|

시장보고서

상품코드

1851909

알코올 에톡실레이트 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Alcohol Ethoxylates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

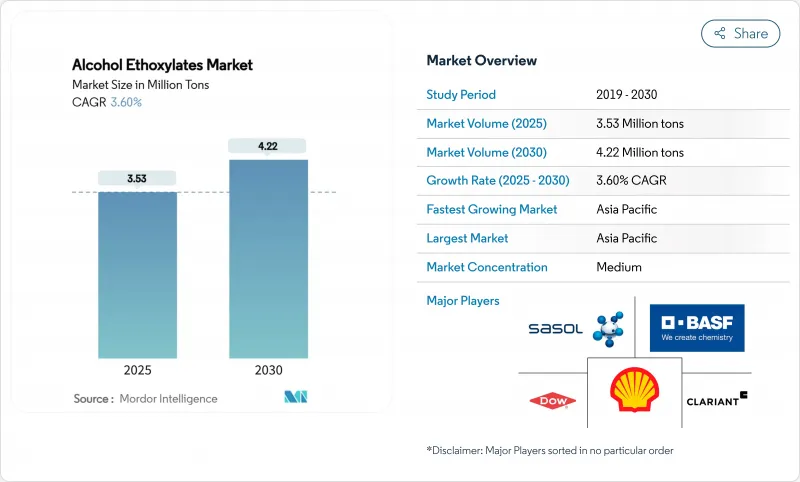

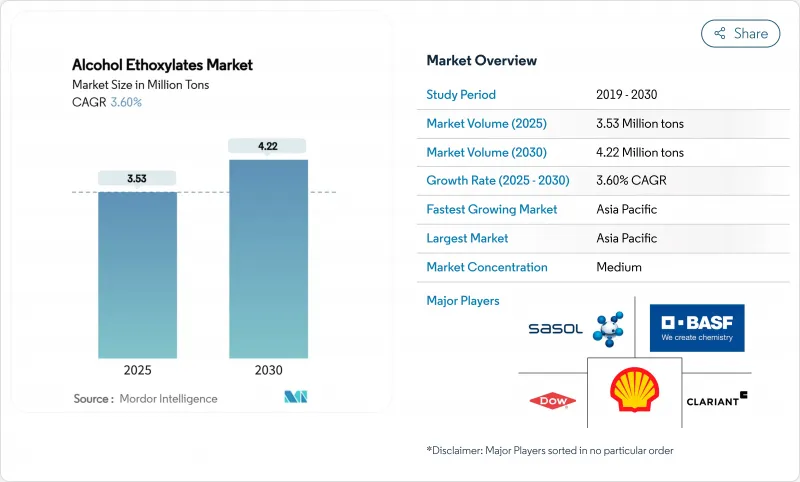

알코올 에톡실레이트 시장 규모는 2025년에 353만 톤, 예측기간(2025-2030년)의 CAGR은 3.60%를 나타내고, 2030년에는 422만 톤에 달할 것으로 예측됩니다.

이 완만한 확장세는 산화에틸렌의 배출을 둘러싼 새로운 지속가능성 규제가 강화되는 가운데도 수요곡선이 성숙하고 있음을 반영하고 있습니다. 생산자는 바이오 원료 프로그램과 에너지 강도를 줄이고 생분해성을 향상시키는 보다 좁은 범위의 에톡실화 기술로 대응하고 있습니다. 고성장을 지속하는 아시아 경제권에서는 개인 관리 및 업무용 청소를 위한 왕성한 수요가 있으며, 인도네시아와 브라질에서는 올레오케미칼 하류 생산 능력이 강화되고 있습니다. 동시에, 북미와 유럽의 규제 압력은 제조업체에 배기 가스 규제의 업그레이드를 강요하고 비용 증가를 초래함과 동시에 저탄소 계면 활성제 등급을 향한 기술 혁신을 가속화하고 있습니다. 이러한 조류는 기술적 차별화와 검증된 지속가능성의 증명이 순수한 스케일 메리트를 능가하는 경쟁의 장을 정의합니다.

