|

시장보고서

상품코드

1910524

약국 자동화 시장 : 점유율 분석, 업계 동향, 통계, 성장 예측(2026-2031년)Pharmacy Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

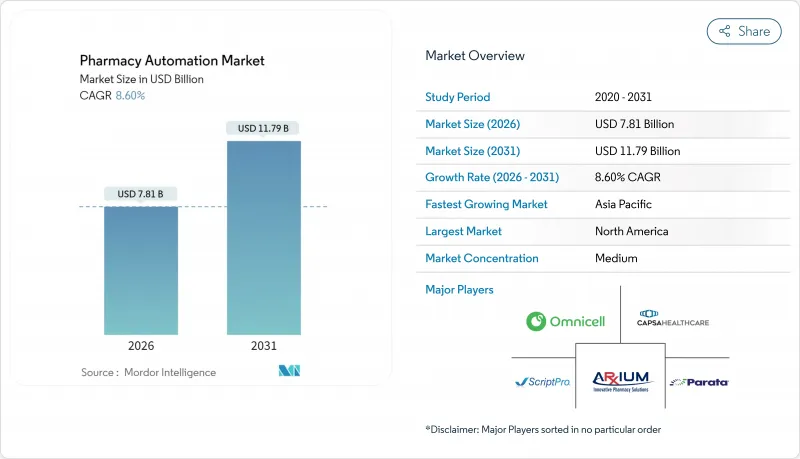

약국 자동화 시장은 2025년 71억 9,000만 달러로 평가되었고, 2026년에는 78억 1,000만 달러, 2031년까지 117억 9,000만 달러에 달할 전망입니다. 2026년부터 2031년에 걸쳐 CAGR은 8.6%를 나타낼 전망입니다.

처방전 수 증가, 만성질환의 만연, 노화, 지속적인 노동력 부족이 결합되어 자동조제, 제제, 재고관리에 대한 수요가 높아지고 있습니다. 2023년 11월에 시행되는 미국 약전(USP) 797에 근거한 새로운 무균 제제 규칙은 의료 종사자와 환자 모두를 보호하는 로봇 솔루션으로의 전환을 촉진하고 있습니다. 기존 의료기기 제조업체와 틈새인 자동화 전문기업이 병원, 소매 및 통신판매의 동일한 구매층을 다투는 것으로 경쟁 격화가 진행되고 있습니다. BD에 의한 2024년 9월 파라타시스템즈 인수로 대표되는 업계 재편은 규모 확대와 엔드 투 엔드 능력의 경쟁을 보여줍니다. 로봇에 내장된 인공지능(AI)은 단순한 조제 하드웨어를 데이터 구동형 자산으로 변환하여 에러율의 저감, 약국 업무의 자동화, 2023년 미국 승인 의약품의 80% 이상을 차지한 전문약 증가분 관리를 실현합니다.

세계의 약국 자동화 시장 동향과 인사이트

처방전 수량 및 약물 처리량 증가

세계 처방전 수는 계속 증가하고 있으며, 많은 병원 약국에서는 현재 하루에 수천 건의 주문을 처리하고 있습니다. 스위스로그의 PillPick과 같은 고밀도 로봇 보관 시스템은 50,000 단위 이상의 약물을 저장할 수 있어 조제 공정에서 인적 접촉을 여러 번 줄이고 급증하는 처리량에 대응합니다. 중앙 채우기 프로그램은 더 큰 확장을 가져옵니다. CoverMyMeds사의 'Central Fill-as-a-Service' 플랫폼은 현장 인력 절감을 도모하면서 처방전당 비용을 30% 절감할 수 있습니다. 이러한 기술은 처리량이 증가하는 동안 규정 준수를 보장하고 추적 가능성을 위해 USP 797에서 요구하는 디지털 로그를 제공합니다.

고령화 인구 확대와 만성 질환 부담 증가

65세 이상의 노인은 급속히 증가하는 층이며, 5개 유형 이상의 처방전을 관리하는 경우가 적지 않습니다. 장기 요양 시설(LTC) 약국에서는 시간 지정 용량을 파우치 포장하는 자동화를 도입하여 오투여를 줄이고 복약 준수율을 향상시키고 있습니다. FrameworkLTC의 보고에 따르면, 워크플로 로보틱스에 의해 직원의 업무 시간이 예방접종이나 포인트 오브 케어 검사에 돌려져, 수익원을 확대하면서 만성 질환 케어 계획을 지원하고 있습니다. 미국 의약품 공급망 안보법도 바코드 기반 추적을 가속화하고 LTC 환경에서는 자동 검증이 필수적입니다.

초기 자본 투자 및 유지비용 높이

로봇 본체, 설치, 소프트웨어에 대한 선행 투자는 약국의 예산을 압박합니다. CoverMyMeds사의 CFaaS(처방전 단위 과금형)와 같은 금융 모델은 비용을 운영 경비로 전환함으로써 자본 장벽을 해소합니다. 독립계 약국에서는 Qx-Dextron과 같은 컴팩트 로봇이 채택되고 있어, 1년 미만으로 투자 회수가 가능해, 일일 1kWh 미만의 전력 소비에 의해 광열비를 최소한으로 억제합니다. 그러나, 2010년경에 도입된 많은 로봇이 수명을 맞이하고 있으며, 운영자는 갱신 사이클의 예산계상이 필요합니다.

부문 분석

자동조제 시스템은 1회 복용량 보관, 바코드 검사, 전자 건강 기록과 연계된 안전 서랍 기능을 통해 2025년 시점에서 약국 자동화 시장의 47.07% 점유율을 유지했습니다. 한편, 무균조제 로봇 플랫폼은 USP 797 기준의 엄격화에 대응하기 위해 의료기관이 유해약제 조제를 자동화하는 움직임을 받아 2031년까지의 예측에서 최고가 되는 10.28%의 연평균 복합 성장률(CAGR)을 기록했습니다. 로봇 조제의 약국 자동화 시장 규모는 AI 비전과 중량 측정에 의한 오염 위험 감소로 꾸준한 성장이 예상됩니다.

자동 포장 및 라벨링 솔루션은 기술자의 작업 시간을 절반으로 줄이고 자동 정제 카운터는 지역 약국에 1분 미만의 사이클 시간을 제공합니다. 보관 및 꺼내기 모듈은 수직 회전 목마로 설치 면적을 압축하고 분석 대시 보드는 약물 목록 합리화에 도움이되는 수요 패턴을 시각화합니다. 약사 워크플로우 소프트웨어에는 현재 재고 기준량을 제안하고 체류품을 경고하는 AI가 통합되어 업무 데이터를 임상 의사결정 지원과 연동시키고 있습니다.

2025년의 의약품 처리량의 대부분은 병원 환경에서 처리되어 응급 대응·만성 질환 관리 도입·급성기 의료 수요에 추진되어 약국 자동화 시장 점유율의 61.94%를 차지했습니다. BD사의 Pyxis MedStation ES와 같은 시스템은 폐쇄형 제제와 실시간 재고 텔레메트리를 제공하여 병동으로의 회수 횟수를 줄입니다. 대규모 학술 센터에 연결된 중앙 약국 조제 허브는 처리 능력과 일관성을 더욱 확대합니다.

우편 주문 및 e 약국 사업자는 가장 높은 11.29%의 연평균 복합 성장률(CAGR) 전망을 보여줍니다. Amazon Pharmacy는 당일 배송과 가격 투명성 용도를 결합하여 CVS Health의 디지털 처방전 관리 도구는 만성 질환 치료의 지속적인 처방전 업데이트를 보장합니다. 프라하의 Dr. Max의 토트 투 파슨 시스템과 같은 고층 자동 창고는 매시간 수천 건의 주문을 사전 분류하여 로봇 포장 스테이션에 공급합니다. 소매 체인은 대기 시간을 2분 미만으로 억제하는 컴팩트 카운터와 픽 투 라이트 선반을 갖춘 POS 거점의 개수를 계속하고 있습니다.

지역별 분석

북미의 수익 점유율 41.12%는 성숙한 전자건강기록(EHR) 연결성, 지불자에 의한 오류 감소 압력, 자동화 프로세스 승인을 가속화하는 FDA의 선진 제조 기술 지정 프로그램 등에 지원되고 있습니다. 대규모 의료 시스템은 USP 797 개정을 받아 무균 조제 로봇에 자본을 집중시키고 캐나다 각주에서는 약사 부족 대책으로 자동화 투자를 조성하고 있습니다.

아시아태평양은 9.39%라는 최고 CAGR을 기록하고 있으며 인도, 중국, 한국이 병원과 공급망의 디지털화를 급속히 진행하고 있습니다. ISPE는 국경을 넘어서는 제조 파트너십이 자동 충전 및 검사 라인으로의 자본 유입을 지원하고 있다고 지적합니다. AI 수요 예측과 벤더 관리 재고를 도입한 중국의 파일럿 사업에서는 재고 회전율이 두 자리수의 향상을 기록했습니다. 인도네시아와 베트남은 의약품검사협력기구(PICS)를 통한 지역규제의 무결성에 의존하여 외국 벤더의 진입을 용이하게 하고 품질보증(QA)을 표준화하고 있습니다.

EU는 북미에 비해 총액에서는 지연을 받고 있지만, 규제의 확실성이라는 이점이 있습니다. 2024년 8월부터 시행되고 있는 EU AI법은 의료용 AI의 위험 계층을 규정하고 있으며, 병원이 조제 로봇, 클라우드 분석, AI 안전 체크를 약국 업무에 도입할 때의 법적 명확성을 제공합니다. 북유럽 국가와 이베리아 반도의 원격지역에서는 원격약국(Telepharmacy)를 통해 운용되는 분산형 캐비닛이 채택되어 엄격한 데이터 프라이버시법에 준거하면서 약물에 대한 액세스를 확대하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 처방전량 증가와 약제 처리량의 확대

- 고령화 인구의 확대와 만성 질환의 부담 증가

- 환자 안전 강화 및 오류 감소 의무 확대

- 중앙 조제 및 허브 약국으로의 전환

- 재고 최적화를 위한 인공지능 통합

- 전문 약제제의 복잡성 급증

- 시장 성장 억제요인

- 높은 초기 자본 투자액과 유지 관리 비용

- 업무 흐름의 혼란과 직원 교육 부담

- 연결 시스템의 데이터 보안 및 개인 정보 보호에 대한 우려

- 로봇에 의한 무균 조제에 관한 규제의 모호함

- 규제 상황

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 자동조제 시스템

- 자동 포장 및 라벨링 시스템

- 자동 탁상 타블렛 카운터

- 자동 저장 및 회수 시스템

- 로봇식 무균 조제 시스템

- 약사 업무 및 분석 소프트웨어

- 최종 사용자별

- 병원 약국(입원 환자용, 외래 환자용)

- 소매 약국 및 체인 약국

- 통신 판매/온라인 약국

- 장기 요양 및 전문 약국

- 전개 모델별

- 집중형 자동화 허브

- 분산형 현장 단위

- 약국 규모별

- 500병상 이상 / 250개 이상 약국

- 100-499병상 / 50-249개 약국

- 100병상 미만 / 독립 약국

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Accu-Chart Plus Healthcare Systems

- ARxIUM

- Baxter International Inc.

- Capsa Healthcare

- BD(Becton, Dickinson & Co.)

- Grifols(LogiFill)

- ICU Medical(IntelliMix)

- Innotech Espana (Rowa)

- McKesson Corporation

- NewIcon Oy

- Omnicell Inc.

- Oracle Health(Cerner Rx)

- Parata Systems LLC

- Pearson Medical Technologies

- RxSafe LLC

- ScriptPro LLC

- Swisslog Healthcare

- Talyst Systems(Swisslog)

- TouchPoint Medical

- Yuyama Co. Ltd.

제7장 시장 기회와 장래의 전망

SHW 26.01.26The pharmacy automation market is expected to grow from USD 7.19 billion in 2025 to USD 7.81 billion in 2026 and is forecast to reach USD 11.79 billion by 2031 at 8.6% CAGR over 2026-2031.

Rising prescription volumes, chronic-disease prevalence, an aging population, and persistent labor shortages all converge to elevate demand for automated dispensing, compounding, and inventory management. New sterile-compounding rules under USP 797, effective November 2023, are pushing health systems toward robotic solutions that safeguard both staff and patients. Competitive intensity is rising because traditional medical-device firms and niche automation specialists now court the same hospital, retail, and mail-order buyers. Consolidation illustrated by BD's September 2024 acquisition of Parata Systems signals a race for scale and end-to-end capability. Artificial intelligence (AI) embedded in robotics transforms raw dispensing hardware into data-driven assets that reduce error rates, automate pharmacy labor, and manage the growing share of specialty drugs, which accounted for over 80% of 2023 U.S. approvals.

