|

시장보고서

상품코드

1687371

분말 야금 시장(2025-2030년) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측Powder Metallurgy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

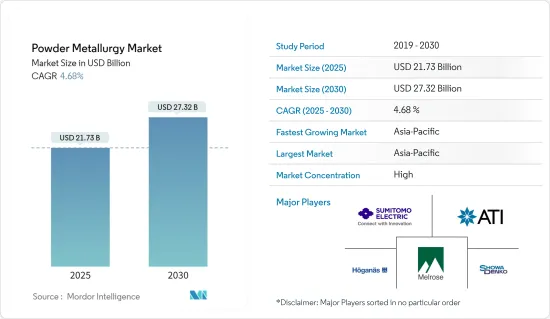

분말 야금 시장 규모는 2025년 217억 3,000만 달러에서 예측 기간(2025-2030년) 동안 CAGR 4.68%로 성장하여 2030년에는 273억 2,000만 달러에 달할 것으로 예측됩니다.

2020년에는 COVID-19가 시장에 부정적인 영향을 미쳤습니다. 그러나 현재 시장은 전염병 이전 수준에 도달한 것으로 추정되고 있으며 앞으로도 안정적인 성장이 예상됩니다.

주요 하이라이트

- 분말 야금은 자동차 OEM에서 점점 더 많이 사용되고 있으며, 이는 시장을 견인하는 주요 요인 중 하나입니다. 게다가, 전기 및 전자기 용도에서의 도입이 확대되고 있는 것도 시장의 성장을 가져올 것으로 예상됩니다.

- 한편, 원재료와 공구의 비용 상승은 시장의 성장을 둔화시킬 가능성이 높습니다.

- 항공우주 및 방위 분야의 급성장과 함께 의료 분야에서의 분말 야금의 채용이 증가하고 있는 것은 시장에 기회를 가져올 것으로 예상됩니다.

- 분말 야금 시장은 아시아태평양이 선도하고 있으며, 향후 수년간 가장 높은 성장률이 예상되고 있습니다.

분말 야금 시장 동향

자동차 용도가 시장을 독점

- 분말 야금 부품은 다공성도를 자유롭게 제어할 수 있으며, 그 자체에 윤활성을 부여할 수 있으므로 가스와 액체를 여과할 수 있습니다. 이 때문에 분말 야금은 복잡한 굽힘, 함몰 및 돌출부를 가진 부품을 만드는 데 매우 적합한 방법입니다.

- 금속과 비금속, 금속과 금속의 조합 등 다양한 조성의 기계 부품을 개발할 수 있는 유연성을 통해 치수 정밀도가 높은 자동차 부품의 제조가 가능해져 스크랩이나 재료의 낭비를 거의 발생시키지 않고 일관된 특성과 치수를 확보할 수 있습니다.

- 베어링과 기어는 분말 야금 공정에서 제조되는 가장 일반적인 자동차 부품입니다. 이 프로세스는 섀시, 스티어링, 배기, 변속기, 쇼크 업소버 부품, 엔진, 배터리, 시트, 에어 클리너, 브레이크 디스크 등 자동차의 여러 부품에도 사용됩니다.

- 자동차 부품은 철(철, 강철, 합금강, 스테인리스 스틸) 및 비철(구리, 청동, 알루미늄 합금, 티타늄 합금)과 같은 광범위한 금속으로 만들어집니다. 분말 야금의 목적은 그물 모양을 개선하고 열처리를 이용하며 특수 표면 처리를 실시하고 정밀도를 향상시키는 것입니다.

- 유럽자동차공업회(ACEA)의 보고에 따르면 2022년 1-3분기에는 세계에서 약 5,000만대의 승용차가 제조되었으며 2021년 동기 대비 9% 가까이 증가했습니다.

- 또한 중국 자동차 제조 협회에 따르면 이 나라에서 제조된 신에너지 자동차의 대수는 2021년 12월부터 2022년 12월에 걸쳐 96.9% 증가했습니다. 따라서 전기자동차 시장의 확대는 예측 기간 동안 시장 수요를 증가시킬 것으로 예상됩니다.

- 이러한 요인으로 인해 자동차 분야에서 분말 야금 수요가 증가하고 있습니다.

아시아태평양이 시장을 독점

- 아시아태평양은 가장 중요한 분말 야금 시장 중 하나가 되었으며, 경제가 성장하고 사람들이 더 많은 자금을 사용할 수 있게 되면서 제조업체에게 가장 중요한 투자처가 되었습니다.

- 중국, 인도, 일본과 같은 국가의 경제적 추세가 최근 몇 년 동안 분말 야금 제품과 응용 분야에 대한 수요를 끌어올리고 있습니다.

- 중국 자동차 산업 협회(CAAM)에 따르면 중국은 세계 최대의 자동차 생산 기지입니다. 2022년에는 중국에서 2,700만대의 자동차가 생산되었으며 이는 2017년의 2,600만대보다 3.4% 높은 수치입니다.

- 게다가 2022년 첫 7개월간 이 나라는 1,457만대의 자동차를 생산하면서 전년 대비 31.5%의 성장률을 기록했습니다.

- 또, 인도 자동차 공업회(SIAM)에 의하면, 인도의 자동차 산업은 2020-21년도(2020년 4월-2021년 3월)의 2,265만 5,609대에 비해 2021-22년도(2021년 4월-2022년 3월)는 2,293만 3,230대 생산을 달성하였습니다.

- 또한 이 지역에서는 항공우주산업도 크게 성장하고 있습니다. 예를 들어 Boeing Commercial Outlook 2022-2041에 따르면 2041년까지 시장 서비스액 5,450억 달러에 해당하는 8,485대 가 중국에서 새로 납품될 것으로 예측했습니다.

- 따라서 앞서 언급한 요인들로부터 예측 기간 동안 아시아태평양이 시장을 독점할 가능성이 높습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 자동차 OEM에서 분말 야금 선호 추세 고조

- 전기 및 전자파 용도에서의 채용 확대

- 억제요인

- 원재료와 금형 비용 상승

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 제품 유형

- 철

- 비철

- 용도

- 자동차

- 산업기계

- 전기 및 전자

- 항공우주

- 기타 용도

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%)**/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- ATI

- Catalus Corporation

- fine-sinter Co., Ltd.

- HC Starck Tungsten GmbH

- Showa Denko Materials Co., Ltd.

- Hoganas AB

- Horizon Technology

- Melrose Industries PLC

- Miba AG

- Perry Tool & Research, Inc.

- Phoenix Sintered Metals, LLC

- Precision Sintered Parts

- Sandvik AB

- Sumitomo Electric Industries, Ltd.

제7장 시장 기회와 앞으로의 동향

- 의료 분야에서의 분말 야금 기술의 채용 증가

- 항공우주 및 방위 분야의 급성장

The Powder Metallurgy Market size is estimated at USD 21.73 billion in 2025, and is expected to reach USD 27.32 billion by 2030, at a CAGR of 4.68% during the forecast period (2025-2030).

In 2020, COVID-19 negatively impacted the market. However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- Powder metallurgy is being used more and more by automotive OEMs, which is one of the main things driving the market. Moreover, the growing implementation of electrical and electromagnetic applications is also expected to provide market growth.

- On the other hand, rising costs of raw materials and tools are likely to slow the market's growth.

- The increasing adoption of powder metallurgy in the medical field along with the rapid growth in the aerospace and defense sector is expected to provide opportunities to the market.

- The Asia-Pacific region led the market for powder metallurgy, and it is expected to have the highest growth rate over the next few years.

Powder Metallurgy Market Trends

Automotive Applications to Dominate the Market

- Powder metal parts have great control over how porous they are and can lubricate themselves, which lets them filter gases and liquids.Because of this, powder metallurgy is a very good way to make parts that have complicated bends, depressions, and projections.

- This flexibility to develop mechanical parts with diverse compositions, such as metal-nonmetal and metal-metal combinations, enables the production of automotive parts with high dimensional accuracy and ensures consistent properties and dimensions with very little scrap and material waste.

- Bearings and gears are the most common vehicle parts made through the powder metallurgy process. The process is also used for a large number of parts in a vehicle, including the chassis, steering, exhaust, transmission, shock absorber parts, engine, battery, seats, air cleaners, brake discs, etc.

- Auto parts are made from a wide range of metals, such as ferrous (iron, steel, alloy steel, and stainless steel) and non-ferrous (copper, bronze, aluminum alloys, and titanium alloys).The focus of powder metallurgy is to improve the net shape, utilize heat treatment, provide special surface treatment, and improve precision.

- In the first three quarters of 2022, around 50 million passenger cars were manufactured worldwide, up nearly 9% compared to the same quarter in 2021, as per the report of the European Automobile Manufacturers' Association (ACEA).

- Also, the China Association of Automobile Manufacturing says that the number of New Energy Vehicles made in the country rose by 96.9% from December 2021 to December 2022.Thus, the expanding electric vehicle market is expected to increase market demand during the forecast period.

- Due to such factors, the demand for powder metallurgy in the automotive sector is increasing.

Asia-Pacific to Dominate the Market

- Asia-Pacific has become one of the most important powder metallurgy markets and a top destination for manufacturers because its economy is growing and people have more money to spend.

- The positive economic growth trends in countries such as China, India, and Japan have boosted the demand for powder metallurgy products and applications in recent years.

- China has the largest automotive production base in the world, according to the China Association of Automobile Manufacturers (CAAM). In 2022, 27 million vehicles were expected to be made in China, which is 3.4% more than the 26 million vehicles made in 2017.

- Further, in the first 7 months of 2022, the country produced 14.57 million units of cars, registering a growth rate of 31.5% year over year.

- Also, the Society of Indian Automobile Manufacturers (SIAM) said that India's automotive industry will make 22,933,230 vehicles in FY 2021-22 (April 2021-March 2022), compared to 22,655,609 units in FY 2020-21 (April 2020-March 2020).

- Furthermore, the aerospace industry is also growing significantly in the region. For instance, the Boeing Commercial Outlook 2022-2041 predicts that by 2041, 8,485 new deliveries with a market service value of USD 545 billion will take place in China.thus boosting market growth.

- Hence, due to the aforementioned factors, Asia-Pacific is likely to dominate the market during the forecast period.

Powder Metallurgy Industry Overview

The powder metallurgy market is consolidated in nature. Some of the major players in the market (not in any particular order) include Melrose Industries PLC, Sumitomo Electric Industries, Ltd., Hoganas AB, ATI, and Showa Denko Materials Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Preference for Powder Metallurgy by Automotive OEMs

- 4.1.2 Growing Implementation in Electrical and Electromagnetic Applications

- 4.2 Restraints

- 4.2.1 Increasing Raw Material and Tooling Costs

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Ferrous

- 5.1.2 Non-ferrous

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Industrial Machinery

- 5.2.3 Electrical and Electronics

- 5.2.4 Aerospace

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ATI

- 6.4.2 Catalus Corporation

- 6.4.3 fine-sinter Co., Ltd.

- 6.4.4 H.C. Starck Tungsten GmbH

- 6.4.5 Showa Denko Materials Co., Ltd.

- 6.4.6 Hoganas AB

- 6.4.7 Horizon Technology

- 6.4.8 Melrose Industries PLC

- 6.4.9 Miba AG

- 6.4.10 Perry Tool & Research, Inc.

- 6.4.11 Phoenix Sintered Metals, LLC

- 6.4.12 Precision Sintered Parts

- 6.4.13 Sandvik AB

- 6.4.14 Sumitomo Electric Industries, Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Powder Metallurgy Techniques in Medical Sector

- 7.2 Rapid Growth in Aerospace and Defense Sector