|

시장보고서

상품코드

1771297

바이오프로세스 자동화 시장 : 업계 동향 및 예측 - 컨트롤러 유형별, 사업 규모별, 운영 모드별, 바이오프로세싱 시스템과의 호환성, 주요 지역Bioprocess Automation Market: Industry Trends and Global Forecasts - Distribution by Type of Controller, Scale of Operation, Mode of Operation, Compatibility with Bioprocessing Systems, and Key Geographical Regions |

||||||

세계의 바이오프로세스 자동화 시장 : 개요

세계의 바이오프로세스 자동화 시장 규모는 현재 38억 달러가 되고 있습니다. 이 시장은 예측 기간 중 12%의 CAGR로 성장할 것으로 전망됩니다.

시장 사이징 및 기회 분석은 다음 매개변수에 걸쳐 세분화됩니다.

컨트롤러 유형별

- 업스트림 및 다운스트림 컨트롤러 시스템

- 바이오프로세스 제어 소프트웨어

사업 규모별

- 전임상 및 임상운용

- 상업 운전

작동 모드별

- 배치 및 페드 배치 제조

- 관류 제조

바이오프로세싱 시스템과의 호환성별

- 일회용 시스템

- 스테인레스 스틸 및 기타 시스템

주요 지역별

- 북미

- 유럽

- 아시아태평양 및 기타 지역

세계의 바이오프로세스 자동화 시장 : 성장 및 동향

최근 수십년 동안 바이오 의약품은 치료 효과, 양호한 안전성 프로파일 및 광범위한 복잡한 질병을 다루는 능력으로 인해 점점 인기가 높아지고 있습니다. 바이오의약품을 사용한 치료의 성공은 생물학적 제조에 사용되는 기존 장치의 현대화를 여러 이해관계자에게 촉구했습니다. 특기할 만한 것은 바이오 프로세스 컨트롤러 및 자동화 시스템이 기존 바이오리액터 시스템의 미흡함을 극복하고 바이오의약품 산업의 프로세스 최적화 솔루션이 되었다는 점입니다. 또한 이러한 컨트롤러 및 자동화 시스템은 프로세스 분석 기술 툴을 이용하고 있으며, 바이오 프로세스 장치에 매끄럽게 통합하여 확장성을 높일 수 있습니다.

게다가 COVID-19의 대유행 속에서 생물제제에 대한 수요 증가가 앞서 설명한 시스템의 채용률의 급상승으로 이어지고 있습니다. 그 결과, 몇몇 바이오 프로세스 기기 개발 기업은 생산성 향상, 생산 스케줄 단축, 상품 비용 절감, 바이오 프로세스 유연성 향상을 목적으로 제어된 자동화 시스템 제공을 증가시켰습니다.

세계의 바이오프로세스 자동화 시장 : 주요 인사이트

이 보고서는 세계 바이오프로세스 자동화 시장의 현황을 파악하고 업계 내 잠재적인 성장 기회를 확인하고 있습니다. 본 보고서의 주요 조사 결과는 다음과 같습니다.

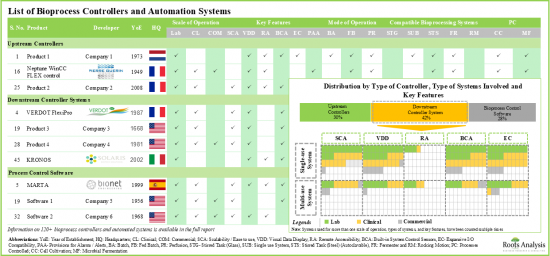

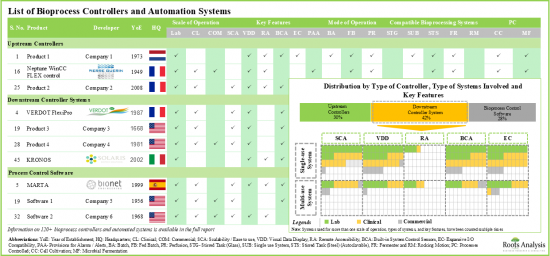

- 120개 이상의 바이오프로세스 컨트롤러 및 자동화 시스템이 세계 여러 지역에 거점을 두는 다양한 기업별 이용 가능 및 개발 중입니다.

- 바이오프로세스 컨트롤러와 자동화 시스템의 40% 이상이 다운스트림 프로세스 최적화를 위해 제공되었으며, 그 후 30% 가까이 있는 컨트롤러가 업스트림 프로세스 최적화를 위해 사용됩니다.

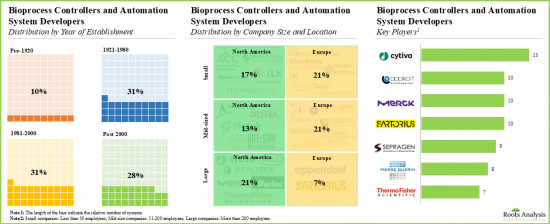

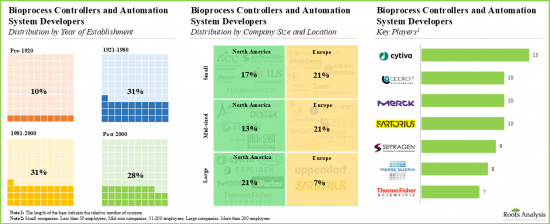

- 이 분야의 특징은 40% 가까이의 소규모 진입기업이 존재하는 것으로, 그 중 30% 이상의 진입 기업이 업스트림 공정의 컨트롤러를 개발하고 있습니다. 또한, 바이오프로세스 컨트롤러와 자동화 시스템을 제공하는 이들 기업의 50% 이상이 유럽에 본사를 둡니다.

- 현재 시장 정세는 세분화되어 있으며 기존 진입기업 및 신규 진입 참가 기업 모두 존재합니다.

- 1970년 이전에 설립된 바이오프로세스 컨트롤러와 자동화 시스템 제공업체의 주요 예(알파벳순)로는 Cytiva, Eppendorf, Merck, Parker Hannifin, Sartorius Stedim Biotech, Thermo Fisher Scientific 등이 있습니다.

- 유럽에 본사를 두고 있는 개발 기업의 40% 이상이 중소기업으로, 그 중 75% 가까이 독일, 프랑스, 스위스에 있습니다.

- 바이오프로세스 컨트롤러 및 자동화 시스템의 65% 이상은 알려진 확립된 진출기업별로 제공되고 있으며, 이 중 57%의 이해관계자는 세포 배양과 미생물 발효 시스템을 모두 제공하고 있다고 주장합니다.

- 경쟁 우위를 확보하기 위해 바이오프로세스 컨트롤러 개발자들은 현재 각 제품에 고급 기능을 통합하는 데 주력하고 있습니다.

- 바이오프로세스 컨트롤러 및 자동화 기술과 관련된 특허는 산업계와 비산업계를 합쳐 3,500건 가까이 출원 및 부여되어 있으며, 이 분야에서의 기술 혁신의 페이스가 가속되고 있음을 나타내고 있습니다.

- 특허의 상당한 비율이 북미에서 출원 및 부여되고(약 65%), 주요 특허 양수처는 GE Healthcare/Cytiva, Cytori Therapeutics, Xyleco, Inscripta, Lonza, Terumo BCT 등이 있습니다.

- 바이오프로세스의 자동화에 대한 수요 증가에 대응하기 위해, 많은 이해 관계자가 기술적으로 고도의 시스템의 도입에 나서고 있습니다.

- 휴먼 에러와 공정 비용 절감 가능성을 고려하면, 바이오프로세스 컨트롤러와 자동화 시스템의 채용이 증가할 것으로 보입니다. 관련 시장은 예측 기간 동안 CAGR 12%로 성장할 것으로 예상됩니다.

세계의 바이오프로세스 자동화 시장 : 주요 부문

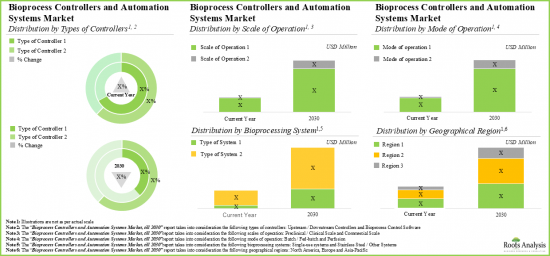

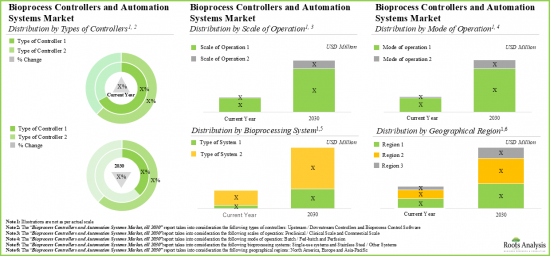

비즈니스 규모별로 시장은 전임상 및 임상사업과 상업사업으로 구분됩니다. 현재 전임상 및 임상 업무 부문이 세계의 바이오프로세스 자동화 시장에서 최대(-75%)의 점유율을 차지하고 있습니다. 이 동향은 앞으로도 변하지 않을 것으로 생각됩니다.

컨트롤러 유형별로 시장은 업스트림 및 다운스트림 컨트롤러 시스템과 바이오프로세스 제어 소프트웨어로 구분됩니다. 현재 업스트림 및 다운스트림 컨트롤러 시스템 부문이 바이오 프로세스 자동화 시장에서 가장 높은 비율(-60%)을 차지하고 있습니다.

유럽이 시장의 최대 점유율을 차지

주요 지역별로 보면, 시장은 북미, 유럽, 아시아태평양, 기타로 구분됩니다. 현재, 유럽(40% 이상)이 바이오프로세스 자동화 시장을 독점해, 최대의 수익 점유율을 차지하고 있습니다.

바이오프로세스 자동화 시장에서의 진출기업 예

- Applikon Biotechnology

- Cytiva

- Repligen

- Sartorius

- Sepragen

- Solaris Biotech

- Sysbiotech

- Thermo Fisher Scientific

본 보고서는 세계의 바이오프로세스 자동화 시장에 대해 조사했으며, 시장 개요와 함께 컨트롤러 유형별, 사업 규모별, 운영 모드별, 바이오프로세싱 시스템과의 호환성별 동향, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 제공합니다.

목차

제1장 서문

제2장 주요 요약

제3장 서문

- 장의 개요

- 바이오프로세스 제어

- 공정 제어의 구성 요소

- 프로세스 제어의 목적

- 바이오프로세스 자동화

- 바이오프로세스 자동화의 장점

- 자동 제어의 과제

- 바이오프로세스 제어에서 돌파구

- 장래의 전망

제4장 시장 상황 : 업스트림 컨트롤러

- 장의 개요

- 업스트림 컨트롤러 : 제품 파이프라인

- 업스트림 컨트롤러 : 개발자 상황

제5장 시장 상황 : 하류 컨트롤러 시스템

- 장의 개요

- 다운스트림 컨트롤러 시스템 : 제품 파이프라인

- 다운스트림 컨트롤러 시스템 : 개발자 상황

제6장 시장 상황 : 바이오프로세스 제어 소프트웨어

- 장의 개요

- 바이오프로세스 제어 소프트웨어 : 제품 파이프라인

- 바이오프로세스 제어 소프트웨어 : 개발자 상황

제7장 제품 경쟁력 분석

- 장의 개요

- 조사 방법

- 전제 및 주요 파라미터

- 제품 경쟁력 분석 : 업스트림 컨트롤러

- 제품 경쟁력 분석 : 다운스트림 컨트롤러 시스템

- 제품 경쟁력 분석 : 바이오프로세스 컨트롤러 소프트웨어

제8장 북미의 바이오프로세스 컨트롤러 및 자동화 시스템 개발 기업 : 기업 프로파일

- 장의 개요

- Cytiva Lifesciences

- Thermo Fisher Scientific

- Sepragen

- Repligen

제9장 유럽의 바이오프로세스 컨트롤러 및 자동화 시스템 개발 기업 : 기업 프로파일

- 장의 개요

- Applikon Biotechnology

- Sartorius

- Solaris Biotech

- Sysbiotech

제10장 시장 동향 분석

- 장의 개요

- 세계 지도별 표현 : 본사 소재지 및 제공 제품의 유형에 의한 참가 기업의 분석

- 시장 동향 분석 : 업스트림 컨트롤러

- 시장 동향 분석 : 다운스트림 컨트롤러 시스템

- 시장 동향 분석 : 바이오프로세스 제어 소프트웨어

제11장 특허 분석

- 장의 개요

- 범위와 조사 방법

- 바이오프로세스 컨트롤러 및 자동화 시스템 : 특허 분석

- 특허 벤치마킹 분석

- 바이오프로세스 컨트롤러 및 자동화 시스템 : 특허 평가 분석

- 인용수 상위의 특허

제12장 브랜드 포지셔닝 분석

- 장의 개요

- 조사 방법

- 주요 파라미터

- 업스트림 컨트롤러 개발자의 브랜드 포지셔닝 매트릭스

- 다운스트림 컨트롤러 시스템 개발자의 브랜드 포지셔닝 매트릭스

- 바이오프로세스 컨트롤러 소프트웨어 개발자의 브랜드 포지셔닝 매트릭스

제13장 시장 예측 및 기회 분석

- 장의 개요

- 예측 조사 방법 및 주요 전제조건

- 바이오프로세스 컨트롤러 및 자동화 시장 전체(-2035년)

- 바이오프로세스 컨트롤러 및 자동화 시장(-2035년) : 컨트롤러 유형별

- 바이오프로세스 컨트롤러 및 자동화 시장(-2035년) : 사업 규모별

- 바이오프로세스 컨트롤러 및 자동화 시장(-2035년) : 조작 모드별

- 바이오프로세스 컨트롤러 및 자동화 시장(-2035년) : 시스템 유형별

- 바이오프로세스 컨트롤러 및 자동화 시장(-2035년) : 주요 지역별

제14장 결론

제15장 주요 인사이트

제16장 부록 1 : 표 형식 데이터

제17장 부록 2 : 기업 및 단체 일람

AJY 25.07.21GLOBAL BIOPROCESS AUTOMATION MARKET: OVERVIEW

As per Roots Analysis, the bioprocess automation market valued at USD 3.8 billion in the current year is anticipated to grow at a CAGR of 12% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Controller

- Upstream / Downstream Controller System

- Bioprocess Control Software

Scale of Operation

- Preclinical / Clinical Operation

- Commercial Operation

Mode of Operation

- Batch / Fed-Batch Manufacturing

- Perfusion Manufacturing

Compatibility with Bioprocessing Systems

- Single-Use Systems

- Stainless Steel / Other Systems

Key Geographical Regions

- North America

- Europe

- Asia-Pacific and Rest of the World

GLOBAL BIOPROCESS AUTOMATION MARKET: GROWTH AND TRENDS

In recent decades, biopharmaceuticals have become increasingly popular due to their therapeutic effectiveness, favorable safety profiles, and capacity to address a wide range of complex diseases. The success of treatments with the use of biopharmaceuticals has encouraged several stakeholders to modernize traditional equipment used for biological manufacturing. Notably, the bioprocess controllers and automation systems have turned out to be a process optimization solution for the biopharmaceutical industries, overcoming the inadequacy of the traditional bioreactor systems. Moreover, these controllers and automated systems utilize process analytical technology tools that can be seamlessly integrated into bioprocessing units to enhance scalability.

Further, amidst the COVID-19 pandemic, the increasing demand for biologics has led to the surge in the adoption rate of the aforementioned systems. As a result, several bioprocess equipment developers increased their controlled and automated systems offerings in order to increase productivity, shorten production timelines, reduce cost of goods, and increase flexibility of the bioprocess.

GLOBAL BIOPROCESS AUTOMATION MARKET: KEY INSIGHTS

The report delves into the current state of global bioprocess automation market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Over 120 bioprocess controllers and automation systems are available / being developed by various companies based in different regions across the globe; majority of the controllers are designed for upstream processes.

- Over 40% of the bioprocess controllers and automation systems are being offered to optimize the downstream processes, followed by nearly 30% controllers, which are used to optimize upstream processes.

- The domain is featured by the presence of nearly 40% small players; of which, over 30% of players are developing upstream controllers. Further, more than 50% of these players offering bioprocess controllers and automation systems are based in Europe.

- The current market landscape is fragmented, featuring the presence of both established players and new entrants; most of the companies are headquartered in developed nations.

- Prominent examples of bioprocess controllers and automated system providers established before 1970 (in alphabetical order) include Cytiva, Eppendorf, Merck, Parker Hannifin, Sartorius Stedim Biotech and Thermo Fisher Scientific.

- More than 40% developers headquartered in Europe are small and mid-sized players; of these, close to 75% companies are located in Germany, France, and Switzerland.

- Over 65% of bioprocess controllers and automation systems are offered by known / established players; of these, 57% of the stakeholders claim to offer systems for both cell cultivation and microbial fermentation.

- In pursuit of gaining a competitive edge, bioprocess controller developers are presently focusing on the integration of advanced features into their respective products.

- Close to 3,500 patents related to bioprocess controller and automation technologies have been filed / granted to industry and non-industry players, indicating the enhanced pace of innovation in this field.

- A significant proportion of patents have been filed / granted in North America (~65%); key patent assignees include GE Healthcare / Cytiva, Cytori Therapeutics, Xyleco, Inscripta, Lonza, and Terumo BCT.

- Over time, several stakeholders have established strong brand positions; in order to cater to increasing demand for bioprocess automation, a number of players have stepped up to introduce technologically advanced systems.

- Given the potential to reduce human errors and process costs, the adoption of bioprocess controllers and automation systems is likely to increase; the affiliated market is expected to grow at a CAGR of 12% during the forecast period.

GLOBAL BIOPROCESS AUTOMATION MARKET: KEY SEGMENTS

Preclinical / Clinical Segment Occupies the Largest Share of the Bioprocess Automation Market

Based on the scale of operation, the market is segmented into preclinical / clinical operations and commercial operations. At present, preclinical / clinical operations segment holds the maximum (~75%) share of the global bioprocess automation market. This trend is likely to remain same in the coming future.

By Type of Controller, Upstream / Downstream Controller System Segment Accounts for the Largest Share in the Bioprocess Automation Market

Based on the type of controller, the market is segmented into upstream / downstream controller system and bioprocess control software. Currently, upstream / downstream controller system segment captures the highest proportion (~60%) of the bioprocess automation market.

Europe Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, and Asia-Pacific and Rest of the World. Currently, Europe (>40%) dominates the bioprocess automation market and accounts for the largest revenue share.

Example Players in the Bioprocess Automation Market

- Applikon Biotechnology

- Cytiva

- Repligen

- Sartorius

- Sepragen

- Solaris Biotech

- Sysbiotech

- Thermo Fisher Scientific

GLOBAL BIOPROCESS AUTOMATION MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global bioprocess automation market, focusing on key market segments, including [A] type of controller, [B] scale of operation, [C] mode of operation, [D] compatibility with bioprocessing systems and [E] key geographical regions.

- Market Landscape: A comprehensive evaluation of bioprocess controllers and automation systems, considering various parameters, such as [A] scale of operation, [B] mode of operation, [C] key features, [D] compatibility with the bioprocessing systems, [E] type of system(s) and [F] type of processes controlled. Additionally, a comprehensive analysis of the companies developing bioprocess controllers and automation systems, based on [A] year of establishment, [B] company size, and [C] geographical presence.

- Product Competitiveness Analysis: A comprehensive competitive analysis of upstream controllers, downstream controller systems and process control software, examining factors, such as [A] product applicability and [B] product strength.

- Company Profiles: In-depth profiles companies providing upstream controllers, downstream controller systems and process control software, focusing on [A] company overview, [B] financial information (if available), [C] product portfolio and [D] recent developments and an informed future outlook.

- Key Insights: In-depth analysis of market trends, focusing on [A] regional distribution of players and [B] type of products offered. Additionally, a [C] distribution of upstream controllers, based on compatibility with bioreactor systems, scale of operation and mode of operation, [D] an analysis of upstream controllers, based on scale of operation, compatibility with bioreactor systems and processes controlled [E] an analysis of downstream controller systems, based on scale of operation, type of systems and key features, [F] an analysis of downstream controller systems, based on mode of operation and application area [G] an analysis of bioprocess control software, based on scale of operation, key features and processes controlled and [H] an analysis of bioprocess control software, based on scale of operation and compatibility with bioprocessing systems.

- Patent Analysis: An insightful analysis of various patents that have been filed / granted for bioprocess controllers and automation systems, based on several parameters, such as [A] type of patents, [B] publication year, [C] application year, [D] issuing authorities involved, [E] type of organizations, [F] emerging focus area, [G] patent age, [H] CPC symbols, [I] leading patent assignees (in terms of number of patents granted / filed), [J] patent characteristics, [K] geography, [L] patent benchmarking and [M] an insightful valuation analysis.

- Brand Positioning Analysis: In-depth analysis of brand positioning of the key industry players, highlighting the current perceptions regarding their proprietary products based on several relevant factors, such as [A] experience of the manufacturer, [B] number of products offered, [C] product diversity and [D] number of patents published.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Bioprocess Control

- 3.3. Building Block of Process Control

- 3.3.1. Components of Process Control Systems

- 3.3.1.1. Sensors

- 3.3.1.2. Actuators

- 3.3.1.3. Controllers

- 3.3.1. Components of Process Control Systems

- 3.4. Purpose of Process Control

- 3.5. Bioprocess Automation

- 3.6. Advantages of Bioprocess Automation

- 3.7. Challenges Faced in Automated Control

- 3.7.1. Process Related Challenges to Automate

- 3.7.2. Compatibility and Infrastructure Challenges

- 3.7.3. Regulatory Challenges

- 3.7.4. IT Concerns and Data Integrity

- 3.8. Breakthrough in Bioprocess Control

- 3.8.1. Flexible and Automated Skids

- 3.8.2. Spectroscopy

- 3.8.3. Multivariate data Analytics

- 3.9. Future Perspective

4. MARKET LANDSCAPE: UPSTREAM CONTROLLERS

- 4.1. Chapter Overview

- 4.2. Upstream Controllers: Product Pipeline

- 4.2.1. Analysis by Scale of Operation

- 4.2.2. Analysis by Key Features

- 4.2.3. Analysis by Compatibility with Bioreactor System

- 4.2.4. Analysis by Mode of Operation

- 4.2.5. Analysis by Types of Processes Controlled

- 4.3. Upstream Controllers: Developer Landscape

- 4.3.1. Analysis by Year of Establishment

- 4.3.2. Analysis by Company Size

- 4.3.3. Analysis by Location of Headquarters

- 4.3.4. Leading Developers: Analysis by Number of Upstream Controllers

5. MARKET LANDSCAPE: DOWNSTREAM CONTROLLER SYSTEMS

- 5.1. Chapter Overview

- 5.2. Downstream Controller Systems: Product Pipeline

- 5.2.1. Analysis by Scale of Operation

- 5.2.2. Analysis by Key Features

- 5.2.3. Analysis by Types of Systems Involved

- 5.2.4. Analysis by Mode of Operation

- 5.2.5. Analysis by Application Area

- 5.3. Downstream Controller Systems: Developer Landscape

- 5.3.1. Analysis by Year of Establishment

- 5.3.2. Analysis by Company Size

- 5.3.3. Analysis by Location of Headquarters

- 5.3.4. Leading Developers: Analysis by Number of Products

6. MARKET LANDSCAPE: BIOPROCESS CONTROL SOFTWARE

- 6.1. Chapter Overview

- 6.2. Bioprocess Control Software: Product Pipeline

- 6.2.1. Analysis by Stage of Bioprocess

- 6.2.2. Analysis by Scale of Operation

- 6.2.3. Analysis by Key Features

- 6.2.4. Analysis by Compatibility with Systems

- 6.2.5. Analysis by Types of Processes Controlled

- 6.3. Bioprocess Control Software: Developer Landscape

- 6.3.1. Analysis by Year of Establishment

- 6.3.2. Analysis of Company Size

- 6.3.3. Analysis by Location of Headquarters

- 6.3.4. Leading Developers: Analysis by Number of Bioprocess Control Software

7. PRODUCT COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Methodology

- 7.3. Assumptions / Key Parameters

- 7.4. Product Competitiveness Analysis: Upstream Controllers

- 7.5. Product Competitiveness Analysis: Downstream Controller Systems

- 7.6. Product Competitiveness Analysis: Bioprocess Controller Software

8. BIOPROCESS CONTROLLER AND AUTOMATION SYSTEM DEVELOPERS IN NORTH AMERICA: COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Cytiva Lifesciences

- 8.2.1. Company Overview

- 8.2.2. Bioprocess Controller and Automation System Portfolio

- 8.2.3. Recent Developments and Future Outlook

- 8.3. Thermo Fisher Scientific

- 8.3.1. Company Overview

- 8.3.2. Bioprocess Controller and Automation System Portfolio

- 8.3.3. Recent Developments and Future Outlook

- 8.4. Sepragen

- 8.4.1. Company Overview

- 8.4.2. Bioprocess Controller and Automation System Portfolio

- 8.4.3. Recent Developments and Future Outlook

- 8.5. Repligen

- 8.5.1. Company Overview

- 8.5.2. Bioprocess Controller and Automation System Portfolio

- 8.5.3. Recent Developments and Future Outlook

9. BIOPROCESS CONTROLLER AND AUTOMATION SYSTEM DEVELOPERS IN EUROPE: COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Applikon Biotechnology

- 9.2.1. Company Overview

- 9.2.2. Bioprocess Controller and Automation System Portfolio

- 9.2.3. Recent Developments and Future Outlook

- 9.3. Sartorius

- 9.3.1. Company Overview

- 9.3.2. Bioprocess Controller and Automation System Portfolio

- 9.3.3. Recent Developments and Future Outlook

- 9.4. Solaris Biotech

- 9.4.1. Company Overview

- 9.4.2. Bioprocess Controller and Automation System Portfolio

- 9.4.3. Recent Developments and Future Outlook

- 9.5. Sysbiotech

- 9.5.1. Company Overview

- 9.5.2. Bioprocess Controller and Automation System Portfolio

- 9.5.3. Recent Developments and Future Outlook

10. MARKET TREND ANALYSIS

- 10.1. Chapter Overview

- 10.2. World Map Representation: Analysis of Players by Location of Headquarters and Type of Product(s) Offered

- 10.3. Market Trend Analysis: Upstream Controllers

- 10.3.1. Heat Map Representation: Analysis by Scale of Operation, Compatibility with Bioreactor Systems and Operating Mode

- 10.3.2. Grid Analysis: Analysis by Scale of Operation, Compatibility with Bioreactor Systems and Types of Processes Controlled

- 10.4. Market Trend Analysis: Downstream Controller Systems

- 10.4.1. Grid Analysis: Analysis by Scale of Operation, Type of System(s) and Key Features

- 10.4.2. Analysis by Operation Mode and Application Area

- 10.5. Market Trend Analysis: Bioprocess Control Software

- 10.5.1. Grid Analysis: Analysis by Scale of Operation, Key Features and Types of Processes Controlled

- 10.5.2. Analysis by Scale of operation and Compatibility with Systems

11. PATENT ANALYSIS

- 11.1. Chapter Overview

- 11.2. Scope and Methodology

- 11.3. Bioprocess Controller and Automations Systems: Patent Analysis

- 11.3.1. Analysis by Publication Year

- 11.3.2. Analysis by Application Year

- 11.3.3. Analysis by Patent Office

- 11.3.4. Analysis by Geographical Location

- 11.3.5. Analysis by CPC Symbols

- 11.3.6. Emerging Focus Area

- 11.3.7. Analysis by Type of Organization

- 11.3.8. Leading Players: Analysis by Number of Patents

- 11.4. Patent Benchmarking Analysis

- 11.4.1. Analysis by Patent Characteristics

- 11.5. Bioprocess Controller and Automations Systems: Patent Valuation Analysis

- 11.6. Leading Patents by Number of Citations

12. BRAND POSITIONING ANALYSIS

- 12.1. Chapter Overview

- 12.2. Methodology

- 12.3. Key Parameters

- 12.4. Brand Positioning Matrix of Upstream Controller Developers

- 12.4.1. Brand Positioning Matrix: Applikon Biotechnology

- 12.4.2. Brand Positioning Matrix: Eppendorf

- 12.4.3. Brand Positioning Matrix: Thermo Fisher Scientific

- 12.4.4. Brand Positioning Matrix: ILS Automation

- 12.4.5. Brand Positioning Matrix: Pierre Guerin

- 12.5. Brand Positioning Matrix of Downstream Controller System Developers

- 12.5.1. Brand Positioning Matrix: Cytiva Lifesciences

- 12.5.2. Brand Positioning Matrix: Sepragen

- 12.5.3. Brand Positioning Matrix: Merck Millipore

- 12.5.4. Brand Positioning Matrix: Sartorius Stedim Biotech

- 12.5.5. Brand Positioning Matrix: Repligen

- 12.5.6. Brand Positioning Matrix: Agilitech

- 12.6. Brand Positioning Matrix of Bioprocess Controller Software Developers

- 12.6.1. Brand Positioning Matrix: Applikon Biotechnology

- 12.6.2. Brand Positioning Matrix: Pierre Guerin

- 12.6.3. Brand Positioning Matrix: Thermo Fisher Scientific

- 12.6.4. Brand Positioning Matrix: Merck Millipore

- 12.6.5. Brand Positioning Matrix: Sartorius Stedim Biotech

- 12.6.6. Brand Positioning Matrix: Cytiva Lifesciences

- 12.6.7. Brand Positioning Matrix: Bionet Engineering

13. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 13.1. Chapter Overview

- 13.2. Forecast Methodology and Key Assumptions

- 13.3. Overall Bioprocess Controller and Automation Market, Till 2035

- 13.4. Bioprocess Controller and Automation Market, Till 2035: Distribution by Type of Controller

- 13.4.1. Bioprocess Controller and Automation Market for Upstream / Downstream Controller Systems, Till 2035

- 13.4.2. Bioprocess Controller and Automation Market for Bioprocess Control Software, Till 2035

- 13.5. Bioprocess Controller and Automation Market, Till 2035: Distribution by Scale of Operation

- 13.5.1. Bioprocess Controller and Automation Market for Preclinical / Clinical Operations, Till 2035

- 13.5.2. Bioprocess Controller and Automation Market for Commercial Operations, Till 2035

- 13.6. Bioprocess Controller and Automation Market, Till 2035: Distribution by Mode of Operation

- 13.6.1. Bioprocess Controller and Automation Market for Batch / Fed-batch Manufacturing, Till 2035

- 13.6.2. Bioprocess Controller and Automation Market for Perfusion Manufacturing, Till 2035

- 13.7. Bioprocess Controller and Automation Market, Till 2035: Distribution by Type of Systems

- 13.7.1. Bioprocess Controller and Automation Market for Single-use Systems, Till 2035

- 13.7.2. Bioprocess Controller and Automation Market for Stainless Steel / Other Systems, Till 2035

- 13.8. Bioprocess Controller and Automation Market, Till 2035: Distribution by Key Geographical Regions

- 13.8.1. Bioprocess Controller and Automation Market in North America, Till 2035

- 13.8.2. Bioprocess Controller and Automation Market in Europe, Till 2035

- 13.8.3. Bioprocess Controller and Automation Market in Asia-Pacific and Rest of the World, Till 2035

14. CONCLUSION

- 14.1. Chapter Overview