|

시장보고서

상품코드

1686293

바이 와이어 시스템 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)X-by-wire System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

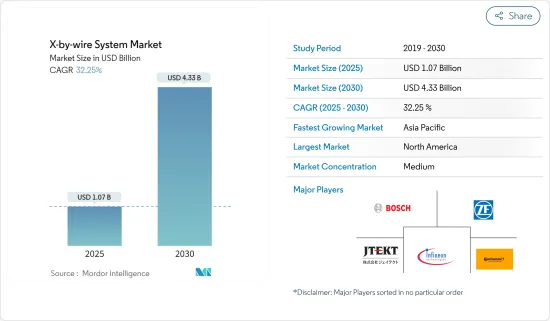

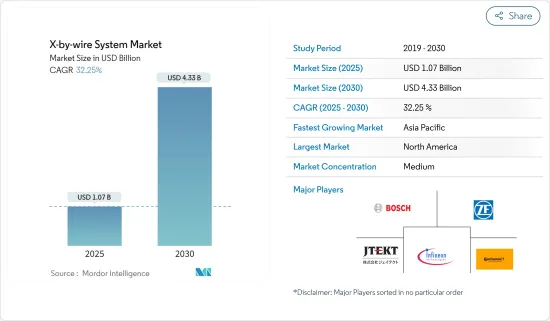

바이 와이어 시스템 시장 규모는 2025년에 10억 7,000만 달러로 추정되고, 2030년에는 43억 3,000만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년)의 CAGR 32.25%를 나타낼 전망입니다.

봉쇄 기간 동안 코로나19 팬데믹으로 인해 전체 자동차 관련 기업의 약 95%가 인력을 보류해야 했습니다. 전 세계적으로 제조 활동의 중단으로 인한 봉쇄의 영향은 전례 없이 막대했고, 그 파급력은 엄청났습니다. 그러나 2021년 경제 활동이 재개되고 전 세계적으로 자동차 생산이 증가하면서 시장은 다시 활기를 되찾기 시작했습니다.

장기적으로는 ADAS(선진운전지원시스템)의 등장과 차량의 자동화 수준 향상으로 차량용 바이 와이어 시스템에 대한 수요가 증가할 것으로 예상됩니다. 그러나 현재 이러한 시스템은 자동차 시장에서 보급률이 낮습니다. 자동차 제조업체들이 차량의 연비 향상과 배기가스 배출량 감소에 초점을 맞추면서 향후 바이 와이어 시스템 시장이 활성화될 것으로 보입니다.

또한 자동차 부문의 차량 전기화 증가와 함께 차량 내 시스템 통합이 증가하면서 시장이 활성화될 것으로 예상됩니다. 자율 주행, 크루즈 컨트롤, 자동 변속기, 차선 이탈 경고 시스템 및 기타 모니터링 시스템과 같은 차량의 고급 기능 사용이 증가함에 따라 자동차 시장에서 스로틀, 서스펜션, 제동 및 기어 변속 측면에서 바이 와이어 시스템에 대한 수요도 증가할 것으로 예상됩니다.

바이 와이어 시스템은 유럽과 북미에서 잘 정립되어 널리 사용되고 있습니다. 아시아 태평양 지역에서도 소비자 소비력 증가, 안전 조치 개선에 대한 요구, 차량 연비 향상에 대한 요구로 인해 이러한 시스템의 사용이 빠르게 증가하고 있습니다.

중국, 독일, 미국, 일본이 바이 와이어 시스템의 주요 시장입니다. 멕시코와 같은 개발도상국에서는 바이 와이어 시스템의 제조가 증가함에 따라 자동차 제조업체에서 이러한 기술에 대한 수요가 급증할 것으로 예상됩니다.

바이 와이어 시스템 시장 동향

스로틀 바이 와이어 시스템은 예측 기간 동안 시장을 지배 할 것으로 예상

전 세계적으로 전기 자동차의 채택률이 증가하고 있습니다. ADAS 기능에 대한 인식이 높아지면서 고급 고급차에서만 운영하던 주요 제조업체들이 고객 유치를 위해 보급형 모델 시장에 진출하고 있습니다. 이러한 사례는 차량의 스로틀 바이 와이어 시스템에 대한 요구 사항을 높일 것으로 예상됩니다.

스로틀 바이 와이어는 기계식 연결의 결합 문제 제거, 연비 개선, 모듈식 시스템 구축, 토크 관리와 크루즈, 트랙션 컨트롤, 안정성 제어를 통합하는 ECU 등 기존 기계식 시스템에 비해 여러 가지 이점이 있어 인기를 얻고 있습니다.

아우디, 콘티넨탈, 포드, 보쉬 등 많은 자동차 제조업체는 스로틀 바이 와이어 시스템이 가속 페달 입력을 감지하고 전력 인버터 모듈에 명령을 보내 전기 모터를 제어하는 데 중요한 역할을 하는 자율주행차 아이디어를 상용화하는 데 주력하고 있습니다.

2021년 11월 중국 그레이트 월 모터스는 스티어 바이 와이어, 브레이크 바이 와이어, 시프트 바이 와이어, 스로틀 바이 와이어, 서스펜션 바이 와이어 등 5가지 핵심 섀시 시스템이 통합된 완전히 새로운 전자 및 전기 아키텍처인 GEEP 4.0 기반의 스마트 커피 시스템 2.0에 기반한 지능형 섀시 바이 와이어를 공개했습니다. 이를 통해 차량의 움직임을 6자유도(6 Degrees of Freedom) 원리에 따라 정밀하게 제어합니다.

자율주행차의 성장과 기술 발전에 발맞춰 정부도 시장 수요를 유지하기 위해 필요한 조치를 취하고 있습니다. 예를 들어

2020년부터 미국에서 새로 생산되는 모든 자동차에는 자동 제동 시스템, 차선 이탈 경고 시스템, 주차 보조 시스템이 의무적으로 장착되어야 합니다. 이러한 요인은 스로틀 바이 와이어 시스템 시장을 촉진할 것으로 예상됩니다.

이러한 발전을 바탕으로 시장의 스로틀 바이 와이어 부문은 예측 기간 동안 상당한 성장을 보일 것으로 예상됩니다.

북미가 시장 개척에 중요한 역할을 할 전망

북미는 예측 기간 동안 가장 큰 시장 점유율을 차지할 것으로 예상됩니다. 전기 자동차, 특히 고급 자율 주행 자동차에 대한 수요 증가는 예측 기간 동안 시장의 성장을 촉진 할 것으로 예상됩니다. 북미의 바이 와이어 시스템 시장은 이미 높은 보급률로 잘 정립되어 있습니다.

또한 여러 기업이 파트너십, 협업 및 기타 전략을 채택하여 시장에서의 입지를 안정화시키고 있습니다.

- 2021년 3월 Motional은 차세대 로보택시 차량 플랫폼으로 전 전기차인 현대 IONIC 5를 사용할 계획을 발표했습니다. 이 제휴를 통해 회사는 2023년부터 일부 시장에서 소비자가 Lyft 앱을 통해 Motional Robo 택시를 예약할 수 있게 됩니다. Motional의 IONIQ 5에는 레벨 4 자율 주행 기능이 탑재되어 스티어 바이 와이어 시스템의 기회가 탄생합니다.

- 2021년 6월 도요타 모빌리티 기금(TMF), 에너지 시스템 네트워크(ESN), 인디애나 경제 개발 공사(IEDC)는 메이 모빌리티와 제휴하여 인디애나 주 중부에서 무료 자율 주행 셔틀 서비스를 시작합니다. 자율주행 차량은 향후 바이 와이어 시스템에 대한 수요를 창출할 것으로 예상됩니다.

이러한 요인으로 인해 북미에서 바이 와이어 시스템에 대한 수요가 증가할 것으로 보입니다. 아시아태평양 지역에서도 소비자 구매력 증가, 더 나은 안전 조치에 대한 선호, 차량의 연비 향상에 대한 필요성 등으로 인해 바이 와이어 시스템의 사용이 크게 증가하고 있습니다.

바이 와이어 시스템 산업 개요

시장은 상당히 통합되어 있으며 Robert Bosch GmbH와 Continental AG와 같은 주요 기업이 시장의 대부분의 점유율을 차지합니다. 시장 진출기업 인수, 시장 진출기업과의 전략적 제휴, 선진적인 바이 와이어 시스템의 신규 투입 등 존재감 확대에 주력하는 주된 기업이 있는 한편, 다른 기업에 대한 경쟁 우위성을 획득하기 위해 다양한 성장 전략을 전개하고 있는 기업도 있습니다.

- 2020년 10월, ZF는 새로운 차세대 AKC 액티브 리어 액슬 스티어링 시스템을 양산하기 시작했습니다. 이 시스템은 10도 후방 조향각을 제공할 수 있으며, 스티어 바이 와이어 기술은 더 긴 전기자동차에 민첩성을 제공합니다.

- 2020년 4월, Infineon Technologies AG는 Cypress Semiconductor Inc.의 인수를 발표했습니다. 이 인수를 통해 회사는 현실의 기계 부품과 디지털 세계를 연결할 수 있는 종합적인 포트폴리오를 제공하고 바이 와이어 시스템에 길을 열어 나갈 수 있습니다.

이 시장의 주요 기업으로는 Robert Bosch GmbH, ZF, JTEKT Corp., Infineon Technologies, Continental AG 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화(시장 규모 : 10억 달러)

- 유형별

- 스로틀 바이 와이어 시스템

- 브레이크 바이 와이어 시스템

- 스티어 바이 와이어 시스템

- 서스펜션 바이 와이어 시스템

- 시프트 바이 와이어 시스템

- 차량 유형별

- 승용차

- 상용차

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Nissan Motor Corp.

- Groupe PSA

- Nexteer Automotive

- Infineon Technologies AG

- JTEKT Corporation

- ZF Friedrichshafen AG

- Orscheln Products LLC

- Tesla Inc.

- Audi AG

- Torc Robotics

- Lokar Performance Products

- Robert Bosch GmBH

- Continental AG

제7장 시장 기회와 앞으로의 동향

HBR 25.04.04The X-by-wire System Market size is estimated at USD 1.07 billion in 2025, and is expected to reach USD 4.33 billion by 2030, at a CAGR of 32.25% during the forecast period (2025-2030).

During the lockdowns, the COVID-19 pandemic compelled about 95% of all automotive-related companies to put their workforces on hold. Globally, the repercussions of the lockdown have been immense and unprecedented due to the halt of manufacturing activities. However, the market started to regain momentum in 2021 as economic activities resumed and vehicle production increased globally.

Over the long term, the emergence of advanced driver assistance systems and the increasing levels of vehicle automation is expected to increase the demand for automotive x-by-wire systems. However, currently, these systems have low penetration rates in the automotive market. The focus of automobile manufacturers on increasing fuel efficiency and reducing the emission level of the vehicle is likely to boost the x-by-wire system market in the future.

Increased integration of vehicular systems in vehicles is also expected to boost the market, coupled with an increase in vehicle electrification in the automotive sector. Increased use of advanced features in vehicles, such as self-driving, cruise control, automatic transmission, lane departure warning systems, and other monitoring systems, is also anticipated to boost the demand for x-by-wire systems in terms of throttle, suspension, braking, and gear shift in the automotive market.

X-by-wire systems are well-established and widely used in Europe and North America. The usage of these systems is also increasing rapidly in Asia-Pacific due to increased consumer spending power, demand for improved safety measures, and the requirement for increased vehicle fuel economy.

China, Germany, the United States, and Japan are major markets for these by-wire systems. Developing countries, such as Mexico, are projected to witness a rapid demand for these technologies from automotive manufacturers, as seen by the increased manufacturing of x-by-wire systems.

X-by-wire Systems Market Trends

Throttle-by-wire System is Expected to Dominate the Market During the Forecast Period

The adoption rate of electric vehicles is increasing globally. With growing awareness about the ADAS features, key manufacturers that operated only in high-end luxury cars are now entering the entry-level models market to attract customers. Such instances are expected to boost the requirements for throttle-by-wire systems in vehicles.

Throttle-by-wire is gaining popularity due to several benefits over traditional mechanical systems, such as eliminating binding problems in mechanical linkages, improving fuel economy, deploying a modular system, and allowing the ECU to integrate torque management with cruise, traction control, and stability control.

Many automakers, including Audi, Continental, Ford, and Bosch, are focusing on commercializing the autonomous car idea where throttle-by-wire systems play a crucial role in controlling electric motors by sensing the accelerator pedal input and sending commands to the power inverter modules.

In November 2021, China's Great Wall Motors unveiled its intelligent chassis-by-wire based on Smart Coffee System 2.0 based on GEEP 4.0, a completely new electronic and electrical architecture where five core chassis systems related steer-by-wire, brake-by-wire, shift-by-wire, throttle-by-wire, and suspension-by-wire are integrated. It controls automotive motions in the principle of six degrees of freedom.

In line with the growth in autonomous cars and technological developments, governments are also taking necessary steps to maintain the demand in the market. For instance,

From 2020 onward, all newly manufactured cars in the United States should be installed with an automatic braking system, a lane departure warning system, and a parking assistance system. This factor is expected to fuel the market for throttle-by-wire systems.

Based on such developments, the throttle-by-wire segment of the market is expected to witness decent growth over the forecast period.

North America Likely to Play a Significant Role in Market Development

North America is anticipated to hold the largest market share during the forecast period. The rising demand for electric vehicles, especially advanced self-driving cars, is anticipated to boost the market's growth over the forecast period. The market for x-by-wire systems in North America is already well-established, with a high penetration rate.

Several companies are also adopting partnerships, collaborations, and other strategies to stabilize their position in the market.

- In March 2021, Motional announced its plans to use the all-electric Hyundai IONIQ 5 as the vehicle platform for its next-generation Robo taxi. Through its partnership, the company could allow consumers in select markets to book a Motional Robo taxi through the Lyft app starting in 2023. Motional's IONIQ 5 would be equipped with Level 4 autonomous driving capabilities, thus creating opportunities for steer-by-wire systems.

- In June 2021, Toyota Mobility Foundation (TMF), Energy Systems Network (ESN), and the Indiana Economic Development Corporation (IEDC) partnered with May Mobility to launch a free autonomous shuttle service in Central Indiana. Autonomous vehicles are expected to create demand for the x-by-wire system in the future.

Such factors are likely to boost the demand for x-by-wire systems in North America. The use of x-by-wire systems is also growing significantly in the Asian-Pacific region due to increased consumer purchasing power, preference for better safety measures, and the need for higher fuel efficiency in the vehicle.

X-by-wire Systems Industry Overview

The market is fairly consolidated, with the key major players, such as Robert Bosch GmbH and Continental AG, holding the majority share in the market. While some key players focus on expanding their presence by acquiring other market participants, forming strategic alliances with other players in the market, and launching new and advanced x-by-wire systems, others are developing various growth strategies to gain a competitive edge over other players.

- In October 2020, ZF launched a new next-generation AKC active rear-axle steering system for mass production. This system could offer a rear steering angle of 10 degrees, and the steer-by-wire technology offers agility for longer electric vehicles.

- In April 2020, Infineon Technologies AG announced the acquisition of Cypress Semiconductor Corporation. With this acquisition, the company could aim to offer a comprehensive portfolio for linking real mechanical parts with the digital world, making way for x-by-wire systems.

Some of the key players in the market are Robert Bosch GmbH, ZF, JTEKT Corp., Infineon Technologies, and Continental AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION ( Market Size in USD Billion)

- 5.1 By Type

- 5.1.1 Throttle-by-wire System

- 5.1.2 Brake-by-wire System

- 5.1.3 Steer-by-wire System

- 5.1.4 Park-by-wire System

- 5.1.5 Shift-by-wire System

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Nissan Motor Corp.

- 6.2.2 Groupe PSA

- 6.2.3 Nexteer Automotive

- 6.2.4 Infineon Technologies AG

- 6.2.5 JTEKT Corporation

- 6.2.6 ZF Friedrichshafen AG

- 6.2.7 Orscheln Products LLC

- 6.2.8 Tesla Inc.

- 6.2.9 Audi AG

- 6.2.10 Torc Robotics

- 6.2.11 Lokar Performance Products

- 6.2.12 Robert Bosch GmBH

- 6.2.13 Continental AG