|

시장보고서

상품코드

1752097

비디오 감시 시장(-2035년) : 컴포넌트 유형별, 서비스 유형별, 관공청 유형별, 가격 결정 모델 유형별, 최종사용자별, 비즈니스 모델별, 주요 지역별 - 산업 동향 및 예측Video Surveillance Market, Till 2035: Distribution by Type of Component, Type of Services, Type of Government and Public Sector, Type of Pricing Model, End User, Business Model and Key Geographical Regions: Industry Trends and Global Forecasts |

||||||

비디오 감시 시장 개요

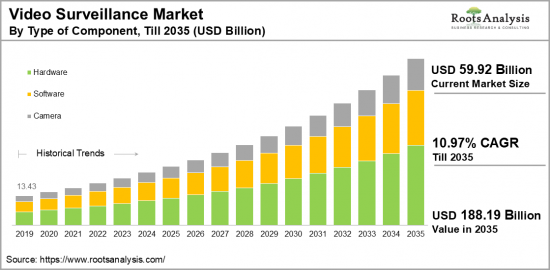

세계 비디오 감시 시장 규모는 현재 599억 2,000만 달러에서 2035년까지 1,881억 9,000만 달러에 달할 것으로 예상되며, 2035년까지 예측 기간 동안 연평균 10.97% 성장할 것으로 예측됩니다.

비디오 감시 시장 : 성장과 동향

비디오 감시는 보안 산업의 판도를 바꾸어 놓았고, 이제는 필수 불가결한 요소로 자리 잡았습니다. 주로 디스플레이 기술과 AI의 발전으로 인해 더 나은 가격을 제공하면서 보안 강화에 기여하고 있습니다. 비디오 감시 세계 시장은 현재 도둑질, 절도, 기물 파손, 심지어 테러와 같은 다양한 원치 않는 행위를 식별하고 방지하도록 설계된 IP 기반 디지털 기술의 혁신에 힘입어 큰 변화를 겪고 있습니다.

이러한 기술은 제조, 은행, 금융 서비스, 운송, 소매 등 다양한 부문에서 채택되고 있으며, 이는 큰 수요와 시장 확장을 촉진하고 있습니다. 이러한 광범위한 채택은 미국, 영국, 인도, 중국, 브라질 등 대규모 산업이 풍부하고 보안에 대한 인식이 높은 주요 경제권에서 두드러지게 나타나고 있습니다.

비디오 분석과 첨단 감시 카메라의 개발 및 통합의 진행이 산업 성장에 중요한 역할을 하고 있습니다. 감시 카메라의 보급은 범죄자를 식별하고 억제하여 전 세계 범죄율을 낮추는 데 기여하고 있습니다. 업계에서는 VSaaS(Video Surveillance as a Service)의 발전으로 더욱 강화된 통합 감시 시스템에 대한 수요가 증가하고 있습니다. 또한, IP 카메라의 도입과 중앙 집중식 데이터 관리 솔루션으로의 전환으로 유망한 기회가 확대되고 있습니다.

이러한 장점에도 불구하고, 비디오 감시는 잠재적인 프라이버시 침해와 수집된 정보의 악용에 대한 우려를 표명하는 인권 옹호 단체와 활동가들의 반대에 부딪히고 있습니다. 이 산업의 지속 가능한 발전을 보장하기 위해서는 이러한 문제를 해결하고, 감시 기술이 윤리적이고 책임감 있게 사용되어 개인의 프라이버시 권리를 보호하면서 정당한 보안 요구를 충족하도록 하는 것이 필수적입니다.

그러나 이 부문은 지속적인 기술 발전과 전 세계 다양한 부문에서 채택이 증가함에 따라 상당한 성장이 예상됩니다. 최첨단 감시 시스템은 설치 및 유지보수가 용이하고 비디오 품질이 우수하여 주목받고 있으며, 예측 기간 동안 비디오 감시 시장의 성장을 더욱 촉진할 것으로 예측됩니다.

세계의 비디오 감시 시장에 대해 조사했으며, 시장 규모 추정 및 기회 분석, 경쟁 구도, 기업 프로파일, SWOT 분석 등의 정보를 전해드립니다.

목차

제1장 서문

제2장 조사 방법

제3장 경제적 고려사항, 기타 프로젝트 특유의 고려사항

제4장 거시경제 지표

제5장 주요 요약

제6장 서론

제7장 경쟁 구도

제8장 기업 개요

- 본 장의 개요

- Avigilon

- BCD

- Bosch

- Canon

- Dahua

- Genetec

- HONEYWELL

- Huawei

- IDIS

- Infinova

- Motorola

- Panasonic

제9장 밸류체인 분석

제10장 SWOT 분석

제11장 세계의 비디오 감시 시장

제12장 시장 기회 : 컴포넌트 유형별

제13장 시장 기회 : 서비스 유형별

제14장 시장 기회 : 관공청 유형별

제15장 시장 기회 : 가격 결정 모델 유형별

제16장 시장 기회 : 데이터 스토리지 유형별

제17장 시장 기회 : 사용자 인터페이스별

제18장 시장 기회 : 기업 규모별

제19장 시장 기회 : 최종사용자별

제20장 시장 기회 : 비즈니스 모델별

제21장 북미의 비디오 감시 시장 기회

제22장 유럽의 비디오 감시 시장 기회

제23장 아시아의 비디오 감시 시장 기회

제24장 중동 및 북아프리카(MENA)의 비디오 감시 시장 기회

제25장 라틴아메리카의 비디오 감시 시장 기회

제26장 기타 지역의 비디오 감시 시장 기회

제27장 표 형식 데이터

제28장 기업 및 단체 리스트

제29장 커스터마이즈 기회

제30장 Roots 구독 서비스

제31장 저자 상세

LSH 25.06.27Video Surveillance Market Overview

As per Roots Analysis, the global video surveillance market size is estimated to grow from USD 59.92 billion in the current year to USD 188.19 billion by 2035, at a CAGR of 10.97% during the forecast period, till 2035.

The opportunity for video surveillance market has been distributed across the following segments:

Type of Component

- Cameras

- Analog

- IP

- Thermal

- PTZ (Pan-Tilt-Zoom)

- Hardware

- Recorders

- Encoders

- Storage Devices

- Monitors

- Software

- Video Management Software (VMS)

- Video Analytics

Type of Services

- VSaaS

- Installation

- Maintenance

- Consulting

- Management Services

Type of Government and Public Sector

- Public Transportation

- Law Enforcement

- Municipal Surveillance

Type of Pricing Model

- Per Camera

- Per System

- Subscription-Based

- Pay-Per-Use

Type of Data Storage

- Local Storage

- Cloud Storage

- Hybrid Storage

Type of User Interface

- Web-Based Interface

- Mobile App

- Desktop Application

Company Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

End User

- Commercial

- Retail

- Banking and Finance

- Hospitality

- Corporate Offices

- Residential

- Homes

- Apartments

- Gated Communities

- Industrial

- Manufacturing Facilities

- Warehouses

- Construction Sites

Business Model

- B2B

- B2C

- B2B2C

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

VIDEO SURVEILLANCE MARKET: GROWTH AND TRENDS

Video surveillance has significantly altered the landscape of the security industry and has now become essential. It has primarily contributed to enhanced security while offering better pricing due to advancements in display technology and artificial intelligence. The global market for video surveillance is currently undergoing a major transformation, propelled by innovations in IP-based digital technologies designed to identify and prevent various unwanted activities such as shoplifting, theft, vandalism, and even terrorist incidents.

These technologies are increasingly being adopted across various sectors including manufacturing, banking, financial services, transportation, and retail, driving substantial demand and market expansion. This widespread uptake is evident in key economies such as the United States, the United Kingdom, India, China, and Brazil, which have a wealth of large-scale industries and a growing awareness of security needs.

The ongoing development and integration of video analytics and advanced surveillance cameras in technology have played a crucial role in the growth of the industry. The deployment of cameras has enabled the identification and deterrence of possible offenders, thereby contributing to a decrease in global crime rates. The industry is experiencing a rise in demand for integrated surveillance systems, further enhanced by advancements in Video Surveillance as a Service (VSaaS). Moreover, the introduction of IP cameras and the move towards centralized data management solutions have opened up promising opportunities.

Despite its advantages, video surveillance has encountered opposition from civil liberties groups and activists, who express concerns regarding potential privacy infringements and the misuse of collected information. It is essential to address these issues to ensure the sustainable progression of the industry, making sure that surveillance technologies are utilized ethically and responsibly, safeguarding individuals' privacy rights while meeting valid security demands.

However, this sector is set for considerable growth, owing to the ongoing technological advancements and increasing adoption across various sectors worldwide. Cutting-edge surveillance systems, noted for their ease of installation, maintenance, and high video quality, are anticipated to further propel the growth of video surveillance market during the forecast period.

VIDEO SURVEILLANCE MARKET: KEY SEGMENTS

Market Share by Type of Component

Based on type of component, the global video surveillance market is segmented into cameras, hardware and software. According to our estimates, currently, cameras segment captures the majority of the market. Notably, the transition from analog cameras to IP cameras marked a significant turning point in the surveillance industry by utilizing internet protocol for the transmission of digital images, resulting in a substantial increase in demand and growth. Innovations, including thermal and PTZ cameras designed for specific environments, highlight the advancements in technology and the corresponding rise in demand for these devices.

Additionally, the integration of more advanced hardware and software technologies has further fueled ongoing growth. Each category of components plays a distinct role in the functionality and efficiency of video surveillance systems, addressing various industry requirements and technological progress.

Market Share by Type of Service

Based on type of services, the video surveillance market is segmented into VSaaS, installation, maintenance, consulting. According to our estimates, currently, VSaaS segment captures the majority of the market. This can be attributed to various advantages offered by VSaaS, such as lower IT expenses, scalability, and seamless integration with other security systems. Additionally, the rising use of IP cameras alongside cloud-based storage has fueled the demand for VSaaS in the industry. VSaaS enables users to store data remotely, facilitating access from various locations while improving security measures.

Market Share by Type of Government and Public Sector

Based on type of government and public sector, the video surveillance market is segmented into public transportation, law enforcement, and municipal surveillance. According to our estimates, currently, public transportation segment captures the majority share of the market. This can be attributed to the fact that in public transportation, video surveillance facilitates real-time observation of passenger behavior, aids in crowd management, and allows for rapid incident response.

As urbanization continues and public transportation networks expand, the need for reliable surveillance systems in this field is ever-increasing. Additionally, the market for in-vehicle video surveillance has proven to be beneficial for law enforcement efforts, owing to its dependability and potential for preventing crime, conducting investigations, and gathering evidence.

Market Share by Type of Pricing Model

Based on type of pricing model, the video surveillance market is segmented into per camera, per system, subscription-based and pay-per-use. According to our estimates, currently, subscription-based pricing model captures the majority share of the market, followed by per-camera pricing model.

The demand in this sector largely depends on the specific industry's needs; for instance, subscription-based models have gained popularity because they offer flexibility and reduced initial costs. This model is particularly favored by technologically adept companies and those in search of scalable, long-term solutions that include regular updates and support. In addition, the lower upfront costs and provision of ongoing updates and support have made it a cost-effective option for many organizations. The demand for video surveillance systems has experienced a notable increase due to their affordability and dependability, and this trend is projected to continue growing in the future.

Market Share by Type of Data Storage

Based on type of data storage, the video surveillance market is segmented into local storage, cloud storage and hybrid storage. According to our estimates, currently, cloud storage captures the majority share of the market. This can be attributed to the growing adoption of Video Surveillance as a Service (VSaaS) and the demand for scalable and secure storage solutions. The ease and flexibility of accessing data from any location have contributed to the increasing popularity of cloud storage.

Market Share by Type of User Interface

Based on type of user interface, the video surveillance market is segmented into web-based interface, mobile app and desktop application. According to our estimates, currently, web-based interface segment captures the majority share of the market. This can be attributed to its accessibility and compatibility with a range of devices and by increased consumer demand.

Market Share by Company Size

Based on company size, the video surveillance market is segmented into large, small and medium sized companies. According to our estimates, currently, large companies segment captures the majority share of the market. This can be attributed to the fact that large firms typically have an established reputation, extensive market presence, and considerable investments in research and development.

Market Share by End User

Based on end user, the video surveillance market is segmented into commercial, retail and industrial. A further breakdown based on end user type includes commercial sectors such as retail, banking, finance, and hospitality. Additionally, there is demand in residential and industrial sectors where surveillance devices are increasingly sought after. Notably, the global video surveillance market is currently experiencing a significant transformation, spurred by improvements in IP-based digital technologies designed to identify and prevent a variety of undesirable actions such as shoplifting, theft, vandalism, and even terrorist acts.

Market Share by Business Model

Based on business model, the video surveillance market is segmented into B2B, B2C and B2B2C. According to our estimates, currently, B2B segment captures the majority share of the market. This can be the rising implementation of global optical technology across various sectors, including education, manufacturing, healthcare, finance, and others. Additionally, the B2C model is projected to experience significant growth rate during this forecast period, as video surveillance technologies become more user-friendly, with consumers increasingly embracing global optical technology for customized applications, smartphone integration, and an enhanced user experience.

Market Share by Geographical Regions

Based on geographical regions, the video surveillance market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market. This can be attributed to the heightened awareness, which has increased the demand in sectors such as retail, banking, and corporate environments. Additionally, government investment has been significant in prioritizing public safety and the protection of critical infrastructure. Moreover, the implementation of advanced video analytics and integrated surveillance systems has substantially enhanced market demand for video surveillance solutions.

However, the market in Asia is expected to grow at a relatively higher CAGR during the forecast period.

Example Players in Video Surveillance Market

- Avigilon

- BCD

- Bosch

- Canon

- CP Plus

- Dahua

- Eagle Eye Networks

- FLIR Systems

- Genetec

- Hanwha Techwin

- Hangzhou Hikvision

- HONEYWELL

- Huawei

- IDIS

- Infinova

- March

- Motorola

- Panasonic

- Pelco

- Robert Bosch GmbH

- Teledyne FLIR

- Tyco

- Verkada

- VIVOTEK

- Zhejiang Uniview

VIDEO SURVEILLANCE MARKET: RESEARCH COVERAGE

The report on the video surveillance market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the video surveillance market, focusing on key market segments, including [A] type of component, [B] type of services, [C] type of government and public sector, [D] type of pricing model, [E] type of data storage, [F] type of user interface, [G] company size, [H] end user, [I] business model and [J] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the video surveillance market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the video surveillance market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] service / product portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in video surveillance market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.2.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7 Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodities

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Video Surveillance

- 6.2.1. Key Characteristics of video surveillance market

- 6.2.2. Type of Component

- 6.2.3. Type of Services

- 6.2.4. Type of Sector

- 6.2.5. Type of Pricing Model

- 6.2.6. Type of Data Storage

- 6.2.7. Type of User Interface

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Video Surveillance: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2.1. Avigilon*

- 8.2.1.1. Company Overview

- 8.2.1.2. Company Mission

- 8.2.1.3. Company Footprint

- 8.2.1.4. Management Team

- 8.2.1.5. Contact Details

- 8.2.1.6. Financial Performance

- 8.2.1.7. Operating Business Segments

- 8.2.1.8. Service / Product Portfolio (project specific)

- 8.2.1.9. MOAT Analysis

- 8.2.1.10. Recent Developments and Future Outlook

- 8.2.2. BCD

- 8.2.3. Bosch

- 8.2.4. Canon

- 8.2.5. Dahua

- 8.2.6. Genetec

- 8.2.7. HONEYWELL

- 8.2.8. Huawei

- 8.2.9. IDIS

- 8.2.10. Infinova

- 8.2.11. Motorola

- 8.2.12. Panasonic

- 8.2.1. Avigilon*

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL VIDEO SURVEILLANCE MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Video Surveillance Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF COMPONENT

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Video Surveillance Market for Cameras: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.6.1. Video Surveillance Market for Analog: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.6.2. Video Surveillance Market for IP: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.6.3. Video Surveillance Market for Thermal: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.6.4. Video Surveillance Market for PTZ (Pan-Tilt-Zoom): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Video Surveillance Market for Hardware: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7.1. Video Surveillance Market for Encoders: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7.2. Video Surveillance Market for Monitors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7.3. Video Surveillance Market for Recorders: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7.4. Video Surveillance Market for Storage Device: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Video Surveillance Market for Software: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8.1. Video Surveillance Market for Video Management Software: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8.2. Video Surveillance Market for Video Analytics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF SERVICES

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Video Surveillance Market for VSaaS: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Video Surveillance Market for Installation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Video Surveillance Market for Maintenance: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Video Surveillance Market for Consulting: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.10. Video Surveillance Market for Management Services: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.11. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON GOVERNMENT AND PUBLIC SECTOR

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Video Surveillance Market for Public Transportation (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Video Surveillance Market for On Law Enforcement: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Video Surveillance Market for Municipal Surveillance: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF PRICING MODEL

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Video Surveillance Market based on Per Camera: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Video Surveillance Market based on Per System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Video Surveillance Market based on Subscription-Based: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.9. Video Surveillance Market based on Pay-Per-Use: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.10. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF DATA STORAGE

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Video Surveillance Market for Local Storage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Video Surveillance Market for Cloud Storage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Video Surveillance Market for Hybrid Storage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.9. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON USER INTERFACE

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Video Surveillance Market for Web Based Interface: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Video Surveillance Market for Desktop Application: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Video Surveillance Market for Mobile App: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Video Surveillance Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Video Surveillance Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON END USER

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Video Surveillance Market for Commercial: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.1. Video Surveillance Market for Retail: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.2. Video Surveillance Market for Banking, Financial Services: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.3. Video Surveillance Market for Hospitality: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.4. Video Surveillance Market for Corporate Offices: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Video Surveillance Market for Residential: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7.1. Video Surveillance Market for Homes: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7.2 Video Surveillance Market for Apartments: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7.3. Video Surveillance Market for Gated Communities: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Video Surveillance Market for Industries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8.1. Video Surveillance Market for Manufacturing Facilities: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9 Video Surveillance Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.10. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON BUSINESS MODEL

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Video Surveillance Market for B2B: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Video Surveillance Market for B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Video Surveillance Market for B2B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035))

- 20.9. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN NORTH AMERICA

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Global Photonics Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.1. Global Photonics Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.2. Global Photonics Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.3. Global Photonics Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.4. Global Photonics Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN EUROPE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Video Surveillance Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Video Surveillance Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. Video Surveillance Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. Video Surveillance Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. Video Surveillance Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.5. Video Surveillance Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.6. Video Surveillance Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.7. Video Surveillance Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.8. Video Surveillance Market in the Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.9. Video Surveillance Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.10. Video Surveillance Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.11. Video Surveillance Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.12. Video Surveillance Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.13. Video Surveillance Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.14. Video Surveillance Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.15. Video Surveillance Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN ASIA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Video Surveillance Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Video Surveillance Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Video Surveillance Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Video Surveillance Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Video Surveillance Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.5. Video Surveillance Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.6. Video Surveillance Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Video Surveillance Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Video Surveillance Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 24.6.2. Video Surveillance Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Video Surveillance Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Video Surveillance Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. Video Surveillance Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. Video Surveillance Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.7. Video Surveillance Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.8. Video Surveillance Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN LATIN AMERICA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Video Surveillance Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Video Surveillance Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. Video Surveillance Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Video Surveillance Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Video Surveillance Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Video Surveillance Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Video Surveillance Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR VIDEO SURVEILLANCE IN REST OF THE WORLD

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Video Surveillance Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Video Surveillance Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. Video Surveillance Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Video Surveillance Market in Other Countries

- 25.7. Data Triangulation and Validation