|

시장보고서

상품코드

1771294

항바이러스제 시장 : 업계 동향 및 예측 - 작용기전별, 적응증별, 약제 표적별, 치료 유형별, 주요 지역별Antiviral Drugs Market: Industry Trends and Global Forecasts - Distribution by Mechanism of Action, Target Indication, Drug Target, Type of Therapy and Key Geographical Regions |

||||||

세계의 항바이러스제 시장 : 개요

세계의 항바이러스제 시장 규모는 2035년까지 예측 기간 동안 6.2%의 연평균 복합 성장률(CAGR)로 확대될 전망이며, 현재 650억 달러에서 2035년까지 1,270억 달러로 성장할 것으로 예측됩니다.

시장 세분화는 시장 규모 및 시장 기회를 다음 매개 변수로 구분합니다.

작용 기전별

- 융합 억제제

- DNA 폴리머라제

- 프로테아제 억제제

- 역전사효소

- 기타

적응증별

- 인간 면역 결핍 바이러스 감염

- 코로나바이러스 감염증

- 간염

- 단순 헤르페스 바이러스 감염

- 사이토메갈로바이러스 감염증

- 인플루엔자

- 기타

약제 표적별

- 바이러스 표적

- 숙주 표적

치료 유형별

- 단제 요법

- 병용 요법

주요 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 북아프리카

세계의 항바이러스제 시장 : 성장 및 동향

전염병은 세계의 주요 사망 톱 10 중 하나로 알려져 있습니다. 실제로 연간 4,000만 명 이상이 다양한 종류의 감염병에 이환되고 있습니다. 게다가 코로나19 팬데믹 발생 5년이 지났지만 바이러스는 완전한 근절의 기미가 보이지 않은 채 계속 존속하고 있습니다. 란셋지에 실린 논문에 따르면 코로나19 팬데믹은 2020년에만 1800만 명 이상의 사망자를 냈습니다. 게다가 대표적인 바이러스성 질환의 하나인 인간 면역결핍 바이러스(HIV)는, 2030년까지 세계에서 650만 명이 사망할 것으로 예측되고 있습니다. 따라서 몇몇 제약회사는 항바이러스제를 개발함으로써 감염병의 위험을 줄이는 연구개발 프로세스를 강화하고 있습니다.

항바이러스제란 인간 면역결핍 바이러스 감염증, 사이토메갈로바이러스(CMV) 감염증, 코로나바이러스 감염증(COVID-19), 인플루엔자 등의 바이러스 감염증을 치료할 가능성을 나타내는 약제 클래스별을 가리킵니다. 여기서 주목해야 할 것은 알려진 220가지 바이러스 중 10가지를 표적으로 하여 사람에게 여러 감염병을 일으키는 80가지 가까운 항바이러스제가 USFDA로부터 승인을 받고 있다는 것입니다. 주목할 만한 것은 현재 여러 항바이러스제가 다양한 임상 시험에서 평가되고 있다는 것입니다. 이 분야의 연구 증가 및 효과적인 항바이러스제에 대한 수요 증가로 시장은 예측 기간 동안 안정적인 성장을 이룰 것으로 예상됩니다.

세계의 항바이러스제 시장 : 주요 인사이트

이 보고서는 세계 항바이러스제 시장의 현재 상태를 조사하고 업계 내 잠재적 성장 기회를 확인하고 있습니다. 주요 조사 결과는 다음과 같습니다.

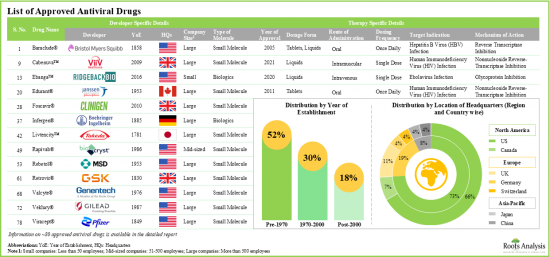

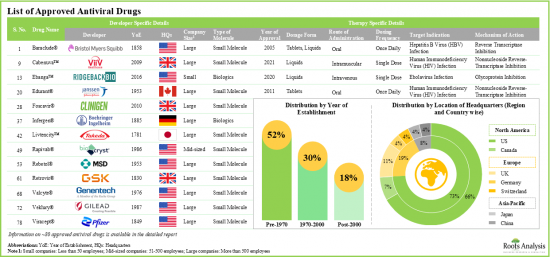

- 현재까지 80유형 가까이의 항바이러스제가 다양한 감염증의 치료제로서 승인되고 있으며 그 75% 가까이가 경구 투여입니다.

- 승인된 항바이러스제의 약 90%는 정제와 액제로 입수 가능합니다. 약제의 대부분은 저분자이며, 다양한 감염병에 대해 다른 투여 레지멘에서 사용할 수 있도록 설계되었습니다.

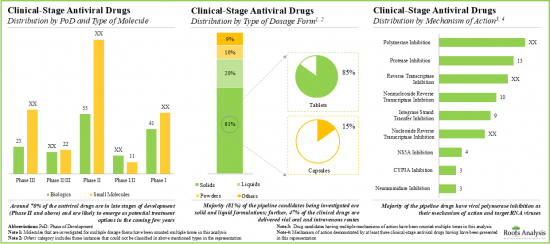

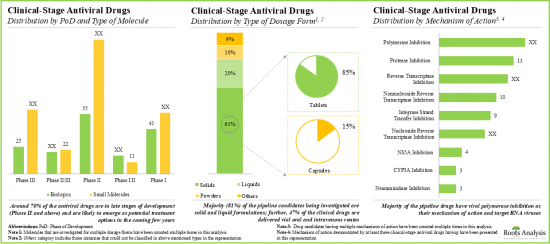

- 현재, 약 430개의 약물 후보가 여러 감염의 치료를 위해 다양한 단계의 임상시험에서 연구되고 있으며, 약물 분자의 대부분은 단제 요법으로 평가되고 있습니다.

- 폴리머라제 저해 및 프로테아제 저해가 가장 인기 있는 작용기전입니다.

- 이해관계자의 관심이 높아지고 있는 것은 제휴 활동의 활성화로부터도 분명합니다. 사실, 항바이러스제와 관련된 제휴는 지난 2년간 가장 많이 맺어졌습니다.

- 이 분야의 기회를 깨달은 여러 투자자들이 지난 4년간 다양한 자금조달 라운드에서 55억 달러 이상을 투자하고 있습니다.

- COVID-19의 유행은 제약 업계에서 효과적인 항바이러스제에 대한 수요의 급증으로 이어지고 있습니다.

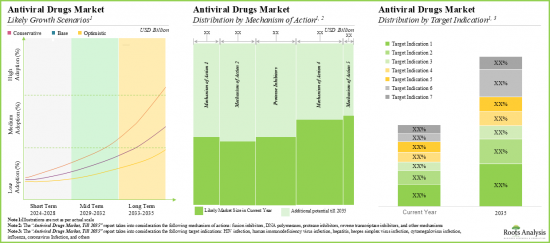

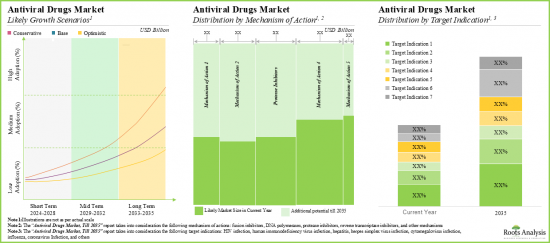

- 항바이러스제 시장은 CAGR 6.2%를 보일 것으로 예측되고 있으며, 현재 시장의 대부분의 점유율(44%)은 HIV 감염을 타겟으로 하는 약제가 차지하고 있습니다.

- 항바이러스제 시장과 관련된 기회는 다양한 유형의 약물 표적, 치료법, 주요 지리적 지역에 잘 분산되어 있을 가능성이 높습니다.

세계의 항바이러스제 시장 : 주요 부문

작용기전별로 시장은 융합 억제제, DNA 폴리머라제 억제제, 프로테아제 억제제, 역전사효소 등으로 구분됩니다. 현재 역전사 효소 부문은 HIV 및 C형 간염 치료에 효과적이기 때문에 세계의 항바이러스제 시장에서 최대 점유율을 차지하고 있습니다.

적응증별로, 시장은 인간 면역결핍 바이러스 감염증(HIV), 코로나 바이러스 감염증, 간염, 단순 헤르페스 바이러스 감염증, 사이토메갈로바이러스 감염증, 인플루엔자, 기타로 구분됩니다. 현재 세계의 항바이러스제 시장에서 가장 높은 비중을 차지하고 있는 것은 인간 면역결핍 바이러스 감염증입니다. 코로나바이러스 감염 부문의 항바이러스제 시장은 비교적 높은 CAGR로 성장할 가능성이 높다는 점은 주목할 만합니다.

약물 표적별로, 시장은 바이러스와 숙주로 구분됩니다. 현재 항바이러스제 시장에서는 바이러스 표적 약물이 최대 점유율을 차지하고 있습니다. 그러나 폭넓은 숙주를 나타낼 가능성이 있기 때문에 숙주 표적 부문은 상대적으로 높은 CAGR로 성장할 가능성이 높습니다.

치료 유형별로, 시장은 단독 요법과 병용 요법으로 구분됩니다. 현재, 단제 요법이 항바이러스제 시장에서 가장 높은 비율을 차지하고 있습니다. 또한, 비용 대비 효과나 높은 효율이라고 하는 이점으로부터, 병용 요법 시장이 비교적 높은 CAGR로 성장할 가능성이 높은 것은 주목할 가치가 있습니다.

주요 지역별로 보면 시장은 북미, 유럽, 아시아태평양, 라틴아메리카, 중동, 북아프리카로 구분됩니다. 현재 북미가 항바이러스제 시장을 독점하며 최대 수익 점유율을 차지하고 있습니다. 이는 이 지역 제약산업이 견조하고 연구기관의 수가 증가하면서 이 지역에서 감염병에 대한 연구 프로그램이 활발히 진행되고 있는 데 기인하고 있습니다.

세계 항바이러스제 시장에서의 진출기업 예

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb

- Genentech

- Gilead Sciences

- GlaxoSmithKline(GSK)

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Roche

- ViiV Healthcare

본 보고서에서는 세계의 항바이러스제 시장에 대해 조사했으며, 시장 개요와 함께 작용기전별, 적응증별, 약물 표적별, 치료 유형별 동향, 지역별 동향 및 시장 진출기업 프로파일 등의 정보를 제공합니다.

목차

제1장 서문

제2장 주요 요약

제3장 서문

- 항바이러스제의 개요

- 바이러스의 유형 및 바이러스성 질환

- 항바이러스제의 작용 기작

- 항바이러스제의 특징

- 항바이러스제의 장점

- 항바이러스제 개발에 따른 과제

- 항바이러스제의 중요한 사실 및 장래의 전망

제4장 시장 상황 : 승인된 항바이러스제

- 승인된 항바이러스제 : 시장 상황

- 승인된 항바이러스제 : 개발 상황

제5장 시장 상황 : 임상 항바이러스제

- 임상 단계 항바이러스제 : 시장 상황

- 임상 단계 항바이러스제 : 개발 정세

제6장 기업 프로파일

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb

- Genentech

- Gilead Sciences

- GlaxoSmithKline(GSK)

- Johnson &Johnson

- Merck

- Novartis

- Pfizer

- Roche

- ViiV Healthcare

제7장 파트너십 및 협업

제8장 자금 조달 및 투자

- 항바이러스제 : 자금 조달 및 투자

제9장 Porter's Five Forces 분석

제10장 시장 예측 및 기회 분석

- 예측 조사 방법 및 주요 전제조건

- 세계의 항바이러스제 시장(-2035년)

- 항바이러스제 시장 : 작용기전별

- 항바이러스제 시장 : 적응증별

- 항바이러스제 시장 : 약제 표적별

- 항바이러스제 시장 : 치료 유형별

- 항바이러스제 시장 : 지역별

제11장 주요 인사이트

제12장 부록 1 : 표 형식 데이터

제13장 부록 2 : 기업 및 단체 일람

AJY 25.07.21GLOBAL ANTIVIRAL DRUGS MARKET: OVERVIEW

As per Roots Analysis, the global antiviral drugs market is estimated to grow from USD 65 billion in the current year to USD 127 billion by 2035, at a CAGR of 6.2% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Mechanism of Action

- Fusion Inhibitors

- DNA Polymerases

- Protease Inhibitors

- Reverse Transcriptase

- Others

Target Indication

- Human Immunodeficiency Virus Infection

- Coronavirus Infection

- Hepatitis

- Herpes Simplex Virus Infection

- Cytomegalovirus Infection

- Influenza

- Others

Drug Target

- Virus Target

- Host Target

Type of Therapy

- Monotherapy

- Combination Therapy

Key Geographical Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and North Africa

GLOBAL ANTIVIRAL DRUGS MARKET: GROWTH AND TRENDS

Infectious diseases are known to be one of the top 10 leading causes of deaths, worldwide. In fact, more than 40 million people are affected by various types of infectious diseases annually. Further, it has been five years since the onset of COVID-19 pandemic, and the virus continues to persist with no indication of complete eradication. An article published in The Lancet journal reported that COVID-19 pandemic caused deaths of over 18 million people in 2020 alone. In addition, it has been reported that human immunodeficiency virus (HIV), one of the leading viral diseases is anticipated to be the cause for 6.5 million deaths globally, by 2030. Consequently, several pharmaceutical companies have increased their R&D processes to mitigate the risk of infectious diseases by developing antiviral drugs.

Antiviral drugs refer to the medication class that has shown potential to treat viral infection, including human immunodeficiency virus infection, cytomegalovirus (CMV) infection, Coronavirus infection (COVID-19), influenza, and others. It is worth highlighting here that close to 80 antiviral drugs that can target 10 out of 220 known viruses, resulting in multiple infections in humans, have received approval from the USFDA. Notably, several antiviral drugs are presently being evaluated under different clinical trials. Owing to the increasing research in this field and rising demand for effective antiviral drugs, the market is anticipated to witness steady growth during the forecast period.

GLOBAL ANTIVIRAL DRUGS MARKET: KEY INSIGHTS

The report delves into the current state of global antiviral drugs market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Close to 80 antiviral drugs have been approved, till date, for the treatment of an array of infectious diseases; nearly 75% of these drugs are administered via oral route.

- Around 90% of the approved antiviral drugs are available in tablet and liquid formulations; most of the drugs are small molecules, designed for use against various infectious diseases at different dosing regimens.

- Currently, around 430 drug candidates are being investigated in various phases of clinical trials for the treatment of multiple infectious diseases; majority of the drug molecules are being evaluated as monotherapies.

- More than 40% of the antiviral drug candidates are currently in phase II clinical trials; polymerase inhibition and protease inhibition are the most popular mechanisms of action.

- The growing interest of stakeholders is also evident from the rise in partnership activity; in fact, the maximum number of collaborations related to antiviral drugs were inked in the last two years.

- Several investors, having realized the opportunity within this segment, have invested over USD 5.5 billion across various funding rounds in the past four years.

- The COVID-19 pandemic led to surge in demand for effective antiviral drugs in the pharmaceutical industry; several stakeholders have entered to tap the opportunities within this domain.

- The antiviral drugs market is expected to grow at a CAGR of 6.2%; currently, the majority share of the market (44%) is captured by drugs targeting HIV infections.

- The opportunity associated with the antiviral drugs market is likely to be well distributed across various types of drug targets, therapies, and key geographical regions.

GLOBAL ANTIVIRAL DRUGS MARKET: KEY SEGMENTS

Reverse Transcriptase Segment Occupy the Largest Share of the Antiviral Drugs Market

Based on the mechanism of action, the market is segmented into fusion inhibitors, DNA polymerases, protease inhibitors, reverse transcriptase and others. At present, reverse transcriptase segment holds the maximum share of the global antiviral drugs market owing to its effectiveness in the treatment of HIV and hepatitis C. This trend is likely to remain same in the future.

By Target Indication, Coronavirus Infection is the Fastest Growing Segment of the Global Antiviral Drugs Market During the Forecast Period

Based on the target indication, the market is segmented into human immunodeficiency virus infection (HIV), coronavirus infection, hepatitis, herpes simplex virus infection, cytomegalovirus infection, influenza, and others. Currently, the human immunodeficiency virus segment captures the highest proportion of the global antiviral drugs market. It is worth highlighting that the antiviral drugs market for coronavirus infection segment is likely to grow at a relatively higher CAGR.

Virus Target Segment Occupy the Largest Share of the Antiviral Drugs Market by Drug Target

Based on the drug target, the market is segmented into virus target and host target. At present, the virus target segment holds the maximum share of the antiviral drugs market. However, owing to the potential to indicate a broad-spectrum host, host target segment is likely to grow at a relatively higher CAGR.

By Type of Therapy, the Combination Therapy Segment is the Fastest Growing Segment of the Antiviral Drugs Market During the Forecast Period

Based on the type of therapy, the market is segmented into monotherapy and combination therapy. Currently, monotherapy segment captures the highest proportion of the antiviral drugs market. Further, it is worth highlighting that the combination therapy market is likely to grow at a relatively higher CAGR owing to its benefits like cost-effectiveness and high efficiency.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America and Middle East and North Africa. Currently, North America dominates the antiviral drugs market and accounts for the largest revenue share. This can be attributed to the region's robust pharmaceutical industry and the rising number of research institutions and their active research programs in infectious diseases within the region.

Example Players in the Global Antiviral Drugs Market

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb

- Genentech

- Gilead Sciences

- GlaxoSmithKline (GSK)

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Roche

- ViiV Healthcare

GLOBAL ANTIVIRAL DRUGS MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global antiviral drugs market, focusing on key market segments, including [A] mechanism of action, [B] target indication, [C] drug target, [D] type of therapy and [E] key geographical regions.

- Approved Antiviral Drug's Market Landscape: A comprehensive evaluation of commercially available antiviral drugs, considering various parameters, such as [A] year of approval, [B] type of dosage form, [C] type of molecule, [D] type of target virus, [E] route of administration, [F] dosing frequency, [G] mechanism of action and [H] target indication. Additionally, a comprehensive evaluation of antiviral drug developers, based on the parameters, such as [A] year of establishment, [B] company size, [C] geographical location and [D] leading players.

- Clinical Antiviral Drug's Market Landscape: A comprehensive evaluation of clinical-stage antiviral drugs, considering various parameters, such as [A] phase of development, [B] type of molecule, [C] type of dosage form, [C] route of administration, [D] target indication, [E] type of developer, [F] type of therapy, [G] target patient segment, [H] mechanism of action, [I] type of target virus and [J] number of doses. Additionally, a comprehensive evaluation of antiviral companies engaged in the development of clinical-stage antiviral drugs, based on the parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] leading players.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the global antiviral drugs market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] target indication, [E] target virus, [F] most active players (in terms of the number of partnerships signed) and [G] geographical distribution of partnership activity.

- Funding and Investments: An in-depth analysis of the fundings received by players in antiviral drugs market, based on relevant parameters, such as [A] number of funding instances, [B] amount invested, [C] type of funding, [D] most active players, [E] most active investors and [F] geography.

- PORTER'S Five Forces Analysis: A detailed analysis of the five competitive forces prevalent in antiviral drugs market, including [A] threats for new entrants, [B] bargaining power of drug developers, [C] bargaining power of buyers, [D] threats of substitute products and [E] rivalry among existing competitors.

- Company Profiles: In-depth profiles of companies engaged in the development of antiviral drugs, focusing on [A] company overviews, [B] product portfolio and [C] recent developments and an informed future outlook.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Overview of Antiviral Drugs

- 3.2. Types of Viruses and Viral Diseases

- 3.3. Mechanism of Action of Antiviral Drugs

- 3.4. Characteristics of Antiviral Drugs

- 3.5. Advantages of Antiviral Drugs

- 3.6. Challenges Associated with Development of Antiviral Drugs

- 3.7. Key Facts and Future Perspectives of Antiviral Drugs

4. MARKET LANDSCAPE: APPROVED ANTIVIRAL DRUGS

- 4.1. Approved Antiviral Drugs: Overall Market Landscape

- 4.1.1. Analysis by Year of Approval

- 4.1.2. Analysis by Type of Dosage Form

- 4.1.3. Analysis by Type of Molecule

- 4.1.4. Analysis by Type of Target Virus

- 4.1.5. Analysis by Route of Administration

- 4.1.6. Analysis by Dosing Frequency

- 4.1.7. Analysis by Target Indication

- 4.1.8. Analysis by Mechanism of Action

- 4.2. Approved Antiviral Drugs: Developer Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Geography (Region-wise)

- 4.2.4. Analysis by Geography (Country-wise)

- 4.2.5. Most Active Players: Analysis by Number of Approved Drugs

5. MARKET LANDSCAPE: CLINICAL ANTIVIRAL DRUGS

- 5.1. Clinical-stage Antiviral Drugs: Overall Market Landscape

- 5.1.1. Analysis by Phase of Development

- 5.1.2. Analysis by Type of Molecule

- 5.1.3. Analysis by Phase of Development and Type of Molecule

- 5.1.4. Analysis by Type of Dosage Form

- 5.1.5. Analysis by Route of Administration

- 5.1.6. Analysis by Target Indication

- 5.1.7. Analysis by Phase of Development and Target Indication

- 5.1.8. Analysis by Type of Developer

- 5.1.9. Analysis by Type of Therapy

- 5.1.10. Analysis by Target Patient Segment

- 5.1.11. Analysis by Mechanism of Action

- 5.1.12. Analysis by Type of Target Virus

- 5.1.13. Analysis by Number of Doses

- 5.2. Clinical-Stage Antiviral Drugs: Developer Landscape

- 5.2.1. Analysis by Year of Establishment

- 5.2.2. Analysis by Company Size

- 5.2.3. Analysis by Geography (Region-wise)

- 5.2.4. Analysis by Geography (Country-wise)

- 5.2.5. Analysis by Company Size and Location of Headquarters

- 5.2.6. Most Active Players: Analysis by Number of Clinical-Stage Drugs

6. COMPANY PROFILES

- 6.1. AbbVie

- 6.1.1. Company Overview

- 6.1.2. Key Executives

- 6.1.3. Financial Information

- 6.1.4. Product Portfolio

- 6.1.5. Recent Developments and Future Outlook

- 6.2. AstraZeneca

- 6.2.1. Company Overview

- 6.2.2. Key Executives

- 6.2.3. Financial Information

- 6.2.4. Product Portfolio

- 6.2.5. Recent Developments and Future Outlook

- 6.3. Bristol-Myers Squibb

- 6.3.1. Company Overview

- 6.3.2. Key Executives

- 6.3.3. Financial Information

- 6.3.4. Product Portfolio

- 6.3.5. Recent Developments and Future Outlook

- 6.4. Genentech

- 6.4.1. Company Overview

- 6.4.2. Key Executives

- 6.4.3. Product Portfolio

- 6.4.4. Recent Developments and Future Outlook

- 6.5. Gilead Sciences

- 6.5.1. Company Overview

- 6.5.2. Key Executives

- 6.5.3. Financial Information

- 6.5.4. Product Portfolio

- 6.5.5. Recent Developments and Future Outlook

- 6.6. GlaxoSmithKline (GSK)

- 6.6.1. Company Overview

- 6.6.2. Key Executives

- 6.6.3. Financial Information

- 6.6.4. Product Portfolio

- 6.6.5. Recent Developments and Future Outlook

- 6.7. Johnson & Johnson

- 6.7.1. Company Overview

- 6.7.2. Key Executives

- 6.7.3. Financial Information

- 6.7.4. Product Portfolio

- 6.7.5. Recent Developments and Future Outlook

- 6.8. Merck

- 6.8.1. Company Overview

- 6.8.2. Key Executives

- 6.8.3. Financial Information

- 6.8.4. Product Portfolio

- 6.8.5. Recent Developments and Future Outlook

- 6.9. Novartis

- 6.9.1. Company Overview

- 6.9.2. Key Executives

- 6.9.3. Financial Information

- 6.9.4. Product Portfolio

- 6.9.5. Recent Developments and Future Outlook

- 6.10. Pfizer

- 6.10.1. Company Overview

- 6.10.2. Key Executives

- 6.10.3. Financial Information

- 6.10.4. Product Portfolio

- 6.10.5. Recent Developments and Future Outlook

- 6.11. Roche

- 6.11.1. Company Overview

- 6.11.2. Key Executives

- 6.11.3. Financial Information

- 6.11.4. Product Portfolio

- 6.11.5. Recent Developments and Future Outlook

- 6.12. ViiV Healthcare

- 6.12.1. Company Overview

- 6.12.2. Key Executives

- 6.12.3. Product Portfolio

- 6.12.4. Recent Developments and Future Outlook

7. PARTNERSHIPS AND COLLABORATIONS

- 7.1. Antiviral Drugs: Partnerships and Collaborations

- 7.1.1. Analysis by Year of Partnership

- 7.1.2. Analysis by Type of Partnership

- 7.1.3. Analysis by Year and Type of Partnership

- 7.1.4. Analysis by Target Indication

- 7.1.5. Analysis by Type of Target Virus

- 7.1.6. Analysis by Type of Partner

- 7.1.7. Most Active Players: Analysis by Number of Partnerships

- 7.1.8. Geographical Analysis

- 7.1.8.1. Intercontinental and Intracontinental Deals

- 7.1.8.2. International and Local Deals

8. FUNDING AND INVESTMENTS

- 8.1. Antiviral Drugs: Funding and Investments

- 8.1.1. Analysis by Year of Funding

- 8.1.2. Analysis of Amount Invested by Year

- 8.1.3. Analysis by Type of Funding

- 8.1.4. Analysis of Amount Invested by Type of Funding

- 8.1.5. Analysis by Target Indication

- 8.1.6. Analysis by Type of Target Virus

- 8.1.7. Analysis by Type of Investor

- 8.1.8. Most Active Players: Analysis by Number of Instances

- 8.1.9. Most Active Players: Analysis by Amount Invested

- 8.1.10. Most Active Investors: Analysis by Number of Instances

- 8.1.11. Geographical Analysis

- 8.1.11.1. Analysis of Amount Invested by Region

- 8.1.11.2. Analysis of Amount Invested by Country

9. PORTER'S FIVE FORCES ANALYSIS

- 9.1. Chapter Overview

- 9.2. Methodology and Key Parameters

- 9.3. Porter's Five Forces

- 9.3.1. Threat of New Entrants

- 9.3.2. Bargaining Power of End Users

- 9.3.3. Bargaining Power of Drug Developers

- 9.3.4. Threat of Substitute Products

- 9.3.5. Rivalry Among Existing Competitors

10. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 10.1. Forecast Methodology and Key Assumptions

- 10.2. Global Antiviral Drugs Market, Till 2035

- 10.2.1. Antiviral Drugs Market: Distribution by Mechanism of Action

- 10.2.1.1. Antiviral Drugs Market for Fusion Inhibitors, Till 2035

- 10.2.1.2. Antiviral Drugs Market for DNA Polymerases, Till 2035

- 10.2.1.3. Antiviral Drugs Market for Protease Inhibitors, Till 2035

- 10.2.1.4. Antiviral Drugs Market for Reverse Transcriptase Inhibitors, Till 2035

- 10.2.1.5. Antiviral Drugs Market for Other Mechanisms, Till 2035

- 10.2.2. Antiviral Drugs Market: Distribution by Target Indication

- 10.2.2.1. Antiviral Drugs Market for Human Immunodeficiency Virus Infection, Till 2035

- 10.2.2.2. Antiviral Drugs Market for Hepatitis, Till 2035

- 10.2.2.3. Antiviral Drugs Market for Coronaviruses Infection, Till 2035

- 10.2.2.4. Antiviral Drugs Market for Herpes Simplex Virus Infection, Till 2035

- 10.2.2.5. Antiviral Drugs Market for Cytomegalovirus Infection, Till 2035

- 10.2.2.6. Antiviral Drugs Market for Influenza, Till 2035

- 10.2.2.7. Antiviral Drugs Market for Other Target Indications, Till 2035

- 10.2.3. Antiviral Drugs Market: Distribution by Type of Drug Target

- 10.2.3.1. Antiviral Drugs Market for Virus Target, Till 2035

- 10.2.3.2. Antiviral Drugs Market for Host Target, Till 2035

- 10.2.4. Antiviral Drugs Market: Distribution by Type of Therapy

- 10.2.4.1. Antiviral Drugs Market for Monotherapy, Till 2035

- 10.2.4.2. Antiviral Drugs Market for Combination Therapy, Till 2035

- 10.2.5. Antiviral Drugs Market: Distribution by Geography

- 10.2.5.1. Antiviral Drugs Market in North America, Till 2035

- 10.2.5.2. Antiviral Drugs Market in Europe, Till 2035

- 10.2.5.3. Antiviral Drugs Market in Asia-Pacific, Till 2035

- 10.2.5.4. Antiviral Drugs Market in Latin America, Till 2035

- 10.2.5.5. Antiviral Drugs Market in MENA, Till 2035

- 10.2.5.6. Antiviral Drugs Market in Rest of the World, Till 2035

- 10.2.1. Antiviral Drugs Market: Distribution by Mechanism of Action

11. EXECUTIVE INSIGHTS

- 11.1. Chapter Overview

- 11.2. Company A

- 11.2.1. Company Snapshot

- 11.2.2. Interview Transcript: Chief Commercial Officer