|

시장보고서

상품코드

1434289

대사 검사 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Global Metabolic Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

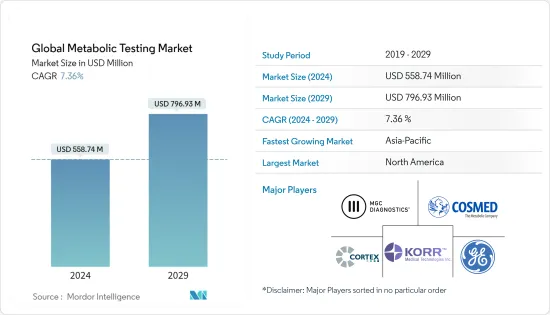

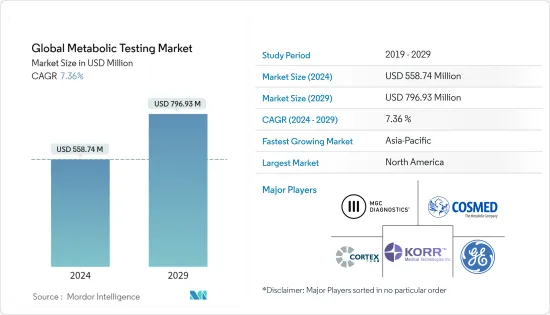

세계 대사 검사 시장 규모는 2024년 5억 5,874만 달러로 추정되며 2029년까지 7억 9,693만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 연평균 7.36%의 CAGR로 성장할 것으로 예상됩니다.

신종 코로나바이러스 감염증(COVID-19) 팬데믹은 봉쇄로 인한 좌식 생활습관의 증가와 신체 활동 감소로 인해 대사 검사 시장에 큰 영향을 미쳤습니다. 예를 들어, 2021년 3월 MedRxiv 저널에 게재된 논문에 따르면, COVID-19의 유행으로 인해 좌식 생활과 건강에 해로운 식습관이 증가했다고 합니다. 건강에 해로운 식습관으로 인한 대사성 질환의 증가로 인해 대유행 기간 동안 대사 검사에 대한 수요가 급증했습니다. 대유행 이후 제한이 해제됨에 따라 대사 검사의 발전과 함께 비만 및 기타 대사성 질환의 증가로 인해 시장이 성장할 수 있습니다.

이 시장은 주로 전 세계적으로 심장병, 고혈압, 고콜레스테롤, 당뇨병, 비만 등 다양한 생활습관병의 발생률과 유병률의 증가와 대사 검사의 기술 발전에 의해 주도되고 있습니다. 예를 들어, World Obesity Atlas 2022에 따르면 2030년까지 여성 5명 중 1명, 남성 7명 중 1명이 비만일 가능성이 높으며, 이는 전 세계 10억 명 이상에 해당할 것으로 예측됩니다.

또한 미국 건강 랭킹에 따르면 2021년 미국 성인의 35.7%가 콜레스테롤 검사를 받은 결과 콜레스테롤이 높은 것으로 나타났다고 합니다. 같은 소식통에 따르면 2021년 웨스트 버지니아 주에서 성인의 14.2%가 협심증 또는 관상동맥 심장 질환, 심장 마비 또는 심근 경색 또는 뇌졸중을 앓고 있다고 의료 전문가들이 보고했습니다. 따라서 질병 부담이 높아질 것으로 예상됩니다. 대사 검사에 대한 수요가 증가할 것입니다. 또한 WHO의 2021년 5월 데이터에 따르면 전 세계적으로 약 11억 3,000만 명이 고혈압을 앓고 있으며, 그 중 3분의 2가 중저소득 국가에 거주하고 있습니다. 따라서 이러한 생활습관병의 확산과 함께 건강 매개변수를 모니터링하는 경향이 높아짐에 따라 대사 검사에 대한 수요도 증가할 것으로 예상됩니다.

비만 환자의 거대한 풀, 대사성 질환의 유병률 증가, 기술 발전, 건강 및 피트니스에 대한 인식 증가 등의 요인으로 인해 예측 기간 동안 시장 성장이 더욱 확대될 것으로 예상됩니다. 예를 들어, 2022년 2월 AliveCor는 KardiaMobile Card를 출시했습니다. 이 카드는 지갑에 쉽게 넣을 수 있는 가장 슬림하고 편리한 개인용 심전도 장치로, 30초 만에 의료용 단일 리드 심전도를 제공합니다. 또한 대사성 질환에 대한 검사 및 치료 옵션의 중요성을 강조하기 위해 전 세계적으로 다양한 인식 개선 프로그램이 진행되고 있습니다. 예를 들어, 2022년 5월 미국 간 재단은 지방간 증가에 대처하기 위해 향후 5 년 동안 50 개 주에서 위험에 처한 어린이와 성인을 대상으로 향후 5 년 동안 검사를 실시하는 전국적인 검진 및 대중 인식 프로그램 인 "Think Liver Think Life"를 실시했습니다. 간 질환.

따라서 심혈관 질환, 비만, 당뇨병과 같은 생활습관병의 유병률 증가, 기술 발전, 의료비 증가가 대사 검사 시장의 주요 촉진요인으로 작용하고 있습니다. 그러나 높은 장비 및 소프트웨어 비용으로 인해 예측 기간 동안 시장 성장이 억제될 것으로 예상됩니다.

대사 검사 시장 동향

체성분 측정기는 예측 기간 동안 시장에서 상당한 시장 점유율을 유지할 것으로 예상

체성분 분석기(BCA)는 다양한 신체 구성요소를 측정하여 검사 장소에서 각각의 값을 제공합니다. 체성분 분석기는 스포츠 및 의학 연구, 특히 인류학, 영양학, 역학 등 인과관계 연구에서 많은 용도로 사용되고 있습니다. 이 분야는 생활습관병의 유병률 증가와 주요 시장 기업의 제품 출시에 의해 주도되고 있습니다.

World Obesity Atlas 2022에 따르면, 인도에서는 2030년까지 4,000만 명의 여성이 비만 진단을 받을 것으로 예상됩니다. 또한, 신흥국에서는 비만 질환의 부담이 크기 때문에 체성분 측정기 등 지방 측정 기기 시장이 확대될 것으로 보입니다.

또한 체성분 측정기의 효능을 입증하는 연구는 사람들이 영양 섭취에 대한 인식을 높이고 BCA에 대한 수요를 증가시켜 예측 기간 동안 시장 성장을 촉진하여 부문의 성장 기회를 확대 할 것입니다. 예를 들어, 2022년 5월 PubMed에 게재된 논문에 따르면, 이 연구는 체성분 평가의 중요성과 전반적인 건강 상태의 지표로서 심폐 기능 예측에 대한 유용성을 보여주었습니다. 또한, 제품 포트폴리오 및 지역 내 입지를 확대하기 위한 합병 및 인수와 같은 중요한 전략적 계획의 실행은 시장 성장을 촉진할 것입니다. 예를 들어, 2022년 4월 인바디(InBody)는 체성분과 체내 수분이 건강에 미치는 영향에 대한 통계를 제공하는 BWA 2.0 체수분 측정기를 출시했습니다. 이 새로운 전문가급 기기는 InBody S10의 출력을 확장한 것으로, 부착 가능한 전극을 사용하여 사지가 고정되어 있거나 절단된 사람의 체성분과 체내 수분을 평가합니다. 따라서 심혈관 질환, 비만, 당뇨병과 같은 생활습관병의 유병률 증가, 기술 발전, 체성분 측정기 제품 출시는 예측 기간 동안 부문의 성장을 촉진하는 주요 요인이 될 것입니다.

북미 지역은 예측 기간 동안 시장에서 상당한 점유율을 차지할 것으로 예상

북미는 탄탄한 의료 인프라, 대사 검사 기술 발전, 대사성 질환에 대한 인식 증가, 심혈관 질환, 비만, 제2형 당뇨병 등 생활습관병의 급증으로 인해 대사 검사 시장에서 큰 비중을 차지할 것으로 예상됩니다. 지역의. 예를 들어, 2021년에 발행된 IDF 당뇨병 아틀라스 10판에 따르면 2021년 멕시코의 당뇨병 환자 수는 1,412만 3,200명입니다. 이 숫자는 2045년까지 1,706만 2,700명으로 증가할 것으로 추정됩니다. 마찬가지로 같은 자료에 따르면 2021년 미국의 당뇨병 인구는 3,221만 5,300명이었습니다. 이 수치는 2045년까지 3,628만 9,900명으로 증가할 것으로 예상됩니다. 캐나다의 당뇨병 환자 수는 2021년 297만 4,000명에 달했습니다. 이 수치는 2045년까지 346만 8,500명으로 증가할 것으로 예상됩니다. 캐나다. 따라서 당뇨병과 같은 대사성 질환의 이러한 증가는이 지역의 대사 검사에 대한 수요를 증가시켜 예측 기간 동안 시장 성장을 촉진할 것으로 예상됩니다.

또한, CDC의 2023년 1월 최신 정보에 따르면, 미국 성인의 거의 절반(47%, 즉 1억 1600만 명)이 고혈압을 앓고 있습니다. 고혈압은 수축기 혈압이 130mmHg 이상 또는 이완기 혈압이 80mmHg 이상인 경우로 정의됩니다. 고혈압 약을 복용하고 있습니다. 또한 대사 장치 개발에 대한 투자는 연구 지역의 시장 성장을 촉진할 것으로 예상됩니다. 예를 들어, 2022년 12월 루멘은 휴대용 체중 감량 하드웨어를 위해 6,200만 달러의 자금을 조달했습니다. 루멘은 신체가 연료로 탄수화물을 태우고 있는지 지방을 태우고 있는지, '대사 연료 사용량'을 판단하기 위해 생성되는 CO2 수준을 측정하는 내장 센서가 내장 된 휴대용 하드웨어 장치를 개발했습니다. 스마트폰에 연결하면 관련 앱이 개인화된 식단, 운동, 수면 권장 사항을 제공합니다. 따라서 당뇨병, 비만, 심장병과 같은 생활습관병의 발병률 증가와 대사 장치 개발에 대한 투자 및 자금 조달 증가로 북미는 예측 기간 동안 조사 대상 시장에서 주목할만한 점유율을 차지할 것으로 예상됩니다.

대사 검사 산업 개요

대사 검사 시장은 본질적으로 여러 시장 참여자들에 의해 세분화되어 있습니다. 시장 점유율 측면에서 보면 소수의 대기업이 시장을 독점하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 생활습관병 증가

- 대사 검사 기술 진보

- 시장 성장 억제요인

- 기기와 소프트웨어의 고비용

- 불충분한 상환 정책

- Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자·소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 기기 유형별

- 체성분계

- 심폐 운동 부하 시험(CPET) 시스템

- 심전도 시스템

- 메타볼릭 카트

- 기타

- 용도별

- 중환자 치료

- 생활습관병

- 최종사용자별

- 병원·클리닉

- 스포츠 트레이닝 센터

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 상황

- 기업 개요

- MGC Diagnostics Corporation

- COSMED srl

- CORTEX Biophysik GmbH

- General Electric Company(GE Healthcare)

- KORR Medical Technologies, Inc

- Becton, Dickinson and Company(CareFusion Corporation)

- Geratherm Medical AG

- OSI Systems, Inc

- AEI Technologies, Inc

- Parvo Medics

- Inbody Co. Ltd

- Koninklijke Philips NV

제7장 시장 기회와 향후 동향

ksm 24.03.06The Global Metabolic Testing Market size is estimated at USD 558.74 million in 2024, and is expected to reach USD 796.93 million by 2029, growing at a CAGR of 7.36% during the forecast period (2024-2029).

The COVID-19 pandemic significantly impacted the metabolic testing market due to increased sedentary lifestyles and reduced physical activities due to the lockdown. For instance, as per the article published in March 2021 in MedRxiv journal, the COVID-19 epidemic increased sedentary lifestyles and unhealthy dietary habits. As a result of the increase in metabolic diseases caused by unhealthy dietary habits, the demand for metabolic testing soared during the pandemic. In the post-pandemic situation, as the restrictions were lifted, the market is likely to witness growth due to the rise in obesity and other metabolic disorders coupled with the advancements in metabolic testing.

The market is primarily driven by the growing incidence and prevalence rate of various lifestyle-related diseases such as heart diseases, hypertension, high cholesterol, diabetes, and obesity worldwide and technological advances in metabolic testing. For instance, as per the World Obesity Atlas 2022, by 2030, it is predicted that 1 in 5 women and 1 in 7 men are likely to be living with obesity, equating to over 1 billion people globally.

Similarly, as per America's Health Rankings, 35.7% of adults reported having their cholesterol checked and considered high in 2021 in the United States. As per the same source, 14.2% of adults reported by a health professional that they had angina or coronary heart disease, a heart attack or myocardial infarction, or a stroke in West Virginia in 2021. Thus, the high burden of diseases is expected to increase the demand for metabolic testing. Additionally, as per the May 2021 data from the WHO, about 1.13 billion people worldwide have hypertension, of which two-thirds live in low- and middle-income countries. Thus, with the growing prevalence of such lifestyle diseases, the demand for metabolic testing is expected to increase as a growing trend toward monitoring health parameters.

Factors such as a huge pool of obese patients, an increase in the prevalence of metabolic disorders, technological advancements, and rising health and fitness consciousness are expected further to augment the market's growth over the forecast period. For instance, in February 2022, AliveCor launched KardiaMobile Card, the slimmest, most convenient personal ECG device which fits easily into any wallet and delivers a medical-grade, single-lead ECG in 30 seconds. Additionally, numerous awareness programs run globally to emphasize the significance of testing and treatment options for metabolic diseases. For instance, in May 2022, the American Liver Foundation conducted a countrywide screening and public awareness program, 'Think Liver Think Life,' to test at-risk children and adults in all 50 states over the next five years to address the increase in fatty liver disease.

Therefore, the increasing prevalence of lifestyle diseases such as cardiovascular disease, obesity, and diabetes, technological advancements, and healthcare expenditure are the key driving factors in the metabolic testing market. However, the high cost of Equipment and Software restrains the market growth over the forecast period.

Metabolic Testing Market Trends

Body Composition Analyzers are Expected to Hold a Significant Market Share in the Market Over the Forecast Period

Body composition analyzers (BCA) measure various body components and offer their respective values at the examination location. Body composition analyzers have numerous uses in sports and medical research, particularly causal association studies in anthropology, nutrition, epidemiology, etc. The segment is driven by rising in the prevalence of lifestyle diseases and product launches by the key market players.

According to the World Obesity Atlas 2022, 40 million females will be diagnosed with obesity by 2030 in India. Furthermore, because emerging countries have a larger obesity illness burden, the market for fat monitoring equipment such as body composition analyzers is likely to rise.

Furthermore, studies demonstrating the efficacy of body composition analyzers expand the opportunities for segment growth because people are becoming more aware of their nutritional intake, increasing the demand for the BCA, thereby fueling the market growth over the forecast period. For instance, as per the article published in May 2022 in PubMed, the study depicted the importance of assessing body composition and its usefulness in predicting cardiopulmonary fitness as an indicator of overall health. Furthermore, implementing important strategic plans such as mergers and acquisitions to extend the product portfolio and regional presence will fuel market growth. For instance, in April 2022, InBody introduced the BWA 2.0 body water analyzer, which gives statistics on how body composition and body water affect well-being. This new professional-grade device expands on the InBody S10's outputs, which use attachable electrodes to assess body composition and body water in individuals who are immobilized or have amputated limbs. Therefore, the increasing prevalence of lifestyle diseases such as cardiovascular disease, obesity, and diabetes, technological advancements, and body composition analyzer product launches are the key driving factors in the segment growth over the forecast period.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to hold a significant market share in the metabolic testing market due to the robust healthcare infrastructure, technological advancements in metabolic testing, increase in awareness of metabolic diseases and surge in lifestyle diseases such as cardiovascular diseases, obesity, and type 2 diabetes in the region. For instance, as per the IDF Diabetes Atlas 10th edition published in 2021, the number of people living with diabetes in Mexico was 14,123.2 thousand in 2021. This number is estimated to increase to 17,062.7 thousand by 2045. Similarly, according to the same source, the diabetic population in the United States was 32,215.3 thousand in 2021. This figure is expected to rise to 36,289.9 thousand by 2045. In Canada, the number of diabetics reached 2,974 thousand in 2021. This figure is expected to rise to 3,468.5 thousand by 2045 in Canada. Hence, such an increase in metabolic diseases like diabetes is anticipated to increase the demand for metabolic testing in the region, thereby driving market growth over the forecast period.

Additionally, as per the CDC January 2023 update, nearly half of the adults in the United States (47%, or 116 million) have hypertension, defined as a systolic blood pressure greater than 130 mmHg or a diastolic blood pressure greater than 80 mmHg or are taking medication for hypertension. Moreover, investments in developing metabolic devices are expected to fuel the market growth in the studies region. For instance, in December 2022, Lumen raised USD 62M for its handheld weight-loss hardware. Lumen developed a handheld hardware device that contains a built-in sensor that measures the level of CO2 produced to determine 'metabolic fuel usage', whether the body is burning carbs or fat for fuel. It connects to a smartphone and the associated app gives personalized food, exercise, and sleep recommendations. Hence, due to the rising incidence of lifestyle disorders like diabetes, obesity, and heart disease as well as an increase in investments and fundraising to develop metabolic devices, North America is expected to hold a notable share in the market studied over the forecast period.

Metabolic Testing Industry Overview

The metabolic testing market is fragmented in nature due to several market players. In terms of market share, a few major players dominate the market. Some of the key companies in the market are MGC Diagnostics Corporation, COSMED Srl, CORTEX Biophysik GmbH, General Electric Company (GE Healthcare), KORR Medical Technologies, Inc, CareFusion Corporation, Geratherm Medical AG, OSI Systems, Inc, AEI Technologies, Inc, and Parvo Medics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Lifestyle Diseases

- 4.2.2 Technological Advancements in Metabolic Testing

- 4.3 Market Restraints

- 4.3.1 High Cost of Equipment and Software

- 4.3.2 Poor Reimbursement Policies

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Equipment Type

- 5.1.1 Body Composition Analyzers

- 5.1.2 Cardiopulmonary Exercise Testing (CPET) Systems

- 5.1.3 ECG Systems

- 5.1.4 Metabolic Carts

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Critical Care

- 5.2.2 Lifestyle Diseases

- 5.3 By End User

- 5.3.1 Hospitals and Clinics

- 5.3.2 Sports Training Centers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 MGC Diagnostics Corporation

- 6.1.2 COSMED srl

- 6.1.3 CORTEX Biophysik GmbH

- 6.1.4 General Electric Company (GE Healthcare)

- 6.1.5 KORR Medical Technologies, Inc

- 6.1.6 Becton, Dickinson and Company (CareFusion Corporation)

- 6.1.7 Geratherm Medical AG

- 6.1.8 OSI Systems, Inc

- 6.1.9 AEI Technologies, Inc

- 6.1.10 Parvo Medics

- 6.1.11 Inbody Co. Ltd

- 6.1.12 Koninklijke Philips NV