|

시장보고서

상품코드

1444942

통신용 블록체인 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Blockchain in Telecom - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

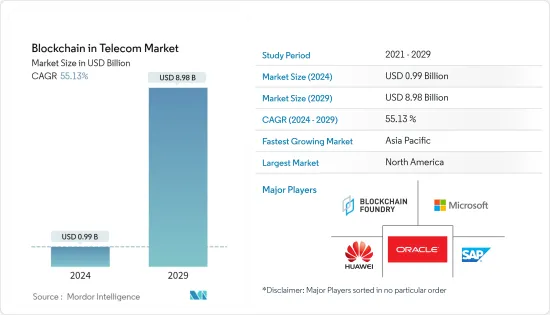

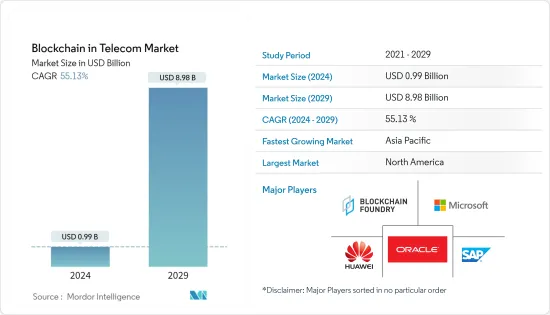

통신용 블록체인 시장 규모는 2024년 9억 9,000만 달러로 추정되며, 2029년에는 89억 8,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 55.13%의 CAGR을 기록할 것으로 예상됩니다.

통신 업계에서 블록체인은 사기 방지, 사용자 신원 보호, 차세대 네트워크 서비스 및 IoT 연결 솔루션 지원에서 매우 중요한 역할을 하고 있으며, 이는 시장을 크게 견인하고 있습니다.

주요 하이라이트

- 5G는 빠르고 신뢰할 수 있는 블록체인 운영에 도움이 되기 때문에 5G의 채택 증가는 통신 분야에서 블록체인 구현을 촉진할 것입니다. 블록체인 기술은 보다 안전하고 검증 가능한 방식으로 네트워크에 데이터를 기록하고 저장할 수 있는 강력한 암호화를 제공합니다. 이를 통해 정보를 투명하게 만들고 변조를 방지할 수 있습니다. 따라서 블록체인 기술은 다양한 통신사가 네트워크 보안을 강화하고 운영 비용을 절감하며 시장 성장을 촉진하는 데 도움이 될 것으로 기대됩니다.

- 또한 원격 통신 또는 통신 사기는 빠르게 성장하는 범죄 행위 분야로, Europol의 European Cybercrime Centre와 Trend Micro에 따르면 통신 사기로 인한 피해액은 연간 약 3270억 달러에 달합니다. 이는 법집행기관에 새로운 도전이 되고 있습니다. 블록체인은 통신 서비스 제공업체의 부정행위를 탐지하고 예방하는 데 도움이 되어 시장 성장을 크게 촉진할 수 있습니다.

- 또한 인도와 같은 신흥국에서는 통신 규제 당국이 스팸 SMS를 억제하기 위해 블록체인 기술을 도입하는 것이 효과적이며, Aadhar 인증, 재산 및 차량 소유권 기록, 직접 세금 징수 등 다양한 중요한 사용 사례에 대해 투명하고 신뢰할 수 있는 프레임워크를 구축하는 정부의 모범이 되고 있습니다. 지난해 3월, 인도 전자정보통신부는 다양한 공공 및 민간 사용 사례에서 블록체인 기술 도입을 규제하는 블록체인 기술 정책 초안을 발표했습니다. 인도 통신 규제 당국(TRAI)도 유통 원장 기술(DLT)을 도입했습니다. 이는 현재 스팸 SMS 트래픽을 제어하기 위한 블록체인 기술의 가장 중요한 사용 사례 중 하나입니다.

- 그러나 한편으로, 확장성과 상호운용성은 블록체인 기술의 전반적인 도입에 필요한 몇 가지 중요한 요소입니다. 이는 업계 표준이 설정된 후에야 가능한데, 아직은 지연되고 있는 단계입니다. 통신 부문은 시장 성장을 저해할 수 있는 블록체인 기술의 대량 도입에 대한 지원이 필요합니다.

- 팬데믹 사태는 통신 인프라의 중요성을 다시 한 번 강조하고 있습니다. 세계 보건 비상사태는 통신 서비스에 새로운 압력을 가하고 있으며, 이는 통신 서비스가 단순한 연결 이상의 중요한 역할을 할 수 있음을 시사하고 있습니다. 코로나 팬데믹을 넘어 가상 및 온라인 서비스에 대한 수요가 증가함에 따라 전 세계적으로 새로운 핀테크 서비스에 대한 관심이 높아질 것으로 예상됩니다. 통신 업계에서는 팬데믹으로 인해 디지털 인프라와 데이터 기반 서비스 확대의 필요성이 커지고 있습니다. 통신사들은 특히 5G에 대한 투자에서 네트워크의 복원력과 안정성을 점점 더 중요하게 여기고 있습니다.

통신용 블록체인 시장 동향

시장을 장악하는 스마트 계약

- 스마트 컨트랙트를 사용하면 특정 조건이 충족될 때 컴퓨터 코드를 실행할 수 있습니다. 통신업계에서는 청구, 공급망 관리, 로밍 등 내부 업무를 자동화할 수 있는 여지가 있기 때문에 큰 폭의 도입이 예상됩니다.

- 스마트 컨트랙트를 도입해 로밍과 관련된 모든 청구를 관리하면 부정 트래픽을 방지할 수 있어 상당한 비용 절감 효과를 기대할 수 있습니다. 블록체인은 스마트 컨트랙트를 통해 중개자를 제거함으로써 신원 관리 솔루션에 가치를 더할 수 있습니다. 이를 통해 로밍 사기를 줄이고, 비용을 절감하며, 즉각적인 결제를 가능하게 합니다. 이를 통해 통신 사업자는 변조 방지 및 검증 가능한 트랜잭션과 최종 고객에게 실시간 업데이트를 통해 분쟁을 신속하게 해결할 수 있습니다.

- STC 바레인은 2022년 3월 공식 체인링크 노드를 도입했습니다. 이는 실제 데이터에 대한 안전한 소스에 대한 액세스와 빠른 오프체인 계산을 갖춘 스마트 계약을 제공하는 것을 목표로 합니다. 이로써 STC 바레인은 중동 및 북아프리카(MENA) 지역에서 체인링크 노드를 도입한 최초의 대형 통신사가 되어 이 지역과 전 세계 스마트 계약 생태계의 발전을 강화할 수 있게 되었습니다.

- 또한 5G 기술은 블록체인이 통신 산업을 어떻게 변화시킬 수 있는지를 보여주는 중요한 사례 중 하나입니다. 예를 들어, 5G 기술에서 스마트 계약을 통해 블록 체인 기반 솔루션을 사용하여 최종사용자와 네트워크 간의 전체 프로비저닝을 간소화 할 수 있으며, 5G를 안전하게 구현하려면 연결된 장치가 수신하는 데이터가 신뢰할 수 있고 다양한 악의적 인 간섭이 없어야합니다, 다양한 악의적인 간섭을 받지 않아야 합니다. 또한, 5G가 잠재력을 최대한 발휘하고 대규모 보안 침해로부터 보호할 수 있도록 블록체인은 분산형, 변조 방지, 실시간 데이터 전송 검증을 실현할 수 있습니다.

- 5G Americas에 따르면, 5G 가입 수의 견고한 성장은 예측 가능한 미래까지 지속될 것이며 2026년 말까지 50억 가입에 도달할 것으로 예상됩니다. 여기에는 현재부터 내년까지 7억 가입, 내년과 내후년 사이에 9억 가입의 종합적인 개발이 포함됩니다.

아시아태평양이 가장 높은 성장률을 기록할 것

- 아시아태평양은 주로 인도, 중국 등의 국가에서 모바일 결제의 부상으로 인해 시장 잠재력이 매우 큰 지역입니다. 인도에서는 특히 수익화 폐지 계획 이후 많은 통신 사업자들이 이 모델로 전환하는 것을 목격했습니다. 예를 들어, 인도의 주요 통신사인 Jio와 Airtel은 고객 간 결제가 가능한 디지털 지갑을 제공하고 있습니다. 따라서 이들 기업이 거래를 처리하기 위해 블록체인을 채택하면 지갑이 더 안전하고 저렴해져 시장이 크게 확대될 수 있습니다.

- China Telecom, China Mobile, China Unicom은 통신 산업의 운영과 보안을 강화하기 위해 블록체인 기술을 사용하는 CAICT의 Trusted Blockchain Initiative에 참여했습니다. 양사는 IoT 데이터 공유 및 고객 신원 확인과 관련된 블록체인 기반 앱에 집중할 것으로 예상됩니다.

- 또한, 현재 전 세계가 WhatsApp의 정책 변경을 둘러싼 프라이버시 논란에 휩싸인 가운데, 인도의 통신 플랫폼 서비스형 플랫폼(CPaaS) 업계는 기업과 서비스 제공업체 간의 상업용 모바일 SMS, 이메일 및 기타 유형의 비즈니스 통신의 엔드투엔드 암호화를 도입하기 위한 준비를 하고 있습니다.

- 예를 들어, 내년 CPaaS 제공 업체 인 Tanla Platforms는 Microsoft와 협력하여 Wisely라는 에지 투 에지 세계 블록 체인 네트워크를 시작했습니다. 암호화 된 SMS를 기업에서 통신 사업자에게 직접 전송하기 위해 만들어졌으며, 회사는 또한 상업적 커뮤니케이션의 기존 애그리 게이터 모델을 파괴 할 것이라고 주장합니다.

- 일본에서도 스타트업 기업들이 공식적인 은행 거래 서류 없이도 스마트폰 기반의 안전한 송금을 가능하게 하는 블록체인 솔루션을 개발하고 있습니다. 예를 들어, 일본 스타트업 텔코인(Telcoin)은 블록체인을 활용하여 통신 사업자가 송금 서비스를 쉽게 제공할 수 있도록 돕고 있으며, 이더리움 블록체인에 구축된 텔코인 월렛(Telcoin Wallet)을 통해 모바일 사용자는 현지 모바일 서비스 제공업체와 상관없이 즉시 전 세계로 송금할 수 있습니다. 모바일 사용자는 현지 모바일 서비스 제공자와 상관없이 즉시 전 세계 송금을 할 수 있습니다. 따라서 표준화된 블록체인 플랫폼을 채택하는 것은 통신 사업자가 기술의 가치를 충분히 인식하고 지역 내 보다 빠른 도입의 길을 열어 시장 성장을 크게 촉진하는 데 도움이 될 수 있습니다.

통신용 블록체인 산업 개요

시장은 집중되어 있으며, 원격 통신 산업 전반에 걸쳐 블록체인 솔루션을 제공하는 주요 공급업체는 거의 없습니다. 공급업체들은 투자자들의 자금을 받아 혁신적인 블록체인 서비스를 더욱 지원하고 있습니다.

- 2022년 11월: 정보기술(IT) 서비스 기업 테크 마힌드라(Tech Mahindra)와 통신 분석 솔루션 제공업체 서브엑스(Subex)가 파트너십을 맺고 통신 사업자를 위한 블록체인 기반 솔루션을 전 세계에 출시할 예정입니다. 이 솔루션은 전반적인 컴플라이언스 문제를 최소화하여 부정행위를 줄이고 통신 서비스 제공업체(CSP)의 운영 효율성을 향상시킬 수 있습니다.

- 2022년 2월: 인도의 선도적인 통신 솔루션 제공업체인 Bharti Airtel은 해당 법적 승인에 따라 Airtel Startup Accelerator Program에 따라 서비스형 블록체인 기업 Aqilliz의 전략적 지분을 인수했다고 발표했습니다. Airtel은 급성장하는 애드테크, 디지털 엔터테인먼트 및 다양한 디지털 마켓플레이스 제품에 걸쳐 Aqilliz의 첨단 블록체인 기술을 대규모로 배포하는 것을 목표로 하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 강도

- COVID-19의 업계에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 통신 사기 검출과 방지에 중점을 두는 것이 시장 성장을 촉진

- 시장 성장 억제요인

- 업계 표준의 결여

제6장 시장 세분화

- 용도

- 계정 관리

- 지불과 청구

- 스마트 계약

- 접속 프로비저닝

- 지역

- 북미

- 유럽

- 아시아태평양

- 세계 기타 지역

제7장 경쟁 상황

- 기업 개요

- Blockchain Foundry Inc.

- Huawei Technologies Co. Ltd.

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- ShoCard Inc.(Ping Identity)

제8장 투자 분석

제9장 시장 전망

ksm 24.03.18The Blockchain in Telecom Market size is estimated at USD 0.99 billion in 2024, and is expected to reach USD 8.98 billion by 2029, growing at a CAGR of 55.13% during the forecast period (2024-2029).

In the telecom industry, blockchain plays a very significant role in preventing fraud, securing user identities, and supporting next-generation network services and IoT connectivity solutions, which in turn is driving the market significantly.

Key Highlights

- The increasing adoption of 5G is a catalyst for blockchain implementation in telecom, as 5G is helping in quick and reliable blockchain operations. Blockchain technology provides robust encryption to record and store the data on the network in a more secure and verifiable way. It makes the information transparent and tamper-proof. Thus, Blockchain technology is expected to help various telecom companies boost their network security and reduce operational costs, driving the market's growth.

- Moreover, telecommunications or telecom fraud is a fast-growing field of criminal activity. According to Europol's European Cybercrime Centre and Trend Micro, telecom fraud costs around USD 32.7 billion annually. It represents a new challenge for law enforcement agencies. Blockchain can help in fraud detection and prevention for communication service providers, exponentially fueling the market's growth.

- Furthermore, in emerging countries such as India, the effectiveness of telecom regulator's deployment of blockchain technology for curbing spam SMSs has set an example for the government to build a transparent and trustworthy framework for various critical use cases such as Aadhar authentication, property, and vehicle ownership records and direct tax collection among others. In March last year, the Ministry of Electronics and IT released a draft policy on blockchain technology to regulate its deployment in various public and private use cases. The telecom regulatory authority of India (TRAI) has also deployed distributor-ledger technology (DLT), which is currently one of the most significant use cases of blockchain technology to control spam SMS traffic.

- However, on the other hand, scalability and interoperability are the several critical factors necessary for the overall adoption of blockchain technology. This is only possible when industry standards are set, which is at a lagging phase. The Telecom sector needs help with the mass adoption of blockchain technology, which can hinder the market's growth.

- The onset of the pandemic has highlighted the criticality of telecom infrastructure. The global health emergency is placing new pressures on telecom services and suggesting a pivotal role they can play beyond simple connectivity in emergency scenarios. Beyond the coronavirus pandemic, the world is expected to see substantial interest in new fintech services as the growing demand for virtual and online services continues to build. Within the telecommunications industry, the pandemic is driving the need for expanding digital infrastructure and data-driven services. Telecom companies increasingly focus on network resiliency and reliability, particularly in 5G investments.

Blockchain in Telecom Market Trends

Smart Contract to Dominate the Market

- Smart contracts allow computer code to execute when specific conditions are met. The telecom industry is expected to witness significant adoption as it provides scope for automation in its internal operations, like billing, supply chain management, and roaming.

- Deploying smart contracts to manage all the billing related to roaming can lead to significant cost savings, as it provides prevention against fraudulent traffic. Blockchain can also add value to identity management solutions by cutting out intermediaries through smart contracts. This helps reduce roaming frauds, cost savings, and instant settlements. It helps telecom players to resolve disputes quickly through tamper-proof verifiable transactions and real-time updates to end customers.

- In March 2022, STC Bahrain introduced its official Chainlink node, which intends to offer smart contracts with access to a secure source of real-world data and fast off-chain computations. This makes STC Bahrain the first major telecom in the Middle East and North Africa (MENA) region to introduce a Chainlink node, enhancing the development of the smart contract ecosystem both in the area and throughout the globe.

- Moreover, 5G technology is one of the significant instances of how blockchain would change the telecommunication industry. For instance, in 5G technology, smart contracts can streamline the overall provisioning between the end user and the networks with a blockchain-based solution. For 5G to be implemented securely, the data received by connected devices must be reliable and free from various malicious interference. Further, to enable 5G to reach its full potential and protect against large-scale security breaches, blockchain can deliver decentralized, tamper-proof, and real-time verification of data transmission.

- As per 5G Americas, Solid growth in 5G subscriptions is expected to continue into the foreseeable future, reaching 5 billion subscriptions by the end of 2026. That includes the overall development of 700 million subscriptions from the current to next year and 900 million by next-to-next year.

Asia Pacific to Witness the Highest Growth

- The Asia-Pacific region boasts tremendous potential for the market, primarily owing to the growing prominence of mobile payments in countries such as India and China. India, specifically after the demonetization scheme, has witnessed many telecom operators shifting toward this model. For instance, Jio and Airtel, the country's leading telcos, offer digital wallets to enable customer-to-customer payments. Thus, the adoption of blockchain to handle the transactions by these companies could make their wallets more secure and cheaper, driving the market significantly.

- China Telecom, China Mobile, and China Unicom have joined the CAICT's Trusted Blockchain Initiative, which would use blockchain technology to bolster operations and security in the telecom industry. The companies are expected to focus on blockchain-based apps that relate to IoT data sharing and customer identity verification.

- Further, as the world is currently embroiled in a privacy debate over WhatsApp's policy changes, India's communication platform as a service (CPaaS) industry has been gearing up for the adoption of end-to-end encryption of commercial mobile SMSes, emails, and all other types of business communication between the enterprises and service providers.

- For instance, next year, CPaaS provider Tanla Platforms, in partnership with Microsoft, launched its edge-to-edge global blockchain network called Wisely, which was made for sending encrypted SMSes directly from enterprises to the telecom operators, which the company also claims to disrupt the existing aggregator model of commercial communication.

- In Japan, too, startups are developing blockchain solutions that enable secure smartphone-based money transfers that do not require formal banking documentation. For instance, a Japanese startup Telcoin leverages blockchain to facilitate telecommunication operators to provide money transfer services. Telcoin Wallet, built on the Ethereum blockchain, allows mobile users to make global transfers instantly, irrespective of local mobile service providers. Hence, adopting a standardized blockchain platform will help operators fully realize the technology's value and pave the path for faster adoption within the region, driving the market's growth significantly.

Blockchain in Telecom Industry Overview

The market is concentrated, with few significant vendors offering blockchain solutions across the telecommunication industry. The vendors are also receiving investors' funds, further helping in innovative blockchain services.

- November 2022 - Information technology (IT) services firm Tech Mahindra and telecom analytics solutions provider Subex have joined hands to roll out blockchain-based solutions for telecom operators globally. These solutions would mitigate fraud and drive operational efficiencies for communication service providers (CSP) by minimizing overall compliance issues.

- February 2022 - Bharti Airtel, India's premier communications solutions provider, declared that it had acquired a strategic stake in Aqilliz, a Blockchain as a Service Company under the Airtel Startup Accelerator Program, subject to applicable statutory approvals. Airtel aims to deploy Aqilliz's advanced blockchain technologies at a larger scale across its fast-growing Adtech, Digital Entertainment, and various Digital Marketplace offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Focus on Telecom Fraud Detection and Prevention is Driving the Market Growth

- 5.2 Market Restraints

- 5.2.1 Lack of Industry Standards

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Identity Management

- 6.1.2 Payment and Billing

- 6.1.3 Smart Contract

- 6.1.4 Connectivity Provisioning

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Blockchain Foundry Inc.

- 7.1.2 Huawei Technologies Co. Ltd.

- 7.1.3 Microsoft Corporation

- 7.1.4 Oracle Corporation

- 7.1.5 SAP SE

- 7.1.6 ShoCard Inc. (Ping Identity)