세계 알코올 에톡실레이트 시장 동향과 통찰

아시아태평양의 퍼스널케어 및 홈 케어 수요 증가

중국, 인도, 동남아시아의 지속적인 도시화와 소득 증가는 프리미엄 퍼스널케어 소비를 계속 추진하고 있습니다. 배합 담당자는 이러한 시장에서 인기 있는 농축 액체 세제와 궁합이 좋은 마일드와 냉수 세정력을 가진 알코올 에톡실레이트를 선호하고 사용하고 있습니다. 다국적 기업은 바이오물질 수지 제도에서 인증된 지속가능한 포트폴리오를 확대하여 저탄소 계면활성제공급망에 대한 축족을 보여줍니다. 소매점을 전자상거래 플랫폼으로 전환하면 제품 차별화가 더욱 촉진되고 공급업체는 관능적인 성능 주장과 함께 투명한 지속가능성 데이터를 제공해야 합니다.

산업용·시설용 세정제에 있어서의 사용 증가

건강 관리, 푸드서비스 및 운송 허브에서 위생 프로토콜의 강화는 팬데믹이 정점에 달한 이후에도 효과적입니다. 알코올 에톡실레이트는 광범위한 pH와 온도 범위에서 효과적으로 얼룩을 제거하고 경수 조건 하에서도 안정적인 성능을 발휘하므로, 배합자는 인산염이나 용매를 사용하지 않고 엄격한 소독 기준을 충족할 수 있습니다. 북미와 서유럽에서의 성장이 가장 크고 노동위생에 관한 규제가 저자극성으로 쉽게 생분해되는 계면활성제 수요를 촉진하고 있습니다.

원료 가격 변동

산화 에틸렌과 지방 알코올의 가격 변동은 위험 회피 프로그램이나 수직 통합이 없는 소규모 생산업체의 마진을 압박합니다. 북미의 주요 공급업체가 최근 발표한 글리콜 에테르의 인상은 에톡실화 비용의 상승 압력을 뒷받침합니다. 남아시아의 수입에 의존하는 조제품은 환율 위험과 운임 대가로 인해 가장 큰 위험에 직면하고 있습니다.

부문 분석

올레오케미컬 등급은 2024년 알코올 에톡실레이트 시장 점유율의 58.19%를 차지했고, CAGR 3.91%로 석유화학의 동업자보다 급속히 성장하고 있습니다. 동남아시아의 수직 통합은 원료의 확실성을 보장하고 물류 배출량을 줄입니다. 재생 가능한 탄소 함량을 의무화하는 기업의 조달 정책은 바이오 공급으로의 전환을 계속하고 있습니다. 유럽과 북미의 생산자는 ISCC PLUS 하에서 플랜트를 인증하고 녹색 산화 에틸렌의 생산량을 증가시킴으로써 대응하고, 석유 화학의 후퇴를 완화하고 있지만, 동향은 역전하지 않았습니다.

유지 화학 부문은 자카르타 및 쿠알라 룸푸르 근처의 야자 기름과 야자 기름의 증류 클러스터에서 혜택을 받으며 저렴한 비용으로 현지 에톡 실화 장치에 공급합니다. 좁은 범위 기술을 판매하는 생산자는 개인 관리 에멀젼에 필요한 등급의 일관성을 제공하여 프리미엄 가격을 실현합니다. 그럼에도 불구하고 탄소 공개가 여전히 선택적 인 비용에 중점을 둔 범용 세제에서는 석유 화학의 변종이 비계를 강화합니다.

C12-C14 컷은 2024년 알코올 에톡실레이트 시장 규모의 41.55%를 차지하며 4.08%의 성장 궤도를 누리고 있습니다. 그 세정력과 생분해성의 균형은 진화하는 지역 규제에 적합합니다. C9-C11의 짧은 동족체는 신속한 습윤성을 중시하는 산업용 세정제로 지지를 모으고, C15-C18의 긴 사슬은 고급 퍼스널케어 제품이나 유전용 화학제품에 사용되고 있습니다.

