|

시장보고서

상품코드

1690783

표면실장기술 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Surface Mount Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

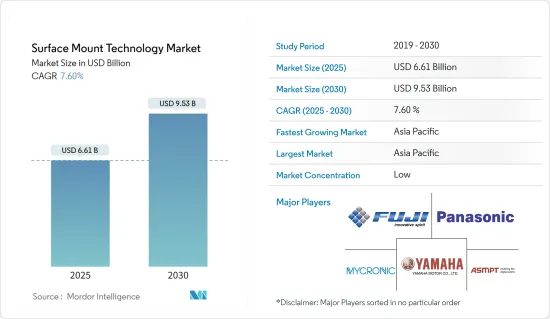

세계의 표면실장기술 시장 규모는 2025년 66억 1,000만 달러로 추계되며, 예측 기간 중(2025-2030년) CAGR 7.6%로 확대되어, 2030년에는 95억 3,000만 달러에 달할 것으로 예측됩니다.

표면실장기술(SMT)은 인쇄 회로 기판(PCB)의 표면에 부품을 직접 실장하는 전자 회로를 구축하는 방법입니다. PCB에 열린 구멍에 부품을 삽입하는 기존의 스루 홀 기술과는 대조적입니다. SMT에서 사용되는 부품을 SMD라고 하며, 작은 금속 탭 또는 엔드 캡이 있으며 PCB 표면에 직접 납땜할 수 있습니다. 이렇게 하면 PCB 하나로 작고 가볍고 더 많은 부품을 사용할 수 있습니다.

팬데믹 이후, 노트북과 서버 시장은 수요의 급증을 목격하고 있습니다. 인도 전자 반도체 협회(IESA)에 의하면, 재택 근무 증가나 협업 툴의 도입에 따라, 보다 많은 데이터가 클라우드 상에 보존되게 되고 있습니다. 수요의 급증은 서버, 데이터센터, 컴퓨팅 분야에서 볼 수 있습니다. 미국의 Micron Technology는 원격근무 경제, 게임, E-Commerce의 활성화에 의해 데이터센터 수요가 높아지고 있다고 보고하고 있습니다. 또한 Cloudscene에 따르면 2024년 3월 현재 미국에는 5,381개의 데이터센터가 있으며, 이는 세계 어느 나라보다 많습니다. 또한 521곳이 독일에, 514곳이 영국에 있습니다.

전자 부품의 소형화로 어디서나 휴대할 수 있는 소형 휴대용 핸드헬드 컴퓨터 디바이스의 제조가 가능해졌습니다. 그 결과 처리 능력이 뛰어나고 작고 가벼운 장비가 시장에 나아갑니다. 부품은(예를 들어, 옷 가방에) 쉽게 끼워 넣을 수 있고 오랫동안 운반 할 수 있기 때문에 더 착용할 수 있습니다. 부품은 소형화되어 실장되는 PCB의 설계에 새로운 요구가 붙어 있습니다. NCAB Group은 초고밀도 울트라 HDI PCB 표준을 정의하는 IPC 이니셔티브에 확실히 커밋하고 있으며 2023년에는 고객에게 제공할 수 있을 것으로 기대했습니다.

표면실장기술(SMT)은 현대의 전자기기 제조에 있어서 매우 중요한 요소가 되어, 수많은 이점에 의해 기존 스루홀 방식을 능가하고 있습니다. SMT의 두드러진 이점은 필요한 PCB 드릴링을 크게 줄일 수 있다는 것입니다. 제조자는 드릴링 공정을 생략함으로써 시간과 비용을 모두 절감할 수 있으며, 복잡하고 고밀도인 기판에 있어서는 특별한 장점이 됩니다. 이 변화는 생산을 간소화하고, 인건비와 재료비를 줄이고, 제조 공정의 전반적인 비용 효과를 강화합니다.

