|

시장보고서

상품코드

1891244

RTU(Ready to Use) 의약품 포장 시장(제3판) : 업계 동향과 세계 예측(-2035년) - 용기 유형별, 마개 유형별, 제조 재료별, 주요 지역별Ready to Use Pharmaceutical Packaging Market (3rd Edition): Industry Trends and Global Forecasts, till 2035 - Distribution by Type of Container, Type of Closure, Material of Fabrication and Key Geographical Regions |

||||||

RTU 의약품 포장 시장 : 개요

세계의 RTU 의약품 포장 시장 규모는 2035년까지의 예측 기간에 CAGR 9.7%로 성장하며, 현재 95억 달러에서 2035년까지 251억 달러에 달할 것으로 추정되고 있습니다.

시장 규모 및 기회 분석은 다음 매개 변수를 기반으로 세분화됩니다.

용기 유형

- 멸균 카트리지

- 멸균 주사기

- 멸균 바이알

클로저 유형

- 캡

- 플런저

- 실

- 스토퍼

- 팁 캡/니들 쉴드

제조 재료

- 알루미늄

- 유리

- 플라스틱

- 고무

주요 지역

- 북미

- 유럽

- 아시아

- 라틴아메리카

- 중동 및 북아프리카

- 기타 지역

의약품 포장 시장 : 성장과 동향

제약 산업에서 백신과 의약품의 안전성과 무결성은 매우 중요합니다. 이러한 제품의 1차 포장은 품질을 유지하고 오염 물질로부터 보호하기 위해 필수적입니다. 따라서 제품의 안전성을 보장하고 엄격한 품질 기준을 준수하기 위해 의약품 제조시 멸균 처리는 필수입니다. 그 결과, 의약품 포장에 있으며, RTU/사전 멸균 용기 및 클로저가 개발되었습니다. RTU 바이알(RTU 바이알)은 내부 멸균 공정의 필요성을 제거하여 오염 위험 감소 및 생산 일정 단축을 실현합니다.

제약 제품 파이프라인이 확대됨에 따라 관련 1차 포장 및 2차 포장 솔루션에 대한 수요가 필연적으로 증가하고 있습니다. 그러나 기존의 1차 포장에는 생산 일정의 장기화, 엄격한 규제 등 여러 가지 문제점이 존재합니다. 이에 따라 업계 이해관계자들은 멸균/RTU 1차 포장 솔루션에 집중하고 있습니다. 의약품 1차 포장의 보급은 기존 1차 포장에 대한 효과적인 대안으로 부상하고 있으며, 의약품의 충전 및 마무리 공정을 최적화하는 데 큰 이점을 제공합니다. 이러한 포장 요소는 전체 충전 및 마무리 공정에서 여러 단계(주로 세척, 멸균, 용기 준비)를 줄이고, 현행 규제 요건을 준수하면서 업무 효율성을 향상시킵니다. 또한 RTU 포장 시스템은 발열 물질(체내로 유입되면 발열을 유발할 수 있는 물질)을 제거하기 위한 전처리 과정을 거쳐 약품 성분이 규제 기준에 부합하도록 보장합니다. 의료용 폴리머가 제공하는 다양한 부가적인 장점으로 인해 RTU 용기 폐쇄 시스템은 제약 업계에서 꾸준히 인기를 얻고 있습니다.

RTU 의약품 포장 시장 : 주요 조사 결과

이 보고서는 RTU 의약품 포장 시장의 현황을 자세히 분석하고 업계의 잠재적인 성장 기회를 파악합니다. 보고서의 주요 내용은 다음과 같습니다.

- 현재 50여개 업체에서 95종 이상의 멸균/즉시 사용 가능한 용기를 제공하거나 개발 중입니다. 이들 기업 중 비교적 많은 비율이 2000년 이전에 설립된 기업입니다.

- RTU 용기의 약 45%는 바이알 형태로 제공되며, 이들 제품의 대부분은 에틸렌옥사이드(EtO)를 사용하여 멸균됩니다.

- 전 세계에서 약 85개 업체가 멸균/RTU(Ready to Use) 용기용 캡을 생산하고 있으며, 이 중 약 60%가 아시아에 본사를 두고 있습니다.

- 바이알, 주사기, 카트리지 등 다양한 유형의 용기에 대응하는 다양한 RTU 클로저가 제공되어 생물제제 및 저분자 화합물에 최적의 포장 솔루션을 실현하고 있습니다.

- 경쟁 우위를 확보하기 위해 RTU 용기 및 클로저 제조 업체들은 현재 제품 라인에 첨단 기능을 통합하는 데 주력하고 있습니다.

- 약 40여개 업체가 다양한 제약 공정의 생산성과 유연성을 높이기 위해 다양한 자유도를 가진 로봇 기계를 제공한다고 주장하고 있습니다.

- RTU 용기 및 캡 분야에 대한 이해관계자들의 관심이 높아진 것은 제휴 활동에서도 알 수 있으며, 실제로 지난 2년 동안 가장 많은 제휴가 체결되었습니다.

- 당사의 지적 자본을 바탕으로 사전 멸균/RTU 1차 포장 산업 진입 가능성을 평가할 수 있는 독자적인 프레임워크를 제안하고 있습니다. 이해관계자들이 이를 평가할 수 있습니다.

- 바이알은 가까운 미래에 멸균/RTU 용기 수요의 약 55%를 차지할 것으로 예측됩니다.

- RTU 1차 포장 시장은 주로 멸균/즉시 사용 가능한 용기의 매출에 힘입어 향후 수년간 연평균 9.2%의 성장률을 보일 것으로 예측됩니다.

- RTU 의약품 포장의 예상 기회는 다양한 유형의 1차 포장 시스템, 제조 재료 및 주요 지역적 지역에 따라 분산될 것으로 예측됩니다.

- 복잡한 제약 제품의 요구 사항을 충족시킬 수 있는 첨단 포장재 및 기술에 대한 수요가 증가함에 따라 업계에는 몇 가지 성장 기회가 존재합니다.

즉시 사용 가능한 의약품 포장 시장 : 주요 부문

멸균 주사기 부문은 즉시 사용 가능한 의약품 포장 시장에서 가장 큰 점유율을 차지하고 있습니다.

용기 유형별로 시장은 무균 카트리지, 무균 주사기, 무균 바이알로 시장 세분화됩니다. 현재, 무균 주사기 카테고리는 전체 의약품 즉석 포장 시장에서 가장 큰 점유율을 차지하고 있습니다. 또한 무균 바이알 부문의 의약품 즉시 사용 포장 시장은 예측 기간 중 가장 큰 성장 잠재력을 보일 것으로 예측됩니다.

클로저 유형별로는 캡 부문이 예측 기간 중 급속한 성장을 보일 것으로 예측됩니다.

클로저 유형에 따라 캡, 플런저, 실, 스토퍼, 팁 캡/니들 쉴드로 분류됩니다. 현재, 플런저 부문은 전 세계 RTU 의약품 포장 시장에서 가장 큰 점유율을 차지하고 있습니다. 그러나 캡 부문 시장은 예측 기간 중 높은 CAGR로 성장할 것으로 예측됩니다.

제조 재료별로는 플라스틱 부문이 세계 RTU 의약품 포장 시장에서 가장 큰 점유율을 차지하고 있습니다.

제조 재료별로 시장은 알루미늄, 유리, 플라스틱, 고무, 플라스틱, 고무로 분류됩니다. 현재, 플라스틱 부문은 세계 RTU 의약품 포장 시장에서 가장 큰 비중을 차지하고 있습니다. 이에 따라 유리 부문은 예측 기간 중 높은 CAGR로 성장할 것으로 예측됩니다.

아시아가 시장에서 가장 큰 점유율을 차지하고 있습니다.

주요 지역별로 북미, 유럽, 아시아, 아시아, 라틴아메리카, 중동 및 북아프리카, 기타 지역으로 구분됩니다. 현재 아시아가 세계 RTU 의약품 포장 시장을 주도하고 있으며, 가장 큰 매출 점유율을 차지하고 있습니다. 또한 아시아 시장은 향후 더 높은 CAGR로 성장할 것으로 예측됩니다.

의약품 즉시 사용 포장 시장의 대표적인 기업 사례

- APG Pharma

- Aptar

- Daikyo Seiko

- Datwyler

- DWK Life Sciences

- Ningbo Zhengli Pharmaceutical Packaging

- SCHOTT

- Stevanto

- West Pharmaceutical Services

RTU 의약품 포장 시장 : 조사 범위

- 시장 규모 및 기회 분석 : 이 보고서는(A) 용기 유형,(B) 마개 유형,(C) 제조 재료,(D) 주요 지역 등 주요 시장 세분화에 초점을 맞춘 세계 RTU 의약품 포장 시장에 대한 상세한 분석을 제공합니다.

- 사전 멸균/즉시 사용 용기 시장 현황: 사전 멸균/즉시 사용 용기 관련,(A)용기 유형,(B)제조 재료,(C)용기 색상,(D)대응 가능한 약품 유형,(E)사업 규모,(F)포장 형태,(G)사용 멸균 기술,(H)획득한 품질 인증,(I)대상 시장,(J 추가 코팅 및 RTU 키트 유무. 또한(A) 설립연도,(B) 기업 규모(직원수),(C) 본사 소재지 등을 기준으로 멸균/사용 가능한 용기 제조업체를 종합적으로 평가합니다.

- 멸균/사용 가능한 클로저 시장 현황: 멸균/사용 가능한 클로저에 대한 종합적인 평가는 다음과 같은 관련 파라미터에 따라 이루어집니다. (A) 클로저 유형,(B) 제조 재료,(C) 지원 가능한 용기 유형,(D) 지원 가능한 약품 유형,(E) 사용된 멸균 기술,(F) 제공 가능한 마감 형태,(G) 획득한 품질 인증,(H) 대상 시장,(I) 추가 코팅 여부 등 여러 관련 파라미터를 기준으로 합니다. 또한 사전 멸균/사용 가능한 상태의 클로저 제조업체에 대해(A) 설립 연도,(B) 기업 규모(직원 수),(C) 본사 소재지 등의 매개 변수를 기반으로 종합적인 평가를 실시합니다.

- 주요 내용: 사전 멸균/사용 준비가 완료된 용기 및 클로저 제품 분야 시장 동향에 대한 상세한 분석. 관련 매개변수에 따라(A)용기 유형 및 사업 규모,(B)용기 유형 및 포장 형태,(C)용기 유형 및 제조 재료,(D)용기 유형 및 용기 색상,(E)용기 유형 및 사용 멸균 기술,(F)용기 유형 및 적합 약품 유형,(G)제조 재료 및 사용 멸균 기술,(H)폐쇄 유형 및 폐쇄 유형 및 사용 멸균 기술,(J)폐쇄 유형 및 사용 가능한 마감 형태,(K 마개 유형 및 제조 재료,(I) 마개 유형 및 사용된 멸균 기술,(J) 마개 유형 및 사용 가능한 마감 형태,(K) 마개 유형 및 적합한 약품 유형.

- 사전 멸균/사용가능 용기 제품 경쟁력 분석 : 각종 사전 멸균/사용가능 용기의 종합적인 경쟁력 분석으로,(A) 기업력 및(B) 제품 경쟁력 등의 요소를 검토합니다.

- 멸균/사용 가능한 클로저의 제품 경쟁력 분석 : 다양한 멸균/사용 가능한 클로저에 대한 종합적인 경쟁 분석. 구체적으로,(A) 기업 역량 및(B) 제품 경쟁력 등의 요소를 고려합니다.

- 기업 개요: 멸균/즉석 사용 용기 및 캡을 제공하는 주요 기업의 상세한 프로파일을 확인할 수 있습니다. (A) 기업 개요,(B) 재무 정보(가능한 경우),(C) 제품 포트폴리오,(D) 최근 동향 및 미래 전망에 중점을 둡니다.

- 제휴/협업: 의약품 즉석포장 시장의 이해관계자 계약을(A) 제휴 연도,(B) 제휴 형태,(C) 파트너 유형,(D) 중점 분야,(E) 포장 시스템 유형,(F) 포장재 유형,(G) 주요 진출기업,(H) 지역 등 여러 매개변수를 기반으로 인사이트 분석이 가능합니다. 분석합니다.

- 시장 진입 의사결정 프레임워크: 미충족 수요를 파악하고 사전 멸균/RTU 1차 포장 분야로의 진입을 지원하는 종합적인 프레임워크.(A) 제품 도달 범위,(B) 시장 활동,(C) 제품 차별화,(D) 경쟁력,(E) 제조 복잡성 등 다양한 요인에 초점을 맞추었습니다.

- 수요 분석 : 1차 포장 시스템 유형 및 사용되는 제조 재료 등 다양한 관련 매개 변수를 기반으로 멸균/사용 가능한 용기 및 마개에 대한 현재 및 미래 수요를 상세하게 평가합니다.

- 시장 영향 분석 : 시장 성장에 영향을 미칠 수 있는 다양한 요인(예: 촉진요인, 제약 요인, 기회, 기존 과제 등)에 대한 철저한 분석.

- 사례 연구: 제약 제조 및 충진 및 마무리 공정에서 로봇 기계 사용에 대한 자세한 인사이트. 이러한 프로세스에서 자동화/자동화 기술 도입에 따른 다양한 이점을 특징적으로 다루고 있습니다.

목차

제1장 서문

제2장 조사 방법

제3장 경제적 및 기타 프로젝트 특유 고려 사항

제4장 개요

제5장 서론

- 챕터 개요

- 의약품 포장과 충전

- RTU 1차 포장

- 결론

제6장 사전 멸균/RTU 용기 : 시장 구도

- 챕터 개요

- 사전 멸균/RTU 용기 : 시장 구도

- 사전 멸균/RTU 용기 : 제조업체 리스트

제7장 사전 멸균/RTU 마개 : 시장 구도

- 챕터 개요

- 사전 멸균/RTU 마개 : 시장 구도

- 사전 멸균/RTU 마개 : 제조업체 상황

제8장 중요 인사이트

- 챕터 개요

- 사전 멸균/RTU 용기 : 중요 인사이트

- 사전 멸균/RTU 마개 : 중요 인사이트

제9장 제품 경쟁력 분석 : 사전 멸균/RTU 용기

- 챕터 개요

- 사전 멸균/RTU 용기 : 제품 경쟁력 분석

제10장 제품 경쟁력 분석 : 사전 멸균/RTU 캡

- 챕터 개요

- 사전 멸균/RTU 마개 : 제품 경쟁력 분석

제11장 기업 개요

- 챕터 개요

- APG Pharma Packaging

- Aptar

- Daikyo Seiko

- Datwyler

- DWK Life Sciences

- Ningbo Zhengli Pharmaceutical Packaging

- SCHOTT

- Stevanato

- West Pharmaceutical Services

제12장 파트너십과 협업

- 챕터 개요

- 파트너십 모델

- 사전 멸균/RTU 의약품 포장 : 파트너십과 협업

제13장 시장 참여 의사결정 프레임워크

제14장 수요 분석

- 챕터 개요

- 범위와 조사 방법

- 사전 멸균/RTU 의약품 포장의 세계 수요 : 용기 유형별

- 사전 멸균/RTU 의약품 포장의 세계 수요 : 마개 유형별

- 사전 멸균/RTU 의약품 포장의 세계 수요 : 제조 재료별

- 사전 멸균/RTU 의약품 포장의 세계 수요 : 주요 지역별

제15장 시장 영향 분석 : 촉진요인, 억제요인, 기회, 과제

제16장 세계의 사전 멸균/RTU 의약품 포장 시장

제17장 사전 멸균/RTU 의약품 포장 시장(용기 유형별)

제18장 사전 멸균/RTU 의약품 포장 시장(마개 유형별)

제19장 사전 멸균/RTU 의약품 포장 시장(제조 재료별)

제20장 사전 멸균/RTU 의약품 포장 시장(주요 지역별)

제21장 의약품 포장 새로운 동향

- 챕터 개요

- 새로운 동향

- 결론

제22장 사례 연구 : 의약품 포장에서 로봇 공학

- 챕터 개요

- 제약 업계에서 로봇의 역할

- 제약 업계용 로봇을 제공하는 기업

- 의약품 포장에서 기기 통합형 로봇 시스템을 제공하는 기업

- Aseptic Technologies

- AST

- Bosch Packaging Technology

- Dara Pharma

- Fedegari

- IMA

- Steriline

- Vanrx Pharmasystems

- 결론

제23장 결론

제24장 이그제큐티브 인사이트

제25장 부록 1 : 표형식 데이터

제26장 부록 2 : 기업·조직 리스트

KSA 25.12.29Ready to Use Pharmaceutical Packaging Market: Overview

As per Roots Analysis, the global ready-to-use pharmaceutical packaging market is estimated to grow from USD 9.5 billion in the current year to USD 25.1 billion by 2035, at a CAGR of 9.7% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Container

- Sterile Cartridges

- Sterile Syringes

- Sterile Vials

Type of Closure

- Caps

- Plungers

- Seals

- Stoppers

- Tip Caps / Needle Shields

Material of Fabrication

- Aluminum

- Glass

- Plastic

- Rubber

Key Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

- Rest of the World

Ready to Use Pharmaceutical Packaging Market: Growth and Trends

The safety and integrity of vaccines and medications are extremely crucial in the pharmaceutical industry. The primary packaging of these products is essential for maintaining their quality and shielding them from contaminants. Consequently, sterilization is essential in pharmaceutical production because it ensures product safety and enforces rigorous quality standards. This has resulted in the development of ready-to-use (RTU) / pre-sterilized containers and closures in pharmaceutical packaging. RTU vials, or ready-to-use vials, remove the necessity for internal sterilization methods, thereby minimizing contamination dangers and shortening production schedules

The expanding pipeline of pharmaceutical drug products has unintentionally resulted in a rise in the need for their related primary and secondary packaging solutions. Nonetheless, conventional primary packaging faces numerous issues, such as prolonged production schedules and strict regulations. This has led industry stakeholders to concentrate on pre-sterilized / (RTU) primary packaging options. The availability of pharmaceutical primary packaging has arisen as a viable alternative to traditional primary packaging, providing substantial benefits to optimize pharmaceutical fill / finish processes. These packaging elements reduce several stages in the complete fill finished production (primarily cleaning, sterilizing, and getting containers ready), thus enhancing operational efficiencies while adhering to current regulatory requirements. Additionally, RTU packaging systems undergo pre-treatment to eliminate pyrogens (agents that can cause fever when introduced into the body) to guarantee that the drug components comply with regulatory standards. Due to various additional advantages provided by medical polymers, RTU container-closure systems have steadily increased in popularity within the pharmaceutical sector.

Ready to Use Pharmaceutical Packaging Market: Key Insights

The report delves into the current state of the ready-to-use pharmaceutical packaging market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, over 95 pre-sterilized / ready-to-use containers are available or being developed by close to 50 manufacturers; a relatively larger proportion of these players were established before 2000.

- Nearly 45% of the ready-to-use containers are being offered as vials; majority of these products are sterilized using ethylene oxide (EtO).

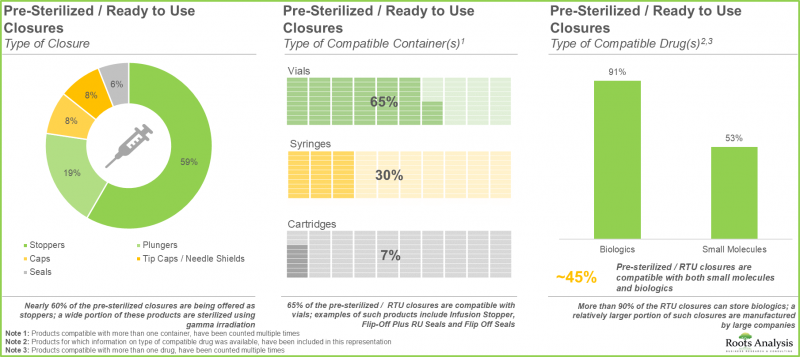

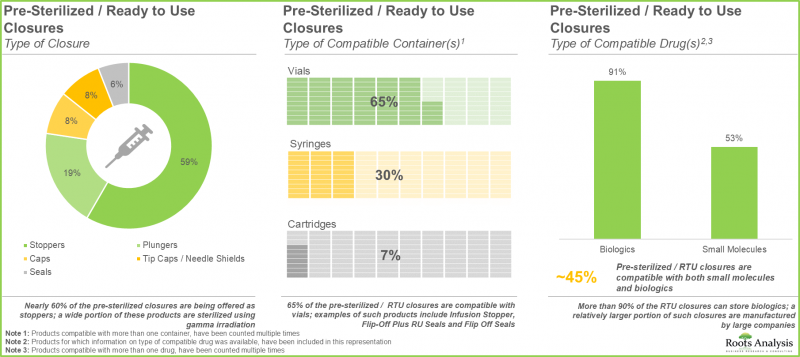

- Around 85 pre-sterilized / RTU closures are being manufactured by players across the globe; ~60% of these firms are headquartered in Asia.

- A wide range of RTU closures are compatible with different types of containers, including vials, syringes and cartridges, providing optimal packaging solutions for biologics and small molecules.

- In pursuit of gaining a competitive edge, companies engaged in the manufacturing of RTU containers and closures are presently focusing on the integration of advanced features into their respective product offerings.

- Around 40 companies claim to offer robotic machinery, with different degrees of freedom, to enhance the productivity and flexibility of various pharmaceutical operations.

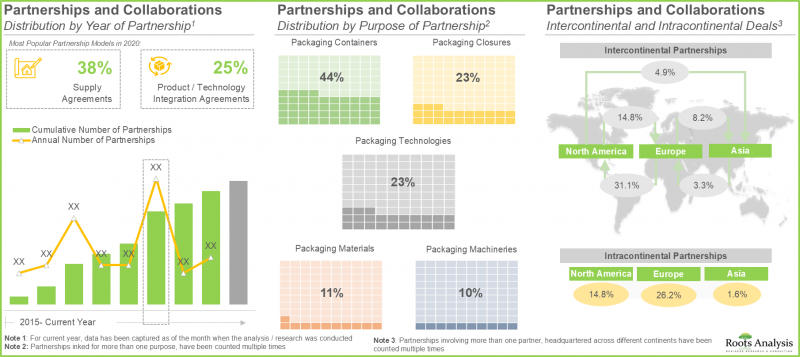

- The rising interest of stakeholders in the RTU containers and closures domain is also evident from the partnership activity; in fact, the maximum number of collaborations were inked in the last two years.

- Based on our intellectual capital, we have proposed a proprietary framework enabling stakeholders to evaluate the viability of entering the pre-sterilized / RTU primary packaging industry.

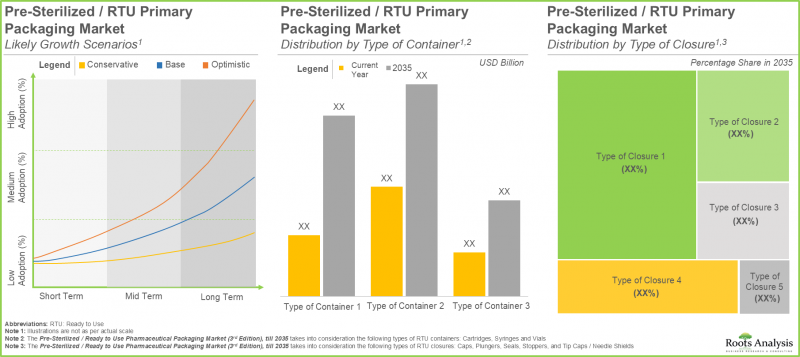

- Vials are expected to account for close to 55% of the demand for pre-sterilized / ready to use containers in the foreseen future.

- The RTU primary packaging market is anticipated to grow at a CAGR of 9.2% over the next few years, primarily driven by the revenues generated from pre-sterilized / ready to use containers.

- The projected opportunity of RTU pharmaceutical packaging is likely to be distributed across different types of primary packaging systems, materials of fabrication and key geographical regions.

- Several growth opportunities exist in the industry owing to the increasing demand for advanced packaging materials and technologies that can accommodate the requirements of complex drug products.

Ready to Use Pharmaceutical Packaging Market: Key Segments

Sterile Syringes Segment holds the Largest Share of the Ready to Use Pharmaceutical Packaging Market

In terms of the type of container, the market is segmented into sterile cartridges, sterile syringes and sterile vials. Currently, the sterile syringes category possesses the largest share of the overall ready-to-use pharmaceutical packaging market. Additionally, the market for ready-to-use pharmaceutical packaging in the sterile vials segment is predicted to exhibit the greatest growth potential throughout the forecast period.

By Type of Closure, Caps Segment is Expected to Grow at a Faster Pace During the Forecast Period

In terms of the type of closure, the market is segmented into caps, plungers, seals, stoppers and tip caps / needle shields. At present, the plungers segment holds the maximum share of the global ready-to-use pharmaceutical packaging market. However, the market for caps segment is expected to grow at a higher CAGR during the forecast period.

By Material of Fabrication, Plastic Segment Accounts for the Largest Share of the Global Ready to Use Pharmaceutical Packaging Market

In terms of the material of fabrication, the market is segmented into aluminum, glass, plastic and rubber. At present, the plastic segment captures the highest proportion of the global ready-to-use pharmaceutical packaging market. This is followed by the glass segment which is expected to grow at a higher CAGR during the forecast period.

Asia Accounts for the Largest Share of the Market

In terms of key geographical regions, the market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and rest of the world. Currently, Asia dominates the global ready-to-use pharmaceutical packaging market and accounts for the largest revenue share. Further, the market in Asia is likely to grow at a higher CAGR in the coming future.

Example Players in the Ready to Use Pharmaceutical Packaging Market

- APG Pharma

- Aptar

- Daikyo Seiko

- Datwyler

- DWK Life Sciences

- Ningbo Zhengli Pharmaceutical Packaging

- SCHOTT

- Stevanto

- West Pharmaceutical Services

Ready to Use Pharmaceutical Packaging Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global ready-to-use pharmaceutical packaging market, focusing on key market segments, including [A] type of container, [B] type of closure, [C] material of fabrication and [D] key geographical regions.

- Pre-Sterilized / Ready to Use Containers Market Landscape: A comprehensive evaluation of the pre-sterilized / ready to use containers, based on several relevant parameters, such as [A] type of container, [B] material(s) of fabrication, [C] container color, [D] type of compatible drug(s), [E] scale of operation, [F] packaging format(s), [G] sterilization technique(s) used, [H] quality certification(s) obtained, [I] target market, [J] availability of additional coating and RTU kits. Additionally, a comprehensive evaluation of pre-sterilized / ready to use container manufacturers, based on parameters, such as [A] year of establishment, [B] company size (in terms of number of employees) and [C] location of headquarters.

- Pre-Sterilized / Ready to Use Closures Market Landscape: A comprehensive evaluation of the pre-sterilized / ready to use closures, based on several relevant parameters, such as [A] type of closure, [B] material(s) of fabrication, [C] type of compatible container(s), [D] type of compatible drug(s), [E] sterilization technique(s) used, [F] available finish format(s), [G] quality certification(s) obtained, [H] target market and [I] availability of additional coating. Additionally, a comprehensive evaluation of pre-sterilized / ready to use closure manufacturers, based on parameters, such as [A] year of establishment, [B] company size (in terms of number of employees) and [C] location of headquarters.

- Key Insights: In-depth analysis of market trends in the pre-sterilized / ready to use containers and closures domain, based on relevant parameters, such as [A] type of container and scale of operation, [B] type of container and packaging format(s), [C] type of container and material(s) of fabrication, [D] type of container and container color, [E] type of container and sterilization technique(s) used, [F] type of container and type of compatible drug(s), [G] material(s) of fabrication and sterilization technique(s) used, [H] type of closure and material(s) of fabrication, [I] type of closure and sterilization technique(s) used, [J] type of closure and available finish format(s), and [K] type of closure and type of compatible drug(s).

- Product Competitiveness Analysis for Pre-Sterilized / Ready to Use Containers: A comprehensive competitive analysis of various types of pre-sterilized / ready to use containers, examining factors, such as [A] company strength and [B] product competitiveness.

- Product Competitiveness Analysis for Pre-Sterilized / Ready to Use Closures: A comprehensive competitive analysis of various types of pre-sterilized / ready to use closures, examining factors, such as [A] company strength and [B] product competitiveness.

- Company Profiles: In-depth profiles of key players that are engaged in offering pre-sterilized / ready-to-use containers and closures, focusing on [A] overview of the company, [B] financial information (if available), [C] product portfolio and [D] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the ready-to-use pharmaceutical packaging market, based on several parameters, such as [A] year of partnership, [B] type of partnership. [C] type of partner, [D] focus area, [E] type of packaging system, [F] type of packaging material, [G] most active players and [H] geography.

- Market Entry Decision Making Framework: A comprehensive framework to identify the unmet needs and assist players in entering the pre-sterilized / RTU primary packaging domain, focusing on various factors, such as [A] product reach, [B] market activity, [C] product differentiation, [D] competitiveness and [E] manufacturing complexity.

- Demand Analysis: A detailed assessment of the current and future demand for pre-sterilized / ready to use containers and closures, based on various relevant parameters, such as [A] type of primary packaging system and [B] material of fabrication used.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

- Case Study: A detailed discussion on the use of robotic machinery in pharmaceutical manufacturing and fill / finish operations, featuring the various advantages of employing automation / automated technologies in such processes.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Key Market Insights

- 1.3. Project Objectives

- 1.4. Scope of the Report

- 1.5. Inclusions and Exclusions

- 1.6. Key Questions Answered

- 1.7. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

- 2.7.9. Key Market Segmentations

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Future Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

- 4.1. Chapter Overview

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Pharmaceutical Packaging and Filling

- 5.2.1. Need for Pharmaceutical Packaging

- 5.2.2. Types of Pharmaceutical Packaging

- 5.2.3. Limitations of Traditional Primary Packaging

- 5.2.4. Innovation in Pharmaceutical Packaging

- 5.3. Ready to Use Primary Packaging

- 5.3.1. Sterilization Techniques used in Primary Packaging

- 5.3.2. Advantages of Ready to Use Primary Packaging

- 5.3.3. Cost Saving Opportunities in Ready to Use Primary Packaging

- 5.3.4. Current Demand for Ready to Use Primary Packaging

- 5.4. Concluding Remarks

6. PRE-STERILIZED / READY TO USE CONTAINERS: MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Pre-Sterilized / Ready to Use Containers: Overall Market Landscape

- 6.2.1. Analysis by Type of Container

- 6.2.2. Analysis by Material(s) of Fabrication

- 6.2.3. Analysis by Container Color

- 6.2.4. Analysis by Type of Compatible Drug(s)

- 6.2.5. Analysis by Scale of Operation

- 6.2.6. Analysis by Packaging Format(s)

- 6.2.7. Analysis by Sterilization Technique(s) Used

- 6.2.8. Analysis by Quality Certification(s) Obtained

- 6.2.9. Analysis by Target Market

- 6.2.10. Analysis by Availability of Additional Coating

- 6.2.11. Analysis by Availability of RTU Kits

- 6.3. Pre-Sterilized / Ready to Use Containers: Manufacturer Landscape

- 6.3.1. Analysis by Year of Establishment

- 6.3.2. Analysis by Company Size

- 6.3.3. Analysis by Location of Headquarters

- 6.3.4. Leading Manufacturers: Analysis by Number of Products

7. PRE-STERILIZED / READY TO USE CLOSURES: MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Pre-Sterilized / Ready to Use Closures: Overall Market Landscape

- 7.2.1. Analysis by Type of Closure

- 7.2.2. Analysis by Material(s) of Fabrication

- 7.2.3. Analysis by Type of Compatible Container(s)

- 7.2.4. Analysis by Type of Compatible Drug(s)

- 7.2.5. Analysis by Sterilization Technique(s) Used

- 7.2.6. Analysis by Available Finish Format(s)

- 7.2.7. Analysis by Quality Certification(s) Obtained

- 7.2.8. Analysis by Target Market

- 7.2.9. Analysis by Availability of Additional Coating

- 7.3. Pre-Sterilized / Ready to Use Closures: Manufacturer Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

- 7.3.4. Leading Manufacturers: Analysis by Number of Products

8. KEY INSIGHTS

- 8.1. Chapter Overview

- 8.2. Pre-Sterilized / Ready to Use Containers: Key Insights

- 8.2.1. Analysis by Type of Container and Scale of Operation

- 8.2.2. Analysis by Type of Container and Packaging Format(s)

- 8.2.3. Analysis by Type of Container and Material(s) of Fabrication

- 8.2.4. Analysis by Type of Container and Container Color

- 8.2.5. Analysis by Type of Container and Sterilization Technique(s) Used

- 8.2.6. Analysis by Type of Container and Type of Compatible Drug(s)

- 8.2.7. Analysis by Material(s) of Fabrication and Sterilization Technique(s) Used

- 8.3. Pre-Sterilized / Ready to Use Closures: Key Insights

- 8.3.1. Analysis by Type of Closure and Material(s) of Fabrication

- 8.3.2. Analysis by Type of Closure and Sterilization Technique(s) Used

- 8.3.3. Analysis by Type of Closure and Available Finish Format(s)

- 8.3.4. Analysis by Type of Closure and Type of Compatible Drug(s)

9. PRODUCT COMPETITIVENESS ANALYSIS: PRE-STERILIZED / READY TO USE CONTAINERS

- 9.1. Chapter Overview

- 9.2. Pre-Sterilized / Ready to Use Containers: Product Competitiveness Analysis

- 9.2.1. Assumptions and Key Parameters

- 9.2.2. Methodology

- 9.2.3. Product Competitiveness Analysis: Vials

- 9.2.4. Product Competitiveness Analysis: Syringes

- 9.2.5. Product Competitiveness Analysis: Bags

- 9.2.6. Product Competitiveness Analysis: Cartridges

10. PRODUCT COMPETITIVENESS ANALYSIS: PRE-STERILIZED / READY TO USE CLOSURES

- 10.1. Chapter Overview

- 10.2. Pre-Sterilized / Ready to Use Closures: Product Competitiveness Analysis

- 10.2.1. Assumptions and Key Parameters

- 10.2.2. Methodology

- 10.2.3. Product Competitiveness Analysis: Stoppers

- 10.2.4. Product Competitiveness Analysis: Plungers

- 10.2.5. Product Competitiveness Analysis: Caps

- 10.2.6. Product Competitiveness Analysis: Tip Caps / Needle Shields

- 10.2.7. Product Competitiveness Analysis: Seals

11. COMPANY PROFILES

- 11.1. Chapter Overview

- 11.2. APG Pharma Packaging

- 11.2.1. Company Overview

- 11.2.2. Product Portfolio

- 11.2.2.1. Ready to Use Closures

- 11.2.3. Recent Developments and Future Outlook

- 11.3. Aptar

- 11.3.1. Company Overview

- 11.3.2. Financial Information

- 11.3.3. Product Portfolio

- 11.3.3.1. Ready to Use Closures

- 11.3.4. Recent Developments and Future Outlook

- 11.4. Daikyo Seiko

- 11.4.1. Company Overview

- 11.4.2. Product Portfolio

- 11.4.2.1. Ready to Use Containers

- 11.4.2.2. Ready to Use Closures

- 11.4.3. Recent Developments and Future Outlook

- 11.5. Datwyler

- 11.5.1. Company Overview

- 11.5.2. Financial Information

- 11.5.3. Product Portfolio

- 11.5.3.1. Ready to Use Closures

- 11.5.4. Recent Developments and Future Outlook

- 11.6. DWK Life Sciences

- 11.6.1. Company Overview

- 11.6.2. Product Portfolio

- 11.6.2.1. Ready to Use Containers

- 11.6.2.2. Ready to Use Closures

- 11.6.3. Recent Developments and Future Outlook

- 11.7. Ningbo Zhengli Pharmaceutical Packaging

- 11.7.1. Company Overview

- 11.7.2. Product Portfolio

- 11.7.2.1. Ready to Use Containers

- 11.7.3. Recent Developments and Future Outlook

- 11.8. SCHOTT

- 11.8.1. Company Overview

- 11.8.2. Financial Information

- 11.8.3. Product Portfolio

- 11.8.3.1. Ready to Use Containers

- 11.8.3.2. Ready to Use Closures

- 11.8.4. Recent Developments and Future Outlook

- 11.9. Stevanato

- 11.9.1. Company Overview

- 11.9.2. Product Portfolio

- 11.9.2.1. Ready to Use Containers

- 11.9.2.2. Ready to Use Closures

- 11.9.3. Recent Developments and Future Outlook

- 11.10. West Pharmaceutical Services

- 11.10.1. Company Overview

- 11.10.2. Financial Information

- 11.10.3. Product Portfolio

- 11.10.3.1. Ready to Use Containers

- 11.10.3.2. Ready to Use Closures

- 11.10.4. Recent Developments and Future Outlook

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnership Models

- 12.3. Pre-Sterilized / Ready to Use Pharmaceutical Packaging: Partnerships and Collaborations

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Year and Type of Partnership

- 12.3.4. Analysis by Type of Partner

- 12.3.5. Analysis by Year of Partnership and Type of Partner

- 12.3.6. Analysis by Type of Partnership and Type of Partner

- 12.3.7. Analysis by Purpose of Partnership

- 12.3.8. Analysis by Type of Packaging System

- 12.3.9. Analysis by Type of Packaging Material

- 12.3.10. Most Active Players: Analysis by Number of Partnerships

- 12.3.11. Analysis by Geography

- 12.3.11.1. Intercontinental and Intracontinental Deals

13. MARKET ENTRY DECISION MAKING FRAMEWORK

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Key Parameters Impacting Market Entry Decision Making

- 13.3.1. Product Reach

- 13.3.2. Product Differentiation

- 13.3.3. Market Activity

- 13.3.4. Product Competitiveness

- 13.3.5. Manufacturing Complexity

- 13.4. Concluding Remarks

14. DEMAND ANALYSIS

- 14.1. Chapter Overview

- 14.2. Scope and Methodology

- 14.3. Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging: Distribution by Type of Container

- 14.3.1. Pre-Sterilized / Ready to Use Vials, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.3.2. Pre-Sterilized / Ready to Use Syringes, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.3.3. Pre-Sterilized / Ready to Use Cartridges, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.4. Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging: Distribution by Type of Closure

- 14.4.1. Pre-Sterilized / Ready to Use Caps, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.4.2. Pre-Sterilized / Ready to Use Plungers, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.4.3. Pre-Sterilized / Ready to Use Seals, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.4.4. Pre-Sterilized / Ready to Use Stoppers, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.4.5. Pre-Sterilized / Ready to Use Tip Caps / Needle Shields, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.5. Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging: Distribution by Material of Fabrication

- 14.5.1. Pre-Sterilized / Ready to Use Aluminum Containers and Closures, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.5.2. Pre-Sterilized / Ready to Use Glass Containers and Closures, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.5.3. Pre-Sterilized / Ready to Use Plastic Containers and Closures, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.5.4. Pre-Sterilized / Ready to Use Rubber Containers and Closures, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.6. Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging: Distribution by Key Geographical Region

- 14.6.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.6.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.6.3. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Asia, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.6.4. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Latin America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.6.5. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Middle East and North Africa, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.6.6. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

15. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 15.1. Chapter Overview

- 15.2. Market Drivers

- 15.3. Market Restraints

- 15.4. Market Opportunities

- 15.5. Market Challenges

- 15.6. Conclusion

16. GLOBAL PRE-STERILIZED / READY TO USE PHARMACEUTICAL PACKAGING MARKET

- 16.1. Chapter Overview

- 16.2. Assumptions and Methodology

- 16.3. Global Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.3.1. Scenario Analysis

- 16.3.1.1. Conservative Scenario

- 16.3.1.2. Optimistic Scenario

- 16.3.1. Scenario Analysis

- 16.4. Key Market Segmentations

- 16.5. Dynamic Dashboard

17. PRE-STERILIZED / READY TO USE PHARMACEUTICAL PACKAGING MARKET, BY TYPE OF CONTAINER

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Pre-Sterilized / Ready to use Pharmaceutical Packaging Market: Distribution by Type of Container

- 17.3.1. Vials: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.3.2. Syringes: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.3.3. Cartridges: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.4. Data Triangulation and Validation

18. PRE-STERILIZED / READY TO USE PHARMACEUTICAL PACKAGING MARKET, BY TYPE OF CLOSURE

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market: Distribution by Type of Closure

- 18.3.1. Caps: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.3.2. Plungers: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.3.3. Seals: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.3.4. Stoppers: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.3.5. Tip Caps / Needle Shields: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.4. Data Triangulation and Validation

19. PRE-STERILIZED / READY TO USE PHARMACEUTICAL PACKAGING MARKET, BY MATERIAL OF FABRICATION

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Aluminum Containers and Closures: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.4. Glass Containers and Closures: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.5. Plastic Containers and Closures: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6. Rubber Containers and Closures: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.7. Data Triangulation and Validation

20. PRE-STERILIZED / READY TO USE PHARMACEUTICAL PACKAGING MARKET, BY KEY GEOGRAPHICAL REGION

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.3.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.4. Europe: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.4.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.5. Asia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.5.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.6. Latin America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.6.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.7. Middle East and North Africa: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.7.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.7.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.8. Rest of the World: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.8.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.8.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.9. Data Triangulation and Validation

21. EMERGING TRENDS IN PHARMACEUTICAL PACKAGING

- 21.1. Chapter Overview

- 21.2. Emerging Trends

- 21.2.1. Preference for Self-Medication of Drugs, Through the Use of Modern Drug Delivery Devices

- 21.2.2. Development of Improved Packaging Components and Efforts to Optimize Manufacturing Costs

- 21.2.3. Availability of Modular Facilities

- 21.2.4. Growing Demand and Preference for Personalized Therapies

- 21.2.5. Rise in Provisions for Automating Fill / Finish Operations

- 21.2.6. Surge in Partnership Activity

- 21.2.7. Increase in Initiatives Undertaken by Industry Stakeholders in Developing Regions

- 21.3. Concluding Remarks

22. CASE STUDY: ROBOTICS IN PHARMACEUTICAL PACKAGING

- 22.1. Chapter Overview

- 22.2. Role of Robotics in Pharmaceutical Industry

- 22.2.1. Key Considerations for Selecting a Robotic System

- 22.2.2. Advantages of Robotic Systems

- 22.2.3. Disadvantages of Robotic Systems

- 22.3. Companies Providing Robots for Use in Pharmaceutical Industry

- 22.4. Companies Providing Equipment Integrated Robotic Systems in Pharmaceutical Packaging

- 22.4.1. Aseptic Technologies

- 22.4.1.1. Crystal L1 Robot Line

- 22.4.1.2. Crystal SL1 Robot Line

- 22.4.2. AST

- 22.4.2.1. ASEPTiCELL

- 22.4.2.2. GENiSYS R

- 22.4.2.3. GENiSYS C

- 22.4.2.4. GENiSYS Lab

- 22.4.3. Bosch Packaging Technology

- 22.4.3.1. ATO

- 22.4.4. Dara Pharma

- 22.4.4.1. SYX-E Cartridge + RABS

- 22.4.5. Fedegari

- 22.4.5.1. Fedegari Isolator

- 22.4.6. IMA

- 22.4.6.1. INJECTA

- 22.4.6.2. STERI LIF3

- 22.4.7. Steriline

- 22.4.7.1. Robotic Nest Filling Machine (RNFM)

- 22.4.7.2. Robotic Vial Filling Machine (RVFM)

- 22.4.7.3. Robotic Vial Capping Machine (RVCM)

- 22.4.8. Vanrx Pharmasystems

- 22.4.8.1. Microcell Vial Filler

- 22.4.8.2. SA25 Aseptic Filling Workcell

- 22.4.1. Aseptic Technologies

- 22.5. Concluding Remarks

23. CONCLUSION

- 23.1. Chapter Overview

24. EXECUTIVE INSIGHTS

- 24.1. Chapter Overview

- 24.2. Company A

- 24.2.1. Company Snapshot

- 24.2.2. Interview Transcript: Business Development Specialist

- 24.3. Company B

- 24.3.1. Company Snapshot

- 24.3.2. Interview Transcript: Founder and Managing Director

- 24.4. Company C

- 24.4.1. Company Snapshot

- 24.4.2. Interview Transcript: Business Development and Technology Director

- 24.5. Company D

- 24.5.1. Company Snapshot

- 24.5.2. Interview Transcript: Former Facilitator

- 24.6. Company E

- 24.6.1. Company Snapshot

- 24.6.2. Interview Transcript: Former Project Manager of Business Development