|

시장보고서

상품코드

1821505

항비만제 시장 : 업계 동향과 세계 예측(-2035년) - 분자 유형별, 사용 활성 화합물별, 작용기전별, 작용제별, 작용 경로별, 투여 경로별, 지역별, 판매 예측, 주요 기업Anti-Obesity Drugs Market: Industry Trends and Global Forecasts, till 2035 - Distribution by Type of Molecule, Active Compound Used, Mechanism of Action, Agonist, Action Pathway, Route of Administration, Regions, Sales Forecast and Key Players |

||||||

항비만제 시장 : 개요

세계 항비만제 시장 규모는 현재 196억 달러에서 2035년까지 1,049억 달러로 성장할 것으로 추정되며, 예측 기간 동안 18.3%의 연평균 복합 성장률(CAGR)을 보일 것으로 예측됩니다.

시장 세분화에서는 시장 규모와 시장 기회를 다음과 같은 매개 변수로 구분합니다.

분자 유형

- 생물학적 제제

- 저분자

사용 활성 화합물

- Tirzepatide

- Semaglutide

- Retatrutide

- Survodutide

- Cagrilintide and Semaglutide

- Orforglipron

- Liraglutide

- 기타 활성 화합물

작용기전

- GLP-1 작용제/GIP 작용제

- GLP-1 작용제/GCGR 작용제

- GLP-1 작용제

- GLP-1 작용제/아밀린 유사체

- GLP-1/GCGR/GIP 작용제

- 기타 작용기전

작용제 유형

- Single-Agonist

- Dual-Agonist

- Tri-Agonist

작용 경로

- 중추성 작용

- 말초성 작용

- 중추성 작용 및 말초성 작용

투여 경로

- 경구

- 비경구

지역

- 북미

- 유럽

- 아시아

- 라틴아메리카

- 중동 및 북아프리카

의약품 매출 예측

- Contrave / Mysimba

- Feisumei

- Imcivree

- LOMAIRA

- QSYMIA

- Saxenda

- Wegovy / Ozempic

- Zepbound / Mounjaro

- BI 456906

- CagriSema

- HM11260C

- HRS-9531

- IBI362

- LM-008

- LY3437943

- LY3502970

- TG103

- Semaglutide 7.2 mg (Subcutaneous)

- Semaglutide (Oral)

- XW003

항비만제 시장 성장 및 동향

세계적으로 만연한 비만증에 대한 대응이 절실해지면서 항비만제 시장이 활성화되고 있습니다. 비만 확산, 가처분 소득 증가, 의료 서비스 접근성 향상 등의 요인이 이러한 추세를 촉진하고 있습니다. 최근 몇 년 동안 항비만제의 승인이 증가하여 환자의 치료 선택권이 넓어지고 있습니다. 이는 미국 성인의 약 40%가 체질량지수(BMI)가 30 이상이면 비만으로 분류된다는 놀라운 통계 결과입니다.

항비만제는 식욕, 지방 흡수, 대사 과정을 조절하여 체중 감소를 목표로 합니다. 이러한 약물에는 비만 및 관련 증상 관리를 돕기 위해 고안된 다양한 치료 옵션이 포함되어 있습니다. 전 세계적으로 비만율이 증가하고 당뇨병, 심혈관 질환, 특정 암 등 관련 건강 위험에 대한 인식이 높아짐에 따라 효과적인 항비만제의 필요성이 증가하고 있습니다. 최근 몇 년 동안 많은 새로운 항비만 약물이 규제 당국의 승인을 받아 환자의 선택권을 넓히고 체중 감량을위한 수술 절차에 대한 대안을 제공한다는 점은 주목할 만합니다.

항비만제는 특히 심각한 비만 관련 건강 문제를 가진 환자들에게 체중 감량 효과를 높이기 위해 필수적입니다. 또한, 이러한 약물은 삶의 질 향상에 기여하고, 비만과 관련된 합병증을 예방하여 의료비용을 절감할 수 있습니다. 약물 제형화 및 전달 시스템의 혁신, 신규 화합물의 통합을 통해 보다 안전하고 효과적인 항비만제 개발이 진행되고 있습니다. 맞춤형 의료와 약리유전체학이 강조되면서 환자 개개인의 니즈에 맞는 맞춤형 치료의 가능성은 더욱 높아지고 있습니다. 또한, 원격 의료 서비스 및 디지털 치료 용도 증가는 환자의 더 나은 참여와 치료 계획 준수를 촉진하고 있습니다.

민관 부문은 혁신 촉진 및 최첨단 치료법 개발과 함께 항비만 분야의 연구개발을 위해 적극적으로 투자하고 있습니다. 장기적인 관리가 필요한 만성질환으로서 비만에 대한 관심이 높아짐에 따라 항비만제 시장은 향후 몇 년 동안 큰 성장세를 보이며 이해관계자들에게 큰 기회를 가져다 줄 것으로 보입니다.

항비만제 시장 주요 인사이트

이 보고서는 항비만제 시장의 현황을 살펴보고 업계 내 잠재적인 성장 기회를 파악합니다. 주요 조사 결과는 다음과 같습니다.

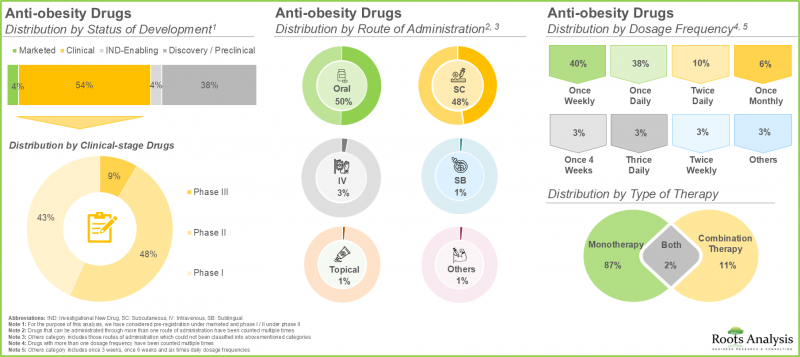

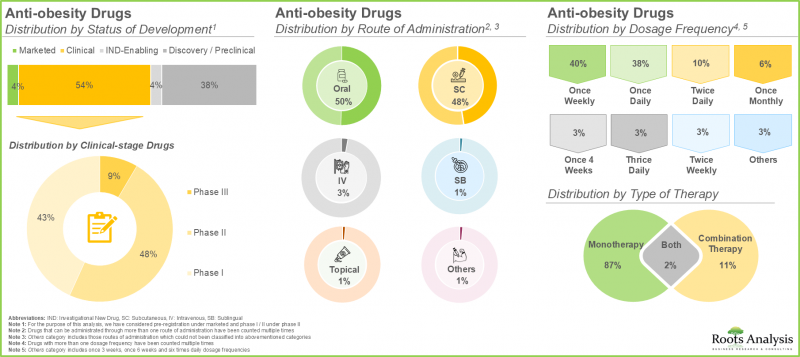

- 현재 비만치료제로 약 225개 품목이 시판/개발되고 있으며, 이 중 약 50%는 경구투여가 가능합니다.

- 현재 항비만제의 약 55%가 임상 개발 단계에 있으며, 그 중 대부분은 단일 요법으로 평가되고 있습니다.

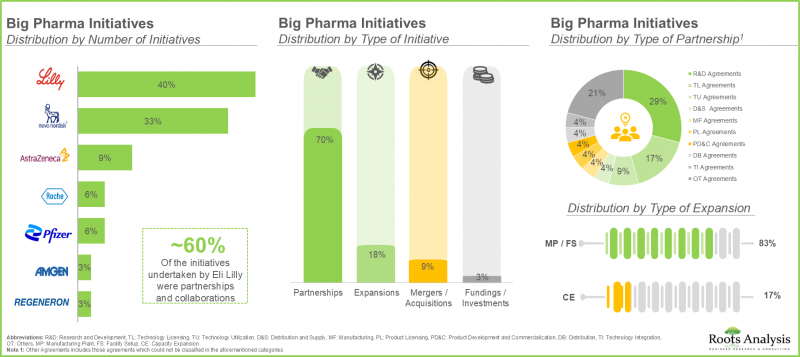

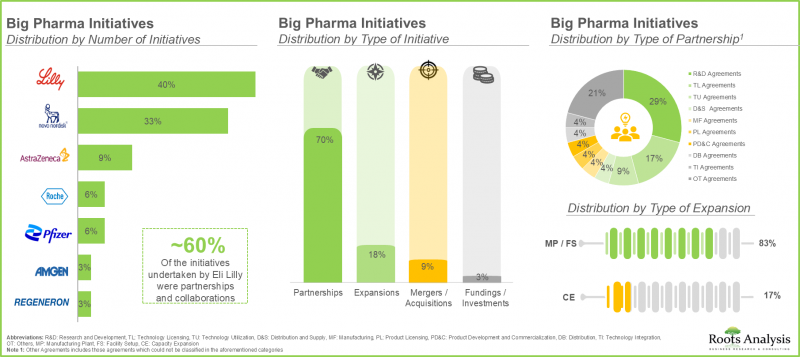

- 대형 제약사 중 상당수(70%)가 항비만제 포트폴리오를 확대하기 위해 다양한 제휴를 맺고 있습니다. 이러한 제휴의 대부분(-30%)은 R&D 계약입니다.

- 비만에 따른 건강 위험에 대한 환자 인식 증가와 비만 확산으로 항비만제 시장은 당분간 안정적인 성장이 예상됩니다.

- 항비만제 시장은 2035년까지 연평균 21.1%(CAGR)로 성장할 것으로 예상되며, 2035년까지 북미가 시장의 대부분(60%)을 차지할 것으로 예측됩니다.

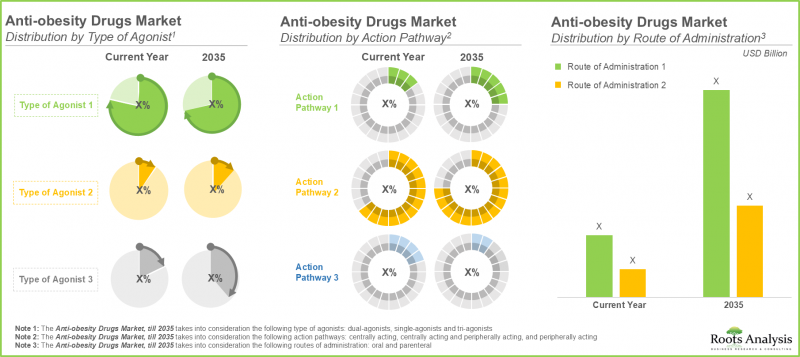

- 현재 중추신경계 항비만제가 시장을 독점하고 있지만, 특히 비경구용 항비만제가 2035년까지 시장 대부분(85%)을 차지할 것으로 예측됩니다.

항비만제 시장 : 주요 부문

분자 유형별로 보면, 항비만제 시장은 생물학적 제제, 저분자 제제 등 다양한 유형의 분자로 구분됩니다. 시장 점유율의 대부분(54%)을 차지하는 저분자는 효능이 입증되고, 투여가 용이하며, 제조비용이 낮고, 쉽게 구할 수 있으며, 안전한 약물 프로파일이 확립되어 있기 때문입니다. 그러나 비만과 관련된 생물학적 경로의 근본적인 치료제로서 생물학적 제제가 유망하고 더 효과적인 대안으로 등장함에 따라 그 상황은 변화할 것으로 예측됩니다.

분자 유형에 따라 항비만제 시장은 세마글루티드, 레타글루티드, 살보듀티드, 카글리틴티드, 올포글리프론, 리라글루티드, 기타 활성 화합물 등 사용되는 다양한 활성 화합물로 분류됩니다. 세마글루타이드는 체중 조절과 당뇨 조절에 강력한 효과를 발휘하기 때문에 현재 항비만제 시장의 대부분을 차지하고 있습니다. 그러나 연구가 진행됨에 따라 틸제파타이드는 GLP-1과 GIP 수용체 작용제로서의 이중 작용으로 주목을 받고 있으며, 임상시험에서 우수한 체중 감소 효과를 보이고 있습니다. 이 혁신적인 접근법은 다양한 대사 경로를 표적으로 삼아 보다 종합적인 비만 치료를 제공합니다. 틸제파타이드는 더 높은 효능과 환자 예후 개선 가능성으로 인해 향후 몇년안에 가장 큰 시장 점유율을 확보하며 부상할 것으로 예측됩니다.

항비만제/체중감량제 시장은 작용기전 측면에서 GLP-1 작용제/GIP 작용제, GLP-1 작용제/GCGR 작용제, GLP-1 작용제, GLP-1 작용제/아밀린 유사체, GLP-1/GCGR/GIP 작용제 및 기타 작용기전으로 구분됩니다. 분류됩니다. 현재 시장은 GLP-1 시장이 지배적입니다. 이는 GLP-1의 작용기전이 확립되어 있기 때문이며, 혈당 조절을 개선하여 체중 감소를 크게 촉진하기 때문입니다. 포만감을 높이고 식욕을 감소시키는 그 능력은 비만 치료의 기초가 되고 있습니다. 그러나 이중 GLP-1 및 GIP 작용제는 여러 대사 경로를 표적으로 삼을 수 있는 능력으로 인해 상대적으로 높은 CAGR로 성장할 것으로 예측됩니다. 임상 연구에 따르면, 이중 작용제는 GLP-1 작용제 단독에 비해 더 큰 체중 감소와 대사 프로파일을 개선하는 것으로 나타났습니다.

시장은 단일 작용제, 이중 작용제, 삼중 작용제 등 다양한 유형의 작용제로 구분됩니다. 현재 항비만제 시장 점유율은 단일 작용제 부문이 68%로 가장 큰 비중을 차지하고 있으며, 이는 환자의 복약 순응도를 높이기 위한 사용 편의성 때문입니다. 이러한 약물은 수년간의 임상적 성공의 역사를 가지고 있기 때문에 의료진은 풍부한 데이터를 바탕으로 자신 있게 처방할 수 있습니다. 이에 따라 여러 생리적 기전을 동시에 표적화하여 복합비만증에 대응할 수 있는 이중 작용제 시장 점유율이 크게 증가할 것으로 예측됩니다. 이를 통해 환자 개개인의 필요와 상태에 맞는 맞춤형 치료가 가능합니다. 듀얼 어고니스트는 헬스케어가 맞춤형 의료로 전환됨에 따라 확산될 것이며, 이에 따라 개발 투자도 확대될 것으로 보입니다.

이 시장은 중추에 작용하는 경로, 말초에 작용하는 경로, 중추와 말초에 작용하는 경로 등 다양한 작용 경로에 대응하고 있습니다. 중추신경계 약물 부문은 현재 항비만제 시장에서 가장 높은 점유율(86%)을 차지하고 있으며, 예측 기간 동안 시장을 독점할 것으로 예측됩니다. 이는 중추신경계와의 직접적인 상호작용을 통해 식욕과 에너지 소비를 조절하는 효과가 있기 때문입니다. 또한, 중추신경계 약물은 안전성 프로파일이 확립되어 있어 임상 현장에서의 입지를 더욱 공고히 하고 있습니다. 또한, 중추에 작용하는 경로에 대한 의존도는 체중 관리에 대한 종합적인 접근을 제공한다는 점에서 앞으로도 계속 강세를 보일 것으로 보입니다. 대체 경로에 대한 연구가 진행 중이지만, 중추신경계 약물의 효능을 뒷받침하는 확고한 임상적 근거가 있기 때문에 시장에서의 우위는 흔들림이 없습니다. 그 결과, 새로운 치료법이 등장할 가능성은 있지만, 비만 관리의 기본적 역할을 반영하여 중추 작용 경로의 추세는 지속될 것으로 예측됩니다.

투여 경로의 관점에서 항비만제 시장은 경구 경로와 비경구 경로로 구분됩니다. 조사에 따르면, 경구제에 비해 작용 발현이 빠르고 생체 이용률이 높아 비경구제가 시장의 대부분(98%)을 차지하고 있는 것으로 나타났습니다. 비경구 투여는 약물이 소화관을 확실하게 우회하기 때문에 흡수 편차를 줄이고 치료 효과를 높일 수 있습니다. 비경구 투여는 최적의 체중 감량 효과를 얻기 위해 정확한 투여와 안정적인 혈장 농도를 필요로 하는 약물에 유리합니다. 또한, 주사제에 대한 선호도가 높아지면서 비경구 투여에 대한 선호도도 높아지고 있습니다. 그 결과, 경구 투여의 선택은 여전히 남아있지만, 항비만제에서 비경구 투여의 우위는 앞으로도 지속될 것으로 보입니다.

세계 시장 규모는 북미, 유럽, 아시아태평양, 라틴아메리카 등 다양한 지역으로 구분됩니다. 당사의 예측에 따르면, 북미가 항비만제 시장의 주요 점유율(70%)을 차지하고 있으며, 이는 예측 기간 동안 변함없이 유지될 것으로 예측됩니다. 이는 이 지역에 고도의 의료 인프라가 구축되어 있고, 제약 연구에 많은 투자가 이루어지고 있으며, 새로운 치료법의 개발 및 승인을 촉진하는 강력한 규제 프레임워크가 존재하기 때문입니다. 아시아태평양의 항비만제 시장은 2035년까지 비교적 높은 CAGR(40%)로 성장할 것으로 예상된다는 점은 주목할 만합니다.

항체 위탁생산 시장 진출기업 사례

- Boehringer Ingelheim

- Eli Lilly

- Novo Nordisk

- Eli Lilly

- Pfizer

- Regeneron

- Kallyope

- CinFina Pharma

- Viking Therapeutics

- AstraZeneca

- Novo Nordisk

- Roche

- Adocia

- Boehringer Ingelheim

- Zealand Pharma

- Hanmi Pharm

- Jiangsu Hengrui Pharmaceuticals

- Gmax Biopharma

- PegBio

- QL Biopharm

- Sciwind Biosciences

항비만제 시장 조사 대상

- 시장 규모 및 기회 분석 : 본 보고서는 세계 항비만제 시장을(A) 분자 유형,(B) 활성 화합물,(C) 작용기전,(D) 작용제 유형,(E) 작용경로,(F) 투여 경로,(G) 지역 등 주요 시장 부문별로 상세하게 분석하였습니다.

- 시장 상황 : A) 시장 개척 상황,(B) 분자 유형,(C) 작용 메커니즘,(D) 작용제 유형,(E) 투여 경로,(F) 투여 빈도,(G) 치료 유형 등 몇 가지 관련 매개 변수를 기반으로 항비만제 시장에 참여하는 기업을 자세히 평가합니다.

- 경쟁 분석 : 항비만제 관련 종합적인 경쟁 분석을 통해(A) 기업 역량,(B) 파이프라인 포트폴리오 등의 요인을 검증합니다.

- 기업 프로파일:(A) 기업 개요,(B) 재무 정보(가능한 경우),(C) 파이프라인 포트폴리오,(D) 최근 동향 및 미래 전망에 초점을 맞춘 항비만제 시장에 종사하는 주요 서비스 제공업체의 상세한 프로파일.

- 주요 제약사의 노력 주요 제약사가 시행한 다양한 비만 퇴치 이니셔티브를 검토하고,(A) 이니셔티브 수,(B) 이니셔티브 연도,(C) 이니셔티브 유형,(D) 파트너십 유형,(D) 확장 유형 등 다양한 매개변수에서 추세를 파악합니다.

목차

제1장 배경

제2장 조사 방법

제3장 시장 역학

- 본 장의 개요

- 예측 조사 방법

- 시장 평가 프레임워크

- 예측 툴과 테크닉

- 중요 고려사항

- 주요 시장 부문

- 견고품질관리

- 제한 사항

제4장 경제적 및 기타 프로젝트 특유의 고려사항

- 본 장의 개요

- 시장 역학

제5장 주요 요약

제6장 서론

- 항비만제 개요

- 장기 비만에 관련된 건강 리스크

- 현재 승인된 항비만제 유형

- 항비만제에 수반하는 과제

- 향후 전망

제7장 시장 구도 : 항비만제

- 시장 구도 : 항비만제

- 개발자 상황 : 항비만제

제8장 기업 개요 : 북미를 거점으로 하는 항비만제 개발 기업

- 본 장의 개요

- 상세한 기업 개요

- Eli Lilly

- Pfizer

- Regeneron

- 간결한 기업 개요

- CinFina Pharma

- Kallyope

- Viking Therapeutics

제9장 기업 개요 : 유럽을 거점으로 하는 항비만제 개발 기업

- 본 장의 개요

- 상세한 기업 개요

- AstraZeneca

- Novo Nordisk

- Roche

- 간결한 기업 개요

- Adocia

- Boehringer Ingelheim

- Zealand Pharma

제10장 기업 개요 : 아시아태평양 및 기타 지역을 거점으로 하는 항비만제 개발 기업

- 본 장의 개요

- 상세한 기업 개요

- Hanmi Pharmaceuticals

- Jiangsu Hengrui Pharmaceuticals

- 간결한 기업 개요

- Gmax Biopharma

- PegBio

- QL Biopharm

- Sciwind Biosciences

제11장 대형 제약회사의 이니셔티브

- 조사 방법

- 대형 제약회사 : 비만 대책에 중점을 둔 이니셔티브

제12장 시장 영향 분석 : 성장 촉진요인 및 억제요인, 기회, 과제

제13장 세계의 항비만제 시장

- 예측 조사 방법과 주요 전제조건

- 세계의 항비만제 시장, 과거 동향(2019년 이후) 및 예측 추정(2035년까지)

- 주요 시장 세분화

제14장 항비만제 시장(분자 유형별)

제15장 항비만제 시장(사용 활성 화합물별)

제16장 항비만제 시장(작용기전별)

제17장 항비만제 시장(작용제별)

제18장 항비만제 시장(작용 경로별)

제19장 항비만제 시장(투여 경로별)

제20장 항비만제 시장(지역별)

제21장 항비만제 시장, 시판약 및 제3상 임상시험약 판매 예측

- 시판약 : 판매 예측

- Contrave / Mysimba (Naltrexone, Bupropion)

- Feisumei (Beinaglutide)

- Imcivree (Setmelanotide)

- LOMAIRA (Phentermine Hydrochloride)

- QSYMIA (Phentermine and Topiramate)

- Saxenda (Liraglutide)

- Wegovy / Ozempic (Semaglutide)

- Zepbound / Mounjaro (Tirzepatide)

- 제III상의약품 : 판매 예측

- BI 456906 (Survodutide)

- CagriSema (Cagrilintide and Semaglutide)

- HM11260C (Efpeglenatide)

- HRS-9531

- IBI362 (Mazdutide)

- LM-008

- LY3437943 (Retatrutide)

- LY3502970 (Orforglipron)

- TG103

- Semaglutide 7.2 mg (Subcutaneous)

- Semaglutide (Oral)

- XW003

제22장 항비만제 시장(주요 기업별)

제23장 부록 1 : 표 형식 데이터

제24장 부록 2 : 기업 및 단체 리스트

LSH 25.09.30Anti-Obesity Drugs Market: Overview

As per Roots Analysis, the global anti-obesity drugs market is estimated to grow from USD 19.6 billion in the current year and USD 104.9 billion by 2035, representing a CAGR of 18.3% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Molecule

- Biologics

- Small Molecules

Active Compound Used

- Tirzepatide

- Semaglutide

- Retatrutide

- Survodutide

- Cagrilintide and Semaglutide

- Orforglipron

- Liraglutide

- Other Active Compounds

Mechanism of Action

- GLP-1 Agonist / GIP Agonist

- GLP-1 Agonist / GCGR Agonist

- GLP-1 Agonist

- GLP-1 Agonist / Amylin Analogue

- GLP-1 / GCGR / GIP Agonist

- Other Mechanisms of Action

Type of Agonist

- Single-Agonist

- Dual-Agonist

- Tri-Agonist

Action Pathway

- Centrally Acting

- Peripherally Acting

- Centrally Acting and Peripherally Acting

Route of Administration

- Oral

- Parenteral

Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

Sales Forecast of Drugs

- Contrave / Mysimba

- Feisumei

- Imcivree

- LOMAIRA

- QSYMIA

- Saxenda

- Wegovy / Ozempic

- Zepbound / Mounjaro

- BI 456906

- CagriSema

- HM11260C

- HRS-9531

- IBI362

- LM-008

- LY3437943

- LY3502970

- TG103

- Semaglutide 7.2 mg (Subcutaneous)

- Semaglutide (Oral)

- XW003

Anti-Obesity drugs Market: Growth and Trends

The urgent need to address obesity epidemic globally has resulted in the boost of the anti-obesity drugs market. Factors such as increasing obesity prevalence, rising disposable incomes, and greater access to healthcare services are propelling this trend. The recent years have witnessed a rise in the approval of anti-obesity drugs, thereby expanding treatment options for patients. This is a result of the alarming statistics of approximately 40% of adults in the U.S. being classified as obese, with a body mass index (BMI) of 30 or higher.

The anti-obesity drugs target weight loss by regulating appetite, fat absorption, and metabolic processes. These drugs include various therapeutic options designed to assist individuals in managing obesity and related conditions. As global obesity rates increase and the awareness of associated health risks, including diabetes, cardiovascular diseases, and certain cancers rise, the need for effective anti-obesity medications has escalated. It is worth mentioning that, in the recent years, many new anti-obesity drugs have gained regulatory approval, expanding options for patients and offering alternatives to surgical procedures for weight loss.

Anti-obesity medications are vital in enhancing weight loss results, especially for patients with severe obesity-related health issues. Further, these drugs contribute to improved quality of life and can lower healthcare expenses by preventing complications related to obesity. Innovations in drug formulation and delivery systems, along with the integration of novel compounds, have resulted in the development of safer and more effective anti-obesity medications. The growing emphasis on personalized medicine and pharmacogenomics further enhances the potential for tailored treatments that address individual patient needs. Additionally, the rise in telehealth services and digital therapeutics applications is facilitating better patient engagement and adherence to treatment plans.

Public and private sectors are actively providing investments in order to conduct research and development in the anti-obesity space, along with fostering innovation and developing cutting-edge therapies. As the focus on obesity as a chronic disease that needs long-term management increases, the anti-obesity drugs market is poised for substantial growth, presenting significant opportunities for stakeholders in the coming years.

Anti-Obesity Drugs Market: Key Insights

The report delves into the current state of the anti-obesity drugs market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Currently, close to 225 drugs are marketed / being developed for the management of obesity; around 50% of these can be administered through the oral route.

- Around 55% of the anti-obesity drugs are presently in their clinical stage of development; of these, majority of these drugs are being evaluated as monotherapy.

- A sizeable proportion (70%) of big pharma players have entered into various partnerships in order to expand their anti-obesity drug portfolios; majority of these partnerships (~30%) were research and development agreements.

- The growing awareness among patients about the health risks associated with obesity coupled with its increasing prevalence, is driving the anti-obesity market and positioning it for steady growth in the foreseeable future.

- The anti-obesity drugs market is anticipated to grow at an annualized rate (CAGR) of 21.1%, till 2035; North America is expected to capture the majority share (~60%) of the market by 2035.

- Currently, the centrally acting anti-obesity drugs dominate the market; notably, parenteral route of administration is expected to capture the majority share (~85%) in the market by 2035.

Anti-Obesity Drugs Market: Key Segments

Small Molecules is the Fastest Growing Segment of the Anti-obesity Drugs Market

In terms of type of molecule, the anti-obesity drugs market is segmented into different type of molecules, such as biologics and small molecules. Majority (54%) of the market share is captured small molecules owing to their proven efficacy, ease of administration, lower production costs, accessibility and established safe drug profiles. However, the landscape is expected to change as biologics emerge as a promising and more effective alternative for the underlying biological pathways associated with obesity.

Semaglutide is Likely to Hold the Largest Share of the Anti-obesity Drugs Market During the Forecast Period

In terms of type of molecule, the anti-obesity drugs market is segmented into various active compounds used, such as semaglutide, retatrutide, survodutide, cagrilintide, orforglipron, liraglutide and other active compounds. Owing to its strong efficacy in weight management and diabetes control, majority of the anti-obesity drugs market is currently captured by semaglutide. However, as research progresses, tirzepatide is gaining attention for its dual action as both a GLP-1 and GIP receptor agonist, demonstrating superior weight loss results in clinical trials. This innovative approach targets various metabolic pathways, offering a more comprehensive treatment for obesity. With its potential for greater efficacy and improved patient outcomes, tirzepatide is expected to rise in prominence, ultimately securing the largest market share in the years to come.

Anti-Obesity Drugs Market for GLP-1 Agonist is Likely to grow at a Relatively Faster Pace During the Forecast Period

In terms of mechanism of action, the anti-obesity drugs / weight loss drugs market is segmented into GLP-1 agonist / GIP agonist, GLP-1 agonist / GCGR agonist, GLP-1 agonist, GLP-1 agonist / amylin analogue, GLP-1 / GCGR / GIP agonist and other mechanisms of action. The current market is dominated by GLP-1 market segment. This is attributed to their well-established mechanism of action, which improve glycemic control, thereby promoting significant weight loss. Their ability to enhance satiety and reduce appetite is the foundation in obesity treatment. However, dual GLP-1 and GIP agonists are anticipated to grow at a comparatively higher CAGR because of their ability to target multiple metabolic pathways. Clinical studies suggest that dual agonists can yield greater weight loss and improved metabolic profiles compared to GLP-1 agonists alone.

Anti-Obesity Drugs Market for Single Agonist is Likely to Grow at a Higher CAGR During the Forecast Period

The market is segmented into different types of agonists, including single-agonist, dual-agonist and tri-agonist. Owing to the ease of use in order to facilitate patient adherence, the single agonist segment currently captures the maximum anti-obesity drugs market share (68%). These medications have a long-standing history of clinical success, which enables healthcare providers to confidently prescribe them based on extensive data. Following it, the dual agonist segment will capture a prominent market share, driven by its capability to address the complexities of obesity by targeting multiple physiological mechanisms simultaneously. This allows for more tailored treatments that can adapt to individual patient needs and conditions. Dual agonists are set to become more popular as healthcare shifts toward personalized medicine, thus resulting in greater investments in their development.

Anti-Obesity Drugs Catering to Centrally Acting Pathways is Likely to Dominate the Anti-Obesity Drugs Market During the Forecast Period

The market caters to a variety of action pathways, including centrally acting, peripherally acting and centrally and peripherally acting pathways. Centrally acting segment currently captures the highest anti-obesity drugs market share (86%) and is expected to dominate the market during the forecast period. This is a result of its effectiveness in modulating appetite and energy expenditure through direct interactions with the central nervous system. Additionally, centrally acting agents have a well-established safety profile, which further solidifies their position in clinical practice. Further, the reliance on centrally acting pathways is likely to remain strong, as they provide a comprehensive approach to managing weight. Despite ongoing research into alternative pathways, robust clinical evidence supporting the efficacy of centrally acting agents ensures their continued dominance in the market. Consequently, while new treatments may emerge, the trend towards centrally acting pathways is expected to persist, reflecting their fundamental role in obesity management.

Currently, Parenteral Route Hold the Largest Share of the Anti-Obesity Drugs Market

In terms of route of administration, the anti-obesity drugs market is segmented across oral and parenteral routes. Our research suggests that parenteral route captures the majority share (98%) in the market owing to its rapid onset of action and higher bioavailability compared to oral formulations. Parenteral delivery ensures the medications to bypass the gastrointestinal tract, reducing variability in absorption and enhancing therapeutic effectiveness. It is advantageous for agents that require precise dosing and consistent plasma levels to achieve optimal weight loss outcomes. Moreover, the growing preference for injectable formulations reinforces the trend toward parenteral administration. Consequently, although oral options remain available, the dominance of parenteral administration in the anti-obesity landscape is likely to persist well into the future as well.

North America Accounts for the Largest Share of the Market

The global market value is segmented across various geographies, including North America, Europe, Asia-Pacific, and Latin America. According to our projections, North America region accounts for the major anti-obesity drugs market share (70%), which is likely to remain the same during the forecast period. This is complemented by the availability of advanced healthcare infrastructure, significant investment in pharmaceutical research, and robust regulatory frameworks in this region that facilitate the development and approval of new therapies. It is worth highlighting that the market for anti-obesity drugs in Asia-Pacific is expected to grow at a relatively higher CAGR (~40%), till 2035.

Example Players in the Antibody Contract Manufacturing Market

- Boehringer Ingelheim

- Eli Lilly

- Novo Nordisk

- Other Drug Developers

- Eli Lilly

- Pfizer

- Regeneron

- Kallyope

- CinFina Pharma

- Viking Therapeutics

- AstraZeneca

- Novo Nordisk

- Roche

- Adocia

- Boehringer Ingelheim

- Zealand Pharma

- Hanmi Pharm

- Jiangsu Hengrui Pharmaceuticals

- Gmax Biopharma

- PegBio

- QL Biopharm

- Sciwind Biosciences

Anti-Obesity Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features a thorough analysis of the global anti-obesity drugs market, in terms of the key market segments, including [A] type of molecule [B] active compound used [C] mechanism of action [D] type of agonist [E] action pathway [F] route of administration and [G] geographical regions.

- Market Landscape: An in-depth assessment of the companies involved in anti-obesity market, based on several relevant parameters, such as including [A] status of development, [B] type of molecule, [C] mechanism of action [D] type of agonist [E] route of administration [F] dosage frequency and [G] type of therapy.

- Company Competitiveness Analysis: A comprehensive competitive analysis of ant-obesity drugs, examining factors, such as [A] company strength and [B] pipeline portfolio.

- Company Profiles: Detailed profiles of key service providers engaged in the anti-obesity drugs market, focused on [A] overview of the company, [B] financial information (if available), [C] pipeline portfolio, and [D] recent developments and an informed future outlook.

- Big Pharma Initiatives A review of the various anti-obesity initiatives undertaken by big pharma players, highlighting trends across various parameters [A] number of initiatives, [B] year of initiative, [C] type of initiative, [D] type of partnership and [D] type of expansion.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Factors

- 2.6.1. Demographics

- 2.6.2. Economic Factors

- 2.6.3. Competitive Landscape

- 2.6.4. Government Regulations and Healthcare Policies

- 2.6.5. R&D Investment

- 2.6.6. Technological Factors

- 2.6.7. Industry Consolidation

- 2.6.8. Supply Chain

- 2.6.9. Market Access

- 2.6.10. COVID Impact / Related Factors

- 2.6.11. Market Access

- 2.6.12. COVID Impact / Related Factors

- 2.6.13. Patient Advocacy and Influence

- 2.6.14. Healthcare Infrastructure

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-Down Approach

- 3.2.2. Botton-Up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Key Market Segments

- 3.7. Robust Quality Control

- 3.8. Limitations

4. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Overview of Anti-Obesity Drugs

- 6.2. Health Risks Linked with Long-term Obesity

- 6.3. Currently Approved Anti-Obesity Drug Classes

- 6.4. Challenges Associated with Anti-Obesity Drugs

- 6.5. Future Perspectives

7. MARKET LANDSCAPE: ANTI-OBESITY DRUGS

- 7.1. Market Landscape: Anti-Obesity Drugs

- 7.1.1. Analysis by Status of Development

- 7.1.2. Analysis by Type of Molecule

- 7.1.3. Analysis by Mechanism of Action

- 7.1.4. Analysis by Type of Agonist

- 7.1.5. Analysis by Route of Administration

- 7.1.6. Analysis by Dosage Frequency

- 7.1.7. Analysis by Type of Therapy

- 7.2. Developer Landscape: Anti-Obesity Drugs

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Headquarters (Country) and Status of Development

- 7.2.5. Most Active Developers: Analysis by Number of Drug Candidates

8. COMPANY PROFILES: ANTI-OBESITY DRUG DEVELOPERS BASED IN NORTH AMERICA

- 8.1. Chapter Overview

- 8.2. Detailed Company Profiles

- 8.2.1. Eli Lilly

- 8.2.1.1. Company Details

- 8.2.1.2. Pipeline Portfolio

- 8.2.1.3. Financial Details

- 8.2.1.4. Recent Developments and Future Outlook

- 8.2.2. Pfizer

- 8.2.3. Regeneron

- 8.2.1. Eli Lilly

- 8.3. Brief Company Profiles

- 8.3.1. CinFina Pharma

- 8.3.1.1. Company Details

- 8.3.1.2. Pipeline Portfolio

- 8.3.2. Kallyope

- 8.3.3. Viking Therapeutics

- 8.3.1. CinFina Pharma

9. COMPANY PROFILES: ANTI-OBESITY DRUG DEVELOPERS BASED IN EUROPE

- 9.1. Chapter Overview

- 9.2. Detailed Company Profiles

- 9.2.1. AstraZeneca

- 9.2.1.1. Company Details

- 9.2.1.2. Pipeline Portfolio

- 9.2.1.3. Financial Details

- 9.2.1.4. Recent Developments and Future Outlook

- 9.2.2. Novo Nordisk

- 9.2.3. Roche

- 9.2.1. AstraZeneca

- 9.3. Brief Company Profiles

- 9.3.1. Adocia

- 9.3.1.1. Company Details

- 9.3.1.2. Pipeline Portfolio

- 9.3.2. Boehringer Ingelheim

- 9.3.3. Zealand Pharma

- 9.3.1. Adocia

10. COMPANY PROFILES: ANTI-OBESITY DRUG DEVELOPERS BASED IN ASIA-PACIFIC AND REST OF THE WORLD

- 10.1. Chapter Overview

- 10.2. Detailed Company Profiles

- 10.2.1. Hanmi Pharmaceuticals

- 10.2.1.1. Company Details

- 10.2.1.2. Pipeline Portfolio

- 10.2.1.3. Financial Details

- 10.2.1.4. Recent Developments and Future Outlook

- 10.2.2. Jiangsu Hengrui Pharmaceuticals

- 10.2.1. Hanmi Pharmaceuticals

- 10.3. Brief Company Profiles

- 10.3.1. Gmax Biopharma

- 10.3.1.1. Company Details

- 10.3.1.2. Pipeline Portfolio

- 10.3.2. PegBio

- 10.3.3. QL Biopharm

- 10.3.4. Sciwind Biosciences

- 10.3.1. Gmax Biopharma

11. BIG PHARMA INITIATIVES

- 11.1. Methodology

- 11.2. Big Pharma Players: Anti-obesity focused Initiatives

- 11.2.1. Analysis of Big Pharma Players by Number of Initiatives

- 11.2.2. Analysis by Year of Initiative

- 11.2.3. Analysis by Big Pharma Player by Year of Initiative and Number of Initiatives

- 11.2.4. Analysis by Type of Initiative

- 11.2.5. Analysis by Year and Type of Initiative

- 11.2.6. Analysis by Big Pharma Player and Type of Initiative

- 11.2.7. Analysis by Big Pharma Player and Number of Partnerships

- 11.2.8. Analysis by Type of Partnership

- 11.2.9. Analysis by Type of Expansion

- 11.2.10. Analysis by Big Pharma Player by Region and Number of Initiatives

- 11.2.11. Benchmarking of Big Pharma Players

12. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 12.1. Chapter Overview

- 12.2. Market Drivers

- 12.3. Market Restraints

- 12.4. Market Opportunities

- 12.5. Market Challenges

13. GLOBAL ANTI-OBESITY DRUGS MARKET

- 13.1. Forecast Methodology and Key Assumptions

- 13.2. Global Anti-Obesity Drugs Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- 13.2.1. Scenario Analysis

- 13.2.1.1. Conservative Scenario

- 13.2.1.2. Optimistic Scenario

- 13.2.1. Scenario Analysis

- 13.3. Key Market Segmentations

14. ANTI-OBESITY DRUGS MARKET, BY TYPE OF MOLECULE

- 14.1. Anti-Obesity Drugs Market: Distribution by Type of Molecule

- 14.1.1. Anti-Obesity Drugs Market for Biologics, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.1.2. Anti-Obesity Drugs Market for Small Molecules, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

15. ANTI-OBESITY DRUGS MARKET, BY ACTIVE COMPOUND USED

- 15.1. Anti-Obesity Drugs Market: Distribution by Active Compound Used

- 15.1.1. Anti-Obesity Drugs Market for Tirzepatide, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.1.2. Anti-Obesity Drugs Market for Semaglutide, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.1.3. Anti-Obesity Drugs Market for Retatrutide, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.1.4. Anti-Obesity Drugs Market for Survodutide, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.1.5. Anti-Obesity Drugs Market for Cagrilintide and Semglutide, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.1.6. Anti-Obesity Drugs Market for Orforglipron, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.1.7. Anti-Obesity Drugs Market for Liraglutide, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.1.8. Anti-Obesity Drugs Market for other active compounds used, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

16. ANTI-OBESITY DRUGS MARKET, BY MECHANISM OF ACTION

- 16.1. Anti-Obesity Drugs Market: Distribution by Mechanism of Action

- 16.1.1. Anti-Obesity Drugs Market for GLP-1 Agonist / GIP Agonist, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.1.2. Anti-Obesity Drugs Market for GLP-1 Agonist, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.1.3. Anti-Obesity Drugs Market for GLP-1 Agonist / GCGR Agonist, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.1.4. Anti-Obesity Drugs Market for GLP-1 / GCGR / GIP Agonist, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.1.5. Anti-Obesity Drugs Market for GLP-1 Agonist / Amylin Analogue, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.1.6. Anti-Obesity Drugs Market for Other Mechanisms of Action, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

17. ANTI-OBESITY DRUGS MARKET, BY TYPE OF AGONIST

- 17.1. Anti-Obesity Drugs Market: Distribution by Type of Agonist

- 17.1.1. Anti-Obesity Drugs Market for Single-Agonist, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.1.2. Anti-Obesity Drugs Market for Dual-Agonist, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.1.3. Anti-Obesity Drugs Market for Tri-Agonist, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

18. ANTI-OBESITY DRUGS MARKET, BY ACTION PATHWAY

- 18.1. Anti-Obesity Drugs Market: Distribution by Action Pathway

- 18.1.1. Anti-Obesity Drugs Market for Centrally Acting Drugs, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 18.1.2. Anti-Obesity Drugs Market for Peripherally Acting Drugs, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 18.1.3. Anti-Obesity Drugs Market for Centrally Acting and Peripherally Acting Drugs, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

19. ANTI-OBESITY DRUGS MARKET, BY ROUTE OF ADMINISTRATION

- 19.1. Anti-Obesity Drugs Market: Distribution by Route of Administration

- 19.1.1. Anti-Obesity Drugs Market for Oral Administration, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 19.1.2. Anti-Obesity Drugs Market for Parenteral Administration, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

20. ANTI-OBESITY DRUGS MARKET, BY GEOGRAPHICAL REGIONS

- 20.1. Anti-Obesity Drugs Market: Distribution by Geographical Regions

- 20.1.1. Anti-Obesity Drugs Market in North America, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.1.2. Anti-Obesity Drugs Market in Europe, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.1.3. Anti-Obesity Drugs Market in Asia-Pacific, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.1.4. Anti-Obesity Drugs Market in Latin America, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

21. ANTI-OBESITY DRUGS MARKET, SALES FORECAST OF MARKETED AND PHASE III DRUGS

- 21.1. Marketed Drugs: Sales Forecast

- 21.1.1. Contrave / Mysimba (Naltrexone, Bupropion)

- 21.1.2. Feisumei (Beinaglutide)

- 21.1.3. Imcivree (Setmelanotide)

- 21.1.4. LOMAIRA (Phentermine Hydrochloride)

- 21.1.5. QSYMIA (Phentermine and Topiramate)

- 21.1.6. Saxenda (Liraglutide)

- 21.1.7. Wegovy / Ozempic (Semaglutide)

- 21.1.8. Zepbound / Mounjaro (Tirzepatide)

- 21.2. Phase III Drugs: Sales Forecast

- 21.2.1. BI 456906 (Survodutide)

- 21.2.2. CagriSema (Cagrilintide and Semaglutide)

- 21.2.3. HM11260C (Efpeglenatide)

- 21.2.4. HRS-9531

- 21.2.5. IBI362 (Mazdutide)

- 21.2.6. LM-008

- 21.2.7. LY3437943 (Retatrutide)

- 21.2.8. LY3502970 (Orforglipron)

- 21.2.9. TG103

- 21.2.10. Semaglutide 7.2 mg (Subcutaneous)

- 21.2.11. Semaglutide (Oral)

- 21.2.12. XW003

22. ANTI-OBESITY DRUGS MARKET, BY KEY PLAYERS

- 22.1. Anti-Obesity Drugs Market: Distribution of Key Players