|

시장보고서

상품코드

1797390

통신 공급업체 시장 : 시장은 회복세, 관세는 오랜 그림자가 드리워져(2025년 2분기)Telecoms Biggest Vendors, 2Q25: Vendor Market Bounces Back, but Tariffs Cast a Long Shadow |

||||||

이 보고서 시리즈의 목적은 통신 업계의 의사 결정자에게 업계의 지출 동향과 공급업체 시장력에 대한 종합적인 관점을 제공하는 것입니다. 이를 위해 광범위한 기업 유형 및 기술 부문에 걸쳐 통신 업계에서 기술 공급업체의 수익을 평가합니다.

이 보고서는 137개 통신 네트워크 인프라공급업체를 추적하고 2013년 1분기부터 2025년 2분기까지의 수익 및 시장 점유율 추정치를 제공합니다. 이들 137개 기업 중 111개 기업은 현재 통신 사업자를 대상으로 판매하고 있으며, 기타 대부분은 데이터베이스 내에서 다른 회사에 인수되고 있습니다. 예를 들어 ADVA는 현재 Adtran의 일부이지만 과거의 판매 실적이 있기 때문에 두 회사 모두 데이터베이스에 남아 있습니다.

비주얼

보고서 하이라이트 :

- 매출액 : 통신 네트워크 인프라공급업체의 수익은 2025년 2분기에 약 543억 달러에 달했으며 전년 동기 대비 2.0% 증가했습니다. 연간 환산 수익은 약 2,077억 달러로 0.7% 증가하여 9분기 연속 축소 경향을 벗어나 네트워크 인프라 투자의 완만한 회복을 보여줍니다. 2024년 전반에 시장 감소를 완화시키는 역할을 했던 Huawei는 2025년 2분기에 다시 하락세로 돌아섰습니다. Huawei의 데이터를 제외하면 시장 수익의 성장은 더욱 강해지고 있습니다.

- 주요 공급업체 : 전통적인 지도자인 Huawei, Ericsson, Nokia는 연간 환산 기준으로 시장의 약 35%를 차지했으며 2025년 2분기 단독으로 36.8%를 차지했습니다. Huawei 시장 점유율은 2021년 이후 현저하게 약해졌으며, 2025년에도 중국 국외에서 지속적인 압력에 직면해 있습니다. 한편 China Comservice, ZTE 등 공급업체들은 4위와 5위 자리를 둘러싼 경쟁을 계속하고 있습니다.

- 전년 동기 대비 수익 성장률을 통한 주요 공급업체 : 2025년 2분기에는 Dixon Technologies와 Wiwynn이 전년 동기 대비 수익 성장을 이끌었습니다. Dixon은 지난해 낮은 비교 기준이 성장을 뒷받침했으며, Wiwynn은 AI 주도 디지털 변환과 관련된 데이터센터 인프라 확장으로 성장했습니다. Broadcom도 VMware 인수로 성장을 계속하고 있습니다. 한편 Alphabet, Microsoft, Amazon, Dell Technologies, Harmonic도 디지털 전환 관련 제공을 통해 성장했습니다.

- 지출 전망 : 2025년후반 이후의 전망은 여전히 신중하고 완만한 성장이 예측되지만 거시 경제의 불확실성, 관세 및 지정 긴장에 의해 억제 될 전망입니다. 자본 지출은 지역 및 통신 사업자의 준비 상황에 따라 다르며, 시장 전체는 진화하는 기술 사이클과 지정학적 복잡성을 극복하면서 진행해 나갈 것입니다.

조사 대상

기재 기업

|

|

목차

제1장 보고서 하이라이트

제2장 요약: 조사 결과 해설

제3장 통신 네트워크 인프라 시장 : 최신 결과

제4장 톱 25 공급업체 : 인쇄 가능한 티어 시트

제5장 차트 : 각 공급업체의 스냅샷

제6장 차트 : 공급업체 5사 비교

제7장 공급업체별 연구개발비

제8장 원시 데이터 : 기업별 수익 예측

제9장 조사 방법·전제

제10장 MTN Consulting 정보

SHW 25.09.03The goal of this report series is to equip telecom industry decision-makers with a comprehensive view of spending trends and vendor market power in their industry. To do this we assess technology vendors' revenues in the telecom vertical, across a wide range of company types and technology segments. We call this market "telco network infrastructure", or "Telco NI." This study tracks 137 Telco NI vendors, providing revenue and market share estimates for the 1Q13-2Q25 period (i.e. 50 quarters). Of these 137 vendors, 111 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

VISUALS

Below are the key highlights of the report:

- Revenues: Telco Network Infrastructure (NI) vendor revenues reached approximately $54.3 billion in 2Q25, representing a 2.0% YoY increase. Annualized revenue edged up 0.7% to about $207.7 billion, snapping a nine-quarter contraction and signaling a modest recovery in network infrastructure investments. Huawei, which assisted in softening the market decline earlier in 2024, reverted to a downtrend in 2Q25. Without Huawei's data included, market revenue growth is much stronger.

- Top vendors: The traditional leaders Huawei, Ericsson, and Nokia accounted for roughly 35% of the Telco NI market on an annualized basis and 36.8% in 2Q25 alone. Huawei's market share has weakened notably since 2021 and faced persistent pressure outside China in 2025. Meanwhile, vendors like China Comservice and ZTE maintained their fight for the 4th and 5th positions.

- Key vendors by YoY revenue growth: Dixon Technologies and Wiwynn led YoY revenue growth in 2Q25, fueled by Dixon's a low year-ago base, and Wiwynn's expansion in data center infrastructure linked to AI-driven digital transformation. Broadcom's surge continues, boosted by its VMware acquisition. Meanwhile, Alphabet, Microsoft, Amazon, Dell Technologies, and Harmonic grew through their digital transformation offerings.

- Spending outlook: The outlook for 2H25 and beyond remains cautious, with gradual growth expected but tempered by macroeconomic uncertainty, tariffs, and geopolitical tensions. Capital spending will vary by region and operator readiness, as the broader market navigates evolving technology cycles and geopolitical complexities.

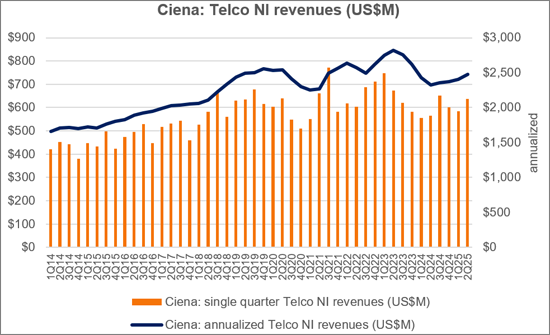

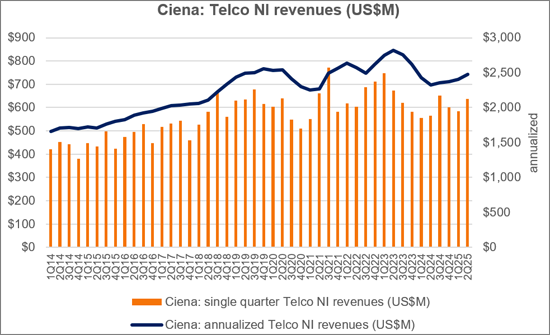

Note: Several companies, including Ciena, were estimated for 2Q results due to the unavailability of official financial reports for the April-June period on a calendar-year basis. These estimates will be revised and updated as more accurate data becomes available.

Research Coverage

Companies Listed:

|

|