meet bonding standards. Together, these factors support steady volume gains for the melamine market.

Construction recovery in United States/European Union spurring wood-adhesive demand

Housing starts stabilized in 2024 and are expected to rise modestly through 2026 in both regions, reviving consumption of oriented strand board and medium-density fiberboard, which rely on melamine-enhanced adhesives. EU builders also seek panel grades that meet upcoming REACH formaldehyde limits of 0.062 mg/m3, effective August 2026. North American producers align with EPA TSCA Title VI, driving substitution toward lower-emission melamine-urea-formaldehyde formulations. European customers are increasingly specifying biomass-balanced resins, with early adopters such as Finsa integrating OCI's bio-melamine grades, which reduce the product's carbon footprint by roughly 50% compared to conventional imports.

Stricter formaldehyde-emission regulations in EU and North America

The EU limit of 0.062 mg/m3 and aligned EPA TSCA Title VI thresholds mandate expensive certification, laboratory testing, and supply-chain documentation. Producers unable to meet the new bar risk market exclusion. While melamine-formaldehyde typically exhibits lower emissions than urea-formaldehyde, the incremental cost to prove compliance compresses margins and deters smaller converters. Sweden has taken a further step with a 0.124 mg/m3 limit, which may soon serve as a benchmark for other Nordic markets.

Other drivers and restraints analyzed in the detailed report include:

- Industrial expansion in Asia-Pacific boosting HPL and molding compounds

- Lightweight heat-resistant melamine foams for aerospace and rail acoustics

- Bio-based adhesive substitutes (soy, lignin, liquefied wood)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Melamine resins retained a 64.70% market share of melamine in 2025, serving as the backbone for decorative laminates, particleboard overlays, and high-pressure laminates. Robust flooring replacement cycles in Asia-Pacific and formaldehyde compliance pressures in Europe underpin growth for resins through 2031. In parallel, the melamine market size for foam is projected to expand at a 4.72% CAGR, albeit from a lower base, because aerospace, EV, and rail sectors prioritize ultra-light acoustic insulation. Foam manufacturers are scaling continuous blocks and bun stock production to supply large panels for interior trimming. BASF's EcoBalanced launch demonstrates how renewable electricity and biomass feedstock can deliver up to 50% lower product carbon footprint without requalification, a competitive differentiator for Original Equipment Manufacturers targeting Net Zero.

Resin formulators are focusing on ultra-low molar ratio systems to reduce formaldehyde emissions below 0.05 mg/m3, thereby protecting panel exports to the EU. Integrated producers that own urea capture and melamine reactors achieve feedstock security and leverage economies of scale to safeguard margins when urea volatility peaks. Grupa Azoty's temporary shutdown in 2024 highlights the exposure of plants that rely on merchant urea and high-cost gas inputs.

The Melamine Market Report is Segmented by Product Form (Melamine Crystals, Melamine Resins, Melamine Foam, and Others), Application (Laminates, Wood Adhesives, and More), End-User Industry (Construction and Infrastructure, Furniture and Woodworking, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific controlled 51.05% melamine market share in 2025, underpinned by China's vast resinification capacity and steady Indian demand for decorative panels. Integrated ammonia-urea-melamine complexes in Shandong and Inner Mongolia benefit from coal or low-cost gas feedstock, reinforcing regional price leadership. Japan and South Korea maintain a premium niche demand for high-purity molding compounds and acoustic foams used in the semiconductor and shipbuilding industries. Southeast Asia's fast-growing furniture exports attract incremental resin investment, boosting regional self-sufficiency despite reliance on imported melamine crystals.

North America is a significant market but remains structurally short, relying on a single domestic producer. Hurricane-related outages and maintenance downtime expose panel and flooring manufacturers to supply disruptions. Import reliance is moderated by countervailing duties placed on products from Germany, Qatar, Trinidad and Tobago, and India. Builders, meanwhile, capitalize on mellower mortgage rates and infrastructure spending to sustain panel consumption, underpinning stable resin demand.

Europe grapples with the strictest emission rules yet enjoys an early-mover advantage in biomass-balanced melamine. The Middle-East and Africa, while currently small, exhibit the highest growth rate of 4.28%, as QatarEnergy and its affiliates push melamine capacity linked to abundant, low-cost gas feedstock. New petrochemical corridors from Ras Laffan aim to serve Asian and European offtakers, yet U.S. duties constrain direct North American access. South America remains opportunistic, drawing spot cargoes from Trinidad and Tobago and Europe when arbitrage allows.

- BASF SE

- Borealis AG

- Cornerstone Chemical Company

- EuroChem Group

- Fushun Huaxing Petroleum Chemical Co., Ltd

- Grupa Azoty

- Gujarat State Fertilizers & Chemicals Ltd (GSFC)

- Henan Xinlianxin Chemicals Group Co. Ltd

- Hexion Inc.

- Methanol Holdings (Trinidad) Ltd (MHTL)

- Mitsui Chemicals Inc.

- Nissan Chemical Corporation

- OCI NV

- Prefere Resins Holding GmbH

- Qatar Melamine Company

- Sichuan Chemical Works Group Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in laminated flooring and furniture production in emerging economies

- 4.2.2 Construction recovery in United States/European union spurring wood-adhesive demand

- 4.2.3 Industrial expansion in APAC boosting HPL and molding compounds

- 4.2.4 Lightweight heat-resistant melamine foams for aero and rail acoustics

- 4.2.5 Low-carbon urea-to-melamine process innovations

- 4.3 Market Restraints

- 4.3.1 Stricter formaldehyde-emission regulations in European Union and North America

- 4.3.2 Bio-based adhesive substitutes (soy, lignin, liquefied wood)

- 4.3.3 Urea-price volatility tied to fertilizer-market disruptions

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Feedstock Analysis and Trends

- 4.8 Production Process

- 4.9 Import-Export Trends

- 4.10 Price Trends

- 4.11 Patent Analysis

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Form

- 5.1.1 Melamine Crystals

- 5.1.2 Melamine Resins (HPL, LPL, Impregnated Paper)

- 5.1.3 Melamine Foam

- 5.1.4 Others (Impregnated Decor Paper, Flame-retardant Blends)

- 5.2 By Application

- 5.2.1 Laminates

- 5.2.2 Wood Adhesives

- 5.2.3 Molding Compounds

- 5.2.4 Paints and Coatings

- 5.2.5 Flame-retardants and Textile Resins

- 5.3 By End-user Industry

- 5.3.1 Construction and Infrastructure

- 5.3.2 Furniture and Woodworking

- 5.3.3 Automotive and Transportation

- 5.3.4 Chemicals and Coatings

- 5.3.5 Appliances and Electrical

- 5.3.6 Others

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Borealis AG

- 6.4.3 Cornerstone Chemical Company

- 6.4.4 EuroChem Group

- 6.4.5 Fushun Huaxing Petroleum Chemical Co., Ltd

- 6.4.6 Grupa Azoty

- 6.4.7 Gujarat State Fertilizers & Chemicals Ltd (GSFC)

- 6.4.8 Henan Xinlianxin Chemicals Group Co. Ltd

- 6.4.9 Hexion Inc.

- 6.4.10 Methanol Holdings (Trinidad) Ltd (MHTL)

- 6.4.11 Mitsui Chemicals Inc.

- 6.4.12 Nissan Chemical Corporation

- 6.4.13 OCI NV

- 6.4.14 Prefere Resins Holding GmbH

- 6.4.15 Qatar Melamine Company

- 6.4.16 Sichuan Chemical Works Group Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment