|

시장보고서

상품코드

1762525

헬스케어용 디지털 트윈 시장 : 업계 동향과 세계 예측 - 치료 영역별, 디지털 트윈 유형별, 용도별, 최종사용자별, 주요 지역별Digital Twins in Healthcare Market: Industry Trends and Global Forecasts - Distribution by Therapeutic Area, Type of Digital Twin, Areas of Application, End Users and Key Geographical Regions |

||||||

헬스케어용 디지털 트윈 시장 : 개요

세계의 헬스케어용 디지털 트윈 시장 규모는 2035년까지의 예측 기간 중 29.6%의 CAGR로 확대하며, 현재 25억 달러에서 2035년까지 334억 달러로 성장할 것으로 예측됩니다.

시장 세분화에서는 시장 규모 및 기회 분석을 다음과 같은 매개 변수로 구분합니다.

치료 영역

- 심혈관 질환

- 대사성 질환

- 정형외과 질환

- 기타

디지털 트윈 유형

- 프로세스 트윈

- 시스템 트윈

- 전신 트윈

- 신체 부위 트윈

용도

- 자산/프로세스 관리

- 맞춤형 치료

- 수술 계획

- 진단

- 기타

최종사용자

- 제약회사

- 의료기기 제조업체

- 의료 서비스 프로바이더

- 환자

- 기타

주요 지역

- 북미

- 유럽

- 아시아

- 라틴아메리카

- 중동 및 북아프리카

- 기타 지역

헬스케어용 디지털 트윈 시장 : 성장과 동향

디지털 트윈은 현실 세계의 사물, 프로세스, 서비스의 디지털 복제본을 말합니다. 이러한 가상 시스템은 인공지능(AI)과 데이터 분석을 사용하여 사물인터넷(IoT) 장비 및 센서를 사용하여 수집된 실시간 데이터를 기반으로 시뮬레이션을 실행하여 원래 시스템의 워크플로우를 정확하게 재현합니다. 주목할 만한 점은 센서, 모델, 이미지 등 다양한 데이터 소스를 사용하여 디지털 트윈을 생성할 수 있다는 점입니다. 현재 디지털 트윈(물리적 물체나 환경의 가상 복제본)은 다양한 산업에서 활용되고 있으며, 헬스케어 분야도 예외는 아닙니다.

헬스케어에 디지털 트윈을 적용하면 환자 치료에 혁명을 일으키고, 원격 치료를 개선하고, 개인화된 치료법을 만들고, 비용을 절감할 수 있는 잠재력을 가지고 있습니다. 실제로 의료 분야에서 이러한 기술은 환자의 병력, 증상, 현재 치료, 심지어 혈압, 심박수와 같은 생체 데이터까지 완벽하게 표현할 수 있습니다. 최근 업계 인사이트에 따르면 헬스케어 경영진의 66%가 향후 3년간 디지털 트윈 기술에 대한 투자가 증가할 것으로 예상하고 있습니다. 디지털 트윈을 활용하면 의료 서비스 프로바이더는 실시간 환자 데이터에 액세스하여 환자의 신체적, 정신적, 정서적 요구에 대한 더 깊은 인사이트를 얻고 보다 효과적이고 맞춤화된 치료를 제공할 수 있습니다. 그 결과, 많은 디지털 트윈 기업이 헬스케어 업계의 요구를 충족시키는 솔루션 개발에 집중하고 있습니다.

헬스케어용 디지털 트윈 시장 : 주요 인사이트

이 보고서는 헬스케어 분야의 디지털 트윈 시장 현황을 살펴보고, 업계의 잠재적 성장 기회를 파악하고자 합니다. 주요 조사 결과는 다음과 같습니다.

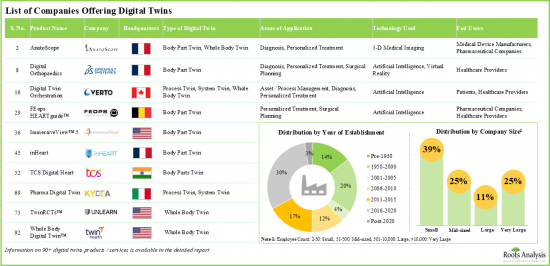

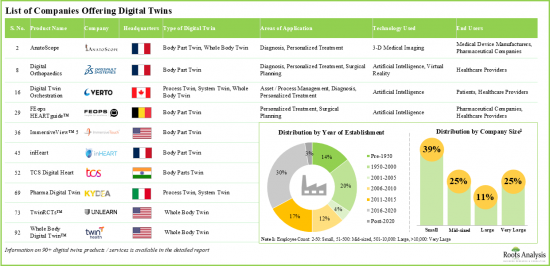

- 현재 90개 이상의 디지털 트윈이 진단, 건강 모니터링, 수술 계획 등 다양한 헬스케어 관련 용도로 시판 중이거나 개발 중입니다.

