|

시장보고서

상품코드

1813196

플라스틱 시장 : 산업 동향, 세계 예측(-2035년) : 제품 유형, 첨가제, 환경 영향, 수지, 가공 기술, 용도, 최종 사용자, 기업 규모, 비즈니스 모델, 주요 지역별Plastics Market, Till 2035: Distribution by Type of Product, Additive, Environmental Impact, Resin, Processing Technique, Application, End User, Company Size, Business Model, and Key Geographical Regions: Industry Trends and Global Forecasts |

||||||

플라스틱 시장 개요

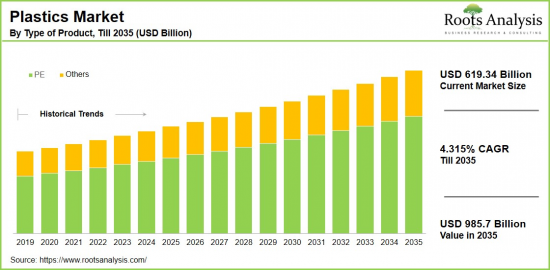

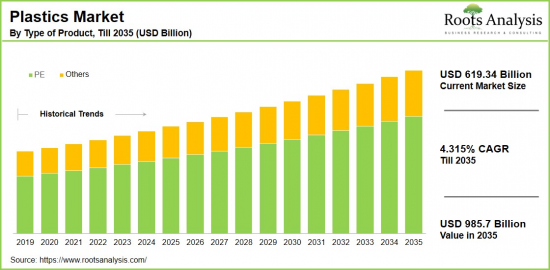

세계의 플라스틱 시장 규모는 현재 6,193억 4,000만 달러에서 예측 기간 동안 4.315%의 연평균 복합 성장률(CAGR)을 나타내 2035년에는 9,857억 달러로 성장할 것으로 예상됩니다.

플라스틱 시장 기회 : 분류

제품 유형

- 아크릴로니트릴 부타디엔 스티렌(ABS)

- 폴리에틸렌(PE)

- 폴리프로필렌(PP)

- 폴리우레탄(PU)

- 폴리염화비닐(PVC)

- 폴리에스터(PET)

- 폴리스티렌(PS)

- 기타

첨가제

- 착색제

- 충진제

- 난연제

- 가소제

- 안정제

환경 영향 유형

- 바이오 기반 플라스틱

- 분해성 플라스틱

- 비재활용성 플라스틱

- 재활용성 플라스틱

시장 구조

- 애프터마켓

- OEM

수지

- 바이오플라스틱

- 열가소성 플라스틱

- 열경화성 플라스틱

가공 기술

- 수지 유형

- 바이오플라스틱

- 열가소성 플라스틱

- 열경화성 플라스틱

용도

- 블로우 성형

- 압축 성형

- 압출 성형

- 사출 성형

- 로토 성형

- 열성형

- 주조

- 기타

최종 사용자

- 자동차 및 운송

- 건축 및 건설

- 소비재 및 라이프스타일

- 전기 및 전자

- 의료 및 제약

- 인프라 및 건설

- 포장

- 섬유

- 기타

기업 규모

- 대기업

- 중소기업

비즈니스 모델

- B2B

- B2C

- B2B2C

지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미 국가

- 유럽

- 오스트리아

- 벨기에

- 덴마크

- 프랑스

- 독일

- 아일랜드

- 이탈리아

- 네덜란드

- 노르웨이

- 러시아

- 스페인

- 스웨덴

- 스위스

- 영국

- 기타 유럽 국가

- 아시아

- 중국

- 인도

- 일본

- 싱가포르

- 한국

- 기타 아시아 국가

- 라틴아메리카

- 브라질

- 칠레

- 콜롬비아

- 베네수엘라

- 기타 라틴아메리카 국가

- 중동 및 북아프리카

- 이집트

- 이란

- 이라크

- 이스라엘

- 쿠웨이트

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동 및 북아프리카 국가

- 세계 기타 지역

- 호주

- 뉴질랜드

- 기타 국가

플라스틱 시장 : 성장과 동향

플라스틱 산업은 활기차고 빠르게 변화하고 있으며 첨단 기술을 통해 기존의 제조 방법을 재구성하고 있습니다. 이 분야는 포장에서 자동차 부품에 이르기까지 다양한 제품과 용도를 다루며 다양한 산업에서 업무 효율성을 높이고 비용을 절감하는 데 필수적입니다. 가볍고 내구성이 높은 소재에 대한 수요가 증가함에 따라 기존의 기술에서 혁신적인 플라스틱 대체품으로의 전환을 촉진하여 생산 효율 향상과 폐기물 절감에 기여하고 있습니다.

기업이 엄격한 품질 기준과 환경 규제를 충족시키고자 하는 가운데, 새로운 가공 기술과 지속 가능한 이니셔티브의 도입은 점점 더 중요해지고 있습니다. 고품질 제품에 대한 수요는 기업이 제품의 균일성과 규제 준수를 보장하는 첨단 제조 방법에 대한 투자를 촉구하고 있습니다. 그럼에도 불구하고 원재료 가격 변동, 환경 문제, 공급망 혼란과 같은 문제가 성장을 방해할 수 있습니다. 또한 중소기업은 첨단기술 도입에 필요한 엄청난 양의 초기 투자에 대응하기 어려울 수 있습니다.

그럼에도 불구하고 플라스틱 시장은 친환경 재활용 가능한 소재에 대한 수요 증가를 배경으로 큰 성장 기회를 가지고 있습니다. 바이오플라스틱, 스마트 폴리머, 자동화의 진전은 업무 효율성을 높이고 환경에 미치는 영향을 줄일 것으로 기대됩니다. 소비자의 취향과 규제 요건의 변화에 대응하는 가운데, 이 업계는 앞으로도 확대가 계속될 전망입니다. 이러한 요인들로부터 플라스틱 시장은 예측 기간 동안 상당한 성장을 이룰 것으로 예측됩니다.

이 보고서는 세계의 플라스틱 시장을 조사했으며 시장 개요, 배경, 시장 영향요인 분석, 시장 규모 추이와 예측, 각종 구분, 지역별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

목차

제1장 서문

제2장 조사 방법

제3장 경제 및 기타 프로젝트별 고려 사항

제4장 거시경제지표

제5장 주요 요약

제6장 서론

제7장 경쟁 구도

제8장 기업 프로파일

- 장 개요

- Arkema

- BASF SE

- Borouge

- Borealis

- Braskem

- Celanese

- Phillips

- Dow

- DuPont

- Eni

- Evonik

- Exxon

- Formosa

제9장 밸류체인 분석

제10장 SWOT 분석

제11장 세계의 플라스틱 시장

제12장 제품 유형별 시장 기회

제13장 첨가제별 시장 기회

제14장 환경 영향 유형별 시장 기회

제15장 시장 구조별 시장 기회

제16장 수지별 시장 기회

제17장 가공 기술별 시장 기회

제18장 용도별 시장 기회

제19장 최종 사용자별 시장 기회

제20장 기업 규모별 시장 기회

제21장 비즈니스 모델별 시장 기회

제22장 북미의 플라스틱 시장 기회

제23장 유럽의 플라스틱 시장 기회

제24장 아시아의 플라스틱 시장 기회

제25장 중동 및 북아프리카의 플라스틱 시장 기회

제26장 라틴아메리카의 플라스틱 시장 기회

제27장 세계 기타 지역의 플라스틱 시장 기회

제28장 표 형식 데이터

제29장 기업 및 단체 목록

제30장 커스터마이즈 기회

제31장 ROOTS 구독 서비스

제32장 저자 상세 정보

KTH 25.09.26Plastics Market Overview

As per Roots Analysis, the global plastics market size is estimated to grow from USD 619.34 billion in the current year to USD 985.7 billion by 2035, at a CAGR of 4.315% during the forecast period, till 2035.

The opportunity for plastics market has been distributed across the following segments:

Type of Product

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Polyester (PET)

- Polystyrene (PS)

- Others

Type of Additive

- Colorants

- Fillers

- Flame retardants

- Plasticizers

- Stabilizers

Type of Environmental Impact

- Bio-based Plastics

- Degradable Plastics

- Non-recyclable Plastics

- Recyclable Plastics

Type of Market Structure

- Aftermarket

- OEM (Original Equipment Manufacturer)

Type of Resin

- Bioplastics

- Thermoplastics

- Thermosetting plastics

Type of Processing Technique

- Type of Resin

- Bioplastics

- Thermoplastics

- Thermosetting plastics

Area of Application

- Blow Molding

- Compression Molding

- Extrusion Molding

- Injection Molding

- Roto Molding

- Thermoforming

- Casting

- Others

End User

- Automotive & Transportation

- Building & Construction

- Consumer Goods/Lifestyle

- Electrical & Electronics

- Healthcare & Pharmaceutical

- Infrastructure & Construction

- Packaging

- Textile

- Others

Company Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Business Model

- B2B

- B2C

- B2B2C

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Plastics Market: Growth and Trends

The plastics industry is a vibrant and quickly changing field that is reshaping conventional manufacturing methods through cutting-edge technologies. This sector is essential for boosting operational efficiency and cost savings across a variety of industries, covering a diverse array of products and uses, from packaging to automotive parts. The increasing need for lightweight and resilient materials has fueled the transition from traditional techniques to innovative plastic alternatives, which enhance production efficiency and reduce waste.

As businesses aim to satisfy stringent quality and environmental regulations, the implementation of new processing technologies and sustainable practices has become increasingly crucial. The demand for high-quality goods compels companies to invest in advanced manufacturing methods that guarantee product uniformity and compliance with regulations. Nevertheless, challenges such as variable raw material prices, environmental issues, and supply chain interruptions can impede growth. Furthermore, small and medium enterprises (SMEs) might find it difficult to cope with the significant upfront investment necessary for advanced technologies.

Despite these obstacles, the plastics market presents considerable growth opportunities, fueled by a rising demand for eco-friendly and recyclable materials. Developments in bioplastics, smart polymers, and automation are expected to improve operational efficiency and lessen environmental consequences. As the industry responds to changing consumer preferences and regulatory requirements, it is set for ongoing expansion in the future. Owing to the above-mentioned factors, the plastics market is anticipated to experience significant growth during this forecast period.

Plastics Market: Key Segments

Market Share by Type of Product

Based on type of product, the global plastics market is segmented into acrylonitrile butadiene styrene (ABS), polyethylene (PE), polypropylene (PP), polyurethane (PU), polyvinyl chloride (PVC), polyester (PET), polystyrene (PS), and others.

According to our estimates, currently, the polyethylene (PE) segment captures the majority of the market share. This growth can be attributed to its extensive application in packaging, construction, and automotive sectors. Additionally, this growth can be linked to its versatility, strength, and recyclability.

Market Share by Type of Additive

Based on type of additive, the plastics market is segmented into colorants, fillers, flame retardants, plasticizers, stabilizers, and others. According to our estimates, currently, colorants segment captures the majority of the market. This can be attributed to its crucial role in enhancing the visual attractiveness of plastic products and in marketing initiatives.

As consumers look for unique and appealing products, the demand for colorants continues to be strong. Furthermore, advancements in colorant technologies facilitate customization and differentiation within the market.

Market Share by Type of Environmental Impact

Based on type of environmental impact, the plastics market is segmented bio-based plastics, degradable plastics, non-recyclable plastics, and recyclable plastics. According to our estimates, currently, recyclable plastics segment captures the majority share of the market. This can be attributed to the rising environmental awareness and regulatory demands to minimize plastic waste. Recyclable plastics present an eco-friendly solution by supporting circular economy practices and lessening environmental harm.

Market Share by Type of Market Structure

Based on type of market structure, the plastics market is segmented into aftermarket and OEM (Original Equipment Manufacturer). According to our estimates, currently, OEM segment captures the majority share of the market. This can be attributed to greater demand for plastic parts in the manufacturing processes of original equipment across several sectors such as automotive, electronics, and consumer products. OEMs depend on plastics to produce robust and lightweight components, which contributes to this segment's substantial market share.

Market Share by Type of Resin

Based on type of resin, the plastics market is segmented into bioplastics, thermoplastics, and thermosetting plastics. According to our estimates, currently, thermoplastics segment captures the majority share of the market, driven by their adaptability and ability to be recycled. They are extensively employed across various sectors such as automotive, packaging, and electronics due to their capacity to be melted and reshaped multiple times.

Market Share by Type of Processing Technique

Based on type of processing technique, the plastics market is segmented into 3D printing, compression molding, extrusion blow molding, injection blow molding, and multi-layer molding. According to our estimates, currently, injection blow molding segment captures the majority share of the market, due to its extensive use in producing plastic items such as bottles, containers, and parts for automobiles. Its popularity stems from high production efficiencies and the capability to fabricate intricate shapes with accuracy.

Market Share by Area of Application

Based on area of application, the plastics market is segmented into roto molding, thermoforming, casting, and others. According to our estimates, currently, OEM segment captures the majority share of the market. This can be attributed to its ability to manufacture a diverse array of plastic products, including automotive parts, packaging items, and consumer goods.

Market Share by End User

Based on end user, the plastics market is segmented into automotive & transportation, building & construction, consumer goods/lifestyle, electrical & electronics, healthcare & pharmaceutical, infrastructure & construction, packaging, textile and others. According to our estimates, currently, packaging segment captures the majority share of the market.

This can be attributed to the common usage of plastic materials in various packaging forms, including bottles, containers, and films. The need for convenient and eco-friendly packaging options has resulted in the widespread adoption of plastics in this sector. Furthermore, the adaptability and cost-effectiveness of plastic materials contribute to their popularity for packaging uses in comparison to other industries such as automotive or construction, which have more specific requirements.

Market Share by Company Size

Based on company size, the plastics market is segmented into large size companies and small and mid-size companies. According to our estimates, currently, large companies captures the majority share of the market. This can be attributed to the fact that large companies possess the resources and capabilities to make significant investments in research and development, manufacturing facilities, and marketing, allowing them to produce plastics at a lower cost per unit compared to their smaller rivals.

Additionally, the plastics offered by medium and small businesses are cost-effective alternatives that maintain good quality. This segment is anticipated to expand by 2035 due to increasing demand and improved availability of plastics in the market.

Market Share by Business Model

Based on business model, the plastics market is segmented into B2B, B2C and B2B2C. According to our estimates, currently, B2B segment captures the majority share of the market. This can be attributed to the growing adoption of plastics technology across various industries, including aerospace, manufacturing, healthcare, finance, and more.

Additionally, the B2C model is projected to experience significant growth during the forecast period, as plastics technologies become increasingly user-friendly, with consumers embracing plastics for customized applications, smartphone integration, and an enhanced user experience.

Market Share by Geographical Regions

Based on geographical regions, the plastics market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently North America captures the majority share of the market.

This can be attributed to its sophisticated technological infrastructure, innovative businesses, and a vast and varied consumer base across multiple industries. Additionally, this region has many top plastic manufacturers and suppliers who utilize state-of-the-art technology, research initiatives, and well-established marketing and distribution networks to connect with a broader global audience.

Example Players in Plastics Market

- Arkema

- BASF SE

- Borouge

- Borealis

- Braskem

- Celanese Corporation

- Chevron Phillips Chemical

- China National Petroleum

- China Petroleum & Chemical

- Dow

- DuPont

- Eni

- Evonik

- Exxon Mobil

- Formosa Plastics

- Huntsman

- INEOS Group

- LANXESS

- LG Chem

- Lotte Chemical

- LyondellBasell

- Mitsui & Co.

- Repsol

- RTP

- SABIC

- Sumitomo

- TEIJIN

- Toray

Plastics Market: Research Coverage

The report on the plastics market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the plastics market, focusing on key market segments, including [A] type of product, [B] type of additive, [C] type of environmental impact, [D] type of market structure, [E] type of resin, [F] type of processing technique, [G] area of application, [H] end user, [I] company size, [J] business model, and [K] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the plastics market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the plastics market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] plastics portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the plastics market

Key Questions Answered in this Report

- How many companies are currently engaged in plastics market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Plastics Market

- 6.2.1. Key Characteristics of Plastics Market

- 6.2.2. Type of Product

- 6.2.3. Type of Additive

- 6.2.4. Type of Environmental Impact

- 6.2.5. Type of Market Structure

- 6.2.6. Stage of Resin

- 6.2.7. Type of Processing Technique

- 6.2.8. Area of Application

- 6.2.9. Type of End User

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Plastics: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Arkema*

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- 8.3. BASF SE

- 8.4. Borouge

- 8.5. Borealis

- 8.6. Braskem

- 8.7. Celanese

- 8.8. Phillips

- 8.9. Dow

- 8.10. DuPont

- 8.11. Eni

- 8.12. Evonik

- 8.13. Exxon

- 8.14. Formosa

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL PLASTICS MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Plastics Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF PRODUCT

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Plastics Market for Acrylonitrile Butadiene Styrene: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Plastics Market for Polyethylene: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Plastics Market for Polypropylene: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Plastics Market for Polyurethane: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.10. Plastics Market for Polyvinyl Chloride: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.11. Plastics Market for Polyester: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.12. Plastics Market for Polystyrene: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.13. Plastics Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.14. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF ADDITIVE

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Plastics Market for Colorants: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Plastics Market for Fillers: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Plastics Market for Flame Retardants: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Plastics Market for Plasticizers: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.10. Plastics Market for Stabilizers: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.11. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF ENVIRONMENTAL IMPACT

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Plastics Market for Bio-based Plastics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Plastics Market for Degradable Plastics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Plastics Market for Non-recyclable Plastics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Plastics Market for Recyclable Plastics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.10. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF MARKET STRUCTURE

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Plastics Market for Aftermarket: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Plastics Market for OEM: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF RESIN

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Plastics Market for Bioplastics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Plastics Market for Thermoplastics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Plastics Market for Thermosetting Plastics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.9. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF PROCESSING TECHNIQUE

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Plastics Market for 3D Printing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Plastics Market for Compression Molding: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Plastics Market for Extrusion Blow Molding: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. Plastics Market for Injection Blow Molding: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.10. Plastics Market for Multi-Layer Molding: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.11. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON AREA OF APPLICATION

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Plastics Market for Roto Molding: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Plastics Market for Thermoforming: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Plastics Market for Casting: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.9. Plastics Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.10. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON END USER

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Plastics Market for Automotive & Transportation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Plastics Market for Building & Construction: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Plastics Market for Consumer Goods/Lifestyle: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9. Plastics Market for Electrical & Electronic: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.10. Plastics Market for Healthcare & Pharmaceutical: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.11. Plastics Market for Infrastructure & Construction: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.12. Plastics Market for Packaging: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.13. Plastics Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.14. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Plastics Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Plastics Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Data Triangulation and Validation

21. MARKET OPPORTUNITIES BASED ON BUSINESS MODEL

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Plastics Market for B2B: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Plastics Market for B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Plastics Market for B2B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.9. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR PLASTICS IN NORTH AMERICA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Plastics Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Plastics Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. Plastics Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. Plastics Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. Plastics Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR PLASTICS IN EUROPE

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Plastics Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Plastics Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Plastics Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Plastics Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Plastics Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.5. Plastics Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.6. Plastics Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.7. Plastics Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.8. Plastics Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.9. Plastics Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.10. Plastics Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.11. Plastics Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.12. Plastics Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.13. Plastics Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.14. Plastics Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.15. Plastics Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR PLASTICS IN ASIA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Plastics Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Plastics Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Plastics Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Plastics Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Plastics Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. Plastics Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. Plastics Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR PLASTICS IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Plastics Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Plastics Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 25.6.2. Plastics Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Plastics Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Plastics Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Plastics Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Plastics Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.7. Plastics Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.8. Plastics Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR PLASTICS IN LATIN AMERICA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Plastics Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Plastics Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. Plastics Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Plastics Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. Plastics Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. Plastics Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. Plastics Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR PLASTICS IN REST OF THE WORLD

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Plastics Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. Plastics Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.2. Plastics Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. Plastics Market in Other Countries

- 27.7. Data Triangulation and Validation