배합자는 유리 알코올의 함량을 최소화하고 냄새와 제품의 안정성을 향상시키는 좁은 범위의 C12-C14 에톡실레이트를 요구하도록 되어 있습니다. 또, 저온에서 결정화하기 어려운 분기 유사체도 조사되고 있어 동계용 세차제로의 용도가 퍼지고 있습니다.

지역 분석

아시아태평양은 2024년 알코올 에톡실레이트 시장 규모의 52.18%를 차지했으며, 2030년까지 연평균 복합 성장률(CAGR) 4.76%로 성장을 이끌고 있습니다. 가처분소득 증가, 소매세제 보급 확대, 견조한 오레오케미컬 원료 공급이 현지 독립기업과 다국적 대기업 모두를 유치하고 있습니다. 인도네시아의 새로운 지방 알코올 콤플렉스는 싱가포르와 태국 지역의 퍼스널케어 허브에 공급되는 에톡실화 유닛에 공급되어 아시아 역내 무역 루프를 강화하고 유럽으로의 수입 의존도를 억제합니다.

북미는 성숙한 혁신 중심의 환경으로, 환경안전보건규제가 조달결정을 지배하고 있습니다. 미국 환경보호청에 의한 농약 사용에 있어서의 에톡실화 프로폭실화 C12-C15 알코올의 내성 면제는 작물 보호에 있어서 이 기술의 안전성 프로파일이 받아들여지고 있음을 강조하고 있습니다. 생산자는 그린 케미스트리 업그레이드와 브랜드 소유자의 투명성 프로그램을 준수하기 위한 디지털화된 공급 추적을 강조합니다.

유럽에서는 규제와 정책이 개정되고 디지털 제품 여권과 생분해성 임계치가 강화되는 등 엄격한 정책에 직면하고 있습니다. 수요 증가는 완만하지만 공급업체는 지속가능성이 확인된 등급의 프리미엄 가격을 즐길 수 있습니다. 라틴아메리카에서는 주요 석유화학 그룹이 브라질 최대의 에톡실레이트 제조업체를 인수함에 따라 공급 체제가 강화되어 지역 고객이 보다 낮은 요금의 제품을 얻을 수 있게 되었습니다. 중동 및 아프리카에서는 판매량이 적지만 고활성 액체 세제에 대한 관심이 높습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 아시아태평양에서의 퍼스널케어 및 홈 케어 수요의 성장

- 산업 및 기관용 세정제 사용 증가

- 다운스트림의 오레오케미컬 생산능력 확대

- 위생·청결 의식의 고조

- 작물 보호를 위한 농약 사용량 증가

- 시장 성장 억제요인

- 원료 가격의 변동

- 증가하는 환경 문제

- 적절한 대체품의 가용성

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 규모와 성장 예측

- 원산지별

- 올레오케미컬 유래

- 석유화학 유래

- 탄소 사슬 길이별

- C9-C11

- C12-C14

- C15-C18 및 분기

- 형태별

- 액체

- 페이스트/고형

- 용도별

- 퍼스널케어

- 비누 및 세제

- 산업·시설 클리닝

- 농업 화학제품

- 페인트 및 코팅

- 섬유 가공

- 기타 용도(석유 및 가스(EOR, 굴삭유제))

- 지리

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN 국가

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)/랭킹 분석

- 기업 프로파일

- BASF

- Clariant

- Croda International plc

- Dow

- Evonik Industries AG

- Huntsman International LLC

- India Glycols Limited

- Indorama Ventures Public Company Limited

- Kao Chemicals Europe, SLU

- Kemipex

- Mitsui Chemicals Inc.

- Nouryon

- Procter & Gamble

- SABIC

- Sasol Ltd

- Shell plc

- Stepan Company

- Syensqo

- Thai Ethoxylate Co., Ltd.(TEX)

제7장 시장 기회와 장래의 전망

SHW 25.11.25The Alcohol Ethoxylates Market size is estimated at 3.53 Million tons in 2025, and is expected to reach 4.22 Million tons by 2030, at a CAGR of 3.60% during the forecast period (2025-2030).

The moderate expansion reflects a maturing demand curve even as new sustainability rules tighten around ethylene oxide emissions. Producers are responding with bio-based feedstock programs and narrower-range ethoxylation technologies that cut energy intensity and improve biodegradability. Strong personal-care and institutional cleaning demand in high-growth Asian economies, plus the build-out of downstream oleochemical capacity in Indonesia and Brazil, underpin steady volume gains. At the same time, regulatory pressure in North America and Europe forces manufacturers to upgrade emission controls, adding cost yet accelerating innovation toward low-carbon surfactant grades. These cross-currents define a competitive arena where technical differentiation and verified sustainability credentials outweigh pure scale economies.

Global Alcohol Ethoxylates Market Trends and Insights

Growing Personal-Care & Home-Care Demand in Asia-Pacific

Sustained urbanization and income growth in China, India, and Southeast Asia continue to lift premium personal-care consumption. Formulators favor alcohol ethoxylates for their mildness and cold-water detergency, traits well matched to concentrated liquid detergents popular in these markets. Multinationals expand sustainable portfolios certified under biomass balance schemes, signaling a pivot toward lower-carbon surfactant supply chains. Retail migration to e-commerce platforms further amplifies product differentiation, pushing suppliers to deliver transparent sustainability data alongside sensory performance claims.

Rising Use in Industrial & Institutional Cleaning Formulations

Elevated hygiene protocols across healthcare, food service, and transport hubs remain in force even after the pandemic peak. Alcohol ethoxylates provide effective soil removal over broad pH and temperature bands and deliver stable performance in hard-water conditions, enabling formulators to meet tightened disinfection standards without phosphates or solvents. Growth is strongest in North America and Western Europe, where regulatory mandates for occupational health drive demand for low-irritancy, readily biodegradable surfactants.

Feedstock Price Volatility

Swing pricing for ethylene oxide and fatty alcohols compresses margins for smaller producers lacking hedging programs or vertical integration. Recent glycol ether increases announced by a major North American supplier underscore the upward pressure on ethoxylation costs. Import-reliant formulators in South Asia face the greatest exposure due to currency risk and freight surcharges.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Downstream Oleochemical Capacity

- Rising Awareness Regarding Hygiene and Cleanliness

- Growing Environmental Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oleochemical grades captured 58.19% of alcohol ethoxylates market share in 2024 and will grow faster than petrochemical peers at a 3.91% CAGR. Vertical integration in Southeast Asia assures feedstock certainty and lowers logistics emissions. Corporate procurement policies that mandate renewable carbon content continue to migrate volumes toward bio-based supply. Producers in Europe and North America respond by certifying plants under ISCC PLUS and ramping green ethylene oxide output, which moderates the petrochemical retreat but does not reverse the trend.

The oleochemical segment benefits from palm and coconut oil distillation clusters near Jakarta and Kuala Lumpur that feed local ethoxylation units at lower cost. Producers marketing narrow-range technology achieve premium pricing by offering grade consistency required in personal-care emulsions. Nevertheless, petrochemical variants retain a foothold in cost-sensitive commodity detergents where carbon disclosure remains voluntary.

The C12-C14 cut constituted 41.55% of the alcohol ethoxylates market size in 2024, enjoying a 4.08% growth trajectory. Its balance of detergency and ready biodegradation meets evolving regional regulations. Shorter C9-C11 homologues gain traction in industrial cleaning where rapid wetting is prized, while longer C15-C18 chains serve premium personal-care and oilfield chemistries.

Formulators increasingly request narrow-range C12-C14 ethoxylates that minimize free alcohol content, improving odor and product stability. Research has also explored branched analogues that resist crystallization at low temperature, broadening usage in winter-grade vehicle washes.

