|

시장보고서

상품코드

1689976

이더넷 컨트롤러 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Ethernet Controller - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

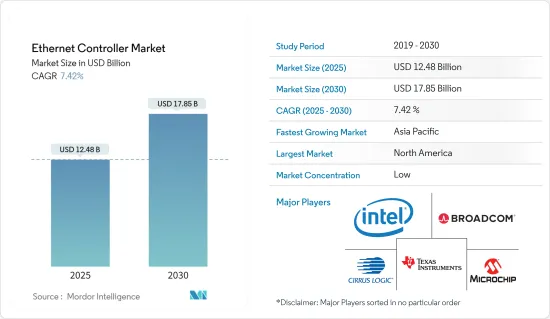

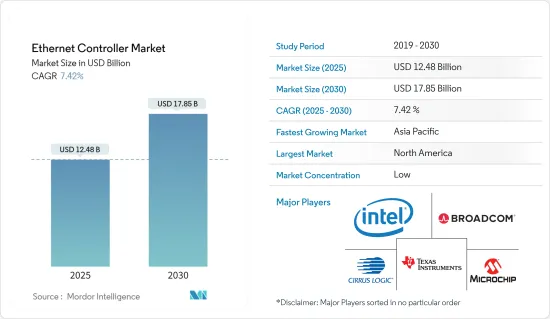

이더넷 컨트롤러 시장 규모는 2025년에 124억 8,000만 달러로 추정되고, 예측 기간 2025년부터 2030년까지 CAGR 7.42%로 성장할 전망이며, 2030년에는 178억 5,000만 달러에 이를 것으로 예측됩니다.

현대의 디지털 경제에서 데이터센터와 클라우드 컴퓨팅의 채택이 증가하고 있다는 것이 시장을 견인하고 있습니다. 과학적 발견부터 인공지능(AI)에 이르기까지 최신 데이터센터는 세계에서 가장 중요한 과제를 해결하는 데 필수적입니다. 이러한 최신 데이터센터는 네트워크 대역폭을 확장하고 AI와 같은 워크로드를 최적화하기 위해 변모하고 있습니다.

데이터 양 증가는 이더넷 컨트롤러의 필요성을 높이고 시장 성장을 가속하고 있습니다. Ericsson Mobility Report에 따르면 데이터 패킷 요금이 낮아지고 스마트폰 사용이 증가함에 따라 인도 전체의 데이터 트래픽이 가속화되고 있습니다. 이 보고서는 모바일 데이터 트래픽 양이 2025년까지 월간 21엑사바이트 이상에 달할 것으로 예측됩니다.

제어 자동화 기술용 이더넷(EtherCAT)은 CANopen 프로토콜과 이더넷을 기반으로 합니다. 그러나 인터넷 및 네트워크 통신과 달리 산업 자동화 제어에 최적화되어 있습니다. OSI 네트워크 모델을 활용하여 Ethernet과 EtherCAT은 동일한 물리 계층과 데이터 링크 계층에 의존합니다. 그 이상으로 두 네트워크는 서로 다른 작업에 최적화되어 있기 때문에 설계상 분기됩니다.

USB-이더넷 컨버터는 다양한 상황에서 유용합니다. 예를 들어, 사용자 노트북의 Wi-Fi 옵션이 기술적인 문제를 경험했거나 사용자가 인터넷 액세스가 필요함에도 불구하고 특정 위치에서는 보안상의 이유로 Wi-Fi가 비활성화되어 있음을 알 수 있습니다. 이러한 상황에서는 이더넷 포트와 간단한 어댑터로 충분합니다.

이러한 장기 연장 계약은 시장을 포화시키고 성장에 영향을 미치기 때문에 시장은 기술적 업데이트를 신속하게 수행하는 데 장애가 될 것으로 예상됩니다. 업계 동향에서 솔루션 제공업체와 서비스 제공업체는 이더넷 컨트롤러와 같은 새로 출현한 기술을 사용해야 하며 장기 계약은 시장에 역효과가 있을 수 있습니다. 게다가 시장 경쟁의 격화는 기존 벤더의 이익률과 성장에 영향을 미칩니다. 공급업체 간의 경쟁 수준은 매우 높으며 이더넷 컨트롤러 제품은 전 세계적으로 상품화되고 있습니다.

공급 감소로 인한 예기치 않은 수요 변동으로 인해 여러 부품 제조업체가 생산 체제를 강화했지만 여전히 불충분합니다. 성장의 주요 원동력은 세계 경제의 디지털화에 대한 지속적인 투자, 5G 기술 배포, 데이터센터 및 클라우드 서비스에 대한 왕성한 투자입니다. 5G 스마트폰의 급속한 보급과 클라우드의 지속적인 강화로 고속 연결에 대한 수요가 증가하고 있기 때문에 시장은 향후 수년간 성장할 것으로 예상됩니다. 에릭슨에 따르면 5G 계약 수는 2019년에서 2028년에 걸쳐 전 세계적으로 각각 1,200만 건 이상에서 45억 건 이상으로 크게 증가할 것으로 예측됩니다.

이더넷 컨트롤러 시장 동향

서버가 가장 큰 시장 점유율을 차지합니다.

- 대부분의 기업은 이메일, 웹사이트, 온라인 거래 등 데이터를 저장해야 하며, 이는 서버에서 수행될 수 있습니다. 서버는 기업의 로컬 네트워크 또는 대부분의 경우 인터넷에 연결된 전용 컴퓨터입니다. 기업의 규모가 작으면 서버를 사내에 놓고 독자적으로 운용할 수도 있습니다. 그러나 조직과 수요가 증가함에 따라 더 많은 데이터가 생성되므로 더 많은 서버와 스토리지 공간이 필요합니다. 일반적인 데이터센터 인프라에는 강력한 컴퓨터인 서버가 많이 포함되어 있습니다.

- 서버는 데이터센터에 전력을 공급하고 클라우드 환경을 지원하기 때문에 서버 업계는 수많은 미션 크리티컬 기업 및 클라이언트 측 컴퓨팅 업무의 백본이 되었습니다. 엔터프라이즈가 빅데이터 및 고급 워크로드 요구사항을 충족시키려고 하는 동안, 고성능 서버에 대한 수요는 계속 증가하고 있습니다. 클라우드 컴퓨팅, AI, 빅데이터 및 데이터센터가 증가함에 따라 서버 요구도 크게 증가합니다. 이러한 서버 수요가 증가함에 따라 이더넷 컨트롤러도 증가합니다.

- 베이스보드 관리 컨트롤러(BMC)는 대부분의 최신 서버의 온도, 전압 및 팬을 모니터링합니다. 시스템의 무언가가 관리자의 주의를 필요로 하는 경우(예 : CPU 과열), BMC는 일반적으로(전자 메일 또는 SNMP 경고의 형태로) 알림을 보내도록 구성될 수 있습니다.

- 애플리케이션 디바이스 큐(ADQ), 동적 디바이스 개인화(DDP), iWARP 및 RoCEv2 원격 직접 메모리 액세스(RDMA) 지원은 인텔 이더넷 800 시리즈 컨트롤러에 포함되어 있습니다. 워크로드에 최적화된 성능과 변화하는 네트워크 요구 사항에 대응하는 유연성을 제공합니다. NFV, 스토리지, HPC-AI, 하이브리드 클라우드 등의 고성능 서버 애플리케이션을 위해 800 시리즈 컨트롤러는 최대 100GbE의 속도를 제공합니다.

- 또한 NetXtreme-E 시리즈 BCM57414 50G PCIe 3.0 이더넷 컨트롤러는 브로드콤의 확장 가능한 10/25/50/100/200G 이더넷 컨트롤러 아키텍처를 기반으로 합니다. 이 아키텍처는 고성능 컴퓨팅, 통신, 머신러닝, 스토리지 디스어그리게이션, 데이터 분석 등 엔터프라이즈 및 클라우드 스케일 네트워킹 및 스토리지 애플리케이션을 위한 확장성이 뛰어나고 기능이 풍부한 네트워킹 솔루션을 서버에 구축하도록 설계되었습니다.

- 에릭슨에 따르면 데이터 트래픽은 2030년까지 3배가 될 것으로 예상됩니다. 2023년에는 전 세계 스마트폰이 월평균 20.37기가바이트의 모바일 데이터를 사용하여 전년 15.93기가바이트에서 증가했습니다. 이 숫자는 2024년에는 25.17기가바이트, 2028년에는 47.27기가바이트에 이를 것으로 예상됩니다. 따라서 이러한 규모를 쉽게 연결하는 데 필요한 저지연과 광대역폭을 확보할 수 있는 분산형 클라우드가 실용화되고 있습니다. 일부 기술 선도자들은 서버와 컴퓨팅 요구를 관리하면서 심각한 문제를 해결하고 있습니다. 고밀도화의 주요 요인은 AI에 대한 데이터 분석의 급증입니다.

북미가 가장 큰 시장 점유율을 차지합니다.

- 5G가 그 잠재력을 완전히 발휘하려면 유연한 네트워킹과 운송 인프라가 필요합니다. 이더넷이 가장 효율적인 전송 기술이 됨에 따라 통신 사업자의 라우터와 스위치는 공유 인프라에서 다양한 이용 사례를 지원해야 하며 이더넷 기어의 도입이 증가하고 있습니다.

- 에릭슨에 따르면 북미에서는 2019년부터 2028년까지 5G 계약 수가 107만 건 이상에서 4억 540만 건 이상으로 급증할 것으로 예측되고 있습니다. 미국에서 5G 산업의 이러한 대규모 성장으로 시장에서는 이더넷 컨트롤러에 대한 수요도 예상됩니다.

- 이더넷 컨트롤러는 컴퓨터 네트워크에 유선 연결을 허용하므로 고속 인터넷 연결이 필요한 장비는 고속 인터넷 연결을 위해 이더넷 컨트롤러를 사용해야 합니다. 클라우드 인프라 네트워크가 그렇습니다. 클라우드 기능이 개발되고 기업 업무가 클라우드로 전환됨에 따라 미국에서는 클라우드 애플리케이션에 대한 수요가 급속히 증가하고 있습니다.

- 저비용, 유지 보수 완화, 데이터 보안 및 거의 무제한 확장성을 통해 향후 몇 년동안 클라우드 스토리지 솔루션을 선택하는 기업이 늘어날 것으로 보입니다. 따라서 이 클라우드 컴퓨팅과 스토리지 증가는 이더넷 컨트롤러 시장에서도 급증할 것으로 보입니다.

- 캐나다의 첨단 통신 연구센터인 CRC(Communication Research Center)는 캐나다인들이 최첨단 통신 시스템, 기술 및 애플리케이션을 활용할 수 있도록 5G 기술을 도입하기 위해 노력하고 있습니다. GSMA에 따르면 2030년까지 5G 연결은 캐나다 전체 모바일 연결의 95%를 차지할 것으로 예상됩니다.

이더넷 컨트롤러 산업 개요

이더넷 컨트롤러 시장은 세계 기업 및 중소기업이 모두 존재하기 때문에 매우 단편화되었습니다. 주요 진출기업은 Intel Corporation, Broadcom Inc., Microchip Technology Inc., Cirrus Logic Inc., Texas Instruments Incorporated 등입니다. 시장 진출기업은 제품 라인업을 강화하고 지속 가능한 경쟁 우위를 확보하기 위해 제휴 및 인수와 같은 전략을 채택하고 있습니다.

2024년 4월-Microchip은 ADAS와 디지털 조종석 커넥티비티의 선구자인 VSI를 인수하여 자동차 네트워킹을 확장했습니다. 이 시장 인수로 Microchip의 광범위한 이더넷 및 PCIe 자동차 네트워크 제품 포트폴리오에 ASA Motion Link 기술이 추가되어 차세대 소프트웨어 정의 차량을 구현할 수 있습니다.

2024년 3월-Marvell Technology Inc.는 TSMC와의 제휴를 통해 고속 인프라 수요를 충족하는 업계 선구적인 2nm 반도체 기술 플랫폼을 발표했습니다. Marvell 2nm 플랫폼은 광범위한 IP 제품군으로 많은 인프라 요구를 충족합니다. 여기에는 200Gbps 이상의 고속 롱 리치 SerDes, 프로세서 서브시스템, 암호화 엔진, 시스템 온 칩 패브릭, 칩 간 상호 연결, 컴퓨팅, 메모리, 네트워킹, 스토리지용 광대역 물리 계층 인터페이스 등이 포함됩니다. 이러한 진보는 클라우드에 최적화된 맞춤형 컴퓨팅 가속기, 이더넷 스위치, 광 및 구리선 상호 연결을 위한 디지털 신호 프로세서, AI 클러스터, 클라우드 데이터센터 및 유사한 고성능 인프라에 필수적인 기타 장치를 개발하기 위한 기초입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도-Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 주요 거시 경제 동향의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 기계 제어용 실시간 네트워크에 EtherCat의 채용

- USB 이더넷 컨트롤러의 채용

- 시장 성장 억제요인

- COVID-19의 영향으로 수요 감소

- 경쟁가격에 따른 엄격한 이익률

제6장 시장 세분화

- 대역폭 유형별

- 고속 이더넷

- 기가비트 이더넷

- 스위치 이더넷

- 기능별

- PHY(물리층)

- 통합

- 최종 사용자별

- 서버

- 라우터 스위치

- 소비자 용도

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 아시아

- 인도

- 중국

- 일본

- 호주 및 뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Intel Corporation

- Broadcom Inc.

- Microchip Technology Inc.

- Cirrus Logic Inc.

- Texas Instruments Incorporated

- Silicon Laboratories Inc.

- Marvell Technology Group

- Realtek Semiconductor Corp.

- Cadence Design Systems Inc.

- Futurlec Inc.

제8장 투자 분석

제9장 시장 기회 및 향후 동향

AJY 25.04.07The Ethernet Controller Market size is estimated at USD 12.48 billion in 2025, and is expected to reach USD 17.85 billion by 2030, at a CAGR of 7.42% during the forecast period (2025-2030).

The increasing adoption of data centers and cloud computing in the modern digital economy drives the market. From scientific discoveries to artificial intelligence (AI), modern data centers are crucial to solving some of the world's most important challenges. These modern data centers are transforming to increase networking bandwidth and optimize workloads, like AI.

The increasing data volume heightened the need for Ethernet controllers, thereby driving the market's growth. According to the Ericsson Mobility Report, the decline in data packet charges and increased smartphone usage accelerated data traffic across India. The report estimates that the volume of mobile data traffic is expected to reach over 21 exabytes per month by 2025.

Ethernet for Control Automation Technology (EtherCAT) is based on the CANopen protocol and Ethernet. However, it differs from Internet or network communications in that it is specifically optimized for industrial automation control. Utilizing the OSI network model, Ethernet and EtherCAT rely on the same physical and data link layers. Beyond that, the two networks diverge by design as they are optimized for different tasks.

A USB-to-ethernet converter is useful in various circumstances. For example, a user's laptop's Wi-Fi option may be experiencing technical difficulties, or the user may discover that the Wi-Fi is disabled for security reasons in specific locations despite users requiring internet access. An Ethernet port and a simple adapter should suffice in such circumstances, as a cable will provide a faster and more consistent connection.

The market is expected to create a roadblock for itself to update faster on technology, as such long-duration contracts with extensions saturate the market, thus impacting its growth. When the industry trends indicate that the solution and service providers should use new and emerging technology, such as Ethernet controllers, long-term contracts can be counterproductive in the market. Moreover, the growing competition in the market impacts the profit margins and growth of the existing vendors. The level of competition between suppliers is so high that Ethernet controller products are transitioning to be commoditized in the world.

The unanticipated swing in demand with reduced supply led to the ramping of production by several component manufacturers, which still fell short. The primary drivers behind the growth are the continued investments in digitizing global economies, the deployment of 5G technologies, and the robust investments in data centers and cloud services. The market is expected to witness growth in the coming years, owing to the increase in the demand for high-speed connectivity, driven by the ongoing 5G smartphone ramp-up and the continued strength of the cloud. According to Ericsson, 5G subscriptions are forecast to increase drastically from 2019 to 2028 globally, from over 12 million to over 4.5 billion subscriptions, respectively.

Ethernet Controller Market Trends

Servers to Hold the Largest Market Share

- Most businesses require data storage, whether for their email, website, or online transactions, and this may be done on a server. Servers are specialized computers linked to a company's local network and, in most cases, the Internet. If a company is small enough, it may keep its servers in-house and run them independently. However, as organizations and their demands expand, more servers and storage space are required as more data is generated. A typical data center infrastructure includes many servers, which are powerful computers.

- As servers power data centers and support cloud environments, the server industry is the backbone of innumerable mission-critical and client-side corporate computing operations. As businesses seek to power big data and advanced workload requirements, demand for higher-performing servers continues to climb. With the increasing cloud computation, AI, big data, and data centers, the need for servers will also grow significantly. With this growing demand for servers, Ethernet controllers will also increase.

- A baseboard management controller (BMC) monitors most modern servers' temperature, voltages, and fans. When something in the system requires an administrator's attention (such as the CPU overheating), the BMC may generally be set to send out notifications (in the form of emails and SNMP alerts).

- Application device queues (ADQ), dynamic device personalization (DDP), and support for both iWARP and RoCEv2 Remote Direct Memory Access (RDMA) are included in Intel Ethernet 800 Series controllers. It provides workload-optimized performance and the flexibility to meet changing network requirements. For high-performance server applications, including NFV, storage, HPC-AI, and hybrid cloud, the 800 Series controllers provide speeds up to 100GbE.

- Further, the NetXtreme-E Series BCM57414 50G PCIe 3.0 Ethernet controller is based on Broadcom's scalable 10/25/50/100/200G Ethernet controller architecture. This architecture is designed to build highly scalable, feature-rich networking solutions in servers for enterprise and cloud-scale networking and storage applications, such as high-performance computing, telco, machine learning, storage disaggregation, and data analytics.

- According to Ericsson, the data traffic is expected to triple by 2030. In 2023, smartphones across the globe used an average of 20.37 gigabytes of mobile data per month, up from 15.93 gigabytes the previous year. This figure is expected to reach 25.17 gigabytes in 2024 and 47.27 gigabytes by 2028. Thus, the distributed cloud that can secure the low latency and high bandwidth required to connect such scale easily is coming into action. Several technology giants are addressing the critical challenges while managing their servers and computational needs. A major factor responsible for the rising densities is the rapid rise of data-crunching for AI.

North America Holds Largest Market Share

- 5G requires a flexible networking and transportation infrastructure to reach its full potential. As Ethernet becomes the most efficient transport technology, carrier routers and switches are being charged with supporting a range of use cases over shared infrastructure, increasing Ethernet gear installations.

- According to Ericsson, 5G subscriptions are predicted to increase drastically in North America from 2019 to 2028, from over 1.07 million to over 405.4 million. With such massive growth in the 5G industry in the United States, the market will also see demand for Ethernet controllers.

- As an Ethernet controller allows wired connections to a computer network, any device requiring a high-speed internet connection has to use Ethernet controllers for fast internet connections. Such is the case with cloud infrastructure networks. With developing cloud capabilities and enterprises shifting their work to the cloud, the demand for cloud applications is increasing rapidly in the United States.

- Due to low costs, less maintenance, data security, and almost unlimited scalability, more businesses will opt for cloud storage solutions in the coming years. Therefore, this rise in cloud computing and storage will also surge in the ethernet controller market.

- The Communications Research Centre (CRC), Canada's leading advanced telecommunications research center, is dedicated to bringing 5G technology to Canadians to ensure they can use state-of-the-art telecommunications systems, technologies, and applications. According to GSMA, by 2030, 5G connections are predicted to account for 95% of all mobile connections in Canada.

Ethernet Controller Industry Overview

The ethernet controller market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Intel Corporation, Broadcom Inc., Microchip Technology Inc., Cirrus Logic Inc., and Texas Instruments Incorporated. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In April 2024, Microchip acquired ADAS and Digital Cockpit Connectivity Pioneer VSI Co. Ltd to extend automotive networking. The market acquisition adds ASA Motion Link technology to Microchip's broad Ethernet and PCIe automotive networking portfolio to enable next-generation software-defined vehicles.

In March 2024, Marvell Technology Inc., in partnership with TSMC, unveiled the industry's pioneering 2 nm semiconductor technology platform, tailored for high-speed infrastructure demands. The Marvell 2 nm platform, an extensive IP suite, addresses many infrastructure needs. It includes high-speed long-reach SerDes exceeding 200 Gbps, processor subsystems, encryption engines, system-on-chip fabrics, chip-to-chip interconnects, and high-bandwidth physical layer interfaces for computing, memory, networking, and storage. These advancements form the cornerstone for developing bespoke cloud-optimized compute accelerators, Ethernet switches, digital signal processors for optical and copper interconnects, and other devices crucial for fueling AI clusters, cloud data centers, and similar high-performance infrastructure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 An Assessment of the Impact of Key Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of EtherCat for Realtime Network for Machine Control

- 5.1.2 Adoption of USB Ethernet Controllers

- 5.2 Market Restraints

- 5.2.1 Low Demand Due to Impact of COVID-19

- 5.2.2 Competitive Prices Led to Stiff Profit Margins

6 MARKET SEGMENTATION

- 6.1 By Bandwidth Type

- 6.1.1 Fast Ethernet

- 6.1.2 Gigabit Ethernet

- 6.1.3 Switch Ethernet

- 6.2 By Function

- 6.2.1 PHY (Physical Layer)

- 6.2.2 Integrated

- 6.3 By End Users

- 6.3.1 Servers

- 6.3.2 Routers and Switches

- 6.3.3 Consumer Applications

- 6.3.4 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Broadcom Inc.

- 7.1.3 Microchip Technology Inc.

- 7.1.4 Cirrus Logic Inc.

- 7.1.5 Texas Instruments Incorporated

- 7.1.6 Silicon Laboratories Inc.

- 7.1.7 Marvell Technology Group

- 7.1.8 Realtek Semiconductor Corp.

- 7.1.9 Cadence Design Systems Inc.

- 7.1.10 Futurlec Inc.