|

시장보고서

상품코드

1817402

전자 배치 기록 시장 : 업계 동향과 세계 예측(-2035년) - 전자 배치 기록 시스템의 유형별, 배포 모드별, 전자 배치 기록의 목적별, 지역별, 주요 참여 기업Electronics Batch Records Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Electronic Batch Record System, Deployment Mode, Purpose of Electronic Batch Record, Geographical Regions and Leading Players |

||||||

전자 배치 기록 시장 : 개요

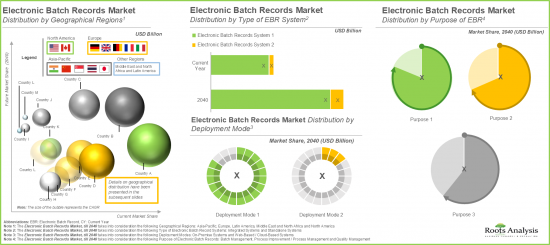

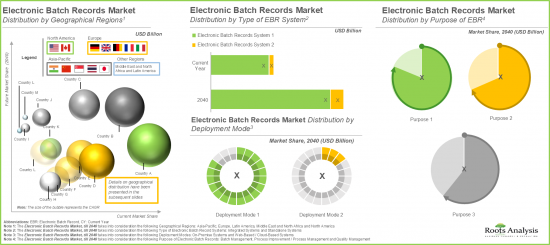

세계의 전자 배치 기록 시장 규모는 현재 12억 8,000만 달러로, 2040년까지 96억 2,000만 달러에 달할 것으로 보이며, 예측 기간 중 14.4%의 CAGR로 성장할 것으로 예측됩니다.

전자 배치 기록 시장 기회는 다음과 같은 부문으로 분류됩니다.

전자 배치 기록 시스템 유형

- 통합 시스템

- 독립형 시스템

전개 모드

- On-Premise

- 웹 기반/클라우드 기반

전자 배치 기록의 목적

- 일괄 관리

- 프로세스 개선/프로세스 관리

- 품질관리

지역

- 북미

- 유럽

- 아시아태평양

- 중동 및 북아프리카

- 라틴아메리카

북미 시장

- 미국

- 캐나다

유럽 시장

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

아시아태평양 시장

- 중국

- 인도

- 일본,기타

중동 및 북아프리카 시장

- 사우디아라비아

- 아랍에미리트

- 이집트

라틴아메리카 시장

- 브라질

- 멕시코

- 아르헨티나

전자 배치 기록 시장 성장 및 동향

전자 배치 기록(EBR)은 제조 공정의 추적, 간소화, 자동화를 목적으로 하는 디지털 솔루션입니다. 이러한 시스템은 생산 라인의 각 배치에 대한 제조 데이터를 수집, 모니터링 및 저장하여 제조 수명주기 전반에 걸쳐 투명성과 품질 표준 준수를 보장합니다. 현재 전자 배치 기록은 제약, 생명공학, 헬스케어, 식품 및 음료 산업 등 규제 준수와 품질 보증이 중요한 다양한 분야에서 널리 사용되고 있습니다.

또한 기존의 수작업에 의한 배치 기록은 인위적인 실수가 발생하기 쉽고, 규제 기준을 위반할 가능성이 있으므로 제조 공정을 혼란스럽게 할 수 있는 몇 가지 문제가 있습니다. 이러한 문제를 극복하기 위해 많은 제조업체들이 전자 배치 기록을 채택하여 운영 비용과 제조 비용을 최소화하면서 제품 품질을 향상시키고 있습니다. 또한 1990년 미국 식품의약국(FDA)이 GMP(Good Manufacturing Practice)를 강화하기 위해 21 CFR Part 11 컴플라이언스 기준을 도입한 것은 디지털 배치 제조 솔루션 도입을 위한 중요한 발걸음으로, EBR 시스템의 중요성을 강조하고 있습니다.

안전에 대한 우려 증가, 규제 요건의 강화, 과학적 검증에 대한 요구는 첨단 EBR 솔루션의 필요성을 가속화하고 있습니다. 또한 품질 중시, 다품종 생산 전략으로의 전환, 첨단 기술의 통합, EBR 시스템에서 인공지능의 출현은 이 시장의 성장을 더욱 촉진할 것으로 예측됩니다.

전자 배치 기록 시장 주요 인사이트

이 보고서는 전자 배치 기록 시장의 현황을 조사하고 업계내 잠재적인 성장 기회를 파악합니다. 이 보고서의 주요 내용은 다음과 같습니다.

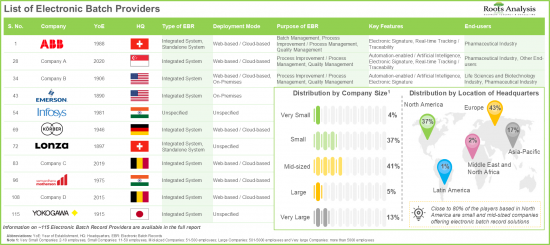

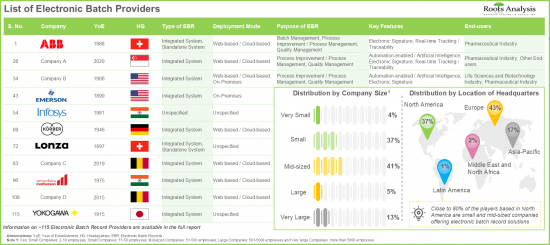

- 현재 약 115개의 전자 배치 기록 솔루션이 전 세계 기업에 의해 제공되고 있습니다.

- 거의 95%의 전자 배치 기록이 품질관리에 초점을 맞추고 있으며, 이러한 EBR의 60% 가까이가 제약 산업 자동화를 위해 개발되었습니다.

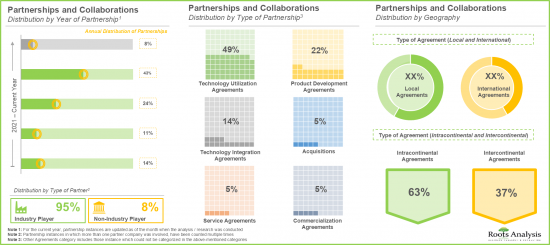

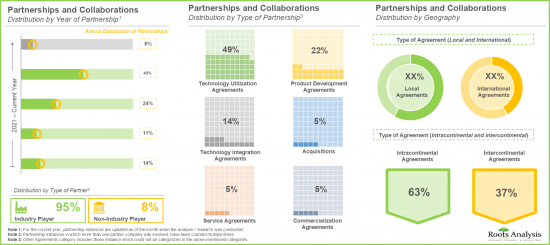

- 최근 파트너십 활동의 꾸준한 성장이 관찰되고 있으며, 기술 이용 계약이 가장 두드러진 파트너 계약 모델로 부상하고 있습니다.

- 최근 EBR 영역의 60% 이상이 새로운 솔루션 출시에 초점을 맞추었습니다. 특히 출시/업그레이드된 솔루션의 83%는 실시간 추적/추적 기능이 내장되어 있습니다.

- 자동화 솔루션에 대한 수요 증가와 규제 준수 강화에 힘입어 전자 배치 기록 시장은 당분간 견고한 성장세를 이어갈 것으로 보입니다.

- 시장은 2040년까지 연평균 14.4%(CAGR)로 성장할 것으로 예상되며, 통합 시스템 부문이 시장의 대부분(약 80%)을 차지할 것으로 예측됩니다.

전자 배치 기록 시장 주요 부문

전자 배치 기록 시스템의 유형에 따라 세계 시장은 통합 시스템과 독립형 시스템으로 구분됩니다. 현재 통합형 시스템이 전체 시장을 주도하고 있습니다. 또한 이러한 추세는 앞으로도 변하지 않을 것임을 강조하고 싶습니다. 이는 이러한 시스템이 제조 공정의 효율성과 생산성을 향상시키고, 컴플라이언스 비용과 수작업으로 인한 실수를 줄일 수 있는 기능을 갖추고 있기 때문입니다.

세계 전자 배치 기록 시장은 도입 형태에 따라 웹 기반/클라우드 기반과 On-Premise로 구분됩니다. 현재 이 시장의 매출은 On-Premise 부문이 대부분을 차지하고 있습니다. 그러나 웹 기반/클라우드 기반 배포 모드에서 창출되는 매출은 예측 기간 중 더 높은 CAGR로 성장할 것으로 예측됩니다.

전자 배치 기록의 목적에 따라 세계 시장은 배치 관리, 공정 개선/공정 관리, 품질관리로 구분됩니다. 현재 시장 세분화에서 품질관리가 가장 큰 점유율을 차지하고 있으며, 품질관리에 대한 인식이 높아지고 생산 배치 기록의 정확성과 신뢰성을 유지함에 따라 이러한 추세는 앞으로도 변하지 않을 것으로 보입니다.

주요 지역별로 시장은 북미, 유럽, 아시아태평양, 중동 및 북아프리카, 라틴아메리카로 구분됩니다. 현재 북미가 가장 큰 시장 점유율을 차지하고 있습니다. 또한 아시아태평양 시장은 예측 기간 중 상대적으로 높은 CAGR로 성장할 것으로 예상된다는 점은 주목할 만합니다.

전자 배치 기록 시장 진출기업 사례

- ABB

- AmpleLogic

- Ant Solutions

- Datex

- Ecubix

- InstantGMP

- Korber

- Sapio Sciences

- Scigeniq

- Siemens

- Solulever

- Supertech Instrumentation

- Thermo Fisher Scientific

- Tulip Interfaces

- Yokogawa

전자 배치 기록 시장 조사 대상

전자 배치 기록 시장 보고서는 다음과 같은 다양한 섹션에 대한 인사이트를 제공합니다.

- 시장 규모 및 기회 분석 :(A) 전자 배치 기록 시스템 유형,(B) 배포 모드,(C) 전자 배치 기록의 목적,(D) 지역,(E) 주요 기업 등 주요 시장 부문에 초점을 맞추어 전자 배치 기록 시장의 현재 시장 기회와 향후 성장 잠재력을 상세하게 분석합니다.

- 시장 영향 분석 : 시장 성장에 영향을 미칠 수 있는(A) 촉진요인,(B) 억제요인,(C) 시장 성장 촉진요인,(D) 기존 과제 등 다양한 요인을 철저하게 분석합니다.

- 시장 상황:(A)전자 배치 기록 시스템 유형,(B)배치 모드,(C)전자 배치 기록의 목적,(D)주요 기능,(E)최종사용자 등 몇 가지 관련 매개 변수를 바탕으로 전자 배치 기록 시스템을 종합적으로 평가합니다.

- 전자 배치 기록 시스템 현황: A) 설립 연도,(B) 기업 규모,(C) 본사 소재지에 따른 분석과 함께 전자 배치 기록 영역에 종사하는 시스템 프로바이더를 나열하고 있습니다.

- 경쟁 분석 : A) 기업 역량, B) 포트폴리오 역량, C) 최종사용자 등 다양한 관련 파라미터를 기반으로 이 분야에서 가상 임상시험 기업의 경쟁력을 살펴봅니다.

- 기업 개요: A) 기업 개요, B) 재무 정보(가능한 경우), C) 솔루션 포트폴리오, D) 최근 개발 동향, E) 미래 전망에 대한 정보를 담고 있습니다.

- 파트너십 및 협업A)파트너십 체결 연도,(B)파트너십 유형,(C)파트너 유형,(D)전자 배치 기록의 목적,(E)최종사용자,(F)가장 활발한 진출기업(파트너십 수),(G)지역과 같은 여러 관련 매개 변수를 2021년이후 전자 배치 기록 시장의 이해 관계자간에 체결된 파트너십에 대한 자세한 분석.

- 최근 구상:(A)구상 연도,(B)구상 유형,(C)전자 배치 기록의 목적,(D)주요 기능,(E)최종사용자,(F)가장 활발한 진출기업(최근 구상 수),(G)지역 등 몇 가지 관련 매개 변수를 기반으로 전자 배치 기록 영역에서 수행된 다양한 구상의 상세 분석 시행된 다양한 구상에 대한 상세한 분석.

목차

섹션 1 리포트 개요

제1장 서문

제2장 조사 방법

제3장 시장 역학

- 챕터 개요

- 예측 조사 방법

- 시장 평가 프레임워크

- 예측 툴과 테크닉

- 주요 고려사항

- 제한 사항

제4장 거시경제 지표

- 챕터 개요

- 시장 역학

- 결론

섹션 2 정성적 인사이트

제5장 개요

제6장 서론

섹션 3 시장 개요

제7장 시장 구도

- 챕터 개요

- 전자 배치 기록 솔루션 프로바이더 : 시장 구도

제8장 기업 경쟁력 분석

- 챕터 개요

- 전제와 주요 파라미터

- 조사 방법

- 피어 그룹의 개요

- 전자 배치 기록 솔루션 프로바이더 : 기업 경쟁력 분석

섹션 4 기업 개요

제9장 기업 개요 : 북미의 전자 배치 기록 솔루션 프로바이더

- 챕터 개요

- Thermo Fisher Scientific

- Datex

- InstantGMP

- Sapio Sciences

- Tulip Interfaces

제10장 기업 개요 : 유럽의 전자 배치 기록 솔루션 프로바이더

- 챕터 개요

- ABB

- Ant Solutions

- Korber

- Siemens

- Solulever

제11장 기업 개요 : 아시아태평양 및 기타 지역의 전자 배치 기록 솔루션 프로바이더

- 챕터 개요

- Yokogawa

- AmpleLogic

- Ecubix

- Scigeniq

- Supertech Instrumentation

섹션 5 시장 동향

제12장 파트너십과 협업

- 챕터 개요

- 파트너십 모델

- 전자 배치 기록 : 파트너십과 협업

제13장 최근 구상

- 챕터 개요

- 전자 배치 기록 솔루션 : 최근 구상

섹션 6 시장 기회 분석

제14장 시장 영향 분석 : 촉진요인, 억제요인, 기회, 과제

- 챕터 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 시장 기회

- 시장이 해결해야 할 과제

- 결론

제15장 세계의 전자 배치 기록 시장

- 챕터 개요

- 전제와 조사 방법

- 세계의 전자 배치 기록 시장 : 역사적 동향(2020년 이후)과 예측 추정(-2040년)

- 주요 시장 세분화

제16장 전자 배치 기록 시장, 전자 배치 기록 시스템의 유형별

제17장 전자 배치 기록 시장, 배포 모드별

제18장 전자 배치 기록 시장, 전자 배치 기록의 목적별

제19장 전자 배치 기록 시장, 지역별

제20장 전자 배치 기록 솔루션 시장, 주요 기업별

섹션 7 기타 인사이트

제21장 결론

제22장 부록 1 : 표형식 데이터

제23장 부록 2 : 기업·단체 리스트

KSA 25.09.25ELECTRONIC BATCH RECORDS MARKET: OVERVIEW

As per Roots Analysis, the global electronic batch records market size is currently valued at USD 1.28 billion and is projected to reach USD 9.62 billion by 2040, growing at a CAGR of 14.4% during the forecast period.

The opportunity for electronic batch records market has been distributed across the following segments:

Type of Electronic Batch Record System

- Integrated System

- Standalone System

Deployment Mode

- On-Premises

- Web-based / Cloud-based

Purpose of Electronic Batch Record

- Batch Management

- Process Improvement / Process Management

- Quality Management

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Market in North America

- US

- Canada

Market in Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Market in Asia-Pacific

- China

- India

- Japan and Rest of Asia-Pacific

Market in Middle East and North Africa

- Saudi Arabia

- UAE

- Egypt

Market in Latin America

- Brazil

- Mexico

- Argentina

Electronic Batch Records Market: Growth and Trends

Electronic batch records (EBR) are digital solutions designed to track, streamline, and automate manufacturing processes. These systems capture, monitor, and store production data for every batch on the production line, ensuring transparency and adherence to quality standards across the entire manufacturing lifecycle. Currently, the electronic batch records are widely used in various sectors, such as pharmaceuticals, biotechnology, healthcare, and the food and beverage industry, where regulatory compliance and quality assurance are critical.

Moreover, the traditional manual batch records pose several challenges that can disrupt manufacturing processes, as they are more prone to human error and can lead to potential violations of regulatory standards. To overcome these challenges, many manufacturers have adopted electronic batch records in order to enhance their product quality while minimizing the operational and production costs. Further, the introduction of 21 CFR Part 11 compliance standards by the US Food and Drug Administration in 1990, aimed at reinforcing Good Manufacturing Practices (GMPs) marked a significant step toward the adoption of digital batch manufacturing solutions, underscoring the importance of EBR systems.

Growing safety concerns, stricter regulatory requirements, and the demand for scientific validation have accelerated the need for advanced EBR solutions. In addition, the increasing emphasis on quality, the shift toward multi-product manufacturing strategies, the integration of advanced technologies, and the emergence of artificial intelligence in EBR systems are expected to drive further growth in this market.

Electronic Batch Records Market: Key Insights

The report delves into the current state of the electronic batch records market and identifies potential growth opportunities within the industry. The key takeaways of the report are:

- Presently, around 115 electronic batch record solutions are offered by companies across the globe; majority of the electronic batch solution providers are headquartered in Europe.

- Close to 95% electronic batch records focus on quality management; nearly 60% of these EBRs are developed for automation in the pharmaceutical industry.

- A steady growth in the partnership activity has been observed in recent years; technology utilization agreements have emerged as the most prominent partnering model.

- More than 60% of the recent initiatives within EBR domain were focused on the launch of new solutions; notably, 83% of the solutions launched / upgraded are incorporated with real-time tracking / traceability.

- Driven by the escalating demand for automated solutions and growing regulatory compliance, the electronic batch record market is poised to rise steadily in the foreseeable future.

- The market is anticipated to grow at an annualized rate (CAGR) of 14.4% by 2040; the integrated systems segment is expected to capture the majority share (close to 80%) of the market.

Electronic Batch Records Market: Key Segments

Integrated Systems are Likely to Hold the Largest Share in the Electronic Batch Records Market During the Forecast Period

Based on the type of electronic batch record systems, the global market is segmented into integrated systems and standalone systems. Currently, the integrated systems segment leads the overall market. Further, it is important to highlight that this trend is unlikely to change in the future as well. This can be attributed to the fact that these systems have the capability to improve the efficiency and productivity of manufacturing processes, while reducing the compliance cost and manual errors.

Electronic Batch Records Market for Web-Based / Cloud-Based Deployment Mode is Likely to Grow at a Relatively Faster Pace During the Forecast Period

Based on the deployment mode, the global electronic batch records market is segmented across web-based / cloud-based segment and on-premises. Presently, the market is dominated by the revenues generated through on-premises segment. However, the revenues generated by web-based / cloud-based deployment mode are anticipated to grow at a higher CAGR during the forecast period.

Quality Management Hold the Largest Share in the Electronic Batch Records Market

Based on the purpose of electronic batch records, the global market is segmented into batch management, process improvement / process management and quality management. Presently, the quality management segment accounts for the largest market share, and this trend is unlikely to change in the future as well owing to the widespread awareness of quality control and maintaining the accuracy and reliability of manufacturing batch records.

North America Accounts for the Largest Share in the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia Pacific, Middle East and North Africa, Latin America. In the current scenario, North America is likely to capture the largest market share. Further, it is worth highlighting that the market in Asia-Pacific is expected to grow at a relatively high CAGR during the forecast period.

Example Players in the Electronic Batch Records Market

- ABB

- AmpleLogic

- Ant Solutions

- Datex

- Ecubix

- InstantGMP

- Korber

- Sapio Sciences

- Scigeniq

- Siemens

- Solulever

- Supertech Instrumentation

- Thermo Fisher Scientific

- Tulip Interfaces

- Yokogawa

Electronic Batch Records Market: Research Coverage

The report on electronic batch records market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of current market opportunity and the future growth potential of electronic batch records market, focusing on key market segments, including [A] type of electronic batch record system, [B] deployment mode, [C] purpose of electronic batch record, [D] geographical regions, and [E] leading players.

- Market Impact Analysis: A thorough analysis of various factors, such as [A] drivers, [B] restraints, [C] opportunities, and [D] existing challenges that are likely to impact market growth.

- Market Landscape: A comprehensive evaluation of electronic batch record systems, based on several relevant parameters, such as [A] type of electronic batch record system, [B] deployment mode, [C] purpose of electronic batch record, [D] key features, and [E] end user.

- Electronic Batch Records Systems Landscape: The report features a list of system providers engaged in the electronic batch records domain, along with analyses based on [A] year of establishment, [B] company size, and [C] location of headquarters.

- Company Competitiveness Analysis: An insightful competitiveness analysis of the virtual clinical trials companies in this domain, based on various relevant parameters, such as [A] company strength, [B] portfolio strength, and [C] end user.

- Company Profiles: Comprehensive profiles of key industry players in the electronic batch records domain, featuring information on [A] company overview, [B] financial information (if available), [C] solutions portfolio, [D] recent developments, and [E] future outlook statements.

- Partnerships and Collaborations: A detailed analysis of partnerships inked between stakeholders in the electronic batch records market, since 2021, based on several relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] purpose of electronic batch record, [E] end user, [F] most active players (in terms of number of partnerships), and [G] geography.

- Recent Initiatives: A detailed analysis of the various initiatives undertaken in the electronic batch records domain, based on several relevant parameters, such as [A] year of initiative, [B] type of initiative, [C] purpose of electronic batch record, [D] key features, [E] end user, [F] most active players (in terms of number of recent initiatives), and [G] geography.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Value and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Types of Batch Records

- 6.3. Features of Electronic Batch Records

- 6.4. Applications of Electronic Batch Records

- 6.5. Advantages of Electronic Batch Records

- 6.6. Disadvantages of Electronic Batch Records

- 6.7. Key Considerations while Selecting an EBR Solution

- 6.8. Future Perspective

SECTION III: MARKET OVERVIEW

7. MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Electronic Batch Record Solution Providers: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Type of Electronic Batch Record System

- 7.2.5. Analysis by Deployment Mode

- 7.2.6. Analysis by Purpose of Electronic Batch Record

- 7.2.7. Analysis by Key Features

- 7.2.8. Analysis by End-user

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Overview of Peer Groups

- 8.5. Electronic Batch Record Solution Providers: Company Competitiveness Analysis

- 8.5.1. Electronic Batch Record Solution Providers based in North America

- 8.5.2. Electronic Batch Record Solution Providers based in Europe

- 8.5.3. Electronic Batch Record Solution Providers based in Asia-Pacific and Rest of the World

SECTION IV: COMPANY PROFILES

9. COMPANY PROFILES: ELECTRONIC BATCH RECORD SOLUTION PROVIDERS IN NORTH AMERICA

- 9.1. Chapter Overview

- 9.2 Thermo Fisher Scientific

- 9.2.1. Company Overview

- 9.2.2. Electronic Batch Record Solution Portfolio

- 9.2.3. Financial Information

- 9.2.4. Recent Developments and Future Outlook

- 9.3. Datex

- 9.4. InstantGMP

- 9.5. Sapio Sciences

- 9.6. Tulip Interfaces

10. COMPANY PROFILES: ELECTRONIC BATCH RECORD SOLUTION PROVIDERS IN EUROPE

- 10.1. Chapter Overview

- 10.2. ABB

- 10.2.1. Company Overview

- 10.2.2. Electronic Batch Record Solution Portfolio

- 10.2.3. Financial Information

- 10.2.4. Recent Developments and Future Outlook

- 10.3. Ant Solutions

- 10.4. Korber

- 10.5. Siemens

- 10.6. Solulever

11. COMPANY PROFILES: ELECTRONIC BATCH RECORD SOLUTION PROVIDERS IN ASIA-PACIFIC AND REST OF THE WORLD

- 11.1. Chapter Overview

- 11.2. Yokogawa

- 11.2.1. Company Overview

- 11.2.2. Electronic Batch Record Solution Portfolio

- 11.2.3. Financial Information

- 11.2.4. Recent Developments and Future Outlook

- 11.3. AmpleLogic

- 11.4. Ecubix

- 11.5. Scigeniq

- 11.6. Supertech Instrumentation

SECTION V: MARKET TRENDS

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnership Models

- 12.3. Electronic Batch Records: Partnerships and Collaborations

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Year and Type of Partnership

- 12.3.4. Analysis by Type of Partner

- 12.3.5. Analysis by Purpose of Electronic Batch Record

- 12.3.6. Analysis by End-user

- 13.2.7. Most Active Players: Analysis by Number of Partnerships

- 12.3.8. Analysis by Geography

- 12.3.8.1. Analysis by Country

- 12.3.8.2. Analysis by Region

13. RECENT INITIATIVES

- 13.1. Chapter Overview

- 13.2. Electronic Batch Record Solutions: Recent Initiatives

- 13.2.1. Analysis by Year of Initiative

- 13.2.2. Analysis by Type of Initiative

- 13.2.3. Analysis by Year and Type of Initiative

- 13.2.4. Analysis by Purpose of Electronic Batch Record

- 13.2.5. Analysis by Key Features

- 13.2.6. Analysis by End-user

- 13.2.7. Most Active Players: Analysis by Number of Recent Initiatives

- 13.2.8. Analysis by Geography

SECTION VI: MARKET OPPORTUNITY ANALYSIS

14. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 14.1. Chapter Overview

- 14.2. Market Drivers

- 14.3. Market Restraints

- 14.4. Market Opportunities

- 14.5. Market Challenges

- 14.6. Conclusion

15. GLOBAL ELECTRONIC BATCH RECORDS MARKET

- 15.1. Chapter Overview

- 15.2. Assumptions and Methodology

- 15.3. Global Electronic Batch Records Market: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 15.3.1. Roots Analysis Perspective on Market Growth

- 15.3.2. Scenario Analysis

- 15.3.2.1. Conservative Scenario

- 15.3.2.2. Optimistic Scenario

- 15.4. Key Market Segmentations

16. ELECTRONIC BATCH RECORDS MARKET, BY TYPE OF ELECTRONIC BATCH RECORD SYSTEM

- 16.1. Chapter Overview

- 16.2. Assumptions and Methodology

- 16.3. Electronic Batch Records Market: Distribution by Type of Electronic Batch Record System

- 16.3.1. Electronic Batch Records Market for Integrated Systems: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 16.3.2. Electronic Batch Records Market for Standalone Systems: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 16.4. Data Triangulation and Validation

17. ELECTRONIC BATCH RECORDS MARKET, BY TYPE OF DEPLOYMENT MODE

- 17.1. Chapter Overview

- 17.2. Assumptions and Methodology

- 17.3. Electronic Batch Records Market: Distribution by Deployment Mode

- 17.3.1. Electronic Batch Records Market for Web-based / Cloud-based Deployment Mode: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 17.3.2. Electronic Batch Records Market for On-Premises Deployment Mode: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 17.4. Data Triangulation and Validation

18. ELECTRONIC BATCH RECORDS MARKET, BY PURPOSE OF ELECTRONIC BATCH RECORD

- 18.1. Chapter Overview

- 18.2. Assumptions and Methodology

- 18.3. Electronic Batch Records Market: Distribution by Purpose of Electronic Batch Record

- 18.3.1. Electronic Batch Records Market for Quality Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.3.2. Electronic Batch Records Market for Process Improvement / Process Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.3.3. Electronic Batch Records Market for Batch Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.4. Data Triangulation and Validation

19. ELECTRONIC BATCH RECORDS MARKET, BY GEOGRAPHICAL REGION

- 19.1. Chapter Overview

- 19.2. Assumptions and Methodology

- 19.3. Electronic Batch Records Market: Distribution by Geographical Region

- 19.3.1. Electronic Batch Records Market for North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.1.1. Electronic Batch Records Market in the US: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.1.2. Electronic Batch Records Market in Canada: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2. Electronic Batch Records Market for Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.1. Electronic Batch Records Market in Germany: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.2. Electronic Batch Records Market in the UK: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.3. Electronic Batch Records Market in France: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.4. Electronic Batch Records Market in Italy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.5. Electronic Batch Records Market in Spain: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.6. Electronic Batch Records Market for Rest of Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.3. Electronic Batch Records Market for Asia-Pacific: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.3.1. Electronic Batch Records Market in China: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.3.2. Electronic Batch Records Market in India: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.3.3. Electronic Batch Records Market for Japan and Rest of Asia-Pacific: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.4. Electronic Batch Records Market for Middle East and North Africa: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.4.1. Electronic Batch Records Market in Saudi Arabia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.4.2. Electronic Batch Records Market in UAE: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.4.3. Electronic Batch Records Market in Egypt: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.5. Electronic Batch Records Market for Latin America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.5.1. Electronic Batch Records Market in Brazil: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.5.2. Electronic Batch Records Market in Mexico: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.5.3. Electronic Batch Records Market in Argentina: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.1. Electronic Batch Records Market for North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.4. Market Movement Analysis

- 19.5 Penetration-Growth (P-G) Matrix

- 19.6. Data Triangulation and Validation

20. ELECTRONIC BATCH RECORDS SOLUTIONS MARKET, BY LEADING PLAYERS

- 20.1. Chapter Overview

- 20.2. Leading Industry Players