|

시장보고서

상품코드

1851078

유전자 치료 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Gene Therapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

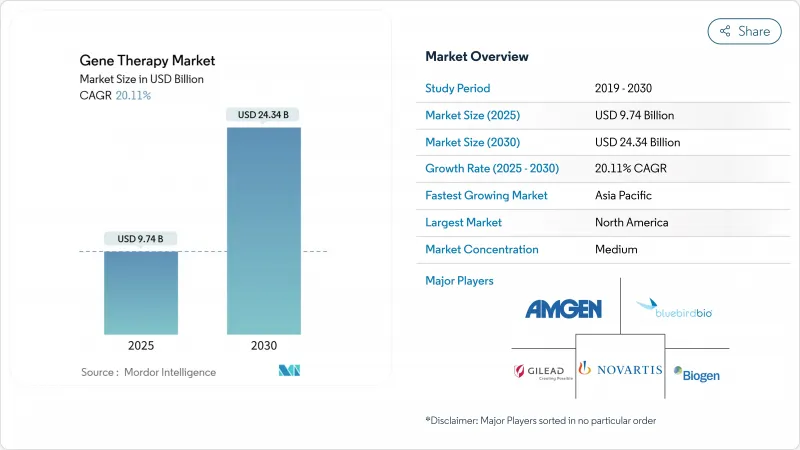

유전자 치료 시장의 규모는 2025년에 97억 4,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 20.11%로, 2030년에는 243억 4,000만 달러에 달할 것으로 예측됩니다.

규제 당국이 2024년에만 9개의 세포 및 유전자 치료제를 승인한 것은 임상적 및 상업적 가능성에 대한 신뢰가 높아지고 주요 시장에서의 환급 경로가 확대됨을 나타냅니다. 바이오파마나 프라이빗 에퀴티로부터의 자금 조달이 활발해지고, 후기 단계의 자산이 가속화하는 한편, 바이러스성 및 비바이러스성 모두 제조 능력이 확대되어, 공급 체인의 마찰이 감소하고 있습니다. 생체 내 편집과 벡터 공학의 급속한 진보는 치료 범위를 희귀질환에서 유병률이 높은 질환 중에서도 특히 신경학과 안과학으로 확대하고 있습니다. 아시아태평양의 두 자릿수의 임상시험 성장과 북미의 정책적 인센티브가 결합되어, 제품 가격 상승과 안전성 감시 요건이 접근 상의 제한이 됨에도 다양한 수요 기반이 확보됩니다.

세계의 유전자 치료 시장의 동향과 인사이트

임상적 및 상업적 유용성을 보여주는 승인 획득 증가

주요 규제 당국으로부터의 빈번한 승인 취득은 개발 위험을 줄이고, 출시까지의 기간을 단축하고 있습니다. FDA는 2024년까지 37개의 세포 및 유전자 제품을 승인했으며, 이는 FDA의 심사관이 재생 의료 등의 선진 요법과 같은 전용 틀을 적용하고 있음을 보여줍니다. 2025년 열성 이영양형 수포성 표피박리증에 대한 ZEVASKYN의 승인은 적응증이 초희소성 질환뿐만 아니라 보다 광범위한 피부과 영역으로 확대되고 있음을 보여줍니다. 이러한 치료 범위의 확대는 유전자 치료 시장의 수년에 걸친 성장을 지원하고 지속적인 임상 이익을 기대하는 지불자로부터 후속 투자를 자극합니다.

벡터 공학 및 생체 내 편집 플랫폼의 지속적인 기술 발전

향상된 캡시드 라이브러리, 머신러닝을 통한 서열 최적화, 새로운 지질 구조로 인해 조직 친화성이 첨예해지고 면역 원성이 저하되었습니다. 페렐만 의과대학의 연구자들은 생체 내에서 수개월간 지속되는 DNA 담지 지질 나노입자를 보고하여 만성 질환에 대한 지속적인 투여를 실현하였습니다. 오가노이드 플랫폼은 FDA 근대화 방법의 비동물 모델 허용을 지원하여 트랜스레이셔널 예측 가능성을 향상시키는 인간 조직 특이적 테스트 베드를 제공합니다. OpenCRISPR-1과 같은 AI 지원 알고리즘은 설계 사이클을 단축하고 편집 정확도를 향상시킵니다. 이러한 기술 혁신이 결합되어, 치료법의 상한이 더 높게 설정되어, 반복 투여의 여지가 발생하고, 임상적 성공과 자본 투입의 선순환이 촉진되어, 유전자 치료 시장이 확대됩니다.

