|

시장보고서

상품코드

1851860

팔레트 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Pallets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

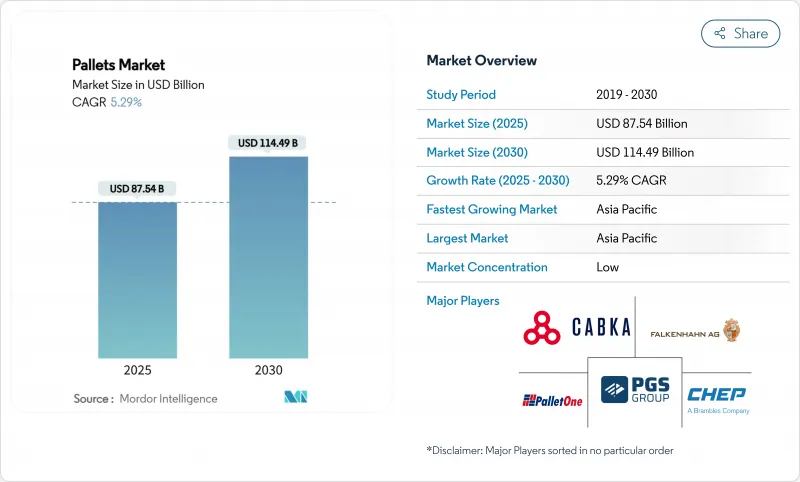

세계의 팔레트 시장 규모는 2025년 875억 4,000만 달러로, 2030년까지 1,144억 9,000만 달러에 이를 것으로 예측되며, 기간 중 CAGR은 5.29%로 예상됩니다.

견조한 전자상거래 활동, 자동화 대응의 창고 설계, ISPM-15 규격과의 세계적인 무결성이 수요를 뒷받침하고 있습니다. 기업은 자동화된 보관 및 검색 시스템의 고액의 재교정을 피하기 위해 블록 팔레트를 선호하고 있으며, 플라스틱은 무공한 접촉면이 필요한 식품, 식품 및 의약품 체인으로 점유율을 확대하고 있습니다. 아시아태평양에서는 인증된 추적 가능한 자산을 선호하는 국경을 넘는 무역 이니셔티브에 도움이 되며, 지역 풀링 모델이 급속히 확대되고 있습니다. 한편 남미와 아프리카의 일부에서는 목재 가격의 난고하와 플라스틱의 역물류의 침체로 인해 성장이 잠재 성장률을 밑돌고 있습니다. 이러한 갈등에도 불구하고, 기술을 구사한 풀링과 바이오 복합재의 혁신은 사용자에게 비용 효율적인 지속 가능한 길을 계속 열고 있습니다.

세계 팔레트 시장 동향과 통찰

블록 팔레트의 도입을 촉진하는 전자상거래 완성 센터

고속 옴니채널 창고는 4방향 액세스와 구조적 무결성을 보장하기 위해 블록 형식을 표준화합니다. 기준 블록 사양에서의 편차는 사이트 당 5만-20만 달러의 재교정 비용을 유발할 수 있으며, 운영자는 치수적으로 일관된 유닛에 고정됩니다. 최대 30%의 처리량 향상과 288%의 로봇에 의한 믹스 케이스 팔레타이징의 이익이 기록되어 블록 설계에 대한 선호가 강해지고 있습니다.

ISPM-15 팔레트의 규제 강화가 아시아태평양에서 풀링을 촉진

ISPM-15의 틀은 현재 182개국에 연간 약 4,500만 달러의 벌금을 부과하고 있기 때문에 화주는 열처리 자산을 보증하는 인증 풀링 네트워크를 이용할 수밖에 없습니다. 아시아태평양의 풀링량은 2024년 이후 23% 증가하고 있습니다. 이것은 컴플라이언스 데이터를 각 팔레트에 연결하는 디지털 추적성 장치 덕분입니다.

미국과 캐나다 관세로 인한 목재 가격 변동

캐나다산 침엽수에 부과되는 14.54%의 관세는 목재 투입 비용을 분기당 40%나 변동시켜 제조업체는 구매 헤지와 마진 압축을 강요합니다. 이 노출은 현재 시험 생산중인 옥수수 줄기 패널과 같은 대체 섬유에 대한 투자를 촉진합니다.

부문 분석

2024년 팔레트 시장 점유율은 목재가 69.45%를 차지하며 8-12달러의 단가 우위에 지지를 받았습니다. 그러나 관세 주도 비용 인플레이션, ISPM-15 열처리 비용, 고객의 탈탄소화 목표가 이 리드를 침식하고 있습니다. Brambles는 78%의 인증 재료를 조달하고 벌목 1개당 2개의 나무를 심어 수영장을 유지하고 있지만, 여전히 사용자는 보다 가볍고 재활용 가능한 옵션을 찾고 있습니다.

