|

시장보고서

상품코드

1687269

아날로그 및 혼성 신호 IP 시장(2025-2030년) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측Analog and Mixed Signal IP - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

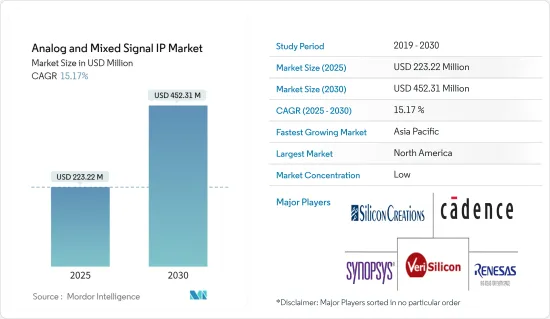

아날로그 및 혼성 신호 IP 시장 규모는 2025년 2억 2,322만 달러에서 2030년에는 4억 5,231만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년) 동안 CAGR은 15.17%로 추정됩니다.

2020년 초반 반도체 시장의 침체는 COVID-19 팬데믹이 업계 전체에 미치는 영향에 크게 기인합니다. COVID-19의 세계적인 확산으로 시행된 봉쇄 조치는 디바이스 제조에 영향을 미쳤을 뿐만 아니라 소비자 수요도 감소시켰습니다.

소비자기술협회에 따르면 미국의 가전업계의 성장률은 2020년에 2.2% 하락했으며 미국의 가전업계에서 수년 만에 성장률 저하를 기록하였습니다.

주요 하이라이트

- 지난 10년 동안 집적 회로는 점점 더 복잡해지고 가격이 상승하고 있습니다. 업계는 시스템 온 칩(SoC), 시스템 인 패키지(SiP), 시스템 온보드(SoB) 설계로 총칭되는 새로운 설계 및 재사용 기법을 채택하기 시작했습니다. 이러한 소형화로의 전환에 따라, 이러한 솔루션을 도입하는 기업은 패러다임 시프트에서 발생하는 재사용 및 통합 문제에 대한 과제에 직면하기 시작했습니다. 이러한 문제를 해결하기 위해 IP 블록은 업계 최종 사용자에게 가장 강력한 솔루션으로 등장했습니다.

- 지난 10년 동안 집적 회로는 점점 더 복잡해지고 가격이 상승하고 있습니다. 업계는 시스템 온 칩(SoC), 시스템 인 패키지(SiP), 시스템 온보드(SoB) 설계로 총칭되는 새로운 설계 및 재사용 기술을 채택하기 시작했습니다.

- 이러한 소형화로의 전환에 따라, 이러한 솔루션을 채용하는 기업은 패러다임 시프트로 직면하는 재사용이나 통합이라는 과제에 직면하기 시작했습니다. 이러한 문제를 해결하기 위해 IP 블록은 업계 최종 사용자에게 가장 강력한 솔루션으로 등장했습니다.

- 재사용 가능한 컴포넌트는 지적 재산(IP) 블록 또는 IP 코어라고도 하며, 일반적으로 소프트 코어라고 하는 합성 가능한 레지스터 전송 레벨(RTL) 설계 또는 하드 코어라고 하는 레이아웃 레벨 설계입니다. 재사용 개념은 블록, 플랫폼 및 칩의 각 레벨에서 구현할 수 있으며, IP를 광범위한 용도에서 사용할 수 있도록 충분히 범용적으로 구성 가능 또는 프로그래밍 가능해야 합니다.

아날로그 및 혼성 신호 IP 시장 동향

통신이 큰 점유율을 차지할 전망

- 통신 인프라는 주로 4G 네트워크와 5G 네트워크의 부분적인 출현으로 인해 시장을 견인하는 중요한 요소 중 하나입니다. 무선 인프라, 특히 4G 및 5G 네트워크 제조업체는 성능, 기능성 및 서비스 품질의 높은 수준을 유지하면서 새로 설치하는 무선 인프라의 크기와 비용을 지속적으로 절감하고 있습니다.

- 5G 인프라는 다양한 광대역 서비스 영역에 혁명을 일으켜 여러 최종 사용자의 수직 연결을 강화할 것으로 기대됩니다. GSMA에 따르면, 5G 네트워크의 새로운 배포 과정을 통해 약 45%의 도시 커버리지를 달성했습니다. 중국과 인도 등 국가도 2020년까지 5G 네트워크의 도입을 계획하였으며, 5G 네트워크 개발에는 5G 대응 인프라에 많은 설비 투자가 필요합니다.

- 인텔과 같은 주요 기업은 2019년 1월 차세대 모바일 기지국 전용으로 설계된 새로운 시스템 온칩(SoC)을 발표했습니다. 마찬가지로 동장 적층판(CCL)의 전문기업인 Iteq는 중국에서 5G 인프라를 주문할 것으로 기대하고 있습니다. 중국 정부는 5G 서비스 개발과 전개에 많은 투자를 하고 있으며, 화웨이와 같은 현지 기업들도 적극적으로 참여하고 있습니다.

- 유무선 방송 및 광대역 통신 기기의 선두 업체인 Zinwell사는 MaxLinear사의 AirPHY 멀티기가비트 모뎀 기술 및 아날로그 혼성 신호 IP와 jjPlus사의 최신 65W 자기 공명 무선 파워 모듈을 통합하여 최대 20cm 두께의 유리창과 구조벽을 통해 전력과 기가비트 데이터를 전송하는 기술을 개발했습니다. 이 솔루션은 4G/LTE 또는 5G 밀리미터 무선 광대역 서비스를 기가비트 속도로 제공 가능하게 하므로 아날로그 및 혼성 신호 IP 통합에 대한 수요를 높일 것으로 보입니다.

북미가 최대 시장 점유율을 차지할 전망

- 아날로그/디지털 혼성 신호 IP 수요는 이러한 제품의 빌딩 블록으로서의 이용이 확대되면서 뒷받침되고 있습니다. 미국 통신 부문은 5G 인프라에 적극적으로 투자하고 있으며 이 나라의 최종 사용자 산업은 5G 기술의 세계 소비의 대부분을 차지합니다. 북미에서는 미국이 투자, 도입, 응용 분야에서 지역 5G 시장을 독점하고 있습니다.

- 5G 초고속 무선 네트워크의 특성은 성장이 둔화된 통신 업계에 필요한 추진력을 제공할 것으로 기대됩니다. 미국통신협회는 미국 통신 사업자가 2025년까지 약 1,040억 달러를 소비할 것으로 추정합니다. 통신 서비스 사업자에게는 기존의 4G 네트워크를 5G 표준으로 업그레이드하여 5G 무선 서비스의 완전한 도입을 수행하는 것이 필수적이 될 것으로 예상됩니다.

- 2019년 10월, Analogue사는 레트로 게임 기기의 현대판인 Analogue Game Boy Pocket의 출시를 발표했습니다. 이 회사가 도입한 중요한 컴포넌트는 추가 FPGA(오리지널 Game Boy에 비해 10배의 고해상도 디스플레이로 고해상도 이미지를 제공하기 위한 이미지 처리용과는 별도)입니다. 추가 FPGA를 사용하면 레트로 게임 커뮤니티가 MiSTER FPGA 디바이스의 작동 방식과 마찬가지로 Pocket에서 다른 게임을 실행하기 위한 코어를 구축하고 이식할 수 있습니다.

- 캐나다는 군사 프로그램(피복 포함)에 충분한 지출과 자금을 제공할 것으로 기대됩니다. 캐나다 정부는 통합 군인 시스템 프로젝트에 주력하고 있으며, 전투복을 전자기기나 무기와 동화시켜 전장을 이동할 때 병사 간 통신을 제공합니다. 이는 이 지역 시장 성장에 긍정적인 영향을 미칠 것으로 예상됩니다.

아날로그 및 혼성 신호 IP 산업 개요

아날로그 및 혼성 신호 IP는 세계의 기업이 가전, 자동차 등 다양한 용도에서 신호를 통합하기 위해 노력하고 있기 때문에 상당히 세분화되어 경쟁사 간의 치열한 경쟁이 일어나고 있습니다. 주요 기업은 Cadence Design Systems Inc., Taiwan Semiconductor Manufacturing Company Limited, Global foundries Inc., Samsung Electronics 등입니다.

- 2020년 5월 - 미국 Synopsys사는 TSMC사의 5nm 프로세스 기술을 채용한 고성능 컴퓨팅 시스템 온칩(SoC)용 고품질 IP 포트폴리오를 발표했습니다. 가장 널리 사용되는 고속 프로토콜 인터페이스 IP 및 기반 IP를 포함한 TSMC 프로세스의 DesignWare IP 포트폴리오는 하이엔드 클라우드 컴퓨팅, AI 가속기, 네트워킹 및 스토리지 애플리케이션을 위한 SoC 개발을 가속화합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 시장 성장 촉진요인

- AMS 블록의 재사용성 향상

- 무선 통신의 보급

- 시장 성장 억제요인

- 아날로그/혼성 신호(AMS) 설계의 복잡성과 감도

- COVID-19가 업계에 미치는 영향 평가

제5장 시장 세분화

- 설계

- 펌/소프트 IP

- 하드 IP

- 제품

- A2D 및 D2A 컨버터

- 전원 관리 모듈

- RF

- 기타 제품

- 최종 사용자 산업

- 소비자 일렉트로닉스

- 통신업계

- 자동차

- 공업

- 기타 최종 사용자 산업

- 지역

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제6장 경쟁 구도

- 기업 프로파일

- Cadence Design Systems Inc.

- Silicon Creations LLC

- VeriSilicon Holdings Co. Ltd

- Renesas Electronics Corporation

- Synopsys Inc.

- ARM Holdings PLC

- Xilinx Inc.

- Intel Corporation

- Analog Devices Inc.

- Maxim Integrated Products Inc.

- Texas Instruments Limited

제7장 투자 분석

제8장 시장의 미래

CSM 25.04.07The Analog and Mixed Signal IP Market size is estimated at USD 223.22 million in 2025, and is expected to reach USD 452.31 million by 2030, at a CAGR of 15.17% during the forecast period (2025-2030).

The semiconductor market's downturn at the start of 2020 is significantly owing to the COVID-19 pandemic's impact on the entire industry. The lockdowns that have been enforced by the spread of COVID-19 across the world have not only affected the manufacturing of devices but also reduced consumer's demand.

According to the Consumer Technology Association, the growth rate of the consumer electronics industry in the United States fell by 2.2% in 2020, which was the first decrease in the growth rate in the consumer electronics landscape of the United States after several years.

Key Highlights

- Over the past decade, the integrated circuits have become increasingly complex and expensive. The industry started to embrace new design and reuse methodologies that are collectively referred to as system-on-chip (SoC), System-in-Package (SiP), and System-on-Board (SoB) design. With this shift toward miniaturization, the companies incorporating such solutions started facing the challenges for the re-usage and integration issues encountered in this paradigm shift. To solve such problems, IP blocks emerged as the most prominent solution for the industry end-users.

- Over the past decade, integrated circuits have become increasingly complex and expensive. The industry started to embrace new design and reuse methodologies that are collectively referred to as system-on-chip (SoC), System-in-Package (SiP), and System-on-Board (SoB) design.

- With this shift toward miniaturization, the companies incorporating such solutions started facing the challenges for the reusage and integration issues encountered in this paradigm shift. To solve such issues, IP blocks emerged as the most prominent solution for the industry end-users.

- The reusable components, also called intellectual property (IP) blocks or IP cores are typically synthesizable register-transfer level (RTL) designs referred to as soft cores or layout level designs, referred to as hard cores. The concept of reusage can be carried out at the block, platform, or chip levels and involves making the IP sufficiently general, configurable, or programmable for use in a wide range of applications.

Analog & Mixed Signal IP Market Trends

Telecommunication is Expected Hold a Significant Share

- Telecommunication infrastructure is one of the key factors driving the market, primarily owing to the advent of the 4G network and some parts of the 5G network. Manufacturers of wireless infrastructure, especially 4G and 5G networks, are continuously reducing the size and cost of their newly installed wireless infrastructure while holding towards the high standards of performance, functionality, and quality of service.

- 5G Infrastructure is expected to revolutionize the domain of various broadband services and is expected to empower connectivity across multiple end-user verticals. According to GSMA, around 45% urban coverage level has been achieved for 5G networks in the new deployment trails. Countries like China and India are also planning to implement the 5G network by 2020, and the development of 5G networks requires large amounts of capital investment in 5G capable infrastructure.

