|

시장보고서

상품코드

1689926

지능형 유량계 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Intelligent Flow Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

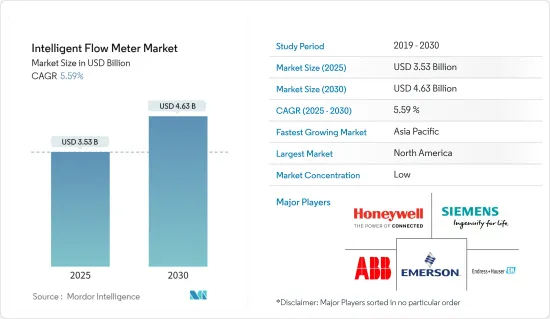

지능형 유량계 시장 규모는 2025년에 35억 3,000만 달러로 추계되고, 2030년에는 46억 3,000만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 5.59%를 나타낼 전망입니다.

업계는 더 나은 결과를 위해 보다 정확한 실시간 관찰을 요구하는 최종 사용자 부문의 변화로 인해 혜택을 받을 수밖에 없습니다.

주요 하이라이트

- 시장 성장은 주로 최적의 활용을 위해 산업용 유체의 안정적인 측정 및 모니터링에 대한 필요성이 증가함에 따라 주도되고 있습니다. 또한 석유 및 가스 산업의 부흥과 향후 상하수도 산업의 인프라 확대로 인해 업계가 수혜를 받을 것으로 보입니다.

- 코리올리 유량계 시장은 인라인 품질 관리에 적용되기 때문에 예측 기간 동안 지능형 유량계 시장에서 큰 비중을 차지할 것으로 예상됩니다. 예를 들어, 유량계의 정확한 밀도 기능은 브릭스 및 플라톤 값을 측정하여 재료의 품질을 보장할 수 있습니다.

- Honeywell이 2021년 1월에 발표한 조사 결과에 따르면, 근로자의 거의 4분의 1이 위험한 작업장으로 복귀하기 전에 그만두는 것으로 나타났습니다. 전 세계 근로자의 약 68%는 회사 건물이 완전히 안전하다고 느끼지 못한다고 답했습니다. 설문조사에 참여한 근로자들은 건물 관리자가 건강 및 안전 지침을 일관되게 시행하지 않을 수 있다는 점(42%)을 가장 우려하고 있으며, 그다음으로 대면 근무를 더 안전하게 만들기 위한 새로운 기술에 항상 투자하지 않을 수 있다는 점(30%)을 우려하고 있습니다.

- 정확도가 높은 유량계는 가격이 비싸고, 유량계 유형과 유량에 따라 정확도를 조금만 높여도 비용이 많이 들 수 있습니다. 코리올리 유량계와 자기 유량계는 일반적으로 특히 파이프 크기가 큰 경우 초기 비용이 높습니다. 유량 제어기 회사인 AlicatScientific에 의하면, 코리올리 유량계는 약 4,000-6,000달러, 층류 유량계는 약 1,000달러입니다.

- 최근 코로나19의 확산은 여러 부문에 걸쳐 여러 경제에 추가적인 압박을 가했습니다. 중요한 용도 범주인 석유 및 가스 산업의 예상치 못한 붕괴는 글로벌 지능형 유량계 시장의 성장에 영향을 미치는 중요한 장애물 중 하나입니다. 스마트 유량계는 석유 및 가스 산업에서 파이프의 액체 흐름을 측정하는 데 사용되기 때문에 지능형 유량계 시장에 상당한 부정적인 영향을 미치고 있습니다.

지능형 유량계 시장 동향

가장 높은 성장을 이루는 식음료 산업

- 식음료 제조 산업에서 원자재 측정 및 제어는 매우 중요합니다. 식품 산업용 유량계는 생산량을 늘리면서 비용을 절감합니다. 식품 분야에서는 특정 공정에서 위생 조건이 필요합니다.

- 식품 산업용 유량계는 식용유를 측정하는 데 사용할 수 있습니다. 식용유 제조 공정의 많은 단계에서 유량계를 사용하여 파이프 라인에서 흘러나오는 오일의 부피와 무게를 측정해야 합니다.

- 음료 산업에는 맥주, 과일 주스 등이 포함되며, 큰 파이프의 유량은 일반적으로 전자식 유량계로 측정합니다. 대형 음료 제조 시설에서 유량을 정확하게 정량화할 수 있습니다.

- 인더스트리 4.0의 도래와 함께 많은 산업에서 데이터로부터 생산성을 향상시킬 수 있는 인사이트를 파악하기 위해 많은 노력을 기울이고 있습니다.

- 2021년 5월, 물, 위생, 감염 예방 솔루션 및 서비스 분야의 선두주자인 Ecolab은 기업, 현장, 자산 수준에서 물 사용량을 실시간으로 파악할 수 있는 디지털 도구인 Water Flow Intelligence를 출시했습니다. 물 흐름 인텔리전스는 스마트 수도 계량기 및 센서와 고급 물 흐름 측정 및 모니터링, 자산 성능 인사이트, 머신러닝을 결합하여 식음료 생산업체가 운영 전반에 걸쳐 물 관리를 개선하고 지속 가능성 목표를 달성하며 운영 비용을 절감할 수 있는 기회를 파악할 수 있도록 지원합니다.

아시아태평양이 급성장 시장으로 부상

- 아시아태평양 지역은 유량계 시장에서 계속해서 상당한 점유율을 차지할 것으로 예상됩니다. 중국, 인도, 일본, 한국, 인도네시아, 호주, 싱가포르와 같은 국가들이 계속해서 글로벌 시장에 큰 영향을 미치고 있습니다. 중국과 인도와 같은 개발도상국에서는 상하수도, 에너지 및 전력, 정유, 화학 및 산업 인프라 활동에 대한 투자가 증가하고 있으며, 이로 인해 유량계 센서를 통과하거나 주변을 흐르는 액체, 가스 또는 증기를 정확하고 비용 효율적으로 측정하기 위한 지능형 유량 측정 솔루션의 구현이 필요한 IoT 통합에 대한 요구가 커지고 있습니다.

- 일본은 아시아태평양 지역에서 자동화된 산업 경제로 전환하는 데 선구적인 역할을 해왔습니다.

- 인도는 2030년까지 세계 경제에 연간 5,000억 달러 이상을 기여하는 글로벌 제조 허브로 부상할 잠재력을 보유하고 있습니다. 2021년 7월 천연가스 생산량은 18.9%, 석탄은 18.7%, 석유 정제 생산량은 6.7%, 비료는 0.5%, 철강은 9.3%, 시멘트는 21.8%, 전기는 9% 증가했습니다.

- 인도 산업 및 내부 무역 촉진부(DPIIT)에 따르면 2000년 4월부터 2021년 6월까지 제조업 하위 부문에 유입된 누적 FDI는 1,003억 5,000만 달러에 달했습니다. 인도는 2021년에 전년 대비 10% 증가한 총 817억 2천만 달러의 외국인 직접투자(FDI)가 유입되었습니다. 따라서 이 지역의 제조 부문이 성장하고 자동화가 크게 도입되면서 예측 기간 동안 지능형 유량계 시장 성장률이 높아질 것으로 분석됩니다.

지능형 유량계 산업 개요

글로벌 지능형 유량계 시장은 세분화되어 있으며, 각 공급업체는 다양한 산업에 여러 유량계를 제공하고 있습니다.

- 2022년 2월, KROHNE는 밸브 및 측정 기술과 고유한 진단 및 제어 기술을 결합한 혁신 제품인 FOCUS-1 프로토타입을 공개했습니다.

- 2021년 12월, ABB는 지능형 물 손실 관리를 가능하게 하는 양방향 연결 기능을 갖춘 세계 최초의 전자기 유량계를 출시했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 시장 성장 촉진요인

- 석유 및 가스 부문과 물 및 폐수 관리에서 고급 유량계의 보급 증가

- 유량 측정 솔루션에서 IoT의 보급

- 시장 성장 억제요인

- 기존 유량계에 비해 지능형 유량계의 높은 비용

- 코리올리 유량계 및 자기 유량계의 높은 초기 비용

- COVID-19가 업계에 미치는 영향 평가

제5장 시장 세분화

- 유형별

- 코리올리

- 자기

- 초음파

- 다상

- 와류

- 가변 면적

- 차압

- 열

- 터빈

- 통신 프로토콜별

- 프로피버스

- 모드 버스

- 하트

- 기타

- 최종 사용자 산업별

- 석유 및 가스

- 제약

- 상하수도

- 종이 및 펄프

- 발전

- 식음료

- 기타

- 지역별

- 북미

- 라틴아메리카

- 유럽

- 아시아태평양

- 중동 및 아프리카

제6장 경쟁 구도

- 기업 프로파일

- KROHNE Messtechnik GmbH

- Teledyne Isco Inc.

- Sierra Instruments, Inc.

- Fuji Electric

- General Electric Company

- Brooks Instrument

- Azbil Corporation

- Yokogawa Electric Corporation

- Siemens AG

- Honeywell International Inc.

- Endress Hauser AG

- Emerson Electric Co.

- ABB Ltd.

제7장 투자 분석

제8장 시장 기회와 앞으로의 동향

HBR 25.05.13The Intelligent Flow Meter Market size is estimated at USD 3.53 billion in 2025, and is expected to reach USD 4.63 billion by 2030, at a CAGR of 5.59% during the forecast period (2025-2030).

The industry is bound to be benefitted from the changing end-user sectors, demanding more accurate and real-time observations for better results.

Key Highlights

- The market growth is majorly driven by the growing need for reliable measurement and monitoring of industrial fluids for optimum utilization. The Industry is also likely to be benefitted from the revival of the oil and gas industry and the expanding infrastructure in the water and wastewater industry in the future.

- The market for Coriolis flowmeter is expected to hold a large share of the intelligent flow meter market during the forecast period because of its applications in inline quality control. For instance, the flow meters' accurate density function can measure Brix and Plato values to ensure the quality of ingredients. Viscosity readings provide continuous measurement to minimize the chance of producing an off-spec product. There is a growing usage of intelligent Coriolis flowmeters to support the demanding hydrogen applications, where accuracy and stability are imperative.

- According to the survey results launched by Honeywell in January 2021, nearly a quarter of workers may quit before returning to a dangerous worksite. About 68% of the global workforce does not feel completely safe in the employers' buildings. Surveyed workers are most worried that the building management may not consistently enforce health and safety guidelines (42%), followed by worry that they may not always invest in new technology to make working in-person safer (30%). Thus, using devices such as flowmeters that provide safety in different aspects of operation is becoming imperative.

- The cost of higher accuracy meters is high, and depending on meter type and flow rate, even a slight increase in accuracy can be expensive. Coriolis flowmeters and magnetic flow meters typically have high initial costs, especially for large pipe sizes. According to AlicatScientific, a flow controller company, the Coriolis flowmeters costs around USD 4,000-6,000, while the laminar flowmeter costs around USD 1,000.

- The recent outbreak of COVID-19 posed additional stress on multiple economies across various sectors. The unexpected breakdown in the oil and gas industry, which is a crucial application category, is one of the significant setbacks affecting the growth of the global intelligent flowmeter market. As smart flow meters are used in the oil and gas industry to measure liquid flow in pipes, there is a significant negative influence on the intelligent flowmeter market.

Intelligent Flow Meter Market Trends

Food and Beverages Industry to Witness the Highest Growth

- Raw material measurement and control are crucially significant in the food and beverage manufacturing business. Flow meters for the food industry reduce costs while increasing output. In the food sector, specific processes necessitate sanitary conditions. These include dairy goods, wine, drinks, syrup, chocolate, edible oil, etc. Food-grade automation equipment is required in the food and beverage industry. Ascertain hygienic and safe conditions. The equipment can be sterilized without disassembly using a food-grade flow meter.

- Food grade flow meters can be used to measure edible oil. Many steps in the edible oil manufacturing process necessitate the use of a flow meter to measure the volume and weight of oil flowing out of the pipeline. Flow meters are required for data on the crude oil that is originally refined and the essential oil that is finally refined by companies that produce and process edible oils.

- The beverage industry includes beer, fruit juice, etc., and the flow of big pipes is usually measured with electromagnetic flowmeters. It can be precisely quantified in a large beverage manufacturing facility. Similarly, these meters are also used in breweries, syrup manufacturing, and so on.

- Many industries are going to significant lengths to identify production-enhancing insights from data in the advent of Industry 4.0. These insights aid in enhancing operational efficiency, increasing uptime and lowering maintenance costs, and acceptance in the food and beverage industry. This is bolstering the demand for intelligent flow meters in the food and beverage industry.

- In May 2021, Ecolab Inc., the prominent in water, hygiene, and infection prevention solutions and services, launched Water Flow Intelligence, a digital tool that offers industry real-time awareness of water usage at the enterprise, site, and asset levels. Water Flow Intelligence combines smart water meters and sensors with advanced water flow measurement and monitoring, asset performance insights, and machine learning to help food and beverage producers identify opportunities to improve water management across their operations, meet sustainability goals, and reduce operational costs.

Asia Pacific to Emerge as the Fastest Growing Market

- The Asia Pacific region is expected to continue occupying a significant share of the flowmeter market. Countries such as China, India, Japan, South Korea, Indonesia, Australia, and Singapore continue to impact the global market significantly. The number of investments in water & wastewater, energy and power, refining, chemicals, and industrial infrastructure activities is increasing in the developing economies such as China and India, which drives the demand for integration of IoT, which requires the implementation of intelligent flow measurement solutions for accurate and cost-effective measurement of liquid, gas, or steam flowing through or around the flow meter sensors.

- Japan has been a pioneer in transforming into an automated industrial economy in the Asia-Pacific region. The Industrial version 4.0 is being adopted at a faster pace. The region has emerged as a significant manufacturing hub for automation and digital solutions and is also supplying them to other markets in the Asia-Pacific region alongside international markets.

- India holds the potential to emerge as a global manufacturing hub, with an annual contribution to the global economy of more than USD 500 billion by 2030. Natural gas output climbed by 18.9%, coal by 18.7%, petroleum refinery output by 6.7%, fertilizers by 0.5%, steel by 9.3%, cement by 21.8%, and electricity by 9% in July 2021.

- The cumulative FDI inflows, between April 2000 and June 2021, into manufacturing subsectors, reached USD 100.35 billion, according to the Department for Promotion of Industry and Internal Trade (DPIIT). India received total foreign direct investment (FDI) inflows of UD$ 81.72 billion in FY21, up 10% Y-o-Y. Therefore, the growing manufacturing sectors in the region, alongside the significant adoption of automation, are analyzed to boost the intelligent flow meters market growth rate during the forecast period.

Intelligent Flow Meter Industry Overview

The global intelligent flow meter market is fragmented, with each vendor providing multiple flowmeters for various industries. The competitive rivalry among existing competitors is high. Moreover, the demand in the intelligent flowmeter market is expected to be boosted by large companies' product innovation and expansion strategies. The flowmeter market has some major manufacturers, such as Siemens AG, Emerson Electric, Sensirion, and others, contributing to the competitive rivalry. Such vendors are established and have deep penetration in the market for flow meters. Some of the key developments in the area are:

- February 2022 - KROHNE unveiled the FOCUS-1 prototype as an innovation that unites valve and measuring technology with unique diagnostics and control functions in one device. FOCUS-1 is available as a standard product, which is claimed by the company as the world's first intelligent process node specifically developed for the process industries.

- December 2021 - ABB introduced the world's first electromagnetic flowmeter with bidirectional connectivity to enable intelligent water loss management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growing Penetration of Advanced Flow Meters in the Oil and Gas Sector and Water & Wastewater Management

- 4.4.2 Penetration of IoT in Flow Rate Measurement Solutions

- 4.5 Market Restraints

- 4.5.1 Higher Cost of Intelligent Flow Meters Compared to Traditional Flow Meters

- 4.5.2 High Initial Cost for Coriolis and Magnetic Flow Meters

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Coriolis

- 5.1.2 Magnetic

- 5.1.3 Ultrasonic

- 5.1.4 Multiphase

- 5.1.5 Vortex

- 5.1.6 Variable Area

- 5.1.7 Differential pressure

- 5.1.8 Thermal

- 5.1.9 Turbine

- 5.2 By Communication Protocol

- 5.2.1 Profibus

- 5.2.2 Modbus

- 5.2.3 Hart

- 5.2.4 Others

- 5.3 By End-User Industry

- 5.3.1 Oil and Gas

- 5.3.2 Pharmaceuticals

- 5.3.3 Water and Wastewater

- 5.3.4 Paper and Pulp

- 5.3.5 Power Generation

- 5.3.6 Food and Beverages

- 5.3.7 Other End-User Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Latin America

- 5.4.3 Europe

- 5.4.4 Asia Pacific

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 KROHNE Messtechnik GmbH

- 6.1.2 Teledyne Isco Inc.

- 6.1.3 Sierra Instruments, Inc.

- 6.1.4 Fuji Electric

- 6.1.5 General Electric Company

- 6.1.6 Brooks Instrument

- 6.1.7 Azbil Corporation

- 6.1.8 Yokogawa Electric Corporation

- 6.1.9 Siemens AG

- 6.1.10 Honeywell International Inc.

- 6.1.11 Endress + Hauser AG

- 6.1.12 Emerson Electric Co.

- 6.1.13 ABB Ltd.