|

시장보고서

상품코드

1851911

라이너리스 라벨 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Linerless Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

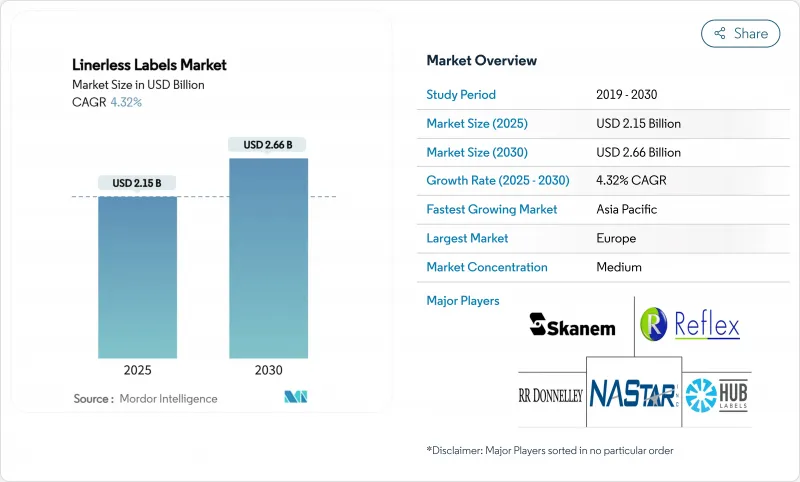

라이너리스 라벨 시장 규모는 2025년에 21억 5,000만 달러로 추정되고, 2030년에는 26억 6,000만 달러에 이를 전망이며, CAGR 4.32%로 성장할 것으로 예측됩니다.

이 규정은 2030년까지 모든 포장을 재활용할 수 있도록 의무화하고 2040년까지 1인당 포장 폐기물을 15% 줄이는 것을 목표로 합니다. 플렉소 인쇄 점유율은 40.32%를 차지하고 있지만, 전자상거래가 가변 길이 온디맨드 인쇄 수요를 견인하고 있기 때문에 잉크젯과 서멀 기술에 견인되는 디지털 시스템이 CAGR 7.43%로 확대되고 있습니다. 필름 기재의 점유율은 48.23%로, 특수 기재와 재활용 기재는 기업의 순환형 경제 목표 중 CAGR 8.11%로 가장 높습니다. 수성 아크릴계 점착제의 점유율은 42.32%로 우위를 유지하고 있으며, UV 경화형 점착제가 CAGR 7.84%로 급성장하여 콜드체인의 성능 갭을 해결하고 있습니다. 유럽이 34.62%의 점유율로 선도하고 있지만, 아시아태평양은 제조 규모 확대 및 전자상거래 확대를 배경으로 CAGR 8.53%로 상승하고 있습니다.

세계의 라이너리스 라벨 시장 동향 및 인사이트

지속 가능한 식음료 포장 수요 급증

식품 브랜드는 규제 준수 및 소비자의 저부하 패키지에 대한 기대를 모두 충족하기 위해 라이너리스 라벨을 내장하고 있습니다. Avery Dennison사는 2024년 Intelligent Labels 부문의 기존 사업 매출 성장률 15%를 보고했으며, 그 증가의 대부분은 라인 포함 제품에 비해 재료 사용량을 30% 삭감하고 이산화탄소 배출량을 49% 삭감한 식품 용도에 의한 것으로 보고 있습니다. 신선한 식품 공급업체는 매립 폐기물을 줄이고 추적성을 강화하기 위해 라이너리스 솔루션을 지정하는 것이 증가하고 있으며, 자동 포장 라인은 동적 라벨 사이징을 활용하여 재료 사용량을 최대 40% 줄입니다. 이러한 요인이 결합됨에 따라 냉장, 냉동 및 상온의 각 제품 카테고리에서 시장 도입이 가속화되고 있습니다. 선도적인 가공업자가 공급업체에 대한 의무를 설정하고 지역 밸류체인에 연결하면 그 효과가 더욱 커집니다. 재활용 가능한 면재 및 식품용 자외선 경화형 접착제에 대한 투자는 조리된 식품 분야에서의 채용을 더욱 추진합니다.

가변 길이 배송 라벨이 필요한 전자상거래 물류 붐

소포의 양이 급증하고, 완성 센터는 라벨의 재고 및 낭비를 최적화해야 합니다. 도시바의 산업용 프린터 DL1024는 배송 라벨과 운송 문서를 하나의 가변 길이 형식으로 통합하여 인쇄 비용을 40% 절감하고 라이너 낭비를 없애줍니다. 미국 우편 공사의 소포 라벨 가이드 개정판은 자동 스캔을 가속화하는 합리적인 디자인을 강조하고 라이너리스화를 간접적으로 지원합니다. 대용량 시설에서는 롤당 라벨 수가 50% 증가하고 롤 교환 횟수가 줄어들고 처리량이 향상되었다고 보고되었습니다. Microflufilment 허브는 라이너리스 공간을 절약하여 피킹 능력을 향상시킵니다. 소매업체의 엄격한 지속가능성 스코어 카드는 과도한 포장과 관련된 벌금을 피하기 위해 공급업체를 라이너리스 시스템으로 향하게 합니다.

레거시 라벨링 라인의 개조 비용

라이너리스로 전환하기 위해서는 라인 당 5만-20만 달러의 자본 업그레이드가 필요한 경우가 많고, 소규모 컨버터에게는 투자 회수 기간이 약 2년으로 연장되는 장애물이 됩니다. FoxJet의 전동식 라벨러는 현재 압축 공기의 필요성을 없애는 모듈식 개방 키트를 제공하여 운전 비용을 절감하고 설치를 용이하게 합니다. 그럼에도 불구하고 작업자 교육 및 유지 보수 루틴 검토는 간접 비용을 증가시킵니다. 많은 생산자는 하이브리드 워크플로우를 채택합니다. 새로운 SKU는 라이너리스로 대응하고 레거시 장비는 장기간 제품을 처리합니다. 금융 패키지 및 구독 모델을 번들로 제공하는 장비 공급업체는 선행 현금 압력을 줄임으로써 전환을 가속화할 수 있습니다.

부문 분석

2024년 라이너리스 라벨 시장에서 플렉소그래피는 40.32%의 점유율을 유지하고 있지만, 디지털 부문은 CAGR 7.43%로 확대되고 있습니다. 전자상거래 브랜드가 가변 데이터와 실시간 맞춤화를 요구하기 때문에 소형 및 중형 디지털 인쇄기의 라이너리스 라벨 시장 규모가 급속히 확대됩니다. 플렉소 프린트의 밑칠과 잉크젯 마감을 융합시킨 하이브리드 인쇄기는 낭비를 줄이고 전환 속도를 높입니다. 다이렉트 서멀 시스템은 라벨이 자재 관리의 마모를 견딜 필요가 있음에도 불구하고 비용 효율성을 유지할 수 있기 때문에 물류에서 위력을 발휘합니다. 디지털 워크플로우는 물과 솔벤트 사용량을 줄이고 지속가능성 스코어카드와 일치합니다. 인라인 마무리와 클라우드에 연결된 컬러 매니지먼트에 대한 투자는 출력의 일관성을 향상시키고 디지털 포맷이 중간 로트에서 기존의 플렉소와 정면에서 경쟁할 수 있게 합니다.

RFID 인레이 삽입과의 호환성은 디지털 역할을 더욱 향상시켜 스마트 라벨의 원패스 생산을 가능하게 합니다. 웹-투-라벨 포털을 활용하는 컨버터는 최소 주문 장애물 없이 개인화된 디자인을 필요로 하는 소규모 판매업체로부터 새로운 수익을 얻고 있습니다. 기판 제조업체가 프라이머 프리 필름을 출시하면 잉크의 밀착성이 향상되고 소모품 비용이 절감됩니다. 요약하면, 인쇄 기술 믹스는 빠르게 변화하고 있으며, Flexo는 상품화된 SKU에 적합하지만, 디지털은 라이너리스 라벨 시장 전반에 걸쳐 움직임이 빠르고 데이터가 풍부한 용도에 적합합니다.

PP와 PET를 중심으로 한 필름 기반의 파이스스톡은 내습성과 보존성의 높이로 라이너리스 라벨 시장에서 48.23%의 점유율을 차지하고 있습니다. 그러나 구매자의 원형 경제(순환형 경제)에 대한 서약과 규제에 따른 재활용 함량 할당으로 인해 특수 소재와 재활용 대체 소재가 CAGR 8.11%를 초과했습니다. 식품 및 퍼스널케어 패키지를 다루는 재활용 컨텐츠 필름의 라이너리스 라벨 시장 규모는 2030년까지 꾸준히 상승할 것으로 예측됩니다. UPM 라프라택의 탄소 액션 포트폴리오는 ISCC 인증 원료를 사용하여 요람에서 게이트까지의 배출량을 줄이고 스코프 3을 줄이려는 브랜드에 호소하고 있습니다.

종이의 페이스 스톡은 퇴비화성이나 촉감의 장점이 내구성보다 우선되는 틈새를 지킵니다. 얇은 PP 오버셀과 재생 크래프트의 베이스를 결합한 하이브리드 구조는 버진 플라스틱의 함량을 줄이면서 강도를 최적화합니다. 알칼리조에서 벗겨내는 워시오프 필름은 PET의 폐쇄 루프 재활용을 가능하게 하며 병 대 병 시스템을 요구하는 음료 공급업체에게 매우 중요합니다. 공급업체는 기존의 라미네이트 라벨에 필적하는 색과 마무리의 폭을 넓혀 특수 라벨 채용의 장벽을 하나 제거했습니다. 바이액스 스트레치 라인과 해중합 재활용 플랜트에 대한 지속적인 투자로 원료 공급 능력은 수요 증가에 대응할 수 있는 규모로 확대됩니다.

지역 분석

유럽은 2024년 매출의 34.62%를 차지했으며, 규제의 조기 도입, 소매망의 치밀함, 컨버터 기반의 확립이 강점이 되고 있습니다. UPM Raflatac과 HERMA와 같은 지역 대기업이 워시 오프와 재활용 컨텐츠 형식을 개척하여 프라이빗 브랜드에 파급 수요를 낳았습니다. 재활용 가능한 포장을 지정하는 정부 조달 기준은 유럽 리드를 더욱 견고하게 만듭니다. 북미는 전자상거래 가속화와 포장 공급업체의 폐기 비용을 내부화하는 주 전체의 확대 생산자 책임 법안에 힘입어 이어지고 있습니다. 이 지역의 컨버터는 냉각 식품 및 소포 허브를 수용하기 위해 고속 UV 라인에 투자하고 CCL 산업은 전략적 인수로 생산 능력을 확대하고 있습니다.

아시아태평양의 CAGR은 8.53%로 가장 빠른 성장이 전망되며, 중국의 제조 규모와 인도의 전자상거래 보급 속도가 견인하고 있습니다. 이 지역의 라이너리스 라벨 시장 점유율은 현지 컨버터가 디지털 인쇄기를 증설하고 해외 브랜드가 조화로운 지속 가능한 패키징을 요구하고 있기 때문에 상승할 전망입니다. 일본의 린텍 주식회사는 내한성 접착제의 생산 능력 증강과 연구 개발에 투자하여 지역 기술 리더십을 강화합니다. 베트남과 인도네시아와 같은 신흥 시장은 서양 소매업체가 설정한 수출 인증 기준을 충족하기 위해 라이너리스를 채택합니다. 남미에서는 브라질의 선도적 인 음료 제조업체가 PET 병의 재활용 프로젝트에서 워시 오프 필름을 시험하고 있으며 선택적 성장을 볼 수 있습니다. 중동 및 아프리카에서는 다국적 FMCG 공장이 세계 사양을 도입하고 있는 아랍에미리트(UAE)과 남아프리카가 도입의 중심이 되고 있습니다.

규제의 조화, 국경을 넘은 전자상거래, 생산 능력에 대한 투자 등을 종합하면 이 지역 수요의 지속적인 회전이 시사됩니다. 아시아태평양의 생산 능력에 자본이 유입됨에 따라 원재료 공급망이 적응하고, 단가가 더욱 낮아지며 라인 재고의 대체가 가속화됩니다. 유럽은 여전히 규제의 기수이며, 그 정책 혁신은 세계적으로 점점 반영되고 있으며, 수출 지향의 제조업체에게 라이너리스 능력이 기본 요건으로 정착하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 지속 가능한 식품 및 음료 포장 수요 급증

- 가변 길이 배송 라벨이 필요한 전자상거래 물류 붐

- 유럽과 북미에서 폐기물 감축의 규제 의무화

- 온디맨드 및 라이너리스 인쇄에 의한 QSR 주방 자동화의 보급

- RFID 대응 커넥티드 패키징 및 마이크로 풀필먼트의 채용

- 시장 성장 억제요인

- 레거시 라벨링 라인의 개수 비용

- 원재료 가격 변동(접착제 및 박리 코팅제)

- 콜드체인 환경에서 접착제의 축적 문제

- 공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 인쇄 기술별

- 디지털(잉크젯 및 서멀)

- 플렉소 인쇄

- 그라비아

- 오프셋 및 볼록판 인쇄

- 파세 스톡 소재별

- 종이

- 필름(PP, PET, PE)

- 특수 및 재활용 기재

- 접착제 유형별

- 수성 아크릴

- 핫멜트

- UV 경화형

- 용제 베이스

- 최종 사용자 업계별

- 식품

- 음료

- 헬스케어 및 의약품

- 화장품 및 퍼스널케어

- 가정용 화학제품

- 물류 및 전자상거래

- 기타 최종 사용자 산업

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주, 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 이집트

- 기타 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Avery Dennison Corporation

- CCL Industries(Inc. & Innovia Films)

- 3M Company

- Beontag

- UPM Raflatac

- Coveris

- Hub Labels Inc.

- Reflex Labels Ltd

- Skanem AS

- NAStar Inc.

- Optimum Group

- SATO Europe GmbH

- ProPrint Group

- Lexit Group AS

- RR Donnelley & Sons Co.

- Gipako UAB

- Lintec Corporation

- HERMA GmbH

- Zebra Technologies

- Multi-Color Corporation

제7장 시장 기회 및 향후 전망

AJY 25.11.19The linerless labels market size is valued at USD 2.15 billion in 2025 and is forecast to reach USD 2.66 billion by 2030, advancing at a 4.32% CAGR.

Growth is anchored in stricter global packaging regulations, particularly the European Union's Packaging and Packaging Waste Regulation, which requires all packaging to be recyclable by 2030 and targets a 15% cut in per-capita packaging waste by 2040. Flexography continues to hold a 40.32% share, yet digital systems led by inkjet and thermal technologies are expanding at a 7.43% CAGR as e-commerce drives demand for variable-length, on-demand printing. Film facestocks account for 48.23% share, while specialty and recycled substrates post the strongest 8.11% CAGR amid corporate circular-economy goals. Water-based acrylic adhesives remain dominant at 42.32% share; UV-curable chemistries grow the fastest at 7.84% CAGR, solving cold-chain performance gaps. Europe leads with 34.62% share; however, Asia-Pacific rises at an 8.53% CAGR on the back of manufacturing scale-up and e-commerce expansion.

Global Linerless Labels Market Trends and Insights

Surge in Sustainable Food and Beverage Packaging Demand

Food brands are embedding linerless labels to meet both regulatory compliance and consumer expectations for lower-impact packaging. Avery Dennison reported 15% organic sales growth in its Intelligent Labels division during 2024, attributing much of the increase to food applications that cut material use by 30% and carbon footprint by 49% versus linered products. Fresh produce suppliers increasingly specify linerless solutions to slash landfill waste and enhance traceability, while automated packaging lines leverage dynamic label sizing to trim material usage by up to 40%. Combined, these factors accelerate market uptake across chilled, frozen and ambient product categories. The effect compounds as large processors set supplier mandates that cascade through regional value chains. Investments in recyclable facestocks and food-grade UV-curable adhesives further propel adoption in prepared-meal sectors.

E-commerce Logistics Boom Requiring Variable-Length Shipping Labels

Soaring parcel volumes force fulfillment centers to optimize label inventory and waste. Toshiba's DL1024 industrial printer merges shipping labels and packing slips into one variable-length format, lowering printing costs by 40% and eliminating liner waste. The United States Postal Service's revised parcel-labeling guide emphasizes streamlined designs that speed automated scanning, indirectly supporting linerless migration. High-volume facilities report 50% more labels per roll, translating into fewer roll changes and faster throughput. In micro-fulfillment hubs, space savings from liner elimination unlock additional picking capacity. Retailers' stricter sustainability scorecards are pushing suppliers toward linerless systems to avoid penalties linked to excess packaging.

Retrofit Costs for Legacy Labeling Lines

Switching to linerless often demands capital upgrades of USD 50,000 - 200,000 per line, a hurdle for smaller converters that extends payback periods to roughly two years. FoxJet's all-electric labelers now offer modular retrofit kits that remove compressed-air requirements, lowering operating costs and easing installation. Still, personnel training and revised maintenance routines add indirect expense. Many producers adopt hybrid workflows: linerless on new SKUs while legacy gear handles long-running products. Equipment vendors that bundle finance packages or subscription models can accelerate conversion by alleviating upfront cash pressure.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Waste-Reduction Mandates in Europe and North America

- QSR Kitchen Automation Uptake of On-Demand Linerless Printing

- Raw-Material Price Volatility Affecting Adhesives and Release Coatings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexography maintained a 40.32% slice of the linerless labels market in 2024, but the digital segment is expanding at a 7.43% CAGR. The linerless labels market size for digital presses serving short and mid runs is set to widen quickly as e-commerce brands demand variable data and real-time customization. Hybrid presses that merge flexo priming with inkjet finishing lower waste and speed changeovers, an advantage for converters chasing small batch jobs. Thermal direct systems flourish in logistics because labels must survive material-handling abrasion yet remain cost-effective. Digital workflows also reduce water and solvent use, aligning with sustainability scorecards. Investments in inline finishing and cloud-connected color management lift output consistency, helping digital formats compete head-on with conventional flexo for medium runs.

Compatibility with RFID inlay insertion further elevates digital's role, enabling one-pass production of smart labels. Converters leveraging web-to-label portals capture new revenue from small sellers needing personalized designs without minimum-order hurdles. As substrate manufacturers release primer-free films, ink adhesion improves and reduces consumable costs. In summary, the printing-technology mix is shifting rapidly, with flexo staying relevant for commoditized SKUs while digital becomes the default for fast-moving, data-rich applications across the linerless labels market.

Film-based facestocks-largely PP and PET-retain a 48.23% grip on the linerless labels market share thanks to moisture resistance and shelf appeal. Yet specialty and recycled alternatives outpace at an 8.11% CAGR, propelled by buyers' circular-economy pledges and regulatory recycled-content quotas. The linerless labels market size for recycled-content films covering food and personal-care packages is forecast to climb steadily through 2030. UPM Raflatac's Carbon Action portfolio uses ISCC-certified feedstocks to cut cradle-to-gate emissions and appeal to brands chasing Scope-3 reductions.

Paper facestocks defend niches where compostability or tactile branding trumps durability. Hybrid structures pairing thin PP overcell with recycled-kraft bases optimize strength while shrinking virgin-plastic content. Wash-off films that delaminate in alkaline baths permit closed-loop PET recycling, crucial for beverage suppliers seeking bottle-to-bottle systems. Suppliers broaden color and finish ranges to rival conventional laminated labels, removing one more barrier to specialty adoption. Continuous investment in biax-stretch lines and depolymerization recycling plants indicates that feed-stock availability will scale to meet rising demand.

The Linerless Labels Market Report is Segmented by Printing Technology (Digital, Flexography, Gravure, Offset and Letterpress), Facestock Material (Paper, Film, Specialty and Recycled Substrates), Adhesive Type (Water-Based Acrylic, Hot-Melt, UV-Curable, Solvent-Based), End-User Industry (Food, Beverage, Healthcare and Pharmaceuticals, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe commanded 34.62% of 2024 revenue on the strength of early regulatory adoption, dense retail networks and established converter bases. Regional majors such as UPM Raflatac and HERMA pioneer wash-off and recycled-content formats, creating spill-over demand among private-label brands. Government procurement criteria specifying recyclable packaging further cement Europe's lead. North America follows, buoyed by e-commerce acceleration and statewide extended-producer-responsibility bills that internalize disposal costs for packaging suppliers. Converters here invest in high-speed UV lines to serve chilled-food and parcel hubs, while CCL Industries expands capacity via strategic acquisitions.

Asia-Pacific registers the fastest 8.53% CAGR, driven by China's manufacturing scale and India's rapid e-commerce penetration. The linerless labels market share in the region is poised to climb as local converters add digital presses and overseas brands demand harmonized sustainable packaging. Japan's Lintec Corporation invests in capacity upgrades and R&D for cold-resistant adhesives, reinforcing regional technology leadership. Emerging markets such as Vietnam and Indonesia adopt linerless to meet export certification standards set by Western retailers. South America sees selective growth as Brazil's beverage giants trial wash-off films in PET bottle recycling projects. In the Middle East & Africa, uptake centers on United Arab Emirates and South Africa where multinational FMCG plants deploy global specifications.

Collectively, regulatory harmonization, cross-border e-commerce and capacity investments suggest sustained regional demand rotation. As capital flows into Asia-Pacific capacity, raw-material supply chains adapt, further lowering unit costs and accelerating substitution away from linered stock. Europe remains the regulatory bellwether; its policy innovations are increasingly mirrored worldwide, embedding linerless capability as a baseline requirement for export-oriented manufacturers.

- Avery Dennison Corporation

- CCL Industries (Inc. & Innovia Films)

- 3M Company

- Beontag

- UPM Raflatac

- Coveris

- Hub Labels Inc.

- Reflex Labels Ltd

- Skanem AS

- NAStar Inc.

- Optimum Group

- SATO Europe GmbH

- ProPrint Group

- Lexit Group AS

- R.R. Donnelley & Sons Co.

- Gipako UAB

- Lintec Corporation

- HERMA GmbH

- Zebra Technologies

- Multi-Color Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in sustainable food and beverage packaging demand

- 4.2.2 E-commerce logistics boom requiring variable-length shipping labels

- 4.2.3 Regulatory waste-reduction mandates in Europe and North America

- 4.2.4 QSR kitchen automation uptake of on-demand linerless printing

- 4.2.5 RFID-enabled connected packaging and micro-fulfillment adoption

- 4.3 Market Restraints

- 4.3.1 Retrofit costs for legacy labeling lines

- 4.3.2 Raw-material price volatility (adhesives and release coating)

- 4.3.3 Adhesive build-up issues in cold-chain environments

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printing Technology

- 5.1.1 Digital (Inkjet and Thermal)

- 5.1.2 Flexography

- 5.1.3 Gravure

- 5.1.4 Offset and Letterpress

- 5.2 By Facestock Material

- 5.2.1 Paper

- 5.2.2 Film (PP, PET, PE)

- 5.2.3 Specialty and Recycled Substrates

- 5.3 By Adhesive Type

- 5.3.1 Water-based Acrylic

- 5.3.2 Hot-Melt

- 5.3.3 UV-Curable

- 5.3.4 Solvent-based

- 5.4 By End-user Industry

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Healthcare and Pharmaceuticals

- 5.4.4 Cosmetics and Personal Care

- 5.4.5 Household Chemicals

- 5.4.6 Logistics and E-commerce

- 5.4.7 Other End-User Industry

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Avery Dennison Corporation

- 6.4.2 CCL Industries (Inc. & Innovia Films)

- 6.4.3 3M Company

- 6.4.4 Beontag

- 6.4.5 UPM Raflatac

- 6.4.6 Coveris

- 6.4.7 Hub Labels Inc.

- 6.4.8 Reflex Labels Ltd

- 6.4.9 Skanem AS

- 6.4.10 NAStar Inc.

- 6.4.11 Optimum Group

- 6.4.12 SATO Europe GmbH

- 6.4.13 ProPrint Group

- 6.4.14 Lexit Group AS

- 6.4.15 R.R. Donnelley & Sons Co.

- 6.4.16 Gipako UAB

- 6.4.17 Lintec Corporation

- 6.4.18 HERMA GmbH

- 6.4.19 Zebra Technologies

- 6.4.20 Multi-Color Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment