|

시장보고서

상품코드

1616875

올리고뉴클레오티드 합성 시장 : 응용 분야별, 합성 제품 유형별, 합성 올리고뉴클레오티드 유형별, 사업 규모별, 치료 분야별, 최종사용자별, 기업 규모별, 지역별 : 산업 동향 및 세계 예측(-2035년)Oligonucleotide Synthesis Market by Application Area, Type of Product Synthesized, Type of Oligonucleotide Synthesized, Scale of Operation, Therapeutic Area, End-Users, Company Size and Regions: Industry Trends and Global Forecasts, Till 2035 |

||||||

세계 올리고뉴클레오타이드 합성 시장 규모는 2035년까지 예측 기간 동안 9.9%의 CAGR로 확대되어 현재 48억 달러에서 2035년까지 135억 달러로 성장할 것으로 예상됩니다.

올리고뉴클레오타이드는 제약 산업에서 가장 빠르게 성장하는 분야 중 하나입니다. 이 분자들은 연구, 유전자 검사, 법의학 분석 및 기타 분석 방법과 같은 다양한 용도로 바이오의약품 및 생명공학 분야에서 널리 사용되고 있습니다. 현재 연구자들은 올리고뉴클레오타이드가 수많은 질병 적응증 치료를 위한 약리학적 접근법이 될 수 있는 가능성을 연구하고 있습니다. 또한, 치료 목적으로 다양한 올리고뉴클레오티드를 평가하기 위해 여러 지역에서 거의 300개의 임상시험이 등록되어 있다는 점은 주목할 만합니다. 올리고뉴클레오타이드 제조 산업이 발전함에 따라 올리고뉴클레오타이드 치료제의 개발 및 생산을 위한 대규모 생산에 수많은 자동 올리고 합성 기계가 통합되고 있습니다. 이러한 합성기는 분자 합성, 보호기 제거, 정제, 탈염, 동결건조 등의 단계를 효율적으로 수행할 수 있습니다. 그러나 올리고뉴클레오타이드 생산과 관련된 과제는 개발 기간의 장기화, 정제 기술 부족, 전문 지식 부족, 개발자의 규제 및 컴플라이언스 관련 문제 등으로 인해 의약품 개발 기업은 주요 업무를 아웃소싱하는 추세입니다. 현재 110개 이상의 올리고뉴클레오타이드 합성 공급업체가 연구, 진단, 치료용 맞춤형 올리고뉴클레오타이드 합성, 올리고뉴클레오타이드 변형, 올리고뉴클레오타이드 정제 서비스를 제공하고 있습니다. 올리고뉴클레오티드 기반 의약품 파이프라인의 성장, 유망한 임상시험 결과, 이 분야의 광범위한 연구 활동은 예측 기간 동안 맞춤형/위탁 서비스 제공업체에게 유리한 시장 성장 기회를 제공할 것으로 예상됩니다.

세계 올리고뉴클레오티드 합성 시장에 대해 조사했으며, 시장 개요와 함께 응용 분야별, 합성 제품 유형별, 합성 올리고뉴클레오티드 유형별, 사업 규모별, 치료 분야별, 최종사용자별, 기업 규모별, 지역별 동향, 시장 진입 기업 프로파일 등을 정리하여 전해드립니다.

목차

제1장 서문

제2장 주요 요약

제3장 소개

제4장 시장 상황 : 올리고뉴클레오티드 제조(조사 및 진단 용도)

제5장 시장 상황 : 올리고뉴클레오티드 제조업체(치료 용도)

제6장 기업 경쟁력 분석 : 올리고뉴클레오티드 제조(연구 및 진단 용도)

제7장 기업 경쟁력 분석 : 올리고뉴클레오티드 제조업체(치료 용도)

제8장 기업 개요 : 올리고뉴클레오티드 제조업체(연구 및 진단 용도)

제9장 기업 개요 : 올리고뉴클레오티드 제조업체(치료 용도)

제10장 제조인가 구입인가 의사 의사결정 프레임워크

제11장 대형 제약회사의 대처

제12장 파트너십과 협업

제13장 최근의 확장

제14장 파트너 후보 분석

제15장 임상시험 분석

제16장 용량 분석

제17장 수요 분석

제18장 시장 규모 평가와 기회 분석

제19장 COVID-19 팬데믹이 올리고뉴클레오티드 합성 시장에 미치는 영향

제20장 SWOT 분석

제21장 조사 분석

제22장 이그제큐티브 인사이트

- 분석 개요

- Hanugen Therapeutics

- Axolabs

- IBA Life Sciences

- BianoScience

제23장 결론

제24장 부록 1 : 표형식 데이터

제25장 부록 2 : 기업·단체 리스트

ksm 24.12.30OLIGONUCLEOTIDE SYNTHESIS MARKET: OVERVIEW

As per Roots Analysis, the global oligonucleotide synthesis market is estimated to grow from USD 4.8 billion in the current year to USD 13.5 billion by 2035, at a CAGR of 9.9% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Application Area

- Research and Diagnostics

- Therapeutics

Type of Product Synthesized

- Active Pharmaceutical Ingredients

- Finished Dosage Forms

Type of Oligonucleotide Synthesized

- Antisense

- DNA

- siRNA

- Other Oligonucleotides

Scale of Operation

- Clinical

- Commercial

Therapeutic Area

- Cardiovascular Disorders

- Genetic Disorders

- Liver Disorders

- Rare Diseases

- Other Disorders

End-users

- Pharmaceutical/Biopharmaceutical Companies

- Academic And Research Institutes

- Hospitals

Company Size

- Small

- Mid-sized

- Large and Very Large

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

OLIGONUCLEOTIDE SYNTHESIS MARKET: GROWTH AND TRENDS

Oligonucleotides are one of the fastest growing segments in the pharmaceutical industry. These molecules are extensively utilized in biopharmaceutical and biotechnology fields for various applications, including research, genetic testing, forensic analysis, and other analytical methods. Currently, researchers are investigating the potential of oligonucleotides as a pharmacological approach for the treatment of a myriad of disease indications. In addition, it is worth noting that close to 300 clinical trials have been registered across different geographical regions to evaluate various oligonucleotides for therapeutic purposes. As the oligonucleotide manufacturing industry advances, numerous automatic oligo synthesizers are being incorporated into large scale production for developing and producing oligonucleotide therapeutics. These synthesizers can execute steps, such as molecule synthesis, removal of protecting groups, purification, desalting and lyophilization, with increased efficiency. However, the challenges associated with oligonucleotide production, including extended timelines, lack of purification techniques, lack of expertise, and regulatory and compliance-related issues among the developers, have driven drug developers to outsource key operations. At present, over 110 oligonucleotide synthesis providers offer custom oligonucleotide synthesis, oligonucleotide modification and oligonucleotide purification services, which are intended for research, diagnostic and therapeutic applications. The growing oligonucleotide-based drugs pipeline, encouraging clinical trial results and extensive research activity in the domain, is likely to present lucrative market growth opportunities for custom / contract service providers, during the forecast period.

OLIGONUCLEOTIDE SYNTHESIS MARKET: KEY INSIGHTS

The report delves into the current state of the oligonucleotide synthesis market and identifies potential growth opportunities within the industry. Some key findings from the report include:

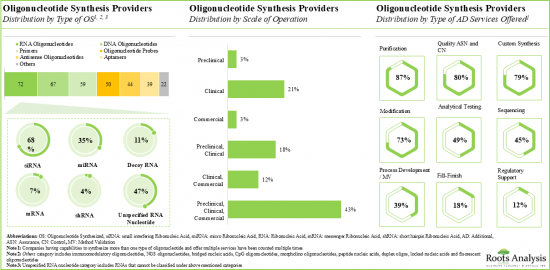

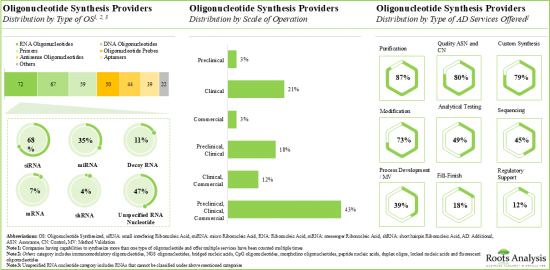

1. Presently, over 110 synthesis providers claim to have the necessary capabilities to offer oligonucleotide synthesis services; the majority of these firms are based in North America.

2. Stakeholders in this domain synthesize various types of oligonucleotides, across different scales of operations; close to 90% of the players offer purification services.

3. In pursuit of building a competitive edge in this field, stakeholders are actively upgrading their existing capabilities and adding new competencies in order to enhance their respective portfolios.

4. Close to 300 clinical trials (with over 75,000 enrolled patients) have been registered to investigate oligonucleotide based-therapeutic products, across different geographies.

5. Since 2017, several deals have been inked between various stakeholders engaged in this domain; acquisitions emerged as the most common type of partnership model.

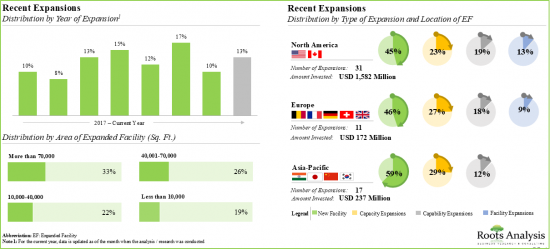

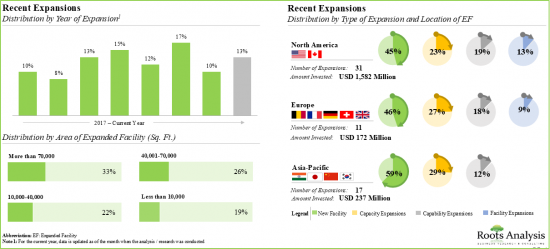

6. To keep pace with the growing demand for oligonucleotides, companies have made elaborate investments to expand their existing capacities and capabilities; this trend is most pronounced in the US and China.

7. Several big pharma players have undertaken various initiatives, including partnerships, expansions and funding initiatives; 48% of such initiatives were focused on the development and manufacturing of RNAi oligonucleotides.

8. The global, installed oligonucleotide synthesis capacity is spread across various geographies; interestingly, more than 75% of the total capacity is installed at the facilities owned by large and very large players.

9. Given the growing complexity of APIs, the demand for oligonucleotides has upsurged; by 2035, it is anticipated to reach around 2,200 kilograms, across clinical and commercial scales.

10. Considering the wide array of applications of oligonucleotides and the continuous research efforts of stakeholders in this domain, the adoption of these modalities is poised to witness steady growth in the foreseeable future.

11. Driven by the increasing number of chronic indications (requiring novel personalized therapies) and ongoing research on oligonucleotide-based therapeutics, this market is anticipated to grow at a CAGR of 9.9%, till 2035.

12. Over 40% of the market is expected to be captured by revenues generated from manufacturing drugs for rare diseases; further, oligonucleotide synthesis market in China is likely to grow at a faster pace.

OLIGONUCLEOTIDE SYNTHESIS MARKET: KEY SEGMENTS

Currently, the Oligonucleotide Finished Dosage Form holds the Largest Share of the Oligonucleotide Synthesis Market

Based on the type of product synthesized, the market is segmented into active pharmaceutical ingredients and finished dosage forms. It is worth highlighting that the majority of the current oligonucleotide synthesis market is captured by oligonucleotide finished dosage form and this trend is likely to remain same in the coming decade.

Antisense Oligonucleotide is Likely to Dominate the Oligonucleotide Synthesis Market During the Forecast Period

Based on the type of oligonucleotide synthesized, the market is segmented into antisense, DNA, siRNA and other oligonucleotides. It is worth highlighting that siRNA and antisense oligonucleotides-based therapies are likely to grow at a relatively higher CAGR, during the forecast period. This can be attributed to the rising number of approved siRNA and antisense oligonucleotides-based therapies for various rare diseases, genetic disorders and other disorders.

By Scale of Operation, Commercial Scale is Likely to Capture the Larger Share of the Oligonucleotide Synthesis Market During the Forecast Period

Based on scales of operation, the market is segmented into clinical and commercial scale. It is worth highlighting that the commercial scale manufacturing will be the primary driver of the overall market in the coming decade.

Currently, Pharmaceutical and Biopharmaceutical Companies hold the Largest Share within the Oligonucleotide Synthesis Market

Based on end user, the market is segmented into pharmaceutical and biopharmaceutical companies, academic and research institutes, and hospitals. It is worth highlighting that the revenues generated from manufacturing of oligonucleotides by pharmaceutical and biopharmaceutical companies is expected to grow substantially in the coming decade as compared to other end-users.

By Company Size, Mid-Sized Companies are Likely to Grow at a Relatively Higher Pace During the Forecast Period

Based on company size, the market is segmented into small, mid-sized, and large and very large companies. It is worth highlighting that the majority of the current oligonucleotide synthesis market is captured by large and very large players.

Rare Diseases Segment Accounts for the Largest Share for the Oligonucleotide Synthesis Market

Based on therapeutic areas, the market is segmented into cardiovascular disorders, genetic disorders, liver disorders, rare diseases and other disorders. While rare diseases account for a relatively higher market share, it is worth highlighting that cardiovascular disorders segment is expected to witness substantial market growth in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. It is worth highlighting that over the years, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the Oligonucleotide Synthesis Market

- Agilent Technologies

- Ajinomoto Bio-Pharma Services

- CordenPharma

- Creative Biolabs

- Ella Biotech

- Eurofins Genomics

- Future synthesis

- Integrated DNA Technologies

- Kaneka Eurogentec

- LGC Biosearch Technologies

- Microsynth

- Nitto Avecia

- Merck

- Ribo Biotechnology

- STA Pharmaceutical

- Sumitomo Chemical

- Thermo Fisher Scientific

- TriLink Biotechnologies

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Founder and Managing Director, BianoGMP

- Co-Founder and Managing Director, Hanugen Therapeutics

- Chief Scientific Officer and Managing Director, IBA Life Sciences

- Chief Scientific Officer, Axolabs

- Business Officer, SBS Genetech

- Chem Lab Manager, Aptagen

- Global Corporate Sales and Business Development, Invitek Diagnostics

OLIGONUCLEOTIDE SYNTHESIS MARKET: RESEARCH COVERAGE

- The report features an in-depth analysis of the oligonucleotide synthesis market, focusing on key market segments, including application area, type of product synthesized, type of oligonucleotide synthesized, scale of operation, therapeutic area, end-users, company size and key geographical regions.

- The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting the market growth.

- A comprehensive evaluation of companies involved in oligonucleotide synthesis, considering various parameters, such as year of establishment, company size (in terms of employee count), location of headquarters, location of oligonucleotide synthesis facilities, scale of operation (preclinical, clinical and commercial), type of oligonucleotide synthesized (antisense oligonucleotides, aptamers, DNA oligonucleotides, oligonucleotide probes, primers, RNA oligonucleotides and others), type of product synthesized (oligonucleotide API and finished dosage form / drug product), application area (research, diagnostic and therapeutic) and type of additional services offered (process development / method validation, analytical testing, custom synthesis, sequencing, modification, purification, fill-finish, quality assurance and control, and regulatory support).

- A comprehensive competitive analysis of oligonucleotide synthesis providers, examining factors such as supplier strength (in terms of years of experience), service strength and number of oligonucleotide synthesis facilities.

- In-depth profiles of key industry players engaged in oligonucleotide synthesis services, focusing on company overviews, financial information (if available), service portfolio, recent developments and an informed future outlook.

- An insightful framework for the make-or-buy decision, emphasizing the key indicators and factors that affect sponsors and developers in determining whether to outsource oligonucleotide manufacturing or develop the means to carry it in-house.

- Examination of completed, ongoing, and planned clinical studies based on parameters like trial registration year, trial status, trial phase, enrolled patient population, type of sponsor, most active industry players (in terms of number of trials conducted), study design, therapeutic area and key geographical regions.

- An analysis of partnerships established in this sector, since 2014, based on several parameters, such as year of partnership, type of partnership, type of oligonucleotide, therapeutic area, application area and the most active players (in terms of the number of partnerships signed). It also provides the regional distribution of the companies involved in these agreements.

- An examination of the different expansion efforts made by oligonucleotide synthesis providers in this field to enhance their manufacturing capabilities, since 2015. This analysis considers various factors, including the year of expansion, type of expansion, scale of operation, application area, amount invested, area of facility and location of expanded facility.

- Assessment of the various oligonucleotide-focused manufacturing initiatives undertaken by big pharma players, based on several relevant parameters, such as number of initiatives, year of initiative, type of initiative, type of initiative, scale of operation, type of oligonucleotide manufactured, and amount invested.

- Estimation of global oligonucleotides manufacturing capacity, derived from data provided by various industry stakeholders in the public domain. This analysis emphasizes the distribution of the available capacity on the basis of company size (small, mid-sized, and large and very large firms) and key geographical regions (North America, Europe and, Asia-Pacific and Rest of the World).

- Informed estimates of the annual clinical demand for oligonucleotide therapeutics (in terms of target patient population in ongoing and planned clinical trials of oligonucleotide therapeutics). It also includes the commercial demand for oligonucleotides, taking into account the top 12 oligonucleotide-based therapies and phase III drugs, based on various relevant parameters, such as target patient population, dosing frequency and dose strength of the abovementioned products.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What kinds of expansion initiatives have been undertaken by industry stakeholders?

- What is the current annual demand for oligonucleotides?

- What are the factors that are likely to influence the evolution of this market?

- What is current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.3. Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

- 2.1. Chapter Overview

3. INTRODUCTION

- 3.1. Context and Background

- 3.2. Overview of Oligonucleotide-based Products

- 3.3. Types of Oligonucleotides

- 3.3.1. Antisense Oligonucleotides

- 3.3.2. Aptamers

- 3.3.3. miRNA

- 3.3.4. shRNA

- 3.3.5. siRNA

- 3.3.6. Other Oligonucleotides

- 3.4. Custom Synthesis of Oligonucleotides

- 3.4.1. Process Development and Characterization

- 3.4.2. Analytical Method Development

- 3.4.3. Method Validation and Testing

- 3.4.4. Quality Control and Quality Assurance

- 3.4.5. Challenges Associated with Custom Synthesis of Oligonucleotides

- 3.5. Chemical Modification of Oligonucleotides

- 3.5.1. Backbone Modification

- 3.5.2. Sugar Ring Modification

- 3.6. Purification of Oligonucleotides

- 3.6.1. Desalting

- 3.6.2. Cartridge Purification

- 3.6.3. Polyacrylamide Gel Electrophoresis (PAGE)

- 3.6.4. High Performance Liquid Chromatography (HPLC)

- 3.7. Outsourcing Oligonucleotide Manufacturing

- 3.7.1. Need for Outsourcing

- 3.7.2. Commonly Outsourced Operations

- 3.7.3. Advantages of Outsourcing Manufacturing Operations

- 3.7.4. Guidelines for Selecting a Service Provider

- 3.8. Growth Drivers and Roadblocks to Oligonucleotide Manufacturing

- 3.9. Recent Developments and Upcoming Trends

4. MARKET LANDSCAPE: OLIGONUCLEOTIDE MANUFACTURERES (RESEARCH AND DIAGNOSTIC APPLICATIONS)

- 4.1. Chapter Overview

- 4.2. Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications: Overall Market Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Scale of Operation

- 4.2.4. Analysis by Geographical Location

- 4.2.5. Analysis by Location of Manufacturing Facilities

- 4.2.6. Analysis by Regulatory Accreditations / Certifications Received

- 4.2.7. Analysis by Type of Oligonucleotide Manufactured

- 4.2.8. Analysis by Type of Offering

- 4.2.9. Analysis by Type of Manufacturing Service(s) Offered

- 4.2.10. Analysis by Type of Modification(s) Offered

- 4.2.11. Analysis by Type of Purification Method(s) Used

5. MARKET LANDSCAPE: OLIGONUCLEOTIDE MANUFACTURERES (THERAPEUTIC APPLICATIONS)

- 5.1. Chapter Overview

- 5.2. Oligonucleotide Manufacturers Focused on Therapeutic Applications: Overall Market Landscape

- 5.2.1. Analysis by Year of Establishment

- 5.2.2. Analysis by Company Size

- 5.2.3. Analysis by Scale of Operation

- 5.2.4. Analysis by Geographical Location

- 5.2.5. Analysis by Location of Manufacturing Facilities

- 5.2.6. Analysis by Regulatory Accreditations / Certifications

- 5.2.7. Analysis by Type of Oligonucleotide Manufactured

- 5.2.8. Analysis by Type of Offering

- 5.2.9. Analysis by Type of Manufacturing Service(s) Offered

- 5.2.10. Analysis by Type of Modification(s) Offered

- 5.2.11. Analysis by Type of Purification Method(s) Used

6. COMPANY COMPETITIVENESS ANALYSIS: OLIGONUCLEOTIDE MANUFACTURES (RESEARCH AND DIAGNOSTIC APPLICATIONS)

- 6.1. Chapter Overview

- 6.2. Assumptions / Key Parameters

- 6.3. Methodology

- 6.4. Company Competitiveness Analysis: Oligonucleotide Manufacturers Focused on Research and Diagnostic Applications

- 6.4.1. Oligonucleotide Manufacturers in North America

- 6.4.2. Oligonucleotide Manufacturers in Europe

- 6.4.3. Oligonucleotide Manufacturers in Asia-Pacific

7. COMPANY COMPETITIVENESS ANALYSIS: OLIGONUCLEOTIDE MANUFACTURERS (THERAPEUTIC APPLICATIONS)

- 7.1. Chapter Overview

- 7.2. Assumptions / Key Parameters

- 7.3. Methodology

- 7.4. Company Competitiveness Analysis: Oligonucleotide Manufacturers Focused on Therapeutic Applications

- 7.4.1. Oligonucleotide Manufacturers in North America

- 7.4.2. Oligonucleotide Manufacturers in Europe

- 7.4.3. Oligonucleotide Manufacturers in Asia-Pacific

8. COMPANY PROFILES: OLIGONUCLEOTIDE MANUFACTURERS (RESEARCH AND DIAGNOSTIC APPLICATIONS)

- 8.1. Chapter Overview

- 8.2. North America

- 8.2.1. Ajinomoto Bio-Pharma Services

- 8.2.1.1. Company Overview

- 8.2.1.2. Financial Information

- 8.2.1.3. Service Portfolio

- 8.2.1.4. Manufacturing Facilities and Capabilities

- 8.2.1.5. Recent Developments and Future Outlook

- 8.2.2. Integrated DNA Technologies

- 8.2.2.1. Company Overview

- 8.2.2.2. Service Portfolio

- 8.2.2.3. Manufacturing Facilities and Capabilities

- 8.2.2.4. Recent Developments and Future Outlook

- 8.2.3. Sigma Aldrich

- 8.2.3.1. Company Overview

- 8.2.3.2. Service Portfolio

- 8.2.3.3. Manufacturing Facilities and Capabilities

- 8.2.3.4. Recent Developments and Future Outlook

- 8.2.4. Thermo Fisher Scientific

- 8.2.4.1. Company Overview

- 8.2.4.2. Financial Information

- 8.2.4.3. Service Portfolio

- 8.2.4.4. Manufacturing Facilities and Capabilities

- 8.2.4.5. Recent Developments and Future Outlook

- 8.2.1. Ajinomoto Bio-Pharma Services

- 8.3. Europe

- 8.3.1. BioSpring

- 8.3.1.1. Company Overview

- 8.3.1.2. Service Portfolio

- 8.3.1.3. Manufacturing Facilities and Capabilities

- 8.3.1.4. Recent Developments and Future Outlook

- 8.3.2. Kaneka Eurogentec

- 8.3.2.1. Company Overview

- 8.3.2.2. Financial Information

- 8.3.2.3. Service Portfolio

- 8.3.2.4. Manufacturing Facilities and Capabilities

- 8.3.2.5. Recent Developments and Future Outlook

- 8.3.3. Microsynth

- 8.3.3.1. Company Overview

- 8.3.3.2. Service Portfolio

- 8.3.3.3. Manufacturing Facilities and Capabilities

- 8.3.3.4. Recent Developments and Future Outlook

- 8.3.1. BioSpring

- 8.4. Asia-Pacific and RoW

- 8.4.1. Sumitomo Chemical

- 8.4.1.1. Company Overview

- 8.4.1.2. Financial Information

- 8.4.1.3. Service Portfolio

- 8.4.1.4. Manufacturing Facilities and Capabilities

- 8.4.1.5. Recent Developments and Future Outlook

- 8.4.1. Sumitomo Chemical

9. COMPANY PROFILES: OLIGONUCLEOTIDE MANUFACTURERS (THERAPEUTIC APPLICATIONS)

- 9.1. Chapter Overview

- 9.2. North America

- 9.2.1. Agilent Technologies

- 9.2.1.1. Company Overview

- 9.2.1.2. Financial Information

- 9.2.1.3. Service Portfolio

- 9.2.1.4. Manufacturing Facilities and Capabilities

- 9.2.1.5. Recent Developments and Future Outlook

- 9.2.2. Nitto Denko Avecia

- 9.2.2.1. Company Overview

- 9.2.2.2. Financial Information

- 9.2.2.3. Service Portfolio

- 9.2.2.4. Manufacturing Facilities and Capabilities

- 9.2.2.5. Recent Developments and Future Outlook

- 9.2.3. TriLink Biotechnologies

- 9.2.3.1. Company Overview

- 9.2.3.2. Financial Information

- 9.2.3.3. Service Portfolio

- 9.2.3.4. Manufacturing Facilities and Capabilities

- 9.2.3.5. Recent Developments and Future Outlook

- 9.2.1. Agilent Technologies

- 9.3. Europe

- 9.3.1. CordenPharma

- 9.3.1.1. Company Overview

- 9.3.1.2. Service Portfolio

- 9.3.1.3. Manufacturing Facilities and Capabilities

- 9.3.1.4. Recent Developments and Future Outlook

- 9.3.2. LGC, Biosearch Technologies

- 9.3.2.1. Company Overview

- 9.3.2.2. Service Portfolio

- 9.3.2.3. Manufacturing Facilities and Capabilities

- 9.3.2.4. Recent Developments and Future Outlook

- 9.3.3. Lonza

- 9.3.3.1. Company Overview

- 9.3.3.2. Financial Information

- 9.3.3.3. Service Portfolio

- 9.3.3.4. Manufacturing Facilities and Capabilities

- 9.3.3.5. Recent Developments and Future Outlook

- 9.3.1. CordenPharma

- 9.4. Asia-Pacific

- 9.4.1. STA Pharmaceutical

- 9.4.1.1. Company Overview

- 9.4.1.2. Financial Information

- 9.4.1.3. Service Portfolio

- 9.4.1.4. Manufacturing Facilities and Capabilities

- 9.4.1.5. Recent Developments and Future Outlook

- 9.4.1. STA Pharmaceutical

10. MAKE VERSUS BUY DECISION FRAMEWORK

- 10.1. Chapter Overview

- 10.2. Assumptions and Key Parameters

- 10.3. Oligonucleotide Manufacturers: Make versus Buy Decision Making

- 10.3.1. Scenario 1

- 10.3.2. Scenario 2

- 10.3.3. Scenario 3

- 10.3.4. Scenario 4

- 10.4. Concluding Remarks

11. BIG PHARMA INITIATIVES

- 11.1. Chapter Overview

- 11.2. List of Oligonucleotide Manufacturing Initiatives

- 11.2.1. Analysis by Year of Initiative

- 11.2.2. Analysis by Type of Initiative

- 11.2.3. Analysis by Type of Oligonucleotide

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnership Models

- 12.3. Oligonucleotide Manufacturers: Recent Partnerships and Collaborations

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Type of Partner

- 12.3.4. Most Active Players: Analysis by Number of Partnerships

- 12.3.5. Analysis by Region

- 12.3.5.1. Most Active Players: Analysis by Number of Partnerships and Region

- 12.3.5.2. Intercontinental and Intracontinental Agreements

- 12.4. Oligonucleotide Manufacturers: Mergers / Acquisitions

- 12.4.1. Analysis by Year of Merger / Acquisition

- 12.4.2. Analysis by Type of Acquisition

- 12.4.3. Key Value Drivers

13. RECENT EXPANSIONS

- 13.1. Chapter Overview

- 13.2. Oligonucleotide Manufacturers: Recent Expansions

- 13.2.1. Analysis by Year of Expansion

- 13.2.2. Analysis by Type of Expansion

- 13.2.3. Analysis by Purpose of Expansion

- 13.2.4. Analysis by Location of Facility

- 13.2.5. Analysis by Expanded Facility Area

- 13.2.6. Analysis by Scale of Operation

- 13.3.7. Most Active Players: Analysis by Number of Expansions

- 13.3.8. Analysis by Region

- 13.3.8.1. Continent-wise Distribution

- 13.3.8.2. Country-wise Distribution

14. LIKELY PARTNER ANALYSIS

- 14.1. Chapter Overview

- 14.2. Scoring Criteria and Key Assumptions

- 14.3. Scope and Methodology

- 14.4. Potential Strategic Partners

- 14.4.1. Likely Partners for Antisense Oligonucleotides Manufacturers

- 14.4.2. Likely Partners for siRNA Therapeutics Manufacturers

- 14.4.3. Likely Partners for miRNA Therapeutics Manufacturers

- 14.4.4. Likely Partners for shRNA and sshRNA Therapeutics Manufacturers

15. CLINICAL TRIAL ANALYSIS

- 15.1. Chapter Overview

- 15.2. Scope and Methodology

- 15.3. Oligonucleotide-based Products: Clinical Trial Analysis

- 15.3.1. Analysis by Trial Registration Year

- 15.3.2. Analysis by Trial Phase

- 15.3.3. Analysis by Type of Oligonucleotide

- 15.3.4. Analysis by Trial Phase and Type of Oligonucleotide

- 15.3.5. Analysis by Trial Recruitment Status

- 15.3.6. Analysis by Trial Focus Area

- 15.3.7. Analysis by Study Design

- 15.3.8. Geographical Analysis by Number of Clinical Trials

- 15.3.9. Geographical Analysis by Enrolled Patient Population

- 15.3.10. Analysis by Type of Sponsor / Collaborator

- 15.3.11. Most Active Players: Analysis by Number of Registered Trials

16. CAPACITY ANALYSIS

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Oligonucleotide Manufacturers: Global Annual Capacity

- 16.3.1. Analysis by Size of Manufacturer

- 16.3.2. Analysis by Scale of Operation

- 16.3.3. Analysis by Location of Manufacturing Facility

17. DEMAND ANALYSIS

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Global Demand for Oligonucleotide Manufacturing

- 17.3.1. Global Commercial Demand for Oligonucleotide Manufacturing

- 17.3.1.1. Analysis by Type of Oligonucleotide

- 17.3.1.2. Analysis by Target Therapeutic Area

- 17.3.1.3. Analysis by Region

- 17.3.2. Global Clinical Demand for Oligonucleotide Manufacturing

- 17.3.2.1. Analysis by Type of Oligonucleotide

- 17.3.2.2. Analysis by Phase of Development

- 17.3.2.3. Analysis by Target Therapeutic Area

- 17.3.2.4. Analysis by Region

- 17.3.1. Global Commercial Demand for Oligonucleotide Manufacturing

- 17.4. Demand and Supply Analysis

- 17.4.1. Scenario 1

- 17.4.2. Scenario 2

- 17.4.3. Scenario 3

18. MARKET SIZING AND OPPORTUNITY ANALYSIS

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Forecast Methodology

- 18.3. Global Oligonucleotide Contract Manufacturing Market, till 2030

- 18.4. Oligonucleotide Manufacturing Market: Analysis by Application Area, till 2030

- 18.4.1. Oligonucleotide Manufacturing Market for Research and Diagnostics Applications, till 2030

- 18.4.2. Oligonucleotide Manufacturing Market for Therapeutics Applications, till 2030

- 18.4.2.1 Oligonucleotide Manufacturing Market: Analysis by Type of Oligonucleotide Manufactured, till 2030

- 18.4.2.1.1. Oligonucleotide Manufacturing Market for Antisense Oligonucleotides, till 2030

- 18.4.2.1.2. Oligonucleotide Manufacturing Market for miRNA, till 2030

- 18.4.2.1.3. Oligonucleotide Manufacturing Market for DNA Oligonucleotides, till 2030

- 18.4.2.1.4. Oligonucleotide Manufacturing Market for siRNA, till 2030

- 18.4.2.1.5. Oligonucleotide Manufacturing Market for Phosphorothioate Oligonucleotides, till 2030

- 18.4.2.1.6. Oligonucleotide Manufacturing Market for Decoy Oligonucleotides, till 2030

- 18.4.2.2. Oligonucleotide Manufacturing Market: Analysis by Scale of Operation, till 2030

- 18.4.2.2.1. Oligonucleotide Manufacturing Market for Clinical Scale Operations, till 2030

- 18.4.2.2.2. Oligonucleotide Manufacturing Market for Commercial Scale Operations, till 2030

- 18.4.2.3. Oligonucleotide Manufacturing Market: Analysis by Type of Operation, till 2030

- 18.4.2.3.1. Oligonucleotide Manufacturing Market for Active Pharmaceutical Ingredients, till 2030

- 18.4.2.3.2. Oligonucleotide Manufacturing Market for Finished Dosage Form, till 2030

- 18.4.2.4. Oligonucleotide Manufacturing Market: Analysis by Purpose of Production, till 2030

- 18.4.2.4.1. Oligonucleotide Manufacturing Market for In-House Operations, till 2030

- 18.4.2.4.2. Oligonucleotide Manufacturing Market for Outsourced Operations, till 2030

- 18.4.2.5. Oligonucleotide Manufacturing Market: Analysis by Target Therapeutic Area, till 2030

- 18.4.2.5.1. Oligonucleotide Manufacturing Market for Cardiovascular Disorders, till 2030

- 18.4.2.5.2. Oligonucleotide Manufacturing Market for CNS Disorders, till 2030

- 18.4.2.5.3. Oligonucleotide Manufacturing Market for Genetic Disorders, till 2030

- 18.4.2.5.4. Oligonucleotide Manufacturing Market for Hematological Diseases, till 2030

- 18.4.2.5.5. Oligonucleotide Manufacturing Market for Infectious Diseases, till 2030

- 18.4.2.5.6. Oligonucleotide Manufacturing Market for Metabolic Disorders, till 2030

- 18.4.2.5.7. Oligonucleotide Manufacturing Market for Neuromuscular Disorders, till 2030

- 18.4.2.5.8. Oligonucleotide Manufacturing Market for Oncological Disorders, till 2030

- 18.4.2.5.9. Oligonucleotide Manufacturing Market for Ophthalmic Disorders, till 2030

- 18.4.2.5.10. Oligonucleotide Manufacturing Market for Other Disorders, till 2030

- 18.4.2.6. Oligonucleotide Manufacturing Market: Analysis by Size of Manufacturer, till 2030

- 18.4.2.6.1. Oligonucleotide Manufacturing Market for Small Companies, till 2030

- 18.4.2.6.2. Oligonucleotide Manufacturing Market for Mid-sized Companies, till 2030

- 18.4.2.6.3. Oligonucleotide Manufacturing Market for Large and Very Large Companies, till 2030

- 18.4.2.7. Oligonucleotide Manufacturing Market: Analysis by Geography, till 2030

- 18.4.2.7.1. Oligonucleotide Manufacturing Market in North America, till 2030

- 18.4.2.7.2. Oligonucleotide Manufacturing Market in Europe, till 2030

- 18.4.2.7.3. Oligonucleotide Manufacturing Market in Asia-Pacific and Rest of the World, till 2030

- 18.4.2.1 Oligonucleotide Manufacturing Market: Analysis by Type of Oligonucleotide Manufactured, till 2030

19. IMPACT OF COVID-19 PANDEMIC ON OLIGONUCLEOTIDE SYNTHESIS MARKET

- 19.1. Chapter Overview

- 19.2. Impact of COVID-19 on Oligonucleotide Synthesis Market

- 19.2.1. Impact on Future Oligonucleotide Market Opportunity

- 19.3. Recuperative Strategies for Businesses

- 19.3.1. Strategies for Implementation in the Short / Mid Term

- 19.3.2. Strategies for Implementation in the Long Term

20. SWOT ANALYSIS

- 20.1. Chapter Overview

- 20.2. Comparison of SWOT Factors

21. SURVEY ANALYSIS

- 21.1. Chapter Overview

- 21.2. Overview of Respondents

- 21.2.1. Analysis by Seniority Level of Respondents

- 21.3. Analysis of Survey Insights

- 21.3.1. Analysis by Type of Offering

- 21.3.2. Analysis by Application

- 21.3.3. Analysis by Installed Manufacturing Capacity

- 21.3.4. Analysis by Location of Manufacturing Facility

- 21.3.5. Analysis by Extent of Outsourcing

- 21.3.6. Analysis by Current Market Opportunity

22. EXECUTIVE INSIGHTS

- 22.1. Chapter Overview

- 22.2. Hanugen Therapeutics

- 22.2.1. Company Snapshot

- 22.2.2. Interview Transcript: Arun Shastry, Co-Founder and Managing Director

- 22.3. Axolabs

- 22.3.1. Company Snapshot

- 22.3.2. Interview Transcript: Hans-Peter Vornlocher, Managing Director

- 22.4. IBA Life Sciences

- 22.4.1. Company Snapshot

- 22.4.2. Interview Transcript: Joachim Bertram, Chief Scientific Officer and Managing Director

- 22.5. BianoScience

- 22.5.1. Company Snapshot

- 22.5.2. Interview Transcript: Tobias Pohlmann, Founder and Managing Director

23. CONCLUDING REMARKS

- 23.1. Chapter Overview