|

시장보고서

상품코드

1690829

제형 개발 아웃소싱 : 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2025-2030년)Global Formulation Development Outsourcing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

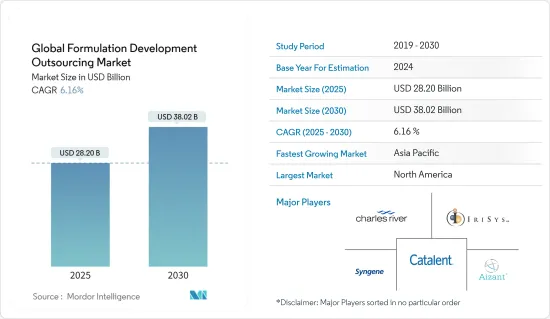

세계의 제형 개발 아웃소싱 시장 규모는 2025년에 282억 달러로 추정되고, 2030년에는 380억 2,000만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 6.16%를 나타낼 전망입니다.

코로나19 팬데믹으로 인해 각국의 보건 시스템은 바이러스 퇴치를 위한 연구 개발에 빠르게 투자하고 있으며, 이는 제형 개발 아웃소싱 시장에도 큰 영향을 미치고 있습니다. 예를 들어, 2020년 10월 AiPharma는 코로나19 경구용 항바이러스제 아비간/리코무스 개발을 위해 제약, 제조, 유통 분야의 글로벌 리더들로 구성된 컨소시엄에 합류했습니다. 컨소시엄의 일원으로서 AiPharma는 COVID-19 및 기타 11개 전염병을 표적으로 하는 광범위한 경구용 항바이러스제인 파비피라비르의 모든 제형을 상용화합니다. 따라서 팬데믹의 시작은 제형 개발 아웃소싱 시장에 큰 도움이 되었습니다. 또한 2021년 8월에 발표된 '제약 기술, 2021 아웃소싱 리소스 보충'이라는 제목의 기사에 따르면 제약 아웃소싱 시장은 특히 코로나19 팬데믹에 대한 업계의 대응으로 인해 지난 한 해 동안 백신 개발 및 제조 활동이 성장한 것으로 나타났습니다. 그 결과 제형 개발 아웃소싱 활동이 증가하여 시장 성장에 기여했습니다.

또한 주요 의약품의 특허 보호 만료 추세와 서비스를 아웃소싱하는 제약 및 바이오 제약 회사의 수가 증가하는 것도 시장 성장을 촉진하는 주요 요인입니다. 주요 의약품의 특허 보호 만료가 증가하는 추세가 시장 성장을 주도하고 있습니다. 예를 들어, 제네릭 및 바이오시밀러 전략의 2021년 업데이트에 따르면, 제네릭의 품질을 개선하고 효율적이고 경쟁력 있는 제네릭 시장을 보장하기 위한 지속적인 조치의 일환으로 한국 식품의약품안전처(MFDS)는 2021년에 158개의 의약품 특허가 만료될 것으로 예상한다고 발표했습니다. 식약처의 그린 리스트에 따르면 이 중 44개 특허는 해당 제품에 대한 다른 특허가 없어 즉시 제네릭 진입이 가능한 것으로 나타났습니다. 따라서 신규 후보물질에 대한 제형 개발 아웃소싱의 필요성이 증가하여 시장 성장에 기여하고 있습니다.

그러나 제약 산업의 구조적 변화와 제형 개발을 통한 의약품 개발 프로세스를 수행하기 위한 자금 부족은 시장 성장을 저해하는 주요 요인입니다.

제형 개발 아웃소싱 시장 동향

예측기간 동안 종양학이 크게 성장할 전망

용도별로는 종양학 부문은 시장에서 주요 점유율을 차지할 것으로 예상됩니다. 이는 전 세계적으로 암 발병률이 증가하고 있기 때문일 수 있습니다. 세계보건기구(WHO)에 따르면 2020년 암으로 인한 사망자 수는 약 1,000만 명에 달했습니다. 또한 미국 암 협회의 2021년 통계에 따르면 2040년에는 전 세계적으로 암으로 인한 부담이 2,750만 건의 신규 발병과 1,630만 건의 암 사망으로 늘어날 것으로 예상됩니다.

안정성, 용해도, 생체 이용률 등 제형 문제는 약물 개발 과정에서 중요한 고려 사항이기 때문에 항암제 개발은 매우 중요한 역할을 합니다. 따라서 대부분의 제약 서비스 회사는 항암제 개발을 위한 엔드투엔드 솔루션을 제공하기 위해 항암제 제형 개발에 집중하고 있습니다. P예를 들어, 2021년 11월 Oncology Pharma Inc.는 나노스마트 파마슈티컬스(NanoSmart Pharmaceuticals Inc.)와의 공동 개발 프로젝트에서 선도 약물 후보 개발에 대한 계획을 밝혔습니다. 또한, 2021년 10월에는 미국의 계약 의약품 개발 및 제조 사업부인 메트릭스 컨트랙트 서비스(Metrics Contract Services)가 ESSA 파마슈티컬스와 개발 및 제조 계약을 체결했습니다. Metrics는 계약의 일환으로 경구 투여 항암제의 지속적인 임상 개발을 지원하기 위해 제형 개발, 분석 서비스 및 제조를 제공할 예정입니다.

따라서 높은 암 발병률과 바이오 제약 회사의 암 치료제에 대한 관심 증가는 예측 기간 동안이 부문의 성장에 도움이 될 것으로 예상됩니다.

예측기간 중 북미가 큰 시장 점유율을 차지할 전망

북미 지역에서는 미국이 시장의 주요 점유율을 차지할 것으로 예상됩니다. 이는 만성 질환의 부담이 증가하고 있고 특히 미국에서 이 지역의 주요 플레이어가 존재하기 때문일 수 있습니다. 대부분의 주요 의약품이 특허 만료 단계에 있기 때문에 주요 업체들이 신약 개발에 참여하고 있습니다. 이러한 맥락에서 제약 회사는 제형 개발에서 일련의 임상 시험 및 평가 연구에 대한 시간과 투자를 절약하기 위해 CRO에 제형 개발 서비스를 아웃소싱하고 있으며, 이는이 지역의 시장 성장을 주도 할 수 있습니다.

또한, 코로나19 팬데믹 상황에서 여러 공동 연구 프로그램이 생물의학첨단연구개발청(BARDA), 전염병대비혁신연합(CEPI) 등의 기관과 협력하여 치료제와 백신을 발전시키는 과정을 빠르게 진행하고자 노력하고 있습니다. 예를 들어, 2020년 5월 미국 상무부 산하 국립표준기술연구소(NIST)는 신종 코로나 발병에 대응하여 큰 영향을 받은 바이오의약품 제조 프로젝트에 약 890만 달러를 지원했습니다. 따라서 이는 제형 개발을위한 아웃소싱 증가에 기여하여 시장 성장에 기여하고 있습니다.

게다가 여러 시장 진출 기업이 전략적 노력하며, 시장 성장에 기여하고 있습니다.

따라서 위의 요인으로 인해 시장은 예측 기간 동안 크게 성장할 것으로 예상됩니다.

제형 개발 아웃소싱 산업 개요

제형 개발 아웃소싱 시장은 적당히 경쟁이 치열합니다. harles River Laboratories, Aizant Drug Research Solutions Private Limited, Catalent Inc., Laboratory Corporation of America Holdings, Syngene International Ltd등 몇사가 최대 점유율을 차지하고 있습니다. 주요 시장 진출기업은 인수, 협업, 신제품 출시 등 다양한 전략적 제휴를 통해 글로벌 제품 포트폴리오를 확장하고 글로벌 시장에서의 입지를 확보하기 위해 진화하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 주요 의약품의 특허 보호 만료 증가 추세

- 서비스를 아웃소싱하는 제약 및 바이오 제약 회사의 수 증가

- 시장 성장 억제요인

- 제약산업의 구조변화

- 제형 개발을 통한 의약품 개발 프로세스 수행을위한 자금 부족

- 산업의 매력 - Porter's Five Forces 분석

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 서비스별

- 프리포뮬레이션 서비스

- 신약 및 전임상 검사 서비스

- 분석 서비스

- 제제 최적화

- 1상

- 2상

- 3상

- 4상

- 프리포뮬레이션 서비스

- 제형별

- 주사제

- 경구제

- 외용제

- 기타

- 용도별

- 종양학

- 유전자 질환

- 신경학

- 감염증

- 호흡기

- 순환기

- 기타

- 최종 사용자별

- 제약회사와 바이오제약회사

- 정부기관과 학술기관

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Charles River Laboratories

- Aizant Drug Research Solutions Private Limited

- Catalent Inc.

- Laboratory Corporation of America Holdings

- Syngene International Ltd

- Irisys LLC

- Intertek Group PLC

- Piramal Pharma Solutions

- QIoTient Sciences

- Patheon(Thermo Fisher Scientific Inc.)

- Emergent BioSolutions Inc.

- Lonza Group AG

- Dr. Reddy's Laboratories Ltd

제7장 시장 기회와 앞으로의 동향

HBR 25.05.09The Global Formulation Development Outsourcing Market size is estimated at USD 28.20 billion in 2025, and is expected to reach USD 38.02 billion by 2030, at a CAGR of 6.16% during the forecast period (2025-2030).

Amid the COVID-19 pandemic, countries' health systems are rapidly investing in research and development to combat the virus, having a significant impact on the formulation development outsourcing market. For instance, in October 2020, AiPharma joined a global consortium of pharmaceutical, manufacturing, and distribution leaders to advance oral antiviral Avigan/Reeqomus for COVID-19. As a part of the consortium, AiPharma commercializes all formulations of favipiravir, a broad spectrum oral antiviral drug that targets COVID-19 and 11 other infectious diseases. Thus, the onset of the pandemic has significantly benefitted the formulation development outsourcing market. Moreover, as per an article titled 'Pharmaceutical Technology, 2021 Outsourcing Resources Supplement', published in August 2021, the pharmaceutical outsourcing market has seen a growth in vaccine development and manufacturing activity in the past year, particularly due to the industry's response to the COVID-19 pandemic. As a result of which, there has been an increase in the formulation development outsourcing activities, thereby contributing to the market growth.

Furthermore, the major factors fueling the market growth are the increasing trend of patent protection expiration of major drugs and the rising number of pharmaceutical and biopharmaceutical companies outsourcing their services. The increasing trend of patent protection expiration of major drugs is driving the market growth. For instance, as per a 2021 update by the Generics and Biosimilar Initiative, as part of ongoing action to improve the quality of generics and ensure an efficient and competitive generics market, the Korean Ministry of Food and Drug Safety (MFDS) announced that 158 patents for pharmaceutical products were anticipated to expire in 2021. As per the same source, the MFDS's Green List (a list similar to the US Food and Drug Administration's (FDA) Orange Book) shows that 44 of the patents will be ready for immediate generics entry, having no other patents on the products involved. Thus, this increases the need for formulation development outsourcing for newer candidates, thereby contributing to the market growth.

However, structural changes in the pharmaceutical industry and insufficient funding to perform the drug development process through formulation development are the major factors hindering the market growth.

Formulation Development Outsourcing Market Trends

The Oncology Segment is Expected to Witness Significant Growth over the Forecast Period

By application, the oncology segment is anticipated to hold a major share of the market. This can be attributed to the rising incidence rates of cancer cases globally. According to the World Health Organization (WHO), cancer accounted for approximately 10 million deaths in 2020. Additionally, as per the 2021 statistics by the American Cancer Society, by 2040, the global burden of cancer is expected to grow to 27.5 million new cases and 16.3 million cancer deaths.

Formulation development plays a vital role in anti-cancer drugs, as formulation issues, including stability, solubility, and bioavailability, are important considerations for the drug development process. Hence, most pharma service companies are focused on oncology formulation development to provide end-to-end solutions for oncology drug development. For instance, in November 2021, Oncology Pharma Inc. revealed plans for the development of a lead drug candidate in a co-development project with NanoSmart Pharmaceuticals Inc. Likewise, in October 2021, Metrics Contract Services, the US-based contract pharmaceutical development and manufacturing division of Mayne Pharma entered a development and manufacturing agreement with ESSA Pharmaceuticals. Metrics will provide formulation development, analytical services, and manufacturing to support the ongoing clinical development of an orally administered oncology drug as a part of the agreement.

Thus, the high incidence rates of cancer cases and the increasing focus on cancer therapeutics by biopharmaceutical companies are expected to aid in the growth of the segment over the forecast period.

North America is Expected to Hold Significant Market Share over the Forecast Period

Within North America, the United States is expected to hold a major share of the market. This can be attributed to the growing burden of chronic diseases and the presence of key players in the region, especially in the United States. As most of the major drugs are in the stage of patent expiration, key players are involved in novel drug development. In this context, to save time and investment on a series of clinical trials and evaluation studies in formulation development, pharmaceutical companies are outsourcing formulation development services to CROs, which may drive market growth in the region.

Additionally, amid the COVID-19 pandemic, several collaborative research programs are looking to fast-track their process in terms of advancing therapeutics and vaccines by collaborating with institutions, such as the Biomedical Advanced Research and Development Authority (BARDA) and Coalition for Epidemic Preparedness Innovations (CEPI). For instance, in May 2020, the United States Department of Commerce's National Institute of Standards and Technology (NIST) funded around USD 8.9 million to the highly impacted biopharmaceutical manufacturing projects in response to the emerged outbreak. Therefore, such initiatives are contributing to the increasing outsourcing for formulation development, thereby contributing to the market growth.

Moreover, several market players are engaged in the implementation of strategic initiatives, thereby contributing to market growth. For instance, in January 2022, Recro Pharma Inc., a contract development and manufacturing organization (CDMO) dedicated to solving complex formulation and manufacturing challenges primarily in small molecule therapeutic development, reported being awarded a new formulation development and cGMP manufacturing contract from a key department of the United States government.

Thus, due to the above-mentioned factors, the market is expected to witness significant growth over the forecast period.

Formulation Development Outsourcing Industry Overview

The formulation development outsourcing market is moderately competitive. In terms of market share, a few companies, such as Charles River Laboratories, Aizant Drug Research Solutions Private Limited, Catalent Inc., Laboratory Corporation of America Holdings, and Syngene International Ltd, among others, hold the largest market shares. Key market players are evolving through various strategic alliances, such as acquisitions, collaborations, and new product launches, to expand their global product portfolios and secure their positions in the global market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Trend of Patent Protection Expiration of Major Drugs

- 4.2.2 Rising Number of Pharmaceutical and Biopharmaceutical Companies Outsourcing Their Services

- 4.3 Market Restraints

- 4.3.1 Structural Changes in the Pharmaceutical Industry

- 4.3.2 Insufficient Funding to Perform the Drug Development Process Through Formulation Development

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Service

- 5.1.1 Pre-formulation Services

- 5.1.1.1 Discovery and Preclinical Services

- 5.1.1.2 Analytical Services

- 5.1.2 Formulation Optimization

- 5.1.2.1 Phase I

- 5.1.2.2 Phase II

- 5.1.2.3 Phase III

- 5.1.2.4 Phase IV

- 5.1.1 Pre-formulation Services

- 5.2 By Dosage Form

- 5.2.1 Injectable

- 5.2.2 Oral

- 5.2.3 Topical

- 5.2.4 Other Dosage Forms

- 5.3 By Application

- 5.3.1 Oncology

- 5.3.2 Genetic Disorders

- 5.3.3 Neurology

- 5.3.4 Infectious Diseases

- 5.3.5 Respiratory

- 5.3.6 Cardiovascular

- 5.3.7 Other Applications

- 5.4 By End User

- 5.4.1 Pharmaceutical and Biopharmaceutical Companies

- 5.4.2 Government and Academic Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle-East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Charles River Laboratories

- 6.1.2 Aizant Drug Research Solutions Private Limited

- 6.1.3 Catalent Inc.

- 6.1.4 Laboratory Corporation of America Holdings

- 6.1.5 Syngene International Ltd

- 6.1.6 Irisys LLC

- 6.1.7 Intertek Group PLC

- 6.1.8 Piramal Pharma Solutions

- 6.1.9 Qiotient Sciences

- 6.1.10 Patheon (Thermo Fisher Scientific Inc.)

- 6.1.11 Emergent BioSolutions Inc.

- 6.1.12 Lonza Group AG

- 6.1.13 Dr. Reddy's Laboratories Ltd