The Alcohol Ethoxylates Market Report Segments the Industry by Origin Type (Oleochemical and Petrochemical), Carbon Chain Length (C9-C11 (Linear Alcohol Ethoxylates), C12-C14 (Lauryl Alcohol Ethoxylates), and More), Form (Liquid and Paste/Solid), Application (Personal Care, Soap and Detergents, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific anchored 52.18% of alcohol ethoxylates market size in 2024 and leads growth at 4.76% CAGR through 2030. Rising disposable income, expanding retail detergent penetration, and robust oleochemical feedstock supplies attract both local independents and multinational majors. Indonesia's new fatty alcohol complexes supply ethoxylation units that serve regional personal-care hubs in Singapore and Thailand, tightening intra-Asian trade loops and curbing import reliance on Europe.

North America presents a mature, innovation-led environment where environmental health and safety regulations dominate procurement decisions. The US Environmental Protection Agency's tolerance exemption for ethoxylated propoxylated C12-C15 alcohols in agrochemical use underscores the technology's accepted safety profile in crop protection. Producers emphasize green chemistry upgrades and digitalized supply tracking to comply with brand-owner transparency programs.

Europe faces a stricter policy backdrop as the revision of Regulation 648/2004 rolls in digital product passports and enhanced biodegradability thresholds. While demand growth is modest, suppliers enjoy premium pricing for verified sustainable grades. Latin America benefits from an enhanced supply position following a major petrochemical group's acquisition of Brazil's largest ethoxylate producer, ensuring regional customers receive local, lower-freight product. The Middle East and Africa record smaller volumes but exhibit keen interest in concentrated liquid detergents, a format that favors high-actives alcohol ethoxylates.

List of Companies Covered in this Report:

- BASF

- Clariant

- Croda International plc

- Dow

- Evonik Industries AG

- Huntsman International LLC

- India Glycols Limited

- Indorama Ventures Public Company Limited

- Kao Chemicals Europe, S.L.U.

- Kemipex

- Mitsui Chemicals Inc.

- Nouryon

- Procter & Gamble

- SABIC

- Sasol Ltd

- Shell plc

- Stepan Company

- Syensqo

- Thai Ethoxylate Co., Ltd. (TEX)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing personal-care & home-care demand in Asia-Pacific

- 4.2.2 Rising use in industrial & institutional cleaning formulations

- 4.2.3 Expanding downstream oleochemical capacity

- 4.2.4 Rising awareness regarding hygiene and cleanliness

- 4.2.5 Growing usage in agrochemicals for crop protection

- 4.3 Market Restraints

- 4.3.1 Feedstock price volatility

- 4.3.2 Growing environmental concerns

- 4.3.3 Availability of suitable alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Volume)

- 5.1 By Origin Type

- 5.1.1 Oleochemical-derived

- 5.1.2 Petrochemical-derived

- 5.2 By Carbon Chain Length

- 5.2.1 C9-C11

- 5.2.2 C12-C14

- 5.2.3 C15-C18 & Branched

- 5.3 By Form

- 5.3.1 Liquid

- 5.3.2 Paste / Solid

- 5.4 By Application

- 5.4.1 Personal Care

- 5.4.2 Soaps and Detergents

- 5.4.3 Industrial and Institutional Cleaning

- 5.4.4 Agricultural Chemicals

- 5.4.5 Paints and Coatings

- 5.4.6 Textile Processing

- 5.4.7 Other Applications (Oil & Gas (EOR, drilling fluids))

- 5.5 Geography

- 5.5.1 Asia-Pacifc

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacifc

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)}

- 6.4.1 BASF

- 6.4.2 Clariant

- 6.4.3 Croda International plc

- 6.4.4 Dow

- 6.4.5 Evonik Industries AG

- 6.4.6 Huntsman International LLC

- 6.4.7 India Glycols Limited

- 6.4.8 Indorama Ventures Public Company Limited

- 6.4.9 Kao Chemicals Europe, S.L.U.

- 6.4.10 Kemipex

- 6.4.11 Mitsui Chemicals Inc.

- 6.4.12 Nouryon

- 6.4.13 Procter & Gamble

- 6.4.14 SABIC

- 6.4.15 Sasol Ltd

- 6.4.16 Shell plc

- 6.4.17 Stepan Company

- 6.4.18 Syensqo

- 6.4.19 Thai Ethoxylate Co., Ltd. (TEX)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment