|

시장보고서

상품코드

1689962

AI 인프라 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)AI Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

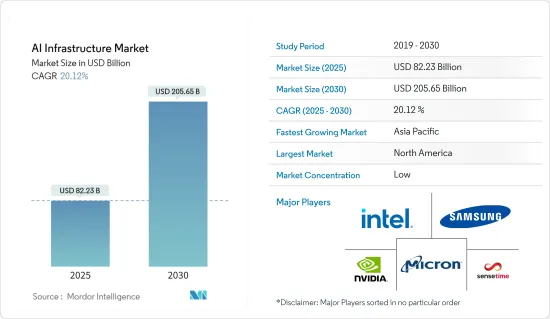

AI 인프라 시장 규모는 2025년에 822억 3,000만 달러로 추정되고, 예측 기간 2025년부터 2030년까지 CAGR 20.12%로 성장할 전망이며, 2030년에는 2,056억 5,000만 달러에 이를 것으로 예측됩니다.

AI 인프라 시장 혁신 및 효율화 촉진

주요 하이라이트

- 고성능 컴퓨팅 데이터센터 수요 급증 : AI 인프라 시장은 고성능 컴퓨팅(HPC) 데이터센터의 AI 하드웨어 수요 증가에 견인되어 획기적인 성장을 이루고 있습니다. 기업은 인공지능의 변화 가능성을 인식하고 다양한 산업에 대한 투자를 촉진하고 있습니다.

- Nvidia의 BlueField-3 DPU : 세계 최초의 400GbE 데이터 프로세싱 유닛(DPU)인 이 기술은 기존 DPU보다 10배 빠르며 AI 하드웨어의 상당한 진보를 뒷받침합니다.

- 구글 클라우드와 인텔 협업 : 이러한 기술 선도자들은 데이터센터에서 AI 기능, 보안 및 생산성을 강화하기 위해 설계된 칩을 공동 개발하여 전략적 파트너십 경향을 보였습니다.

- AMD의 MI300X 시리즈 : 어드밴스드 마이크로 디바이스는 MI300X 칩 시리즈를 발표하여 최대 800억 개의 파라미터를 가진 생성형 AI 모델을 실행할 수 있게 되어 AI 모델의 복잡화가 진행되고 있음을 입증했습니다.

- 성장을 가속하는 IIoT와 자동화 기술 : 산업용 사물 인터넷(IIoT)과 자동화 기술의 통합은 AI 인프라 시장을 크게 밀어 올리고 있습니다. 이러한 혁신은 효율성을 높이고 프로세스를 최적화하며 가치 있는 데이터를 생성합니다.

- AFCOM 2021의 조사 결과 : 참가 기업의 40% 이상이 2024년까지 데이터센터 모니터링 및 유지보수에 로보틱스와 자동화를 도입할 예정이며, 자동화의 급격한 증가를 시사하고 있습니다.

- 어드밴텍 및 액티리티 통합 : 이 회사들은 기계의 예후 진단 및 헬스케어를 위한 AI 기반 솔루션을 발표하여 실시간으로 기계의 상태 모니터링을 가능하게 했습니다.

- TD SYNNEX의 Data-IoTSolv : 이 솔루션 제품군은 데이터 분석 및 IoT를 활용하는 도구를 파트너에게 제공하며, AI를 활용한 IoT 솔루션에 대한 수요 증가를 보여줍니다.

- 혁신을 추진하는 머신러닝 및 딥러닝 : 머신 러닝 및 딥러닝 기술은 AI 인프라 성장의 중요한 원동력으로 기업이 엄청난 데이터세트에서 가치 있는 인사이트를 끌어낼 수 있도록 합니다.

- TAZI.AI의 성공적인 자금 조달 : TAZI.AI는 의료, 보험 및 제약 분야에서 머신러닝 솔루션을 배포하기 위해 460만 달러를 받았으며, 분야별 AI 채택을 강조하고 있습니다.

- 정부 부문 활용 : 머신러닝은 업무 자동화 및 데이터 분석에 활용되며 인적 자원을 핵심 기능으로 돌릴 수 있습니다.

- 팬데믹 시대의 가속화 : 팬데믹은 네트워크 자동화를 위한 AI 및 ML의 채택을 가속화했으며, 네트워크 제공업체는 운영 간소화에서 AI의 중요한 역할을 인식했습니다.

- 자동차 및 헬스케어 분야에서의 데이터 폭발 : 자동차나 헬스케어 등의 업계에서는 데이터량이 증가하고 있어 데이터를 효율적으로 관리 및 분석하는 첨단 AI 기술의 필요성이 높아지고 있습니다.

- Alpine Health Systems의 AI 기반 플랫폼 : 이 플랫폼은 복잡한 병리학 환자의 퇴원 과정을 단순화하고 의료 관리에서 AI의 잠재력을 보여줍니다.

- Intangles Lab의 EV용 앰비언트 인지 AI : 이 혁신은 전기자동차, 특히 상용 EV 분야에서의 항속 거리 불안에 대응합니다.

- 헬스케어 용도의 AI : AI는 임상 의사결정, 질병 진단, 환자 데이터 관리에 대한 이용이 증가하고 있어 헬스케어에서 그 범용성을 나타내고 있습니다.

- 시장 상황 및 미래 전망 : AI 인프라 시장은 최첨단 솔루션을 제공하는 하이테크 선도 기업, 신흥 기업, 클라우드 제공업체가 혼합되어 지속적인 성장이 예상됩니다.

- 클라우드 부문 성장 : AI 인프라의 클라우드 시장은 2022년에 161억 2,000만 달러로 평가되었고, 2028년에는 CAGR 20.22%를 반영하여 492억 9,000만 달러에 이를 것으로 예측됩니다.

- 북미 시장의 리더십 : 북미는 2022년에 195억 7,000만 달러로 AI 인프라 시장을 선도하였고, 2028년에는 565억 9,000만 달러에 이를 전망이며, CAGR 19.10%로 성장할 것으로 예측됩니다.

- 새로운 기술 : 양자 컴퓨팅, 6G 커넥티비티, 고급 로봇 공학 등의 혁신이 AI 인프라 기능의 한계를 넓혀 새로운 용도 및 이용 사례를 가능하게 할 것으로 예상됩니다.

AI 인프라 시장 동향

AI 인프라의 핵심 하드웨어 부문

- 시장 규모 및 성장 : 하드웨어 부문은 AI 인프라 시장의 핵심입니다. 2022년에는 시장 점유율의 73.70%를 차지해 345억 2,000만 달러에 달했습니다. CAGR 19.19%로 성장하여 2028년에는 1,002억 9,000만 달러에 달할 것으로 예측됩니다.

- 프로세서 하위 부문 리드 : 프로세서는 2022년에 207억 3,000만 달러로 평가되었고, 보다 강력한 처리를 필요로 하는 AI 알고리즘의 복잡화로 인해 2028년에는 575억 6,000만 달러에 도달할 것으로 예측됩니다.

- 맞춤형 추세 : TensorFlow를 사용하여 일반 카드 두 배의 학습 속도를 입증한 화웨이의 Ascend 910 AI 프로세서처럼 기업은 맞춤형 AI 칩으로 이동합니다.

- 에지 컴퓨팅의 영향력 : 에지 컴퓨팅의 상승이 AI 프로세서 개발을 형성하고 있습니다. 각 제조업체는 특히 IoT 애플리케이션으로부터 사용 지점에서 실시간 데이터 처리를 가능하게 하는 프로세서에 주력하고 있습니다.

- 하이브리드 프로세서 : 각 회사는 CPU와 GPU 또는 NPU(Neural Processing Unit)를 결합한 하이브리드 AI 프로세서를 개발하여 다양한 AI 애플리케이션의 범용성 및 효율성을 높이고 있습니다.

북미가 주요 시장 점유율을 차지

클라우드 부문 : AI 민주화 기폭제

- 급속한 성장 궤도 : 2022년에 161억 2,000만 달러였던 클라우드 분야는 CAGR 20.22%로 성장할 전망이며, 2028년에는 492억 9,000만 달러에 이를 것으로 예측됩니다. 이 성장은 전체 시장의 CAGR을 능가하며 AI 인프라에서 클라우드 솔루션의 중요한 역할을 보여줍니다.

- AI 민주화 : 클라우드 기반 AI 인프라는 전개 장벽을 낮추어 모든 규모의 기업이 AI 기술에 액세스할 수 있도록 합니다. 이 민주화는 디지털 변환을 가속화하고 혁신을 촉진합니다.

- 확장성 및 유연성 : 클라우드 플랫폼은 비교할 수 없는 확장성을 제공하므로 기업은 데이터 집약적인 모델 교육 및 추론과 같은 AI 워크로드를 쉽게 관리할 수 있습니다.

- AI-as-a-Service의 보급 : AI-as-a-Service(AIaaS)의 상승으로 기업은 사전 훈련된 모델과 도구 세트에 액세스할 수 있습니다. 예를 들어 Nvidia의 DGX Cloud는 AI 모델 교육을 위한 슈퍼컴퓨팅 서비스를 제공하고 Salesforce의 AI Cloud는 엔터프라이즈 지원 AI 도구를 제공합니다.

- 전략적 협업 : Google Cloud와 싱가포르의 Smart Nation 이니셔티브와의 제휴를 포함하여 AI 하드웨어 제공업체와 클라우드 플랫폼 간의 협업을 통해 분야별 AI 클라우드 솔루션을 구축하고 있습니다.

- 시장 전망 : AI 인프라 시장은 하드웨어와 클라우드의 두 분야가 상승적으로 발전함에 따라 앞으로도 진화를 계속할 것으로 보입니다. AI 용도의 보급에 따라 확장 가능하고 견고한 인프라에 대한 수요가 증가하고 AI 하드웨어와 클라우드 네이티브 솔루션 전문화에 박차를 가할 것으로 보입니다.

AI 인프라 업계 개요

하이테크 대기업이 시장을 선도하는 AI 인프라 시장은 Intel, Nvidia, IBM, Microsoft, Samsung 등 하이테크 대기업이 독점하고 있습니다. 이러한 기업들은 풍부한 자원, 종합적인 AI 솔루션, 세계의 도달범위를 통해 시장 점유율이 높습니다.

엔비디아의 DGX 클라우드 서비스 : 이 AI 슈퍼컴퓨팅 서비스는 기업이 첨단 생성형 AI 모델을 교육할 수 있게 해주며 엔드 투 엔드 AI 인프라 솔루션을 제공하는 회사의 리더십을 보여줍니다.

IBM과 Microsoft의 하이브리드 솔루션 : 양사는 AI 기능을 통합한 하이브리드 클라우드 솔루션을 개발하여 기업이 다양한 환경에 AI를 효율적으로 배포할 수 있도록 합니다.

대규모 연구개발 투자 : 대기업은 경쟁력을 유지하기 위해 연구개발에 많은 투자를 실시하여 AI 기술의 진보의 최전선에 있음을 보장합니다.

혁신 및 전문화가 시장 성공을 촉진 AI 인프라 시장에서의 성공은 지속적인 혁신과 업계 고유의 전문성에 달려 있습니다.

시스코의 생성형 AI 솔루션 시스코는 제네레이티브 AI를 활용한 새로운 네트워크, 보안, 관측 가능성을 발표하고 경쟁 우위를 확보하기 위한 혁신의 중요성을 강조했습니다.

Mphasis.ai의 산업 포커스 : Mphasis는 기존 기술 환경에 AI 기능을 통합하고 특정 분야의 업무 효율성을 최적화하는 데 주력하고 있습니다.

전략적 파트너십 : Google 클라우드의 AI 컨설팅 서비스 확대는 기업이 전략적 제휴를 활용하여 제공하는 서비스를 확장하고 새로운 시장을 개척하는 방법을 보여줍니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도-Porter's Five Forces 분석

- 소비자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 시장에 대한 COVID-19의 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 고성능 컴퓨팅 데이터센터의 AI 하드웨어 수요 증가

- IIoT 및 자동화 기술의 용도 확대

- 머신러닝 및 딥러닝 기술의 용도 확대

- 자동차나 헬스케어 등의 산업에서 생성되는 방대한 데이터량

- 시장 성장 억제요인

- 업계에서 숙련된 전문가의 부족

제6장 시장 세분화

- 제품별

- 하드웨어

- 프로세서

- 스토리지

- 메모리

- 소프트웨어

- 하드웨어

- 전개별

- 온프레미스

- 클라우드

- 하이브리드

- 최종 사용자별

- 기업

- 정부기관

- 클라우드 서비스 제공업체

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 아시아

- 중국

- 인도

- 한국

- 일본

- 호주 및 뉴질랜드

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 카타르

- 이스라엘

- 남아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Intel Corporation

- Nvidia Corporation

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- Sensetime Group Inc.

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services Inc.

- Cisco Systems Inc.

- Arm Holdings

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Advanced Micro Devices

- Synopsys Inc.

제8장 투자 분석

제9장 시장의 미래

AJY 25.04.07The AI Infrastructure Market size is estimated at USD 82.23 billion in 2025, and is expected to reach USD 205.65 billion by 2030, at a CAGR of 20.12% during the forecast period (2025-2030).

AI Infrastructure Market: Driving Innovation and Efficiency

Key Highlights

- Demand Surge in High-Performance Computing Data Centers: The AI Infrastructure market is experiencing exponential growth, driven by increasing demand for AI hardware in high-performance computing (HPC) data centers. Businesses are realizing the transformative potential of artificial intelligence, fueling investments across various industries.

- Nvidia's BlueField-3 DPU: This technology, the world's first 400GbE data processing unit (DPU), is ten times faster than its predecessor, underscoring significant advancements in AI hardware.

- Google Cloud and Intel Collaboration: These tech giants jointly developed a chip designed to enhance AI capabilities, security, and productivity in data centers, marking a trend of strategic partnerships.

- AMD's MI300X Series: Advanced Micro Devices Inc. introduced the MI300X chip series, enabling the execution of generative AI models with up to 80 billion parameters, demonstrating the escalating complexity of AI models.

- IIoT and Automation Technologies Propelling Growth: The integration of Industrial Internet of Things (IIoT) and automation technologies is significantly boosting the AI Infrastructure market. These innovations are enhancing efficiency, optimizing processes, and generating valuable data.

- AFCOM 2021 Study Results: Over 40% of participants plan to deploy robotics and automation in data center monitoring and maintenance by 2024, signaling a sharp rise in automation.

- Advantech and Actility Integration: These companies launched an AI-based solution for machine prognostics and health management, enabling real-time machine status monitoring.

- TD SYNNEX's Data-IoTSolv: This solution suite equips partners with tools for leveraging data analytics and IoT, illustrating the growing demand for AI-powered IoT solutions.

- Machine Learning and Deep Learning Driving Innovation: Machine learning and deep learning technologies are critical drivers of AI infrastructure growth, empowering companies to extract valuable insights from massive datasets.

- TAZI.AI's Funding Success: The startup secured $4.6 million to roll out machine learning solutions in healthcare, insurance, and pharmaceuticals, highlighting sector-specific AI adoption.

- Government Sector Utilization: Machine learning is increasingly used in government sectors to automate operations and analyze data, freeing human resources for core functions.

- Pandemic-Era Acceleration: The pandemic sped up AI and ML adoption for network automation, with network providers recognizing the essential role of AI in operational streamlining.

- Data Explosion in Automotive and Healthcare Sectors: The growing volume of data in industries like automotive and healthcare is propelling the need for advanced AI technologies to manage and analyze data efficiently.

- Alpine Health Systems' AI-Powered Platform: This platform simplifies hospital discharge processes for patients with complex medical conditions, demonstrating AI's potential in healthcare management.

- Intangles Lab's Ambient Cognitive AI for EVs: This innovation addresses range anxiety in electric vehicles, particularly in the commercial EV sector.

- AI in Healthcare Applications: AI is increasingly used for clinical decision-making, disease diagnosis, and patient data management, showcasing its versatility in healthcare.

- Market Landscape and Future Outlook: The AI Infrastructure market is poised for sustained growth, led by a mix of tech giants, startups, and cloud providers delivering cutting-edge solutions.

- Cloud Segment Growth: The AI Infrastructure cloud market, valued at $16.12 billion in 2022, is forecasted to reach $49.29 billion by 2028, reflecting a CAGR of 20.22%.

- North American Market Leadership: North America led the AI infrastructure market in 2022 with $19.57 billion in value, projected to hit $56.59 billion by 2028, growing at a 19.10% CAGR.

- Emerging Technologies: Innovations like quantum computing, 6G connectivity, and advanced robotics are expected to push the boundaries of AI infrastructure capabilities, enabling new applications and use cases.

AI Infrastructure Market Trends

Hardware Segment Cornerstone of AI Infrastructure

- Market Size and Growth: The hardware segment is the backbone of the AI Infrastructure market. In 2022, it accounted for 73.70% of the market share, valued at $34.52 billion. It is expected to grow at a CAGR of 19.19%, reaching $100.29 billion by 2028.

- Processor Subsegment Leads: Processors were valued at $20.73 billion in 2022 and are forecasted to reach $57.56 billion by 2028, driven by the increasing complexity of AI algorithms requiring more powerful processing.

- Customization Trend: Companies are shifting towards custom AI chips, like Huawei's Ascend 910 AI processor, which demonstrated twice the training speed of common cards using TensorFlow.

- Edge Computing Influence: The rise of edge computing is shaping AI processor development. Manufacturers are focusing on processors that enable real-time data processing at the point of use, particularly in IoT applications.

- Hybrid Processors: Companies are developing hybrid AI processors that combine CPUs with GPUs or Neural Processing Units (NPUs), enhancing versatility and efficiency for diverse AI applications.

North America to Hold Major Market Share

Cloud Segment: Catalyst for AI Democratization

- Rapid Growth Trajectory: The cloud segment, valued at $16.12 billion in 2022, is projected to grow at a 20.22% CAGR, reaching $49.29 billion by 2028. This growth is outpacing the overall market CAGR, signaling the critical role of cloud solutions in AI infrastructure.

- Democratization of AI: Cloud-based AI infrastructure lowers adoption barriers, making AI technologies accessible to businesses of all sizes. This democratization accelerates digital transformation and fosters innovation.

- Scalability and Flexibility: Cloud platforms offer unmatched scalability, enabling enterprises to easily manage AI workloads, such as model training and inference, which are data-intensive.

- AI-as-a-Service Proliferation: The rise of AI-as-a-Service (AIaaS) allows companies to access pre-trained models and toolsets. For example, Nvidia's DGX Cloud offers supercomputing services for AI model training, while Salesforce's AI Cloud delivers enterprise-ready AI tools.

- Strategic Collaborations: Collaborations between AI hardware providers and cloud platforms, such as Google Cloud's partnership with Singapore's Smart Nation initiative, are creating sector-specific AI cloud solutions.

- Market Outlook: The AI Infrastructure market will continue to evolve with the hardware and cloud segments developing synergistically. As AI applications proliferate, the demand for scalable, robust infrastructure will grow, spurring further specialization in AI hardware and cloud-native solutions.

AI Infrastructure Industry Overview

Tech Giants Lead the Market: The AI Infrastructure market is dominated by tech giants like Intel, Nvidia, IBM, Microsoft, and Samsung. These companies hold significant market share due to their extensive resources, comprehensive AI solutions, and global reach.

Nvidia's DGX Cloud Service: This AI supercomputing service enables businesses to train sophisticated generative AI models, showcasing the company's leadership in providing end-to-end AI infrastructure solutions.

IBM and Microsoft Hybrid Solutions: Both companies have developed hybrid cloud solutions that integrate AI capabilities, empowering enterprises to deploy AI across various environments efficiently.

Substantial R&D Investments: Leading players invest heavily in research and development to maintain their competitive edge, ensuring they stay at the forefront of AI technology advancements.

Innovation and Specialization Drive Market Success: Success in the AI Infrastructure market hinges on continuous innovation and industry-specific specialization.

Cisco's Generative AI Solutions: Cisco introduced new network, security, and observability offerings powered by generative AI, highlighting the importance of innovation in gaining a competitive edge.

Mphasis.ai's Industry Focus: Mphasis focuses on integrating AI capabilities into existing technological environments, optimizing operational efficiency in specific sectors.

Strategic Partnerships: Google Cloud's expansion of AI consulting services exemplifies how companies can leverage strategic collaborations to broaden their offerings and tap into new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for AI Hardware in High-performance Computing Data Centers

- 5.1.2 Increasing Applications of IIoT and Automation Technologies

- 5.1.3 Rising Application of Machine Leaning and Deep Learning Technologies

- 5.1.4 Huge Volume of Data Being Generated in Industries such as Automotive and Healthcare

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professionals in the Industry

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Hardware

- 6.1.1.1 Processor

- 6.1.1.2 Storage

- 6.1.1.3 Memory

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.2.3 Hybrid

- 6.3 By End User

- 6.3.1 Enterprises

- 6.3.2 Government

- 6.3.3 Cloud Service Providers

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 South Korea

- 6.4.3.4 Japan

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 Saudi Arabia

- 6.4.6.2 United Arab Emirates

- 6.4.6.3 Qatar

- 6.4.6.4 Israel

- 6.4.6.5 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Nvidia Corporation

- 7.1.3 Samsung Electronics Co. Ltd

- 7.1.4 Micron Technology Inc.

- 7.1.5 Sensetime Group Inc.

- 7.1.6 IBM Corporation

- 7.1.7 Google LLC

- 7.1.8 Microsoft Corporation

- 7.1.9 Amazon Web Services Inc.

- 7.1.10 Cisco Systems Inc.

- 7.1.11 Arm Holdings

- 7.1.12 Dell Inc.

- 7.1.13 Hewlett Packard Enterprise Development LP

- 7.1.14 Advanced Micro Devices

- 7.1.15 Synopsys Inc.