|

시장보고서

상품코드

1852079

인터벤션 영상의학 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Interventional Radiology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

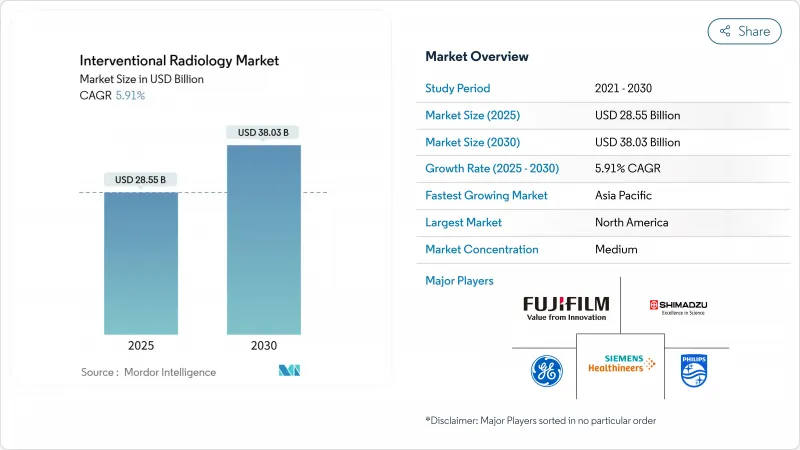

인터벤션 영상의학 시장 규모는 2025년에 285억 5,000만 달러, 2030년에는 380억 3,000만 달러에 이를 것으로 예측되며, CAGR은 5.91%를 나타낼 전망입니다.

개복 수술에서 낮은 침습 영상 유도 치료로의 급속한 전환은 이 확대를 지원하고, 회복 시간을 단축하고, 지불자와 의료 제공업체의 총 지출을 감소시킵니다. 고급 화상처리장치에 내장된 인공지능은 실시간 지침을 향상시키고, 치료의 질을 높이고, 복잡한 심장혈관, 종양, 신경혈관 사례에서 수술 건수를 자극합니다. 또한 반복적인 개입과 장기적인 질병 관리를 필요로 하는 만성 질환의 세계적인 증가도 수요의 추풍이 되고 있습니다. 동시에 외래환자센터는 페이포 밸류의 상환모델이 비용 효율적인 케어 설정에 보상함에 따라 변화하는 절차의 흐름을 포착하고 있습니다. 선도적인 제조업체의 R & D 투자 강화는 대응 가능한 환자 풀을 확장하고 수익률이 높은 소모품의 수익원을 개척하는 장비, 소프트웨어 및 로봇의 강력한 파이프라인을 유지합니다.

세계 인터벤션 영상의학 시장 동향과 통찰

만성 질환과 생활 습관병의 유병률 상승

심혈관계 및 종양계의 부담은 내구성 있는 임상적 이점을 제공하는 카테터 기반 인터벤션에 대한 수요를 증가시키고 있습니다. 경 카테터적 대동맥 판막 치환술만으로도 2024년에는 70억 달러 가까이를 만들어 내고 지속적인 수술의 보급을 시사하고 있습니다. Termo의 WEB 시스템과 같은 신경혈관의 진보는 파열 동맥류의 폐색률 86.5%를 달성해, 종래 개두 수술로 치료되고 있던 적응을 확대했습니다. 말초동맥질환 치료는 애봇사가 FDA의 인가를 받은 Esprit BTK 용해 스텐트로 진보하여 2,000만명 이상의 이환 환자를 가진 미국인을 위해 설계되었습니다. 평균 수명이 연장됨에 따라 만성 합병증은 안정적인 치료 파이프라인을 만들어 내고 인터벤션 영상의학 시장의 장기 성장을 지원합니다.

낮은 침습 이미징 기술의 끊임없는 진보

지멘스 헤르티니어스의 Ciartic Move로 대표되는 바와 같이, 인공지능은 투시 시간과 방사선량을 줄이고 척추와 골반 수술을 최대 50% 가속합니다. AI와 통합된 로보틱스는 애봇의 시험용 전도계 페이싱 플랫폼에서 처음으로 실시한 리드리스 좌속 가지 페이싱을 가능하게 합니다. RapidAI의 Lumina 3D는 몇 분 안에 고품질의 신경 이미지를 재구성하고, 기사 부족을 해결하고, 시간에 민감한 뇌졸중 워크플로우를 지원합니다. Philips는 엔비디아와의 여러 해에 걸친 협업을 통해 제로 클릭 스캔 계획을 실현하는 MRI 기반 모델을 개발하여 혁신 능력을 심화시키고 있습니다. 이러한 개발은 절차의 정확성을 향상시키고 프리미엄 이미징 스위트에서 차별화를 실현합니다.

하이브리드 이미징 스위트의 높은 자본 비용과 운영 비용

혈관 조영술, CT 및 MRI를 결합한 하이브리드 제품군은 수백만 달러를 초과할 수 있으며 특수 차폐, 에어컨 시설 업그레이드 및 멀티모달 소프트웨어 통합이 필요합니다. 지속적인 서비스 계약 및 직원 교육은 총 소유 비용을 늘리고 예산에 제약이 있는 병원 채용을 방해합니다. 지멘스 헤르티니어스는 현대화 비용을 상각하고 장비 그룹을 표준화하는 10년간의 가치 파트너십을 통해 이러한 장벽을 완화하고 있습니다. 그럼에도 불구하고 소규모 시설에서는 자금 조달 및 수영장 조달을 이용하기 위해 합병을 추구하는 경우가 많으며, 발전하지 않은 의료 시스템의 보급을 늦추고 있습니다.

부문 분석

2024년 영상 진단 시스템의 점유율은 46.34%를 유지했으며, 수기 계획과 수술 지도에서 기본적인 역할이 강조되었습니다. 지멘스의 syngo DynaCT에 탑재된 AI 학습에 의한 뼈 제거 알고리즘 등, 지속적인 기능 업그레이드는 예산이 박박하고 있는 가운데도 정기적인 설비 갱신 사이클을 지원하고 있습니다. 그러나 IR 소모품은 2030년까지의 CAGR 7.45%로 성장할 것으로 예측되며, 사례 수 증가에 따른 경상수익의 우위성을 반영하고 있습니다. 단일 사용 카테터와 색전 코일은 교차 오염의 위험을 줄이고 재고 관리를 간소화하여 회전율이 높은 외래 실험실에 매력적입니다. 소모품의 인터벤션 영상의학 시장 규모는 치료의 복잡성이 증가함에 따라 빠르게 확대될 것으로 예측됩니다.

액세서리와 워크플로우 소프트웨어는 클라우드 분석이 모달리티 다운타임을 단축하고 스케줄링을 최적화하기 때문에 하드웨어 성장을 능가합니다. Philips의 헬륨 프리 BlueSeal MRI는 1대당 연간 약 40MWh를 절약하고 환경 효율이 임상 성능을 보완한다는 것을 보여줍니다. AI를 활용한 선량 모니터링 기능을 탑재한 투시 검사 시스템은 안전성의 의무화에 대응해, 중견 병원에 어필하고 있습니다. 전반적으로 성숙한 영상처리 인프라는 고효율의 일회용 보급 무대를 마련해 인터벤션 영상의학 시장 전체에서 수익성 높은 확대를 추진하고 있습니다.

치료 치료는 CAGR 7.66%로 진행되고 있으며, Merit Medical사의 Wrapsody 세포 불투과성 엔도보테제와 같은 장치의 획기적인 진보가 뒷받침되고 있습니다. 혈관 성형술과 스텐트 유치술은 Abbott의 Esprit BTK 플랫폼과 같은 약물 전달을 보장하면서 혈관 치유를 지원하는 흡수 스캐폴드의 혜택을 받고 있습니다. 절제 기술의 진보는 예측 가능한 병변 경계를 가져오고 측면 부상해를 줄임으로써 종양학과 통증 관리의 적응을 확대합니다. 그 결과, 치료 서비스로 인한 인터벤션 영상의학 시장 규모는 부문 수준에서 2030년까지 252억 달러에 이를 것으로 예측됩니다.

진단 절차는 38.23%의 점유율을 차지했고 인터벤셔니스트에게 필수적인 영상 진단 로드맵을 제공하지만, 1건당 수익은 낮습니다. 그럼에도 불구하고 콘빔 CT와 AI 지원 혈관 조영술의 혁신은 진단 정확도를 높이고 간접적으로 치료 확대를 지원합니다. 생검과 배수는 종양의 병기 분류와 감염 대책에 필수적인 것으로 변함이 없습니다. 불후의 진단 기반은 치료 파이프라인으로의 안정적인 환자 유입을 보장하고, 보다 광범위한 인터벤션 영상의학 시장의 성장 모멘텀을 지속시킵니다.

지역 분석

북미는 2024년 매출액의 43.21%를 차지했고, 확립된 임상 지침, 장비의 높은 보급률, 지멘스 헤르티니어스의 미국에서 1억 5,000만 달러의 시설 확장을 포함한 견고한 R&D 헌신에 지지되고 있습니다. 메디케어가 2.83%의 진료 보상 인하를 실시하고, 인터벤션 영상의학의 진료 보수가 4% 인하될 것으로 예측되기 때문에 지불 압력이 가까워지고, 의료 제공업체는 비용 효율적인 외래 설비에 대한 투자에 박차가 걸립니다. FDA의 Transitional Coverage for Emerging Technologies pathway와 같은 규제 이니셔티브는 획기적인 의료기기 시장 도입을 촉진하고 재정 박멸에도 불구하고 혁신의 흐름을 유지합니다.

아시아태평양은 CAGR 6.34%로 가장 빠른 성장을 기록하고 있으며, 대규모 미충족 요구, 도시에서의 병원 건설, 합작 사업 등이 그 요인이 되고 있습니다. Inari Medical과 6 Dimensions Capital과의 제휴는 중국에서 혈전 제거 장치의 상업화를 가속화하고 선진 치료를 현지화하는 해외 및 국내 협력 관계를 보여줍니다. 각국 정부는 의료 투어리즘을 억제하기 위해 이미징 인프라와 의사 양성을 우선하고, 관민 제휴는 지역 네트워크 전체에서 AI 툴을 확장하기 위해 클라우드 플랫폼을 활용합니다.

유럽에서는 엄격한 장비 안전 기준과 강력한 대학 병원 네트워크를 지원하여 안정적인 확장을 유지하고 있습니다. Philips는 2024년에 594건의 의료기술 출원으로 유럽 특허청을 선도하여 이 지역의 기술 혁신에 대한 평가를 높였습니다. 동유럽 시스템은 혈관 조영 실험실 업그레이드에 유럽 연합(EU)의 통합 기금을 할당하여 기술 능력을 향상 시켰습니다. 중동 및 아프리카와 남미는 아직 시작됐지만, 탄자니아의 Road2IR 프로그램과 같은 트레이닝 이니셔티브가 1,500개 이상의 수술을 높은 성공률로 완료하고 있기 때문에 도입이 가속되고 있음을 알 수 있습니다. 다국적 OEM은 이러한 가치관이 강한 시장에 진입하기 위해 대출 패키지를 조정하여 세계 인터벤션 영상의학 시장 전체의 수익원을 다양화하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 만성 질환과 생활 습관병 증가

- 저침습 이미징 기술의 끊임없는 진보

- 치료 영역을 넘은 용도의 확대

- 외래 및 당일 진료 환경으로의 전환

- 하이엔드 이미지 인프라에 대한 설비 투자 증가

- 영상 유도 절차에 대한 상환 지원 확대

- 시장 성장 억제요인

- 하이브리드 이미징 스위트의 높은 자본 비용과 운영 비용

- 엄격한 방사선 안전 규제와 준수 부담

- 숙련된 중재 방사선 전문의 및 직원 부족

- 대체 혈관내 치료 전문 분야로부터의 경쟁 압력

- 규제 상황

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력/소비자

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 이미징 시스템

- 혈관 조영 시스템

- 투시 시스템

- CT 스캐너

- MRI 시스템

- IR 소모품

- 카테터 및 가이드와이어

- 풍선 및 스텐트 시스템

- 색전·혈전 제거 장치

- 액세서리 & 소프트웨어

- 이미징 시스템

- 수술 유형별

- 진단

- 혈관 조영

- 생검과 배액

- 치료

- 혈관 성형술과 스텐트 유치술

- 색전술

- 절제

- 진단

- 용도별

- 심장병학

- 종양학

- 소화기내과 및 간내과

- 비뇨기과·신장내과

- 기타 용도

- 최종 사용자별

- 병원

- 외래수술센터(ASC)(ASCs)

- 오피스 기반 랩(OBL)(OBL) 및 이미징 센터

- 지리

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Siemens Healthineers AG

- GE HealthCare

- Koninklijke Philips NV

- Canon Medical Systems Corp.

- Fujifilm Holdings Corporation

- Shimadzu Corporation

- Hologic Inc.

- Samsung Medison Co. Ltd.

- Boston Scientific Corp.

- Medtronic PLC

- Cook Medical LLC

- Terumo Corp.

- Abbott Laboratories

- Stryker Corp.

- Penumbra Inc.

- AngioDynamics Inc.

- Merit Medical Systems Inc.

- Cardinal Health Inc.

- Teleflex Inc.

- Esaote SpA

제7장 시장 기회와 장래의 전망

SHW 25.11.19The interventional radiology market size is valued at USD 28.55 billion in 2025 and is forecast to reach USD 38.03 billion by 2030, advancing at a 5.91% CAGR.

Rapid migration from open surgery to minimally invasive, image-guided therapies underpins this expansion, reducing recovery times and lowering total expenditure for payers and providers. Artificial intelligence embedded in advanced imaging suites improves real-time guidance, elevates care quality, and stimulates procedure volumes in complex cardiovascular, oncologic, and neurovascular cases. Demand also benefits from a worldwide rise in chronic diseases that require repeat interventions and long-term disease management. At the same time, outpatient centers capture shifting procedure flows as pay-for-value reimbursement models reward cost-efficient care settings. Intensifying R&D investment from leading manufacturers sustains a strong pipeline of devices, software, and robotics that widen the addressable patient pool and open high-margin consumable revenue streams.

Global Interventional Radiology Market Trends and Insights

Rising Prevalence of Chronic and Lifestyle Diseases

Cardiovascular and oncologic burdens elevate demand for catheter-based interventions that offer durable clinical benefits. Transcatheter aortic valve replacement alone generated nearly USD 7 billion in 2024, signaling sustained procedure uptake. Neurovascular advances such as Terumo's WEB system achieved an 86.5% occlusion rate for ruptured aneurysms, broadening indications previously treated via open craniotomy. Peripheral artery disease therapies progress with Abbott's FDA-cleared Esprit BTK dissolving stent, designed for more than 20 million affected Americans. As life expectancy rises, chronic comorbidities generate steady procedural pipelines, anchoring long-term growth for the interventional radiology market.

Continuous Advancements in Minimally Invasive Imaging Technologies

Artificial intelligence reduces fluoroscopy times and radiation dose, exemplified by Siemens Healthineers' Ciartic Move, which accelerates spine and pelvic procedures by up to 50%. Robotics integrated with AI enable leadless left bundle branch pacing, first performed with Abbott's investigational conduction system pacing platform. RapidAI's Lumina 3D reconstructs high-quality neuro images within minutes, addressing technologist shortages and supporting time-sensitive stroke workflows. Philips deepens innovation capacity through a multi-year collaboration with NVIDIA to develop MRI foundational models that deliver zero-click scan planning. Together, these developments raise procedural accuracy and create defensible differentiation for premium imaging suites.

High Capital and Operating Costs of Hybrid Imaging Suites

Hybrid suites blending angiography, CT, and MRI can exceed several million USD and require specialized shielding, HVAC upgrades, and multi-modal software integration. Ongoing service contracts and staff training raise the total cost of ownership and deter adoption in budget-constrained hospitals. Siemens Healthineers mitigates these barriers through decade-long Value Partnerships that amortize modernization costs and standardize equipment fleets. Nonetheless, small facilities often pursue mergers to access financing and pooled procurement, slowing diffusion in less-developed health systems.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Interventional Radiology Applications Across Therapeutic Areas

- Shift Toward Outpatient and Day-Case Treatment Settings

- Stringent Radiation Safety Regulations and Compliance Burdens

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, Imaging Systems retained a 46.34% share, underscoring their foundational role in procedure planning and guidance. Continuous feature upgrades-such as AI-trained bone-removal algorithms on Siemens' syngo DynaCT-support recurrent capital replacement cycles even as budgets tighten. IR Consumables, however, exhibit a 7.45% CAGR through 2030, reflecting their recurring revenue advantage as case volumes climb. Single-use catheters and embolization coils reduce cross-contamination risks and streamline inventory control, making them attractive for outpatient labs where turnover is high. The interventional radiology market size for consumables is projected to broaden swiftly as therapeutic complexity rises.

Accessories and workflow software outpace hardware growth because cloud analytics lower modality downtime and optimize scheduling. Philips' helium-free BlueSeal MRI saves nearly 40 MWh annually per unit, illustrating how eco-efficiency complements clinical performance. Fluoroscopy systems that bundle AI-enabled dose monitoring meet tightening safety mandates and appeal to mid-tier hospitals. Overall, mature imaging infrastructure sets the stage for high-margin disposable uptake, driving profitable expansion across the interventional radiology market.

Therapeutic procedures are advancing at a 7.66% CAGR, propelled by device breakthroughs like Merit Medical's Wrapsody cell-impermeable endoprosthesis that achieved strong primary patency for hemodialysis access. Angioplasty and stenting benefit from absorbable scaffolds that support vessel healing while ensuring drug delivery, such as Abbott's Esprit BTK platform. Ablation technology progression yields predictable lesion boundaries and shrinks collateral injury, broadening oncology and pain-management indications. Consequently, the interventional radiology market size attributed to therapeutic services is projected to reach USD 25.2 billion by 2030 at segment level.

Diagnostic procedures hold a 38.23% share, providing essential imaging roadmaps for interventionists but delivering lower revenue per case. Nevertheless, innovations in cone-beam CT and AI-assisted angiography enhance diagnostic accuracy, indirectly supporting therapeutic expansion. Biopsy and drainage remain vital for oncologic staging and infection control. The enduring diagnostic foundation ensures a steady flow of patients into the therapeutic pipeline, sustaining growth momentum in the broader interventional radiology market.

The Interventional Radiology Market Report is Segmented by Product (Imaging Systems, IR Consumables, and More), Procedure Type (Diagnostic and Therapeutics), Application (Cardiology, Oncology, and More), End-User (Hospitals, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 43.21% revenue in 2024, supported by established clinical guidelines, high device penetration, and robust R&D commitments including Siemens Healthineers' USD 150 million facility expansion in the United States. Payment pressures loom as Medicare enacts a 2.83% fee schedule reduction and a projected 4% cut in interventional radiology reimbursements, spurring provider investment in cost-efficient outpatient capacity. Regulatory initiatives such as the FDA's Transitional Coverage for Emerging Technologies pathway expedite market uptake for breakthrough devices, sustaining innovation flow despite fiscal tightening.

Asia-Pacific registers the fastest growth at a 6.34% CAGR, fueled by large unmet procedural needs, urban hospital build-outs, and joint ventures. Inari Medical's partnership with 6 Dimensions Capital accelerates commercialization of thrombectomy devices in Greater China, illustrating foreign-domestic collaboration that localizes advanced therapies. Governments prioritize imaging infrastructure and physician training to curb outbound medical tourism, while public-private alliances leverage cloud platforms to scale AI tools across regional networks.

Europe maintains stable expansion anchored by tight device-safety standards and strong university hospital networks. Philips led European Patent Office filings with 594 medical technology applications in 2024, reinforcing the region's innovation reputation. Eastern European systems allocate European Union cohesion funds to upgrade angiography labs, boosting procedure capacity. The Middle East & Africa and South America remain nascent but show accelerating adoption as training initiatives like Tanzania's Road2IR program complete more than 1,500 procedures with high success rates. Multinational OEMs tailor financing packages to penetrate these value-conscious markets, diversifying revenue streams across the global interventional radiology market.

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips

- Canon

- FUJIFILM

- Shimadzu

- Hologic

- Samsung Medison Co. Ltd.

- Boston Scientific

- Medtronic

- Cook Group

- Terumo Corp.

- Abbott Laboratories

- Stryker

- Penumbra

- AngioDynamics

- Merit Medical Systems

- Cardinal Health

- Teleflex

- Esaote

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic And Lifestyle Diseases

- 4.2.2 Continuous Advancements in Minimally Invasive Imaging Technologies

- 4.2.3 Expansion of Applications Across Therapeutic Areas

- 4.2.4 Shift Toward Outpatient and Day-Case Treatment Settings

- 4.2.5 Increasing Capital Investments in High-End Imaging Infrastructure

- 4.2.6 Growing Reimbursement Support For Image-Guided Procedures

- 4.3 Market Restraints

- 4.3.1 High Capital and Operating Costs Of Hybrid Imaging Suites

- 4.3.2 Stringent Radiation Safety Regulations and Compliance Burdens

- 4.3.3 Shortage of Skilled Interventional Radiologists and Staff

- 4.3.4 Competitive Pressure From Alternative Endovascular Specialties

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Imaging Systems

- 5.1.1.1 Angiography Systems

- 5.1.1.2 Fluoroscopy Systems

- 5.1.1.3 CT Scanners

- 5.1.1.4 MRI Systems

- 5.1.2 IR Consumables

- 5.1.2.1 Catheters & Guidewires

- 5.1.2.2 Balloon & Stent Systems

- 5.1.2.3 Embolization & Thrombus Devices

- 5.1.3 Accessories & Software

- 5.1.1 Imaging Systems

- 5.2 By Procedure Type

- 5.2.1 Diagnostic

- 5.2.1.1 Angiography

- 5.2.1.2 Biopsy & Drainage

- 5.2.2 Therapeutic

- 5.2.2.1 Angioplasty & Stenting

- 5.2.2.2 Embolization

- 5.2.2.3 Ablation

- 5.2.1 Diagnostic

- 5.3 By Application

- 5.3.1 Cardiology

- 5.3.2 Oncology

- 5.3.3 Gastroenterology & Hepatology

- 5.3.4 Urology & Nephrology

- 5.3.5 Other Applications

- 5.4 By End-user

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers (ASCs)

- 5.4.3 Office-Based Labs (OBLs) & Imaging Centers

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Siemens Healthineers AG

- 6.3.2 GE HealthCare

- 6.3.3 Koninklijke Philips NV

- 6.3.4 Canon Medical Systems Corp.

- 6.3.5 Fujifilm Holdings Corporation

- 6.3.6 Shimadzu Corporation

- 6.3.7 Hologic Inc.

- 6.3.8 Samsung Medison Co. Ltd.

- 6.3.9 Boston Scientific Corp.

- 6.3.10 Medtronic PLC

- 6.3.11 Cook Medical LLC

- 6.3.12 Terumo Corp.

- 6.3.13 Abbott Laboratories

- 6.3.14 Stryker Corp.

- 6.3.15 Penumbra Inc.

- 6.3.16 AngioDynamics Inc.

- 6.3.17 Merit Medical Systems Inc.

- 6.3.18 Cardinal Health Inc.

- 6.3.19 Teleflex Inc.

- 6.3.20 Esaote SpA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment