|

시장보고서

상품코드

1641832

클라우드 워크로드 스케줄링 소프트웨어 - 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Cloud-based Workload Scheduling Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

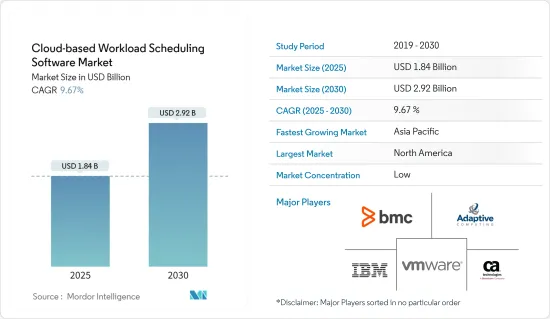

클라우드 워크로드 스케줄링 소프트웨어 시장 규모는 2025년에 18억 4,000만 달러로 추정됩니다. 예측 기간(2025-2030년)의 CAGR은 9.67%로, 2030년에는 29억 2,000만 달러에 이를 것으로 예상됩니다.

기업은 신기술을 도입할 때 분산 및 클라우드 환경에서 워크로드 처리 및 중요한 용도 가용성과 관련된 영향을 고려하고 계획해야 합니다. 그러므로 더 나은 워크로드 스케줄링 소프트웨어의 필요성이 향후 높아질 것으로 예상됩니다.

주요 하이라이트

- 클라우드 워크로드 스케줄링 소프트웨어는 워크로드 통합, 모니터링, 운영, 분석 및 예측을 수행할 수 있습니다. 이렇게 하면 향후 발생할 수 있는 문제를 해결하고 자산을 관리할 수 있는 능력이 조직에 부여됩니다.

- 클라우드 워크로드 스케줄링 소프트웨어는 사용자의 손 없이 워크로드 스케줄링을 개선하는 데 도움이 됩니다. 정교한 스케줄링과 분석 능력을 통해 조직은 직원의 효율성을 높일 수 있습니다. 이것은 클라우드 워크로드 스케줄링 소프트웨어의 큰 원동력이 되고 있습니다.

- 마찬가지로, 다양한 다국적 기업들이 클라우드 기반 서비스를 급속하게 채택하고 선호하는 추세는 예측 기간 동안 클라우드 워크로드 스케줄링 소프트웨어 시장의 확대를 촉진하고 충분한 새로운 기회를 제공할 것으로 예상됩니다.

- 그러나 가용성과 오픈소스 소프트웨어의 급속한 보급은 클라우드 워크로드 스케줄링 소프트웨어의 성장에 큰 제약이 되었습니다. 엄격한 컴플라이언스와 규제를 충족시킬 필요성이 커지면 클라우드 워크로드 스케줄링 소프트웨어의 성장에 어려움이 있을 수 있습니다.

- 팬데믹(세계적 대유행) 도중 세계 많은 나라에서 공중위생상의 우려로 재택근무가 의무화되어 원격 근무 인프라의 필요성이 높아졌습니다. 그러므로 정부기관을 포함한 모든 수준에서 활동하는 조직은 가상 서비스에 대한 수요 증가와 이러한 서비스 제공에 대한 시민들의 기대감을 높이고 정부 노동력을 재편성하는 장기적인 가능성, 적응적이고 동적인 규제 모델을 제공할 필요성 등 다양한 잠재적 영향을 예상했습니다. 따라서 클라우드 워크로드 스케줄링 소프트웨어가 필요했습니다. 팬데믹 후, 기업은 클라우드 기반 서비스로 전환하고 시장은 급성장했습니다.

클라우드 워크로드 스케줄링 소프트웨어 시장 동향

퍼블릭 클라우드 기반 서비스가 최대 시장 점유율을 차지

- 기업은 클라우드 기반 서비스로 전환하고 있으며 비용을 효과적으로 관리하고 있습니다. 대용량 데이터 관리도이 시프트로 해결 된 문제 중 하나입니다. 이 트렌드에 박차를 가하고 있는 것은 무료로 오픈소스, 고도로 커스터마이징 가능한 클라우드 기반 서비스를 이용할 수 있다는 것입니다.

- 클라우드 워크로드 스케줄링 소프트웨어로의 마이그레이션은 워크로드를 관리하기 위해 비용 효율적인 옵션을 취하고자 하는 중소기업에게 급속히 침투하는 동향입니다.

- 예를 들어 2022년 12월 자율형 디지털 엔터프라이즈용 소프트웨어 솔루션의 유명한 진출기업 중 하나인 BMC는 클라우드 기반의 BMC Helix 솔루션이 Buchanan Technologies나 Mphasis 등 디지털 변혁의 여로에서 직원, 툴, 데이터의 사일로화를 해소하는 ServiceOps 기능을 모색하고 있는 현대 기업으로

- 스타트업 문화는 클라우드 기반 서비스에 대한 수요를 높이고 있으며, 클라우드 기반 서비스의 보급은 스타트업 동향의 출현에 필수적인 요소가 되고 있습니다.

- Flexera Software에 따르면 엔터프라이즈 응답자의 80%가 퍼블릭 클라우드 목적으로 Microsoft Azure를 사용합니다. 하이퍼스케일러로 알려진 Amazon, Microsoft Azure, Google Cloud는 세계 최대 규모의 클라우드 컴퓨팅 플랫폼 제공업체입니다. 2022년 3월 현재 기업 응답자의 80%가 자사에 하이브리드 클라우드를 도입하고 있다고 응답하고 있습니다. 하이브리드 클라우드 솔루션으로의 전환은 일반적으로 단일 프라이빗 및 퍼블릭 클라우드의 운영 비용을 감수하면서 이루어집니다.

북미가 최대 시장 점유율을 차지할 전망

- 북미에서는 IT 인프라 증가와 새로운 조직의 출현으로 클라우드 워크로드 스케줄링 소프트웨어에 대한 수요가 높아지고 있다

- 북미에서는 완전히 자동화된 클라우드 기반 조직 경향이 커지고 시장을 견인하고 있습니다. 북미는 BYOD(Bring-your-own-device) 문화의 선구자로, BYOD의 도입이 퍼졌습니다. 이를 통해 조직은 하이브리드 클라우드 모델로 전환하고 프라이빗 클라우드를 통해 민감한 비즈니스 정보의 안전성을 보장하면서 퍼블릭 클라우드 솔루션을 통해 직원들에게 더 많은 용도을 제공하게 되었습니다. 이 동향은 생산성에 유리하며, 예측 기간 동안에도 계속 확장될 것으로 예상됩니다.

- 북미에서는 대기업의 클라우드 워크로드 스케줄링 소프트웨어 제품이 증가하고 있으며 Workfront과 같은 신규 진출기업도 증가하고 있습니다. 주요 기업은 Asana, Acuity Scheduling 등입니다.

- 또한, 이 지역에서는 하이브리드 클라우드와 멀티클라우드 환경에 채택된 새로운 클라우드 툴이 폭발적으로 증가하고 있습니다. 동시에 기존 클라우드 플랫폼은 새로운 하이브리드 현실에 맞게 방향을 바꾸고 있습니다. 주요 퍼블릭 클라우드 제공업체는 하이브리드 클라우드 운영을 지원하기 위해 관리, 워크로드 스케줄링 소프트웨어, 컴퓨팅, 네트워킹, 보안 등의 도구를 강화합니다. 또한 데이터 무결성과 프라이버시를 통한 클라우드 플랫폼에 대한 수요의 지속적인 증가는 조사 기간 동안 워크로드 스케줄 소프트웨어 시장의 채택을 더욱 증가시켜 주요 공급업체가 시장에서 성장할 기회를 늘릴 수 있을 것으로 예상됩니다.

클라우드 워크로드 스케줄링 소프트웨어 산업 개요

클라우드 워크로드 스케줄링 소프트웨어 시장은 BMC Software(Boxer Parent Company, Inc), CA, Inc(Broadcom Inc), VMware, Inc, IBM Corporation, Adaptive Computing Enterprises, Inc(ALA Services LLC) 등의 주요 기업이 존재하며 매우 세분화되어 있습니다. 이 시장 진출 기업은 소프트웨어 제공을 강화하고 지속 가능한 경쟁 우위를 얻기 위해 제휴 및 인수와 같은 전략을 채택하고 있습니다.

- 2023년 10월 세계 소프트웨어 솔루션 제공업체인 TeamPoint Software와 진정한 클라우드 리액티브 실시간 리소스 스케줄링 및 최적화 SAAS 용도인 More-IQ는 현장 서비스 관리 부문을 혁신할 것으로 예상되는 전략적 제휴를 발표했습니다. 이 제휴를 통해 More-IQ의 첨단 작업 스케줄링 기술과 TeamPoint의 필드 서비스 소프트웨어 솔루션 경험을 융합하여 비즈니스 최적화를 목표로 하는 기업이 새로운 기회에 액세스할 수 있습니다. 팀 포인트는 현재 지능형 작업 스케줄링 전문가인 More-IQ와의 제휴를 통해 자사 제품을 프로모션하고 있습니다. More-IQ의 작업 스케줄링 소프트웨어는 영업 경비 절감, 서비스 제공 개선, 가능한 한 효율적인 자원 배분을 목적으로 합니다.

- 2023년 9월, 저명한 기술 기업인 Microsoft와 세계의 컴퓨터 소프트웨어 기업인 Oracle은 고객이 미션 크리티컬한 데이터베이스 워크로드를 Azure로 마이그레이션할 수 있도록 제휴 관계를 확대한다고 발표했습니다. Microsoft는 Oracle과의 강력한 파트너십을 통해 워크로드를 퍼블릭 클라우드로 마이그레이션할 때 고객의 일반적인 장애를 완화하는 데 주력하고 있습니다. Azure 내에서 Oracle Database 서비스를 제공하는 최신 솔루션은 Oracle Database@Azure입니다. 조직은 고객이 Oracle 데이터베이스를 OCI로 마이그레이션하고 Microsoft Cloud의 현재 워크로드와 함께 Azure에 배포할 수 있게 함으로써 혁신적인 솔루션을 개발하고 경쟁업체와의 차별화를 더욱 발전시킬 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계의 강도

- COVID-19가 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 기업의 클라우드 기반 서비스로의 전환

- 클라우드 워크로드 스케줄링 소프트웨어에서 분석 도구의 가용성

- 시장 성장 억제요인

- 오픈소스 프리 소프트웨어

제6장 시장 세분화

- 클라우드별

- 퍼블릭

- 프라이빗

- 하이브리드

- 최종 사용자별

- 기업

- 정부기관

- 기타

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- BMC Software(Boxer Parent Company, Inc.)

- CA, Inc.(Broadcom Inc.)

- VMware, Inc.

- IBM Corporation

- Adaptive Computing Enterprises, Inc.(ALA Services LLC)

- ASG Technologies Group, Inc.

- Cisco Systems Inc.

- Hitachi, Ltd.

- ManageIQ, Inc.(Red Hat, Inc.)

제8장 시장 기회와 앞으로의 동향

제9장 투자 분석

KTH 25.02.17The Cloud-based Workload Scheduling Software Market size is estimated at USD 1.84 billion in 2025, and is expected to reach USD 2.92 billion by 2030, at a CAGR of 9.67% during the forecast period (2025-2030).

As enterprises roll out new technologies, they need to consider and plan for impacts related to workload processing and the availability of critical applications across distributed and cloud environments; hence the need for better workload scheduling software is projected to increase in the future.

Key Highlights

- The cloud-based workload scheduling software available can integrate, monitor, and operate workloads, perform analysis, and give predictions for the future. This empowers organizations with abilities to tackle problems that can arise in the future and also manage assets.

- Cloud-based workload scheduling software helps to improve workload scheduling without the need for human intervention. Sophisticated scheduling and analytical abilities help organizations increase employee efficiency. This is a significant drive for the cloud-based workload scheduling software.

- Similarly, the rapid adoption and increasing preference for cloud-based services by various multinational businesses would provide enough new opportunities, driving the expansion of the cloud-based workload scheduling software market during the forecasted period.

- However, the ease of availability, and the rapid growth of open-source software, are acting as major constraints for the growth of cloud-based workload scheduling software. The growing need to meet strict compliance and regulations has the potential to challenge the growth of cloud-based workload scheduling software.

- During the pandemic, many countries across the globe mandated work from home based on public health safety concerns that drove the need for remote working infrastructure. Therefore, organizations operating at all levels, including government bodies, expected a wide range of potential impacts, such as increased demand for virtual services coupled with rising citizen expectations around the delivery of these services, the longer-term potential for reshaping the government workforce, and the need to provide adaptive and dynamic regulatory models. Thus, such impacts necessitated the cloud-based workload scheduling software for enhanced service experience. Post-pandemic, the market grew rapidly, with enterprises shifting towards cloud-based services.

Cloud Based Workload Scheduling Software Market Trends

Public Cloud-Based Services is set to hold the largest market share

- Enterprises are shifting towards cloud-based services effectively manage costs. Large data management is another problem eliminated due to this shift. Adding to this trend is the growing availability of free, open-source, and highly customizable cloud-based services.

- The change to cloud-based workload scheduling software is a trend fast catching up the Small and Medium Enterprises that would like to take up cost-effective alternatives to manage their workloads.

- For instance, in December 2022, BMC, one of the prominent players in software solutions for the Autonomous Digital Enterprise, confirmed that its cloud-based BMC Helix solution is offering a choice for modern enterprises exploring ServiceOps capabilities to break down staff, tool, and data siloes on their digital transformation journeys, such as Buchanan Technologies and Mphasis.

- The startup culture has increased the demand for cloud-based services, and the proliferation of cloud-based services remains an essential factor for the emergence of the startup trend.

- According to Flexera Software, 80 percent of enterprise respondents used Microsoft Azure for public cloud purposes. Amazon, Microsoft Azure, and Google Cloud, known as hyper scalers, are among the largest global cloud computing platform providers. As of March 2022, 80 percent of enterprise respondents stated they had implemented a hybrid cloud in their firm. The transition to hybrid cloud solutions is typically done at the expense of operating single private and public clouds.

North America is Expected to Register the Largest Market Share

- Increasing IT infrastructure and the emergence of new organizations in the North American region have led to increasing demand for cloud-based workload scheduling software.

- The growing trend of an entirely automated and cloud-based organization in the American region drives the market. North America pioneered the bring-your-own-device (BYOD) culture, resulting in widespread incorporation. This has led organizations to shift toward hybrid cloud models to ensure the safety of sensitive business information via private cloud while providing a greater reach of applications to employees through public cloud solutions, which is necessary for some applications requiring on-field access. This trend benefits productivity and is expected to continue and grow during the forecast period.

- North America has witnessed an increase in cloud-based workload scheduling software products from the major players and growing new players like Workfront. Asana, Inc., Acuity Scheduling, and Inc., among others.

- Further, the region is witnessing an explosion of new cloud tools adopted for hybrid and multi-cloud environments. At the same time, established cloud platforms are pivoting to fit into the new hybrid reality. The large public cloud providers are ramping up tools, including offerings in management, workload scheduling software, computing, networking, and security, to support hybrid cloud operations. In addition, the ongoing increase in demand for cloud platforms based on data integrity and privacy is further expected to increase the workload schedule software market adoption in the study period and enable leading vendors with more opportunities to grow in the market.

Cloud Based Workload Scheduling Software Industry Overview

The Cloud-based Workload Scheduling Software Market is highly fragmented, with the presence of key players like BMC Software (Boxer Parent Company, Inc.), CA, Inc. (Broadcom Inc.), VMware, Inc., IBM Corporation, and Adaptive Computing Enterprises, Inc.(ALA Services LLC). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their software offerings and gain sustainable competitive advantage.

- In October 2023, TeamPoint Software, a global software solution provider, and More-IQ, a true cloud reactive and real-time resource scheduling and optimization SAAS application, announced a strategic partnership that is anticipated to transform the field service management sector. Organizations looking to optimize their operations through this partnership will access new opportunities as More-IQ's advanced job scheduling technology and TeamPoint's experience in field service software solutions are combined. TeamPoint is now promoting its products through a partnership with the intelligent job scheduling professionals More-IQ. More-IQ's work scheduling software aims to reduce operating expenses, improve service delivery, and allocate resources as efficiently as possible.

- In September 2023, Microsoft, a prominent technology corporation and Oracle, a global computer software firm, announced extending their partnership to ensure customers can migrate their mission-critical database workloads to Azure. Microsoft's strong partnership with Oracle keeps them focused on lowering clients' typical obstacles when moving workloads to the public cloud. The newest solution to deliver Oracle Database services inside Azure is Oracle Database@Azure. Organizations can develop innovative solutions and further differentiate themselves from competitors by enabling clients to transfer Oracle databases to OCI and deploy them in Azure alongside their present workloads in the Microsoft Cloud.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Enterprises Shifting Towards Cloud-Based Services

- 5.1.2 Availability of Analytical tools in Cloud based Workload Scheduling Software

- 5.2 Market Restraints

- 5.2.1 Opensource-Free Software Hampering the Growth of Market

6 MARKET SEGMENTATION

- 6.1 By Cloud

- 6.1.1 Public

- 6.1.2 Private

- 6.1.3 Hybrid

- 6.2 By End User

- 6.2.1 Corporate

- 6.2.2 Government

- 6.2.3 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BMC Software (Boxer Parent Company, Inc.)

- 7.1.2 CA, Inc. (Broadcom Inc.)

- 7.1.3 VMware, Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Adaptive Computing Enterprises, Inc. (ALA Services LLC)

- 7.1.6 ASG Technologies Group, Inc.

- 7.1.7 Cisco Systems Inc.

- 7.1.8 Hitachi, Ltd.

- 7.1.9 ManageIQ, Inc. (Red Hat, Inc.)