Global Pharmacy Automation Market Trends and Insights

Growing Prescription Volume and Medication Throughput

Global prescription counts continue to grow, and many hospital pharmacies now process thousands of orders daily. High-density robotic storage such as Swisslog's PillPick holds more than 50,000 unit doses and eliminates multiple human touches in the dispensing chain, keeping pace with volume spikes. Central-fill programs layer additional scale; CoverMyMeds' Central Fill-as-a-Service platform can trim cost-per-script by 30% while shrinking on-site labor. These technologies also deliver the digital logs required under USP 797 for traceability, ensuring compliance while throughput climbs.

Expanding Geriatric Population and Chronic Disease Burden

Adults aged 65 and older represent a fast-growing cohort that often manages five or more prescriptions. Long-term-care (LTC) pharmacies adopt automation to pouch-package timed doses, reducing errors and boosting adherence. FrameworkLTC reports that workflow robotics now redirect staff hours toward immunizations and point-of-care testing, broadening revenue streams while supporting chronic-care plans. The U.S. Drug Supply Chain Security Act also accelerates barcode-based tracking, making automated verification indispensable in LTC settings.

High Initial Capital Investment and Maintenance Costs

Up-front outlays for robotics, installation, and software stretch pharmacy budgets. Pay-per-script financing models such as CoverMyMeds' CFaaS remove the capital hurdle by converting costs into operating expenses. Independent outlets adopt compact robots like Qx-Dextron, which posts payback in under one year and draws less than 1 kWh per day, keeping utility costs minimal. Still, many robots installed around 2010 are hitting end-of-life, forcing operators to budget for replacement cycles.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Patient Safety and Error-Reduction Mandates

- Shift Toward Centralized Fill and Hub Pharmacies

- Workflow Disruption and Staff-Training Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automated medication dispensing systems retained a 47.07% pharmacy automation market share in 2025 thanks to unit-dose storage, bar-code checks, and secure drawers that integrate with electronic health records. Robotic sterile-compounding platforms recorded the highest 10.28% CAGR forecast to 2031 as institutions automate hazardous-drug preparation to comply with tightening USP 797 thresholds. The pharmacy automation market size for robotic compounding is expected to climb steadily as AI vision and gravimetric checks mitigate contamination risk.

Automated packaging and labeling solutions slash technician time by half, while automated tablet counters bring sub-minute cycle times to community outlets. Storage-and-retrieval modules use vertical carousels to compress square footage, and analytic dashboards surface demand patterns that inform formulary rationalization. Pharmacist workflow software now embeds AI that proposes par levels and flags slow-moving items, linking operational data to clinical decision support.

Hospital environments processed most of the 2025 medication volume and accounted for 61.94% of pharmacy automation market share, propelled by emergencies, chronic-care onboarding, and acute-care needs. Systems such as BD's Pyxis MedStation ES supply closed-loop dispensing and real-time inventory telemetry that reduce on-ward retrieval trips. Central pharmacy dispensing hubs attached to large academic centers further expand capacity and consistency.

Mail-order and ePharmacy operators deliver the strongest 11.29% CAGR outlook. Amazon Pharmacy bundles same-day delivery with price-transparency applications, while CVS Health's digital prescription-management tools lock in chronic-therapy refills. High-bay automated warehouses, like the Tote-to-Person system at Dr. Max in Prague, pre-sort thousands of orders per hour and feed robotic packing stations. Retail chains continue to retrofit point-of-sale locations with compact counters and pick-to-light shelving that keep wait times under two minutes.

The Pharmacy Automation Market Report is Segmented by Product (Automated Medication Dispensing Systems, and More), End User (Hospital Pharmacies, and More), Deployment Model (Centralised Automation Hubs, and More), and Pharmacy Size (>500 Beds / >250 Stores, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 41.12% revenue share rests on mature EHR connectivity, payer pressures to cut errors, and FDA programs such as the Advanced Manufacturing Technologies designation that accelerate approval of automated processes. Large health systems funnel capital into sterile-compounding robotics following USP 797 revisions, and Canadian provinces now subsidize automation investments to address pharmacist shortages.

Asia-Pacific charts the highest 9.39% CAGR as India, China, and South Korea sprint toward hospital and supply-chain digitization. ISPE notes that cross-border manufacturing partnerships anchor capital inflows for automated filling and inspection lines. Chinese pilots using AI demand-forecasting and vendor-managed inventory registered double-digit lifts in stock-turn ratios. Indonesia and Vietnam rely on regional regulatory alignment via the Pharmaceutical Inspection Co-operation Scheme, easing foreign vendor entry and standardizing QA.

The EU lags North America in raw dollars yet benefits from regulatory certainty. The EU AI Act, live since August 2024, stipulates risk tiers for medical AI, giving hospitals the legal clarity to deploy compounding robots, cloud analytics, and AI safety checks in pharmacy workflows. Remote communities across the Nordics and Iberia adopt decentralized cabinets operated via telepharmacy, extending medication access while staying compliant with stringent data-privacy statutes.

- Accu-Chart Plus Healthcare Systems

- ARxIUM

- Baxter

- Capsa Healthcare

- BD (Becton, Dickinson & Co.)

- Grifols (LogiFill)

- ICU Medical (IntelliMix)

- Innotech Espana (Rowa)

- Mckesson

- NewIcon Oy

- Omnicell

- Oracle Health (Cerner Rx)

- Parata Systems

- Pearson Medical Technologies

- RxSafe

- ScriptPro

- Swisslog Healthcare

- Talyst Systems (Swisslog)

- TouchPoint Medical

- Yuyama Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prescription Volume and Medication Throughput

- 4.2.2 Expanding Geriatric Population and Chronic Disease Burden

- 4.2.3 Heightened Patient Safety and Error-Reduction Mandates

- 4.2.4 Shift Toward Centralized Fill and Hub Pharmacies

- 4.2.5 Integration of Artificial Intelligence for Inventory Optimization

- 4.2.6 Surge in Specialty Drug Dispensing Complexity

- 4.3 Market Restraints

- 4.3.1 High Initial Capital Investment And Maintenance Costs

- 4.3.2 Workflow Disruption And Staff Training Barriers

- 4.3.3 Data Security And Privacy Concerns In Connected Systems

- 4.3.4 Regulatory Ambiguity For Robotic Sterile Compounding

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Automated Medication Dispensing Systems

- 5.1.2 Automated Packaging & Labeling Systems

- 5.1.3 Automated Table-top Tablet Counters

- 5.1.4 Automated Storage & Retrieval Systems

- 5.1.5 Robotic Sterile Compounding Systems

- 5.1.6 Pharmacist Workflow & Analytics Software

- 5.2 By End User

- 5.2.1 Hospital Pharmacies (In-patient, Out-patient)

- 5.2.2 Retail & Chain Pharmacies

- 5.2.3 Mail-order / ePharmacies

- 5.2.4 Long-term-care & Specialty Pharmacies

- 5.3 By Deployment Model

- 5.3.1 Centralised Automation Hubs

- 5.3.2 Decentralised Point-of-Care Units

- 5.4 By Pharmacy Size

- 5.4.1 >500 beds / >250 stores

- 5.4.2 100-499 beds / 50-249 stores

- 5.4.3 <100 beds / Independent stores

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Accu-Chart Plus Healthcare Systems

- 6.3.2 ARxIUM

- 6.3.3 Baxter International Inc.

- 6.3.4 Capsa Healthcare

- 6.3.5 BD (Becton, Dickinson & Co.)

- 6.3.6 Grifols (LogiFill)

- 6.3.7 ICU Medical (IntelliMix)

- 6.3.8 Innotech Espana (Rowa)

- 6.3.9 McKesson Corporation

- 6.3.10 NewIcon Oy

- 6.3.11 Omnicell Inc.

- 6.3.12 Oracle Health (Cerner Rx)

- 6.3.13 Parata Systems LLC

- 6.3.14 Pearson Medical Technologies

- 6.3.15 RxSafe LLC

- 6.3.16 ScriptPro LLC

- 6.3.17 Swisslog Healthcare

- 6.3.18 Talyst Systems (Swisslog)

- 6.3.19 TouchPoint Medical

- 6.3.20 Yuyama Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment