|

시장보고서

상품코드

1771307

자동 무균 샘플링 시장 : 업계 동향 및 예측 - 모니터링 방법별, 바이오프로세스 방법별, 작업량별, 확장 성별, 주요 지역별Automatic Aseptic Sampling Market: Industry Trends and Global Forecasts - Distribution by Type of Monitoring Method, Bioprocessing Method, Working Volume, Scalability and Key Geographical Regions |

||||||

세계의 자동 무균 샘플링 시장 : 개요

세계의 자동 무균 샘플링 시장 규모는 2035년까지 예측 기간 동안 19.3%의 연평균 복합 성장률(CAGR)로 확대될 전망이며, 현재 1억 5,700만 달러에서 2035년까지 9억 1,300만 달러로 성장할 것으로 예측됩니다.

시장 규모 및 기회 분석은 다음 매개변수로 세분화됩니다.

모니터링 방법별

- 온라인

- 오프라인

- 앳라인

바이오프로세스 방법별

- 업스트림

- 다운스트림

작업량별

- 10ml 미만

- 10-50ml

- 51-100ml

- 100ml 이상

확장성별

- 실험실 스케일

- 파일럿 스케일

- 상업 스케일

주요 지역별

- 북미

- 유럽

- 아시아태평양

- 기타 지역

세계의 자동 무균 샘플링 시장 : 성장 및 동향

정확한 샘플링은 의약품 제조에 있어서 가장 중요한 프로세스 중 하나입니다. 기존의 샘플링 접근법과 수작업에 의한 샘플링 기술에서는 오염의 위험이 있어 샘플 준비나 샘플링 중에 작업자간의 어긋남이 발생할 가능성이 있습니다. 또한 실시간 데이터를 관리하는 것은 조작 프로세스에 재적하는 노동자에게 있어서 어려운 과제입니다. 그 결과 정확한 핸들링과 무균 샘플링을 가능하게 하는 샘플링 시스템에 대한 수요가 높아지고 있습니다. 이러한 맥락에서 자동 무균 샘플링 시스템은 정확한 샘플링, 오류 최소화 및 실시간 데이터 모니터링을 위한 이상적인 솔루션으로 떠오르고 있습니다.

특히 자동 무균 샘플링 시스템의 도입은 편차를 약 65% 감소시키고 전체 생산성을 최대 80% 향상시키는 데 도움이 됩니다. 게다가 자동 샘플링 시스템이 제공하는 의의에 의해, 몇몇 제약 회사는 심리스하고 오류가 없는 샘플링 작업을 위해 이러한 시스템을 채택하기 시작했습니다. 그 결과, 자동 무균 샘플링 시장은 그 광범위한 채택에 의해 예측 기간 동안 성장할 것으로 예상됩니다.

세계의 자동 무균 샘플링 시장 : 주요 인사이트

이 조사 보고서는 세계의 자동 무균 샘플링 시장의 현재 상태를 조사하고 업계 내 잠재적 성장 기회를 확인합니다. 본 보고서의 주요 조사 결과는 다음과 같습니다.

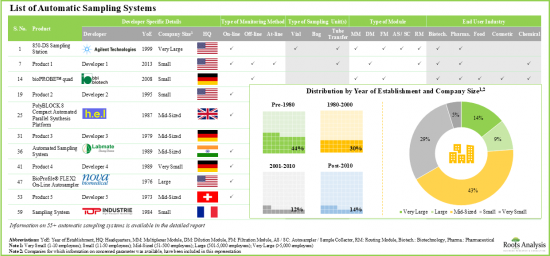

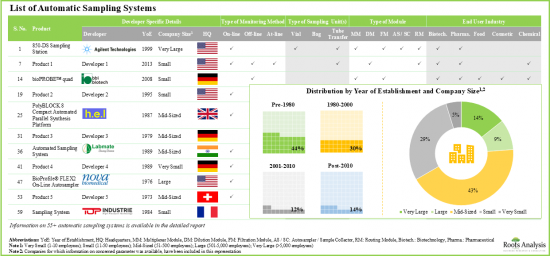

- 현재 55개 이상의 자동 샘플링 시스템이 세계 여러 지역에서 시판되고 있으며, 이들 기업의 비교적 큰 비율은 중견기업입니다.

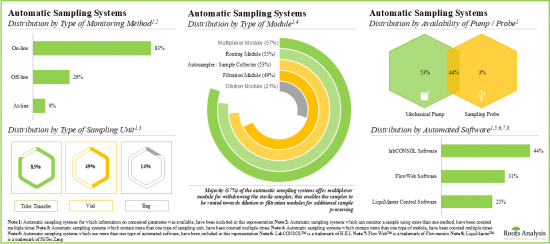

- 자동 샘플링 시스템의 대부분(83%)은 온라인 실시간 모니터링과 연속 공정 제어를 가능하게 하고, 이러한 시스템의 가장 두드러진 최종 사용자로서 제약회사와 바이오테크놀러지 회사가 부상하고 있습니다.

- 자동 샘플 채취/제조 시스템 제조업체의 80% 이상은 2000년 이전에 설립되어, 그 대부분은 북미에 거점을 두고 있습니다.

- 경쟁 우위를 구축하기 위해 이 분야의 이해관계자는 제품 포트폴리오를 충실히 하고, 고급 기능을 갖춘 자동 샘플링 시스템의 업그레이드에 노력하고 있습니다.

- 바이오 의약품 산업에 있어서의 자동 샘플링에 관련하는 400건 이상의 특허가, 이 분야에서 만들어진 지적 재산을 보호하기 위해서, 다양한 이해 관계자에 의해 출원 및 부여되고 있습니다.

- 이 영역에서 출원된 특허의 수는 2018년 이후 CAGR 40%로 증가하고 있으며, 특허의 30% 가까이가 지난 12개월에 출원되고 있습니다.

- 이해관계자의 관심의 고조는 자동 샘플링 시스템용으로 개최된 이벤트에도 반영되고 있어 제품 개발자에게 아이디어를 공유해, 이러한 시스템에 대한 이해를 깊게 할 기회를 제공합니다.

- 파트너십의 35% 이상은 제품 유통을 목적으로 체결된 것으로 북미를 거점으로 하는 이해관계자는 자동 샘플링과 관련된 최대 규모의 계약을 체결하고 있습니다.

- 바이오 의약품 업계에 있어서의 자동 샘플링 시스템의 채용 증가는 시스템 제조업체에 유익한 기회를 가져올 것으로 예측됩니다.

- 프로세스의 무균성을 유지하면서 바이오리액터로부터 분석장치로 직접 바이오프로세스 샘플을 이송할 수 있는 시스템의 필요성을 감안하면, 자동 샘플링의 채용은 대폭 증가할 것으로 예측됩니다.

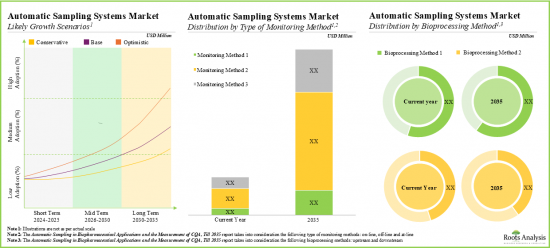

- 시장은 2035년까지 연률 19.3% 이상으로 성장할 가능성이 높습니다. 이 기회는 다양한 지역 및 기타 중요한 시장 부문에 잘 분산될 가능성이 높습니다.

세계의 자동 무균 샘플링 시장 : 주요 부문

모니터링 방법별로 시장은 온라인, 오프라인, 앳라인으로 구분됩니다. 현재 온라인 부문이 세계의 자동 멸균 샘플링 시장의 대부분의 점유율(-60%)을 차지하고 있습니다. 또한 앳라인 부문은 다른 부문과 비교하여 빠른 속도로 성장할 것으로 생각됩니다.

작업량별로는 시장은 10ml 미만, 10-50ml, 51-100ml, 100ml 이상으로 구분됩니다. 현재, 세계의 자동 무균 샘플링 시장에서 가장 높은 비율(-40%)을 차지하고 있는 것은 10-50ml의 부문입니다. 51-100ml 부문의 자동 무균 샘플링 시장은 비교적 높은 CAGR로 성장할 가능성이 높다는 점은 주목할 만합니다.

바이오프로세스 방법별로, 시장은 업스트림 및 다운스트림으로 구분됩니다. 현재 자동 무균 샘플링 시장에서는 업스트림 부문이 최대 점유율(-60%)을 차지하고 있습니다. 또한 이 부문은 비교적 높은 CAGR로 성장할 가능성이 높습니다.

확장성별로 시장은 실험실 규모, 파일럿 규모 및 상업 규모로 구분됩니다. 현재, 랩 스케일 부문이 자동 무균 샘플링 시장에서 가장 높은 비율(-50%)을 차지하고 있습니다. 게다가 파일럿 스케일의 자동 무균 샘플링 시장은 비교적 높은 CAGR로 성장할 가능성이 높다는 것은 주목할 만합니다.

주요 지역별로 보면, 시장은 북미, 유럽, 아시아태평양 및 기타 지역으로 구분됩니다. 현재 북미(55%)가 자동 무균 샘플링 시장을 독점하며 최대 수익 점유율을 차지하고 있습니다. 그러나 아시아태평양 시장은 더 높은 CAGR로 성장할 것으로 예상됩니다.

자동 무균 샘플링 시장 진출기업 예

- Agilent Technologies

- Biotage

- Cytiva

- Flownamics

- MGI Tech

- Mettler Toledo

- Pall Corporation

- Shimadzu

- SOTAX

본 보고서에서는 세계의 자동 무균 샘플링 시장에 대해 조사했으며, 시장 개요와 함께 모니터링 방법별, 바이오프로세스 방법별, 작업량별, 확장성별 동향, 지역별 동향 및 시장 진출기업 프로파일 등의 정보를 제공합니다.

목차

제1장 서문

제2장 주요 요약

제3장 서문

- 장의 개요

- 샘플링에서 프로세스 분석 기술

- 수동 샘플링 및 자동 샘플링

- 자동 샘플링 시스템의 필요성

- 자동 무균 샘플링 시스템

- 샘플링 시스템의 컴포넌트

- 독립형 시스템 및 통합 시스템

- 바이오프로세스의 감시 및 제어 방법

- 자동 샘플링에 대한 중요한 고려 사항

- 자동 샘플링 시스템의 장점

- 표준 및 요건

- 미래의 혁신

제4장 시장 상황 자동 샘플링 시스템

- 장의 개요

- 자동 샘플링 시스템 : 시장 상황

- 자동 샘플링 시스템 제조업체 일람

제5장 기업 경쟁력 분석

- 장의 개요

- 전제 및 주요 파라미터

- 범위 및 조사 방법

- 기업 경쟁력 분석 : 북미의 자동 샘플링 시스템 제조업체

- 기업 경쟁력 분석 : 유럽의 자동 샘플링 시스템 제조업체

- 기업 경쟁력 분석 : 아시아태평양의 자동 샘플링 시스템 제조업체

제6장 기업 프로파일 자동 샘플링 시스템 제조업체

- 장의 개요

- Agilent Technologies

- Cytiva

- Mettler Toledo

- Pall Corporation

- 시마즈

- Xylem

제7장 시장 상황 : 자동 샘플 채취 및 조제 시스템

- 장의 개요

- 자동 샘플 채취 및 제조 시스템 : 시장 상황

- 자동 샘플 채취 및 제조 시스템 : 제조업체 일람

제8장 기업 프로파일 자동 샘플 채취 및 제조 시스템 제조업체

- 장의 개요

- Agilent Technologies

- Biotage

- Flownamics

- MGI Tech

- SOTAX

제9장 특허 분석

- 장의 개요

- 범위 및 조사 방법

- 바이오의약품에서 자동 샘플링 및 CQA 측정 : 특허 분석

- 바이오의약품에서 자동 샘플링 및 CQA 측정 : 특허 벤치마킹 분석

- 바이오의약품에서 자동 샘플링 및 CQA 측정 : 특허 평가 분석

- 인용수 상위의 특허

제10장 최근 동향

- 장의 개요

- 바이오의약품에서 자동 샘플링 및 CQA 측정 : 파트너십 활동

- 바이오의약품에서 자동 샘플링 및 CQA 측정 : 세계 이벤트

- 결론

제11장 SWOT 분석

제12장 Porter's Five Forces 분석

- 장의 개요

- 조사 방법 및 가정

- 주요 파라미터

- 결론

제13장 시장 예측 및 기회 분석

- 장의 개요

- 주요 전제 및 조사 방법

- 세계의 바이오의약품에서 자동 샘플링 및 CQA 측정 시장(-2035년)

- 바이오의약품에서 자동 샘플링 및 CQA 측정 시장 : 모니터링 방법별

- 바이오의약품에서 자동 샘플링 및 CQA 측정 시장 : 바이오프로세스 방법별

- 바이오의약품에서 자동 샘플링 및 CQA 측정 시장 : 작업량별

- 바이오의약품에서 자동 샘플링 및 CQA 측정 시장 : 확장성별

- 바이오의약품에서 자동 샘플링 및 CQA 측정 시장 : 주요 지역별

제14장 산업 혁명 : 인더스트리 1.0에서 인더스트리 5.0으로

- 장의 개요

- 인더스트리 1.0에서 인더스트리 5.0으로의 전환

- 실험실 진화의 지평

- 인더스트리 4.0의 장점

- 인더스트리 5.0의 장점

- 결론

제15장 결론

제16장 주요 인사이트

제17장 부록 1 : 표 형식 데이터

제18장 부록 2 : 기업 및 단체 일람

AJY 25.07.21GLOBAL AUTOMATIC ASEPTIC SAMPLING MARKET: OVERVIEW

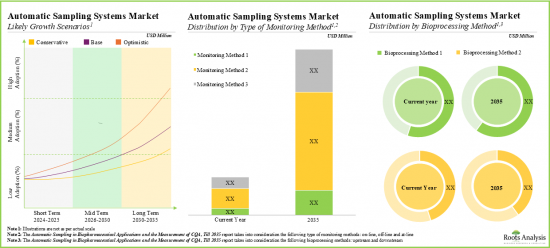

As per Roots Analysis, the global automatic aseptic sampling market is estimated to grow from USD 157 million in the current year to USD 913 million by 2035, at a CAGR of 19.3% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Monitoring Method

- Online

- Off-line

- At-line

Bioprocessing Method

- Upstream

- Downstream

Working Volume

- Less than 10 ml

- 10-50 ml

- 51-100 ml

- More than 100 ml

Scalability

- Lab Scale

- Pilot Scale

- Commercial Scale

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

GLOBAL AUTOMATIC ASEPTIC SAMPLING MARKET: GROWTH AND TRENDS

Accurate sampling is one of the most crucial processes during the production of pharmaceutical products. The conventional sampling approach or manual sampling techniques pose a risk of contamination and may result in operator-to-operator deviations during sample preparation and sampling. Furthermore, managing real-time data can be challenging for the labor enrolled in operational processes. Consequently, there is an increasing demand for sampling systems that allow accurate handling and aseptic sampling. In this context, an automatic aseptic sampling system emerges as an ideal solution for accurate sampling, minimizing errors, and real-time data monitoring.

Notably, the implementation of automated aseptic sampling systems helps to reduce deviation by around 65% and improve overall productivity by up to 80%. Further, owing to the significance offered by automated sampling systems, several pharmaceutical companies have begun to adopt these systems for seamless, error-free sampling operations. As a result, the automated aseptic sampling market is anticipated to grow during the forecast period driven by its wide-scale adoption.

GLOBAL AUTOMATIC ASEPTIC SAMPLING MARKET: KEY INSIGHTS

The report delves into the current state of global automatic aseptic sampling market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, more than 55 automatic sampling systems are commercially available in different regions of the globe; a relatively larger proportion of these players are mid-sized companies.

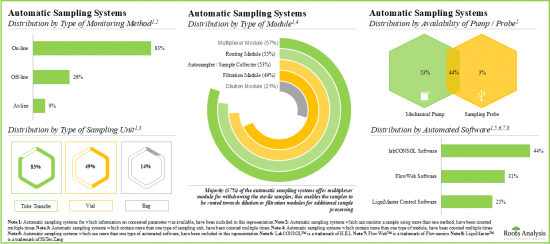

- Majority of the automatic sampling systems (83%) allow on-line real-time monitoring and continuous process control; pharma and biotech companies have emerged as the most prominent end users of these systems.

- More than 80% of the automatic sample collection / preparation system manufacturers were established before 2000; majority of them are based in North America.

- In pursuit of building a competitive edge, stakeholders in this domain are striving to enhance their product portfolio and upgrade their automatic sampling systems with advanced features.

- Over 400 patents related to automatic sampling in biopharmaceutical industry have been filed / granted by various stakeholders in order to protect the intellectual property generated within this field.

- The number of patents filed in this domain has increased at a CAGR of 40% since 2018; close to 30% of the patents have been filed in the last 12 months.

- The growing interest of stakeholders is also reflected by the events organized for automatic sampling systems, providing product developers with the opportunity to share their ideas and develop a better understanding of such systems.

- Over 35% of the partnerships were signed for product distribution purposes; stakeholders based in North America have signed maximum agreements related to automatic sampling.

- The increasing adoption of automatic sampling systems in the biopharmaceutical industry is anticipated to create profitable business opportunities for the system manufacturers.

- Given the requirement of systems that can transfer bioprocess samples directly from bioreactors to analyzers while maintaining the process sterility, the adoption of automatic sampling is anticipated to rise significantly.

- The market is likely to grow at an annualized rate of more than 19.3% by 2035; the opportunity is likely to be well distributed across different geographies, and other important market segments.

GLOBAL AUTOMATIC ASEPTIC SAMPLING MARKET: KEY SEGMENTS

The Online Segment Occupies the Largest Share of the Automatic Aseptic Sampling Market

Based on type of monitoring method, the market is segmented into online, off-line and at-line. At present, the online segment holds the majority share (~60%) of the global automatic aseptic sampling market. Additionally, the at-line segment is likely to grow at a faster pace compared to the other segments.

By Working Volume, 51-100 ml is the Fastest Growing Segment of the Global Automatic Aseptic Sampling Market

Based on the working volume, the market is segmented into less than 10 ml, 10-50 ml, 51-100 ml, and more than 100 ml. Currently, the 10-50 ml segment captures the highest proportion (~40%) of the global automatic aseptic sampling market. It is worth highlighting that the automatic aseptic sampling market for 51-100 ml segment is likely to grow at a relatively higher CAGR.

Upstream Segment Occupy the Largest Share of the Automatic Aseptic Sampling Market

Based on the bioprocessing method, the market is segmented into upstream and downstream. At present, the upstream segment holds the maximum share (~60%) of the automatic aseptic sampling market. In addition, this segment is likely to grow at a relatively higher CAGR.

By Scalability, the Pilot Scale Segment is the Fastest Growing Segment of the Automatic Aseptic Sampling Market During the Forecast Period

Based on the scalability, the market is segmented into lab scale, pilot scale, and commercial scale. Currently, lab scale segment captures the highest proportion (~50%) of the automatic aseptic sampling market. Further, it is worth highlighting that the automatic aseptic sampling market for pilot scale is likely to grow at a relatively higher CAGR.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. Currently, North America (~55%) dominates the automatic aseptic sampling market and accounts for the largest revenue share. However, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the Automatic Aseptic Sampling Market

- Agilent Technologies

- Biotage

- Cytiva

- Flownamics

- MGI Tech

- Mettler Toledo

- Pall Corporation

- Shimadzu

- SOTAX

GLOBAL AUTOMATIC ASEPTIC SAMPLING MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global automated liquid handling systems market, focusing on key market segments, including [A] type of monitoring method, [B] bioprocessing method, [C] working volume, [D] scalability and [E] key geographical regions.

- Automatic Sampling Systems Market Landscape: A comprehensive evaluation of automatic sampling systems, considering various parameters, such as [A] type of monitoring method, [B] type of sampling unit(s), [C] availability of pump / probe, [D] type of module, [E] automated software, [F] type of vessel, [G] vessel fabrication material, [H] type of analyte monitored, [I] type of analyzer, [J] number of sampling vessels, [K] working volume, [L] operating temperature, [M] end-user industry, [N] scalability and [O] applications of the system. Additionally, the module presents comprehensive analysis of automatic sampling system developers, based on [A] year of establishment, [B] company size, [C] location of headquarters and [D] leading players (in terms of number of systems being offered).

- Automatic Sampling System Manufacturers Competitiveness Analysis: A comprehensive competitive analysis of automatic sampling systems manufacturers, examining factors, such as [A] overall experience of the company, [B] product portfolio strength and [C] portfolio diversity.

- Automatic Sampling System Company Profiles: In-depth profiles of companies engaged in the automatic aseptic sampling market, focusing on [A] company overviews, [B] financial information (if available), [C] product portfolio and [D] recent developments and an informed future outlook.

- Automatic Sample Collection / Preparation System Manufacturers Market Landscape: A comprehensive evaluation of automatic sample collection / preparation systems, considering various parameters, such as [A] system category, [B] system classification, [C] type of monitoring method, [D] type of sampling unit, [E] type of module, [F] working volume, [G] type of analyzer, [H] end-user industry and [I] scalability of the products. Additionally, a comprehensive analysis of players engaged in developing automatic sample collection / preparation systems, based on [A] year of establishment, [B] company size and [C] location of headquarters.

- Automatic Sample Collection / Preparation System Company Profiles: In-depth profiles of companies offering automatic sample collection / preparation systems, focusing on [A] company overviews, [B] product portfolio and [C] recent developments and an informed future outlook.

- Patent Analysis: An in-depth analysis of patents filed / granted till date in the automatic sampling systems domain, based on various relevant parameters, such as [A] type of patent, [B] publication year, [C] geographical location, [D] CPC symbols, [E] emerging focus areas, [F] type of organization, [G] leading players (in terms of number of patents granted / filed in the given time period), [H] patent characteristics, [I] patent benchmarking and [J] patent valuation.

- Recent Developments: An in-depth analysis of various developments / recent trends related to automatic sampling systems, providing insights on recent global events related to automatic sampling systems and partnerships and collaborations established within the domain.

- SWOT Analysis: An analysis of industry affiliated trends, opportunities and challenges, which are likely to impact the evolution of automatic sampling systems market; it includes a Harvey ball analysis, assessing the relative impact of each SWOT parameter on industry dynamics.

- PORTER'S Five Forces Analysis: A detailed analysis of the five competitive forces prevalent in automatic sampling systems market, including [A] threats of new entrants, [B] bargaining power of customers, [C] bargaining power of automatic sampling system manufacturers, [C] threats of substitute products and [D] rivalry among existing competitors.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Process Analytical Technology in Sampling

- 3.3. Manual Sampling versus Automatic Sampling

- 3.4. Need for Automatic Sampling Systems

- 3.5. Automatic Aseptic Sampling System

- 3.6. Components of a Sampling System

- 3.7. Stand-alone Systems versus Integrated Systems

- 3.8. Bioprocess Monitoring and Control Methods

- 3.8.1. At-line Monitoring

- 3.8.2. In-line Monitoring

- 3.8.3. Off-line Monitoring

- 3.8.4. On-line Monitoring

- 3.9. Key Considerations for Automatic Sampling

- 3.9.1. Sample Volume

- 3.9.2. Cell Removal

- 3.9.3. Sampling Rate

- 3.9.4. Integration of Analyzers

- 3.9.5. Feedback to Bioreactor

- 3.9.6. Flexibility

- 3.9.7. Transferability

- 3.9.8. Price

- 3.10. Benefits of Automatic Sampling Systems

- 3.11. Standards and Requirements

- 3.12. Future Innovations

4. MARKET LANDSCAPE: AUTOMATIC SAMPLING SYSTEMS

- 4.1. Chapter Overview

- 4.2. Automatic Sampling Systems: Overall Market Landscape

- 4.2.1. Analysis by Type of Monitoring Method

- 4.2.2. Analysis by Type of Sampling Unit

- 4.2.3. Analysis by Availability of Pump / Probe

- 4.2.4. Analysis by Type of Module

- 4.2.5. Analysis by Automated Software

- 4.2.6. Analysis by Type of Vessel

- 4.2.7. Analysis by Vessel Fabrication Material

- 4.2.8. Analysis by Type of Analyte Monitored

- 4.2.9. Analysis by Type of Analyzer

- 4.2.10. Analysis by Number of Sampling Vessels

- 4.2.11. Analysis by Working Volume

- 4.2.12. Analysis by Operating Temperature

- 4.2.13. Analysis by End User Industry

- 4.2.14. Analysis by Scalability

- 4.2.15. Analysis by Application(s)

- 4.3. List of Automatic Sampling System Manufacturers

- 4.3.1. Analysis by Year of Establishment

- 4.3.2. Analysis by Company Size

- 4.3.3. Analysis by Region of Headquarters

- 4.3.4. Analysis by Company Size and Region of Headquarters

- 4.3.5. Analysis by Location of Headquarters

- 4.3.6. Leading Players: Analysis by Number of Automatic Sampling Systems Manufactured

- 4.3.7. Leading Automatic Sampling System Manufacturers: Analysis by Number of End User Industries

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions / Key Parameters

- 5.3. Scope and Methodology

- 5.4. Company Competitiveness Analysis: Automatic Sampling System Manufacturers in North America

- 5.5. Company Competitiveness Analysis: Automatic Sampling System Manufacturers in Europe

- 5.6. Company Competitiveness Analysis: Automatic Sampling System Manufacturers in Asia-Pacific

6. COMPANY PROFILES: AUTOMATIC SAMPLING SYSTEM MANUFACTURERS

- 6.1. Chapter Overview

- 6.2. Agilent Technologies

- 6.2.1. Company Overview

- 6.2.2. Financial Information

- 6.2.3. Product Portfolio

- 6.2.4. Recent Developments and Future Outlook

- 6.3. Cytiva

- 6.3.1. Company Overview

- 6.3.2. Product Portfolio

- 6.3.3. Recent Developments and Future Outlook

- 6.4. Mettler Toledo

- 6.4.1. Company Overview

- 6.4.2. Financial Information

- 6.4.3. Product Portfolio

- 6.4.4. Recent Developments and Future Outlook

- 6.5. Pall Corporation

- 6.5.1. Company Overview

- 6.5.2. Product Portfolio

- 6.5.3. Recent Developments and Future Outlook

- 6.6. Shimadzu

- 6.6.1. Company Overview

- 6.6.2. Financial Information

- 6.6.3. Product Portfolio

- 6.6.4. Recent Developments and Future Outlook

- 6.7. Xylem

- 6.7.1. Company Overview

- 6.7.2. Financial Information

- 6.7.3. Product Portfolio

- 6.7.4. Recent Developments and Future Outlook

7. MARKET LANDSCAPE: AUTOMATIC SAMPLE COLLECTION / PREPARATION SYSTEMS

- 7.1. Chapter Overview

- 7.2. Automatic Sample Collection / Preparation Systems: Overall Market Landscape

- 7.2.1. Analysis by System Category

- 7.2.2. Analysis by System Classification

- 7.2.3. Analysis by Type of Monitoring Method

- 7.2.4. Analysis by Type of Sampling Unit

- 7.2.5. Analysis by Type of Module

- 7.2.6. Analysis by Working Volume

- 7.2.7. Analysis by Type of Analyzer

- 7.2.8. Analysis by End User Industry

- 7.2.9. Analysis by Scalability

- 7.3. List of Automatic Sample Collection / Preparation System Manufacturers

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Region of Headquarters

- 7.3.4. Analysis by Company Size and Region of Headquarters

- 7.3.5. Analysis by Location of Headquarters

- 7.3.6. Leading Players: Analysis by Number of Automatic Sample Collection / Preparation Systems Manufactured

8. COMPANY PROFILES: AUTOMATIC SAMPLE COLLECTION / PREPARATION SYSTEM MANUFACTURERS

- 8.1. Chapter Overview

- 8.2. Agilent Technologies

- 8.2.1. Company Overview

- 8.2.2. Product Portfolio

- 8.2.3. Recent Developments and Future Outlook

- 8.3. Biotage

- 8.3.1. Company Overview

- 8.3.2. Product Portfolio

- 8.3.3. Recent Developments and Future Outlook

- 8.4. Flownamics

- 8.4.1. Company Overview

- 8.4.2. Product Portfolio

- 8.4.3. Recent Developments and Future Outlook

- 8.5. MGI Tech

- 8.5.1. Company Overview

- 8.5.2. Product Portfolio

- 8.5.3. Recent Developments and Future Outlook

- 8.6. SOTAX

- 8.6.1. Company Overview

- 8.6.2. Product Portfolio

- 8.6.3. Recent Developments and Future Outlook

9. PATENT ANALYSIS

- 9.1. Chapter Overview

- 9.2. Scope and Methodology

- 9.3. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA: Patent Analysis

- 9.3.1. Analysis by Publication Year

- 9.3.2. Analysis by Annual Number of Granted Patents and Patent Applications

- 9.3.3. Analysis by Geographical Location

- 9.3.4. Analysis by CPC Symbols

- 9.3.5. Word Cloud: Emerging Focus Areas

- 9.3.6. Analysis by Type of Organization

- 9.3.7. Leading Industry Players: Analysis by Number of Patents

- 9.3.8. Leading Non-Industry Players: Analysis by Number of Patents

- 9.3.9. Leading Individual Assignees: Analysis by Number of Patents

- 9.4. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA: Patent Benchmarking Analysis

- 9.4.1. Analysis by Patent Characteristics

- 9.5. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA: Patent Valuation Analysis

- 9.6. Leading Patents by Number of Citations

10. RECENT DEVELOPMENTS

- 10.1. Chapter Overview

- 10.2. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA: Partnership Activity

- 10.2.1. Partnership Models

- 10.2.2. List of Partnerships and Collaborations

- 10.2.2.1. Analysis by Year of Partnership

- 10.2.2.2. Analysis by Type of Partnership

- 10.2.2.3. Analysis by Type of Product

- 10.2.2.4. Analysis by Product and Type of Partnership

- 10.2.2.5. Most Active Players: Analysis by Number of Partnerships

- 10.2.2.6. Word Cloud: Emerging Focus Areas

- 10.2.2.7. Regional Analysis

- 10.2.2.8. Intercontinental and Intracontinental Agreements

- 10.3. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA: Global Events

- 10.3.1. List of Global Events

- 10.3.1.1. Analysis by Year of Event

- 10.3.1.2. Analysis by Event Platform

- 10.3.1.3. Analysis by Type of Event

- 10.3.1.4. Analysis by Geography

- 10.3.1.5. Word Cloud: Evolutionary Trends in Event Agenda / Key Focus Area

- 10.3.1.6. Most Active Participants: Analysis by Number of Events

- 10.3.1.7. Analysis by Seniority Level of Event Speakers

- 10.3.1. List of Global Events

- 10.4. Concluding Remarks

11. SWOT ANALYSIS

- 11.1. Chapter Overview

- 11.2. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA: SWOT Analysis

- 11.2.1. Comparison of SWOT Factors

12. PORTERS FIVE FORCES ANALYSIS

- 12.1. Chapter Overview

- 12.2. Methodology and Assumptions

- 12.3. Key Parameters

- 12.3.1. Threats of New Entrants

- 12.3.2. Bargaining Power of Customers

- 12.3.3. Bargaining Power of Automatic Sampling System Manufacturers

- 12.3.4. Threats of Substitute Products

- 12.3.5. Rivalry Among Existing Competitors

- 12.4. Concluding Remarks

13. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Global Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA Market, Till 2035

- 13.3.1. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA Market: Distribution by Type of Monitoring Method

- 13.3.1.1. Automatic Sampling Market for On-line Monitoring, Till 2035

- 13.3.1.2. Automatic Sampling Market for Off-line Monitoring, Till 2035

- 13.3.1.3. Automatic Sampling Market for At-line Monitoring, Till 2035

- 13.3.2. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA Market: Distribution by Type of Bioprocessing Method

- 13.3.2.1. Automatic Sampling Market for Upstream Bioprocessing, Till 2035

- 13.3.2.2. Automatic Sampling Market for Downstream Bioprocessing, Till 2035

- 13.3.3. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA Market: Distribution by Working Volume

- 13.3.3.1. Automatic Sampling Market for Systems with less than 10 mL Working Volume, Till 2035

- 13.3.3.2. Automatic Sampling Market for Systems with 10-50 mL Working Volume, Till 2035

- 13.3.3.3. Automatic Sampling Market for Systems with 51-100 mL Working Volume, Till 2035

- 13.3.3.4. Automatic Sampling Market for Systems with more than 100 mL Working Volume, Till 2035

- 13.3.4. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA Market: Distribution by Scalability

- 13.3.4.1. Automatic Sampling Market for Lab Scale Operations, Till 2035

- 13.3.4.2. Automatic Sampling Market for Pilot Scale Operations, Till 2035

- 13.3.4.3. Automatic Sampling Market for Commercial Scale Operations, Till 2035

- 13.3.5. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA Market: Distribution by Key Geographical Regions

- 13.3.5.1. Automatic Sampling Market in North America, Till 2035

- 13.3.5.2. Automatic Sampling Market in Europe, Till 2035

- 13.3.5.3. Automatic Sampling Market in Asia-Pacific and Rest of the World, Till 2035

- 13.3.1. Automatic Sampling in Biopharmaceutical Applications and the Measurement of CQA Market: Distribution by Type of Monitoring Method

14. INDUSTRIAL REVOLUTION FROM INDUSTRY 1.0 TO INDUSTRY 5.0

- 14.1. Chapter Overview

- 14.2. Transition from Industry 1.0 to Industry 5.0

- 14.2.1. Industry 1.0

- 14.2.2. Industry 2.0

- 14.2.3. Industry 3.0

- 14.2.4. Industry 4.0

- 14.2.5. Industry 5.0

- 14.3. Horizons of Lab Evolution

- 14.4. Benefits of Industry 4.0

- 14.5. Benefits of Industry 5.0

- 14.6. Concluding Remarks