|

시장보고서

상품코드

1771313

컴퓨터 기반 신약 개발 시장 : 업계 동향 및 예측 - 신약 개발 단계별, 기업 규모별, 치료 영역별, 주요 지역별(북미, 유럽, 아시아태평양, 기타 지역)Computer Aided Drug Discovery Market: Industry Trends and Global Forecasts - Distribution by Drug Discovery Steps, Company Size, Therapeutic Area, and Key Geographical Regions (North America, Europe, and Asia-Pacific and Rest of the World) |

||||||

세계의 컴퓨터 기반 신약 개발 시장 : 개요

세계의 컴퓨터 기반 신약 개발 시장 규모는 2,900만 달러로 평가되었고, 예측 기간 동안 15.6%의 연평균 복합 성장률(CAGR)로 확대될 것으로 예측되고 있습니다.

시장 세분화 및 기회 분석은 다음 매개변수로 세분화됩니다.

신약 개발 단계별

- 타겟 식별

- 타겟 검증

- 히트 제너레이션

- 히트 투 리드(HTL)

- 리드 최적화

고분자 유형별

- 항체

- 단백질

- 펩티드

- 핵산

- 벡터

기업 규모별

- 소기업

- 중견기업

- 대기업

치료 영역별

- 자가면역질환

- 혈액 질환

- 심혈관 질환

- 소화기 질환

- 호르몬 질환

- HIV/AIDS

- 감염증

- 대사질환

- 정신질환

- 근골격계 질환

- 신경질환

- 종양학적 장애

- 호흡기 질환

- 피부장애

- 비뇨기계 질환

- 기타

스폰서 유형별

- 업계 진출기업

- 비업계 진출기업

주요 지역

- 북미(미국, 캐나다)

- 유럽(이탈리아, 독일, 프랑스, 스페인, 기타)

- 아시아태평양(중국, 인도, 일본)

세계의 컴퓨터 기반 신약 개발 시장 : 성장 및 동향

시간이 지남에 따라 신약 개발과 관련된 복잡성이 증가하고 있으며 특히 고분자 의약품의 경우 기존의 저분자 의약품보다 본질적으로 복잡합니다. 그 결과, 의약품 수탁 제조 및 바이오 테크놀로지 분야에서 연구 개발비 전체의 증가를 볼 수 있게 되었습니다. 복잡성에 더해 신약 개발 과정은 설비 투자 및 시간 양면에서 매우 까다롭습니다. 그 결과 컴퓨터 지원에 의한 신약 개발 서비스가 이 문제의 잠재적인 해결책으로 떠올랐습니다.

수년 동안 다양한 계산 도구와 서비스가 등장하여 잠재적 리드 후보 화합물의 선택, 모델링, 분석 및 최적화를 가능하게 해 왔습니다. 컴퓨터 지원에 의한 신약 개발자의 예측력은 연구자가 수백 개의 생물학적 표적에 걸쳐 분자를 무작위로 스크리닝하는 것을 피할 수 있도록 하여 매우 유리하다는 것이 증명되었습니다. 또한 이 접근방식을 통해 신약 개발에 드는 총 비용의 35% 가까이를 절약할 수 있을 것으로 추정되며, 그 결과 고분자를 대상으로 한 보다 효율적인 신약 개발 서비스에 대한 수요가 높아지고 있다는 점은 주목할 만합니다. 그 결과 CADD와 같은 참신한 in-silico 신약 개발 서비스를 제공하는 기업은 이제 제약업계에 필수불가결한 존재가 되었습니다.

세계의 컴퓨터 기반 신약 개발 시장 : 주요 인사이트

본 보고서에서는 세계의 컴퓨터 기반 신약 개발 시장의 현재 상태를 파고 업계 내 잠재적인 성장 기회를 확인하고 있습니다. 주요 조사 결과는 다음과 같습니다.

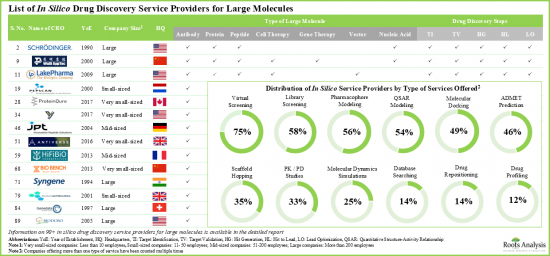

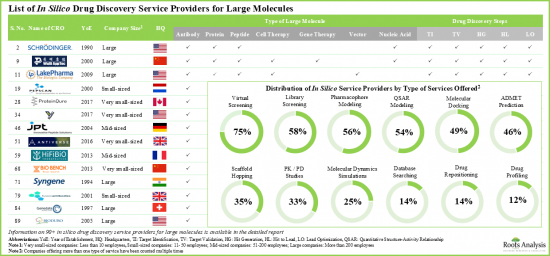

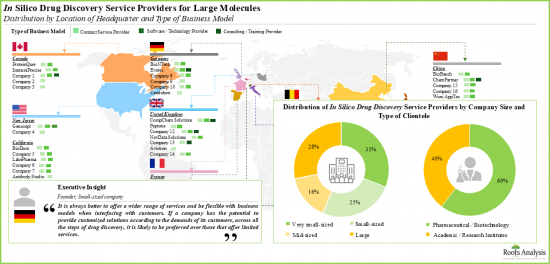

- 90사 이상의 기업이 다양한 유형의 생물 제제의 신약 개발에 in silico 서비스를 제공하는 데 적극적으로 관여하고 있으며, 이 중 약 30사가 신약 개발의 전 단계에 대응하는 서비스를 제공할 수 있다고 주장하고 있습니다.

- 이 중 약 30개사가 신약 개발의 전 공정을 커버하는 서비스를 제공할 수 있다고 주장하고 있습니다. 대부분의 기업은 항체, 단백질, 펩타이드 등 다양한 고분자의 조기 창약에 초점을 맞춘 구조 기반의 약물 디자인을 제공하고 있습니다.

- in silico 서비스를 제공하는 대기업의 대표적인 예로는 ChemPartner, Evotec, Jubilant Biosys, Schrodinger, Signature Discovery, WuXi AppTec 등을 들 수 있습니다.

- 30% 이상의 서비스 제공업체가 신약 개발의 모든 단계에 대해 in silico 서비스를 제공합니다. 대조적으로, 타겟 기반의 신약 단계에서는 광범위한 실험적 지원이 필요합니다.

- 주목해야 할 것은 silico 서비스의 60% 가까이가, 모든 유형의 항체 중에서도 단일클론항체를 대상으로 하고 있는 것입니다. 이것에 계속되는 것이, 다양한 유형의 단백질이나 펩티드를 대상으로 한 in silico 신약 개발 서비스를 제공하는 기업입니다.

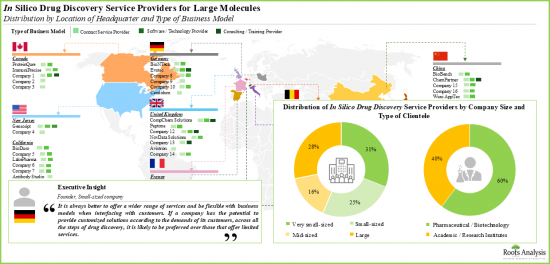

- 중소기업의 존재를 특징으로 하는 in-silico 서비스 제공업체는 다양한 지역에 분산되어 있으며, 이러한 진출기업은 고객의 진화하는 요구에 부응하기 위해 다양한 비즈니스 모델을 채용하고 있습니다.

- 이 분야에 종사하는 일부 기업은 각각의 silico 기반 서비스 포트폴리오를 강화하고 이 업계에서 경쟁력을 유지하기 위해 꾸준히 능력을 확대하고 있습니다.

- 인공지능 및 클라우드 기반 플랫폼과 같은 새로운 컴퓨팅 기술과 in silico 접근법의 통합은 신약 개발 프로세스 전반에 혁명을 가져올 가능성이 높습니다.

- 서비스 제공업체는 의약품의 타임라인을 가속화하고 제품의 성공을 향상시키면서 상당한 비용 절감의 이점을 계속 제공하기 위해 다양한 비즈니스 전략을 채택하고 있습니다.

- 효과적인 치료제에 대한 수요의 높아짐과 폭넓은 치료 영역에 걸친 다양한 생물 제제의 신약 개발 활동 증가에 의해 시장은 앞으로도 지속적인 성장이 예상됩니다.

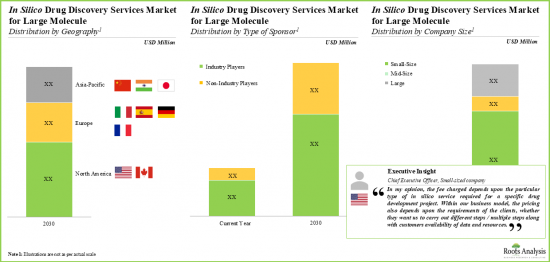

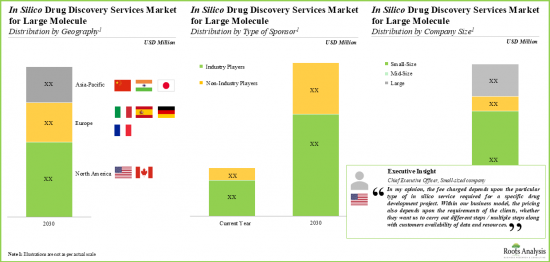

- 장기적으로는 다양한 지역, 스폰서의 유형, 서비스 제공업체의 기업 규모에 걸쳐, 예측되는 기회는 충분히 분산하고 있는 것으로 전망됩니다.

컴퓨터 기반 신약 개발 시장의 진출기업 예

- BioDuro

- Creative Biostructure

- GenScript

- LakePharma

- Abzena

- BioNTech

- Sygnature Discovery

- ChemPartner

- Sundia MediTech

- Viva Biotech

본 보고서에서는 세계의 컴퓨터 기반 신약 개발 시장에 대해 조사했으며, 시장 개요와 함께 신약 개발 단계별, 기업 규모별, 치료 영역별 동향, 지역별 동향 및 시장 진출기업 프로파일 등의 정보를 제공합니다.

목차

제1장 서문

제2장 주요 요약

제3장 서문

- 장의 개요

- 의약품의 발견 및 개발의 타임라인

- in silico 신약 개발 도구의 개요

- 신약 과정에서 in silico 도구의 용도

- 신약 개발업무에서 In Silico 툴의 이용의 장점

- in silico 신약 개발 오퍼레이션의 실시에 수반하는 과제

- in silico 신약 개발 업무의 아웃소싱 증가 예측

- 결론

제4장 시장 상황

- 장의 개요

- 고분자를 대상으로 한 In Silico 신약 개발 서비스 : 업계 진출기업 일람

- in silico 신약 개발 서비스 : 소프트웨어 및 기술 일람

제5장 중요한 인사이트

제6장 기업 프로파일

- 장의 개요

- 북미에 본사를 둔 주요 in silico 서비스 제공 업체

- BioDuro

- Creative Biostructure

- GenScript

- LakePharma

- 유럽에 본사를 둔 주요 기업

- Abzena

- BioNTech

- Sygnature Discovery

- 아시아태평양에 본사를 둔 주요 기업

- ChemPartner

- Sundia MediTech

- Viva Biotech

제7장 기업 경쟁력 분석

- 장의 개요

- 주요 파라미터

- 조사 방법

- 기업 경쟁력 분석 : 북미의 in silico 신약 개발 서비스 제공업체

- 기업 경쟁력 분석 : 유럽의 in silico 신약 개발 서비스 제공업체

- 기업 경쟁력 분석 : 아시아태평양 및 기타 지역의 in silico 신약 개발 서비스 제공업체

제8장 주요 기회 분야

- 장의 개요

- 주요 전제 및 파라미터

- 조사 방법

- 항체

- 펩티드

- 단백질

- 기타 선진 치료법

제9장 새로운 비즈니스 모델 및 전략

- 장의 개요

- 주요 전제 및 조사 방법

- in silico 서비스 제공업체 : 대상이 되는 고분자 수 및 신약 개발 단계별 분석

- 결론

제10장 사례 연구 : 저분자 및 고분자의 신약 개발 과정 비교

- 장의 개요

- 저분자 및 고분자 의약품 및 치료법

- 고분자의 발견 프로세스를 개선하기 위한 접근

제11장 조사 인사이트

제12장 비용 절감 분석

제13장 시장 예측

- 장의 개요

- 예측 조사 방법 및 주요 전제조건

- 고분자용 in silico 신약 개발 서비스 시장 전체(-2035년)

- 고분자용 in silico 신약 개발 서비스 시장(-2035년) : 신약 개발 단계별

- 고분자용 in silico 신약 개발 서비스 시장(-2035년) : 고분자 유형별

- 고분자용 in silico 신약 개발 서비스 시장(-2035년) : 기업 규모별

- 고분자용 in silico 신약 개발 서비스 시장(-2035년) : 치료 영역별

- 고분자용 in silico 신약 개발 서비스 시장(-2035년) : 스폰서 유형별

- 고분자용 in silico 신약 개발 서비스 시장(-2035년) : 주요 지역별

제14장 신약 개발에서 in silico 툴과 향후의 동향

- 장의 개요

- 비용과 시간에 관한 잠재적인 이점에 의해 신약 개발 업무의 아웃소싱은 향후 증가할 전망

- 기술의 진보는 현재의 신약 개발 프로세스에 혁명을 가져올 가능성 상승

- 결론

제15장 주요 인사이트

제16장 부록 I : 표 형식 데이터

제17장 부록 II : 기업 및 조직 목록

제18장 부록 III : 신약 개발을 위한 비계산적 기법

AJY 25.07.21GLOBAL COMPUTER AIDED DRUG DISCOVERY MARKET: OVERVIEW

As per Roots Analysis, the global computer aided drug discovery market valued at USD 29 million in anticipated to grow at a CAGR of 15.6% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Drug Discovery Steps

- Target Identification

- Target Validation

- Hit Generation

- Hit-to-Lead

- Lead Optimization

Type of Large Molecule

- Antibodies

- Proteins

- Peptides

- Nucleic Acids

- Vectors

Company Size

- Small Companies

- Mid-sized Companies

- Large Companies

Therapeutic Area

- Autoimmune Disorders

- Blood Disorders

- Cardiovascular Disorders

- Gastrointestinal and Digestive Disorders

- Hormonal Disorders

- HIV / AIDS

- Infectious Diseases

- Metabolic Disorders

- Mental Disorders

- Musculoskeletal Disorders

- Neurological Disorders

- Oncological Disorders

- Respiratory Disorders

- Skin Disorders

- Urogenital Disorders

- Others

Type of Sponsor

- Industry Players

- Non-Industry Players

Key Geographical Regions

- North America (US and Canada)

- Europe (Italy, Germany, France, Spain and Rest of Europe)

- Asia-Pacific (China, India and Japan)

GLOBAL COMPUTER AIDED DRUG DISCOVERY MARKET: GROWTH AND TRENDS

Over time, the complexities associated with drug discovery have increased, especially in case of large molecule drugs, which are inherently more complex than conventional small molecules. As a result, an increase in the overall research and development (R&D) expenditure in the pharmaceutical contract manufacturing / biotechnology sector has been witnessed. In addition to the complexities involved, the drug discovery process is extremely demanding, both in terms of capital expenses and time. Consequently, computer-aided drug discovery services have emerged as a potential solution to the cause.

Over the years, various computational tools and services have emerged, enabling the selection, modelling, analysis and optimization of potential lead candidates. The predictive power of computer aided drug discovery providers has proven to be extremely advantageous, allowing researchers to bypass the random screening of molecules across hundreds of biological targets. Moreover, it is worth highlighting that this approach has been estimated to save nearly 35% of the total cost involved in developing a new drug, resulting in growing demand for more efficient drug discovery services for large molecules. As a result, players offering novel in-silico drug discovery services, such as CADD, have now become an integral part of the pharmaceutical industry.

GLOBAL COMPUTER AIDED DRUG DISCOVERY MARKET: KEY INSIGHTS

The report delves into the current state of global computer aided drug discovery market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Over 90 firms are actively involved in providing in silico services for drug discovery of different types of biologics; of these, around 30 players claim to have the capabilities to offer services for all steps of discovery.

- Majority of the companies offer structure-based drug design focused on early-stage drug discovery of a range of large molecules, including antibodies, proteins and peptides.

- Prominent examples of large companies that offer in-silico services include ChemPartner, Evotec, Jubilant Biosys, Schrodinger, Sygnature Discovery, WuXi AppTec.

- More than 30% of the service providers offer in-silico services for all the steps of drug discovery; in contrast, target-based drug discovery steps require extensive experimental support.

- Notably, nearly 60% of the in-silico services are offered for monoclonal antibodies among all types of antibodies; this is followed by companies offering in silico drug discovery services for different types of proteins and peptides.

- Featuring the presence of small and mid-sized firms, the in-silico service provider landscape is well distributed across various regions; these players have adopted various business models to cater to the evolving needs of the clients.

- Several players involved in this domain are steadily expanding their capabilities in order to enhance their respective in-silico-based service portfolios and maintain a competitive edge in this industry.

- The integration of novel computational techniques, such as artificial intelligence and cloud-based platforms, with in-silico approaches, is likely to revolutionize the overall drug discovery process.

- Service providers are adopting various business strategies in order to continue providing significant cost saving advantages, along with expediting discovery timelines and improving product success.

- Driven by the growing demand for effective therapeutics and increase in drug discovery efforts of various biologics across a wide range of therapeutic areas, the market is expected to witness sustained growth in future.

- In the long-term, the projected opportunity is anticipated to be well distributed across various geographies, type of sponsors and company sizes of service providers.

Example Players in the Computer Aided Drug Discovery Market

- BioDuro

- Creative Biostructure

- GenScript

- LakePharma

- Abzena

- BioNTech

- Sygnature Discovery

- ChemPartner

- Sundia MediTech

- Viva Biotech

PRIMARY RESEARCH OVERVIEW

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews conducted with the following industry stakeholders:

- Founder and Chief Executive Officer, Company A

- Chief Executive Officer and Chief Technical Officer, Company B

- Senior Vice President, Drug Discovery, Company C

- Founder, Company D

GLOBAL COMPUTER AIDED DRUG DISCOVERY MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global computer aided drug discovery market, focusing on key market segments, including [A] drug discovery steps, [B] type of large molecule, [C] company size, [D] therapeutic area, [E] type of sponsor and [F] key geographical regions.

- Market Landscape: A comprehensive evaluation of companies offering in silico drug discovery services for large molecules, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of business model used, [E] number of drug discovery step(s) for which the company offers services involving the use of in silico approaches, [F] type of large molecules(s) handled, [G] type of in silico approach used, [H] type of in silico service(s) offered and [I] type of clientele served.

- Key Insights: An insightful analysis of contemporary market trends that have been depicted using four schematic representations, including [A] an analysis of the industry players engaged in this domain, distributed based on the location of their company size and respective headquarters, [B] an analysis of in silico service providers, [C] a detailed analysis, highlighting the key hubs with respect to outsourcing activity within this domain, and [D] an insightful grid analysis, presenting the distribution of companies based on the type of large molecule, in silico approach used and type of clientele.

- Company Profiles: In-depth profiles of companies that offer in silico drug discovery services, focusing on [A] company overview, [B] financial information (if available), [C] in silico-based service(s) portfolio and [D] recent developments and an informed future outlook.

- Company Competitiveness Analysis: A comprehensive competitive analysis of at-home self-testing kit manufacturers, examining factors, such as strength of their respective service portfolios, taking into consideration the [A] experience of a service provider, [B] number of drug discovery services offered and [C] number of large molecules, for which the aforementioned services are offered.

- Key Opportunity Areas: In-depth analysis of current opportunity within in-silico drug discovery services market, comparing the number of pipeline products and current market size based on [A] type of large molecule and the availability and capabilities of affiliated in silico drug discovery service providers.

- Emerging Business Models and Strategies: A comprehensive discussion on the various business strategies that can be adopted by in-silico drug discovery service providers, based on [A] the different types of large molecules handled and [B] the technical expertise of service providers, in terms of capabilities across different steps of drug discovery.

- Cost Saving Analysis: A detailed analysis focusing on the cost saving potential associated with the use of in-silico approaches in the drug discovery process.

- Case Study: A detailed discussion on the key challenges associated with the [A] discovery and production of large molecules, [B] affiliated product development timelines, and [C] manufacturing protocols, with those of small molecule drugs.

- Survey Insights: Comprehensive insights from an industry-wide survey, highlighting inputs solicited from various experts who are directly or indirectly engaged in providing in silico services for discovery of large molecule drugs.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Drug Discovery and Development Timelines

- 3.3. Overview of In Silico Drug Discovery Tools

- 3.3.1. Historical Evolution of the In Silico Approach

- 3.3.2. Comparison of Traditional Drug Discovery Approaches and In Silico / Computer Aided Methods

- 3.3.3. In Silico / Computed Aided Approaches for Drug Design and Development

- 3.4. Applications of In Silico Tools in the Drug Discovery Process

- 3.4.1. Target Identification

- 3.4.1.1. Chemoinformatics-based Tools

- 3.4.1.2. Network-based Drug Discovery

- 3.4.1.3. Computational Platforms and Interaction Repositories

- 3.4.2. Target Validation

- 3.4.3. Hit Generation

- 3.4.3.1. High-Throughput Screening

- 3.4.3.2. Fragment Based Screening

- 3.4.3.3. Virtual Screening

- 3.4.4. Hit-to-Lead

- 3.4.4.1. Pharmacodynamics and Pharmacokinetics Modeling

- 3.4.4.2. Other Novel Approaches

- 3.4.5. Lead Optimization

- 3.4.5.1. Pharmacophore Modeling

- 3.4.5.2. Docking

- 3.4.5.3. Structure Activity Relationships (SAR) / Quantitative Structure Activity Relationship (QSAR)

- 3.4.5.4. Molecular Modeling

- 3.4.1. Target Identification

- 3.5. Advantages of using In Silico Tools for Drug Discovery Operations

- 3.6. Challenges Associated with Conducting In Silico Drug Discovery Operations

- 3.7. Anticipated Rise in Outsourcing In Silico Drug Discovery Operations

- 3.8. Concluding Remarks

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. In Silico Drug Discovery Services for Large Molecules: List of Industry Players

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Company Size and Location of Headquarters

- 4.2.5. Analysis by Type of Business Model

- 4.2.6. Analysis by Drug Discovery Steps

- 4.2.7. Analysis by Type of Large Molecule

- 4.2.7.1. Analysis by Type of Antibody

- 4.2.7.2. Analysis by Type of Protein

- 4.2.8. Analysis by Type of In Silico Approach Used

- 4.2.9. Analysis by Types of In Silico Services Offered

- 4.2.10. Analysis by Type of Clientele

- 4.3. In Silico Drug Discovery Services: List of Software / Technologies

5. KEY INSIGHTS

- 5.1. Chapter Overview

- 5.2. Logo Landscape: Analysis by Company Size and Location of Headquarters

- 5.3. Tree Map Representation: Analysis by Company Size and Drug Discovery Steps

- 5.4. World Map Representation: Regional Analysis of Outsourcing Activity

- 5.5. Grid Representation: Analysis by Type of Large Molecule, In Silico Approach Used and Type of Clientele

6. COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. Key In Silico Service Providers Based in North America

- 6.2.1. BioDuro

- 6.2.1.1. Company Overview

- 6.2.1.2. Funding and Investment Information

- 6.2.1.3. In Silico-based Service Portfolio

- 6.2.1.4. Recent Developments and Future Outlook

- 6.2.1.5. Peer Group Benchmark Comparison

- 6.2.2. Creative Biostructure

- 6.2.2.1. Company Overview

- 6.2.2.2. Funding and Investment Information

- 6.2.2.3. In Silico-based Service Portfolio

- 6.2.2.4. Recent Developments and Future Outlook

- 6.2.2.5. Peer Group Benchmark Comparison

- 6.2.3. GenScript

- 6.2.3.1. Company Overview

- 6.2.3.2. Funding and Investment Information

- 6.2.3.3. In Silico-based Service Portfolio

- 6.2.3.4. Recent Developments and Future Outlook

- 6.2.3.5. Peer Group Benchmark Comparison

- 6.2.4. LakePharma

- 6.2.4.1. Company Overview

- 6.2.4.2. Funding and Investment Information

- 6.2.4.3. In Silico-based Service Portfolio

- 6.2.4.4. Recent Developments and Future Outlook

- 6.2.4.5. Peer Group Benchmark Comparison

- 6.2.1. BioDuro

- 6.3. Leading Players Based in Europe

- 6.3.1. Abzena

- 6.3.1.1. Company Overview

- 6.3.1.2. Funding and Investment Information

- 6.3.1.3. In Silico-based Service Portfolio

- 6.3.1.4. Recent Developments and Future Outlook

- 6.3.1.5. Peer Group Benchmark Comparison

- 6.3.2. BioNTech

- 6.3.2.1. Company Overview

- 6.3.2.2. Funding and Investment Information

- 6.3.2.3. Recent Developments and Future Outlook

- 6.3.2.4. Peer Group Benchmark Comparison

- 6.3.3. Sygnature Discovery

- 6.3.3.1. Company Overview

- 6.3.3.2. Funding and Investment Information

- 6.3.3.3. In Silico-based Service Portfolio

- 6.3.3.4. Recent Developments and Future Outlook

- 6.3.3.5. Peer Group Benchmark Comparison

- 6.3.1. Abzena

- 6.4. Leading Players Based in Asia-Pacific

- 6.4.1. ChemPartner

- 6.4.1.1. Company Overview

- 6.4.1.2. In Silico-based Service Portfolio

- 6.4.1.3. Recent Developments and Future Outlook

- 6.4.1.4. Peer Group Benchmark Comparison

- 6.4.2. Sundia MediTech

- 6.4.2.1. Company Overview

- 6.4.2.2. Funding and Investment Information

- 6.4.2.3. In Silico-based Service Portfolio

- 6.4.2.4. Recent Development and Future Outlook

- 6.4.2.5. Peer Group Benchmark Comparison

- 6.4.3. Viva Biotech

- 6.4.3.1. Company Overview

- 6.4.3.2. Funding and Investment Information

- 6.4.3.3. In Silico-based Service Portfolio

- 6.4.3.4. Recent Development and Future Outlook

- 6.4.3.5. Peer Group Benchmark Comparison

- 6.4.1. ChemPartner

7. COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Key Parameters

- 7.3. Methodology

- 7.4. Company Competitiveness Analysis: In Silico Drug Discovery Service Providers in North America

- 7.5. Company Competitiveness Analysis: In Silico Drug Discovery Service Providers in Europe

- 7.6. Company Competitiveness Analysis: In Silico Drug Discovery Service Providers in Asia-Pacific and Rest of the World

8. KEY OPPORTUNITY AREAS

- 8.1. Chapter Overview

- 8.2. Key Assumptions and Parameters

- 8.3. Methodology

- 8.4. Antibodies

- 8.4.1. Developer Landscape

- 8.4.1.1. Number of Pipeline Molecules

- 8.4.1.2. Affiliated Market Size and Growth Rate

- 8.4.2. In Silico Service Providers for Antibodies: 3D Bubble Analysis Based on Number of Drug Discovery Steps, Strength of Service Portfolio and Company Size

- 8.4.1. Developer Landscape

- 8.5. Peptides

- 8.5.1. Developer Landscape

- 8.5.1.1. Number of Pipeline Molecules

- 8.5.1.2. Affiliated Market Size and Growth Rate

- 8.5.2. In Silico Service Providers for Peptides: 3D Bubble Analysis Based on Number of Drug Discovery Steps, Strength of Service Portfolio and Company Size

- 8.5.1. Developer Landscape

- 8.6. Proteins

- 8.6.1. Developer Landscape

- 8.6.1.1. Number of Pipeline Molecules

- 8.6.1.2. Affiliated Market Size and Growth Rate

- 8.6.2. In Silico Service Providers for Proteins: 3D Bubble Analysis Based on Number of Drug Discovery Steps, Strength of Service Portfolio and Company Size

- 8.6.1. Developer Landscape

- 8.7. Other Advanced Therapies

- 8.7.1. Developer Landscape

- 8.7.1.1. Number of Pipeline Molecules

- 8.7.1.2. Affiliated Market Size and Growth Rate

- 8.7.2. In Silico Service Providers for Vectors: 3D Bubble Analysis Based on Number of Drug Discovery Steps, Strength of Service Portfolio and Company Size

- 8.7.1. Developer Landscape

9. EMERGING BUSINESS MODELS AND STRATEGIES

- 9.1. Chapter Overview

- 9.2. Key Assumptions and Methodology

- 9.3. In Silico Service Providers: Analysis by Number of Large Molecules and Drug Discovery Steps Covered

- 9.3.1. Strategies for Short Term Success

- 9.3.2. Strategies for Long Term Success

- 9.4. Concluding Remarks

10. CASE STUDY: COMPARISON OF DRUG DISCOVERY PROCESSES OF SMALL MOLECULES AND LARGE MOLECULES

- 10.1. Chapter Overview

- 10.2. Small Molecule and Large Molecule Drugs / Therapies

- 10.2.1. Comparison of Key Specifications

- 10.2.2. Comparison of Manufacturing Processes

- 10.2.3. Comparison of Drug Discovery Processes

- 10.3. Approaches to Improve Discovery Process of Large Molecules

11. SURVEY INSIGHTS

- 11.1. Chapter Overview

- 11.2. Overview of Respondents

- 11.2.1. Designation of Respondents

- 11.3. Survey Insights

- 11.3.1. Drug Discovery Steps

- 11.3.2. Type of Molecules Handled

- 11.3.3. In Silico Drug Design Focused Service Portfolio

- 11.3.4. Likely Adoption of In Silico Tools for Large Molecules Drug Discovery

- 11.3.5. Current Market Opportunity

- 11.3.6. Likely Growth Rate

- 11.3.7. Cost Saving Potential of the In Silico Approach

12. COST SAVING ANALYSIS

- 12.1. Chapter Overview

- 12.2. Key Assumptions

- 12.3. Methodology

- 12.4. Overall Cost Saving Potential of In Silico Tools in Large Molecule Drug Discovery, Till 2035

- 12.5. Concluding Remarks

13. MARKET FORECAST

- 13.1. Chapter Overview

- 13.2. Forecast Methodology and Key Assumptions

- 13.3. Overall In Silico Drug Discovery Services Market for Large Molecules, Till 2035

- 13.3.1. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Drug Discovery Steps, Till 2035

- 13.3.1.1. In Silico Drug Discovery Services Market for Large Molecules: Share of Target Identification, Till 2035

- 13.3.1.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Target Validation, Till 2035

- 13.3.1.3. In Silico Drug Discovery Services Market for Large Molecules: Share of Hit Generation, Till 2035

- 13.3.1.4. In Silico Drug Discovery Services Market for Large Molecules: Share of Hit-to-Lead, Till 2035

- 13.3.1.5. In Silico Drug Discovery Services Market for Large Molecules: Share of Lead Optimization, Till 2035

- 13.3.2. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Type of Large Molecule, Till 2035

- 13.3.2.1. In Silico Drug Discovery Services Market for Large Molecules: Share of Antibodies, Till 2035

- 13.3.2.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Proteins, Till 2035

- 13.3.2.3. In Silico Drug Discovery Services Market for Large Molecules: Share of Peptides, Till 2035

- 13.3.2.4. In Silico Drug Discovery Services Market for Large Molecules: Share of Nucleic Acids, Till 2035

- 13.3.2.5. In Silico Drug Discovery Services Market for Large Molecules: Share of Vectors, Till 2035

- 13.3.3. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Company Size, Till 2035

- 13.3.3.1. In Silico Drug Discovery Services Market for Large Molecules: Share of Small Companies, Till 2035

- 13.3.3.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Mid-sized Companies, Till 2035

- 13.3.3.3. In Silico Drug Discovery Services Market for Large Molecules: Share of Large Companies, Till 2035

- 13.3.4. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Therapeutic Area, Till 2035

- 13.3.4.1. In Silico Drug Discovery Services Market for Large Molecules: Share of Autoimmune Disorders, Till 2035

- 13.3.4.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Blood Disorders, Till 2035

- 13.3.4.3. In Silico Drug Discovery Services Market for Large Molecules: Share of Cardiovascular Disorders, Till 2035

- 13.3.4.4. In Silico Drug Discovery Services Market for Large Molecules: Share of Gastrointestinal and Digestive Disorders, Till 2035

- 13.3.4.5. In Silico Drug Discovery Services Market for Large Molecules: Share of Hormonal Disorders, Till 2035

- 13.3.4.6. In Silico Drug Discovery Services Market for Large Molecules: Share of Human Immunodeficiency Virus (HIV) / Acquired Immunodeficiency Syndrome (AIDS), Till 2035

- 13.3.4.7. In Silico Drug Discovery Services Market for Large Molecules: Share of Infectious Diseases, Till 2035

- 13.3.4.8. In Silico Drug Discovery Services Market for Large Molecules: Share of Metabolic Disorders, Till 2035

- 13.3.4.9. In Silico Drug Discovery Services Market for Large Molecules: Share of Mental Disorders, Till 2035

- 13.3.4.10. In Silico Drug Discovery Services Market for Large Molecules: Share of Musculoskeletal Disorders, Till 2035

- 13.3.4.11. In Silico Drug Discovery Services Market for Large Molecules: Share of Neurological Disorders, Till 2035

- 13.3.4.12. In Silico Drug Discovery Services Market for Large Molecules: Share of Oncological Disorders Till 2035

- 13.3.4.13. In Silico Drug Discovery Services Market for Large Molecules: Share of Respiratory Disorders, Till 2035

- 13.3.4.14. In Silico Drug Discovery Services Market for Large Molecules: Share of Skin Disorders, Till 2035

- 13.3.4.15. In Silico Drug Discovery Services Market for Large Molecules: Share of Urogenital Disorders, Till 2035

- 13.3.4.16. In Silico Drug Discovery Services Market for Large Molecules: Share of Others, Till 2035

- 13.3.5. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Type of Sponsor, Till 2035

- 13.3.5.1. In Silico Drug Discovery Services Market for Large Molecules: Share of Industry Players, Till 2035

- 13.3.5.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Non-Industry Players, Till 2035

- 13.3.6. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Key Geographical Regions, Till 2035

- 13.3.6.1. In Silico Drug Discovery Services Market for Large Molecules: Share of North America, Till 2035

- 13.3.6.1.1. In Silico Drug Discovery Services Market for Large Molecules: Share of US, Till 2035

- 13.3.6.1.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Canada, Till 2035

- 13.3.6.2. In Silico Drug Discovery Services Market for Large Molecules: Share in Europe, Till 2035

- 13.3.6.2.1. In Silico Drug Discovery Services Market for Large Molecules: Share in Germany, Till 2035

- 13.3.6.2.2. In Silico Drug Discovery Services Market for Large Molecules: Share in France, Till 2035

- 13.3.6.2.3. In Silico Drug Discovery Services Market for Large Molecules: Share in the UK, Till 2035

- 13.3.6.2.4. In Silico Drug Discovery Services Market for Large Molecules: Share in Italy, Till 2035

- 13.3.6.2.5. In Silico Drug Discovery Services Market for Large Molecules: Share in Spain, Till 2035

- 13.3.6.2.6. In Silico Drug Discovery Services Market for Large Molecules: Share in Rest of Europe, Till 2035

- 13.3.6.3. In Silico Drug Discovery Services Market for Large Molecules: Share in Asia-Pacific and Rest of the World, Till 2035

- 13.3.6.3.1. In Silico Drug Discovery Services Market for Large Molecules: Share in China, Till 2035

- 13.3.6.3.2. In Silico Drug Discovery Services Market for Large Molecules: Share in India, Till 2035

- 13.3.6.3.3. In Silico Drug Discovery Services Market for Large Molecules: Share in Japan, Till 2035

- 13.3.6.1. In Silico Drug Discovery Services Market for Large Molecules: Share of North America, Till 2035

- 13.3.1. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Drug Discovery Steps, Till 2035

14. IN SILICO TOOLS AND UPCOMING TRENDS IN DRUG DISCOVERY

- 14.1. Chapter Overview

- 14.2. Owing to Potential Cost and Time-related Benefits, Outsourcing of Drug Discovery Operations is Expected to Increase in the Future

- 14.3. Technological Advancements are Likely to Revolutionize the Current Drug Discovery Processes

- 14.3.1. Integration of Artificial Intelligence in the Drug Discovery Process is Expected to Improve Overall Efficiency and Productivity

- 14.3.2. Increased Adoption of Cloud Based Technology Platforms is Anticipated to Enhance the Scalability and Flexibility of the Drug Discovery Process

- 14.3.3. Rising Interest in Use of Force Fields for In Silico Drug Discovery

- 14.4. Concluding Remarks

15. EXECUTIVE INSIGHTS

- 15.1. Chapter Overview

- 15.2. Company A

- 15.2.1. Company Snapshot

- 15.2.2. Interview Transcript: Founder and Chief Executive Officer

- 15.3. Company B

- 15.3.1. Company Snapshot

- 15.3.2. Interview Transcript: Chief Executive Officer and Chief Technical Officer

- 15.4. Company C

- 15.4.1. Company Snapshot

- 15.4.2. Interview Transcript: Senior Vice President, Drug Discovery

- 15.5. Company D

- 15.5.1. Company Snapshot

- 15.5.2. Interview Transcript: Founder