|

시장보고서

상품코드

1851210

배송 드론 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Delivery Drones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

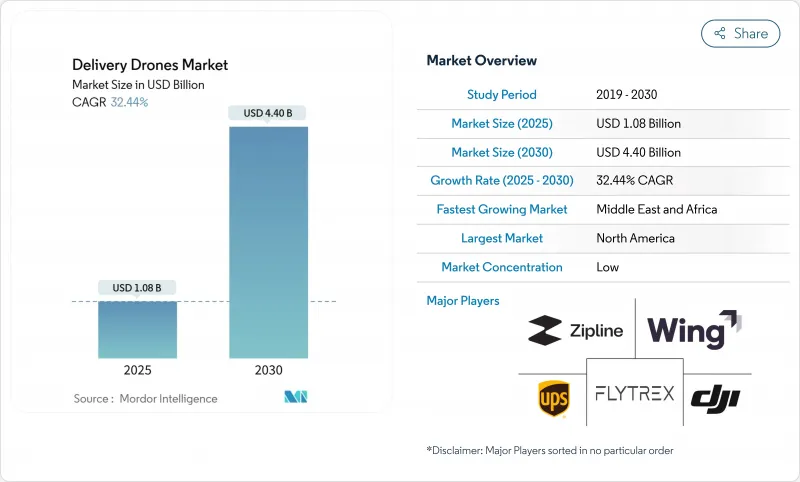

세계의 배송 드론 시장 규모는 2025년 10억 8,000만 달러로, 2030년까지 44억 달러에 이르고, CAGR 32.44%를 보일 것으로 예측됩니다.

이 성장은 급속한 규제 자유화, 육안 경계선(BVLOS) 허가의 확대, 기존 택배업자는 대응하기 어려운 30분 이내의 배달을 요구하는 소비자 수요 증가를 반영합니다. FAA와 캐나다 교통부의 규제 가속화와 미국의 행정 조치로 승인주기가 단축되어 상업 사업자의 컴플라이언스 리스크가 떨어지고 있습니다. 하이브리드 수직 이착륙(VTOL) 설계, 인공지능 기반 비행 제어, 트리플 드롭 페이로드 시스템의 획기적인 실용적인 항속 거리와 페이로드의 한계를 끌어올리는 동시에 디젤 밴에 비해 배송당 에너지 사용량을 94% 줄였습니다. 소매업체는 드론을 활용하여 빈약한 도로 인프라와 일관성 없는 콜드체인 능력을 회피해 잊힌 상품 수요를 새로운 매출로 전환하고 있습니다. 투자의 기세는 여전히 강하고, Wingcopter, DeltaQuad, 그리고 미국과 유럽의 초기 단계의 기업 몇사가 2024년부터 2025년까지 대규모 라운드를 종료하고 있습니다.

세계 배송 드론 시장 동향과 통찰

당일 도시 배송 수요 가속

밀집된 도시 지역에서는 30분 이내의 배달에 대한 소비자의 기대가 집중되고 있으며, 소매업체는 현재 드론을 서비스 차별화에 필수적인 것으로 파악하고 있습니다. Walmart와 Wing은 미국 100개 매장에서 평균 19분의 채우기를 입증하여 규모의 상업 처리량을 검증했습니다. 라스트 마일은 총 배송비용의 최대 50%를 차지합니다. 멀티로터 플릿은 높은 빈도의 "잊힌 물건" 주문을 중심으로 경로를 최적화하여 이 부담을 93% 줄입니다. 중국의 Meituan은 2025년 춘절에 식품 배달 항공편을 기록하고 아시아의 거대 도시의 밀도 우위를 강조했습니다. 5G와 자율적인 교통 관리 레이어를 통합하면 수십 개의 동시 비행을 실시간으로 조정할 수 있습니다. 이러한 요인들이 결합되어 드론 서비스는 트럭 루트를 공식하는 것이 아니라 오히려 증가하는 운송량을 획득할 수 있습니다.

원격지에서 신뢰할 수 있는 건강 관리 물류에 대한 요구 증가

라이프 크리티컬 페이로드는 프리미엄 가격과 신속한 규제 면제를 정당화합니다. Zipline 네트워크는 르완다와 가나에서 혈액과 백신을 30분 이내에 전달하고 미국 교외 처방전 시장에도 진출하고 있습니다. Japan Airlines은 지방자치단체와 제휴해, 태풍이 지나간 후 섬 지역에 구원 물자를 셔틀 수송해, 재해 대응 코리도의 선례를 만들었습니다. 인도에서는 20명의 사업자가 BVLOS 의료시험을 허가하고 공공 부문의 수용을 가속화하고 있습니다. 이러한 이용 사례는 지역사회의 신뢰를 구축하고, 영구적인 비행 회랑을 만들고, 인도적 목적이 달성되면, 보다 광범위한 상업화물을 위한 템플릿을 확립합니다.

레거시 ATC와의 복잡한 공역 통합

기존 항공기, 긴급 헬리콥터 및 레크리에이션 드론이 같은 하늘을 다투기 때문에 교통량이 많은 콜리도는 대역폭 한계에 직면하고 있습니다. FAA가 곧 구현하는 eVTOL 통합 파일럿 프로그램은 자동화된 디컨플릭션 플랫폼을 테스트합니다. 그러나 도시 지역에서의 배포에는 레이더, ADS-B, 휴대폰에서 위성 통신으로의 백홀 등 수십억 달러 규모의 U-스페이스 업그레이드가 필요할 수 있습니다. 호주 교외에서의 시험에서 밝혀진 것은 많은 불만이 아직 여러 부처의 심사의 방아쇠가 될 수 있기 때문에 지역사회의 소음과 프라이버시에 대한 우려의 민감성이 부각되었습니다.

부문 분석

로터리 플랫폼은 도시 환경에서 수직 이륙의 편의성으로 2024년 매출의 71.32%를 차지했습니다. 이 우위가 현재의 배송 드론 시장을 지지하고 있지만, 운항회사가 보다 긴 루트와 보다 무거운 짐을 추구하는 가운데, 고정익 모델의 CAGR은 35.21%로 성장을 지속하고, 있습니다.

Wingcopter의 틸트 로터 시스템이 94km 떨어진 곳에 전달하는 등 비행 효율의 향상이 헬스케어나 지방의 전자상거래 프로젝트를 유치하고 있습니다. 하이브리드 VTOL 컨셉은 두 모드를 모두 융합시켜 미래 리더가 단일 아키텍처에 베팅하는 것이 아니라 유연한 함대에서 비행한다는 것을 시사합니다.

5kg 미만 클래스는 2024년 배송 드론 시장 규모의 55.67%를 차지하며, 규제의 보수성과 배터리의 제약을 반영하고 있습니다. 10kg이 넘는 플랫폼은 개념 증명 파일럿이 더 이익률이 높은 화물로 전환함에 따라 CAGR로 가장 빠른 36.78%를 나타냅니다.

캐나다의 새로운 25kg에서 150kg까지의 규칙은 보다 무거운 의료품과 공업품의 운송을 가능하게 하는 한편, 배터리 밀도의 향상에 의해 10년 후까지는 비행 시간이 2배가 될 것으로 기대되고 있습니다. 신뢰할 수 있는 중량물 운송 서비스를 제공할 수 있는 사업자는 터빈 예비에서 인도적 팔레트까지 기존의 택배회사가 훨씬 높은 비용으로 제공하고 있던 프리미엄 섹터를 해방할 것으로 보입니다.

지역 분석

북미는 유리한 FAA 지침, 200만 명을 커버하는 Walmart-Wing의 전개, Amazon의 자사 Prime Air 네트워크에 지지되어 2024년 매출의 36.95%를 확보했습니다. 미국은 2025년 12월까지 BVLOS 규칙이 확정될 전망이며, 이로 인해 이 지역에서 유일하게 최대 규모의 장벽이 제거됩니다. 캐나다의 2025년 11월 BVLOS 프레임워크는 중형급 항공기 비행 코리도를 더욱 확대합니다. 벤처 투자자는 최초의 FAA 유형 증명서에 의해 상업적 안전 기준선이 검증된 후 Matternet 및 기타 캘리포니아의 신흥 기업에 기록적인 자본을 주입했습니다.

아시아태평양이 배송 드론 시장의 기술 엔진으로서 가동. 중국은 세계 최초의 파일럿리스 eVTOL 택시 라이선스를 취득했으며, 2025년까지 저고도 공역 레인을 건설하기 위해 1조 5,000억 위안(2,089억 3,000만 달러)을 기록했습니다. 또한 인도의 Skye Air는 벵갈루루 교통 정체를 7분 안에 약국에 배달하는 것을 달성했습니다. Japan Airlines과 Rakuten은 재해구호와 섬 물류의 조종사를 선도하고, 용도의 초점에서 지역의 다양성을 밝히고 있습니다.

유럽은 항공법의 조화를 강력하게 전진하고 있습니다. 2024년 4월 VTOL 패키지는 인증을 명확히 했으며, EASA의 U-Space Rulebook은 회원국이 현재 실시하고 있는 디지털 코리도를 정의했습니다. Wingcopter는 독일 식료품 프로젝트에서 3구획 드론을 확대하기 위해 유럽 투자 은행으로부터 4,000만 유로(4,601만 달러)를 획득했습니다. 기업의 플릿은 EU의 녹색 물류 체계 하에서 라스트 마일 배출량을 94% 절감하고 세금 혜택을 받을 수 있습니다.

중동 및 아프리카는 CAGR 37.39%로 가장 빠르게 성장하는 지역입니다. 희박한 도로, 넓은 사막 거리, 건강 관리에 대한 접근 격차로 인해 드론 함대가 필수적입니다. 사우디아라비아는 Matternet의 상업 운영을 허가하고 여러 걸프 국가들은 저고도 경제권에 자금을 제공합니다. 르완다와 가나는 전국적인 혈액 전달 네트워크를 계속 확대하고 있으며, 드론 물류가 기존 인프라 제약을 극복할 수 있음을 입증합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 인구 밀도가 높은 도심부에서의 E-Commerce 및 풀필먼트에 대한 수요 가속

- 지리적으로 격리되고 서비스가 충분하지 않은 지역에서 신뢰할 수 있는 건강 관리 배달 솔루션에 대한 요구가 확대

- 상업용 드론에 의한 배송 사업을 가능하게 하는 규제 프레임워크의 세계적 확대

- 교통량이 많은 환경에서 보다 효율적인 라스트 마일 딜리버리로 운행 비용 절감

- 기업과 정부의 배출량 목표에 힘입어 지속 가능한 물류 관행의 채용이 증가

- 하이브리드 VTOL 시스템의 기술적 진보로 인해 보다 장거리로 유연한 배달 업무가 현실화

- 시장 성장 억제요인

- 운영의 확장성을 제한하는 기존 민간 항공 시스템과의 복잡한 공역 통합

- 낮은 페이로드 용량으로 인해 대량 운송 부문에서 수익 가능성 제한

- 주택 밀집지에서의 프라이버시와 소음에 대한 뿌리 깊은 사회적 우려

- 중소기업에게 장벽이 되는 높은 초기 투자 요건

- 밸류체인 분석

- 규제 전망과 기술 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 드론 유형별

- 회전익

- 고정익

- 페이로드 용량별

- 5kg 미만

- 5-10kg

- 10kg 이상

- 배송 범위별

- 25km 미만

- 25-50 km

- 50km 이상

- 최종 사용 업계별

- 소매 및 전자상거래

- 식품 및 식품 잡화

- 헬스케어 및 의약품 물류

- 우편 및 특급 소포

- 산업 및 건설

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 기타 중동

- 아프리카

- 남아프리카

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Prime Air(Amazon.com, Inc.)

- Wing Aviation LLC(Alphabet Inc.)

- United Parcel Service of America, Inc.

- FedEx Corporation

- Airbus SE

- Zipline International Inc.

- SZ DJI Technology Co., Ltd.

- Wingcopter GmbH

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Drone Delivery Canada Corp.

- Flytrex Inc.

- Matternet Inc.

- Kite Aero

- Manna Drone Delivery

- Skyports Drone Services

- Speedbird Aero

- Rakuten Group, Inc.

- JDLogistics, Inc

- DroneUp, LLC

제7장 시장 기회와 장래의 전망

JHS 25.11.21The delivery drones market size is valued at USD 1.08 billion in 2025 and is forecasted to reach USD 4.40 billion by 2030, advancing at a 32.44% CAGR.

The growth reflects rapid regulatory liberalization, expanding beyond-visual-line-of-sight (BVLOS) approvals, and growing consumer demand for 30-minute fulfillment windows that conventional couriers struggle to meet. Accelerated rule-making by the FAA and Transport Canada and executive action in the United States are shortening approval cycles and lowering compliance risk for commercial operators. Breakthroughs in hybrid vertical-take-off-and-landing (VTOL) designs, AI-based flight control, and triple-drop payload systems are raising practical range and payload limits while trimming per-delivery energy use by 94% compared with diesel vans. Retailers use drone fleets to convert incremental "forgotten goods" demand into new sales, while healthcare networks leverage unmanned aircraft to bypass poor road infrastructure and inconsistent cold-chain capacity. Investment momentum remains strong-Wingcopter, DeltaQuad, and several early-stage US and European firms closed sizeable rounds in 2024-2025-yet near-term profitability hinges on compressing flight costs that still exceed customer fees in most pilot programs.

Global Delivery Drones Market Trends and Insights

Accelerating Demand for Same-Day Urban Fulfillment

Dense metro areas concentrate consumer expectations for 30-minute delivery, and retailers now view drones as critical to service differentiation. Walmart and Wing demonstrated an average 19-minute fulfillment from 100 US stores, validating commercial throughput at scale. Last-mile accounts for up to 50% of total shipping cost; multi-rotor fleets reduce that burden by 93% when routes are optimized around high-frequency "forgotten-item" orders. China's Meituan recorded food-delivery flights during the 2025 Spring Festival, highlighting the density advantage of Asian megacities. Integrating 5G and autonomous traffic-management layers enables real-time coordination among dozens of simultaneous flights. Together, these factors position drone services to win incremental volume rather than cannibalizing truck routes.

Rising Need for Reliable Healthcare Logistics in Remote Areas

Life-critical payloads justify premium pricing and fast-track regulatory waivers. Zipline's network delivers blood and vaccines within 30 minutes across Rwanda and Ghana, and the firm has expanded into US suburban markets for prescription fulfillment. Japan Airlines partnered with local governments to shuttle relief supplies to island communities following typhoon events, setting precedents for disaster response corridors. India cleared 20 operators for BVLOS medical trials, accelerating public-sector acceptance. Such use cases build community trust, create permanent flight corridors, and establish a template for broader commercial cargo once humanitarian objectives are met.

Complex Airspace Integration with Legacy ATC

High-traffic corridors face bandwidth limits as conventional aircraft, emergency helicopters, and recreational drones contend for the same sky. The FAA's forthcoming eVTOL Integration Pilot Program will test automated de-confliction platforms. Yet, urban deployment may require multibillion-dollar U-space upgrades across radar, ADS-B, and cellular-to-satcom backhaul. Australia's suburban trials revealed that many complaints can still trigger multi-agency reviews, underscoring the sensitivity of community noise and privacy concerns.

Other drivers and restraints analyzed in the detailed report include:

- Global Expansion of Regulatory Frameworks Enabling Commercial Drone Delivery Operations

- Last-Mile Cost Reductions in Congested Cities

- Low Payload Capacity Restricting Revenue Potential

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rotary platforms owned 71.32% of 2024 revenue due to vertical take-off convenience in city settings. That dominance anchors the current delivery drones market, yet fixed-wing models post a 35.21% CAGR as operators chase longer routes and heavier loads.

Flight-efficiency gains, such as Wingcopter's tilt-rotor system delivering to sites 94 km away, are luring healthcare and rural e-commerce projects. Hybrid VTOL concepts blend both modes, hinting that future leaders will field flexible fleets rather than single-architecture bets.

The sub-5 kg class accounted for 55.67% of the 2024 delivery drones market size, reflecting regulatory conservatism and battery constraints. Platforms exceeding 10 kg show the fastest 36.78% CAGR as proof-of-concept pilots migrate toward higher-margin cargo.

Canada's new 25 to 150 kg rules unlock heavier medical and industrial consignments, while battery-density improvements promise double flight time by the decade's end. Operators able to field reliable heavy-lift services will unlock premium sectors-from turbine spares to humanitarian pallets-that conventional couriers serve at far higher costs.

The Delivery Drones Market Report is Segmented by Drone Type (Rotary Wing and Fixed Wing), Payload Capacity (Less Than 5 Kg, 5 To 10 Kg, and More Than 10 Kg), Delivery Range (Less Than 25 Km, 25 To 50 Km, and More Than 50 Km), End-User Industry (Retail and E-Commerce, Food and Grocery, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secures 36.95% of 2024 revenue, anchored by favorable FAA guidance, Walmart-Wing deployments covering 2 million people, and Amazon's in-house Prime Air network. The United States expects a definitive BVLOS rule by December 2025, which would remove the single largest scale barrier in the region. Canada's November 2025 BVLOS framework further broadens flight corridors for medium-class aircraft. Venture investors injected record capital into Matternet and other California start-ups after the first FAA-type certificates validated commercial safety baselines.

Asia-Pacific operates as the technology engine for the delivery drones market. China licensed the world's first pilotless eVTOL taxi and earmarked CNY 1.5 trillion (USD 208.93 billion) to build low-altitude airspace lanes by 2025. Meituan and JD Logistics conduct dense urban sorties that dwarf Western volumes, while India's Skye Air achieved seven-minute pharmacy deliveries across Bengaluru's traffic gridlock. Japan Airlines and Rakuten lead disaster relief and island logistics pilots, revealing regional diversity in application focus.

Europe advances on the strength of harmonized air law. The April 2024 VTOL package clarified certification, while EASA's U-space rulebook defined digital corridors that member states now implement. Wingcopter secured EUR 40 million (USD 46.01 million) from the European Investment Bank to expand tri-parcel drones in German grocery projects. Sustainability targets accelerate adoption; corporate fleets can trim last-mile emissions by 94% and gain tax advantages under EU green logistics schemes.

The Middle East and Africa are the fastest-growing regions, with a 37.39% CAGR. Sparse roads, wide desert distances, and healthcare access gaps make drone fleets a necessity. Saudi Arabia authorized Matternet's commercial operations, and multiple Gulf states fund low-altitude economic zones. Rwanda and Ghana continue to scale national blood-delivery networks, proving that drone logistics can leapfrog conventional infrastructure constraints.

- Prime Air (Amazon.com, Inc.)

- Wing Aviation LLC (Alphabet Inc.)

- United Parcel Service of America, Inc.

- FedEx Corporation

- Airbus SE

- Zipline International Inc.

- SZ DJI Technology Co., Ltd.

- Wingcopter GmbH

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Drone Delivery Canada Corp.

- Flytrex Inc.

- Matternet Inc.

- Kite Aero

- Manna Drone Delivery

- Skyports Drone Services

- Speedbird Aero

- Rakuten Group, Inc.

- JDLogistics, Inc

- DroneUp, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating demand for same-day e-commerce fulfillment in densely populated urban centers

- 4.2.2 Rising need for reliable healthcare delivery solutions in geographically isolated and underserved areas

- 4.2.3 Global expansion of regulatory frameworks enabling commercial drone delivery operations

- 4.2.4 Operational cost reductions through more efficient last-mile delivery in high-traffic environments

- 4.2.5 Increased adoption of sustainable logistics practices driven by corporate and government emissions targets

- 4.2.6 Technological advancements in hybrid VTOL systems enabling longer-range and more flexible delivery missions

- 4.3 Market Restraints

- 4.3.1 Complex airspace integration with existing civil aviation systems limiting operational scalability

- 4.3.2 Low payload capacity restricting revenue potential in high-volume delivery segments

- 4.3.3 Persistent public concerns over privacy and noise in densely populated residential areas

- 4.3.4 High upfront fleet investment requirements posing barriers for small and medium-sized enterprises

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Drone Type

- 5.1.1 Rotary-wing

- 5.1.2 Fixed-wing

- 5.2 By Payload Capacity

- 5.2.1 Less than 5 kg

- 5.2.2 5 to 10 kg

- 5.2.3 More than 10 kg

- 5.3 By Delivery Range

- 5.3.1 Less than 25 km

- 5.3.2 25 to 50 km

- 5.3.3 More than 50 km

- 5.4 By End-User Industry

- 5.4.1 Retail and E-commerce

- 5.4.2 Food and Grocery

- 5.4.3 Healthcare and Pharma Logistics

- 5.4.4 Postal and Express Parcel

- 5.4.5 Industrial and Construction

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global and market overview, core segments, financials, strategic info, market rank/share, products and services, recent developments)

- 6.4.1 Prime Air (Amazon.com, Inc.)

- 6.4.2 Wing Aviation LLC (Alphabet Inc.)

- 6.4.3 United Parcel Service of America, Inc.

- 6.4.4 FedEx Corporation

- 6.4.5 Airbus SE

- 6.4.6 Zipline International Inc.

- 6.4.7 SZ DJI Technology Co., Ltd.

- 6.4.8 Wingcopter GmbH

- 6.4.9 Guangzhou EHang Intelligent Technology Co. Ltd.

- 6.4.10 Drone Delivery Canada Corp.

- 6.4.11 Flytrex Inc.

- 6.4.12 Matternet Inc.

- 6.4.13 Kite Aero

- 6.4.14 Manna Drone Delivery

- 6.4.15 Skyports Drone Services

- 6.4.16 Speedbird Aero

- 6.4.17 Rakuten Group, Inc.

- 6.4.18 JDLogistics, Inc

- 6.4.19 DroneUp, LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment