|

시장보고서

상품코드

1723658

비바이러스 약물 전달 시스템 시장(제3판) : 전달되는 분자 유형별, 전달되는 생물 제제 유형별, 사용되는 부형제 유형별, 표적 치료 영역별, 주요 지역별, 주요 기업별 업계 동향 및 예측(-2035년)Non-Viral Drug Delivery Systems Market:3rd Edition by Type of Molecule Delivered, Type of Biologic Delivered, Type of Vehicle Used, Target Therapeutic Area, Key Geographical Regions and Leading Players: Industry Trends and Global Forecasts, till 2035 |

||||||

비바이러스 약물 전달 시스템 시장

세계의 비바이러스 약물 전달 시스템 시장 규모는 현재 86억 달러로, 시장은 예측 기간 동안 9.0%의 연평균 복합 성장률(CAGR)로 확대될 전망이며, 2035년까지 204억 달러에 달할 것으로 예측됩니다.

비바이러스 약물 전달 시스템 시장 기회는 다음 부문에 분포되어 있습니다.

전달되는 분자 유형별

- 생물 제제

- 저분자

전달되는 생물 제제 유형별

- RNA

- DNA

- 단백질 및 펩티드

- 항체

사용되는 부형제 유형별

- 나노입자

- 세포외 소포

- 폴리머

- 올리고뉴클레오티드

- 세포관통 펩티드

표적 치료 영역별

- 종양 질환

- 감염증

- 심혈관 질환

- 유전자 질환

- 간장애

- 대사 질환

- 신경 질환

- 폐 질환

- 희귀 질환

- 기타 질환

결제 방법

- 계약 일시금

- 마일스톤

주요 지역별

- 북미(미국 및 캐나다)

- 유럽(영국, 독일, 벨기에, 아일랜드, 덴마크, 기타 유럽 전역)

- 아시아태평양(한국, 호주, 중국)

비바이러스 약물 전달 시스템 시장 : 성장 및 동향

비바이러스 약물 전달은 유전자 물질 및 생물학적 치료제를 세포, 조직 및 기관에 전달하기 위한 바이러스 벡터를 대체하는 유망한 선택이 되는 혁신적인 접근법입니다. 특히 최근에는 세포내 비바이러스 약물 전달 방법 중 일부는 약물 전달의 효율성에 큰 지지를 얻고 있습니다. 이처럼 세포 내 비바이러스 약물 전달법에 대한 이해관계자들의 관심이 높아지고 있는 것은 안전성 향상, 표적 세포에 대한 높은 특이성, 면역 반응을 활성화하는 위험 감소 등 바이러스 벡터에 비해 비바이러스 벡터와 관련된 다양한 이점이 있기 때문으로 보입니다. 게다가 비바이러스성 벡터는 돌연변이 발생 가능성을 낮추기 때문에 유전자 도입을 위한 바람직한 선택지가 됩니다. 또, 아데노 수반 바이러스 벡터와 같은 바이러스 벡터에 비해, 보다 큰 페이로드를 운반할 수 있기 때문에, 표적 약물 전달에 대한 용도가 퍼집니다. 비바이러스성 벡터의 주목할 만한 예로는 나노입자(특히 지질 나노입자), 세포 투과성 펩타이드(CPP), 엑소좀 기반 약물 전달 시스템 등이 있습니다. 이러한 비바이러스성 벡터는 세포 내 단백질이나 효소를 표적으로 하는 특수한 메커니즘을 활용하여 일반적으로 컨쥬케이션이나 캡슐화 기술을 이용하여 RNA, 펩타이드, 항체, 단백질, DNA를 세포 내로 전달합니다. 약물 전달의 표적화를 통해 치료제의 적절한 농도가 의도된 생리학적 작용 부위에 도달하는 것이 보장되어 표적 외 작용이나 전신 독성을 최소화하면서 임상 효과를 극대화할 수 있습니다. 또한 세포 생물학과 약물 전달 시스템의 진보로 세포막 내에 국소화되기 위해 이전에는 치료 불가능하다고 생각되었던 잠재적인 치료 표적이 몇 가지 발견되고 있는 것도 중요합니다.

2024년 9월, NanoSyrinx는 세포 내 도달하기 어려운 부위에 생물 제제를 전달하기 위해 설계된 세포내 나노시린지 기술을 전진시키기 위해 1,300만 달러의 시드 자금을 확보했습니다. 이 개발에 대해 에드윈 모세 박사(NanoSyrinx 이사회장)는 'NanoSyrinx의 기술은 치료약의 세포내 전달과 관련된 기존의 과제에 긍정적인 변화를 가져올 것을 약속합니다. 저는 이사회에 합류하여 이번 자금 조달의 기세를 더욱 가속화하여 막대한 가치를 창출하고 환자의 생활에 진정한 변화를 가져올 수 있는 이 독특한 플랫폼의 추가 개발에 있어 동사와 그 리더십 팀을 지원할 수 있게 된 것을 기쁘게 생각합니다.'라고 전했습니다.

조사에 의하면 발암성 단백질, 세포대사 조절인자, 주요 신호전달 경로의 구성요소 등 인간 프로테옴의 20% 이상이 세포막 내에 국소화돼 있습니다. 인간 유전자의 10%밖에 저분자 약제로 효과적으로 표적화할 수 없다는 점을 감안하면 업계 전문가들은 세포 내 치료, 특히 유전자 전달이 기존 치료를 대체할 유력한 선택지가 될 것으로 보고 있습니다. 비바이러스 약물 전달 시스템의 개발에 있어서 기술 혁신의 진행 페이스와 맞물려 표적화 비바이러스 약물 전달에 대한 수요가 증가하고 있는 것으로부터, 시장 전체는 예측 기간 중 큰폭의 시장 성장이 전망됩니다.

비바이러스 약물 전달 시스템 시장 : 주요 인사이트

이 보고서는 비바이러스 약물 전달 시스템 시장의 현재 상태를 파악하고 업계의 잠재적 성장 기회를 확인합니다. 본 보고서의 주요 포인트는 다음과 같습니다. :

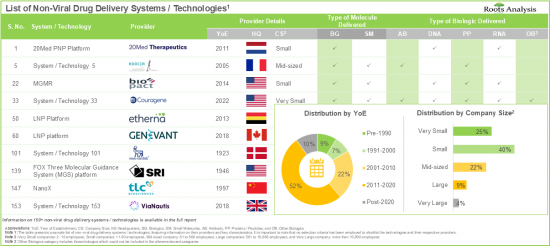

- 시스템 및 기술의 45% 이상은 약물을 캡슐화하고 세포질로의 전달을 촉진하는 비히클을 채용하고 있습니다.

- 비바이러스 약물 전달 시스템에 대한 다양한 이해관계자들의 관심 증가가 관련 지적자본의 확대로 이어진 것은 분명합니다.

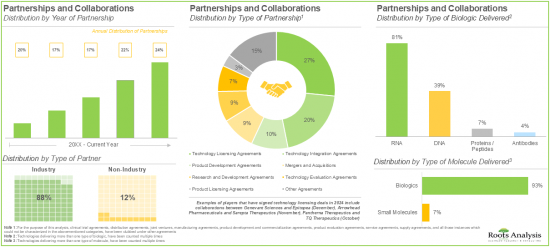

- 50% 이상의 이해관계자가 다양한 비바이러스 약물 전달 시스템 및 기술의 라이선스 공여, 통합, 평가를 목적으로 한 파트너십을 체결했습니다.

- 효과적인 비바이러스 치료제에 대한 수요 고조로 비바이러스 약물 전달 시스템 시장 전체는 향후 10년간 9%의 성장이 예상되고 있습니다.

비바이러스 약물 전달 시스템 시장 : 주요 부문

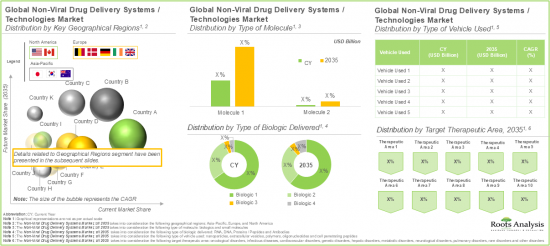

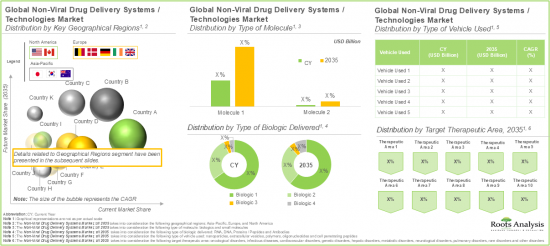

분자 유형별로 세계 시장은 저분자와 생물 제제로 구분됩니다. 이 유형 중 생물 제제 부문은 현재 시장 전체에서 가장 큰 점유율을 차지합니다. 이는 특정 복잡한 생물학적 경로를 표적으로 하여 보다 높은 정확도와 유효성을 제공하는 능력에 기인하고 있습니다.

전달되는 생물 제제별로 세계의 비바이러스 약물 전달 시스템 시장은 RNA, DNA, 단백질 및 펩티드, 항체로 구분됩니다. 현재 RNA 부문이 시장 전체에서 가장 높은 점유율을 차지하고 있습니다. 그러나 항체 부문은 예측 기간 동안 비교적 높은 CAGR로 성장할 것으로 예측된다는 점에 유의하는 것이 중요합니다.

사용되는 부형제 유형별로, 세계의 비바이러스 약물 전달 시스템 시장은 나노입자, 세포외 소포, 폴리머, 올리고뉴클레오티드, 세포관통 펩티드로 세분화됩니다. 현재 나노입자 부문은 비바이러스 약물 전달 시스템 시장을 선도하고 있습니다. 이 동향은 앞으로도 바뀌지 않을 것을 강조해 두고 싶습니다. 이것은 나노입자의 독특한 사이즈와 표면적 대 체적비의 크기에 의한 것으로, 특정 조직을 타겟으로 하기 위해 정밀하게 설계할 수 있어 다른 약물 전달 비히클과 비교하여 약물 방출의 제어가 가능합니다.

세계의 비바이러스 약물 전달 시스템 시장은 대상으로 하는 치료 영역별로는 종양성 질환, 감염증, 심혈관 질환, 유전성 질환, 간 질환, 대사성 질환, 신경 질환, 폐 질환, 희귀질환 및 기타 질환으로 구분됩니다. 현재 시장은 종양 질환 치료를 목적으로 한 시스템에서 얻을 수 있는 수익이 지배적입니다. 그러나 빠르게 진화하는 병원체에 대한 효과적인 표적치료가 시급해짐에 따라 감염병 시장은 예측 기간 동안 높은 성장률을 보일 것으로 예상됩니다.

세계의 비바이러스 약물 전달 시스템 시장은 채용되는 결제 유형별로는 일시금과 마일스톤 지불에 분포하고 있습니다. 현재로서는 일시금 부문이 비바이러스 약물 전달 시스템 시장에서 가장 높은 점유율을 차지하고 있습니다. 게다가 이 동향은 앞으로도 바뀔 것 같지 않다는 것을 강조해 두고 싶습니다.

시장은 주요 지역별로 북미, 유럽, 아시아태평양으로 구분됩니다. 현재 북미가 최대 시장 점유율을 차지하고 있습니다. 또한 아시아태평양 지역은 예측 기간 동안 비교적 높은 CAGR로 성장할 것으로 예상된다는 점은 주목할 만합니다.

이 보고서에서 대답하는 주요 질문

- 현재, 이 시장에 참가하고 있는 기업은 몇사인가

- 이 시장의 주요 기업

- 이 시장의 진화에 영향을 줄 것 같은 요인

- 현재 및 미래 시장 규모

- 이 시장의 CAGR

- 현재 및 미래 시장 기회는 주요 시장 부문에 어떻게 분배될 것인가

이 보고서를 구입하는 이유

- 이 보고서는 종합적인 시장 분석을 제공하며 시장 전체와 특정 하위 부문에 대한 자세한 수익 예측을 제공합니다. 이 정보는 이미 시장을 선도하고 있는 기업에 있어서도, 신규 참가 기업에 있어서도 귀중한 것입니다.

- 이해관계자는 시장 내 경쟁력학을 보다 깊이 이해하기 위해 보고서를 활용할 수 있습니다. 경쟁 상황을 분석함으로써 기업은 시장에서의 포지셔닝을 최적화하고 효과적인 시장 진입 전략을 개발하기 위해 정보에 입각한 의사결정을 할 수 있습니다.

- 이 보고서는 주요 촉진요인 및 억제요인과 과제 등 시장의 종합적인 개요를 이해관계자에게 제공합니다. 이 정보는 이해관계자가 시장 동향을 항상 파악하고 성장 전망을 활용하기 위한 데이터 주도의 의사 결정을 하기 위한 힘이 됩니다.

기타 혜택

- PPT 인사이트 팩

- 보고서의 모든 분석 모듈의 무료 엑셀 데이터 팩

- 10% 무료 컨텐츠 커스터마이즈

- 조사팀에 의한 상세 보고서의 워크스루 세션

- 보고서가 6-12개월 이상 전인 경우, 무료 갱신 보고서

본 보고서에서는 세계의 비바이러스 약물 전달 시스템 시장에 대해 조사했으며, 시장 개요와 함께 전달되는 분자 유형별, 전달되는 생물 제제 유형별, 사용되는 부형제 유형별, 표적 치료 영역별, 주요 지역별, 주요 기업별 동향, 시장 진출 기업 프로파일 등의 정보를 제공합니다.

목차

섹션 I : 보고서 개요

제1장 서문

제2장 조사 방법

제3장 시장 역학

제4장 거시경제지표

섹션 II : 질적 인사이트

제5장 주요 요약

제6장 서문

섹션 III : 시장 개요

제7장 기술의 정세

- 장의 개요

- 비바이러스성 약물 전달 : 시스템 및 기술의 전체 상황

- 비바이러스성 약물 전달 : 시스템 및 기술 제공업체의 전반적인 상황

제8장 기술 경쟁력 분석

- 장의 개요

- 전제 및 주요 파라미터

- 조사 방법

- 비바이러스 약물 전달 시스템 및 기술 : 기술 경쟁력 분석

섹션 IV : 기업 프로파일

제9장 기업 프로파일

- 장의 개요

- Arcturus Therapeutics

- Bio-Path Holdings

- CureVac

- Entos Pharmaceuticals

- etherna

- Matinas Biopharma

- MDimune

- PCI Biotech

섹션 V : 시장 동향

제10장 특허 분석

- 장의 개요

- 범위 및 조사 방법

- 비바이러스 약물 전달 시스템 및 기술 : 특허 분석

- 특허 평가별 분석

제11장 파트너십 및 협업

제12장 기회 평가 프레임워크 : KALBACH 혁신 모델, 경쟁 평가

프레임워크 및 BCG 매트릭스

- 장의 개요

- KALBACH 혁신 모델

- 경쟁 평가 프레임워크

- BCG 매트릭스

섹션 VI : 시장 기회 분석

제13장 세계의 비바이러스 약물 전달 시스템 시장

- 장의 개요

- 주요 전제 및 조사 방법

- 세계의 비바이러스 약물 전달 시스템 시장 : 예측(-2035년)

- 주요 시장 세분화

제14장 비바이러스 약물 전달 시스템 시장 : 전달되는 분자 유형별

제15장 비바이러스 약물 전달 시스템 시장 : 전달되는 생물 제제 유형별

제16장 비바이러스 약물 전달 시스템 시장 : 사용되는 부형제 유형별

제17장 비바이러스 약물 전달 시스템 시장 : 대상 치료 영역별

제18장 비바이러스 약물 전달 시스템 시장 : 결제 방법별

제19장 비바이러스 약물 전달 시스템 시장 : 주요 지역별

제20장 비바이러스 약물 전달 시스템 시장 : 주요 기업별

섹션 VII : 기타 독점 인사이트

제21장 결론

제22장 주요 인사이트

제23장 부록 1 : 표 형식 데이터

제24장 부록 2 : 기업 및 단체 일람

AJY 25.05.23NON-VIRAL DRUG DELIVERY SYSTEMS MARKET

As per Roots Analysis, the global non-viral drug delivery systems market size is valued at $8.6 billion in the current year and is projected to reach $20.4 billion by 2035, growing at a CAGR of 9.0% during the forecast period.

The opportunity for non-viral drug delivery systems market has been distributed across the following segments:

Type of Molecule Delivered

- Biologics

- Small Molecules

Type of Biologics Delivered

- RNA

- DNA

- Proteins / Peptides

- Antibodies

Type of Vehicle Used

- Nanoparticles

- Extracellular Vesicles

- Polymers

- Oligonucleotides

- Cell Penetrating Peptides

Target Therapeutic Area

- Oncological Disorders

- Infectious Diseases

- Cardiovascular Disorders

- Genetic Disorders

- Hepatic Disorders

- Metabolic Disorders

- Neurological Disorders

- Pulmonary Disorders

- Rare Disorders

- Other Disorders

Type of Payment Employed

- Upfront Payments

- Milestone Payments

Key Geographical Regions

- North America (US and Canada)

- Europe (UK, Germany, Belgium, Ireland, Denmark and Rest of Europe)

- Asia-Pacific (South Korea, Australia and China)

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: GROWTH AND TRENDS

Non-viral drug delivery represents an innovative approach that serves as a promising alternative to viral vectors for delivering genetic material or biotherapeutics to cells, tissues or organs. Notably, in recent years, several intracellular non-viral drug delivery methods have gained significant traction owing to their efficiency in delivering drugs. This growing interest of stakeholders in intracellular non-viral drug delivery methods can be attributed to the various advantages associated with non-viral vectors over viral vectors, including enhanced safety, higher specificity towards the target cells and a reduced risk of activating immune responses. Moreover, non-viral vectors lower the likelihood of mutagenesis, making them a preferred option for gene delivery. They can also carry larger payloads compared to the viral vectors, such as adeno-associated viral vectors, increasing their applications in targeted drug delivery. Notable examples of non-viral vectors include nanoparticles (particularly lipid nanoparticles), cell penetrating peptides (CPPs) and exosome-based drug delivery systems. These non-viral vectors leverage specialized mechanisms to target intracellular proteins and enzymes, typically employing conjugation and / or encapsulation techniques to deliver RNA, peptides, antibodies, proteins and DNA into cells. Targeted drug delivery ensures that an adequate concentration of therapeutic agents reaches the intended physiological site of action, maximizing the clinical benefits while minimizing off-targets effects and systemic toxicity. Additionally, it is important to highlight that the ongoing advancements in cell biology and drug delivery systems have uncovered several potential therapeutic targets that were previously considered incurable owing to their localization within the cell membrane.

In September 2024, NanoSyrinx secured $13 million in seed funding to advance its intracellular nanosyringe technology, designed to target biologics in hard-to-reach sites within cells. Reflecting on the development, Dr. Edwin Moses (Chairman of Board of Directors, NanoSyrinx), quoted that "NanoSyrinx's technology promises to make a positive difference to the existing challenges associated with intracellular delivery of therapeutics. I am delighted to join the Board and help build on the momentum of this latest fundraise, to support the company and its leadership team in the further development of this unique platform which has the potential to create enormous value and make a real difference to patients' lives".

Research suggests that over 20% of the human proteome, including oncogenic proteins, cell metabolism regulators, and components of key signaling pathways are localized within the cell membrane. Given that only 10% of the human genome can be effectively targeted with small molecule drugs, industry experts see intracellular therapies, particularly gene delivery, as a compelling alternative to conventional treatments. Given the increasing demand for targeted non-viral drug delivery coupled with the ongoing pace of innovation in the development of non-viral drug delivery systems, the overall market is anticipated to witness substantial market growth during the forecast period.

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: KEY INSIGHTS

The report delves into the current state of the non-viral drug delivery systems market and identifies potential growth opportunities within the industry. The key takeaways of the report are:

- More than 45% of the systems / technologies employ vehicles that encapsulate the drug payloads and facilitate their delivery into the cytosol of the cell.

- The rising interest of various stakeholders in non-viral drug delivery systems has evidently led to the expansion of associated intellectual capital; notably, most (54%) of the patents were filed in the North American jurisdiction.

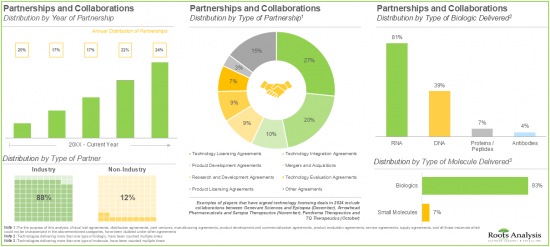

- More than 50% of the partnerships were signed by the stakeholders to license, integrate and evaluate different non-viral drug delivery systems / technologies; most of the inked deals focused on biologics, particularly RNA.

- Owing to the rising demand for effective non-viral therapeutics, the overall non-viral drug delivery systems market is anticipated to witness a growth of 9% over the next decade.

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: KEY SEGMENTS

Biologics are Likely to Hold the Largest Share of the Non-Viral Drug Delivery Systems Market During the Forecast Period

Based on the type of molecule, the global market is segmented into small molecules and biologics. Amongst these types, the biologics segment occupies the largest share of the current overall market. This can be attributed to their ability to target specific, complex biological pathways, offering greater precision and efficacy.

Based on the Type of Biologic Delivered, RNA Segment Captures the Majority of the Current Market Share

Based on the type of biologic delivered, the global non-viral drug delivery systems market is segmented into RNA, DNA, proteins / peptides and antibodies. Presently, the RNA segment occupies the highest share of the overall market. However, it is important to note that the antibodies' segment is anticipated to grow at a relatively higher CAGR during the forecast period.

Nanoparticles Segment is Likely to Hold the Largest Share in the Non-Viral Drug Delivery Systems Market During the Forecast Period

Based on the type of vehicle used, the global non-viral drug delivery systems market is segmented into nanoparticles, extracellular vesicles, polymers, oligonucleotides and cell penetrating peptides. Currently, nanoparticles segment leads the non-viral drug delivery systems market. It is important to highlight that this trend is unlikely to change in the future as well. This is due to the unique size and large surface area-to-volume ratio of nanoparticles which enables them to be precisely engineered in order to target specific tissues, allowing for controlled drug release as compared to other drug delivery vehicles.

Non-Viral Drug Delivery Systems Market for Oncological Disorders is Likely to Grow at a Relatively Faster Pace During the Forecast Period

Based on the target therapeutic area, the global non-viral drug delivery systems market is segmented across oncological disorders, infectious diseases, cardiovascular disorders, genetic disorders, hepatic disorders, metabolic disorders, neurological disorders, pulmonary disorders, rare disorders and other disorders. Presently, the market is dominated by the revenues generated through the systems intended for the treatment of oncological disorders. However, the market for infectious disease is anticipated to witness a higher growth rate during the forecast period owing to the pressing need for effective targeted treatments against rapidly evolving pathogens.

Upfront Payments are Likely to Dominate the Non-Viral Drug Delivery Systems Market During the Forecast Period

Based on the type of payment employed, the global non-viral delivery systems market is distributed across upfront payments and milestone payments. Presently, the upfront segment occupies the highest share in the non-viral drug delivery systems market. Further, it is important to highlight that this trend is unlikely to change in the future as well.

North America Accounts for the Largest Share in the Market

Based on key geographical regions, the market is segmented into North America, Europe, and Asia Pacific. In the current scenario, North America is likely to capture the largest market share. Further, it is worth highlighting that Asia-Pacific is expected to grow at a relatively high CAGR during the forecast period.

Example Players in the Non-Viral Drug Delivery Systems Market

- Arcturus Therapeutics

- Bio-Path Holdings

- CureVac

- Entos Pharmaceuticals

- etherna

- Matinas Biopharma

- MDimune

- PCI Biotech

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: RESEARCH COVERAGE

The report on non-viral drug delivery systems market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of current market opportunity and the future growth potential of non-viral drug delivery systems market, focusing on key market segments, including [A] type of molecule delivered, [B] type of biologic delivered, [C] type of vehicle used, [D] target therapeutic area, [E] type of payment employed, [F] key geographical regions, and [G] leading players.

- Market Impact Analysis: A thorough analysis of various factors, such as [A] drivers, [B] restraints, [C] opportunities, and [D] existing challenges that are likely to impact market growth.

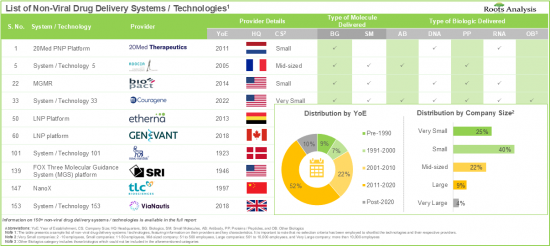

- Technology Market Landscape: A comprehensive evaluation of non-viral drug delivery systems / technologies, based on several relevant parameters, such as [A] type of molecule delivered, [B] type of biologic delivered, [C] type of drug interaction, and [D] type of vehicle used.

- Non-Viral Drug Delivery Systems / Technology Providers Landscape: The report features a list of systems / technology providers engaged in the non-viral drug delivery domain, along with analyses based on [A] year of establishment, [B] company size [C] location of headquarters, and [D] most active players.

- Technology Competitiveness Analysis: An insightful competitiveness analysis of the non-viral drug delivery systems / technologies, based on various relevant parameters, such as [A] company strength, and [B] technology strength.

- Company Profiles: Comprehensive profiles of key industry players in the non-viral drug delivery systems domain, featuring information on [A] company overview, [B] financial information (if available), [C] technology portfolio, [D] recent developments, and [E] future outlook statements.

- Patent Analysis: An in-depth analysis of various patents that have been filed / granted by various systems / technology providers related to non-viral drug delivery, based on various relevant parameters, such as [A] type of patent, [B] publication year, [C] application year, [D] issuing authority, [E] type of player, [F] top sections, [G] leading industry players (in terms of number of patents), [H] leading non-industry players (in terms of number of patents), [I] leading inventors, [J] patent benchmarking analysis, and [K] patent valuation.

- Partnerships and Collaborations: A detailed analysis of partnerships inked between stakeholders in the non-viral drug delivery market, since 2020, based on several relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] type of molecule delivered, [E] type of biologic delivered, [F] therapeutic area, [G] most active players (in terms of number of partnerships), and [H] geography.

- Opportunity Assessment Framework, Kalbach Innovation Model, Competitive Assessment Framework and BCG Matrix: An insightful framework which provides Kalbach, Ansoff and BCG matrix for respective non-viral drug delivery technologies currently employed by stakeholders across four zones of evaluation and product portfolio matrix based on various parameters, such as [A] number of drugs in the pipeline, [B] number of companies, [C] deal amount, [D] partnership activity, [E] trends related to grants, [F] number of publications, [G] google hits and qualitative scoring. It also provides Kalbach, Ansoff and BCG matrix for respective non-viral drug delivery technologies currently employed by stakeholders.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Need for Targeted Drug Delivery

- 6.3. Advanced Approaches for Delivery of Drug Payloads

- 6.3.1. Nanoparticular Delivery Systems

- 6.3.1.1. Liposomes

- 6.3.1.2. Nanoparticles / Microparticles

- 6.3.1.3. Poly-ethylene Glycol (PEG)

- 6.3.1.4. Cell Penetrating Peptides (CPPs)

- 6.3.2. Other Drug Delivery Technologies

- 6.3.1. Nanoparticular Delivery Systems

- 6.4. Future Perspectives

SECTION III: MARKET OVERVIEW

7. TECHNOLOGY LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Non-Viral Drug Delivery: Overall Systems / Technology Landscape

- 7.2.1. Analysis by Type of Molecule Delivered

- 7.2.2. Analysis by Type of Biologic Delivered

- 7.2.3. Analysis by Type of Drug Interaction

- 7.2.4. Analysis by Type of Vehicle Used

- 7.2.5. Analysis by Most Active Players

- 7.3. Non-Viral Drug Delivery: Overall Systems / Technology Providers Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

- 7.3.4. Analysis by Company Size and Location of Headquarters

- 7.3.5. Analysis by Company Size and Type of Molecule Delivered

8. TECHNOLOGY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Non-Viral Drug Delivery Systems / Technologies: Technology Competitiveness Analysis

- 8.4.1. Non-Viral Drug Delivery Systems / Technologies of Players based in North America

- 8.4.2. Non-Viral Drug Delivery Systems / Technologies of Players based in Europe

- 8.4.3. Non-Viral Drug Delivery Systems / Technologies of Players based in Asia-Pacific and Rest of the World

SECTION IV: COMPANY PROFILES

9. COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Arcturus Therapeutics

- 9.2.1. Company Overview

- 9.2.2. Technology Portfolio

- 9.2.3. Recent Developments and Future Outlook

- 9.3. Bio-Path Holdings

- 9.4. CureVac

- 9.5. Entos Pharmaceuticals

- 9.6. etherna

- 9.7. Matinas Biopharma

- 9.8. MDimune

- 9.9. PCI Biotech

SECTION V: MARKET TRENDS

10. PATENT ANALYSIS

- 10.1. Chapter Overview

- 10.2. Scope and Methodology

- 10.3. Non-Viral Drug Delivery Systems / Technologies: Patent Analysis

- 10.3.1. Analysis by Type of Patent

- 10.3.2. Analysis by Publication Year

- 10.3.3. Analysis by Application Year

- 10.3.4. Analysis by Cumulative Number of Annual Granted Patents

- 10.3.5. Analysis by Cumulative Number of Patent Applications

- 10.3.6. Analysis by Issuing Authority

- 10.3.7. Analysis by Type of Player

- 10.3.8. Analysis by Top Sections

- 10.3.9. Leading Industry Players: Analysis by Number of Patents

- 10.3.10. Leading Non-Industry Players: Analysis by Number of Patents

- 10.3.11. Leading Inventors: Analysis by Number of Patents

- 10.3.12. Non-Viral Drug Delivery Systems / Technologies: Patent Benchmarking Analysis

- 10.4. Analysis by Patent Valuation

11. PARTNERSHIPS AND COLLABORATIONS

- 11.1. Chapter Overview

- 11.2. Partnerships and Collaborations

- 11.3. Partnership Models

- 11.4. Non-Viral Drug Delivery Systems / Technologie: List of Partnerships and Collaborations

- 11.4.1. Analysis by Year of Partnership

- 11.4.2. Analysis by Type of Partnership

- 11.4.3. Analysis by Year and Type of Partnership

- 11.4.4. Analysis by Type of Partner

- 11.4.5. Analysis by Type of Molecule Delivered

- 11.4.6. Analysis by Type of Biologic Delivered

- 11.4.7. Analysis by Therapeutic Area

- 11.4.8. Most Active Players: Analysis by Number of Partnerships

- 11.4.9. Analysis by Geography

- 11.4.9.1. Local and International Agreements

- 11.4.9.2. Intracontinental and Intercontinental Agreements

12. OPPORTUNITY ASSESSMENT FRAMEWORK: KALBACH INNOVATION MODEL, COMPETITIVE ASSESSMENT

FRAMEWORK AND BCG MATRIX

- 12.1 Chapter Overview

- 12.2. Kalbach Innovation Model

- 12.2.1. Key Assumptions and Methodologies

- 12.2.2. Analysis by Trends in Research Activity

- 12.2.3. Analysis by Trends in Investment Activity

- 12.2.4. Analysis by Trends in Partnership Activity

- 12.2.5. Analysis by Number of Technologies

- 12.2.6. Analysis by Trends in Deal Amount

- 12.2.7. Analysis by Number of Google Hits

- 12.2.8. Qualitative and Quantitative Assessment based on Secondary and Primary Research

- 12.2.9. Kalbach Innovation Model: Analysis Output

- 12.3. Competitive Assessment Framework

- 12.3.1. Key Assumptions and Methodology

- 12.3.2. Competitive Assessment Framework: Analysis Output

- 12.4. BCG Matrix

- 12.4.1. Key Assumptions and Methodology

- 12.4.2. BCG Matrix: Output Analysis

SECTION VI: MARKET OPPORTUNITY ANALYSIS

13. GLOBAL NON-VIRAL DRUG DELIVERY SYSTEMS MARKET

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Global Non-Viral Drug Delivery Systems Market, Forecasted Estimates, Till 2035

- 13.3.1. Multivariate Scenario Analysis

- 13.3.1.1. Conservative Scenario

- 13.3.1.2. Optimistic Scenario

- 13.3.1. Multivariate Scenario Analysis

- 13.4. Key Market Segmentations

14. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF MOLECULE DELIVERED

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Non-Viral Drug Delivery Systems Market: Distribution by Type of Molecule Delivered

- 14.3.1. Non-Viral Drug Delivery Systems Market for Biologics, Forecasted Estimates, Till 2035

- 14.3.2. Non-Viral Drug Delivery Systems Market for Small Molecules, Forecasted Estimates, Till 2035

- 14.4. Data Triangulation and Validation

15. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF BIOLOGIC DELIVERED

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Non-Viral Drug Delivery Systems Market: Distribution by Type of Biologic Delivered

- 15.3.1. Non-Viral Drug Delivery Systems Market for RNA, Forecasted Estimates, Till 2035

- 15.3.2. Non-Viral Drug Delivery Systems Market for DNA, Forecasted Estimates, Till 2035

- 15.3.3. Non-Viral Drug Delivery Systems Market for Proteins / Peptides, Forecasted Estimates, Till 2035

- 15.3.4. Non-Viral Drug Delivery Systems Market for Antibodies, Forecasted Estimates, Till 2035

- 15.4. Data Triangulation and Validation

16. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF VEHICLE USED

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Non-Viral Drug Delivery Systems Market: Distribution by Type of Vehicle Used

- 16.3.1. Non-Viral Drug Delivery Systems Market for Nanoparticles, Forecasted Estimates, Till 2035

- 16.3.2. Non-Viral Drug Delivery Systems Market for Extracellular Vesicles, Forecasted Estimates, Till 2035

- 16.3.3. Non-Viral Drug Delivery Systems Market for Polymers, Forecasted Estimates, Till 2035

- 16.3.4. Non-Viral Drug Delivery Systems Market for Oligonucleotides, Forecasted Estimates, Till 2035

- 16.3.5. Non-Viral Drug Delivery Systems Market for Cell Penetrating Peptides, Forecasted Estimates, Till 2035

- 16.4. Data Triangulation and Validation

17. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TARGET THERAPEUTIC AREA

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Non-Viral Drug Delivery Systems Market: Distribution by Target Therapeutic Area

- 17.3.1. Non-Viral Drug Delivery Systems Market for Oncological Diseases, Forecasted Estimates, Till 2035

- 17.3.2. Non-Viral Drug Delivery Systems Market for Infectious Disorders, Forecasted Estimates, Till 2035

- 17.3.3. Non-Viral Drug Delivery Systems Market for Cardiovascular Disorders, Forecasted Estimates, Till 2035

- 17.3.4. Non-Viral Drug Delivery Systems Market for Genetic Diseases, Forecasted Estimates, Till 2035

- 17.3.5. Non-Viral Drug Delivery Systems Market for Hepatic Disorders, Forecasted Estimates, Till 2035

- 17.3.6. Non-Viral Drug Delivery Systems Market for Metabolic Disorders, Forecasted Estimates, Till 2035

- 17.3.7. Non-Viral Drug Delivery Systems Market for Neurological Disorders, Forecasted Estimates, Till 2035

- 17.3.8. Non-Viral Drug Delivery Systems Market for Pulmonary Disorders, Forecasted Estimates, Till 2035

- 17.3.9. Non-Viral Drug Delivery Systems Market for Rare Disorders, Forecasted Estimates, Till 2035

- 17.3.10. Non-Viral Drug Delivery Systems Market for Other Disorders, Forecasted Estimates, Till 2035

- 17.4. Data Triangulation and Validation

18. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF PAYMENT EMPLOYED

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Non-Viral Drug Delivery Systems Market: Distribution by Type of Payment Employed

- 18.4.1. Non-Viral Drug Delivery Systems Market for Upfront Payments, Forecasted Estimates, Till 2035

- 18.4.2. Non-Viral Drug Delivery Systems Market for Milestone Payments, Forecasted Estimates, Till 2035

- 18.5. Data Triangulation and Validation

19. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY KEY GEOGRAPHICAL REGIONS

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Non-Viral Drug Delivery Systems Market: Distribution by Key Geographical Regions

- 19.3.1. Non-Viral Drug Delivery Systems Market in North America, Forecasted Estimates, Till 2035

- 19.3.2. Non-Viral Drug Delivery Systems Market in Europe, Forecasted Estimates, Till 2035

- 19.3.3. Non-Viral Drug Delivery Systems Market in Asia-Pacific, Forecasted Estimates, Till 2035

- 19.4. Penetration-Growth (P-G) Matrix

- 19.5. Data Triangulation and Validation

20. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY LEADING PLAYERS

SECTION VII: OTHER EXCLUSIVE INSIGHTS

21. CONCLUDING REMARKS

22. EXECUTIVE INSIGHTS

- 22.1. Chapter Overview

- 22.2. Small Company, Israel

- 22.2.1. Company Snapshot

- 22.2.2. Interview Transcript

- 22.3. Small Company, US

- 22.3.1. Company Snapshot

- 22.3.2. Interview Transcript

- 22.4. Small Company, France

- 22.4.1. Company Snapshot

- 22.4.2. Interview Transcript

- 22.5. Mid-sized Company, US

- 22.5.1. Company Snapshot

- 22.5.2. Interview Transcript

- 22.6. Small Company, Norway

- 22.6.1. Company Snapshot

- 22.6.2. Interview Transcript

- 22.7. Large Company, US

- 22.7.1. Company Snapshot

- 22.7.2. Interview Transcript