- Significant players like Intel have announced a new system on chip (SoC) designed specifically for next-generation mobile base stations in Jan 2019. Similarly, Copper-clad laminate (CCL) specialist Iteq expects orders for 5G infrastructure to pull in from China. The country is investing significantly in the development and deployment of 5G services with the government and local players like Huawei actively taking part

- Zinwell, a leading manufacturer of wired and wireless broadcast and broadband communication equipment has integrated MaxLinear's AirPHY multi-gigabit modem technology with jjPlus's latest 65W magnetic resonant wireless power module integrated with analog mixed-signal IP into its 3rd generation ZRA-003 device, which can transfer power and gigabit data through glass windows or structural walls up to 20cm thick. The solution will enhance the demand of the analog mixed-signal IP integration as the solution will enable 4G/LTE or 5G millimeter wave wireless broadband service with gigabit speeds.

North America is Expected to Hold the Largest Market Share

- The demand for the analog and digital mixed-signal IP is driven by the growing utilization of these products as building blocks. The telecommunication sector in the US has been actively investing in 5G infrastructure. The end-user industry in the country accounts for the significant portion of the global consumption of 5G technology. In the North American region, the US dominates the regional 5G market, regarding investment, adoption, and applications.

- The nature of the 5G superfast wireless networks is expected to provide the needed primary impetus to the telecom industry, which has been experiencing slow growth. The US Telecom Association has estimated that the US telecom operators are expected to spend around USD 104 billion by 2025. It is expected to be essential for the telecom service providers to upgrade existing 4G networks to the upcoming 5G standards and, consequently, execute the full installation of 5G wireless services.

- In October 2019, Analogue announced the launch of its Analogue Game Boy Pocket, which is a modern version of the retro-gaming device. The critical component the company has introduced is the second FPGA (apart from one for image processing to deliver high-resolution image on its 10X high-resolution display compared to the original Game Boy). This second FPGA enables the retro-gaming community to build and port their cores to run other games on the Pocket, similar to how the MiSTER FPGA device works.

- Canada is expected to provide sufficient expenditure and funding for its military programs (including clothing). The Canadian government has been focusing on the Integrated Soldier System Project, which is assimilating the soldier suit with electronic devices, weapons, and feed communication among soldiers as they move through the battlefield. This is expected to impact the market's growth positively in the region.

Analog & Mixed Signal IP Industry Overview

The analog and mixed signal IP is quite fragmented as the global players are engaged in integrating the signal in various applications like consumer electronics, automotive, etc., which gives an intense rivalry among the competitors. Key players are Cadence Design Systems Inc., Taiwan Semiconductor Manufacturing Company Limited, Global foundries Inc., and Samsung Electronics Co. Ltd.

- May 2020 - Synopsys, Inc. announced the broadest portfolio of high-quality IP on TSMC's 5nm process technology for high-performance computing system-on-chips (SoCs). The DesignWare IP portfolio on the TSMC process, encompassing interface IP for the most widely used high-speed protocols and foundation IP, accelerates the development of SoCs for high-end cloud computing, AI accelerators, networking, and storage applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increasing Reusability of AMS Block

- 4.4.2 Growing Prevalence of Wireless Communications

- 4.5 Market Restraints

- 4.5.1 Complexity and Sensitivity of Analog/Mixed-Signal (AMS) design

- 4.6 An Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Design

- 5.1.1 Firm/Soft IP

- 5.1.2 Hard IP

- 5.2 Product

- 5.2.1 A2D and D2A Converter

- 5.2.2 Power Management Modules

- 5.2.3 RF

- 5.2.4 Other Products

- 5.3 End-user Industry

- 5.3.1 Consumer Electronics

- 5.3.2 Telecommunication

- 5.3.3 Automotive

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cadence Design Systems Inc.

- 6.1.2 Silicon Creations LLC

- 6.1.3 VeriSilicon Holdings Co. Ltd

- 6.1.4 Renesas Electronics Corporation

- 6.1.5 Synopsys Inc.

- 6.1.6 ARM Holdings PLC

- 6.1.7 Xilinx Inc.

- 6.1.8 Intel Corporation

- 6.1.9 Analog Devices Inc.

- 6.1.10 Maxim Integrated Products Inc.

- 6.1.11 Texas Instruments Limited