|

시장보고서

상품코드

1849802

차세대 시퀀싱 시장 : 업계 동향과 세계 예측(-2035년) - 컴포넌트 유형별, NGS 기술 유형별, 사용 기술별, 용도별, 대상 치료 영역별, 목적별, 최종사용자별, 지역별Next Generation Sequencing Market: Industry Trends and Global Forecasts, Till 2035: Distribution by Type of Component, Type of NGS Technique, Technology Used, Application Area, Target Therapeutic Area, Purpose, End Users and Geographical Regions |

||||||

차세대 시퀀싱 시장 규모는 현재 86억 달러에서 성장하며, 2040년까지 465억 달러에 달할 것으로 예측되며, 예측 기간 중 CAGR은 18.4%로 높습니다.

차세대 시퀀싱 시장의 기회는 다음과 같은 부문에 분포되어 있습니다.

NGS 기술 유형

- 타겟 시퀀싱

- 전장유전체 시퀀싱/전장엑솜 시퀀싱

- RNA 시퀀싱

- 기타

사용 기술 유형

- 합성 기술별 시퀀싱

- 이온 반도체 기술

- 나노포어 시퀀싱 기술

- 기타 기술

용도

- 임상 적용

- 연구 및 응용

대상 치료 영역

- 종양학 질환

- 유전자 질환

- 생식 질환

- 기타

치료 목적

- 진단

- 리스크 평가

- 무증상 평가

- 스크리닝

- 기타

최종사용자

- 학술-연구기관

- 병원 및 클리닉

- 제약-바이오 기업

- 기타 최종사용자

지역

- 북미

- 유럽

- 아시아태평양

- 중동 및 북아프리카

- 라틴아메리카

북미 시장

- 미국

- 캐나다

유럽 시장

- 독일

- 영국

- 프랑스

- 이탈리아

- 영국

- 스페인

아시아태평양 시장

- 중국

- 한국

- 인도

- 호주

- 기타

중동 및 북아프리카 시장

- 사우디아라비아

- 아랍에미리트

- 기타

라틴아메리카 시장

- 브라질

- 아르헨티나

- 기타

차세대 시퀀싱 시장 성장과 동향

차세대 염기서열 분석은 광범위한 질병과 관련된 유전적 변이를 이해하기 위해 전체 유전체의 염기서열을 결정합니다. 전체 유전체의 염기서열을 동시에 결정할 수 있게 되면서 연구와 질병 분자진단에 대한 폭넓은 가능성이 열렸습니다.

만성질환의 유병률은 해마다 눈에 띄게 증가하고 있으며, 심각한 우려를 낳고 있습니다. 의 보고서에 따르면 미국인 10명 중 6명 가까이가 적어도 한 가지 이상의 만성질환을 앓고 있으며, 이는 만성질환의 위험성이 증가하고 있음을 보여줍니다. 이러한 우려를 해소하기 위해 연구자들은 차세대 염기서열분석을 활용하고, 메타유전체 연구를 통해 질병을 분자 수준에서 분석했습니다. 차세대 염기서열 분석은 질병 진단 외에도 표적 치료제의 설계, 식별 및 개발에 도움이 됩니다.

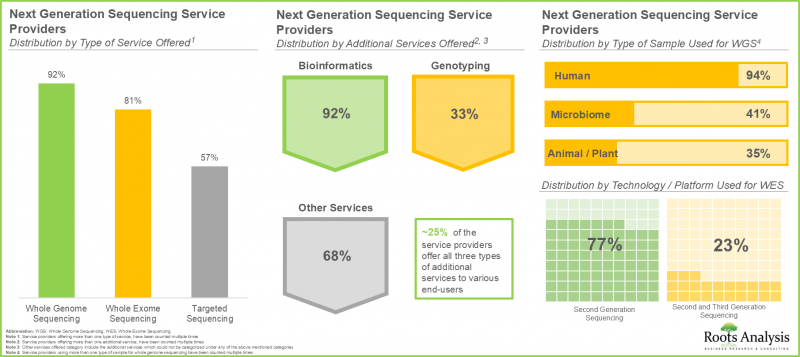

현재 차세대 시퀀싱 플랫폼의 도입은 제한적입니다. 그 이유는 높은 도입 비용, 숙련된 인력이 필요하고, NGS 워크플로우를 수행하기 위한 내부 인프라가 충분하지 않기 때문입니다. 이러한 문제를 해결하기 위해 다양한 업계 기업(Illumina, PacBio 등)이 차세대 시퀀싱 서비스를 제공합니다.

NGS 솔루션 아웃소싱은 경제적이며, 분석 기간을 단축하고, 시퀀싱 데이터 생성의 정확성을 보장합니다. 이러한 차세대 시퀀싱 아웃소싱의 장점은 현재 여러 국가 게놈 매핑과 관련된 여러 구상에 참여하고 있는 다양한 정부 기관 및 업계 리더의 관심을 끌고 있습니다. 또한 차세대 기술은 임상시험에서 큰 효과를 발휘하여 임상시험에 대한 자원 봉사자 참여를 증가시키고, 연구자들이 평가된 의약품과 기술에 대해 보다 현명한 결정을 내릴 수 있도록 돕고 있습니다.

이 분야의 지속적인 연구와 기술 혁신은 이러한 시퀀싱 기술의 채택을 크게 증가시켜 차세대 시퀀싱 시장의 성장을 가속할 것으로 예측됩니다.

차세대 시퀀싱 시장 주요 인사이트

이 보고서는 차세대 시퀀싱 시장의 현황을 살펴보고, 업계내 잠재적인 성장 기회를 확인합니다. 이 보고서의 주요 요점은 다음과 같습니다.

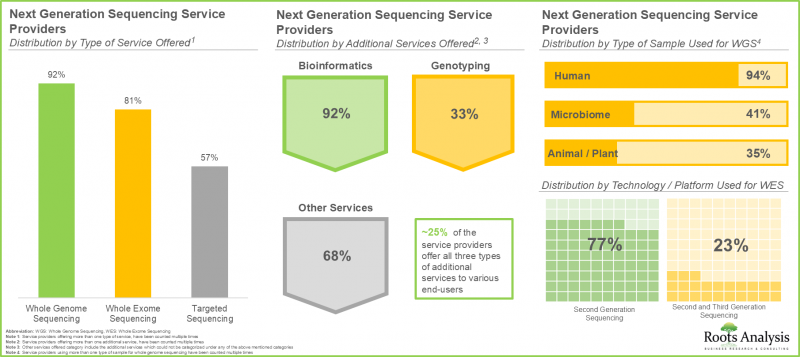

- 차세대 염기서열 분석 서비스 프로바이더의 45% 이상이 소규모 기업이며, 이는 시장내 신규 시장 진출기업 증가를 의미합니다.

- -차세대 염기서열 분석 서비스 프로바이더의 95%가 전체 유전체 염기서열 분석 서비스를 제공하고 있으며, 그 중 약 85%의 서비스 프로바이더가 바이오인포매틱스 추가 서비스를 제공합니다.

- 차세대 시퀀싱 기술을 제공하는 기업의 약 40%는 중견기업이며, 그 중 75%는 북미에 기반을 두고 있습니다.

- NGS 기술에 대한 수요가 증가함에 따라 그 용도가 눈에 띄게 증가하고 있으며, 현재 약 25개의 기술이 전체 유전체 시퀀싱과 타겟 시퀀싱 모두에 사용되고 있습니다.

- 2020년 이후 전 세계에서 차세대 기술/플랫폼 연구개발에 초점을 맞춘 특허가 3,060건 이상 출원/취득되었습니다.

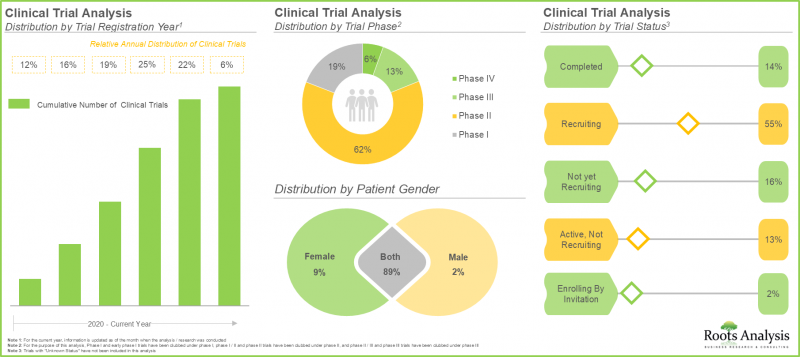

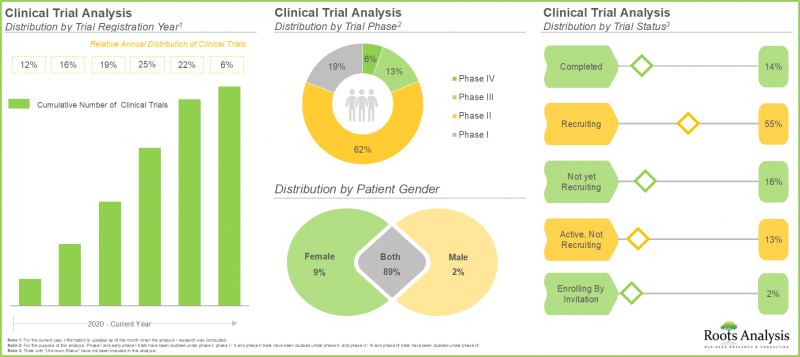

- 최근 수년간 이 분야의 임상시험 등록 건수가 크게 증가했으며, 차세대 염기서열 분석에 초점을 맞춘 임상시험의 60% 이상이 현재 임상 2상 단계에 있습니다.

- 차세대 염기서열 분석 분야에 대한 대형 제약사들의 관심은 최근 설립된 다양한 구상에 반영되어 있습니다.

- 차세대 시퀀싱 시장은 2035년까지 연평균 복합 성장률(CAGR) 18.4%를 보일 것으로 예측되며, 북미가 시장 점유율의 대부분을 차지하고 유럽이 그 뒤를 이을 것으로 보입니다.

- 시장 기회는 컴포넌트 유형, NGS 기술 유형, 사용 기술, 용도, 적용 분야, 대상 치료 영역, 목적, 최종사용자 등 다양한 부문으로 잘 분산될 것으로 예측됩니다.

차세대 시퀀싱 시장 주요 부문

소모품 부문이 차세대 시퀀싱 시장의 대부분을 차지합니다.

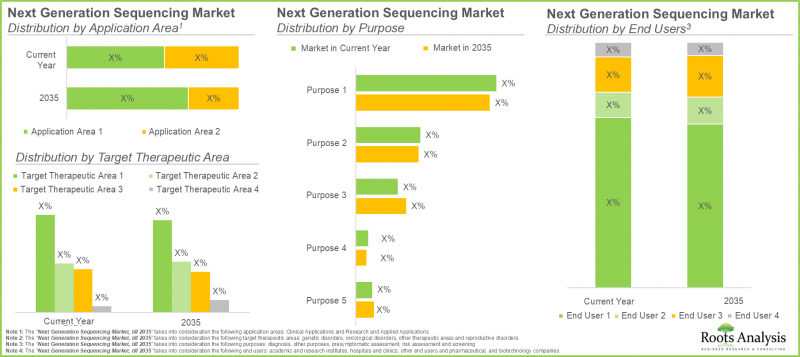

컴포넌트 유형으로 볼 때, 차세대 시퀀싱 시장은 소모품 및 서비스, 장비로 구분됩니다. 올해에는 소모품 부문이 전체 시장의 대부분(67%)을 차지하고 있으며, 이러한 추세는 앞으로도 지속될 것으로 보인다(CAGR 18.7%).

타겟 시퀀싱 부문이 차세대 시퀀싱 시장에서 가장 큰 점유율을 차지하고 있습니다.

이 보고서에서는 NGS 기술 유형별로 시장 규모를 타겟 시퀀싱, 전유전체 시퀀싱/전체 엑솜 시퀀싱, RNA 시퀀싱, 기타 기술 등으로 구분하여 분석했습니다. 현재 타겟 시퀀싱 분야는 전체 시장에서 가장 큰 점유율(45%)을 차지하고 있습니다. 그러나 전체 유전체 시퀀싱/엑솜 시퀀싱 분야는 2035년까지의 예측 기간 중 비교적 높은 CAGR(19.5%)로 성장할 것으로 예측됩니다.

나노포어 시퀀싱 기술 부문은 더 높은 CAGR로 성장할 것으로 예측됩니다.

이 보고서에서는 사용 기술별로 시장을 합성기술에 의한 시퀀싱, 이온 반도체 기술, 나노포어 시퀀싱 기술, 기타 기술로 구분하고 있습니다. 현재 합성 기술을 통한 시퀀싱 부문이 차세대 시퀀싱 시장에서 가장 큰 점유율(82%)을 차지하고 있으며, 이러한 추세는 앞으로도 변하지 않을 것으로 보입니다. 그러나 나노포어 시퀀싱 기술 부문은 2035년까지의 예측 기간 중 비교적 높은 CAGR(20.5%)로 성장할 것으로 예측됩니다.

임상 용도가 차세대 시퀀싱 시장을 주도하고 있습니다.

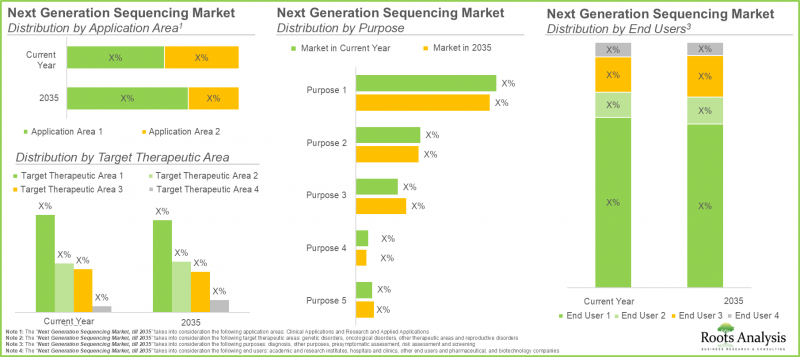

차세대 시퀀싱 시장 규모는 임상, 연구 및 응용 등 용도에 따라 다양한 하위 부문으로 나뉩니다. 현재 전체 시장에서 임상 용도가 가장 큰 점유율(57%)을 차지하고 있습니다. 이 부문은 2035년까지의 예측 기간 중 비교적 높은 CAGR(21.1%)로 성장할 것으로 예측됩니다.

종양성 질환이 가장 높은 시장 점유율을 차지했습니다.

이 부문은 종양 질환, 유전성 질환, 생식계 질환, 기타 치료 분야 등 다양한 치료 분야에 걸친 시장 분포를 보여줍니다. 현재 암 질환이 차세대 시퀀싱 시장에서 가장 높은 점유율(50%)을 차지하고 있으며, 이러한 추세는 앞으로도 변하지 않을 것으로 보입니다. 이는 분자 수준에서 암을 조기에 진단하고 예방하기 위한 차세대 염기서열 분석 기술에 대한 선호도가 높아졌기 때문으로 풀이됩니다. 그러나 기타 치료 영역 부문은 2035년까지의 예측 기간 중 비교적 높은 CAGR(26.6%)로 성장할 것으로 예측됩니다.

진단 분야가 가장 높은 시장 점유율을 차지

차세대 시퀀싱 시장은 진단, 위험 평가, 예후 평가, 스크리닝, 기타 목적 등 목적에 따라 다양한 하위 부문으로 나뉩니다. 현재 전체 시장에서는 진단 부문(58%)이 시장을 주도하고 있으며, 이러한 추세는 앞으로도 변함없이 유지될 것으로 보입니다. 그러나 기타 목적 부문은 2035년까지의 예측 기간 중 비교적 높은 CAGR(20.1%)로 성장할 것으로 예측됩니다.

학계 및 연구기관이 시장 점유율의 대부분을 차지합니다.

세계 시장은 학계 및 연구기관, 병원 및 클리닉, 제약 및 생명공학 기업, 기타 최종사용자 등 다양한 최종사용자로 분류됩니다. 현재 차세대 시퀀싱 시장의 최대 점유율(45%)을 차지하고 있는 곳은 학계 및 연구기관이며, 이러한 추세는 앞으로도 변함없이 유지될 것으로 보입니다. 그러나 병원 및 클리닉 부문은 2035년까지의 예측 기간 중 상대적으로 높은 CAGR(21.7%)로 성장할 것으로 예측됩니다.

북미가 차세대 시퀀싱 시장을 주도할 것입니다.

차세대 시퀀싱 시장은 북미, 유럽 및 아시아태평양, 중동 및 북아프리카, 라틴아메리카 등 다양한 지역에 분포되어 있지만, 현재 시장 점유율의 대부분(51%)을 북미가 차지하고 있으며, 이러한 추세는 앞으로도 변하지 않을 것으로 보입니다.

차세대 시퀀싱 시장 진출기업 사례

- Illumina

- MGI Tech

- Oxford Nanopore Technologies

- Pacific Biosciences

- Thermo Fisher Scientific

차세대 시퀀싱 시장 조사 대상

차세대 시퀀싱 시장에 대한 조사 보고서는 다음과 같은 다양한 섹션에 대한 인사이트를 제공합니다.

- 시장 규모 및 기회 분석 :(A) 구성 요소 유형,(B) NGS 기술 유형,(C) 사용되는 기술 유형,(D) 용도,(E) 표적 치료 분야,(F) 지역 등 주요 시장 부문에 초점을 맞추어 차세대 시퀀싱 시장의 현재 시장 기회와 향후 성장 가능성을 자세히 분석합니다.

- 시장 영향 분석 : 시장 성장에 영향을 미칠 것으로 예상되는(A) 촉진요인,(B) 억제요인,(C) 시장 성장 촉진요인,(D) 기존 과제 등 다양한 요인을 철저하게 분석합니다.

- 시장 현황:(A) 전장유전체 시퀀싱에 사용되는 시료 유형별 분석과 함께 차세대 영역 관련 서비스 프로바이더 리스트,(B) 전장유전체 시퀀싱에 사용되는 기술/플랫폼 유형,(C) 전장유전체 시퀀싱에 사용되는 시료 유형별 분석,(D) 전장유전체 시퀀싱에 사용되는 기술/플랫폼 유형별 분석,(E) 타겟 시퀀싱에 사용되는 기술/플랫폼 유형별 분석하는 시료 유형별 분석,(D)전체 엑솜 시퀀싱에 사용되는 기술/플랫폼 유형별 분석,(E)타겟 시퀀싱에 사용되는 시료 유형별 분석,(F)타겟 시퀀싱에 사용되는 기술/플랫폼 유형별 분석,(G)설립연도,( G)설립연도,(H)기업 규모,(i)본사 소재지.

- 기술 현황:(A) 응용 유형,(B) 기술/플랫폼 런타임,(C) 최대 출력,(D) 최대 품질,(E) 사용 시퀀싱 기술,(F) 설립 연도,(G) 기업 규모,(H) 본사 소재지에 대한 정보를 제시하는 인사이트 있는 기술 현황 분석.

- 기술 경쟁 분석 : A) 기술 프로바이더의 강점,(B) 플랫폼의 강점 등 다양한 관련 파라미터를 기반으로 한 인사이트 있는 기술 경쟁력.

- 기업 개요: A) 기업 개요, B) 재무 정보(입수 가능한 경우), C) 차세대 시퀀싱 서비스 포트폴리오, D) 최근 동향, E) 미래 전망에 대한 정보를 제공합니다.

- 특허 분석 :(A) 특허 유형,(B) 특허 공개 연도,(C) 특허 출원 연도,(D) 특허 관할권,(E) 특허 협력 분류(CPC) 기호,(F) 출원인 유형 등 여러 관련 파라미터를 기반으로 2020년 이후 차세대 시퀀싱 분야에서 출원/허여된 특허를 상세하게 분석합니다.

- 임상시험 분석 :(A) 임상시험 등록 연도, 등록 환자 수,(B) 임상시험 단계,(C) 임상시험 상태,(D) 대상 환자군,(E) 환자 성별,(F) 스폰서/공동연구자 유형,(G) 임상시험 설계 등 다양한 매개변수에 걸친 차세대 염기서열분석 관련 완료 및 진행 중인 임상시험에 대한 상세 분석에 대한 상세한 임상시험 분석.

목차

제1장 서문

제2장 조사 방법

- 챕터 개요

- 조사의 전제

- 데이터베이스 구축

- 프로젝트 조사 방법

- 견고 품질 관리

제3장 시장 역학

- 챕터 개요

- 예측 조사 방법

- 시장 평가 프레임워크

- 예측 툴과 테크닉

- 주요 고려사항

- 제한 사항

제4장 거시경제 지표

- 챕터 개요

- 시장 역학

- 결론

제5장 개요

제6장 서론

제7장 차세대 시퀀싱 서비스 프로바이더 : 시장 구도

- 챕터 개요

- 차세대 시퀀싱 서비스 프로바이더 : 업계 참여 기업의 시장 구도

- 차세대 시퀀싱 서비스 프로바이더 : 업계외 참여 기업 리스트

제8장 차세대 시퀀싱 : 테크놀러지의 상황

- 챕터 개요

- 차세대 시퀀싱 : 기술 상황

- 차세대 시퀀싱 : 테크놀러지/플랫폼 프로바이더의 상황

제9장 차세대 시퀀싱 기술/플랫폼 : 경쟁 분석

- 챕터 개요

- 전제와 주요 파라미터

- 조사 방법

- 차세대 시퀀싱 기술/플랫폼 : 경쟁 분석

제10장 기업 개요 : 차세대 시퀀싱 서비스 프로바이더

- 챕터 개요

- Admera Health

- Applied Biological Materials

- BGI Genomics

- CD Genomics

- DNA Link

- Eurofins Genomics

- Gene by Gene

- GENEWIZ

- MedGenome

- Novogene

- Psomagen

- Veritas

- Xcerlis Labs

제11장 기업 개요 차세대 시퀀싱 기술 프로바이더

- 챕터 개요

- Illumina

- MGI Tech

- Oxford Nanopore Technologies

- Pacific Biosciences

- Thermo Fisher Scientific

제12장 특허 분석

- 챕터 개요

- 범위와 조사 방법

- 차세대 시퀀싱 : 특허 분석

- 특허 벤치마킹 분석

- 특허 평가

- 인용수 상위 특허

제13장 임상시험 분석

- 챕터 개요

- 범위와 조사 방법

- 차세대 시퀀싱 : 임상시험 분석

제14장 대형 제약회사 분석

- 챕터 개요

- 범위와 조사 방법

- 구상 연별 분석

제15장 사례 연구 : 정부 주도 차세대 시퀀싱 구상

제16장 시장 영향 분석 : 촉진요인, 억제요인, 기회, 과제

제17장 세계의 차세대 시퀀싱 시장

제18장 차세대 시퀀싱 시장 : 컴포넌트별

제19장 차세대 시퀀싱 시장 : NGS 기술 유형별

제20장 차세대 시퀀싱 시장 : 사용 기술별

제21장 차세대 시퀀싱 시장 : 용도별

제22장 차세대 시퀀싱 시장 : 대상 치료 영역별

제23장 차세대 시퀀싱 시장 : 목적별

제24장 차세대 시퀀싱 시장 : 최종사용자별

제25장 차세대 시퀀싱 시장 : 지역별

제26장 결론

제27장 이그제큐티브 인사이트

제28장 부록 1 : 표형식 데이터

제29장 부록 2 : 기업·단체 리스트

KSA 25.11.05Next Generation Sequencing Market: Overview

The next generation sequencing market is estimated to grow from USD 8.6 billion in the current year and reach USD 46.5 billion by 2040, representing a higher CAGR of 18.4% during the forecast period.

The opportunity for next generation sequencing market has been distributed across the following segments:

Type of NGS Technique

- Targeted Sequencing

- Whole Genome Sequencing / Whole Exome Sequencing

- RNA Sequencing

- Other Techniques

Type of Technology Used

- Sequencing by Synthesis Technology

- Ion Semiconductor Technology

- Nanopore Sequencing Technology

- Other Technologies

Application Area

- Clinical Applications

- Research and Applied Applications

Target Therapeutic Area

- Oncological Disorders

- Genetic Disorders

- Reproductive Disorders

- Other Therapeutic Areas

Purpose

- Diagnosis

- Risk Assessment

- Presymptomatic Assessment

- Screening

- Other Purposes

End users

- Academic and Research Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other End Users

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Market in North America

- US

- Canada

Market in Europe

- Germany

- UK

- France

- Italy

- UK

- Spain

Market in Asia-Pacific

- China

- South Korea

- India

- Australia

- Rest of the Asia-Pacific

Market in Middle East and North Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and North Africa

Market in Latin America

- Brazil

- Argentina

- Rest of Latin America

Next Generation Sequencing Market: Growth and Trends

Next generation sequencing involves the sequencing of whole genomes to understand genetic variations associated with a wide range of diseases. The ability to sequence entire genomes at the same time has created wide possibilities for both research and the molecular diagnosis of diseases.

The prevalence of chronic diseases has significantly increased over the years, raising serious concerns. According to the report of , nearly six out of 10 Americans are suffering from at least one chronic disease, indicating the growing risk of chronic diseases. In order to mitigate this concern, researchers are leveraging next generation sequencing for analyzing diseases at molecular level through metagenomics studies. In addition to disease diagnosis, next generation sequencing helps to design , identify and develop targeted therapies.

Currently, next generation sequencing platforms experience limited adoption because of high installation costs, the need for skilled personnel, and inadequate in-house infrastructure to carry out NGS workflows. To tackle these issues, various industry companies (such as Illumina and PacBio) are providing next generation sequencing services.

Outsourcing NGS solutions is economical, shortens analysis duration, and ensures precision in producing sequencing data. Such advantages of outsourcing next generation sequencing have attracted the interest of various government agencies and industry leaders who are currently involved in several initiatives related to multiple national genome mapping. Moreover, next-generation technologies have demonstrated great effectiveness in clinical trials, leading to a rise in volunteer participation in these trials, which assists researchers in making more informed decisions regarding the assessed drug or technology.

Ongoing research and innovation in this domain are expected to lead to a significant rise in the adoption of these sequencing techniques, propelling the growth of the next generation sequencing market.

Next Generation Sequencing Market: Key Insights

The report delves into the current state of the next generation sequencing market and identifies potential growth opportunities within the industry. The key takeaways of the report are:

- Over 45% of the next generation sequencing service providers are small players; this is indicative of the increase in number of new entrants within the market.

- ~95% of the next generation sequencing service providers offer whole genome sequencing services; of these, around 85% of the service providers offer additional services for bioinformatics.

- Close to 40% of the companies engaged in offering next generation sequencing technologies are mid-sized firms; further, ~75% of the firms are based in North America.

- The rising demand for NGS technologies has led to a notable increase in its application sectors, with around 25 technologies currently used for both whole genome sequencing and targeted sequencing.

- Since 2020, more than 3,060 patents have been filed / granted focused on the research and development of next generation technologies / platforms across the globe.

- In recent years, a significant increase in the number of registered clinical trials has been observed in this domain; over 60% of the trials focused on next generation sequencing are currently in phase II.

- The rising interest of big pharma players in the field of next generation sequencing is reflected by the wide array of initiatives established in the recent past; ~75% of the initiatives were focused collaborations with other players.

- The next generation sequencing market is anticipated to grow at a CAGR of 18.4% till 2035; majority of the market share is likely to be occupied by North America, followed by Europe.

- The market opportunity is projected to be well distributed across various segments, such as type of component, type of NGS technique, technology used, application area, target therapeutic area, purpose and end users.

Next Generation Sequencing Market: Key Segments

Consumables Segment Capture the Majority of the Next Generation Sequencing Market

In terms of type of component, the next generation sequencing market is segmented in consumables and services and instruments. In the current year, the consumables segment captures the majority share (67%) in the overall market and this trend is likely to remain unchanged in the future as well (CAGR of 18.7%).

Targeted Sequencing Segment Captures the Maximum Share of the Next Generation Sequencing Market

This next generation sequencing market report highlights the segmentation of the market size into targeted sequencing, whole genome sequencing / whole exome sequencing, RNA sequencing and other techniques, based on the type of NGS technique. Currently, the targeted sequencing segment captures the maximum share (45%) in the overall market. However, whole genome sequencing / whole exome sequencing segment is expected to grow at a relatively higher CAGR (19.5%), during the forecast period, till 2035.

Nanopore Sequencing Technology Segment is Likely to Grow at a Higher CAGR

This market report highlights the segmentation of the market into sequencing by synthesis technology, ion semiconductor technology, nanopore sequencing technology and other technologies, based on the type of technology used. Currently, the sequencing by synthesis technology segment captures the maximum next generation sequencing market share (82%) and this trend is likely to remain unchanged in the future as well. However, nanopore sequencing technology segment is expected to grow at a relatively higher CAGR (20.5%), during the forecast period, till 2035.

Clinical Applications Segment Leads the Next Generation Sequencing Market

The next generation sequencing market size is further divided into various sub-segments based on the application area, such as clinical applications, and research and applied applications. Currently, the clinical applications segment captures the maximum share (57%) in the overall market. This segment is expected to grow at a relatively higher CAGR (21.1%), during the forecast period, till 2035.

Oncological Disorders Capture the Highest Market Share

This segment highlights the distribution of market across various target therapeutic area such as, oncological disorders, genetic disorders, reproductive disorders and other therapeutic area. Currently, oncological disorders occupy the highest next generation sequencing market share (50%), and this trend is likely to remain unchanged. This can be attributed to the growing preference of next generation sequencing technologies for early diagnosis and prevention of cancer at molecular level. However, the other therapeutic areas segment is likely to grow at a relatively higher CAGR (26.6%) during the forecast period, till 2035.

Diagnosis Segment Captures the Highest Market Share

The next generation sequencing market is further divided into various sub-segments based on the purpose such as diagnosis, risk assessment, presymptomatic assessment, screening and other purposes. Currently, the market is driven by the diagnosis segment (58%) in the overall market, and this trend is likely to remain unchanged. However, other purposes segment is expected to grow at a relatively higher CAGR (20.1%), during the forecast period, till 2035.

Academic And Research Institutes Hold the Majority of the Market Share

The global market is segmented into different end users, including academic and research institutes, hospitals and clinics, pharmaceutical and biotechnology companies, and other end users. Currently, the academic and research institutes segment captures the maximum next generation sequencing market share (45%), and this trend is likely to remain unchanged in the future as well. However, we anticipate hospitals and clinics segment to grow at a relatively higher CAGR (21.7%) during the forecast period, till 2035.

North America will Propel the Next Generation Sequencing Market

Next generation sequencing market is distributed across various geographies, such as North America, Europe and Asia-Pacific, Middle East and North Africa and Latin America., North America is likely to capture the majority (51%) of the current market share, and this trend is likely to remain unchanged in the future.

Example Players in the Next Generation Sequencing Market

- Illumina

- MGI Tech

- Oxford Nanopore Technologies

- Pacific Biosciences

- Thermo Fisher Scientific

Next Generation Sequencing Market: Research Coverage

The report on next generation sequencing market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of current market opportunity and the future growth potential of next generation sequencing market , focusing on key market segments, including [A] type of component, [B] type of NGS technique, [C] type of technology used, [D] application area, [E] target therapeutic area and [F] geographical regions.

- Market Impact Analysis: A thorough analysis of various factors, such as [A] drivers, [B] restraints, [C] opportunities, and [D] existing challenges that are likely to impact market growth.

- Market Landscape: The report features a list of service providers involved in the next generation domain, along with analyses based on [A] type of sample used for whole genome sequencing, [B] type of technology / platform used for whole genome sequencing and [C] analysis by type of sample used for whole exome sequencing [D] analysis by type of technology / platform used for whole exome sequencing [E] analysis by type of sample used for targeted sequencing, [F] analysis by type of technology / platform used for targeted sequencing [G] year of establishment, [H] company size [I] location of headquarters.

- Technology Landscape: An insightful technology landscape analysis, presenting information on [A] type of application, [B] technology / platform run time [C] maximum output [D] maximum quality, [E] sequencing technique used, [F] year of establishment, [G] company size [H] location of headquarters.

- Technology Competitiveness Analysis: An insightful technology competitiveness, based on various relevant parameters, such as [A] technology provider strength, and [B] platform strength.

- Company Profiles: Comprehensive profiles of prominent players that are engaged in offering next generation sequencing services and next generation sequencing technologies, featuring information on [A] company overview, [B] financial information (if available), [C] next generation sequencing service portfolio, [D] recent developments, and [E] future outlook statements.

- Patent Analysis: A detailed analysis of patents filed / granted since 2020 in the next generation sequencing domain, based on several relevant parameters, such as [A] type of patent, [B] patent publication year, [C] patent application year, [D] patent jurisdiction, [E] cooperative patent classification (CPC) symbols, and [F] type of applicant.

- Clinical Trial Analysis: A detailed clinical trial analysis of completed / ongoing clinical trials related to next-generation sequencing relevant information across parameters, such as [A] trial registration year, number of patients enrolled, [B] trial phase, [C] trial status, [D] target patient population, [E] patient gender, [F] type of sponsor / collaborator and [G] study design

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Genome Sequencing

- 6.3. Types of Genome Sequencing

- 6.4. History and Evolution of Next Genration Sequencing

- 6.5. Generations of Next generation sequencing Technology

- 6.5.1. First Generation DNA Sequencers

- 6.5.2. Second Generation HT-NGS Platforms

- 6.5.3. Third Generation HT-NGS Platforms

- 6.5.3.1. Heliscope Single Molecule Sequencer

- 6.5.3.2. Single Molecule Real Time (SMRT(TM)) Sequencer

- 6.5.3.3. Single Molecule Real Time (RNAP) Sequencer

- 6.5.3.4. Multiplex Polony Technology

- 6.5.3.5. Nanopore DNA Sequencer

- 6.5.3.6. The Ion Torrent Sequencing Technology

- 6.6. Comparison of First, Second and Third Generation Technologies

- 6.7. Applications of Genome Sequencing

- 6.8. Challenges Associated with Genome Sequencing

- 6.9. Future Perspectives

7. NEXT GENERATION SEQUENCING SERVICE PROVIDERS: MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Next Genration Sequencing Service Providers: Overall Market Landscape of Industry Players

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Company Size and Location of Headquarters (Region)

- 7.2.5. Analysis by Type of Service Offered

- 7.2.6. Analysis by Additional Service Offered

- 7.2.7. Analysis by Type of Sample Used for Whole Genome Sequencing

- 7.2.8. Analysis by Type of Technology / Platform Used for Whole Genome Sequencing

- 7.2.9. Analysis by Type of Sample Used for Whole Exome Sequencing

- 7.2.10. Analysis by Type of Technology / Platform Used for Whole exome Sequencing

- 7.2.11. Analysis by Type of Sample Used for Targeted Sequencing

- 7.2.12. Analysis by Type of Technology / Platform Used for Targeted Sequencing

- 7.3. Next Genration Sequencing Service Providers: List of Non-Industry Players

8. NEXT-GENERATION SEQUENCING: TECHNOLOGY LANDSCAPE

- 8.1. Chapter Overview

- 8.2. Next Genration Sequencing: Technology Landscape

- 8.2.1. Analysis by Type of Application

- 8.2.2. Analysis by Technology / Platform Run Time (Hours)

- 8.2.3. Analysis by Maximum Output (Gb)

- 8.2.4. Analysis by Maximum Base Pair Reads per Run (Million)

- 8.2.5. Analysis by Maximum Quality

- 8.2.6. Analysis by Sequencing Technique Used

- 8.3. Next-generation Sequencing: Technology / Platform Providers Landscape

- 8.3.1. Analysis by Year of Establishment

- 8.3.2. Analysis by Company Size

- 8.3.3. Analysis by Location of Headquarters (Country and Region)

- 8.3.4. Analysis by Company Size and Location of Headquarters (Region)

9. NEXT GENERATION SEQUENCING TECHNOLOGIES / PLATFORMS: COMPETITIVE ANALYSIS

- 9.1. Chapter Overview

- 9.2. Assumptions and Key Parameters

- 9.3. Methodology

- 9.4. Next generation sequencing Technologies / Platforms: Competitive Analysis

- 9.4.1. Next generation sequencing Technologies / Platforms Provided by Players based in North America

- 9.4.2. Next generation sequencing Technologies / Platforms Provided by Players based in Europe and Asia-Pacific

10. COMPANY PROFILES: NEXT GENERATION SEQUENCING SERVICE PROVIDERS

- 10.1. Chapter Overview

- 10.2. Admera Health

- 10.2.1. Company Overview

- 10.2.2. Service Portfolio

- 10.2.3. Recent Developments and Future Outlook

- 10.3. Applied Biological Materials

- 10.4. BGI Genomics

- 10.5. CD Genomics

- 10.6. DNA Link

- 10.7. Eurofins Genomics

- 10.8. Gene by Gene

- 10.9. GENEWIZ

- 10.10. MedGenome

- 10.11. Novogene

- 10.12. Psomagen

- 10.13. Veritas

- 10.14. Xcerlis Labs

11. COMPANY PROFILES: NEXT GENERATION SEQUENCING TECHNOLOGY PROVIDERS

- 11.1. Chapter Overview

- 11.2. Illumina

- 11.2.1. Company Overview

- 11.2.2. Technology / Platform Portfolio

- 11.2.3. Financial Information

- 11.3. MGI Tech

- 11.4. Oxford Nanopore Technologies

- 11.5. Pacific Biosciences

- 11.6. Thermo Fisher Scientific

12. PATENT ANALYSIS

- 12.1. Chapter Overview

- 12.2. Scope And Methodology

- 12.3. Next-generation Sequencing: Patent Analysis

- 12.3.1. Analysis by Patent Publication Year

- 12.3.2. Analysis by Type of Patent and Publication Year

- 12.3.3. Analysis by Patent Application Year

- 12.3.4. Analysis by Patent Jurisdiction

- 12.3.5. Analysis by CPC Symbols

- 12.3.6. Analysis by Type of Applicant

- 12.3.7. Leading Industry Players: Analysis by Number of Patents

- 12.3.8. Leading Non-Industry Players: Analysis by Number of Patents

- 12.4. Patent Benchmarking Analysis

- 12.4.1. Analysis by Patent Characteristics

- 12.5. Patent Valuation

- 12.6. Leading Patents by Number of Citations

13. CLINICAL TRIALS ANALYSIS

- 13.1. Chapter Overview

- 13.2. Scope and Methodology

- 13.3. Next-generation Sequencing: Clinical Trial Analysis

- 13.3.1. Analysis by Trial Registration Year

- 13.3.2. Analysis of Number of Patients Enrolled by Trial Registration Year

- 13.3.3. Analysis by Trial Phase

- 13.3.4. Analysis of Number of Patients Enrolled by Trial Phase

- 13.3.5. Analysis by Trial Status

- 13.3.6. Analysis by Trial Registration Year and Trial Status

- 13.3.7. Analysis by Target Patient Population

- 13.3.8. Analysis by Patient Gender

- 13.3.9. Analysis by Study Design

- 13.3.9.1. Analysis by Type of Allocation

- 13.3.9.2. Analysis by Type of Intervention Model

- 13.3.9.3. Analysis by Type of Masking

- 13.3.9.4. Analysis by Trial Purpose

- 13.3.10. Analysis by Type of Sponsor / Collaborator

- 13.3.11. Leading Players: Analysis by Number of Clinical Trials

- 13.3.12. Analysis by Geography

- 13.3.12.1. Analysis of Clinical Trials by Geography

- 13.3.12.2. Analysis of Clinical Trials by Geography and Trial Status

- 13.3.12.3. Analysis of Patients Enrolled by Geography and Trial Status

14. BIG PHARMA ANALYSIS

- 14.1 Chapter Overview

- 14.2. Scope and Methodology

- 14.3. Analysis by Year of Initiative

- 14.3.1. Analysis by Type of Initiative

- 14.3.2. Analysis by Type of Collaboration

- 14.3.3. Analysis by Focus Area

- 14.3.4. Most Active Big Pharma Players: Analysis by Number of Initiatives

15. CASE STUDY: NEXT GENERATION SEQUENCING INITIATIVES SPONSORED BY GOVERNMENT

- 15.1. Chapter Overview

- 15.2. Next-generation Sequencing: List of Government Sponsored Initiatives

- 15.2.1. Analysis by Initiative Establishment Year

- 15.2.2. Analysis by Aim and Objective of Initiative

- 15.2.3. Analysis by Geographical Reach

- 15.2.4. Analysis by Number of Individual's Genome Sequenced

- 15.2.5. Analysis by Focus Area

- 15.2.6. Analysis by Type of Partner

- 15.2.7. Analysis by Type of Sponsor

16. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 16.1. Chapter Overview

- 16.2. Market Drivers

- 16.3. Market Restraints

- 16.4. Market Opportunities

- 16.5. Market Challenges

- 16.6. Conclusion

17. GLOBAL NEXT GENERATION SEQUENCING MARKET

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Global Next Generation Sequencing Market, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 17.3.1. Scenario Analysis

- 17.3.1.1. Conservative Scenario

- 17.3.1.2. Optimistic Scenario

- 17.3.1. Scenario Analysis

- 17.4. Key Market Segmentations

18. NEXT GENERATION SEQUENCING MARKET: BY TYPE OF COMPONENT

- 18.1. Chapter Overview

- 18.2. Assumptions and Methodology

- 18.3. Next Generation Sequencing Market: Distribution by Type of Component

- 18.3.1. Next Generation Sequencing Market for Consumables, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.3.2. Next Generation Sequencing Market for Services, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.3.3. Next Generation Sequencing Market for Instruments, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.4. Data Triangulation and Validation

19 NEXT GENERATION SEQUENCING MARKET: BY TYPE OF NGS TECHNIQUE

- 19.1. Chapter Overview

- 19.2. Assumptions and Methodology

- 19.3. Next Generation Sequencing Market: Distribution by Type of NGS technique

- 19.3.1. Next Generation Sequencing Market for Targeted Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.3.2. Next Generation Sequencing Market for Whole Genome Sequencing / Whole Exome Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.3.3. Next Generation Sequencing Market for RNA Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.3.4. Next Generation Sequencing Market for Other Techniques, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.4. Data Triangulation and Validation

20. NEXT GENERATION SEQUENCING MARKET: BY TYPE OF TECHNOLOGY USED

- 20.1. Chapter Overview

- 20.2. Assumptions and Methodology

- 20.3. Next Generation Sequencing Market: Distribution by Type of Technology Used

- 20.3.1. Next Generation Sequencing Market for Sequencing by Synthesis Technology, Historical Trends (Since 2020) and Forecasted Estimates (Till2035)

- 20.3.2. Next Generation Sequencing Market for Ion Semiconductor Technology, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.3.3. Next Generation Sequencing Market for Nanopore Sequencing Technology, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.3.4. Next Generation Sequencing Market for Other Technologies, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.4. Data Triangulation and Validation

21. NEXT GENERATION SEQUENCING MARKET: BY APPLICATION AREA

- 21.1. Chapter Overview

- 21.2. Assumptions and Methodology

- 21.3. Next Generation Sequencing Market: Distribution by Application Area

- 21.3.1. Next Generation Sequencing Market for Clinical Applications, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.3.2. Next Generation Sequencing Market for Research and Applied Applications, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.4. Data Triangulation and Validation

22. NEXT GENERATION SEQUENCING MARKET: BY TARGET THERAPEUTIC AREA

- 22.1. Chapter Overview

- 22.2. Assumptions and Methodology

- 22.3. Next Generation Sequencing Market: Distribution by Target Therapeutic Area

- 22.3.1. Next Generation Sequencing Market for Oncological Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.3.2. Next Generation Sequencing Market for Genetic Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.3.3. Next Generation Sequencing Market for Reproductive Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.3.4. Next Generation Sequencing Market for Other Therapeutic Areas, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.4. Data Triangulation and Validation

23. NEXT GENERATION SEQUENCING MARKET: BY PURPOSE

- 23.1. Chapter Overview

- 23.2. Assumptions and Methodology

- 23.3. Next Generation Sequencing Market: Distribution by Purpose

- 23.3.1. Next Generation Sequencing Market for Diagnosis, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.3.2. Next Generation Sequencing Market for Risk Assessment, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.3.3. Next Generation Sequencing Market for Presymptomatic Assessment, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.3.4. Next Generation Sequencing Market for Screening, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.3.5. Next Generation Sequencing Market for Other Purposes, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.4. Data Triangulation and Validation

24. NEXT GENERATION SEQUENCING MARKET: BY END USERS

- 24.1. Chapter Overview

- 24.2. Assumptions and Methodology

- 24.3. Next Generation Sequencing Market: Distribution by End Users

- 24.3.1. Next Generation Sequencing Market for Academic and Research Institutes, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.3.2. Next Generation Sequencing Market for Hospitals and Clinics, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.3.3. Next Generation Sequencing Market for Pharmaceutical and Biotechnology Companies, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.3.4. Next Generation Sequencing Market for Other End Users, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.4. Data Triangulation and Validation

25. NEXT GENERATION SEQUENCING MARKET: BY GEOGRAPHICAL REGIONS

- 25.1. Chapter Overview

- 25.2. Assumptions and Methodology

- 25.3. Next Generation Sequencing Market: Distribution by Geographical Regions

- 25.3.1. Next Generation Sequencing Market in North America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.1.1. Next Generation Sequencing Market in the US, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.1.2. Next Generation Sequencing Market in Canada, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2. Next Generation Sequencing Market in Europe, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.1. Next Generation Sequencing Market in Germany, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.2. Next Generation Sequencing Market in France, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.3. Next Generation Sequencing Market in Italy, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.4. Next Generation Sequencing Market in Spain, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.5. Next Generation Sequencing Market in the UK, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.6. Next Generation Sequencing Market in Rest of Europe, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3. Next Generation Sequencing Market in Asia-Pacific, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.1. Next Generation Sequencing Market in China, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.2. Next Generation Sequencing Market in India, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.3. Next Generation Sequencing Market in Japan, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.4. Next Generation Sequencing Market in South Korea, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.5. Next Generation Sequencing Market in Singapore, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.6. Next Generation Sequencing Market in Rest of Asia-Pacific, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.4. Next Generation Sequencing Market in Middle East and North Africa, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.4.1. Next Generation Sequencing Market in Egypt, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.4.2. Next Generation Sequencing Market in Israel, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.4.3. Next Generation Sequencing Market in Saudi Arabia, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.4.4. Next Generation Sequencing Market in Rest of Middle East and North Africa, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.5. Next Generation Sequencing Market in Latin America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.5.1. Next Generation Sequencing Market in Brazil, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.5.2. Next Generation Sequencing Market in Argentina, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.5.3. Next Generation Sequencing Market in Rest of Latin America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.1. Next Generation Sequencing Market in North America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.4. Next Generation Sequencing Market, by Geographical Regions: Market Dynamics Assessment

- 25.4.1. Penetration Growth (P-G) Matrix

- 25.4.2. Market Movement Analysis

- 25.5. Data Triangulation and Validation