|

시장보고서

상품코드

1689875

야시장비 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Night Vision Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

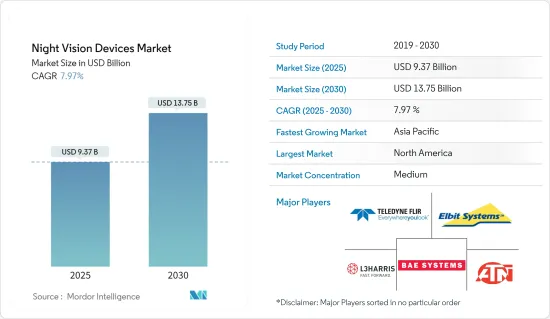

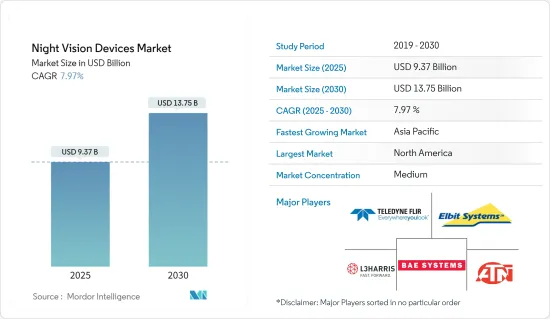

야시장비 시장 규모는 2025년에 93억 7,000만 달러로 예측되며, 2030년에는 137억 5,000만 달러에 달할 것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 7.97%입니다.

야시 기능은 저조도 보안이나 완전한 어둠 속에서의 야간 감시에 많이 사용됩니다. 야시 기능이 있는 적외선 카메라는 업무나 취미로 어둠을 감시해야 하는 사람들에게 적합합니다. 적외선 카메라는 완전한 어둠이나 저조도 조건에서 더 나은 사진을 만들기 위해 일반 조명 스펙트럼이 아닌 적외선 빛(일루미네이터)을 사용합니다. 현재 많은 보안 시스템에는 주간용과 야간용 카메라가 모두 장착되어 있습니다.

야시경 장비는 전장의 어두운 상황에서 병사들에게 컬러 영상을 제공합니다. 이러한 장비는 최근 수년간 산불 전문가들 사이에서 인기를 얻고 있으며, 장비에 대한 수요가 증가할 것으로 예측됩니다. 수요는 헤드 마운트 야시경과 저렴한 비용과 같은 기술 및 용도의 실현 가능성에 의해 촉진되었습니다. 이러한 가젯은 야간에 150-200야드 이상의 선명한 시야를 제공합니다.

시장 성장을 가속하는 주요 요인은 군비 증가입니다. 테러리즘과 불법 이민 등의 문제로 인해 세계 안보 위협이 심화됨에 따라 세계 각국은 자국의 군에 최신 기술 장비와 무기, 탄약을 갖추기 위해 군비를 늘리고 있습니다. 예를 들어 SIPRI에 따르면 세계 군비는 2017년 1조 8,070억 달러에서 2022년에는 2조 2,400억 달러에 달할 것으로 예측됩니다. 군 현대화에 대한 지출이 확대될 것으로 예상되는 가운데, 이러한 추세는 시장 성장에 유리한 생태계를 조성할 것으로 예측됩니다.

그러나 야시경의 높은 가격과 투명 장애물을 통한 조준의 한계와 같은 기술적 한계는 조사 대상 시장의 성장에 있으며, 여전히 주요한 과제로 남아있습니다.

COVID-19의 전 세계적인 확산은 조사 대상 시장의 성장에 큰 영향을 미치고 있습니다. 예를 들어 COVID-19 초기에는 다양한 산업의 세계 공급망에 혼란이 발생하여 제조 및 기타 산업 분야에 사용되는 원자재 및 부품 부족이 발생했습니다. 또한 수작업으로 인한 노동력 사용이 제한되면서 팬데믹의 영향이 더욱 커졌습니다. 팬데믹 기간 중 다양한 산업 분야의 최종사용자 조직도 중요하지 않은 요구 사항에 많은 비용을 지출하는 것을 피했습니다. 따라서 시장은 둔화되는 것을 목격했습니다.

그러나 상황이 점차 개선되고 공급망 압력이 완화됨에 따라 다양한 업종의 산업이 성장을 보고했습니다. COVID-19가 다양한 업종에 미치는 영향이 완화되고 수요 및 공급 측면에서 시장 환경이 정상화됨에 따라 이러한 추세는 앞으로도 지속될 것으로 예측됩니다. 그 결과, COVID-19 이후 시장의 성장은 기대할 수 있을 것으로 보입니다.

야간투시경 시장 동향

모니터링 용도가 큰 비중을 차지

- 야시장비는 군의 중요한 소품이며, 대부분의 현대 군는 모든 병사에게 야시장비를 장착하고 있습니다. 야간 시력은 군가 지역을 방어하고 탱크나 해를 끼치려는 사람과 같은 위협을 스캔하는 데 도움이 됩니다. 이 장비를 사용하는 동안에는 빛이 풍경에 반사되어 모든 것이 녹색으로 보입니다.

- 차량용 야시장비는 민간 시장에서 점점 더 많이 사용되고 있습니다. 악천후와 야간에는 자동차 야시장비는 운전자의 인식과 가시거리를 향상시킬 수 있습니다. 일반적으로 적외선 또는 적외선 이미지로 데이터를 수집하고 능동형 조명과 결합하여 운전자에게 표시합니다. 야시장비는 항공기, 헬리콥터, 저조도 사냥, 야간 사격 경기에도 사용됩니다.

- 최근에는 SWIR 또는 단파장 적외선 야시경 카메라 시스템이 차량 내비게이션에 사용되고 있습니다. 트럭, 탱크, 장갑차, 장갑차 등 군용 지상 운송 차량은 완전한 어둠 속에서 활동해야 하므로 단파장 적외선(SWIR) 조명과 센서가 장착된 확장된 비전 시스템(EVS)에 대한 수요가 증가하고 있습니다. 단파장 적외선 야시 카메라 시스템을 통해 위험 지역에서도 눈에 띄지 않게 행동할 수 있으며, SWIR 카메라는 MWIR 및 LWIR과 달리 앞 유리를 통해 촬영할 수 있으므로 운전석에서 전방 도로를 볼 수 있습니다. 또한 견고한 외부 하우징에도 SWIR 카메라를 장착할 수 있습니다.

- 2024년 1월, 레이저 광원 상용화 기업 교세라에스엘디레이저(KSLD)는 가시광선 영역의 용도를 위한 InGaN 레이저 다이오드를 포함한 레이저 라이트의 새로운 기능을 발표했습니다. 이 회사는 해저, 국방, 보안 용도를 위한 LiFi 혁신을 개발하고 있습니다.

- 레이저 라이트 모듈 기반 헤드라이트는 야시경 및 센싱을 위한 고휘도 백색 및 적외선(IR) 듀얼 조명을 제공합니다. 이 회사의 레이저 라이트 LiFi 시스템은 1Gbps의 양방향 전송으로 백색 및 적외선을 조사하여 향후 무선 연결을 지원합니다. 블루 레이저 구동 기술은 시스템의 능력을 수중 용도로 확장합니다. 레이저 라이트 모듈은 초소형이며, 렌즈 높이가 12.7mm 이하로 슬림하게 설계되었습니다.

- NATO에 따르면 2023년 NATO 회원국의 국방비는 총 1조 2,600억 달러에 달할 것으로 예상되며, 이는 NATO 회원국이 해당 기간 중 지출한 총액 중 최고치를 기록할 것으로 예측됩니다. 다양한 지역에서의 군비 증가는 조사 대상 시장의 성장에도 영향을 미치고 있습니다. 각국 정부는 군력 향상에 점점 더 많은 노력을 기울이고 있으며, 이는 야시장비의 채택 기회를 제공합니다.

- 이러한 발전은 예측 기간 중 군 및 방위 산업에서 야시경 시장의 성장을 가속할 것으로 예측됩니다.

북미가 큰 시장 점유율을 차지

- 이 지역의 군 및 국방에 대한 지출이 증가함에 따라 기업은 연구개발 활동을 수행 할 수 있으며, 그 결과 혁신을 가져와 국민과 국경의 안전과 보안을 더 잘 관리 할 수 있게 되었습니다. 또한 야간 공중 소방 능력을 향상시키기 위해 소방 활동에서 야시장비의 사용이 증가함에 따라 이 지역에서 야시장비의 채택이 증가하고 있습니다.

- 기술의 발전으로 야간투시경 장비는 머신러닝 및 증강현실(Augmented Reality)과 통합되어 야간투시경 장비의 야간투시 능력을 향상시킬 수 있게 되었습니다. 또한 미 육군은 최근 강화된 야간투시 고글-쌍안경(ENVG-B)을 사용하여 부대를 훈련하기 시작했습니다. 이 고글은 전장의 데이터와 이미지를 병사의 눈에 직접 제공합니다. 이 시스템에는 고해상도 디스플레이, 내장형 무선 개인 네트워크, 신속한 목표물 포착 시스템, 증강현실 알고리즘이 포함되어 있으며, 육군 병사들의 야간 시력을 향상시킵니다.

- 2023년 11월, 레오나르도DRS는 미 육군을 위한 차세대 열화상 무기 조준경 생산을 수주했으며, 1억 3,400만 달러가 넘는 이번 수주는 FWS-I(Family of Weapon Sights-Individual) IDIQ 계약에 따라 이루어졌습니다. 은 클립온식 조준기로, 강화된 야간투시경 쌍안경(ENVG-B), 통합시각보강시스템(IVAS) 등 헬멧에 장착하는 시각 시스템에 무선으로 연결됩니다. DRS의 비냉각 열화상 기술을 활용해 밤낮을 가리지 않고 연기와 안개 속에서도 목표물을 포착할 수 있는 능력을 제공합니다. 이번 제휴를 통해 DRS는 미 육군에 이 중요한 기술을 지속적으로 제공할 수 있게 되었습니다.

- 2023년 5월, 미국 연방항공청(FAA)은 에릭슨의 S-64F 에어크레인 헬리콥터에 대한 야간투시경(NVG) 운용을 승인했습니다. 에릭슨의 통합 NVG 프로그램은 고객에게 향상된 유연성과 확장된 운영 능력을 제공합니다. 또한 NVG 비행 승무원이 현행 FAA 규정을 준수할 수 있도록 보장합니다. 이 인증을 통해 에릭슨은 공중 화재 진압 및 시민 보호 활동에서 전술적 계획과 민첩성을 향상시킬 수 있습니다. 또한 에릭슨은 Aviation Specialties Unlimited(ASU)와 협력하여 S-64F를 NVG 운용을 위해 개조했습니다.

- 따라서 지역 정부가 개발, 통합, 실험, 실험실 및 플랫폼에서의 테스트, 사용 중인 다양한 시스템과의 통합을 통한 평가를 통해 야시장비의 능력을 발전시키는 것을 목표로 하고 있으므로 이 지역 시장은 성장할 가능성이 높습니다.

야간투시경 산업 개요

암시 장비 시장은 세계 기업과 중소기업이 모두 존재하므로 반고체화되어 있습니다. 시장의 주요 기업에는 Teledyne FLIR LLC, L3harris Technologies Inc., American Technologies Network Corp., Elbit Systems Deutschland, BAE Systems PLC 등이 있습니다. 이 시장의 기업은 제품 제공을 강화하고 지속가능한 경쟁 우위를 확보하기 위해 제휴 및 인수와 같은 전략을 채택하고 있습니다.

- 2024년 1월 - Exosens는 25mm 이미지 인텐시파이어 솔루션의 출시를 발표했습니다. 이 솔루션은 Hi-CE MCP 기술을 기반으로 하며, 첨단 Hi-QE 광전 표면을 사용할 수 있습니다.

- 2023년 12월 - 타레스와 스페인 보안업체 트라브리사는 지능형 국경 관리를 위해 시민 경비대 메릴야 사령부에 통합 감시 시스템 설치를 완료하기 위해 합작회사를 설립했습니다. 이 감시 시스템을 통해 시민 경비대는 고해상도 주야간 카메라를 사용할 수 있게 됩니다. 야간 카메라와 감시 및 제어 소프트웨어(HORUS)를 통해 센서와 액추에이터의 중앙 집중식 관리 및 제어, 이미지 처리가 가능해집니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 업계 밸류체인 분석

- 거시경제 동향 시장에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 군비의 증가

- 법집행기관의 채택 증가

- 시장 성장 억제요인

- 정비에 수반하는 고비용

제6장 시장 세분화

- 유형별

- 카메라

- 고글

- 단안경·쌍안경

- 라이플 스코프

- 기타 유형

- 기술별

- 서멀 이미징

- 이미지 인텐시파이어

- 적외선 조명

- 기타 기술

- 용도별

- 군·방위

- 야생 동물 관찰과 보호

- 감시

- 내비게이션

- 기타 용도

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 개요

- Teledyne FLIR LLC

- L3Harris Technologies Inc.

- American Technologies Network Corp.

- Elibit Systems Ltd

- BAE Systems PLC

- Thales Group SA

- Raytheon Technologies Corporation

- Bushnell Inc.

- Satir

- Apresys International Inc.

- Luna Optics Inc.

- Opgal Optronic Industries Ltd

- EOTECH LLC

- Exosens

- Panasonic Holding Corporation

- Tak technologies private Limited

- TACTICAL NIGHT VISION COMPANY

- sharp Corporation

- nivisys LLC

- Excelitas Technologies Corp.

제8장 투자 분석

제9장 시장의 미래

KSA 25.05.14The Night Vision Devices Market size is estimated at USD 9.37 billion in 2025, and is expected to reach USD 13.75 billion by 2030, at a CAGR of 7.97% during the forecast period (2025-2030).

Night vision is often employed in night surveillance at low-light security or completely dark conditions. Infrared cameras with night vision capabilities are excellent for anyone who needs to monitor in the dark for work or pleasure. Infrared cameras use infrared light (illuminator) rather than the usual illumination spectrum to create better photos in complete darkness or low light conditions. Many security systems now include both day and night versions of cameras.

The night vision equipment provides soldiers with color visuals in low-light situations on the battlefield. These devices have acquired appeal among wildfire experts in recent years, which is expected to increase demand for the devices. The demand was fueled by technological and application feasibility, such as head-mounted night vision and low cost. These gadgets provide clear visibility of more than 150 to 200 yards at night.

A major factor driving the market's growth is the growing military expenditure. As the global security threat deepens owing to issues such as terrorism, illegal migration, etc., countries across the globe are increasing their military expenditure to equip their protection forces with the latest technology devices, arms, and ammunition. For instance, according to SIPRI, the global military expenditure reached USD 2.240 trillion in 2022, compared to USD 1.807 trillion in 2017. With expenditures on military modernization anticipated to grow, such trends are anticipated to create a favorable ecosystem for the market's growth.

However, the higher cost and technical limitations of night vision devices, such as their limitations in targeting through transparent obstacles, continue to remain among the major challenging factors for the growth of the market studied.

The global outbreak of COVID-19 has had a notable impact on the growth of the market studied. For instance, during the initial days of COVID-19, the global supply chain of various industries was disrupted, resulting in a scarcity of raw materials and components used in manufacturing and other industrial applications. Furthermore, restrictions imposed on the use of manual workforce further intensified the pandemic's influence. During the pandemic, organizations across different end-user verticals also were averted on spending high on less crucial requirements. Hence, the market witnessed a slowdown.

However, with the conditions gradually improving and supply chain pressure easing out, industries across different sectors reported growth, which is anticipated to be the case going forward as the influence of the pandemic on different verticals has been reducing, leading to the normalization in the market conditions both in terms of demand and supply. As a result, the market's growth in the post-COVID-19 period appears promising.

Night Vision Devices Market Trends

Surveillance Applications to Hold Significant Share

- Night vision devices are crucial gadgets of armed forces, and most modern armies equip each of their soldiers with these devices. Night vision aids military forces in defending an area or scanning for threats, such as tanks or persons wishing to harm them. Because the light reflects off the landscape, everything appears to have a greenish hue while utilizing these devices.

- In automotive, night vision has become increasingly commonly used in the civilian market. In bad weather conditions or at night, automotive night vision systems can increase a driver's perception and viewing distance. Typically, they capture data via infrared or thermal imaging, which is occasionally paired with active illumination techniques, and then show it to the driver. Night vision has also been used in aircraft and helicopters, low-light hunting, and night shooting competitions.

- Recently, SWIR or short-wavelength Infrared Night Vision Camera systems have been used for vehicle navigation. Military ground transport vehicles such as trucks, tanks, and armored personnel carriers must operate in complete darkness, increasing the demand for Enhanced Vision Systems (EVS) with short-wave Infrared (SWIR) illumination and sensors. Infinite short wave infrared night vision camera systems to maneuver discreetly through dangerous territory. SWIR cameras, unlike MWIR and LWIR, can image through the windshield, allowing them to be positioned in the driver's compartment for a "driver's eye" view of the road ahead. Ruggedized outside housings can also accommodate SWIR cameras.

- In January 2024, KYOCERA SLD Laser, Inc. (KSLD), a company in the commercialization of laser light sources, introduced its new LaserLight capabilities, including InGaN Laser Diodes for Applications in the Visible Spectral Range. The company is pioneering LiFi innovations for undersea, defense, and security applications.

- The laserlight module-based headlight offers high-brightness white and infrared (IR) dual illumination for night vision and sensing. The company's laserlight LiFi system offers white and IR illumination with a 1 Gbps bi-directional transmission rate to support the future of wireless connectivity. The blue laser-powered technology expands the system's capability into underwater applications. The laserlight Modules are ultra-compact and have a slim profile with less than a 12.7 mm lens height.

- According to NATO, in 2023, the combined defense expenditure for members of NATO was approximately USD 1.26 trillion, the highest NATO members have collectively spent on defense during the provided period. The growing military expenditure in the various regions also results in the growth of the market under study. Governments are increasingly focusing on improving their military capabilities, thereby providing opportunities for the adoption of night vision devices.

- Such developments are anticipated to propel the growth of the night vision devices market in the military and defense industry during the forecast period.

North America to Hold Significant Market Share

- The increased spending on military and defense in the region has allowed companies to conduct R&D activities, resulting in innovations, enabling them to manage better the safety and security of their people and the borders. Further, increased night vision use in firefighting activities to enhance night-time aerial firefighting capabilities increases the adoption of night vision devices in the region.

- Technological advancements have enabled night vision devices to be integrated with machine learning and Augmented reality to enhance the night vision capabilities of the devices. Further, the US Army recently started training its forces using Enhanced Night Vision Goggle-Binocular (ENVG-B). These goggles provide data and imagery from the battlefield directly to the soldier's eye. The system includes a high-resolution display, an embedded wireless personal network, a rapid target acquisition system, and Augmented reality algorithms that enhance the night vision capabilities of army personnel.

- In November 2023, Leonardo DRS, Inc. received an order for the production of its next-generation thermal weapon sights for the US Army. The production order for more than USD 134 million was made under the Family of Weapon Sights - Individual (FWS-I) IDIQ contract. FWS-I, a clip-on weapon sight, connects wirelessly to helmet-mounted vision systems, including the enhanced night vision goggle binoculars (ENVG-B) and the integrated visual augmentation system (IVAS). It offers rapid target acquisition capabilities to the soldier. It leverages DRS' uncooled thermal imaging technology, enabling soldiers to acquire targets day or night and in smoke or fog. The partnership will help the company to continue to deliver this vital technology to the US Army.

- In May 2023, the Federal Aviation Administration (FAA) certified the Erickson Incorporated S-64F Air-Crane helicopter for night vision goggles (NVG) operation. Erickson's integrated NVG program offers customers increased flexibility and expanded operational capabilities. It ensures that the NVG flight crew maintains accordance with current FAA regulations. The certification will allow the company to increase tactical planning and agility in aerial firefighting and civil protection operations. Further, Erickson also collaborated with Aviation Specialties Unlimited (ASU) to modify S-64F to perform NVG operations.

- Therefore, as the regional governments aim to evolve their night vision capabilities through development, integration, experimentation, laboratory and platform tests, and evaluation with integration with various systems in use, the market in the region is likely to grow.

Night Vision Devices Industry Overview

The night vision devices market is semi-consolidated due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Teledyne FLIR LLC, L3harris Technologies Inc., American Technologies Network Corp., Elbit Systems Deutschland, and BAE Systems PLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2024 - Exosens announced the introduction of the 25 mm Image Intensifier solution. It is based on the company's Hi-CE MCP technology and is available with advanced Hi-QE photocathodes.

- December 2023 - Thales and the Spanish security company Trablisa formed a joint venture to complete the installation of the integrated surveillance system in the Melilla Command of the Civil Guard for intelligent border control. The surveillance system will enable the Civil Guard with high-resolution day and night cameras. The night vision cameras and the monitoring and control software (HORUS) allow the centralized management and control of sensors and actuators as well as the processing of images.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Military Expenditure

- 5.1.2 Increasing Adoption from Law Enforcement

- 5.2 Market Restraints

- 5.2.1 High Costs Associated with Maintenance

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Camera

- 6.1.2 Goggles

- 6.1.3 Monoculars and Binoculars

- 6.1.4 Rifle Scope

- 6.1.5 Other Types

- 6.2 By Technology

- 6.2.1 Thermal Imaging

- 6.2.2 Image Intensifier

- 6.2.3 Infrared Illumination

- 6.2.4 Other Technologies

- 6.3 By Application

- 6.3.1 Military and Defense

- 6.3.2 Wildlife Spotting and Conservation

- 6.3.3 Surveillance

- 6.3.4 Navigation

- 6.3.5 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Teledyne FLIR LLC

- 7.1.2 L3Harris Technologies Inc.

- 7.1.3 American Technologies Network Corp.

- 7.1.4 Elibit Systems Ltd

- 7.1.5 BAE Systems PLC

- 7.1.6 Thales Group SA

- 7.1.7 Raytheon Technologies Corporation

- 7.1.8 Bushnell Inc.

- 7.1.9 Satir

- 7.1.10 Apresys International Inc.

- 7.1.11 Luna Optics Inc.

- 7.1.12 Opgal Optronic Industries Ltd

- 7.1.13 EOTECH LLC

- 7.1.14 Exosens

- 7.1.15 Panasonic Holding Corporation

- 7.1.16 Tak technologies private Limited

- 7.1.17 TACTICAL NIGHT VISION COMPANY

- 7.1.18 sharp Corporation

- 7.1.19 nivisys LLC

- 7.1.20 Excelitas Technologies Corp.