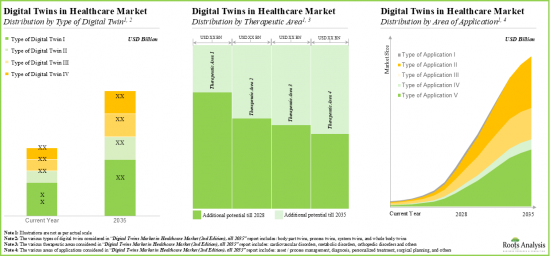

- 업계에서 제공하는 디지털 트윈의 42% 이상이 프로세스 트윈이며, 그 대부분은 주로 자산/프로세스 관리, 개인화 치료, 수술 계획 등을 목적으로 하고 있습니다.

- 헬스케어 산업의 디지털 트윈에서 경쟁 우위를 점하기 위해 각 업체들은 기존 제품을 지속적으로 업그레이드하고 포트폴리오를 확장하고 있습니다.

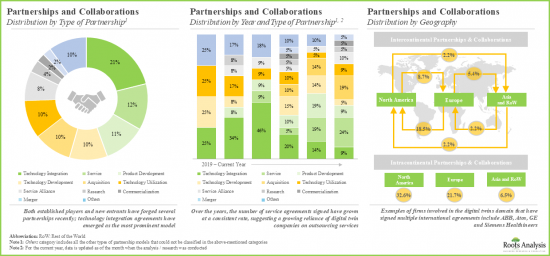

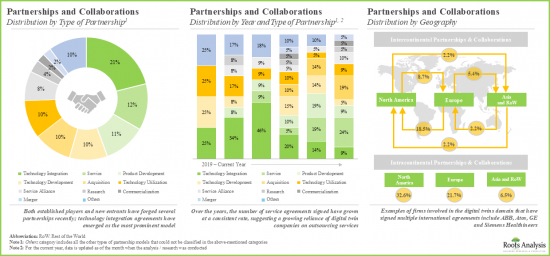

- 이 업계의 파트너십 활동은 지난 3년 동안 20% 이상의 비율로 성장하고 있으며, 지난 2년 동안 45% 이상의 거래가 체결되었습니다는 점은 주목할 만합니다.

- 현재 진행 중인 혁신을 지원하기 위해 여러 민간 및 공공 투자자들이 막대한 자본을 투자하고 있습니다.

- 디지털 트윈 시장의 스타트업들은 경쟁사와의 차별화를 위해 인공지능, 블록체인 등 진보적이고 혁신적인 기술을 점진적으로 도입하고 있습니다.

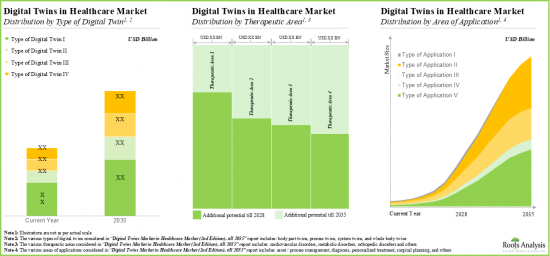

- 헬스케어 및 제약업계의 디지털 트윈 기술 도입 확대에 힘입어 헬스케어 분야의 세계 디지털 트윈 시장은 2035년까지 연평균 29.6%의 성장률을 보일 것으로 전망하고 있습니다.

- 전체 시장 기회는 다양한 최종사용자에게 잘 분배될 가능성이 높습니다. 지역별로는 북미가 시장 점유율의 대부분을 차지할 것으로 예측됩니다.

헬스케어용 디지털 트윈 시장 : 주요 부문

이 시장은 치료 영역별로 심혈관 질환, 대사성 질환, 정형외과 질환, 기타 질환으로 구분됩니다. 현재 전 세계 디지털 트윈 헬스케어 시장에서는 심혈관 질환 분야가 가장 큰 비중을 차지하고 있습니다. 이 추세는 앞으로도 변하지 않을 것으로 보입니다.

디지털 트윈 유형에 따라 시장은 프로세스 트윈, 시스템 트윈, 전신 트윈, 신체 부위 트윈으로 구분됩니다. 현재 프로세스 트윈 부문이 세계 헬스케어 디지털 트윈 시장에서 가장 높은 비중을 차지하고 있습니다. 그 주요 이유는 디지털 트윈의 프로세스가 헬스케어 워크플로우의 상세한 시뮬레이션과 최적화를 용이하게 하여 효율성, 비용 절감, 환자 결과 개선으로 이어지기 때문입니다. 또한 신체 부위 트윈 부문은 향후 가장 높은 성장률을 보일 것으로 예측됩니다.

시장 세분화에서는 용도별로 자산/프로세스 관리, 개별 치료, 수술 계획, 진단, 기타로 분류하고 있습니다. 현재 세계 헬스케어 디지털 트윈 시장에서는 자산/프로세스 관리 분야가 가장 큰 비중을 차지하고 있습니다. 그러나 개인화 치료 부문은 그 채택이 증가함에 따라 향후 더 높은 CAGR로 성장할 것으로 예측됩니다.

최종사용자별로 시장은 제약사, 의료기기 제조업체, 의료 서비스 프로바이더, 환자, 기타 최종사용자로 구분됩니다. 현재 제약회사 부문은 세계 헬스케어 디지털 트윈 시장에서 가장 큰 점유율을 차지하고 있습니다. 또한 환자 부문은 예측 기간 중 높은 성장률로 성장할 것으로 예측됩니다.

주요 지역별로 시장은 북미, 유럽, 아시아, 아시아, 라틴아메리카, 중동 및 아프리카, 기타 라틴아메리카로 구분됩니다. 현재 북미가 전 세계 디지털 트윈 헬스케어 시장을 독점하고 있으며, 가장 큰 매출 점유율을 차지하고 있습니다. 또한 아시아 시장은 향후 더 높은 CAGR로 성장할 가능성이 높습니다.

헬스케어용 디지털 트윈 시장의 참여 기업 예

- BigBear.ai

- Certara

- Dassault Systemes

- DEO

- Mesh Bio

- NavvTrack

- OnScale

- Phesi

- PrediSurge

- SingHealth

- Twin Health

- Unlearn

- Verto

- VictoryXR

- Virtonomy

목차

제1장 서문

헬스케어용 디지털 트윈 시장 : 시장 개요

제2장 조사 방법

제3장 경제적 및 기타 프로젝트 특유 고려 사항

제4장 개요

제5장 서론

- 챕터 개요

- 헬스케어용 디지털 트윈의 개요

- 헬스케어에서 이용되는 디지털 트윈 유형

- 헬스케어 분야에서 디지털 트윈의 응용

- 디지털 트윈의 도입에 수반하는 과제

- 결론

제6장 시장 구도

- 챕터 개요

- 헬스케어용 디지털 트윈 : 시장 구도

- 헬스케어용 디지털 트윈 : 개발자 상황

제7장 주요 인사이트

- 챕터 개요

- 용도와 개발 상황별 분석

- 사용되는 기술의 유형과 디지털 트윈 유형별 분석

- 최종사용자의 유형과 디지털 트윈 유형별 분석

- 본사 소재지와 용도별 분석

- 기업 규모와 본사 소재지별 분석

제8장 기업 경쟁력 분석

- 챕터 개요

- 전제와 주요 파라미터

- 조사 방법

- 헬스케어용 디지털 트윈 : 기업 경쟁력 분석

제9장 상세한 기업 개요

- 챕터 개요

- BigBear.ai

- Certara

- Dassault Systemes

- NavvTrack

- Unlearn.ai

제10장 기업 개요 리스트

- 챕터 개요

- 북미에 기반을 둔 기업

- OnScale

- Phesi

- Twin Health

- Verto

- VictoryXR

- 유럽에 기반을 둔 기업

- DEO

- PrediSurge

- Virtonomy

- 아시아에 기반을 둔 기업

- Mesh Bio

- SingHealth

제11장 파트너십과 협업

- 챕터 개요

- 헬스케어용 디지털 트윈 : 파트너십과 협업

제12장 자금조달과 투자 분석

- 챕터 개요

- 자금조달의 유형

- 헬스케어용 디지털 트윈 : 자금조달과 투자 리스트

- 결론

제13장 BERKUS 스타트업 평가 분석

- 챕터 개요

- 주요 전제와 조사 방법

- Berkus 스타트업 평가 : 참여 기업의 총평가

- 헬스케어용 디지털 트윈 : Berkus 스타트업 평가 파라미터의 벤치마킹

- 헬스케어용 디지털 트윈 : 참여 기업의 벤치마킹

제14장 시장 영향 분석 : 촉진요인, 억제요인, 기회, 과제

제15장 헬스케어 시장의 세계 디지털 트윈

제16장 헬스케어용 디지털 트윈 시장(치료 영역별)

제17장 헬스케어용 디지털 트윈 시장(디지털 트윈 유형별)

제18장 헬스케어용 디지털 트윈 시장(용도별)

제19장 헬스케어용 디지털 트윈 시장(최종사용자별)

제20장 헬스케어용 디지털 트윈 시장(지역별)

제21장 결론

제22장 이그제큐티브 인사이트

제23장 부록 I : 표형식 데이터

제24장 부록 II : 기업 및 조직 리스트

KSA 25.07.10DIGITAL TWINS IN HEALTHCARE MARKET: OVERVIEW

As per Roots Analysis, the global digital twins in healthcare market is estimated to grow from USD 2.5 billion in the current year to USD 33.4 billion by 2035, at a CAGR of 29.6% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Therapeutic Area

- Cardiovascular Disorders

- Metabolic Disorders

- Orthopedic Disorders

- Other Disorders

Type of Digital Twin

- Process Twins

- System Twins

- Whole Body Twins

- Body Part Twins

Area of Application

- Asset / Process Management

- Personalized Treatment

- Surgical Planning

- Diagnosis

- Other Applications

End Users

- Pharmaceutical Companies

- Medical Device Manufacturers

- Healthcare Providers

- Patients

- Other End Users

Key Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

- Rest of the World

DIGITAL TWINS IN HEALTHCARE MARKET: GROWTH AND TRENDS

Digital twins refer to a digital replica of a real-world object, process, or service. These virtual systems use artificial intelligence (AI) and data analytics to run simulations based on the real-time data gathered using internet of things (IoT) devices and sensors, to accurately replicate the workflow of an original system. Notably, digital twins can be created using a wide range of data sources, such as sensors, models, and images. At present, digital twins, or virtual replicas of physical objects and environments, are being used in many different industries, and healthcare is no exception.

The application of digital twins in healthcare has the potential to revolutionize patient care, improve remote care, create personalized treatments and reduce costs. In fact, in healthcare, these technologies can provide the full representation of a patient's medical history, symptoms, current treatment, and even biometric data, such as blood pressure and heart rate. According to recent industry insights, 66% of healthcare executives anticipate increased investment in digital twin technologies over the next three years. By leveraging digital twins, healthcare providers can access real-time patient data, gaining deeper insight into their physical, mental, and emotional needs to deliver more effective and tailored care. Consequently, a number of digital twin companies are focusing on developing solutions that meet the needs of the healthcare industry.

DIGITAL TWINS IN HEALTHCARE MARKET: KEY INSIGHTS

The report delves into the current state of the digital twins in healthcare market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Currently, over 90 digital twins are either commercially available in the market or are under development for various healthcare related applications including diagnosis, health monitoring and surgical planning.

- Over 42% of the digital twins offered by industry players are process twins; majority of the twins are primarily intended for asset / process management, personalized treatment and surgical planning.

- In order to gain a competitive edge in digital twins in healthcare industry, companies are continuously upgrading their existing offerings to expand their portfolio.

- The partnership activity in this industry has grown at a rate of over 20% in the past three years; it is worth noting that over 45% of the deals have been signed in the last two years.

- To support the ongoing innovations, several private and public investors have made substantial capital investments; notably, most of the funding rounds took place in the past few years.

- Start-ups in the digital twin market are gradually adopting advanced and innovative technologies, such as artificial intelligence and blockchain, in order to differentiate themselves from their competitors.

- Driven by increasing adoption of digital twin technologies in healthcare and pharmaceutical industries, we anticipate the global digital twins market in healthcare domain to grow at an annualized rate of 29.6%, till 2035.

- The overall market opportunity is likely to be well distributed among various end users; in terms of geographical regions, North America is expected to capture the majority of the market share.

DIGITAL TWINS IN HEALTHCARE MARKET: KEY SEGMENTS

Cardiovascular Disorders Segment holds the Largest Share of the Digital Twins in Healthcare Market

Based on the therapeutic area, the market is segmented into cardiovascular disorders, metabolic disorders, orthopedic disorders, and other disorders. At present, the cardiovascular disorders segment holds the maximum share of the global digital twins in healthcare market. This trend is likely to remain the same in the coming years.

By Type of Digital Twin, Body Part Twins is the Fastest Growing Segment of the Global Digital Twins in Healthcare Market

Based on the type of digital twin, the market is segmented into process twins, system twins, whole body twins and body part twins. Currently, the process twins segment captures the highest proportion of the global digital twins in healthcare market. The primary reason for this is that the process of digital twins facilitates detailed simulations and optimizations of healthcare workflows, resulting in greater efficiency, cost reductions, and better patient outcomes, which fuels their broad adoption. Further, the body part twins segment is anticipated to show the highest growth rate in the coming future.

Asset / Process Management Segment Occupy the Largest Share of the Global Digital Twins in Healthcare Market by Area of Application

Based on the area of application, the market is segmented into asset / process management, personalized treatment, surgical planning, diagnosis and other applications. At present, the asset / process management segment holds the maximum share of the global digital twins in healthcare market. However, the market for personalized treatment segment is expected to grow at a higher CAGR in the coming future owing to its increasing adoption.

Pharmaceutical Companies Segment Account for the Largest Share of the Global Digital Twins in Healthcare Market

Based on the end users, the market is segmented into pharmaceutical companies, medical device manufacturers, healthcare providers, patients, and other end users. Currently, pharmaceutical companies segment holds the maximum share of the global digital twins in healthcare market. Further, the patient's segment is anticipated to grow at a higher growth rate during the forecasted period.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. Currently, North America dominates the global digital twins in healthcare market and accounts for the largest revenue share. Further, the market Asia is likely to grow at a higher CAGR in the coming future.

Example Players in the Digital Twins in Healthcare Market

- BigBear.ai

- Certara

- Dassault Systemes

- DEO

- Mesh Bio

- NavvTrack

- OnScale

- Phesi

- PrediSurge

- SingHealth

- Twin Health

- Unlearn

- Verto

- VictoryXR

- Virtonomy

DIGITAL TWINS IN HEALTHCARE MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global digital twins in healthcare market, focusing on key market segments, including [A] therapeutic area, [B] type of digital twin, [C] area of application, [D] end users and [E] key geographical regions.

- Market Landscape: A comprehensive evaluation of players engaged in the development of digital twins, based on several relevant parameters, such as [A] year of establishment, [B] company size, and [C] location of headquarters. Additionally, a comprehensive evaluation of digital twins in the healthcare market, based on several relevant parameters, such as [D] status of development, [E] therapeutic area, [F] areas of application, [G] type of technology used, [H] type of digital twin and [I] end users.

- Key Insights: In-depth market analysis, highlighting the contemporary market trends, using five schematic representations, focusing on [A] areas of application and status of development, [B] type of technology used and type of digital twin, [C] type of end user and type of digital twin, [D] area of application and location of headquarters, and [E] company size and location of headquarters.

- Company Competitiveness Analysis: A comprehensive competitive analysis of players involved in the production / development of digital twins in the healthcare industry, examining factors, such as [A] years of experience, [B] portfolio strength, [C] partnership strength and [D] funding strength.

- Company Profiles: In-depth profiles of key players that are currently involved in the digital twins in healthcare market, focusing on [A] overview of the company, [B] financial information (if available) and [C] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in this domain, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] most active players (in terms of the number of partnerships signed) and [D] geographical distribution of partnership activity.

- Funding and Investment Analysis: An in-depth analysis of the fundings received by players in digital twin domain, based on relevant parameters, such as [A] number of funding instances, [B] amount invested, [C] type of funding, [D] most active players, [E] most active investors and [F] geography.

- Berkus Start-up Valuation Analysis: A detailed analysis to evaluate start-ups engaged in digital twin domain, by assigning monetary values to various competition differentiators possessed by a player, focusing on the Berkus start-up valuation parameters, such as [A] sound idea, [B] prototype, [C] management experience and [D] strategic relationships undertaken by market players.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

1.1. Digital Twins in Healthcare Market: Market Overview

- 1.2. Market Share Insights

- 1.3. Market Segmentation Overview

- 1.4. Key Market Insights

- 1.5. Report Coverage

- 1.6. Key Questions Answered

- 1.7. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Trends Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Overview of Digital Twins in Healthcare

- 5.3. Types of Digital Twins Used in Healthcare

- 5.3.1. System Twin

- 5.3.2. Process Twin

- 5.3.3. Human Digital Twin

- 5.4. Applications of Digital Twins in the Healthcare Domain

- 5.4.1. Asset / Process Management

- 5.4.2. Clinical Trial Evaluation

- 5.4.3. Personalized Medicine

- 5.4.4. Surgical Planning

- 5.5. Challenges Associated with the Adoption of Digital Twins

- 5.6. Concluding Remarks

6. MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Digital Twins in Healthcare: Overall Market Landscape

- 6.2.1. Analysis by Development Status

- 6.2.2. Analysis by Therapeutic Area

- 6.2.3. Analysis by Area of Application

- 6.2.4. Analysis by Type of Technology Used

- 6.2.5. Analysis by End Users

- 6.2.6. Analysis by Type of Digital Twin

- 6.3. Digital Twins in Healthcare: Developer Landscape

- 6.3.1. Analysis by Year of Establishment

- 6.3.2. Analysis by Company Size

- 6.3.3. Analysis by Location of Headquarters

7. KEY INSIGHTS

- 7.1. Chapter Overview

- 7.2. Analysis by Area of Application and Development Status

- 7.3. Analysis by Type of Technology Used and Type of Digital Twin

- 7.4. Analysis by Type of End User and Type of Digital Twin

- 7.5. Analysis by Location of Headquarters and Area of Application

- 7.6. Analysis by Company Size and Location of Headquarters

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Digital Twins in Healthcare: Company Competitiveness Analysis

- 8.4.1. Company Competitiveness Analysis: Benchmarking of Portfolio Strength

- 8.4.2. Company Competitiveness Analysis: Benchmarking of Partnership Activity

- 8.4.3. Company Competitiveness Analysis: Benchmarking of Funding Activity

- 8.4.4. Company Competitiveness Analysis: Players Based in North America

- 8.4.5. Company Competitiveness Analysis: Players Based in Europe

- 8.4.6. Company Competitiveness Analysis: Players Based in Asia and Rest of the World

9. DETAILED COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. BigBear.ai

- 9.2.1. Company Overview

- 9.2.2. Financial Information

- 9.2.3. Recent Developments and Future Outlook

- 9.3. Certara

- 9.3.1. Company Overview

- 9.3.2. Financial Information

- 9.3.3. Recent Developments and Future Outlook

- 9.4. Dassault Systemes

- 9.4.1. Company Overview

- 9.4.2. Financial Information

- 9.4.3. Recent Developments and Future Outlook

- 9.5. NavvTrack

- 9.5.1. Company Overview

- 9.5.2. Recent Developments and Future Outlook

- 9.6. Unlearn.ai

- 9.6.1. Company Overview

- 9.6.2. Recent Developments and Future Outlook

10. TABULATED COMPANY PROFILES

- 10.1. Chapter Overview

- 10.2. Players Based in North America

- 10.2.1. OnScale

- 10.2.2. Phesi

- 10.2.3. Twin Health

- 10.2.4. Verto

- 10.2.5. VictoryXR

- 10.3. Players Based in Europe

- 10.3.1. DEO

- 10.3.2. PrediSurge

- 10.3.3. Virtonomy

- 10.4. Players Based in Asia

- 10.4.1. Mesh Bio

- 10.4.2. SingHealth

11. PARTNERSHIPS AND COLLABORATIONS

- 11.1. Chapter Overview

- 11.2. Digital Twins in Healthcare: Partnerships and Collaborations

- 11.2.1. Partnership Models

- 11.2.2. List of Partnerships and Collaborations

- 11.2.3. Analysis by Year of Partnership

- 11.2.4. Analysis by Type of Partnership

- 11.2.5. Analysis by Year and Type of Partnership

- 11.2.6. Analysis by Type of Partnership and Company Size

- 11.2.7. Most Active Players: Analysis by Number of Partnerships

- 11.2.8. Local and International Agreements

- 11.2.9. Intercontinental and Intracontinental Agreements

12. FUNDING AND INVESTMENTS ANALYSIS

- 12.1. Chapter Overview

- 12.2. Types of Funding

- 12.3. Digital Twins in Healthcare: List of Funding and Investments

- 12.3.1. Analysis by Number of Funding Instances

- 12.3.2. Analysis by Amount Invested

- 12.3.3. Analysis by Type of Funding

- 12.3.4. Analysis by Geography

- 12.3.5. Most Active Players: Analysis by Number of Funding Instances

- 12.3.6. Most Active Players: Analysis by Amount of Funding

- 12.3.7. Most Active Investors: Analysis by Number of Funding Instances

- 12.4. Concluding Remarks

13. BERKUS START-UP VALUATION ANALYSIS

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Berkus Start-Up Valuation: Total Valuation of Players

- 13.4. Digital Twins in Healthcare: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.1. AI Body: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.2. AnatoScope: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.3. Antleron: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.4. EmbodyBio: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.5. Klinik Sankt Moritz: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.6. KYDEA: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.7. MAI: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.8. Mindback AI: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.9. Neo PLM: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.10. Twinsight: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.4.11. Yokogawa Insilico Biotechnology: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.5. Digital Twins in Healthcare: Benchmarking of Players

- 13.5.1. Sound Idea: Benchmarking of Players

- 13.5.2. Prototype: Benchmarking of Players

- 13.5.3. Management Experience: Benchmarking of Players

- 13.5.4. Strategic Relationships: Benchmarking of Players

- 13.5.5. Total Valuation: Benchmarking of Players

14. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 14.1. Chapter Overview

- 14.2. Market Drivers

- 14.3. Market Restraints

- 14.4. Market Opportunities

- 14.5. Market Challenges

- 14.6. Conclusion

15. GLOBAL DIGITAL TWIN IN HEALTHCARE MARKET

- 15.1. Chapter Overview

- 15.2. Assumptions and Methodology

- 15.3. Global Digital Twin in Healthcare Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.3.1. Scenario Analysis

- 15.4. Key Market Segmentations

16. DIGITAL TWIN IN HEALTHCARE MARKET, BY THERAPEUTIC AREA

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Cardiovascular Disorders: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.4. Metabolic Disorders: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.5. Orthopedic Disorders: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.6. Other Disorders: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.7. Data Triangulation and Validation

17. DIGITAL TWIN IN HEALTHCARE MARKET, BY TYPE OF DIGITAL TWINS

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Process Twins: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.4. System Twins: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.5. Whole Body Twins: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.6. Body Part Twins: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.7. Data Triangulation and Validation

18. DIGITAL TWIN IN HEALTHCARE MARKET, BY AREA OF APPLICATION

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Asset / Process Management: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.4. Personalized Treatment: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.5. Surgical Planning: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.6. Diagnosis: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.7. Other Applications: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.8. Data Triangulation and Validation

19. DIGITAL TWIN IN HEALTHCARE MARKET, BY END USERS

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Pharmaceutical Companies: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.4. Medical Device Manufacturers: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.5. Healthcare Providers: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6. Patients: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.7. Other End Users: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

20. DIGITAL TWIN IN HEALTHCARE MARKET, BY GEOGRAPHY

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.1. US: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.2. Canada: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4. Europe: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.1. France: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.2. Germany: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.3. Italy: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.4. Spain: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.5. UK: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.6. Rest of Europe: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5. Asia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.1. China: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.2. India: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.3. Japan: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.4. Singapore: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.5. South Korea: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.6. Rest of Asia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6. Latin America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.1. Brazil: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.7. Middle East and North Africa: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.7.1. UAE: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.8. Rest of the World: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.8.1. Australia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.8.2. New Zealand: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.9. Data Triangulation and Validation

21. CONCLUSION

22. EXECUTIVE INSIGHTS

- 22.1. Chapter Overview

- 22.2. Company A

- 22.2.1. Company Snapshot

- 22.2.2. Interview Transcript, Business Consultant

- 22.3. Company B

- 22.3.1. Company Snapshot

- 22.3.2. Interview Transcript, Co-Founder and Chief Scientific Officer

- 22.4. Company C

- 22.4.1. Company Snapshot

- 22.4.2. Interview Transcript, Business Development Executive

- 22.5. Company D

- 22.5.1. Company Snapshot

- 22.5.2. Interview Transcript, Managing Director and Chief Executive Officer