표면실장기술은 작고 효율적이고 비용 효율적인 전자기기 제조를 가능하게 함으로써 전자기기 제조업계에 혁명을 가져왔습니다. 그러나 많은 장점이 있음에도 불구하고 SMT는 모든 용도에 적합하지는 않습니다. SMT는 변압기 및 전원 회로와 같은 고전력 및 고전압 부품에는 적합하지 않습니다. 이 부품은 열을 발생시키고 높은 전기 부하가 걸리므로 SMT는 효과적으로 처리하도록 설계되지 않았습니다.

미국 의회 예산국에 따르면 미국의 국방비는 2033년까지 매년 증가할 것으로 예상됩니다. 미국의 국방비는 2023년 7,460억 달러에 달할 전망입니다. 이 예측에서 2033년 국방비는 1조 1,000억 달러까지 증가할 것으로 예측됩니다.

표면실장기술(SMT) 시장 동향

소비자 일렉트로닉스 최종 사용자 산업 부문이 큰 시장 점유율을 차지할 전망

- 자동차 산업에서 SMT는 전자 제어 장치(ECU), 대시보드 디스플레이, 레이더 카메라 모듈, 배터리 관리 시스템(BMS), 안전 지원 시스템 등에 사용됩니다. SMT는 자동차 응용 분야에서 매우 중요한 제조 공정으로 부상했습니다. 효율, 정밀도, 신뢰성으로 알려진 SMT는 ADAS(첨단 운전 지원 시스템), 인포테인먼트 시스템, 차량제어시스템 등 다양한 차재 일렉트로닉스 제품의 강화에 필수적입니다.

- 최신 자동차에서는 자동차 제어 시스템이 자동차의 "두뇌" 역할을 수행하고 전자 부품의 기능을 감독하고 조화를 이루고 있습니다. 자동차 제어 시스템은 내비게이션에서 오디오, 에어컨에 이르기까지 완벽한 작동에 매우 중요합니다. 이러한 제어 시스템의 신뢰성의 핵심은 SMT 기술입니다. 이 기술은 회로 보드에 매우 작은 전자 부품을 정확하게 실장할 수 있어 시스템의 효율적이고 신뢰할 수 있는 작동을 보장합니다.

- 엔진 컨트롤 유닛(ECU)은 자동차 전자 시스템의 핵심이며 엔진 성능, 변속기, 브레이크 등의 중요한 동작을 감독합니다. 마이크로칩, 저항기, 커패시터 및 기타 표면 실장 부품을 ECU에 조립하려면 표면실장기술(SMT)이 필수적입니다.

- 또한 인공지능 기술은 자동차 분야에서의 채용이 증가할 전망입니다. 전자 부품 조립의 표면실장기술(SMT)의 정확성과 효율성은 AI 칩과 프로세서의 생산을 강화합니다. 그 결과, 자동차용 전자제품은 자율적인 의사결정 능력이 강화되어, 지능적인 운전과 자동차의 자동화가 진행됩니다.

- IEA가 강조한 바와 같이 세계 자동차 산업은 큰 변화를 맞이하고 있으며 에너지 부문에도 잠재적으로 큰 영향을 미치고 있습니다. 예측에 따르면 전동화의 진전으로 2030년까지 하루 500만 배럴의 석유가 불필요해질 것으로 예상됩니다.

- IEA 보고서는 또한 전기차 판매량이 크게 증가하는 것으로 나타났으며, 2023년에는 2022년 대비 350만 대가 판매되어 35% 성장을 보였습니다. 특필해야할 것은 연간 매주 25만대 이상의 신규 등록이 기록된 것입니다. 2023년에는 전기차가 전체 판매 대수의 약 18%를 차지해 5년 전의 2%, 2022년의 14%에서 대폭 증가했습니다. 이러한 추세는 전기자동차 시장이 성숙함에 따라 견조한 성장이 지속될 것으로 예상된다는 것을 보여줍니다. 또한 2023년에는 전기자동차 스톡의 70%가 배터리 전기자동차로 구성될 것으로 예측됩니다.

아시아태평양이 가장 빠른 성장을 이룰 전망

- 아시아태평양, 특히 일본, 중국, 한국, 대만, 동남아시아 등의 국가들은 전자제조의 세계 허브가 되고 있습니다. 이 지역의 견고한 제조 인프라, 숙련된 노동력, 정부의 지원 정책이 다국적 기업을 끌어들여 현지의 일렉트로닉스 산업의 성장을 가속하고 있습니다. 태블릿, 스마트폰 및 기타 전자 기기에 대한 수요는 계속 증가하고 있으며, 표면실장기술을 통한 효율적이고 대량 생산 능력이 필요합니다. 이 회사는 현지에서 SMT(표면실장기술)를 도입함으로써 부가가치가 현재의 15%에서 25%로 증가할 것으로 예측했습니다.

- 예를 들어, 2023년 8월 인도 정부는 향후 5-10년간 60-80%의 대폭적인 증가를 목표로 인도에서 조립된 제품의 현지 부가가치 향상을 강화하기 위해 세계 전자기업과 적극적으로 관여하고 있습니다. 이를 달성하기 위해 정부는 인도의 산업계에 표면실장기술(SMT) 라인과 같은 고급 생산 방식을 채택하도록 촉구하고 있습니다.

- 실리콘 카바이드(SiC)는 고온 내성, 우수한 전도성, 우수한 에너지 효율로 점점 각광을 받고 있습니다. Industry 4.0에서 전기자동차(EV), 태양전지판, 첨단 전력 관리에 대한 수요가 높아지는 가운데 SiC 제조의 의의는 높아지고 있습니다. 광대역 갭 도체는 이러한 분야에서 전력 소비를 최소화할 필요성을 고려하면 자연스럽게 적합합니다.

- 2024년 2월, Continental Device India Limited(CDIL)는 SiC 표면실장기술(SMT) 부품 전용의 새로운 조립 라인을 가동시켜 중요한 단계를 내딛었습니다. 이에 따라 CDIL은 SiC 부품 제조에서 인도의 선구자로서의 지위를 확립했습니다. 이 강화로 CDIL은 SiC 쇼트키 다이오드, SiC MOSFET, 제너, 정류기, TVS 다이오드 등 다양한 오토그레이드 디바이스를 생산할 수 있게 되었으며, 세계 시장과 국내 시장 모두에 대응할 수 있게 되었습니다.

- 2024년 4월, TDK Corporation는 최대 4.6A(100kHz, 125°C)에 대응하는 하이브리드 폴리머 커패시터의 라인업, B40910 시리즈를 발표했습니다. 이 표면 실장 부품은 실온에서 17m 옴과 22m 옴이라는 놀라운 낮은 ESR 값을 자랑합니다.

- 액체 전해질을 사용하는 표준 전해 커패시터와 달리 TDK 커패시터의 ESR은 온도 변화가 거의 없습니다. 10×10.2mm 또는 10×12.5mm(D×H)의 소형 부품으로 정격 전압은 63V, 정전 용량은 82μF-120μF입니다. 따라서 SMT 제조업체는 기술의 통합과 혁신을 통해 이 기술의 필요성을 추진하고 있습니다. 이러한 노력은 다양한 산업에서 표면실장기술(SMT)의 광범위한 채택과 성장에 기여하고 있습니다.

표면실장기술(SMT) 산업 개요

표면실장기술 시장은 세계 기업와 중소기업 모두가 존재하기 때문에 매우 단편화되고 있습니다. 이 시장의 주요 기업으로는 Fuji Corporation, Yamaha Motor Co. Ltd, Micronic AB, ASMPT, Panasonic Corporation 등이 있습니다. 이 시장의 기업은 제품 라인업을 강화하고 경쟁 우위를 확보하기 위해 제휴 및 인수를 채택하고 있습니다.

2024년 3월 - Nordson Corporation은 멕시코 케레타로에 본사를 둔 새로운 라틴아메리카 기술 센터를 도입하여 이 지역 제조업체가 어셈블리 유체, 부품, 기판 및 생산 요구 사항에 가장 적합한 액체 도포 장비에 대한 적시 피드백을 제공합니다. 실험실에는 3D 프린터, 스케일 및 기타 측정 장비가 설치되어 있어 각 고객별 용도 요구 사항에 적합한 액체 도포 장비를 결정할 수 있습니다.

2024년 1월 - Yamaha Motor Co. Ltd는 실장 성능으로 클래스 중 가장 빠른 칭호를 가진 표면 실장기 YRM10의 발매를 발표했습니다. 52,000CPH라는 놀라운 속도로 1빔 1헤드 카테고리에서 경쟁사를 압도합니다. 이 장치는 컴팩트하고 장소를 차지하지 않고 다양한 부품 호환성과 범용성을 제공하며 고속 모듈 조립을 위한 차세대 솔루션이 되고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- COVID-19가 표면실장기술 시장에 미치는 영향

제5장 시장 역학

- 기술 소형화에 대한 수요 증가

- 다른 기술에 비해 프린트 기판에 열리는 구멍이 적다

- 시장의 과제

- SMT는 대형, 고출력, 고전압 부품이나 기계적 스트레스가 자주 걸리는 부품에는 적합하지 않음

- 높은 초기 비용과 재작업 문제

제6장 시장 세분화

- 컴포넌트별

- 수동 부품

- 저항기

- 커패시터

- 능동부품

- 트랜지스터

- 집적회로

- 수동 부품

- 최종 사용자 산업별

- 소비자 일렉트로닉스

- 자동차

- 산업용 일렉트로닉스

- 항공우주 및 방위

- 헬스케어

- 기타 최종 사용자 산업

- 지역별

- 북미

- 유럽

- 아시아

- 호주 및 뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Fuji Corporation

- Yamaha Motor Co. Ltd

- Mycronic AB

- ASMPT

- Panasonic Corporation

- Nordson Corporation

- Juki Corporation

- Hanwa Precision Machinery Co. Ltd

- Zhejiang Neoden Technology Co. Ltd

- Europlacer Limited

- Viscom SE

제8장 투자 분석

제9장 시장 기회와 앞으로의 동향

JHS 25.04.09The Surface Mount Technology Market size is estimated at USD 6.61 billion in 2025, and is expected to reach USD 9.53 billion by 2030, at a CAGR of 7.6% during the forecast period (2025-2030).

Surface mount technology (SMT) is a method for constructing electronic circuits in which the components are mounted directly onto the surface of printed circuit boards (PCBs). This contrasts with older through-hole technology, where components are inserted into holes drilled into the PCB. Components used in SMT, known as SMDs, have small metal tabs or end caps that can be soldered directly onto the PCB surface. This allows for using smaller, lighter, and more components on a single PCB.

After the effect of the pandemic, the market for laptops and servers is witnessing a surge in demand. According to the India Electronics and Semiconductor Association (IESA), more data is stored on the cloud as work-from-home increases and more collaboration tools are deployed. A surge in demand is witnessed in the server, data centers, and computing segments. US-based Micron Technology also reported a more robust demand from data centers due to the remote-work economy, increased gaming, and e-commerce activity. Additionally, as per Cloudscene, as of March 2024, there are 5,381 data centers in the United States, the most of any country worldwide. A further 521 are in Germany, while 514 are in the United Kingdom.

Miniaturization of electronic components has made it possible to build small portable and handheld computer devices that can be carried anywhere. As a result, smaller, lighter devices with high processing capacity are available on the market. They are becoming more wearable since components can be easily embedded (for example, in clothing bags) and carried for long periods. Components are shrinking, putting new demands on the design of the PCBs they are mounted on. NCAB Group is firmly committed to IPC's efforts in defining standards for ultra-dense Ultra HDI PCBs and anticipates being able to provide them to clients in 2023.