플라스틱 팔레트는 2030년까지 연평균 복합 성장률(CAGR)이 7.2%로 예상됩니다. 특히 엄격한 접촉재 규칙에 묶인 제약과 식품 분야에서는 총소유비용이 취득가격 상승을 상쇄함으로써 채용이 가속화됩니다. 쌀 껍질과 옥수수 줄기를 원료로 한 바이오 복합재료는 2개월 이내에 생분해되어 규제와 기업의 탄소 목표를 모두 충족합니다. 이러한 특성은 농업 잔류물이 풍부하고 폐기물 감소 정책이 지지되는 아시아태평양 전역에서 지지를 모으고 있습니다.

2024년 팔레트 시장의 55.34%는 4방향 액세스와 로봇과의 호환성에 의해 블록 형식이 차지하고 있습니다. 자동화된 풀필먼트 플로어는 스트링거의 대체품에 비해 15-20% 처리가 빠르다고 보고되었습니다.

커스터마이즈된 팔레트는 RFID 인서트, 센서 슬롯, 특정 컨베이어 계수에 맞춘 데크면을 오퍼레이터가 요구하기 때문에 CAGR 7.5%의 성장을 이루고 있습니다. 목재 데크와 플라스틱 러너를 결합한 하이브리드 구조는 마찰 최적화와 비용 균형을 유지하고 식료품 및 의류 유통에서 자동화 설치 기반 증가를 지원합니다.

지역 분석

2024년 팔레트 시장 점유율은 아시아태평양이 45.12%로 가장 높았고, CAGR은 6.4%로 예상됩니다. 중국과 인도의 제조 거점의 통합, 동남아시아의 전자상거래 가속화가 계속 대수를 밀어 올리고 있습니다. Loscam의 풀 확장은 국경을 넘는 자산의 회전이 재배치 마일을 줄이고 불균형을 줄이는 방법을 보여줍니다.

북미는 자동화 리노베이션과 니어쇼어링 정책이 팔레트 업그레이드를 촉진하고 2위를 차지했습니다. 목재 관세는 변동성을 높이지만 대체 섬유와 플라스틱의 채택을 촉진합니다. 멕시코가 미국 공급망에 깊게 통합되어 ISPM-15 인증 팔레트에 대한 새로운 수요가 탄생하여 국내 및 수출 레인 모두에 공급되고 있습니다.

유럽 시장은 순환경제 법, 탄소 가격 및 자동화에 유리한 높은 인건비로부터 이익을 얻고 있습니다. 재사용 가능한 팔레트 제도의 도입으로 폐기물이 줄어들고 독일과 북유럽에서는 바이오 복합재의 시험 운용이 차세대 소재를 테스트하고 있습니다. 중동, 아프리카, 남미는 높은 잠재력을 보이고 있지만 역물류와 표준의 단편화에 의해 제약을 받고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- E커머스 풀필먼트 센터가 북미와 유럽에서 블록 팔레트 채용을 촉진

- ISPM-15 유형의 규제 강화가 아시아태평양에서 풀링을 촉진

- FSMA와 EU1935/2004에 따러 식품 및 음료 공장으로에서 위생 플라스틱 유형 수요 증가

- 오세아니아와 인도의 의약품 콜드체인 물류에서 RTP 이용률

- 치수적으로 일관된 복합재를 필요로 하는 창고 로봇 공학 팔레트 시장

- 중국과 동남아시아에서 바이오 복합 쌀겨 팔레트가 가속하는 넷 제로 목표

- 시장 성장 억제요인

- 미-캐나다 관세에 의한 목재 가격의 변동

- 남미와 아프리카에서 플라스틱 유형의 약한 역물류

- EMEA 항공화물의 고비용 및 중량 제한이 있는 금속 유형

- 풀링의 확장성을 막는 단편화한 ASEAN 규격

- 공급망 분석

- 규제 전망

- 팔레트의 지속가능성과 재활용/재사용성 팔레트 시장

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 지정학적 영향 분석

제5장 시장 규모와 성장 예측

- 재료 유형별

- 목재

- 플라스틱

- 금속

- 골판지 및 복합

- 설계별

- 블록

- 스트링어

- 커스터마이즈

- 팔레트 유형별

- 네스터블

- 랙커블

- 스태커블

- 기타 팔레트 유형

- 적재 용량별

- 라이트 듀티 팔레트

- 미디엄 듀티 팔레트

- 헤비 듀티 팔레트

- 최종 사용자 업계별

- 식음료

- 화학제품

- 의약품 및 헬스케어

- 소매 및 E커머스

- 물류 및 창고

- 자동차

- 기타 산업

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주, 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 이집트

- 기타 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Brambles Ltd(CHEP)

- PalletOne Inc.

- CABKA Group GmbH

- Craemer Holding GmbH

- Schoeller Allibert

- Rehrig Pacific Co.

- Loscam International Holdings

- UFP Industries Inc.

- ORBIS Corporation(Menasha)

- Pallet Logistics of America

- PECO Pallet LLC

- Falkenhahn AG

- World Steel Pallet Co. Ltd.

- Millwood Inc.

- PGS Group(Palettes Gestion Services)

- Euroblock Pallets

- Beijing LuckyStar Logistics

- Interpak Pallets

- Palletways Group

- Polymer Logistics

제7장 시장 기회와 장래의 전망

JHS 25.11.25The pallets market size stood at USD 87.54 billion in 2025 and is forecast to reach USD 114.49 billion by 2030, reflecting a 5.29% CAGR during the period.

Robust e-commerce activity, automation-ready warehouse design and global alignment with ISPM-15 standards underpin demand. Companies are prioritizing block pallets to avoid costly recalibration of automated storage and retrieval systems, while plastics gain share in food, beverage and pharmaceutical chains that require non-porous contact surfaces. Regional pooling models are scaling rapidly in Asia-Pacific, helped by cross-border trade initiatives that favor certified, track-and-trace assets. At the same time, lumber price volatility and weak reverse-logistics for plastics in parts of South America and Africa hold growth below potential. Despite these frictions, technology-enabled pooling and bio-composite innovations continue to open cost-efficient and sustainable pathways for users.

Global Pallets Market Trends and Insights

E-commerce fulfilment centres driving block-pallet adoption

High-velocity omnichannel warehouses are standardising on block formats to secure four-way access and structural integrity. Deviation from the reference block specification can trigger USD 50,000-200,000 recalibration costs per site, locking operators into dimensionally consistent units.Throughput improvements of up to 30% and robotic mixed-case palletising gains of 288% have been recorded, reinforcing the preference for block designs.

Regulatory push for ISPM-15 pallets fuelling pooling in Asia-Pacific

The ISPM-15 framework now spans 182 countries and levies roughly USD 45 million in annual penalties, forcing shippers toward certified pooling networks that guarantee heat-treated assets. Pooling volumes in Asia-Pacific have risen 23% since 2024, aided by digital traceability devices that keep compliance data linked to each pallet.

Volatile lumber prices from US-Canada tariffs

A 14.54% duty on Canadian softwood swings wood input costs by as much as 40% per quarter, forcing manufacturers to hedge purchases and compress margins. The exposure encourages investment in alternative fibres such as corn stover panels now in pilot production.

Other drivers and restraints analyzed in the detailed report include:

- Hygienic plastic pallets demand from FSMA and EU 1935/2004 compliance

- RTP uptake in pharma cold-chain logistics across Oceania and India

- Weak reverse-logistics for plastic pallets in South America and Africa

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wood retained 69.45% of pallets market share in 2024, underpinned by a USD 8-12 unit price advantage. However, tariff-driven cost inflation, ISPM-15 heat-treatment fees and customer decarbonisation targets are eroding this lead. Brambles sources 78% certified timber and plants two trees for each harvested one to sustain its pool, yet users still seek lighter, recyclable options.

Plastic pallets are tracking a 7.2% CAGR through 2030 as hygiene and reusability requirements mount. Adoption accelerates where total cost of ownership offsets higher acquisition prices, especially in pharma and food sectors bound by strict contact-material rules. Bio-composites derived from rice husk and corn stover offer biodegradability within two months, meeting both regulatory and corporate carbon objectives. These attributes are gaining traction across Asia-Pacific, where agricultural residues are abundant and waste-reduction policies supportive.

Block formats commanded 55.34% of the pallets market in 2024 due to four-way access and robotic compatibility. Automated fulfilment floors report 15-20% faster handling relative to stringer alternatives.

Customized pallets are growing 7.5% CAGR as operators demand RFID inserts, sensor slots and deck surfaces tailored to specific conveyor coefficients. Hybrid builds that marry wooden decks to plastic runners balance friction optimisation with cost, supporting the rising automation installed base in grocery and apparel distribution.

The Pallets Market Report is Segmented by Material Type (Wood, Plastic, and More), Design (Block, Stringer, Customized), Pallet Type (Nestable, Rackable, Stackable, Other Pallet Types), Load Capacity (Light-Duty, and More, End-User Industry (Food and Beverage, Chemical, Pharmaceutical and Healthcare, Retail and E-Commerce, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 45.12% of pallets market share in 2024 and is expected to post a 6.4% CAGR. Manufacturing hub consolidation in China and India, plus e-commerce acceleration in Southeast Asia, continue to lift volume. Loscam's pool expansion illustrates how cross-border asset rotation lowers repositioning miles and reduces imbalances.

North America ranks second as automation retrofits and near-shoring policy drive pallet upgrades. Lumber tariffs inject volatility but also promote alternative fibres and plastic adoption. Mexico's deeper integration into US supply chains generates fresh demand for ISPM-15-certified pallets serving both domestic and export lanes.

Europe's market benefits from circular-economy law, carbon pricing and high labour costs that favour automation. Implementation of reusable pallet schemes compresses waste, while bio-composite pilots in Germany and the Nordics test next-generation materials. Middle East, Africa and South America exhibit high latent potential yet remain constrained by reverse-logistics and standards fragmentation, although national logistics plans in Saudi Arabia and Brazil point to upside beyond 2027.

- Brambles Ltd (CHEP)

- PalletOne Inc.

- CABKA Group GmbH

- Craemer Holding GmbH

- Schoeller Allibert

- Rehrig Pacific Co.

- Loscam International Holdings

- UFP Industries Inc.

- ORBIS Corporation (Menasha)

- Pallet Logistics of America

- PECO Pallet LLC

- Falkenhahn AG

- World Steel Pallet Co. Ltd.

- Millwood Inc.

- PGS Group (Palettes Gestion Services)

- Euroblock Pallets

- Beijing LuckyStar Logistics

- Interpak Pallets

- Palletways Group

- Polymer Logistics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce Fulfilment Centres Driving Block-Pallet Adoption in North America and Europe

- 4.2.2 Regulatory Push for ISPM-15 Pallets Fuelling Pooling in Asia-Pacific

- 4.2.3 Hygienic Plastic Pallets Demand from FSMA and EU 1935/2004-Compliant FandB Plants

- 4.2.4 RTP Uptake in Pharma Cold-Chain Logistics across Oceania and India

- 4.2.5 Warehouse Robotics Requiring Dimensionally Consistent Composite Pallets

- 4.2.6 Net-Zero Targets Accelerating Bio-Composite Rice-Husk Pallets in China and SE-Asia

- 4.3 Market Restraints

- 4.3.1 Volatile Lumber Prices from US-Canada Tariffs

- 4.3.2 Weak Reverse-Logistics for Plastic Pallets in South America and Africa

- 4.3.3 High Cost and Weight Limiting Metal Pallets in EMEA Air-Freight

- 4.3.4 Fragmented ASEAN Standards Hindering Pooling Scalability

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Sustainability and Recycling/Reusability of Pallets

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Geopolitical Impact Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Wood

- 5.1.2 Plastic

- 5.1.3 Metal

- 5.1.4 Corrugated Paper/Composite

- 5.2 By Design

- 5.2.1 Block

- 5.2.2 Stringer

- 5.2.3 Customized

- 5.3 By Pallet Type

- 5.3.1 Nestable

- 5.3.2 Rackable

- 5.3.3 Stackable

- 5.3.4 Other Pallet Types

- 5.4 By Load Capacity

- 5.4.1 Light - Duty Pallets

- 5.4.2 Medium - Duty Pallets

- 5.4.3 High - Duty Pallets

- 5.5 By End-User Industry

- 5.5.1 Food and Beverage

- 5.5.2 Chemical

- 5.5.3 Pharmaceutical and Healthcare

- 5.5.4 Retail and E-Commerce

- 5.5.5 Logistics and Warehousing

- 5.5.6 Automotive

- 5.5.7 Other Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Brambles Ltd (CHEP)

- 6.4.2 PalletOne Inc.

- 6.4.3 CABKA Group GmbH

- 6.4.4 Craemer Holding GmbH

- 6.4.5 Schoeller Allibert

- 6.4.6 Rehrig Pacific Co.

- 6.4.7 Loscam International Holdings

- 6.4.8 UFP Industries Inc.

- 6.4.9 ORBIS Corporation (Menasha)

- 6.4.10 Pallet Logistics of America

- 6.4.11 PECO Pallet LLC

- 6.4.12 Falkenhahn AG

- 6.4.13 World Steel Pallet Co. Ltd.

- 6.4.14 Millwood Inc.

- 6.4.15 PGS Group (Palettes Gestion Services)

- 6.4.16 Euroblock Pallets

- 6.4.17 Beijing LuckyStar Logistics

- 6.4.18 Interpak Pallets

- 6.4.19 Palletways Group

- 6.4.20 Polymer Logistics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment