|

시장보고서

상품코드

1687971

건설용 로봇 - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Construction Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

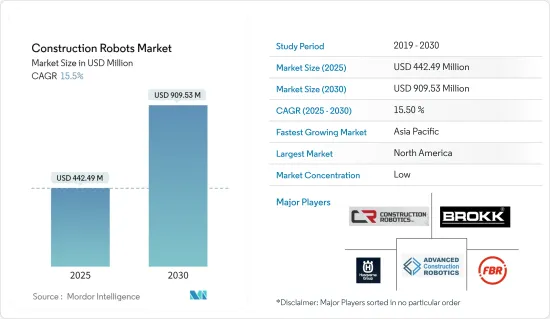

건설용 로봇 시장 규모는 2025년에 4억 4,249만 달러에 이르고 예측 기간(2025-2030년)의 CAGR은 15.5%를 나타내 2030년에는 9억 953만 달러에 달할 것으로 전망됩니다.

도시화의 진전, 공업화의 침투, 건설·해체 작업의 고도화 등의 요인이 시장의 수익 성장을 견인하고 있습니다.

주요 하이라이트

- 건설중의 건축자재의 자원과 자재폐기물의 삭감에 대한 건설조직의 관심이 높아지면서 건설용 로봇 시장의 채용을 촉진합니다.

- 게다가 프로젝트의 공사 단축이 건설용 로봇의 성장을 뒷받침하고 있습니다. 개조를 용이하게 합니다.다기능 건설용 로봇」이라고 형용되는 이 로버 에스크형 디바이스는 콘크리트 3D 프린팅에 머무르지 않습니다.

- 게다가 2022년 5월, Dusty Robotics는 4,500만 달러를 조달해, 선진적 로봇 공학을 통해 건설 미스를 박멸하는 산업 최초의 하드웨어, 소프트웨어, 서비스 솔루션을 발표했습니다.

- 새로운 인프라 정비의 필요성이 높아지는 가운데, 자동화 건설 솔루션은 향후 수년에 걸쳐 기세를 늘려 시장에 플러스의 영향을 줄 것으로 예상됩니다.

- 게다가 건설용 로봇의 도입에는 기술의 취득과 유지에 따른 높은 비용이 과제의 하나가 되고 있습니다. 이에 더해, 오토메이션 기술은 갱신이나 유지관리가 필요하고, 그 대부분이 고액입니다.

- 과거에 발생한 COVID-19는 건설 산업에 악영향을 미쳤고, 봉쇄된 최초의 몇 달은 건설 작업이 정지했습니다.

건설용 로봇 시장 동향

상업용 건물과 주택이 건설용 로봇의 최대 용도로

- 새로운 상업시설과 주택의 인프라 정비의 필요성이 높아지는 가운데, 자동화된 건설 솔루션은 향후 수년간 기세를 늘리고, 시장에 플러스의 영향을 줄 것으로 예상됩니다.

- 도시화는 급격히 진행되고 있습니다.세계 은행의 데이터에 의하면, 세계 인구의 약 55%에 해당하는 42억명이 도시에 살고 있어, 이 경향은 향후도 계속될 것으로 예상되고 있습니다. 사람 근처가 도시에 살게 될 것으로 예상되고 있습니다.이 때문에 자동화나 인공지능 등의 기술적 변화가 가져오고, 복수의 도시 과제에 대처하기 위해, 로보틱스를 포함한 다양한 기술이 급속하게 전개될 것으로 예상됩니다.

- 인구문제 연구소가 발표한 「세계 인구 데이터시트 2021」에 의하면, 북미는 세계에서 가장 도시화가 진행된 대륙으로, 인구의 82%가 도시에 살고 있습니다. 카리브해 국가에서는 도시화의 정도는 79%였습니다.

- 도시화의 필요성과 규모는 적당한 주택, 교통망, 기타 기본적인 생활 인프라에 대한 가속적인 수요를 충족시키는 과제를 가져오고 있습니다.

- 세계의 주요 경제권은 저소득층이 주택을 구입할 수 있도록 도시 주택 가격을 억제하기 위해 더 많은 주택 솔루션의 건설을 검토하고 있습니다. 거기서 건설에 걸리는 시간이 대폭 단축되어 지속 가능한 3D 프린팅 솔루션이 향후 수년간 수요를 견인해 나갈 것으로 예상됩니다.

- 주택이나 아파트 등의 주택 건설이 증가하고 있기 때문에 예측 기간 중에 건설용 로봇 수요가 높아질 것으로 예상됩니다.

시장을 독점하는 아시아태평양

- 아시아태평양은 건설용 로봇 시장에 있어서 중요한 지역의 하나이며, 주요 3개국은 인도, 중국, 일본입니다.

- 또한 3D 프린팅 수요가 높기 때문에 다양한 국제 기업이 이 지역에서의 사업 확대를 모색하고 있습니다. 예를 들어, 2022년 6월 덴마크의 3D 건설 프린팅 기술 개발사인 COBOD International은 호주에 최첨단 콘크리트 3D 프린팅 기술을 도입하고 아시아 태평양 지역에서 3D 건설 프린팅을 강화하기 위한 전략의 일환으로 호주 기업인 Fortex와 새로운 유통 계약을 체결했습니다.

- 아시아는 팬데믹 이전에 이미 로봇공학과 산업 자동화를 완전히 도입하고 있었습니다.

- 도시화의 진전은 한층 더 시장 성장을 위한 수요를 낳을 것으로 예상됩니다.

- 건설산업의 전망은 낙관적이며, 노동력에 대한 수요는 왕성합니다.

건설용 로봇 산업 개요

건설용 로봇 시장은 Brokk AB(Lifco Public AB), Husqvarna AB, Construction Robotics LLC, FBR Ltd., Advanced Construction Robotics Inc.와 같은 대기업이 존재하고 세분화되고 있습니다. 동 시장의 진출기업은 제품 제공을 강화하고 지속 가능한 경쟁 우위를 획득하기 위해 제휴, 혁신, 인수 등의 전략을 채용하고 있습니다.

2022년 12월 의료용 및 산업용 외골격 기술의 산업 리더인 Ekso Bionics는 모션 및 제어 기술의 세계 리더인 Parker Hannifin Corporation(이하 '파커')에서 휴먼 모션 앤 컨트롤(이하 'HMC') 사업 부문을 인수했다고 발표했습니다.

2022년 10월, 원격조작 해체 로봇의 세계적인 선두업체인 브록크는 보수·수리 용도에 있어서 벽, 바닥, 천장의 도장이나 석면 등의 재료 제거, 표면 처리, 연마용 BROKK SURFACE GRINDER 530(BSG 530) 어태치먼트의 추가를 발표했습니다.

2022년 8월 Husqvarna Construction은 지역의 주요 산업용 공구 및 장비 공급업체인 AABTools와 전략적 파트너십을 체결했습니다. Construction의 유기 제품은 AABTools에 의해 판매되며, 헤비 듀티 및 고주파 콘크리트 코어 링 머신, 벽돌 및 철근 콘크리트 용으로 설계된 월소, 원격 조작 해체 로봇, 핸드 헬드 파워 커터, 먼지 추출기, 플로어 톱의 20개 이상의 모델이 포함됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁의 강도

- 시장에 대한 COVID-19의 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 급속한 도시화

- 근로자의 안전성에 관한 정부의 엄격한 규제

- 시장 성장 억제요인

- 높은 설비 투자와 설치 비용

제6장 시장 세분화

- 유형별

- 철거

- 벽돌 쌓기

- 3D 프린팅

- 기타

- 용도별

- 공공 인프라

- 상업 및 주거용 건물

- 기타

- 지역별

- 북미

- 유럽

- 아시아태평양

- 기타

제7장 경쟁 구도

- 기업 프로파일

- BROKK AB(Lifco publ AB)

- Husqvarna AB

- Construction Robotics LLC

- FBR Ltd.

- Advanced Construction Robotics Inc.

- Dusty Robotics

- Apis Cor

- COBOD International AS

- Ekso Bionics

제8장 투자 분석

제9장 시장의 미래

KTH 25.05.12The Construction Robots Market size is estimated at USD 442.49 million in 2025, and is expected to reach USD 909.53 million by 2030, at a CAGR of 15.5% during the forecast period (2025-2030).

The growing urbanization, industrialization penetration, and advanced construction & demolition operation factors are driving market revenue growth.

Key Highlights

- The increasing focus of construction organizations on reducing building materials' resources and material waste during construction will drive the adoption of the construction robot market. Further, Autodesk identifies that while it is difficult to get exact figures of the waste produced on a typical construction site, several construction organizations have thought that nearly 30% of the total weight of building materials transported to a building site gets wasted.

- Further, reducing the construction time of the projects is aiding the growth of construction robots. Printstones, an Austria-based manufacturer of mobile 3D printing robots for construction, has launched its latest manufacturing robot. A modular design indicates the Baubot, which easily allows third-party customer modifications. Described as a 'multi-functional construction robot,' the rover-Esque device goes beyond concrete 3D printing. It qualifies for many flexible manufacturing processes such as material transportation, welding, milling, screwdriver, cutting, painting, and even bricklaying.

- Further, in May 2022, Dusty Robotics raised USD 45 million to announce the Industry's First Hardware, Software, and Services Solution to Destroy Construction Errors Through Advanced Robotics. FieldPrinter automates digital floor techniques on construction sites by printing them full-size on the floor through a mixture of hardware, software, and services.

- With the growing need for new infrastructure, automated construction solutions are expected to gain momentum over the coming years and impact the market positively. According to Redshift, the industry must build 13,000 buildings daily from now to 2050 to support an expected population of seven billion living in urban areas.

- Furthermore, high costs associated with acquiring and maintaining the technologies are one of the challenges in implementing construction robotics. The purchase, along with the implementation of the technologies, is costly. Therefore, only firms with a good turnover and market competition can afford these technologies. In addition to this, automation technologies need to be updated and maintained, and most of them are expensive to do it. The maintenance cost for the new robotics equipment is higher because of the exceptional technician's needs.

- The past outbreak of COVID-19 adversely affected the construction industry, with construction work coming to a standstill in the initial months of the lockdown. However, the product demand witnessed an increased interest in adoption from the industry owing to the safety benefits offered by the technology.

Construction Robots Market Trends

Commercial and Residential Buildings to be the Largest Application for Construction Robots

- With the growing need for new commercial and residential infrastructure, automated construction solutions are expected to gain momentum over the coming years and impact the market positively. According to Redshift, the industry must build 13,000 buildings daily from now to 2050 to support an expected population of seven billion in urban areas.

- Urbanization is rising at an exponential rate. According to World Bank data, about 55% of the world's population, or 4.2 billion people, live in cities, and the trend is expected to continue over the coming years. By 2050, the urban population worldwide is expected to double, with nearly seven out of 10 people living in cities. This is expected to bring about technological changes such as automation and artificial intelligence and rapidly deploy various technologies, including robotics, to address multiple urban challenges.

- According to the World Population Data Sheet 2021, published by the Population Reference Bureau, North America was the most urbanized continent worldwide, with 82% of the population living in cities. In Latin America and the Caribbean, the degree of urbanization stood at 79%. It is projected that the share of people living in urban areas globally will increase from 56% in 2020 to 70% in 2050.

- The need and scale of urbanization are bringing challenges that include meeting accelerated demand for affordable housing, well-connected transport systems, and other basic infrastructure for living. According to the World Bank, nearly one billion urban poor who live in informal settlements are near opportunities that result in conflicts, which is leading to 60% of them being forcibly displaced in urban areas.

- Major economies worldwide are considering building more housing solutions to control the price of homes in urban areas so that lower-income citizens can afford them. Urban planning departments across major economies in North America and Europe are looking to build more housing for the market, which will somewhat moderate some prices. This is where 3D printing solutions that consume significantly less time to build and are sustainable are expected to gain traction in demand over the coming years. The demand for infrastructure and housing solutions in growing economies, mainly situated in the Asia-Pacific region, is expected to accelerate their investment in construction technologies.

- The growing construction of residential places like homes and apartments is expected to propel the demand for construction robots over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is one of the significant regions for the construction robotics market, with the three major countries being India, China, and Japan. The increasing development of 3D-printed houses in the region is expected to boost market growth.

- Additionally, various international companies are looking to expand their regional offerings due to the high demand for 3D printing. For instance, in June 2022, COBOD International, a Danish developer of 3D construction printing technology, signed a new distribution agreement with Fortex, an Australian company, as part of the company's strategy to bring cutting-edge concrete 3D printing technology to Australia and strengthen 3D construction printing in the Asia-Pacific region.

- Asia was already fully embracing robotics and industrial automation before the pandemic. In a post-COVID world, the adoption of these technologies and industries that integrate them, like manufacturing, logistics, and construction, will continue to rise.

- The increasing urbanization is further expected to create demand for market growth. As per the National Bureau of Statistics of China, in 2022, approximately 65.2% of the population in China lived in cities. The urbanization rate has increased significantly in the country over the last few decades.

- The prospect of the construction industry is optimistic, with a strong demand for manpower. Nevertheless, in the face of a continuous and huge amount of construction work, the industry needs to improve construction efficiency and ensure worker and site safety, thereby enhancing overall productivity and cost-effectiveness. Such trends are expected to create positive growth for the market studied over the forecast period.

Construction Robots Industry Overview

The construction robots market is fragmented with the presence of major players like Brokk AB (Lifco Public AB), Husqvarna AB, Construction Robotics LLC, FBR Ltd., and Advanced Construction Robotics Inc. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain a sustainable competitive advantage.

In December 2022, Ekso Bionics, an industry leader in exoskeleton technology for medical and industrial use, announced the acquisition of the Human Motion and Control ("HMC") Business Unit from Parker Hannifin Corporation ("Parker"), a global leader in motion and control technologies. The acquisition included the Indegolower limb exoskeleton line of products as well as the planned development of robotic-assisted orthotic and prosthetic devices.

In October 2022, Brokk, the world's leading manufacturer of remote-controlled demolition robots, announced the addition of the BROKK SURFACE GRINDER 530 (BSG 530) attachment for material removal, such as paint and asbestos, surface preparation, and polishing on walls, floors, and ceilings in renovation and restoration applications.

In August 2022, Husqvarna Construction entered into a strategic partnership with AABTools, the region's leading industrial tools and equipment supplier. Husqvarna Construction's organic products were to be distributed by AABTools, including heavy-duty and high-frequency concrete coring machines, wall saws designed for brick and reinforced concrete, remote-controlled demolition robots, and twenty-plus models of handheld power cutters, dust extractors, and floor saws.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Urbanization

- 5.1.2 Stringent Government Regulations for Worker's Safety

- 5.2 Market Restraints

- 5.2.1 High Equipment and Setup Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Demolition

- 6.1.2 Bricklaying

- 6.1.3 3D Printing

- 6.1.4 Other Types

- 6.2 By Application

- 6.2.1 Public Infrastructure

- 6.2.2 Commercial and Residential Buildings

- 6.2.3 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BROKK AB (Lifco publ AB)

- 7.1.2 Husqvarna AB

- 7.1.3 Construction Robotics LLC

- 7.1.4 FBR Ltd.

- 7.1.5 Advanced Construction Robotics Inc.

- 7.1.6 Dusty Robotics

- 7.1.7 Apis Cor

- 7.1.8 COBOD International AS

- 7.1.9 Ekso Bionics