높은 치료제 가격이 초래하는 접근과 가격의 장벽

단회 투여에 의한 치료제의 정가는 37만 3,000달러에서 425만 달러로, 지불자의 예산을 압박하고 사회가 근치치료법에 자금을 제공하는 의욕이 저해되고 있습니다. 의료 제공업체는 사회적 지원 격차, 이동 거리, 사전 승인 장애물을 접근을 방해하는 가장 큰 요인으로 꼽습니다. 결과 기반 계약, 감가상각 모델, 워런티 등 혁신적인 환급 옵션이 등장하고 있지만, 복잡한 데이터 공유와 장기 후속 인프라가 필요합니다. Medicare & Medicaid Service Center는 2025년 셀 액세스 모델(Cell and Gene Treatment Access Model)을 시작하여 주 수준에서 풀 구매를 장려하고 예산에 미치는 영향을 완화하려고 합니다. 이러한 재정적 역풍은 비용에 민감한 지역에서의 채용을 억제하고 강력한 임상적 가치 제안에도 불구하고 유전자 치료 시장의 성장 곡선을 연화시킬 것으로 예측됩니다.

부문 분석

AAV 벡터는 혈우병 및 유전성 망막 질환에 대한 여러 승인 제품을 지원하는 좋은 안전성과 지속적인 트랜스진 발현을 통해 2024년 유전자 치료 시장 점유율의 38.54%를 차지했습니다. 이 리더십은 광범위한 조직 친화성과 특이성을 향상시키는 유전자 재조합 혈청형의 확대에 의해 강화되었습니다. 그러나 비바이러스성 지질 나노입자 시스템은 보다 큰 유전자 페이로드를 운반하고 제조 경제성을 간소화하기 위해 2030년까지 연평균 복합 성장률(CAGR)이 24.34%가 될 것으로 예측되어 가장 빠르게 성장하고 있습니다. 이 때문에 비바이러스 플랫폼의 유전자 치료 시장의 규모는 현재 수익 갭의 일부를 채울 것입니다. 렌티바이러스 벡터는 여전히 생체외 CAR-T 제조의 주력 부문이지만, 헤르페스 기반 시스템은 페이로드 용량으로 인해 암 영역에서 지지를 모으고 있습니다. 캡시드 라이브러리와 합성 프로모터의 최적화가 계속됨에 따라 바이러스 벡터가 비용 효율적인 비바이러스성 과제로부터 공유를 보호할 수 있는지 여부가 결정됩니다.

비바이러스 접근법의 급증은 지질 성분이 표준 의약품 공급망에 적합하기 때문에 원료의 제약도 완화시킵니다. 수개월 동안 활성을 유지하는 DNA 탑재 나노입자는 반복 투여의 필요성을 감소시키고 장기 선택적 흡수를 위해 조절할 수 있습니다. 이러한 유연성은 페이로드 크기가 AAV의 패키징 한계를 초과하는 다유전성 신경 질환을 표적으로 하는 개발자를 흡수합니다. 그 결과 시장 경쟁력학은 벡터의 가용성에서 전달 정확도로 이동하고 플랫폼에 얽매이지 않는 CDMO가 새로운 수요를 획득할 여지를 창출하고 있습니다.

종양학에의 응용은 2024년 매출의 42.92%를 차지하였고, CAR-T의 꾸준한 승인 취득과 고형암을 대상으로 한 충실한 파이프라인에 의해 지지되고 있습니다. 재발혈 악성 종양의 완전한 효과에 대한 확고한 증거는 가격 압력에도 불구하고 지불자의 지지를 유지합니다. 그러나 신경 영역은 2030년까지 연평균 복합 성장률(CAGR)이 25.62%로 가장 높은 성장 궤도를 그릴 것으로 예상됩니다. 혈액 뇌 장벽을 통과하는 캡시드와 정확한 생체내 편집 도구가 등장하여, 레트 증후군이나 헌팅턴병 등의 질환에의 직접적인 개입이 가능하게 되었습니다. 중추 신경계 질환에 할당되는 유전자 치료 시장의 규모는 양자 간 규제 인센티브가 개발 위험을 압축하므로 확대될 것으로 예측됩니다.

희귀한 대사성 질환과 안과 부위는 조직 면역 특권과 명확한 바이오마커가 임상 엔드포인트를 단순화하므로 새로운 승인을 받게 됩니다. 비대형 심근증과 같은 심혈관 질환 치료제가 벤처 기업의 자금을 얻고 있다는 사실은 전신 질환 치료제가 더 널리 받아들여지는 것을 시사합니다. 치료의 폭이 넓어짐에 따라 포트폴리오 최적화가 중요해집니다. 스폰서는 암 영역의 현금 흐름과 미래는 높지만 과학적으로 복잡한 신경 영역의 자산과 균형을 이루어야 합니다.

지역 분석

북미는 2024년 세계 매출의 41.78%를 차지하였으며, 규제 환경의 정비, 벤처 캐피탈의 윤택한 자금, 광범위한 임상 인프라에 지원되고 있습니다. 미국은 2024년에만 34개의 퍼스트 인 클래스 유전자 치료를 승인했으며, 제품 출시 시퀀싱에서 핵심 역할을 강조하고 있습니다. ARPA-H 보조금과 같은 연방 정부의 이니셔티브는 제조 기술 혁신과 안전 모니터링에 상당한 자금을 투자하여 유전자 치료 시장에서 이 지역의 리더십을 강화하고 있습니다.

유럽은 강력한 과학적 실적을 유지하고 획기적인 치료를 촉진하는 EMA의 적응 패스웨이의 혜택을 누리고 있습니다. 2025년 7월에 시행된 분산형 제조에 관한 영국의 틀은 물류 부담을 줄이고 포인트 오브 케어에서 제조를 자극할 수 있습니다. 2025년에 시행되는 EU의 새로운 의료기술 평가 규정은 증거 요건의 조화를 목표로 하고 있지만, 협상이 장기화될 수도 있습니다. 영국과 덴마크에서 헴 제닉스와의 합의에서 입증된 바와 같이, 결과 기반 지불 모델은 도입 장애물을 점차 완화하고 있습니다.

아시아태평양은 CAGR 27.68%로 가장 빠른 성장을 보이고 있습니다. 중국은 400개가 넘는 세포 기반 연구를 실시하여 국내 벡터 공장에 많은 투자를 하고 있으며 수요 및 공급 엔진 모두로 자리매김하고 있습니다. 일본의 재생 의료를 위한 가속 패스웨이와 싱가포르의 디지털 라이선싱 포털은 추가 승인을 간소화합니다. 규제 기준은 구미의 기관에 수렴하고 있지만, 환급액의 변동이나 유전자 재료의 수출 규제가 과제로서 남아 있습니다. 그럼에도 불구하고 지속적인 정책 지원과 성숙을 이루고 있는 현지 CDMO는 아시아태평양이 유전자 치료 시장에서 차지하는 비율이 높아짐을 보여주고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 임상적 및 상업적 가능성을 나타내는 승인 수 증가

- 벡터 공학과 생체내 편집 플랫폼의 끊임없는 기술 진보

- 세계 바이러스, 벡터 및 비바이러스 제조 인프라의 확대

- 상업용 AAV CDMO의 생산 능력의 급속한 스케일 업

- 유전자 치료 연구 개발에 대한 바이오파마와 프라이빗 에퀴티로부터의 자금 제공 증가

- 희귀질환 유전자 치료의 확대

- 시장 성장 억제요인

- 높은 치료제 가격이 액세스나 구입의 장벽이 됨

- 제조의 복잡성과 GMP 등급 벡터공급의 제약

- 장기적인 모니터링이 필요한 안전성에 대한 우려

- GMP그레이드의 플라스미드/캡시드 원료의 부족이 CMC의 타임라인을 연장

- 규제 상황

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 벡터 유형별

- 아데노바이러스 벡터

- 아데노 관련 바이러스 벡터

- 렌티바이러스 벡터

- 레트로바이러스 벡터

- 헤르페스 바이러스 벡터

- 기타 벡터 유형

- 적응증별

- 종양학

- 희소대사질환

- 안과

- 신경/중추 신경계

- 순환기 및 근골격

- 기타 적응증

- 딜리버리 모드별

- In Vivo 유전자 전달

- Ex Vivo 유전자 전달

- 최종 사용자별

- 병원 및 클리닉

- 전문치료/수액센터

- 학술연구기관

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Novartis AG

- Gilead Sciences Inc.

- F. Hoffmann-La Roche Ltd

- bluebird bio Inc.

- UniQure NV

- Amgen Inc.

- Biogen Inc.

- Astellas Pharma Inc.

- Sarepta Therapeutics Inc.

- Regenxbio Inc.

- Krystal Biotech Inc.

- Orchard Therapeutics plc

- Rocket Pharmaceuticals Inc.

- Editas Medicine Inc.

- Intellia Therapeutics Inc.

- Sangamo Therapeutics Inc.

- CSL Behring

- Mustang Bio Inc.

- Poseida Therapeutics Inc.

- Generation Bio Co.

제7장 시장 기회와 미래 전망

CSM 25.11.20The Gene Therapy Market size is estimated at USD 9.74 billion in 2025, and is expected to reach USD 24.34 billion by 2030, at a CAGR of 20.11% during the forecast period (2025-2030).

Regulatory authorities cleared nine cell and gene therapies in 2024 alone, signalling rising confidence in clinical and commercial viability and unlocking wider reimbursement pathways in key markets. Heightened biopharma and private-equity funding is accelerating late-stage assets, while expanding manufacturing capacity both viral and non-viral reduces historic supply-chain friction. Rapid advances in in-vivo editing and vector engineering are broadening therapeutic scope beyond rare diseases to high-prevalence disorders, especially in neurology and ophthalmology. Asia-Pacific's double-digit trial growth and North America's policy incentives together ensure a diversified demand base, even as high product prices and safety-monitoring requirements pose access headwinds.

Global Gene Therapy Market Trends and Insights

Rising Regulatory Approvals Demonstrating Clinical and Commercial Viability

Frequent clearances from major regulators are reducing development risk and compressing launch timelines. The FDA's cumulative total of 37 approved cell and gene products by 2024 shows that agency reviewers now apply dedicated frameworks such as the Regenerative Medicine Advanced Therapy designation, which trims development time by about 40% for qualifying programs.Europe's PRIME scheme and the United Kingdom's 2025 rule for point-of-care manufacture further ease market entry. Approval of ZEVASKYN for recessive dystrophic epidermolysis bullosa in 2025 exemplifies how indications are extending beyond ultra-rare diseases into broader dermatological segments. Such widening therapeutic reach supports multi-year growth in the gene therapy market and stimulates follow-on investment from payers expecting durable clinical benefit.

Continuous Technological Advances in Vector Engineering and In-Vivo Editing Platforms

Enhanced capsid libraries, machine-learning-guided sequence optimisation, and novel lipid constructs are sharpening tissue tropism and reducing immunogenicity. Researchers at the Perelman School of Medicine reported DNA-loaded lipid nanoparticles that persist in vivo for months, opening durable dosing for chronic diseases.Organoid platforms offer human tissue-specific test beds that improve translational predictability, supported by the FDA Modernization Act's acceptance of non-animal models. AI-assisted algorithms such as OpenCRISPR-1 cut design cycles and elevate editing precision. Collectively these innovations shift the therapeutic ceiling higher, create room for repeat dosing, and fuel a virtuous loop of clinical success and capital deployment that enlarges the gene therapy market.

High Therapy Price Tags Creating Access and Affordability Barriers

Single-dose cures command list prices between USD 373,000 and USD 4.25 million, straining payer budgets and testing societal willingness to fund curative therapies. Providers cite social support gaps, travel distance, and prior authorisation hurdles as the top access blockers. Innovative reimbursement options-outcome-based contracts, amortisation models, and warranties are emerging but still require complex data sharing and long-term follow-up infrastructure. The Centers for Medicare & Medicaid Services launched a Cell and Gene Therapy Access Model in 2025 that encourages state-level pooled purchasing to temper budget impact. These financial headwinds are expected to moderate adoption in cost-sensitive regions, softening the gene therapy market growth curve despite strong clinical value propositions.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Global Viral-Vector and Non-Viral Manufacturing Infrastructure

- Escalating Biopharma & Private-Equity Funding into Gene-Therapy R&D

- Manufacturing Complexity and Constrained Supply of GMP-Grade Vectors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

AAV vectors held 38.54% of the gene therapy market share in 2024 owing to favourable safety and sustained transgene expression that underpin multiple approved products for haemophilia and inherited retinal disorders. This leadership is reinforced by broad tissue tropism and an expanding pool of engineered serotypes that improve specificity. However, non-viral lipid nanoparticle systems are the fastest-rising alternative, forecast to post a 24.34% CAGR through 2030 as they carry larger genetic payloads and simplify manufacturing economics. The gene therapy market size for non-viral platforms is therefore set to close part of the current revenue gap. Lentiviral vectors remain the mainstay for ex-vivo CAR-T manufacture, whereas herpes-based systems gain traction in oncology for their payload capacity. Continued optimisation of capsid libraries and synthetic promoters will determine whether viral vectors can defend share against cost-efficient non-viral challengers.

The surge in non-viral approaches also alleviates raw-material constraints because lipid components are amenable to standard pharmaceutical supply chains. DNA-loaded nanoparticles that remain active for months lower repeat-dosing requirements and can be tuned for organ-selective uptake. Such flexibility attracts developers targeting polygenic neurological disorders where payload size exceeds AAV's packaging limit. Consequently, the competitive dynamic inside the gene therapy market is shifting from vector availability toward delivery precision, creating space for platform-agnostic CDMOs to capture emerging demand.

Oncology applications generated 42.92% of revenue in 2024, supported by a steady flow of CAR-T approvals and a deep pipeline aimed at solid tumours. Robust evidence for complete responses in relapsed haematological malignancies sustains payer acceptance despite price pressures. Yet neurology claims the highest growth trajectory at a 25.62% CAGR to 2030. Emerging capsids that cross the blood-brain barrier and precise in-vivo editing tools permit direct intervention in disorders like Rett syndrome and Huntington's disease. The gene therapy market size allocated to CNS disorders is expected to multiply as bilateral regulatory incentives compress development risk.

Rare metabolic and ophthalmology indications continue to yield new approvals because tissue immune privilege and clear biomarkers simplify clinical endpoints. Cardiovascular targets such as hypertrophic cardiomyopathy are gaining venture funding, hinting at broader systemic disease uptake. As therapeutic breadth widens, portfolio optimisation becomes critical; sponsors must balance oncology cash flows with high-potential but scientifically complex neurology assets.

The Gene Therapy Market Report Segments the Industry Into by Vector Type (Adeno Virus Vector, and More), Indication (Oncology, Rare Metabolic Disorders, and More), Delivery Mode (In Vivo Gene Delivery and Ex Vivo Gene Delivery), End User (Hospitals and Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America held 41.78% of global revenue in 2024, sustained by an accommodating regulatory environment, deep venture capital pools, and extensive clinical infrastructure. The United States approved 34 first-in-class gene therapies in 2024 alone, highlighting its central role in product launch sequencing. Federal initiatives such as ARPA-H grants channel significant funds toward manufacturing innovation and safety surveillance, reinforcing the region's leadership in the gene therapy market.

Europe maintains strong scientific output and benefits from the EMA's adaptive pathways that expedite breakthrough treatments. The forthcoming UK framework for decentralised manufacture, effective July 2025, may reduce logistical burdens and stimulate point-of-care production. However, unequal national reimbursement policies prolong time-to-patient across the bloc; the new EU Health Technology Assessment regulation in 2025 aims to harmonise evidence requirements but could also lengthen negotiations. Outcomes-based payment models, as demonstrated by Hemgenix agreements in England and Denmark, are gradually easing adoption hurdles.

Asia-Pacific registers the fastest growth at a 27.68% CAGR. China hosts more than 400 cell-based studies and invests heavily in domestic vector plants, positioning itself as both demand and supply engine. Japan's accelerated pathways for regenerative medicines and Singapore's digital licensing portal further streamline approvals. While regulatory standards converge with Western agencies, variable reimbursement and export controls on genetic materials remain challenges. Continuous policy support and maturing local CDMOs nevertheless assure that Asia-Pacific will capture an increasing proportion of the gene therapy market.

- Novartis

- Gilead Sciences

- Roche

- bluebird bio Inc.

- UniQure N.V.

- Amgen

- Biogen

- Astellas Pharma

- Sarepta Therapeutics

- Regenxbio Inc.

- Krystal Biotech Inc.

- Orchard Therapeutics plc

- Rocket Pharmaceuticals Inc.

- Editas Medicine

- Intellia Therapeutics Inc.

- Sangamo Therapeutics

- CSL Behring

- Mustang Bio Inc.

- Poseida Therapeutics Inc.

- Generation Bio Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising number of regulatory approvals demonstrating clinical and commercial viability

- 4.2.2 Continuous technological advances in vector engineering and in-vivo editing platforms

- 4.2.3 Expansion of global viral-vector and non-viral manufacturing infrastructure

- 4.2.4 Rapid scale-up of commercial AAV CDMO capacity

- 4.2.5 Escalating biopharma & private-equity funding into gene-therapy R&D

- 4.2.6 Growing inclusion of rare-disease gene therapies

- 4.3 Market Restraints

- 4.3.1 High therapy price tags creating access and affordability barriers

- 4.3.2 Manufacturing complexity and constrained supply of GMP-grade vectors

- 4.3.3 Safety concerns necessitating long-term monitoring

- 4.3.4 Shortage of GMP-grade plasmid/capsid raw materials extending CMC timelines

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Vector Type

- 5.1.1 Adeno Virus Vector

- 5.1.2 Adeno-associated Virus Vector

- 5.1.3 Lentiviral Vector

- 5.1.4 Retroviral Vector

- 5.1.5 Herpes Virus Vector

- 5.1.6 Other Vector Types

- 5.2 By Indication

- 5.2.1 Oncology

- 5.2.2 Rare Metabolic Disorders

- 5.2.3 Ophthalmology

- 5.2.4 Neurology / CNS

- 5.2.5 Cardiovascular and Musculoskeletal

- 5.2.6 Other Indications

- 5.3 By Delivery Mode

- 5.3.1 In Vivo Gene Delivery

- 5.3.2 Ex Vivo Gene Delivery

- 5.4 By End User

- 5.4.1 Hospitals and Clinics

- 5.4.2 Specialty Treatment / Infusion Centers

- 5.4.3 Academic and Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Novartis AG

- 6.3.2 Gilead Sciences Inc.

- 6.3.3 F. Hoffmann-La Roche Ltd

- 6.3.4 bluebird bio Inc.

- 6.3.5 UniQure N.V.

- 6.3.6 Amgen Inc.

- 6.3.7 Biogen Inc.

- 6.3.8 Astellas Pharma Inc.

- 6.3.9 Sarepta Therapeutics Inc.

- 6.3.10 Regenxbio Inc.

- 6.3.11 Krystal Biotech Inc.

- 6.3.12 Orchard Therapeutics plc

- 6.3.13 Rocket Pharmaceuticals Inc.

- 6.3.14 Editas Medicine Inc.

- 6.3.15 Intellia Therapeutics Inc.

- 6.3.16 Sangamo Therapeutics Inc.

- 6.3.17 CSL Behring

- 6.3.18 Mustang Bio Inc.

- 6.3.19 Poseida Therapeutics Inc.

- 6.3.20 Generation Bio Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment