|

시장보고서

상품코드

1869578

환각제 시장 : 업계 동향과 세계 예측 - 물질 유래별, 환각제 유형별, 대상 적응증별, 투여 경로별, 주요 지역별Psychedelic Drugs Market: Industry Trends and Global Forecasts - Distribution by Origin of Substance, Psychedelic Substance, Target Disease Indications, Route of Administration and Key Geographical Regions |

||||||

세계의 환각제 시장 : 개요

Roots Analysis의 조사에 따르면, 세계 환각제 시장은 예측 기간 동안 CAGR 15%로 성장하여 현재 31억 9,000만 달러에서 128억 9,000만 달러에 달할 것으로 예측됩니다.

시장 규모 및 기회 분석은 다음 매개 변수를 기반으로 세분화됩니다.

물질 유래

- 천연 유래

- 합성

환각제 유형

- Gamma-hydroxybutyrate

- Ketamine

- MDMA

- Psilocybin

대상 적응증

- 우울증 및 불안장애

- 통증 장애

- 수면 관련 장애

- 트라우마

투여 경로

- 경구

- 정맥 내

- 비강 내

- 설하 투여

주요 지역

- 북미

- 유럽

- 아시아태평양

- 기타 지역

세계 환각제 시장 : 성장과 동향

정신장애란 환각물질 사용 후 지속적인 지각장애가 발생하는 정신 건강 문제이며, 특히 환각제 지속성 지각장애(HPPD)가 이에 해당합니다. HPPD에서는 시각적 잡음, 잔상, 운동지각의 변화와 같은 지속적인 시각적 현상이 나타나며, 이는 다른 정신질환이나 신체질환에 기인하지 않고, 상당한 고통을 가져옵니다.

정신장애는 다른 정신 건강 문제와 함께 전 세계적으로 연간 1조 달러 이상의 생산성 손실을 초래할 것으로 예측됩니다. 최근 데이터에 따르면, 전염병은 기존 추세를 악화시켰고, 특히 젊은 여성에서 두드러지게 나타났으며, 코로나19 이후 10대 청소년의 발병률은 130%, 젊은 성인의 발병률은 57% 더 빠르게 증가했습니다. 2022년 현재, 항우울제는 처방약 중 세 번째로 널리 보급된 카테고리입니다. WHO에 따르면, 우울증 및 기타 정신질환을 효과적으로 치료하기 위해서는 이러한 질환에 대한 이해 부족, 지속적인 사회적 편견, 오진, 효과적인 치료법 부족 등 여러 가지 장벽이 존재한다고 합니다. 이러한 어려움으로 인해 우울증 등 정신질환에 대한 환각제 화합물의 치료 가능성에 초점을 맞춘 임상연구가 증가하고 있습니다. 연구진은 환각제가 적절한 용량으로 투여되면 환각제가 환자의 특정 심각한 심리적 영향을 완화하는 데 도움이 될 수 있다고 제안했습니다.

환각제 화합물은 세로토닌, 아세틸콜린, 노르에피네프린, 도파민과 관련된 신경전달물질 시스템을 포함한 여러 신경전달체계에 영향을 미치는 것으로 나타났습니다. 현재 제약업계의 다양한 관계자들이 환각제 화합물의 천연 및 합성 유도체를 연구하고 있습니다. 환각제 시장은 향후 10년간 큰 폭의 성장이 예상됩니다.

세계 환각제 시장 : 주요 인사이트

이 보고서는 세계 환각제 시장의 현황을 자세히 분석하고 업계의 잠재적인 성장 기회를 식별합니다. 보고서의 주요 내용은 다음과 같습니다.

- 현재 케타민, 실로시빈 등 여러 환각제 화합물을 기반으로 한 치료 후보물질을 개발 및 평가하고 있다고 주장하는 회사는 전 세계적으로 45개 이상에 달할 전망입니다.

- 개발 파이프라인에는 다양한 유형의 환각제 계열에 기반한 제품 후보물질이 포함되어 있으며, 다양한 적응증에 대한 연구가 진행 중이며, 다양한 투여 경로를 통해 다양한 적응증에 대한 연구가 진행되고 있습니다.

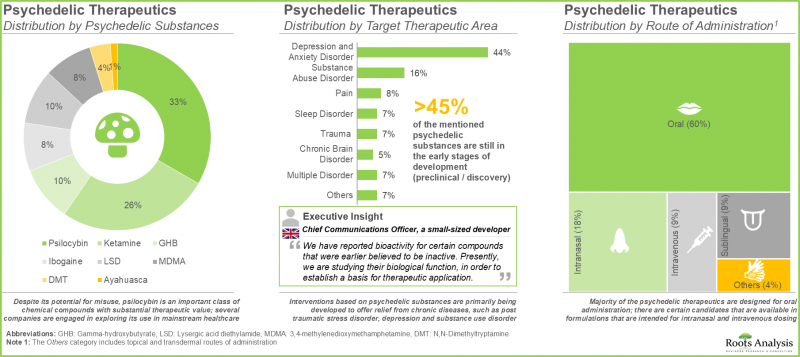

- 악용 가능성이 있는 실로시빈(33%)은 치료적 가치가 높은 중요한 화합물군으로 여러 기업이 주류 의료 분야에서의 활용을 모색하고 있습니다.

- 환각제의 대부분(60%)은 경구 투여를 염두에 두고 설계되었지만, 비강 내 투여나 정맥 내 투여를 목적으로 하는 제형 형태의 후보물질도 일부 존재합니다.

- 세계 관점에서 볼 때, 각국의 연방/지역 규제 당국이 이 제품군의 임상적 중요성을 점차 인식하고 있기 때문에 향후 몇 년 동안 이 산업은 크게 발전할 것으로 예측됩니다.

- 환각제의 미개척 가능성을 인식한 여러 기관들이 환각제라는 신흥 분야에 총 2,500건 이상, 미화 2억 7,500만 달러 이상의 보조금을 지원했습니다.

- 이 분야(미국)의 이해관계자에 대한 보조금 지급 건수는 CAGR 5%로 증가하고 있으며, 총액의 45% 이상이 R01 메커니즘에 따라 지급되었습니다.

- 이 분야에서는 NIH(미국 국립보건원) 내 다양한 후원기관의 참여가 눈에 띕니다. 참여 기관 중 NIMH(국립정신건강연구소), NIDA(국립약물남용연구소), NIGMS(국립일반의학과학연구소), NIAAA(국립알코올남용 및 중독연구소)의 참여가 상대적으로 두드러졌습니다.

- 워드클라우드는 이 신흥 분야에서 연구기관들의 관심 분야로, 특히 우울증과 외상 후 스트레스 장애(PTSD)와 같은 질병이 주목받고 있습니다.

- 최근 다양한 치료 적응증에 대한 여러 환각제 화합물을 평가하는 임상시험이 등록되고 있습니다.

- 이러한 관심은 제휴 활동에도 반영되어 여러 지역에서 다양한 약품군을 다루는 다양한 계약이 체결되고 있습니다.

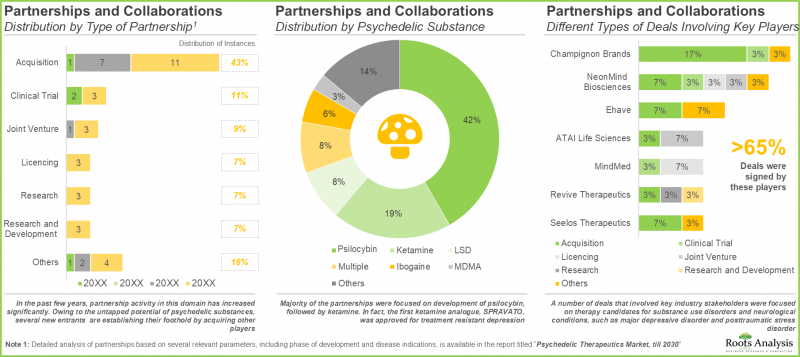

- 제휴의 대부분은 실로시빈(42%) 개발에 초점을 맞추고 있으며, 케타민(19%)이 그 뒤를 잇고 있습니다. 실제로 최초의 케타민 유사체인 스프라바토(SPRAVATO)는 난치성 우울증 치료제로 승인되었습니다.

- 주요 업계 이해관계자들이 참여한 다수의 계약은 물질사용장애 및 신경질환(주요우울증, 외상후스트레스장애 등)의 치료 후보물질에 초점을 맞춘 계약들이었습니다.

- 현재 북미 기업들은 전략적 인수를 통해 현지에서의 입지를 강화하고 있으며, 이러한 거래의 주요 가치 창출 요인으로는 포트폴리오 확대와 지리적 확장을 들 수 있습니다.

