|

시장보고서

상품코드

1771309

바이오센서 시장 : 업계 동향 및 예측 - 바이오센서 유형별, 최종 사용자 유형별, 주요 지역별Biosensors Market: Industry Trends and Global Forecasts - Distribution by Type of Biosensors, Type of End User and Key Geographical Regions |

||||||

세계의 바이오센서 시장 : 개요

세계의 바이오센서 시장 규모는 2035년까지 예측 기간 동안 9.0%의 연평균 복합 성장률(CAGR)로 확대될 전망이며, 현재 59억 달러에서 2035년까지 140억 달러로 성장할 것으로 예측됩니다.

이 시장 세분화는 시장 규모 및 기회 분석을 다음 매개 변수로 구분합니다.

바이오센서 유형별

- 광학 바이오센서

- 전기화학 바이오센서

- 열 바이오센서

- 기타

최종 사용자별

- 학술연구기관

- 업계 진출기업

주요 지역별

- 북미

- 유럽

- 아시아태평양

- 중동 및 북아프리카

- 라틴아메리카

- 기타 지역

세계의 바이오센서 시장 : 성장 및 동향

수년간 의약품 개발 및 질병 진단에서 약리학적 분자를 확인하기 위한 고처리량 스크리닝 기법과 고급 분석 도구의 보급이 진행되고 있으며, 바이오센서 수요가 급증하고 있습니다. 바이오센서는 항체, 세포, 효소, 지질, 올리고뉴클레오타이드 등의 생물학적 요소와 물리적 변환기를 결합한 분석장치입니다. 전기화학 바이오센서, 광학 바이오센서, 열 바이오센서 등의 바이오센서 기술의 진보로 생물학적 타겟의 동정과 검증이 용이해지고 있습니다. 게다가 바이오센서의 실시간 분석 능력은 연구자가 의약품 개발을 위해 잠재적인 생물학적 표적을 신속하게 동정하는 데 도움이 되며 오류 가능성을 배제하면서 높은 정확도를 보장합니다. 신약 개발에 있어서 바이오센서의 중요성으로 인해 현재 여러 이해관계자들이 수천 개의 히트 화합물에서 주요 의약품 후보를 스크리닝하고 리드 화합물을 최적화하기 위해 바이오센서의 이용을 모색하고 있습니다.

게다가, 의약품 개발 프로세스에 바이오센싱 기술을 도입함으로써 정확한 스크리닝이 가능해지고 연구개발 활동 전체가 강화될 것으로 예상되는 것은 흥미롭습니다. 80개가 넘는 바이오센서가 의약품 개발 목적으로 이용 가능하거나 여러 이해관계자에 의해 개발되고 있습니다. 게다가 이 분야에는 과거 5년간 주요 산업 및 비산업 참가 기업에 의해 12억 달러 이상이 투자되고 있습니다. 바이오센서 시장 진입 기업들이 이 분야에서 적극적으로 임함에 따라 시장은 예측 기간 동안 성장할 것으로 예상됩니다.

세계의 바이오센서 시장 : 주요 인사이트

이 보고서는 세계 바이오센서 시장의 현재 상태를 자세히 조사하고 산업 내 잠재적 성장 기회를 확인합니다. 본 보고서의 주요 조사 결과는 다음과 같습니다.

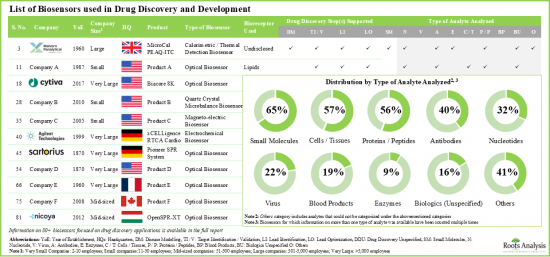

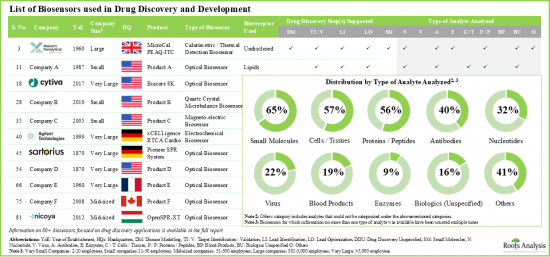

- 현재, 창약에 초점을 맞춘 80 이상의 바이오센서가 세계의 다양한 기업에 의해 개발되고 있습니다.

- 이 시장에서 입수할 수 있는 디바이스의 65% 가까이가 광학식 바이오센서이며, 이러한 바이오센서 기술의 90% 이상이 신약의 리드 화합물의 동정을 서포트하고 있습니다.

- 15% 이상의 바이오센서가 창약의 전 공정을 지원한다고 주장하고 있습니다. 이러한 바이오센서 개발 기업의 예로는 Malvern Panalytical, Invitrometrix, Nicoya Lifesciences 등이 있습니다.

- 주요 참가 기업의 50% 이상이 북미를 거점으로 하고 있으며, 그 중 약 70%의 기업이 광학 및 전기화학 바이오센싱 기술을 창약에 이용하고 있습니다.

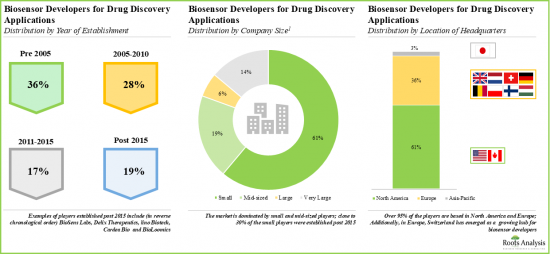

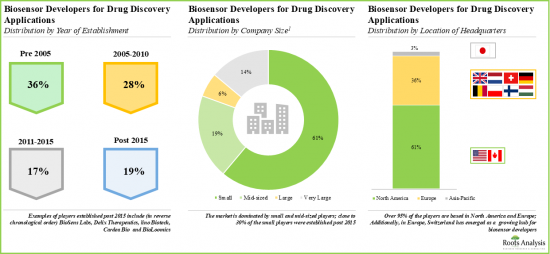

- 시장 상황은 2005년 이후에 설립된 소규모 기업이 지배적입니다. 미국은 바이오센서에 초점을 맞춘 신약의 중요한 거점으로 떠오르고 있으며, 최대 규모의 개발 기업이 존재합니다.

- 경쟁 우위를 획득하기 위해 바이오센서 개발 기업은 현재 기존의 능력을 확대하고 각각의 제품 포트폴리오를 증강하는 대처를 실시했습니다.

- 오랜 세월에 걸쳐, 이 분야에 종사하는 참가 기업은 기존의 바이오센서 기술의 개발을 한층 더 진행해, 개량을 가능하게 하기 위해서 여러가지 대처를 실시해 왔습니다.

- 일부 투자자들은 향후 4년 동안 다양한 자금 조달 라운드에서 12억 달러 이상을 투자하고 있습니다.

- 자금 조달 활동은 꾸준히 증가하고 있으며, 특히 2024년에는 업계 관계자는 합계로 6억 달러 가까이를 조달했습니다.

- 약 1억 8,500만 달러가 벤처 라운드를 통해 조달되었으며, 이 중 83%가 벤처 시리즈 A에서 조달되었습니다.

- 북미에서는 자금조달 라운드의 대부분(82%)이 미국을 거점으로 하는 조직에 의해 주도되어, 11억 달러에 상당하는 금액이 투자되었습니다.

- 발표된 과학문헌은 진화하는 창약 개발의 요구에 부응하기 위해 새로운 바이오센서 기술을 발견하려고 하는 연구자의 적극적인 대처를 나타내고 있습니다.

- 창약에서 바이오센서의 사용과 관련된 논문의 55% 이상이 지난 2년간 발표되었으며, 그 대부분(60%)은 연구논문이었습니다.

- 다양한 업계 관계자나 비업계 관계자가 복수의 세계 이벤트에 참가해, 창약에 있어서 바이오센서의 사용에 관련하는 연구 성과, 관련하는 과제, 기회에 대해 논의했습니다.

- 창약 용도에 특화한 다양한 바이오센서 기술에 대해 주로 북미를 거점으로 하는 기업에 의해 350건 이상의 특허가 부여 및 출원되고 있습니다.

- 또한 특허의 16%는 세계지적소유권기관(WIPO)에 출원되고 있습니다.

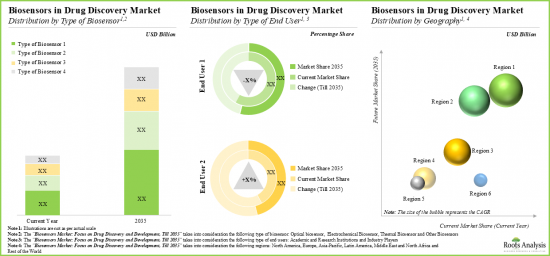

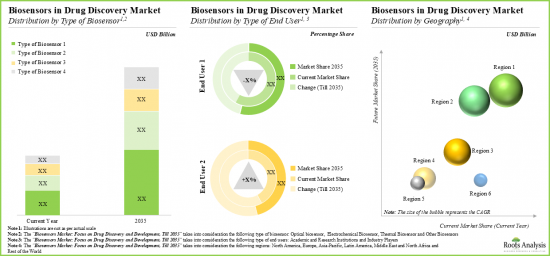

- 창약 바이오센서 시장은 2035년까지 연평균 복합 성장률(CAGR) 9%를 보일 것으로 예측되고 있습니다. 이번 기회는 바이오센서 유형, 최종 사용자, 지역별로 충분히 분산될 것으로 보입니다.

세게의 바이오센서 시장 : 주요 부문

바이오센서 유형별로 시장은 광학 바이오센서, 전기화학 바이오센서, 기타로 구분됩니다. 현재, 광학식 바이오센서 분야가 세계의 바이오센서 시장에서 최대(-70%)의 점유율을 차지하고 있습니다. 이 동향은 앞으로도 변하지 않을 것으로 생각됩니다.

최종 사용자의 유형에 따라 시장은 학술기관 및 연구기관과 산업 참가 기업으로 구분됩니다. 현재 학술기관 및 연구기관 부문이 바이오센서 시장에서 가장 높은 비율(-60%)을 차지하고 있습니다. 게다가 산업 참가 기업 부문은, 예측 기간중에 10.1%라고 하는 높은 복합 연간 성장률로 성장할 것으로 예측되고 있습니다.

주요 지역별로 볼 때 시장은 북미, 유럽, 아시아태평양, 라틴아메리카, 중동, 북아프리카 및 기타 지역으로 구분됩니다. 현재 북미(40%)가 바이오센서 시장을 독점하며 최대 수익 점유율을 차지하고 있습니다. 게다가 유럽의 시장은 향후 몇 년간 더 높은 CAGR로 성장할 것으로 예상되고 있습니다.

바이오센서 시장 진출기업 예

- Agilent Technologies

- Axion Biosystems

- BioNavigations

- Creoptix

- Cytiva

- Dynamic Biosensors

- Malvern Panalytical

- Microvacuum

- Sartorius

- Tempo Bioscience

이 보고서는 세계의 바이오센서 시장을 조사했으며, 시장 개요와 함께 바이오센서 유형별, 최종 사용자 유형별 동향, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 제공합니다.

목차

제1장 서문

제2장 주요 요약

제3장 서문

- 장의 개요

- 바이오센서 개요

- 바이오센서의 구성요소

- 바이오센서 유형

- 창약에서 바이오센서 용도

- 창약에서 바이오센서의 사용에 따른 과제

- 결론

제4장 시장 상황

- 장의 개요

- 창약의 바이오센서 : 시장 상황

제5장 제품 경쟁력 분석

- 장의 개요

- 전제 및 주요 파라미터

- 조사 방법

- 제품 경쟁력 분석 : 창약의 바이오센서

제6장 기업 프로파일 : 창약의 바이오센서 개발 기업

- 장의 개요

- Agilent Technologies

- Axion Biosystems

- BioNavigations

- Creoptix

- Cytiva

- Dynamic Biosensors

- Malvern Panalytical

- Microvacuum

- Sartorius

- Tempo Bioscience

제7장 브랜드 포지셔닝 분석

- 장의 개요

- 주요 파라미터

- 조사 방법

- 창약의 바이오센서 개발자

제8장 자금 조달 및 투자 분석

- 장의 개요

- 자금 조달 유형

- 창약의 바이오센서 : 자금 조달 및 투자

제9장 출판물 분석

제10장 세계 규모의 이벤트 분석

- 장의 개요

- 범위 및 조사 방법

- 창약의 바이오센서 관련 세계 이벤트 일람

제11장 특허 분석

- 장의 개요

- 범위 및 조사 방법

- 창약의 바이오센서 : 특허 분석

- 창약의 바이오센서 : 특허 평가

- 주요 특허 : 인용수별 분석

제12장 시장 예측 및 기회 분석

- 장의 개요

- 예측 조사 방법 및 주요 전제조건

- 창약 시장에서 세계의 바이오센서(-2035년)

- 창약 시장에서 바이오센서 : 바이오센서 유형별

- 창약 시장에서 바이오센서 : 최종 사용자별

- 창약 시장에서 바이오센서 : 지역별

제13장 결론

제14장 주요 인사이트

제15장 부록 1 : 표 형식 데이터

제16장 부록 2 : 기업 및 단체 일람

AJY 25.07.21GLOBAL BIOSENSORS MARKET: OVERVIEW

As per Roots Analysis, the biosensors market is estimated to grow from USD 5.9 billion in the current year to USD 14 billion by 2035, at a CAGR of 9.0% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Biosensor

- Optical Biosensors

- Electrochemical Biosensors

- Thermal Biosensors

- Others

Type of End User

- Academic and Research Institutes

- Industry Players

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

- Rest of the World

GLOBAL BIOSENSORS MARKET: GROWTH AND TRENDS

Over the years, the growing prevalence of high throughput screening methodologies and advanced analytical tools to identify pharmacological molecules during drug development and disease diagnosis has led to a surge in demand for biosensors. Biosensors are analytical devices that consist of biological elements like antibodies, cells, enzymes, lipids, or oligonucleotides, combined with a physical transducer. With advances in biosensor technology, such as electrochemical biosensors, optical biosensors and thermal biosensors, identifying and validating biological targets has become easier. Moreover, the real-time analysis ability of biosensors helps researchers in rapid identification of potential biological targets for drug development, ensuring high precision while eliminating the chances of errors. Owing to its significance in drug discovery, several industrial stakeholders are currently exploring the use of biosensors in screening the leading drug candidates from thousands of hits and lead optimization.

Further, it is interesting to note that implementing biosensing technologies in the drug development and discovery process is anticipated to enhance the overall R&D activities by enabling accurate screening. Over 80 biosensors are available or are being developed by several industrial stakeholders for drug development purposes. Additionally, more than USD 1.2 billion has been invested in this field by key industrial and non-industrial players within the past five years. Given the active approach undertaken by the biosensors market players in this domain, the market is anticipated to grow during the forecast period.

GLOBAL BIOSENSORS MARKET: KEY INSIGHTS

The report delves into the current state of global biosensors market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, more than 80 biosensors, focused on drug discovery applications, are being developed by various companies across the world; 65% of such biosensors are capable of analyzing small molecules.

- Nearly 65% of the available devices in this market are optical biosensors; over 90% of these biosensor technologies support the identification of new drug leads.

- More than 15% of the biosensors claim to support all the steps in drug discovery; examples of such biosensor developers include Malvern Panalytical, Invitrometrix and Nicoya Lifesciences.

- More than 50% of the key players are based in North America; of these, around 70% of the companies are using optical and electrochemical biosensing technologies for drug discovery.

- The market landscape is dominated by small players, which were established post 2005; the US has emerged as a key hub for drug discovery focused on biosensors, featuring the presence of maximum developers.

- In pursuit of gaining a competitive edge, biosensor developers are presently undertaking initiatives to expand their existing capabilities and augment respective product portfolios.

- Over the years, players engaged in this domain have carried out a variety of initiatives to further advance the development / enable improvement of their existing biosensor technologies.

- Several investors, having realized the opportunity within this upcoming segment, have invested over USD 1.2 billion across various funding rounds in the past four years.

- There has been a steady increase in the funding activity; specifically, in 2024, industry players collectively raised close to USD 0.6 billion.

- Around USD 185 million was raised through venture rounds; of this, 83% funding was raised from venture series A.

- In North America, majority (82%) of the funding rounds were led by organizations based in the US, having invested amount worth USD 1.1 billion.

- Published scientific literature signifies the active initiatives of researchers to discover new biosensor technologies in order to cater to the evolving drug discovery and development needs.

- Over 55% of articles related to use of biosensor in drug discovery have been published in the last two years; majority (60%) of the publications were research papers.

- Various industry and non-industry players have participated in multiple global events to discuss research outcomes, affiliated challenges and opportunities associated with the use of biosensors in drug discovery.

- More than 350 patents have been granted / filed for various biosensor technologies focused on drug discovery applications, primarily by players based in North America.

- Nearly 85% of the total patents have been filed in developed regions, such as the US and Europe; Additionally, 16% of the patents have been filed in World Intellectual Property Organization (WIPO).

- The market for biosensors in drug discovery is expected to grow at a CAGR of 9%, till 2035; the opportunity is likely to be well-distributed across different types of biosensors, end users and geographies.

GLOBAL BIOSENSORS MARKET: KEY SEGMENTS

Optical Biosensors Segment Occupies the Largest Share of the Biosensors Market

Based on the type of biosensor, the market is segmented into optical biosensors, electrochemical biosensors, thermal biosensors and others. At present, optical biosensors segment holds the maximum (~70%) share of the global biosensors market. This trend is likely to remain same in the coming future.

By Type of End User, Industry Players is the Fastest Growing Segment of Biosensors Market

Based on the type of end user, the market is segmented into academic and research institutes and industry players. Currently, academic and research institutes segment captures the highest proportion (~60%) of the biosensors market. Further, industry players' segment is expected to grow at a higher compounded annual growth rate of 10.1% during the forecast period.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East and North Africa, and the Rest of the World. Currently, North America (~40%) dominates the biosensors market and accounts for the largest revenue share. Further, the market in Europe is expected to grow at a higher CAGR in the coming years.

Example Players in the Biosensors Market

- Agilent Technologies

- Axion Biosystems

- BioNavigations

- Creoptix

- Cytiva

- Dynamic Biosensors

- Malvern Panalytical

- Microvacuum

- Sartorius

- Tempo Bioscience

PRIMARY RESEARCH OVERVIEW

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews conducted with the following industry stakeholders:

- Chief Executive Officer, Company A

- Chief Executive Officer, Company B

- Associate Director R&D, Head of Biology, Company C

GLOBAL BIOSENSORS MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global biosensors market, focusing on key market segments, including [A] type of biosensor, [B] type of end user and [C] key geographical regions.

- Market Landscape: A comprehensive evaluation of biosensors in drug discovery, considering various parameters, such as [A] type of biosensor, [B] bioreceptor used, [C] drug discovery step(s) supported, [D] other applications, [E] type of analyte analyzed, [F] type of carrier plate format, [G] sample capacity, [H] sample volume, [I] type of detection and [J] type of system. Additionally, a comprehensive evaluation of biosensor developers based on various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, and [D] leading players (in terms of number of biosensors developed).

- Product Competitiveness Analysis: A comprehensive competitive analysis of biosensors used for drug discovery purposes, examining factors, such as [A] supplier power and [B] product competitiveness.

- Company Profiles: In-depth profiles companies developing biosensors for drug discovery applications, focusing on [A] company overview, [B] product portfolio and [C] recent developments and an informed future outlook.

- Brand Positioning Analysis: In-depth brand positioning analysis of leading industry firms, highlighting the current perceptions regarding their proprietary brands across biosensors in drug discovery.

- Funding And Investment Analysis: A detailed analysis of investments that have been made into companies developing biosensors for drug discovery applications, based on various relevant parameters, such as [A] year of investment, [B] the amount invested, [C] type of funding, [D] most active players (in terms of the number of funding instances), and [E] type of investor.

- Publication Analysis: An insightful analysis of around 333 peer-reviewed scientific articles related to research on biosensors in drug discovery, based on various relevant parameters, such as [A] year of publication, [B] type of publication, [C] emerging focus areas, [D] most active publishers, [E] most active affiliated institutes and [F] geography.

- Global Event Analysis: An in-depth analysis of the global events attended by participants, based on various relevant parameters, such as [A] year of event, [B] type of event platform, [C] location of event, [D] emerging focus areas, [E] active organizers (in terms of number of events), [F] active industry and non-industry participants, [G] designation of participants, and [H] affiliated organizations of participant.

- Patent Analysis: An insightful analysis of various patents that have been filed / granted related to biosensors in drug discovery, based on several parameters, such as [A] publication year, [B] geographical region, [C] CPC symbols, [D] patent focus areas, [E] type of applicant, [F] detailed valuation analysis and [G] leading players (in terms of size of intellectual property portfolio).

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. An Overview of Biosensors

- 3.3. Components of Biosensors

- 3.4. Types of Biosensors

- 3.5. Applications of Biosensors in Drug Discovery

- 3.6. Challenges Associated with Use of Biosensors in Drug Discovery

- 3.7. Concluding Remarks

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Biosensors in Drug Discovery: Overall Market Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Most Active Players: Analysis by Number of Biosensors Developed

- 4.2.5. Analysis by Type of Biosensor

- 4.2.6. Analysis by Type of Bioreceptor Used

- 4.2.7. Analysis by Type of Biosensor and Type of Bioreceptor Used

- 4.2.8. Analysis by Drug Discovery Step(s) Supported

- 4.2.9. Analysis by Other Applications Supported

- 4.2.10. Analysis by Type of Analyte

- 4.2.11. Analysis by Carrier Plate Format

- 4.2.12. Analysis by Type of Biosensor and Carrier Plate Format

- 4.2.13. Analysis by Sample Capacity

- 4.2.14. Analysis by Sample Volume

- 4.2.15. Analysis by Type of Detection Method Employed

- 4.2.16. Analysis by Type of System

5. PRODUCT COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions and Key Parameters

- 5.3. Methodology

- 5.4. Product Competitiveness Analysis: Biosensors in Drug Discovery

6. COMPANY PROFILES: BIOSENSORS DEVELOPERS FOR DRUG DISCOVERY APPLICATIONS

- 6.1. Chapter Overview

- 6.2. Agilent Technologies

- 6.2.1. Company Overview

- 6.2.2. Product Portfolio

- 6.2.3. Recent Developments and Future Outlook

- 6.3. Axion Biosystems

- 6.3.1. Company Overview

- 6.3.2. Product Portfolio

- 6.3.3. Recent Developments and Future Outlook

- 6.4. BioNavigations

- 6.4.1. Company Overview

- 6.4.2. Product Portfolio

- 6.4.3. Recent Developments and Future Outlook

- 6.5. Creoptix

- 6.5.1. Company Overview

- 6.5.2. Product Portfolio

- 6.5.3. Recent Developments and Future Outlook

- 6.6. Cytiva

- 6.6.1. Company Overview

- 6.6.2. Product Portfolio

- 6.6.3. Recent Developments and Future Outlook

- 6.7. Dynamic Biosensors

- 6.7.1. Company Overview

- 6.7.2. Product Portfolio

- 6.7.3. Recent Developments and Future Outlook

- 6.8. Malvern Panalytical

- 6.8.1. Company Overview

- 6.8.2. Product Portfolio

- 6.8.3. Recent Developments and Future Outlook

- 6.9. Microvacuum

- 6.9.1. Company Overview

- 6.9.2. Product Portfolio

- 6.9.3. Recent Developments and Future Outlook

- 6.10. Sartorius

- 6.10.1. Company Overview

- 6.10.2. Product Portfolio

- 6.10.3. Recent Developments and Future Outlook

- 6.11. Tempo Bioscience

- 6.11.1. Company Overview

- 6.11.2. Product Portfolio

- 6.11.3. Recent Developments and Future Outlook

7. BRAND POSITIONING ANALYSIS

- 7.1. Chapter Overview

- 7.2. Key Parameters

- 7.3. Methodology

- 7.4. Biosensor Developers for Drug Discovery Applications

- 7.4.1. Brand Positioning Matrix: Agilent Technologies

- 7.4.2. Brand Positioning Matrix: Cytiva

- 7.4.3. Brand Positioning Matrix: Sartorius

- 7.4.4. Brand Positioning Matrix: Malvern Panalytical

8. FUNDING AND INVESTMENT ANALYSIS

- 8.1. Chapter Overview

- 8.2. Types of Funding

- 8.3. Biosensors in Drug Discovery: Funding and Investments

- 8.3.1. Analysis of Funding Instances by Year

- 8.3.2. Analysis of Amount Invested by Year

- 8.3.3. Analysis of Funding Instances by Type of Funding

- 8.3.4. Analysis of Amount Invested by Type of Funding

- 8.3.5. Analysis of Funding Instances by Type of Biosensor

- 8.3.6. Most Active Players: Analysis by Number of Funding Instances

- 8.3.7. Most Active Players: Analysis by Amount Invested

- 8.3.8. Most Active Investors: Analysis by Number of Funding Instances

- 8.3.9. Analysis of Amount Invested by Geography

- 8.3.9.1. Analysis by Region

- 8.3.9.2. Analysis by Country

9. PUBLICATION ANALYSIS

- 9.1. Chapter Overview

- 9.2. Scope and Methodology

- 9.3. Biosensors in Drug Discovery: Publication Analysis

- 9.3.1. Analysis by Year of Publication

- 9.3.2. Analysis by Type of Publication

- 9.3.3. Most Popular Journals: Analysis by Number of Publications

- 9.3.4. Most Popular Journals: Analysis by Impact Factor

- 9.3.5. Analysis by Most Popular Keywords

- 9.3.6. Most Active Publisher: Analysis by Number of Publications

- 9.3.7. Most Active Affiliated Institutes: Analysis by Number of Publications

- 9.3.8. Analysis by Geography

10. GLOBAL EVENT ANALYSIS

- 10.1. Chapter Overview

- 10.2. Scope and Methodology

- 10.3. List of Global Events Related to Biosensors in Drug Discovery

- 10.3.1. Analysis by Year of Event

- 10.3.2. Analysis by Event Platform

- 10.3.3. Analysis by Type of Event

- 10.3.4. Analysis by Location of Event

- 10.3.5. Analysis by Evolutionary Trends in Event Agendas / Key Focus Areas

- 10.3.6. Most Active Organizers: Analysis by Number of Events

- 10.3.7. Analysis by Designation of Participants

- 10.3.8. Analysis by Affiliated Department of Participants

- 10.3.9. Analysis by Geography of Upcoming Events

11. PATENT ANALYSIS

- 11.1. Chapter Overview

- 11.2. Scope and Methodology

- 11.3. Biosensors in Drug Discovery: Patent Analysis

- 11.3.1. Analysis by Publication Year

- 11.3.2. Analysis by Geography

- 11.3.3. Analysis by CPC Symbols

- 11.3.4. Analysis by Emerging Focus Areas

- 11.3.5. Analysis by Patent Age

- 11.3.6. Analysis by Type of Applicant

- 11.3.7. Leading Industry Players: Analysis by Number of Patents

- 11.3.8. Leading Non-Industry Players: Analysis by Number of Patents

- 11.3.9. Leading Individual Assignees: Analysis by Number of Patents

- 11.4. Biosensors in Drug Discovery: Patent Valuation

- 11.5. Leading Patents: Analysis by Number of Citations

12. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 12.1. Chapter Overview

- 12.2. Forecast Methodology and Key Assumptions

- 12.3. Global Biosensors in Drug Discovery Market, Till 2035

- 12.3.1. Biosensors in Drug Discovery Market: Distribution by Type of Biosensor

- 12.3.1.1. Optical Biosensors in Drug Discovery Market, Till 2035

- 12.3.1.2. Electrochemical Biosensors in Drug Discovery Market, Till 2035

- 12.3.1.3. Thermal Biosensors in Drug Discovery Market, Till 2035

- 12.3.1.4. Other Biosensors in Drug Discovery Market, Till 2035

- 12.3.2. Biosensor in Drug Discovery Market: Distribution by Type of End User

- 12.3.2.1. Biosensor in Drug Discovery Market for Academic and Research Institutes, Till 2035

- 12.3.2.2. Biosensor in Drug Discovery Market for Industry Players, Till 2035

- 12.3.3. Biosensor in Drug Discovery Market: Distribution by Region

- 12.3.3.1. Biosensor in Drug Discovery Market in North America, Till 2035

- 12.3.3.2. Biosensor in Drug Discovery Market in Europe, Till 2035

- 12.3.3.3. Biosensor in Drug Discovery Market in Asia Pacific, Till 2035

- 12.3.3.4. Biosensor in Drug Discovery Market in Latin America, Till 2035

- 12.3.3.5. Biosensor in Drug Discovery Market in Middle East and North Africa, Till 2035

- 12.3.3.6. Biosensor in Drug Discovery Market in Rest of the World, Till 2035

- 12.3.1. Biosensors in Drug Discovery Market: Distribution by Type of Biosensor

13. CONCLUDING REMARKS

14. EXECUTIVE INSIGHTS

- 14.1. Chapter Overview

- 14.2. Company A

- 14.2.1. Company Snapshot

- 14.2.2. Interview Transcript: Chief Executive Officer

- 14.3. Company B

- 14.3.1. Company Snapshot

- 14.3.2. Interview Transcript: Chief Executive Officer

- 14.4. Company C

- 14.4.1. Company Snapshot

- 14.4.2. Interview Transcript: Associate Director R&D, Head of Biology