Surface mount technology (SMT) has emerged as a pivotal element in modern electronics manufacturing, eclipsing traditional through-hole methods with its myriad benefits. A standout advantage of SMT lies in its drastic reduction of necessary PCB drilling. Manufacturers slash both time and costs by sidestepping the drilling process, a notable boon for intricate, high-density boards. This shift streamlines production and trims labor and material expenses, bolstering the overall cost-effectiveness of the manufacturing process.

Surface mount technology has revolutionized the electronics manufacturing industry by enabling the production of smaller, more efficient, and cost-effective electronic devices. However, despite its numerous advantages, SMT is unsuitable for all applications. SMT is unsuitable for high-power and high-voltage components, such as transformers and power circuitry. These components generate heat and carry high electric loads, which SMT is not designed to handle effectively.

According to the US Congressional Budget Office, defense spending in the United States is predicted to increase yearly until 2033. Defense outlays in the United States amounted to USD 746 billion in 2023. The forecast predicts an increase in defense outlays up to USD 1.1 trillion in 2033.

Surface Mount Technology (SMT) Market Trends

Consumer Electronics End-user Industry Segment is Expected to Hold Significant Market Share

- In the automotive industry, SMT is used in Electronic Control Units (ECU), dashboard displays, radar and camera modules, Battery Management Systems (BMS), safety assistance systems, and more. SMT has emerged as a pivotal manufacturing process in the automotive application. Renowned for its efficiency, precision, and reliability, SMT is crucial in bolstering various automotive electronic products, including advanced driver-assistance systems (ADAS), infotainment systems, and vehicle control systems.

- In modern cars, the on-board control system acts as the vehicle's 'brain,' overseeing and harmonizing the functions of its electronic components. The on-board control system is crucial in their seamless operation, from navigation to audio and air conditioning. Central to the reliability of these control systems is SMT technology. This technology enables the precise mounting of minuscule electronic components on circuit boards, ensuring the systems operate efficiently and reliably.

- The Engine Control Unit (ECU) is the automotive electronic system's nucleus, overseeing critical operations like engine performance, transmission, and braking. Surface-mount technology (SMT) is essential in assembling microchips, resistors, capacitors, and other surface-mounted components onto the ECU.

- Furthermore, Artificial Intelligence technology is poised to see increased adoption in the automotive sector. The precision and efficiency of Surface Mount Technology (SMT) in electronic assembly are set to bolster the production of AI chips and processors. Consequently, automotive electronic products will have enhanced autonomous decision-making abilities, advancing intelligent driving and vehicle automation.

- As highlighted by the IEA, the global automotive industry is undergoing a significant transformation, with potentially far-reaching implications for the energy sector. According to projections, the rise of electrification is anticipated to result in a daily elimination of the need for 5 million barrels of oil by 2030.

- The IEA's report also revealed a substantial increase in electric vehicle sales, with 3.5 million units sold in 2023 compared to 2022, marking a 35% growth. Notably, over 250,000 new registrations were recorded weekly, and over 250,000 new registrations were recorded weekly throughout the year. In 2023, electric vehicles accounted for approximately 18% of all vehicles sold, a significant increase from 2% five years ago and 14% in 2022. These trends indicate that solid growth is expected to persist as the electric vehicle market matures. Additionally, it was projected that 70% of the electric vehicle stock in 2023 would consist of battery electric vehicles.

Asia Pacific is Expected to Witness Fastest Growth

- Asia-Pacific, particularly countries like Japan, China, South Korea, Taiwan, and Southeast Asia, has become a global hub for electronics manufacturing. The region's robust manufacturing infrastructure, skilled labor force, and supportive government policies attract multinational corporations and promote the growth of local electronics industries. Demand for tablets, smartphones, and other electronic devices continues to grow, necessitating efficient and high-volume production capabilities by surface mount technology. The company projects that by implementing SMT (Surface Mount Technology) locally, the value addition will increase to 25% from the current 15%.

- For instance, in August 2023, the Indian government is actively engaging with global electronics firms to ramp up local value addition in products assembled in India, targeting a significant increase of 60-80% over the next five to ten years. To achieve this, the government is urging industries in India to adopt advanced production methods, like surface-mount technology (SMT) lines.

- Silicon Carbide (SiC) is increasingly in the spotlight for its high-temperature resilience, superior electrical conductivity, and remarkable energy efficiency. As the demand for electric vehicles (EVs), solar panels, and advanced power management rises with Industry 4.0, SiC manufacturing's significance has heightened. Wide Band Gap conductors are a natural fit given the imperative for minimal power consumption in these sectors.

- In February 2024, Continental Device India Limited (CDIL) took a significant step by inaugurating a new assembly line specifically for SiC Surface Mount Technology (SMT) components. This move positions CDIL as India's pioneer in SiC component manufacturing. With this enhancement, CDIL can now produce a range of auto-grade devices, such as SiC Schottky Diodes, SiC MOSFETs, Zeners, Rectifiers, and TVS Diodes, catering to both global and domestic markets.

- In April 2024, TDK Corporation introduced the B40910 series, a line of hybrid polymer capacitors designed to handle up to 4.6 A (at 100 kHz and +125 °C). These surface mount components boast impressively low ESR values of 17 mΩ and 22 mΩ at room temperature.

- Notably, unlike standard electrolytic capacitors with liquid electrolytes, the ESR of TDK's capacitors shows minimal variation with temperature. These compact components, measuring 10 x 10.2 mm or 10 x 12.5 mm (D x H), feature a rated voltage of 63 V and offer capacitances ranging from 82 µF to 120 µF. Thus, SMT manufacturers drive the need for the technology by integrating and innovating technologies. These efforts contribute to the widespread adoption and growth of surface mount technology (SMT) in various industries.

Surface Mount Technology (SMT) Industry Overview

Surface Mount Technology market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Fuji Corporation, Yamaha Motor Co. Ltd, Mycronic AB, ASMPT, and Panasonic Corporation. Players in the market are adopting partnerships and acquisitions to enhance their product offerings and gain competitive advantage.

March 2024 - Nordson Corporation introduced a new Latin America Tech Center based in Queretaro, Mexico, to allow manufacturers in the region to get timely feedback on the best fluid dispensing equipment for their assembly fluid, parts, substrates, and production requirements. The lab has a 3D printer, scales, and other measurement equipment to determine the correct fluid dispensing equipment for each customer's unique application requirements.

January 2024 - Yamaha Motor Co. Ltd announced the launch of YRM10, a surface mounter with the title of being the fastest in its class regarding mounting performance. With an impressive speed of 52,000 CPH, it outshines its competitors in the 1-Beam/1-Head category. This device is compact and space-saving and offers a range of component compatibility and versatility, making it a next-generation solution for high-speed modular assembly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Surface Mount Technology Market

5 MARKET DYNAMICS

- 5.1 Rising Demand For Miniaturization of Technology

- 5.1.1 Fewer Holes Required to Drill on PCBs Compared to Other Technologies

- 5.2 Market Challenges

- 5.2.1 SMT is Unsuitable for Any Large, High-Power and High-Voltage Parts and Parts Undergoing Frequent Mechanical Stress

- 5.2.2 High Initial Cost and Rework Issues

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Passive Components

- 6.1.1.1 Resistors

- 6.1.1.2 Capacitors

- 6.1.2 Active Components

- 6.1.2.1 Transistors

- 6.1.2.2 Integrated Circuits

- 6.1.1 Passive Components

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Industrial Electronics

- 6.2.4 Aerospace and Defense

- 6.2.5 Healthcare

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fuji Corporation

- 7.1.2 Yamaha Motor Co. Ltd

- 7.1.3 Mycronic AB

- 7.1.4 ASMPT

- 7.1.5 Panasonic Corporation

- 7.1.6 Nordson Corporation

- 7.1.7 Juki Corporation

- 7.1.8 Hanwa Precision Machinery Co. Ltd

- 7.1.9 Zhejiang Neoden Technology Co. Ltd

- 7.1.10 Europlacer Limited

- 7.1.11 Viscom SE