|

시장보고서

상품코드

1437500

자동차용 자동 리프트게이트 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Automotive Automatic Liftgate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

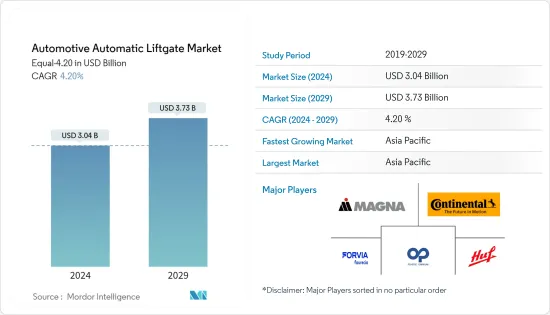

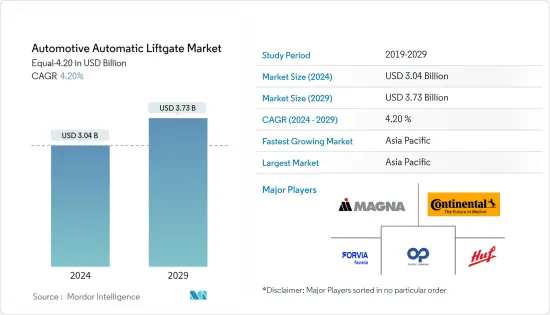

Equal-4.20의 관점로부터 자동차용 자동 리프트게이트 시장 규모는 예측 기간(2024-2029년) 중 4.20%의 CAGR로, 2024년 30억 4,000만 달러에서 2029년까지 37억 3,000만 달러로 성장할 것으로 예상됩니다.

중기적으로 승용차 외장 시장에서 탑승자 편의성 향상은 가장 중요한 고려 사항 중 하나입니다. 컴포넌트는 사람의 노력을 최소화하고 최대한의 편안함을 제공해야 합니다. 따라서 이 부분에 대한 일관된 개발이 이루어지고 있습니다.

자동차의 안전 기능에 대한 소비자 트렌드 증가, 기술 발전, 고급 자동차에 대한 수요 급증은 예측 기간 중 주로 시장을 주도할 것으로 보입니다.

부품 공급업체들은 끊임없이 변화하는 승객과 추진 요인의 요구사항에 적응할 수 있는 다양한 새로운 기능을 갖춘 차량 외장용 신기술에 집중하고 있습니다. 이러한 리프트게이트 솔루션은 차량의 무게를 줄이고 연료 소비를 개선하여 차량의 효율성을 향상시킵니다. 이러한 특성은 금속 자체를 사용할 때 추가 무게를 발생시키지 않고 크롬과 같은 외관을 만들어내는 금속화 페인트를 통해 더욱 강화됩니다. 이 새로운 도장 기술은 크롬 전기도금보다 약 5-20% 저렴하며, 전체 무게를 10-20% 줄일 수 있습니다.

공력도 뒷문의 중요한 측면입니다. 현재 테일게이트의 공기역학적 성능은 액티브 리어 스포일러와 사이드 스포일러의 도움으로 개선되어 차량의 지붕에 공기를 더 잘 전달할 가능성이 있습니다. 새로운 뒷문은 항력 계수를 3-4% 개선하여 CO2 배출량을 1km당 1g씩 줄일 수 있습니다.

자동차용 자동 리프트게이트 시장 동향

SUV가 시장 성장을 가속할 것입니다.

자동차용 자동 리프트게이트 산업 수요를 자극할 가능성이 높은 요인은 올해 승용차에서 SUV의 점유율이 증가할 것으로 보입니다. 주요 자동차 OEM 및 외장 부품 제조업체는 미래 차량 외관의 연구개발에 막대한 비용을 지출하고 있습니다.

SUV 부문은 높은 CAGR을 기록할 것으로 예상됩니다. 이 부문의 판매가 다른 승용차 부문보다 증가함에 따라 승용차 판매는 SUV 판매 증가와 거의 같은 비율로 감소했습니다.

SUV가 부상하는 이유로는 유연성, 적재 능력, 기동성, 운전석에서의 시야, 객실 접근성 등을 꼽을 수 있습니다. 대부분의 최신 SUV는 미국에서 픽업트럭 기반의 스포츠유틸리티차량(SUV)이 아닌 더 크고 구형의 차량인 크로스오버 카테고리에 속합니다.

SUV는 해치백이나 세단형 자동차에 비해 넓은 공간과 안락한 승차감으로 인해 인기가 높아지고 있습니다. 대부분의 SUV에는 하이브리드가 있으며, 전기 버전도 인기를 끌고 있는데, 이는 SUV가 친환경 운전을 추구하는 운전자들에게도 좋은 선택이 될 수 있기 때문입니다. 대부분의 최신 모델들은 하이브리드 및 순수 전기 옵션으로 제공됩니다.

소비자들은 이제 차량의 잔존가치, 양질의 금융 수수료, 가용성, 지불한 가격, 그리고 경우에 따라서는 거래 종료시 판매자의 이익률을 인식하고 있습니다. 이러한 인식으로 인해 힘의 관계가 바뀌고 고객 인사이트을 활용할 수 있으며, 그 결과 전기 스포츠 다목적 차량이 선택될 가능성이 높으며, 마조 지역에서 중고 SUV를 구입한 사람들의 광범위한 중고차 범위를 고려할 때 예측 기간 중 시장이 크게 성장할 가능성이 있습니다.

전 세계에서 위와 같은 발전과 함께 SUV에 대한 수요는 향후 수년간 증가할 것으로 예상되며, 예측 기간 중 시장이 크게 성장할 것으로 예상됩니다.

아시아태평양이 시장을 선도할 것으로 예상

아시아태평양은 세계 최고의 자동차 생산국입니다. 중국, 인도, 일본은 지역 시장의 주요 경제 국가로 세계 시장에도 영향을 미칠 것으로 예상됩니다. 신에너지 자동차의 영향으로 전체 자동차 판매에 대한 시장 심리가 침체되었음에도 불구하고 이 지역의 자동차 판매는 2022년 안정적인 성장 궤도를 반영했습니다.

이 지역은 많은 세계 및 현지 자동차 제조업체와 티어 기업의 주요 시장이며, 자동차 외장 부품 제조업체는 OEM과 협력하여 미래 차량용 차세대 리프트게이트를 개발하고 있습니다.

중국은 자동차 산업 처리량 및 자동차 생산량 측면에서 아시아태평양에서 지배적인 위치를 차지하고 있습니다. 이 지역에는 주요 OEM, 자동차 공급업체 및 자동차 부품 제조업체가 모여 전 세계에 안정적인 공급을 유지하고 있습니다. 2022년 중국에서 판매된 총 차량은 2,686만 3,745대로 2021년 2,627만 4,820대에 비해 전년 대비 2.2% 성장했습니다.

자동차 배기가스 배출량 증가와 친환경 자동차에 대한 수요 증가는 예측 기간 중 시장 확대를 촉진할 것으로 예상됩니다. 이 지역 전체에서 전기자동차에 대한 수요가 증가함에 따라 향후 수년간 시장에 유리한 기회를 창출할 수 있습니다.

인도 기업은 예측 기간 중 목표 시장의 성장에 긍정적인 영향을 미칠 수 있는 신제품을 개발하기 위해 연구개발 활동을 하고 있습니다. 예를 들어

지난 8월, 인도 최대 자동차 제조업체인 멀티 스즈키(Multi Suzuki)는 2025년 말까지 첫 번째 전기자동차를 출시할 예정이라고 발표했습니다.

자동차의 안전성과 편의성 향상에 따른 자동차 판매 증가로 인해 향후 수년간 자동 리프트게이트에 대한 수요가 증가할 것으로 예상됩니다.

자동차용 자동 리프트게이트 산업 개요

Magna International Inc., Faurecia SE, Plastic Omnium, Continental AG 등 몇몇 주요 기업이 자동차 자동 리프트게이트 시장을 독점하고 있습니다. 첨단 기술, 센서 사용 증가, 연구개발 프로젝트에 대한 투자 증가, 전기자동차 시장 성장 등의 요인으로 인해 시장이 크게 성장하고 있습니다. 자동차 소유자에게 더 편리한 경험을 제공하기 위해 주요 자동차 자동 리프트게이트 제조업체는 더 가볍고 편리한 리프트게이트를위한 새로운 기술을 개발하고 있습니다. 예를 들어

2023년 10월, Tata Motor Ltd는 인도에서 Tata Harrier Facelift를 출시했습니다. 신형 모델은 파워 리프트게이트를 채택했습니다. 이번 출시를 통해 회사는 차기 모델의 안전 및 편의 기능을 강화했습니다.

2023년 10월, STMicroelectronics NV는 다양한 부품의 차체 컨트롤러 설계를 간소화하는 새로운 차량용 전원 관리 IC를 발표했습니다.

지프 인도는 지난 3월, 인도 시장을 위해 개발된 완전히 새로운 3열 SUV인 메리디안 SUV를 발표했습니다. 새로운 모델에는 파워 리프트게이트 등이 탑재되었습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 촉진요인

- 고급차 판매 증가

- 시장 억제요인

- 시스템에 수반하는 고액의 비용

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁의 강도

제5장 시장 세분화(금액 기반 시장 규모 - 달러)

- 차종별

- 해치백

- SUV

- 세단

- 기타

- 재료 유형별

- 금속

- 복합재료

- 판매채널 유형별

- OEM

- 애프터마켓

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 세계의 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 개요

- Faurecia SE

- Magna International Inc.

- Plastic Omnium SE

- Huf Hulsbeck &First GmbH &Co.KG

- Continental AG

- STMicroelectronics NV

- Autoease Technology

- Brose Fahrzeugteile SE &Co. KG

- Aisin Seiki Co., Ltd.

- Stabilus SE

- Johnson Electric Holdings Limited.

제7장 시장 기회와 향후 동향

KSA 24.03.07The Automotive Automatic Liftgate Market size in terms of Equal-4.20 is expected to grow from USD 3.04 billion in 2024 to USD 3.73 billion by 2029, at a CAGR of 4.20% during the forecast period (2024-2029).

Over the medium term, increasing passenger comfort has become one of the most important considerations in the passenger car exterior market. Components should take as little human effort as possible and provide the maximum level of comfort. As a result, consistent development is taking place in this regard.

Growing consumer trends toward safety features in vehicles, rising technological advancements, and a surge in demand for luxurious vehicles are likely to primarily drive the market during the forecast period.

Component suppliers are working intensively on various new technologies for vehicle exteriors with a variety of new functionalities that can be adapted to the continuously changing requirements of passengers and drivers. These liftgate solutions improve vehicle efficiency by reducing the weight of the vehicle and improving fuel consumption. Such properties are further enhanced by metalized paint that creates a chrome-like appearance without the additional weight in case of using the metal itself. This new paint technique is around 5 to 20% less expensive than chrome electroplating and reduces overall weight by 10 to 20%.

Aerodynamics is also a key aspect of the tailgate; nowadays, the tailgate aerodynamics are improved with the help of an active rear spoiler and side spoiler that transfer the air better over the car roof. The new tailgates can improve the drag coefficient by 3-4% and also reduce CO2 emissions by 1 g per km.

Automotive Automatic Liftgate Market Trends

SUV Will Fuel The Growth Of The Market

The factor that is likely to fuel the demand for the automotive automatic liftgate industry is the increasing share of SUVs in passenger cars in the current year. Leading automotive OEMs and exterior component manufacturers are spending of huge amount on research and development of exteriors for future vehicles.

The SUV segment is expected to register a high CAGR; on account of the rising sales of this segment over other passenger cars segment, passenger-vehicle sales declined at roughly the same rate as SUV sales have risen.

Some of the reasons for the rise of SUVs are flexibility, payload-carrying ability, drivability, commanding view from the driver's seat, and ease of cabin access. Most of the latest SUVs come under the crossover category, which are larger, more bulbous cars rather than the pickup truck-based sports utilities in the United States.

The rise in popularity of SUV vehicles as the vehicle offers extra space and provides better comfort as compared to hatchback and sedan vehicles. Most SUVs come in hybrid and electric versions are gaining popularity as SUVs can also be a great choice for drivers who are trying to be more eco-friendly. Many of the latest models are offered in hybrid and all-electric options.

Consumers are now aware of the vehicle's residual value, quality finance charges, availability, the price paid, and, in some cases, the seller's profit margin in a closing transaction. This awareness has changed the dynamics and allowed them to capitalize on customer insight, which in turn is likely to opt for electric sport utility vehicles. Considering the wide range of used cars among people who bought a used SUV in the Majo region, which in turn is likely to witness major growth for the market during the forecast period.

With the development mentioned above across the globe, the demand for sport utility vehicles is likely to grow in the coming years, which in turn is anticipated to witness major growth for the market during the forecast period.

Asia Pacific is Anticipated to Lead the Market

The Asia-Pacific is among the leading automobile producers in the world. China, India, and Japan are the major economies in the regional market that are anticipated to influence the global market, too. Regional automotive sales reflected a steady growth trajectory in 2022 despite weak market sentiment in overall car sales due to new energy vehicles.

The region is the main market for many global as well as local car manufacturers and tier players, the automotive exterior component manufacturers are a partnership with OEMs to develop next-generation liftgates for their future vehicles.

China holds the dominating hand in the Asia-Pacific region regarding auto industry throughput and vehicle production. Region houses leading OEM, auto suppliers, and automotive component manufacturers maintain steady supply across the globe. In 2022, the total number of vehicles sold in China stood up at 26,863,745 units as compared to 26,274,820 Units in 2021, registering a year-on-year growth of 2.2%.

Rising levels of vehicular emissions and increased demand for environmentally friendly automobiles are likely to drive market expansion over the forecast period. The rise in demand for electric vehicles across the region is likely to create a lucrative opportunity for the market in the coming years.

Indian companies are working on research and development activities to develop new products that would positively impact the target market growth during the forecast period. For instance,

In August 2022, India's largest automaker, Maruti Suzuki, confirmed that it shall soon introduce its first electric vehicle by 2025 end.

An increase in vehicle sales with the rise in safety and comfort features in vehicles is likely to enhance the demand for automatic liftgates in the coming years.

Automotive Automatic Liftgate Industry Overview

Several key players, such as Magna International Inc., Faurecia SE, Plastic Omnium, Continental AG, and others, dominate the automotive automatic liftgate market. Factors like advanced technology, more use of sensors, growing investment in R&D projects, and a growing market of electric vehicles highly drive the market. To provide a more convenient experience for the car owner, major automotive automatic liftgate manufacturers are developing new technology for lighter and more convenient liftgates. For instance,

In October 2023, Tata Motor Ltd introduced the Tata Harrier Facelift in India. The new facelift model consists of the power liftgate. Through this launch, the company enhanced its safety and comfort features in its upcoming models.

In October 2023, STMicroelectronics N.V. introduced new automotive power-management ICs that simplify the design of car-body controllers for various components.

In March 2022, Jeep India introduced the Meridian SUV, an all-new 3-row SUV developed for the Indian market. The new models come with features such as a power liftgate.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Sale of Luxury Vehicles

- 4.2 Market Restraints

- 4.2.1 High Costs Associated With the System

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sports Utility vehicle

- 5.1.3 Sedan

- 5.1.4 Other Vehicle Types

- 5.2 By Material Type

- 5.2.1 Metal

- 5.2.2 Composite

- 5.3 By Sales Channel Type

- 5.3.1 Original Equipment Manufacturers (OEM)

- 5.3.2 Aftermarket

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Faurecia SE

- 6.2.2 Magna International Inc.

- 6.2.3 Plastic Omnium SE

- 6.2.4 Huf Hulsbeck & First GmbH & Co.KG

- 6.2.5 Continental AG

- 6.2.6 STMicroelectronics N.V.

- 6.2.7 Autoease Technology

- 6.2.8 Brose Fahrzeugteile SE & Co. KG

- 6.2.9 Aisin Seiki Co., Ltd.

- 6.2.10 Stabilus SE

- 6.2.11 Johnson Electric Holdings Limited.