- 저명한 대학에 소속된 다수의 저명한 과학자들이 환각제 기반 중재요법 관련 임상 개발 활동에 적극적으로 참여하면서 이 분야의 KOL로 부상하고 있습니다.

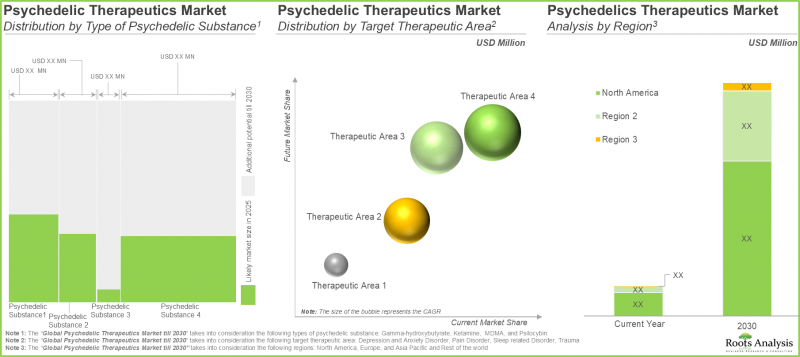

- 향후 시장 규모 예측은 시판 및 후기 단계의 사이키델릭 치료제의 매출을 기반으로 다양한 치료 분야 및 주요 지역에 분산될 것으로 예측됩니다.

- 실제로 업계 전문가들의 견해에 따르면 이 분야의 엄청난 잠재력을 확인할 수 있습니다. 전반적인 기회는 다양한 천연/합성 유래 물질 및 투여 경로에 광범위하게 분산되어 있습니다.

세계 환각제 시장 : 주요 부문

대상 질환별로는 우울증-불안장애, 통증장애, 수면 관련 장애, 트라우마로 분류됩니다. 현재 외상 분야가 환각제 시장을 독점하고 있으며, 시장의 대부분을 차지하고 있습니다.

주요 지역별로 북미, 유럽, 아시아태평양, 기타 지역으로 구분됩니다. 현재 북미가 환각제 시장을 주도하고 있으며, 가장 큰 매출 점유율을 차지하고 있습니다.

세계의 환각제 시장의 대표적인 기업 사례

- Celon Pharma

- iX Biopharma

- MAPS Public Benefit

- MindMed

- Janssen Pharmaceuticals

- Jazz Pharmaceutical

목차

제1장 서문

제2장 주요 요약

제3장 서론

- 본 장의 개요

- 환각제의 역사

- 환각제의 잠재적인 치료 응용

- 의료 용도에 관한 규제, 독성에 관한 우려, 조달 관련 과제와 인식

- 향후 기회

제4장 시장 구도 : 환각제

- 본 장의 개요

- 환각제 : 판매 및 개발 파이프라인

- 환각제 : 개발자 리스트

제4장 본사 소재지별 분석

제5장 기업 개요

- 본 장의 개요

- Celon Pharma

- iX Biopharma

- MAPS Public Benefit

- MindMed

- Janssen Pharmaceuticals

- Jazz Pharmaceutical

제6장 임상시험 분석

- 본 장의 개요

- 범위와 조사 방법

- 사이키델릭 치료 : 임상시험 분석

제7장 임상시험 시행 시설 분석

제8장 KOL 분석

제9장 학술 보조금 분석

제10장 파트너십 및 협업

제11장 합병과 인수

제12장 시장 예측과 기회 분석

제13장 결론

제14장 경영진 인사이트

제15장 부록 1 : 표 형식 데이터

제16장 부록 2 : 기업 및 단체 리스트

LSH 25.11.24Global Psychedelic Drugs Market: Overview

As per Roots Analysis, the global psychedelic drugs market is expected to grow from USD 3.19 billion in the current year to USD 12.89 billion, at a CAGR of 15% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Origin of Substance

- Natural

- Synthetic

Type of Psychedelic Substance

- Gamma-hydroxybutyrate

- Ketamine

- MDMA

- Psilocybin

Target Disease Indications

- Depression and Anxiety Disorders

- Pain Disorders

- Sleep Related Disorders

- Trauma

Route of Administration

- Oral

- Intravenous

- Intranasal

- Sublingual

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

Global Psychedelic Drugs Market: Growth and Trends

Psychedelic disorders are mental health issues defined by persistent perceptual disturbances following the use of psychedelic substances, especially hallucinogen persisting perception disorder (HPPD). HPPD involves persistent visual phenomena such as visual snow, trails, and altered motion perception, which are not part of another mental or medical condition and cause significant distress.

Psychedelic disorders, in addition to other mental health issues, are projected to lead to worldwide productivity losses surpassing USD 1 trillion each year. Recent data suggests that the pandemic intensified existing trends, especially among younger women, with rates rising 130% quicker for teenagers and 57% quicker for young adults after the COVID-19 pandemic. As of 2022, antidepressants ranked as the third most prevalent category of prescribed medications. The WHO states that there are numerous obstacles for effectively treating depression and other mental health disorders including insufficient understanding of these conditions, ongoing social stigma, incorrect diagnoses, and limited effective treatments. Due to such difficulties, an increase in clinical research emphasizes the treatment possibilities of psychedelic compounds for mental health issues such as depression. Researchers suggest that when given in suitable doses, psychedelics may assist in alleviating certain severe psychological effects in patients.

Psychedelic compounds have been shown to affect multiple neurotransmitter systems, including those related to serotonin, acetylcholine, norepinephrine, and dopamine. At present, various participants in the pharmaceutical sector are involved in research of both natural and synthetic derivatives of psychedelic compounds. The market for psychedelic drugs is expected to experience significant growth in the next decade.

Global Psychedelic Drugs Market: Key Insights

The report delves into the current state of global psychedelic drugs market and identifies potential growth opportunities within industry. Some key findings from the report include:

- More than 45 players from across the world presently claim to be engaged in the development and evaluation of therapeutic candidates based on a number of psychedelic compounds, such as ketamine and psilocybin.

- The pipeline features product candidates based on a variety of psychedelic drug classes, which are being investigated for a wide range of target disease indications and have different routes of administration.

- Despite its potential for misuse, psilocybin (33%) is an important class of chemical compounds with substantial therapeutic value; several companies are engaged in exploring its use in mainstream healthcare.

- Majority (60%) of the psychedelic therapeutics are designed for oral administration; there are certain candidates that are available in formulations that are intended for intranasal and intravenous dosing.

- From a global perspective, this industry is anticipated to evolve significantly over the next few years as federal / regional regulators in different nations are gradually convinced of the clinical significance of this product class.

- Several organizations, having realized the untapped opportunity within this emerging segment of psychedelic therapeutics, have awarded grants of over USD 275 million across 500+ instances.

- The number of grants awarded to stakeholders in this domain (in the US) has increased at a CAGR of 5%; more than 45% of the total amount was awarded under the R01 mechanism.

- The field has witnessed the involvement of various sponsor institutes from within the NIH; of all the involved departments, the participation of the NIMH, NIDA, NIGMS, and NIAAA was observed to be relatively more prominent.

- The word cloud represents the area of interest of research organizations within this emerging domain; indications such as depression and posttraumatic stress disorder have garnered significant attention.

- Several trials evaluating various psychedelic compounds against a wide range of therapeutic indications have been registered in the recent past.

- The growing interest is also reflected in the partnership activity; a number of different types of deals involving various drug classes have been established across multiple geographies.

- Majority of the partnerships were focused on development of psilocybin (42%), followed by ketamine (19%). In fact, the first ketamine analogue, SPRAVATO, was approved for treatment of resistant depression.

- A number of deals that involved key industry stakeholders were focused on therapy candidates for substance use disorders and neurological conditions, such as major depressive disorder and posttraumatic stress disorder.

- Presently, North American companies are actively consolidating their indigenous presence through strategic acquisitions; key value drivers behind such deals include both portfolio and geographical expansion.

- A number of eminent scientists from renowned universities have emerged as key opinion leaders in this domain, owing to their active involvement in clinical development efforts related to interventions based on psychedelics.

- Future market size, based on revenue reported from the sales of marketed and late-stage psychedelic-based therapies, is anticipated to be distributed across different therapeutic areas and key geographical regions.

- In fact, opinions from industry experts confirm the vast potential of this segment; the overall opportunity is well distributed across the various natural / synthetically derived substances and routes of administration.

Global Psychedelic Drugs Market: Key Segments

Trauma Segment Occupies the Largest Share of the Psychedelic Drugs Market

In terms of target disease indications, the market is segmented into depression and anxiety disorders, pain disorders, sleep related disorders and trauma. Currently, the trauma segment dominates the psychedelic drug market, capturing majority share of the market.

North America Accounts for the Largest Share of the Market

In terms of key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. Currently, North America dominates the psychedelic drugs market and accounts for the largest revenue share.

Primary Research Overview

Discussions with multiple stakeholders in this domain influenced the opinions and insights presented in this study. The market report includes detailed transcripts of interviews conducted with the following individuals:

- Founder & Chief Executive Officer, Small Company

- Chief Operating Officer and Chief Medical Officer, Mid-sized Company

- Chief Operating Officer, Small Company

- Chief Communications Officer, Mid-sized Company

- Associate Research Scientist, Large Company

Example Players in the Global Psychedelic Drugs Market

- Celon Pharma

- iX Biopharma

- MAPS Public Benefit

- MindMed

- Janssen Pharmaceuticals

- Jazz Pharmaceutical

Global Psychedelic Drugs Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global psychedelic drugs market, focusing on key market segments, including [A] origin of substance, [B] type of psychedelic substance [C] target disease indications, [D] route of administration and [H] key geographical regions.

- Market Landscape: A comprehensive evaluation of marketed / pipeline molecules, considering various parameters, such as [A] phase of development of lead candidates, [B] type of psychedelic substance, [C] origin of psychedelic substance, [D] target therapeutic area (s), [E] route of administration and [F] dosing frequency. Additionally, a comprehensive evaluation of drug developer(s), based on [A] year of their establishment, [B] company size, and [C] location of headquarters.

- Company Profiles: In-depth profiles of companies that are engaged in the development of at least two or more psychedelic-based therapies, focusing on [A] company overview, [B] financial information (if available), [C] product portfolio, and [E] recent developments and an informed future outlook.

- Clinical Trial Analysis: An in-depth analysis of completed, ongoing and planned clinical studies of various psychedelic therapeutics, highlighting prevalent trends across various relevant parameters, such as [A] trial registration year, [B] phase of development, [C] current trial status, [D] enrolled patient population, [E] geographical distribution of trials, [F] study design, [G] leading industry, [H] study focus, [I] target therapeutic area and [J] key geographical regions.

- Clinical Trial Site Analysis: A detailed analysis of clinical trial sites where the studies have been / are being conducted for evaluation of various psychedelic therapeutics, based on relevant parameters, such as [A] type of psychedelic substance, [B] trial phase, [C] target disease indications and [D] location of the trial.

- Grant Analysis: An insightful analysis of nearly 550 grants that were awarded to research institutes engaged in psychedelic therapeutics related projects, based on the parameters, such as the [A] year of grant award, [B] amount awarded, [C] funding institute center, [D] support period, [E] type of grant application, [F] purpose of grant award, [G] activity code, [H] responsible study section, [I] prominent program officers and [J] type of recipient organizations.

- Partnerships and Collaborations: A comprehensive analysis of various collaborations and partnerships that have been inked amongst stakeholders in this domain, based on [A] year of partnership, [B] type of partnership and [C] regional activity.

- Mergers and Acquisitions: A detailed analysis of the various mergers and acquisitions that have taken place in this domain, based on parameters, such as [A] key value drivers, [B] year of acquisition, [C] type of acquisition, [D] geographical location of the acquirer and [E] the acquired company.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. History of Psychedelic Substances

- 3.3. Potential Therapeutic Applications of Psychedelic Substances

- 3.4. Regulation, Toxicity Concerns, Procurement-related Challenges and Perceptions Regarding Medical Use

- 3.5. Future Opportunities

4. MARKET LANDSCAPE: PSYCHEDELIC THERAPEUTICS

- 4.1. Chapter Overview

- 4.2. Psychedelic Therapeutics: Marketed and Development Pipeline

- 4.2.1. Analysis by Phase of Development

- 4.2.2. Analysis by Type of Psychedelic Substance

- 4.2.3. Analysis by Origin of Psychedelic Substance

- 4.2.4. Analysis by Target Therapeutic Area

- 4.2.5. Analysis by Route of Administration

- 4.2.6. Analysis by Dosing Frequency

- 4.3. Psychedelic Therapeutics: List of Developers

- 4.3.1. Analysis by Year of Establishment

- 4.3.2. Analysis by Company Size

4. 3.3. Analysis by Location of Headquarters

- 4.4. Grid Analysis: Distribution by Phase of Development, Origin of Psychedelic Substance and Location of Headquarters

5. COMPANY PROFILES

- 5.1. Chapter Overview

- 5.2. Celon Pharma

- 5.2.1. Company Overview

- 5.2.2. Financial Information

- 5.2.3. Psychedelic Therapeutics Portfolio

- 5.2.3.1. Esketamine DPI

- 5.2.4. Recent Developments and Future Outlook

- 5.3. iX Biopharma

- 5.3.1. Company Overview

- 5.3.2. Financial Information

- 5.3.3. Psychedelic Therapeutics Portfolio

- 5.3.3.1. Wafermine(TM)

- 5.3.3.2. Unnamed (Ketamine)

- 5.3.4. Recent Developments and Future Outlook

- 5.4. MAPS Public Benefit

- 5.4.1. Company Overview

- 5.4.2. Financial Information

- 5.4.3. Psychedelic Therapeutics Portfolio

- 5.4.3.1. Unnamed (MDMA)

- 5.4.3.2. Unnamed (Ibogaine Hydrochloride)

- 5.4.3.3. Unnamed (LSD)

- 5.4.3.4. Unnamed (Ayahuasca)

- 5.4.4. Recent Developments and Future Outlook

- 5.5. MindMed

- 5.5.1. Company Overview

- 5.5.2. Psychedelic Therapeutics Portfolio

- 5.5.2.1. LSD Micro-dosing

- 5.5.2.2. 18-MC

- 5.5.2.3. Unnamed (LSD and MDMA)

- 5.5.3. Recent Developments and Future Outlook

- 5.6. Janssen Pharmaceuticals

- 5.6.1. Company Overview

- 5.6.2. Financial Information

- 5.6.3. Psychedelic Therapeutics Portfolio

- 5.6.3.1. SPRAVATO(R)

- 5.6.4. Recent Developments and Future Outlook

- 5.7. Jazz Pharmaceutical

- 5.7.1. Company Overview

- 5.7.2. Financial Information

- 5.7.3. Psychedelic Therapeutics Portfolio

- 5.7.3.1. XYREM(R)

- 5.7.3.2. JZP-258

- 5.7.3.3. JZP-324

- 5.7.4. Recent Developments and Future Outlook

6. CLINICAL TRIAL ANALYSIS

- 6.1. Chapter Overview

- 6.2. Scope and Methodology

- 6.3. Psychedelic Therapeutics: Clinical Trial Analysis

- 6.3.1. Analysis by Trial Registration Year

- 6.3.2. Analysis by Trial Phase

- 6.3.3. Analysis by Trial Recruitment Status

- 6.3.4. Analysis by Trial Registration Year and Number of Patients Enrolled

- 6.3.5. Analysis by Study Design

- 6.3.6. Leading Trial Sponsors: Analysis by Number of Registered Trials

- 6.3.7. Leading Industry Sponsors: Analysis by Number of Registered Trials

- 6.3.8. Word Cloud: Key Focus Areas

- 6.3.9. Analysis by Target Therapeutic Area

- 6.3.10. Popular Interventions: Analysis by Number of Registered Trials

- 6.3.11. Geographical Analysis by Number of Registered Trials

- 6.3.12. Geographical Analysis by Trial Recruitment Status

- 6.3.13. Geographical Analysis by Number of Patients Enrolled

7. CLINICAL TRIAL SITE ANALYSIS

- 7.1. Chapter Overview

- 7.2. Scope and Methodology

- 7.3. Psychedelic Therapeutics: Clinical Trial Site Analysis

- 7.3.1. Analysis by Type of Psychedelic Substance

- 7.3.2. Analysis by Trial Phase

- 7.3.3. Analysis by Target Therapeutic Area

- 7.3.4. Analysis by Location of Clinical Trial Site

8. KEY OPINION LEADER (KOL) ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Methodology

- 8.3. Principal Investigators Involved in Clinical Trials

- 8.3.1. Analysis by Type of Organization (KOL Affiliation)

- 8.3.2. Geographical Distribution of KOLs

- 8.4. Prominent KOLs

- 8.5. KOL Benchmarking: Roots Analysis' Assessment versus Third Party (ResearchGate Score)

- 8.6. Most Active KOLs

- 8.6.1. KOL Profile: A (Emory School of Medicine)

- 8.6.2. KOL Profile: B (Imperial College London)

- 8.6.3. KOL Profile: C (Rigshospitalet)

- 8.6.4. KOL Profile: D (Thriving Mind South Florida)

- 8.6.5. KOL Profile: E (University Health Network)

9. ACADEMIC GRANTS ANALYSIS

- 9.1. Chapter Overview

- 9.2. Scope and Methodology

- 9.3. Psychedelic Therapeutics: Analysis of Academic Grants

- 9.3.1. Analysis by Year of Grant Award

- 9.3.2. Analysis by Amount Awarded

- 9.3.3. Analysis by Funding Institute Center

- 9.3.4. Analysis by Support Period

- 9.3.5. Analysis by Funding Institute Center and Support Period

- 9.3.6. Analysis by Type of Grant Application

- 9.3.7. Analysis by Purpose of Grant Award

- 9.3.8. Analysis by Activity Code

- 9.3.9. Analysis by Study Section Involved

- 9.3.10. Analysis by Recipient Organization

- 9.3.11. Geographical Distribution of Recipient Organizations

- 9.3.12. Word Cloud: Emerging Focus Areas

- 9.3.13. Popular Psychedelic Therapeutics: Analysis by Number of Grants

- 9.3.14. Popular Funding Institute Centers: Analysis by Number of Grants

- 9.3.15. Prominent Program Officers: Analysis by Number of Grants

- 9.3.16. Popular Recipient Organizations: Analysis by Number of Grants

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Chapter Overview

- 10.2. Partnership Models

- 10.3. Psychedelic Therapeutics: List of Partnerships and Collaborations

- 10.3.1. Analysis by Year of Partnership

- 10.3.2. Analysis by Type of Partnership

- 10.3.3. Analysis by Type of Partnership and Type of Psychedelic Substance Involved

- 10.3.4. Analysis by Type of Partnership and Phase of Development of Involved Intervention

- 10.3.5. Analysis by Type of Partnership and Target Therapeutic Area Mentioned

- 10.3.6. Analysis by Type of Psychedelic Substance and Target Therapeutic Area

- 10.3.7. Analysis by Type of Partnership and Type of Partner

- 10.3.8. Analysis by Type of Psychedelic Substance Involved and Type of Partner

- 10.3.9. Most Active Players: Analysis by Number of Partnerships

- 10.3.10. Regional Analysis

- 10.3.10.1 Intercontinental and Intracontinental Agreements

11. MERGERS AND ACQUISITIONS

- 11.1. Chapter Overview

- 11.2. Acquisition Models

- 11.3. Psychedelic Therapeutics: Mergers and Acquisitions

- 11.3.1. Cumulative Year-wise Trend of Mergers and Acquisitions

- 11.3.2. Analysis by Type of Acquisition

- 11.3.3. Analysis by Type of Psychedelic Substance Involved

- 11.3.4. Analysis by Year of Acquisition and Type of Psychedelic Substance Involved

- 11.3.5. Most Active Players: Analysis by Number of Acquisitions

- 11.3.6. Regional Analysis

- 11.3.6.1. Continent-Wise Distribution of Acquisitions

- 11.3.6.2. Country-Wise Distribution of Acquisitions

- 11.3.7. Analysis by Key Value Drivers

- 11.3.7.1, Analysis by Year of Acquisition and Key Value Drivers

12. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 12.1. Chapter Overview

- 12.2. Forecast Methodology and Assumptions

- 12.3. Global Psychedelic Therapeutics Market

- 12.4. Global Psychedelic Therapeutics Market: Individual Product Sales Forecasts

- 12.4.1. COMP360 (COMPASS Pathways)

- 12.4.1.1. Target Patient Population

- 12.4.1.2. Sales Forecast

- 12.4.2. Esketamine DPI (Celon Pharma)

- 12.4.2.1. Target Patient Population

- 12.4.2.2. Sales Forecast

- 12.4.3. FT218 (Avadel Pharmaceuticals)

- 12.4.3.1. Target Patient Population

- 12.4.3.2. Sales Forecast

- 12.4.4. JZP-258 (Jazz Pharmaceuticals)

- 12.4.4.1. Target Patient Population

- 12.4.4.2. Sales Forecast

- 12.4.5. NRX-100 (NeuroRx)

- 12.4.5.1. Target Patient Population

- 12.4.5.2. Sales Forecast

- 12.4.6. R-107 (Doughlas pharmaceuticals)

- 12.4.6.1. Target Patient Population

- 12.4.6.2. Sales Forecast

- 12.4.7. SPRAVATO(R) (Janssen Pharmaceuticals)

- 12.4.7.1. Target Patient Population

- 12.4.7.2. Sales Forecast

- 12.4.8. Unnamed (MDMA) (MAPS Public Benefit)

- 12.4.8.1. Target Patient Population

- 12.4.8.2. Sales Forecast

- 12.4.9. Unnamed (Psilocybin) (The Emmes Company)

- 12.4.9.1. Target Patient Population

- 12.4.9.2. Sales Forecast

- 12.4.10. Wafermine(TM) (iX Biopharma)

- 12.4.10.1. Target Patient Population

- 12.4.10.2. Sales Forecast

- 12.4.11. XYREM(R) (Jazz Pharmaceuticals)

- 12.4.11.1. Target Patient Population

- 12.4.11.2. Sales Forecast

- 12.4.1. COMP360 (COMPASS Pathways)

- 12.5. Global Psychedelic Therapeutics Market: Distribution by Origin of Psychedelic Substance, Till 2035

- 12.5.1. Global Psychedelic Therapeutics Market for Synthetic Substances, Till 2035

- 12.5.2. Global Psychedelic Therapeutics Market for Natural Substances, Till 2035

- 12.6. Global Psychedelic Therapeutics Market: Distribution by Type of Psychedelic Substance, Till 2035

- 12.6.1. Global Psychedelic Therapeutics Market for GHB, Till 2035

- 12.6.2. Global Psychedelic Therapeutics Market for Ketamine, Till 2035

- 12.6.3. Global Psychedelic Therapeutics Market for MDMA, Till 2035

- 12.6.4. Global Psychedelic Therapeutics Market for Psilocybin, Till 2035

- 12.7. Global Psychedelic Therapeutics Market: Distribution by Geography, Till 2035

- 12.7.1. Psychedelic Therapeutics Market in North America, Till 2035

- 12.7.2. Psychedelic Therapeutics Market in Europe, Till 2035

- 12.7.3. Psychedelic Therapeutics Market in Asia-Pacific and Rest of the World, Till 2035

- 12.8. Psychedelic Therapeutics Market: Distribution by Target Therapeutic Area, Till 2035

- 12.8.1. Global Psychedelic Therapeutics Market for Depression and Anxiety Disorders, Till 2035

- 12.8.2. Global Psychedelic Therapeutics Market for Pain Disorders, Till 2035

- 12.8.3. Global Psychedelic Therapeutics Market for Sleep-Related Disorders, Till 2035

- 12.8.4. Global Psychedelic Therapeutics Market for Trauma, Till 2035

- 12.9. Global Psychedelic Therapeutics Market: Distribution by Route of Administration, Till 2035

- 12.9.1. Global Psychedelic Therapeutics Market for Intranasal Therapies, Till 2035

- 12.9.2. Global Psychedelic Therapeutics Market for Intravenous Therapies, Till 2035

- 12.9.3. Global Psychedelic Therapeutics Market for Oral Therapies, Till 2035

- 12.9.4. Global Psychedelic Therapeutics Market for Sublingual Therapies, Till 2035

13. CONCLUDING REMARKS

- 13.1. Chapter Overview

- 13.2. Key Takeaways

14. EXECUTIVE INSIGHTS

- 14.1. Chapter Overview

- 14.2 Company A

- 14.2.1. Company Snapshot

- 14.2.2. Interview Transcript: Founder & Chief Executive Officer

- 14.3. Company B

- 14.3.1. Company Snapshot

- 14.3.2. Interview Transcript: Founder & Chief Executive Officer

- 14.4. Company C

- 14.4.1. Company Snapshot

- 14.4.2. Interview Transcript: Chief Operating Officer and Chief Medical Officer

- 14.5 Company D

- 14.5.1. Company Snapshot

- 14.5.2. Interview Transcript: Chief Operating Officer

- 14.6 Company E

- 14.6.1. Company Snapshot

- 14.6.2. Interview Transcript: Chief Communications Officer

- 14.7 Company F

- 14.7.1. Company Snapshot

- 14.7.2. Interview Transcript: Assistant Professor of Psychiatry