|

시장보고서

상품코드

1891252

차세대 시퀀싱 키트 시장 : 시퀀싱 대상 뉴클레오타이드 유형별, 최종사용자 유형별, 주요 지역별 업계 동향과 예측NGS Kits Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Nucleotide Sequenced, Type of End User and Key Geographical Regions |

||||||

차세대 시퀀싱(NGS) 키트 시장 - 개요

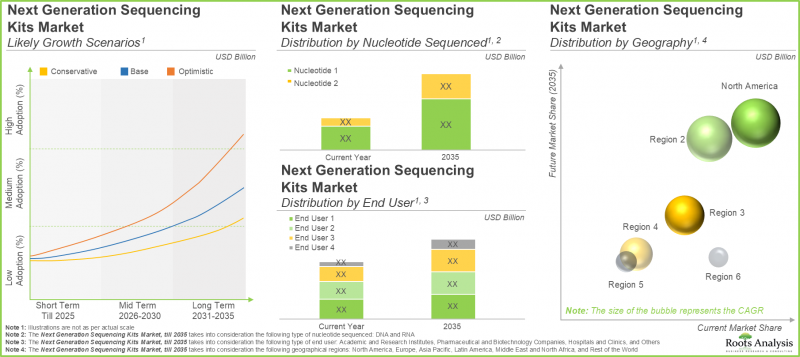

차세대 시퀀싱(NGS) 키트 시장 규모는 올해 11억 달러 규모로 추정되며, 2035년까지 예측 기간 동안 115억 달러 규모로 성장할 것으로 전망됩니다.

NGS 키트 시장 - 개요

시장 규모 및 기회 분석은 다음 매개변수에 따라 세분화됩니다.

시퀀싱 대상 뉴클레오타이드 유형

- DNA

- RNA

최종 사용자

- 학술기관 및 연구기관

- 제약 및 생명공학 기업

- 병원 및 진료소

- 기타

주요 지역

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 북아프리카

- 기타 지역

차세대 시퀀싱 키트 시장 - 성장과 동향

Frederick Sanger가 1977년에 유전자 시퀀싱 기술을 도입한 이래 유전체 데이터 수집 및 분석 분야는 현저한 진보를 이루었습니다. DNA 시퀀싱 방법의 개선은 정밀의료 및 진단을 포함한 다양한 의료 관련 조사 분야에서 현저한 진전을 보이고 있습니다. 특히, 전장 유전체와 전장 엑솜 시퀀싱을 가능하게 하는 차세대 시퀀싱(NGS) 기술과 NGS 검사 키트의 영향이 가장 두드러집니다. 이 선진적이고 신속한 유전체 시퀀싱 기술은 비용과 소요 시간을 크게 줄였습니다. 인간 유전체 프로젝트(약 30억 달러)와 비교할 때, 현재의 기술은 개인용 유전체 시퀀싱 비용이 상당히 감소(1,000 USD)했습니다.

NGS 검사 키트와 차세대 시퀀싱 키트 시장의 지속적인 발전으로 인해 이해관계자들은 앞으로 10년간 앞서 언급한 비용이 100달러까지 떨어질 가능성도 예상하고 있습니다. 이 유전체 시퀀싱 비용의 저감이 세계적으로 시퀀싱되는 유전체 수 증가로 이어지고 있습니다.

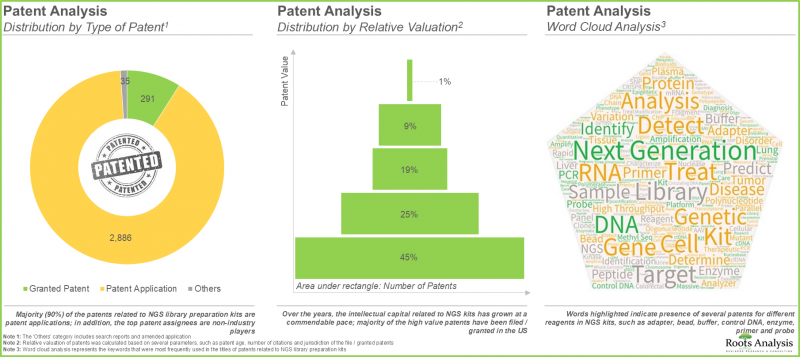

유전체학 분야에서의 최신 진보에도 불구하고, 뉴클레오타이드 라이브러리 제조 공정에는 여전히 몇 가지 과제가 존재합니다. 구체적으로는 많은 양의 입력 샘플이 필요하고 수율이 적으며 제품 품질이 우려됩니다. 게다가, 수동으로 DNA 라이브러리 및 RNA 라이브러리를 준비하는 과정은 시간이 많이 걸리고 많은 조작과 고가의 시약을 필요로 합니다. 따라서 제약 업계의 혁신자들은 DNA 라이브러리 및 RNA 라이브러리의 제조 공정을 개선하는 방법을 끊임없이 모색 및 개발하고 있습니다. 다른 대안들 중에서 차세대 시퀀싱(NGS) 라이브러리 준비 키트의 사용은 기존의 DNA 라이브러리 및 RNA 라이브러리 준비 방법과 관련된 기존 과제를 극복하는 효과적인 옵션으로 다양한 의약품 개발 기업과 학술 및 연구 기관 간에 대두되었습니다. 이 키트는 소량의 입력 재료로 만들어져 최소한의 오류로 정확한 DNA 인코딩 라이브러리 및 RNA 라이브러리를 생성할 수 있습니다. 현재 시장에는 280가지 유형 이상의 NGS 라이브러리 준비 키트가 유통되고 있으며, 일루미나(R), Ion Torrent(R), BGI NGS 플랫폼 등 폭넓은 시퀀싱 플랫폼에 대응하고 있습니다. 지난 수년간 NGS 라이브러리 준비 키트와 관련된 3,200건 이상의 특허가 출원 및 승인되고 있으며, NGS 키트 시장에서 지속적인 기술 혁신이 나타나고 있는 점이 특징입니다. 유전자 치료에 대한 수요 증가와 새로운 고급 NGS 기술의 도입을 배경으로 NGS 라이브러리 준비 키트 시장은 예측 기간 동안 꾸준한 성장이 예상됩니다.

NGS 키트 시장 - 주요 인사이트

이 보고서는 NGS 키트 시장의 현재 상태를 상세하게 분석하고 업계 내 잠재적 성장 기회를 확인합니다. 주요 조사 결과는 다음과 같습니다.

- 현재 약 60개사의 제조업체에 의해 280가지 유형 이상의 NGS 라이브러리 준비 키트가 제공되고 있으며, 이 키트는 정제 RNA 및 DNA나 세포 등 다양한 입력 샘플에 대응하고 있습니다.

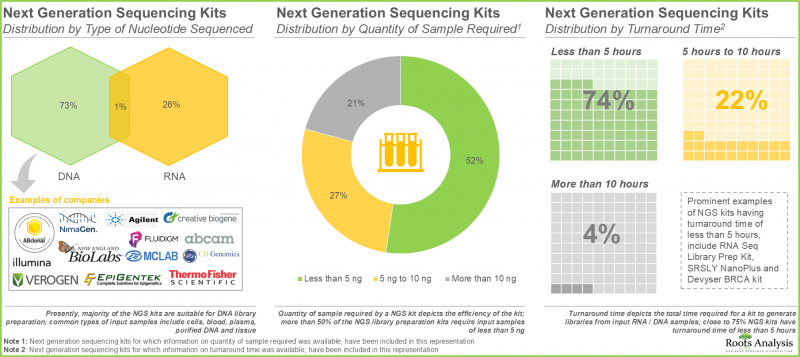

- 이해관계자는 전문 지식을 활용하여 DNA 및 RNA 라이브러리 준비를 위한 다양한 NGS 키트를 제공합니다. 이 키트의 대부분은 5ng 미만의 입력 샘플로 사용할 수 있습니다.

- 현재 시장 상황은 신규 진출기업과 기존 기업이 분산된 상태이며, 미국은 NGS 라이브러리 준비 키트의 혁신 거점으로 간주되고 있습니다.

- 경쟁 우위를 확보하기 위해 NGS 라이브러리 준비 키트 제공업체는 현재 기존 능력을 확대하고 각 기업의 제품 포트폴리오를 확대하는 데 주력하고 있습니다.

- NGS 라이브러리 준비 키트와 관련된 3,250건 이상의 특허가 최근 출원 및 승인되고 있으며, 이 분야에서 혁신의 페이스가 가속하고 있음을 나타내고 있습니다.

- 약 70개의 업계 진출 기업이 2세대 및 3세대 시퀀싱 기술을 활용한 NGS 기반 서비스에 대한 정교한 포트폴리오를 제공하고 있습니다.

- 이 시장은 2035년까지 높은 CAGR로 성장할 것으로 예상되고 있으며, 예측되는 기회는 다른 유형의 핵산 서열, 최종 사용자, 주요 지리적 지역에 분산될 가능성이 높습니다.

NGS 키트 시장 - 주요 부문

DNA 부문이 NGS 키트 시장 점유율의 대부분을 차지할 전망

핵산 유형별로 시장은 DNA와 RNA로 구분됩니다. 올해에는 DNA 부문이 시장 점유율의 대부분(약 70%)을 차지하고 있습니다. 그러나 예측 기간 동안 RNA 분절이 5.1%라는 더 높은 CAGR로 성장할 것으로 예측됩니다.

2035년에는 병원 및 진료소가 NGS 키트 시장에서 가장 큰 점유율을 차지할 전망

최종 사용자별로는 병원 및 진료소, 제약 및 생명공학 기업, 학술연구기관, 기타로 시장이 구분됩니다. 2035년까지 병원 및 진료소가 약 45% 시장 점유율을 차지하고 제약 및 생명공학 기업이 30%의 점유율을 획득할 것으로 예측됩니다.

북미가 차세대 시퀀싱 키트 시장 성장을 견인할 전망

지리적 지역별로 시장은 북미, 유럽, 아시아태평양, 중동 및 북아프리카(MENA), 라틴아메리카 및 기타 세계 지역으로 구분됩니다. 특히 북미는 2035년까지 약 40%라는 최대 시장 점유율을 획득할 것으로 전망됩니다.

NGS 키트 시장의 대표 기업

- Agilent Technologies

- BioDynami

- Creative Biogene

- New England Biolabs

- PerkinElmer

- Thermo Fisher Scientific

- Abcam

- Devyser

- Diagenode

- Lexogen

- Roche

- Tecan

- Enzynomics

- MGI

- Takara Bio

- TIANGEN Biotech

- TransGen Biotech

- Vazym

NGS 키트 시장 - 조사 범위

- 시장 규모 및 기회 분석 : 본 보고서는 차세대 시퀀싱 키트 시장에 대해 (A)시퀀싱 대상 뉴클레오타이드 유형, (B)최종 사용자 유형, (C)주요 지역과 같은 주요 시장 부문에 초점을 맞춘 상세한 분석을 제공합니다.

- 시장 상황 : (A)시퀀싱 대상 뉴클레오타이드 유형, (B)키트 구성요소, (C)필요 샘플량, (D)턴어라운드 시간, (E)보존 온도, (F)사용 샘플 유형, (G)키트 보존 기간, (H)시퀀싱 유형, (I)사용 시퀀싱 플랫폼 유형 등 다수의 관련 파라미터에 기초한 차세대 시퀀싱 시장 상황을 제시합니다.

- 기업 경쟁력 분석 : (A)공급업체의 힘, (B)제품의 경쟁력 등의 요소를 종합적으로 검토한 NGS 라이브러리 준비 키트에 대한 분석을 제공합니다.

- 기업 프로파일 : 북미, 유럽, 아시아태평양의 NGS 라이브러리 준비 키트 제공 기업에 대해 (A)설립 연도, (B)본사 소재지, (C)독점 기술 플랫폼, (D)최근 동향, (E)미래 전망과 같은 여러 매개 변수를 기반으로 상세한 프로파일을 제공합니다.

- 특허 분석 : 업계가 R&D 관점에서 어떻게 진화하는지에 대한 개요를 제공하기 위한 상세한 특허 분석을 제공합니다. 구체적으로는 (A)공개연도, (B)지리적 지역, (C)CPC기호, (D)특허 중점분야, (E)출원인 유형, (F)주요업계 진입기업 등을 대상으로 분석합니다.

목차

제1장 서문

제2장 주요 요약

제3장 소개

- 개요

- 유전체 시퀀싱의 개요

- 유전체 시퀀싱 유형

- 미래 전망

제4장 시장 상황

- 개요

- 차세대 시퀀싱 키트 : 시장 상황

- 차세대 시퀀싱 키트 : 제공업체 일람

제5장 제품 경쟁력 분석

제6장 기업 프로파일 : 북미의 차세대 시퀀싱 키트 제공업체

- 개요

- Agilent Technologies

- BioDynami

- Creative Biogene

- New England Biolabs

- PerkinElmer

- Thermo Fisher Scientific

제7장 기업 프로파일 : 유럽의 차세대 시퀀싱 키트 제공업체

- 개요

- Abcam

- Devyser

- Diagenode

- Lexogen

- Roche

- Tecan

제8장 기업 프로파일 : 아시아태평양의 차세대 시퀀싱 키트 제공업체

- 개요

- Enzynomics

- MGI

- Takara Bio

- TIANGEN Biotech

- TransGen Biotech

- Vazyme

제9장 특허 분석

제10장 시장 예측과 기회 분석

- 개요

- 예측 조사 방법과 주요 전제조건

- 세계의 차세대 시퀀싱 키트 시장(-2035년)

제11장 사례 연구 : 차세대 시퀀싱 기술 및 서비스 제공업체

- 개요

- 유전체 시퀀싱의 역사적 진화

- 차세대 시퀀싱 기술

- 차세대 시퀀싱 서비스 제공업체

- 차세대 시퀀싱 서비스 제공업체 : 업계외 기업

제12장 결론

제13장 주요 인사이트

제14장 부록 1 : 표 형식 데이터

제15장 부록 2 : 기업 및 단체 일람

CSM 25.12.26NGS Kits Market: Overview

As per Roots Analysis, the NGS kits market is estimated to grow from USD 1.1 billion in the current year and is anticipated to grow to USD 11.5 billion during the forecast period, till 2035.

NGS Kits Market: Overview

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Nucleotide Sequenced

- DNA

- RNA

End-user

- Academics and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Hospitals and Clinics

- Other End-users

Key Geographies

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and North Africa

- Rest of the World

NGS Kits market: Growth and Trends

The field of genomic data gathering and analysis has progressed notably since Frederick Sanger introduced a gene sequencing technique in 1977. Improvements in DNA sequencing methods have resulted in notable progress across various healthcare-related research areas, including precision medicine and diagnostics. Specifically, the effect of next generation sequencing (NGS) techniques and NGS testing kits, which facilitate whole genome and whole exome sequencing, has been the most significant. This advanced, rapid genome sequencing method has significantly lowered both the expenses and time required. In comparison to the Human Genome Project (~USD 3 billion), the expense of sequencing an individual genome has significantly dropped (to USD 1,000) with present technologies.

Due to the continuous advancements in NGS testing kits and next generation sequencing kits market, stakeholders also expect that, in the coming decade, the previously mentioned cost might drop to USD 100. It is important to note that this reduction in genome sequencing expenses has resulted in a rise in the number of genomes sequenced worldwide.

Despite the recent advances in the field of genomics, the nucleotide library preparation process still faces several challenges, including requirement of large amounts of input samples, low volume of yield and concerns related to quality of the product. In addition, the manual DNA library / RNA library preparation process is time consuming, requiring extensive manipulation and expensive reagents. Therefore, innovators in the pharmaceutical industry are constantly identifying / developing ways to improve the process of DNA library / RNA library preparation. Amidst other alternatives, the use of NGS library preparation kits has emerged as a viable option for various drug developers and academic / research institutes to overcome the existing challenges associated with conventional DNA library / RNA library preparation methods. These kits require less input material and are capable of generating precise DNA encoded library / RNA libraries with minimum errors. Presently, more than 280 NGS library preparation kits are available in the market; these are compatible with a broad range of sequencing platforms, including Illumina(R), Ion Torrent(R) and BGI NGS platforms. It is worth mentioning that over 3,200 patents related to NGS library preparation kits have been filed / granted in the past few years, demonstrating the continued innovation in NGS kits market. Driven by the increasing demand for gene therapies and the introduction of novel and advanced NGS techniques, the NGS library preparation kits market is anticipated to witness steady market growth during the forecast period.

NGS Kits Market: Key Insights

The report delves into the current state of the NGS kits market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, more than 280 NGS library preparation kits are being offered by close to 60 players; these kits are compatible with a variety of input samples, including purified RNA / DNA and cells.

- Leveraging their expertise, stakeholders are offering a myriad of NGS kits for preparing DNA and RNA libraries; majority of these kits require less than 5 ng of input samples

- The current market landscape is fragmented, featuring both new entrants and established players; the US is currently considered to be a hub of innovation for NGS library preparation kits.

- In pursuit of gaining a competitive edge, NGS library preparation kit providers are presently focusing on expansion of their existing capabilities and augmenting their respective product portfolios.

- Over 3,250 patents related to NGS library preparation kits have recently been filed / granted, indicating the heightened pace of innovation in this domain.

- Around 70 industry players claim to offer elaborate portfolios of NGS based services, leveraging a variety of second and third generation sequencing technologies.

- The market is anticipated to grow at a notable CAGR till 2035; the projected opportunity is likely to be distributed across different type of nucleotide sequenced, end user and key geographical regions.

NGS Kits Market: Key Segments

DNA Segment is Likely to Capture Majority of the NGS Kits Market Share

In terms of type of nucleotide sequenced, the market is segmented across DNA and RNA. In the current year, the DNA segment captures most of the market share (~ 70%). However, the RNA segment will grow at a higher CAGR of 5.1% during the forecast period.

Hospitals and Clinics are Likely to Capture the Highest NGS Kits Market Share in 2035

In terms of end-users, the market is segmented across hospitals and clinics, pharmaceutical and biotechnology companies, academic and research institutes and others. Around 45% of the market share will be captured by hospitals and clinics by 2035, followed by pharmaceutical and biotechnology companies capturing 30% of the market share.

North America is Likely to Propel the Growth of NGS Kits Market

In terms of geographical regions, the market is segmented across North America, Europe, Asia Pacific, MENA, Latin America, and rest of the world. Notably, North America will capture the maximum market share of around 40% by 2035.

Example Players in NGS Kits Market

- Agilent Technologies

- BioDynami

- Creative Biogene

- New England Biolabs

- PerkinElmer

- Thermo Fisher Scientific

- Abcam

- Devyser

- Diagenode

- Lexogen

- Roche

- Tecan

- Enzynomics

- MGI

- Takara Bio

- TIANGEN Biotech

- TransGen Biotech

- Vazym

NGS Kits Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the next generation sequencing kits market, focusing on key market segments, including [A] type of nucleotide sequenced, [B] type of end user, [C] and [E] key geographical regions.

- Market Landscape: A detailed assessment of overall competitive landscape next generation sequencing based on several relevant parameters, such as [A] type of nucleotide sequenced, [B] kit components, [C] quantity of sample required, [D] turnaround time, [E] storage temperature, [F] type of sample used, [G] kit shelf life, [H] type of sequencing and [I] type of sequencing platform used.

- Company Competitiveness Analysis: A comprehensive NGS library preparation kits examining factors, such as [A] supplier power and [B] product competitiveness.

- Company Profiles: In-depth profiles of NGS library preparation kits providers in North America, Europe and Asia-Pacific, based on several parameters such as [A] year of establishment, [B] location of headquarters, [C] proprietary technology platforms, [D] recent developments and [E] an informed future outlook.

- Patent Analysis: An in-depth patent analysis to provide an overview of how the industry is evolving from the R&D perspective such as [A] publication year, [B] geographical region, [C] CPC symbols, [D] patent focus areas, [E] type of applicant and [F] leading industry players.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the current global capacity of developers?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.3. Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Genome Sequencing

- 3.3. Types of Genome Sequencing

- 3.3.1. Next Generation Sequencing

- 3.3.1.1. Applications of Next Generation Sequencing

- 3.3.1.1.1. Cancer and Affiliated Biomarker Research

- 3.3.1.1.2. Diagnostics

- 3.3.1.1.3. Personalized / Precision Medicine

- 3.3.1.1.4. Forensics

- 3.3.1.2. Steps Involved in Next Generation Sequencing

- 3.3.1.2.1. Library Preparation

- 3.3.1.2.2. Amplification

- 3.3.1.2.3. Sequencing

- 3.3.1.2.4. Bioinformatics Analysis and Data Interpretation

- 3.3.1.3. Components of Next Generation Sequencing Kits

- 3.3.1.1. Applications of Next Generation Sequencing

- 3.3.1. Next Generation Sequencing

- 3.4. Future Perspectives

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Next Generation Sequencing Kits: Overall Market Landscape

- 4.2.1. Analysis by Type of Nucleotide Sequenced

- 4.2.2. Analysis by Kit Components

- 4.2.3. Analysis by Quantity of Sample Required

- 4.2.4. Analysis by Turnaround Time

- 4.2.5. Analysis by Storage Temperature

- 4.2.6. Analysis by Type of Sample Used

- 4.2.7. Analysis by Kit Shelf Life

- 4.2.8. Analysis by Type of Sequencing

- 4.2.9. Analysis by Type of Sequencing Platform Used

- 4.3. Next Generation Sequencing Kits: List of Providers

- 4.3.1. Analysis by Year of Establishment

- 4.3.2. Analysis by Company Size

- 4.3.3. Analysis by Location of Headquarters

- 4.3.4. Leading Players: Analysis by Number of Products

5. PRODUCT COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions and Methodology

- 5.3. Product Competitiveness Analysis: Competitive Landscape

6. COMPANY PROFILES: NEXT GENERATION SEQUENCING KITS PROVIDERS IN NORTH AMERICA

- 6.1. Chapter Overview

- 6.2. Agilent Technologies

- 6.2.1. Company Overview

- 6.2.2. Financial Information

- 6.2.3. NGS Kit Portfolio

- 6.2.4. Recent Developments and Future Outlook

- 6.3. BioDynami

- 6.3.1. Company Overview

- 6.3.2. NGS Kit Portfolio

- 6.3.3. Recent Developments and Future Outlook

- 6.4. Creative Biogene

- 6.4.1. Company Overview

- 6.4.2. NGS Kit Portfolio

- 6.4.3. Recent Developments and Future Outlook

- 6.5. New England Biolabs

- 6.5.1. Company Overview

- 6.5.2. NGS Kit Portfolio

- 6.5.3. Recent Developments and Future Outlook

- 6.6. PerkinElmer

- 6.6.1. Company Overview

- 6.6.2. Financial Information

- 6.6.3. NGS Kit Portfolio

- 6.6.4. Recent Developments and Future Outlook

- 6.7. Thermo Fisher Scientific

- 6.7.1. Company Overview

- 6.7.2. Financial Information

- 6.7.3. NGS Kit Portfolio

- 6.7.4. Recent Developments and Future Outlook

7. COMPANY PROFILES: NEXT GENERATION SEQUENCING KITS PROVIDERS IN EUROPE

- 7.1. Chapter Overview

- 7.2. Abcam

- 7.2.1 Company Overview

- 7.2.2. Financial Information

- 7.2.3. NGS Kit Portfolio

- 7.2.4. Recent Developments and Future Outlook

- 7.3. Devyser

- 7.3.1 Company Overview

- 7.3.2. NGS Kit Portfolio

- 7.3.3. Recent Developments and Future Outlook

- 7.4. Diagenode

- 7.4.1 Company Overview

- 7.4.2. NGS Kit Portfolio

- 7.4.3. Recent Developments and Future Outlook

- 7.5. Lexogen

- 7.5.1 Company Overview

- 7.5.2. NGS Kit Portfolio

- 7.5.3. Recent Developments and Future Outlook

- 7.6. Roche

- 7.6.1 Company Overview

- 7.6.2. Financial Information

- 7.6.3. NGS Kit Portfolio

- 7.6.4. Recent Developments and Future Outlook

- 7.7. Tecan

- 7.7.1 Company Overview

- 7.7.2. Financial Information

- 7.7.3. NGS Kit Portfolio

- 7.7.4. Recent Developments and Future Outlook

8. COMPANY PROFILES: NEXT GENERATION SEQUENCING KITS PROVIDERS IN ASIA PACIFIC

- 8.1. Chapter Overview

- 8.2. Enzynomics

- 8.2.1. Company Overview

- 8.2.2. NGS Kit Portfolio

- 8.2.3. Recent Developments and Future Outlook

- 8.3. MGI

- 8.3.1. Company Overview

- 8.3.2. NGS Kit Portfolio

- 8.3.3. Recent Developments and Future Outlook

- 8.4. Takara Bio

- 8.4.1. Company Overview

- 8.4.2. Financial Information

- 8.4.3. NGS Kit Portfolio

- 8.4.4. Recent Developments and Future Outlook

- 8.5. TIANGEN Biotech

- 8.5.1. Company Overview

- 8.5.2. NGS Kit Portfolio

- 8.5.3. Recent Developments and Future Outlook

- 8.6. TransGen Biotech

- 8.6.1. Company Overview

- 8.6.2. NGS Kit Portfolio

- 8.6.3. Recent Developments and Future Outlook

- 8.7. Vazyme

- 8.7.1. Company Overview

- 8.7.2. NGS Kit Portfolio

- 8.7.3. Recent Developments and Future Outlook

9. PATENT ANALYSIS

- 9.1. Chapter Overview

- 9.2. Scope and Methodology

- 9.3. Next Generation Sequencing Kits: Patent Analysis

- 9.3.1 Analysis by Publication Year

- 9.3.2. Analysis by Geography

- 9.3.3. Analysis by CPC Symbols

- 9.3.4. Emerging Focus Areas

- 9.3.5. Analysis by Type of Applicant

- 9.3.6. Leading Players: Analysis by Number of Patents

- 9.4. Next Generation Sequencing Kits: Patent Benchmarking

- 9.4.1. Analysis by Patent Characteristics

- 9.5. Next Generation Sequencing Kits: Patent Valuation

- 9.6. Leading Patents: Analysis by Number of Citations

10. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 10.1. Chapter Overview

- 10.2. Forecast Methodology and Key Assumptions

- 10.3. Global Next Generation Sequencing Kits Market, Till 2035

- 10.3.1. Next Generation Sequencing Kits Market, 2021 and 2035: Distribution by Type of Nucleotide Sequenced

- 10.3.1.1. Next Generation Sequencing Kits Market for DNA, Till 2035

- 10.3.1.2. Next Generation Sequencing Market for RNA, Till 2035

- 10.3.2. Next Generation Sequencing Kits Market, 2021 and 2035: Distribution by Type of End User

- 10.3.2.1. Next Generation Sequencing Kits Market for Academic and Research Institutes, Till 2035

- 10.3.2.2. Next Generation Sequencing Kits Market for Pharmaceutical and Biotechnology Companies, Till 2035

- 10.3.2.3. Next Generation Sequencing Kits Market for Hospitals and Clinics, Till 2035

- 10.3.2.4. Next Generation Sequencing Kits Market for Others, Till 2035

- 10.3.3. Next Generation Sequencing Kits Market, 2021 and 2035: Distribution by Geography

- 10.3.3.1. Next Generation Sequencing Kits Market in North America, Till 2035

- 10.3.3.2. Next Generation Sequencing Kits Market in Europe, Till 2035

- 10.3.3.3. Next Generation Sequencing Kits Market in Asia Pacific, Till 2035

- 10.3.3.4. Next Generation Sequencing Kits Market in Middle East and North Africa, Till 2035

- 10.3.3.5. Next Generation Sequencing Kits Market in Latin America, Till 2035

- 10.3.3.6. Next Generation Sequencing Kits Market in Rest of the World, Till 2035

- 10.3.1. Next Generation Sequencing Kits Market, 2021 and 2035: Distribution by Type of Nucleotide Sequenced

11. CASE STUDY: NEXT GENERATION SEQUENCING TECHNOLOGIES AND SERVICE PROVIDERS

- 11.1. Chapter Overview

- 11.2. Historical Evolution of Genome Sequencing

- 11.2.1. First Generation DNA Sequencers

- 11.2.2. Second Generation HT-NGS Platforms

- 11.2.3. Third Generation HT-NGS Platforms

- 11.2.3.1. Heliscope Single Molecule Sequencer

- 11.2.3.2. Single Molecule Real Time Sequencer

- 11.2.3.3. Single Molecule Real Time (RNAP) Sequencer

- 11.2.3.4. Nanopore DNA Sequencer

- 11.2.3.5. Multiplex Polony Technology

- 11.2.3.6. The Ion Torrent Sequencing Technology

- 11.2.4. Comparison of First, Second and Third Generation technologies

- 11.3. Next Generation Sequencing Technologies

- 11.3.1. Analysis by Type of Application

- 11.4. Next Generation Sequencing Service Providers

- 11.4.1. Next Generation Sequencing Service Providers: Industry Players

- 11.4.2. Analysis by Year of Establishment

- 11.4.3. Analysis by Company Size

- 11.4.4. Analysis by Location of Headquarters

- 11.4.5. Analysis by Type of Service Offered

- 11.5. Next Generation Sequencing Service Providers: Non-Industry Players

- 11.5.1. Analysis by Year of Establishment

- 11.5.2. Analysis by Location of Headquarters

- 11.5.3. Analysis by Type of Service Offered

12. CONCLUDING REMARKS

13. EXECUTIVE INSIGHTS

- 13.1. Chapter Overview

- 13.2. Company A

- 13.2.1. Company Snapshot

- 13.2.2. Interview Transcript: General Manager, Very Large Company, Switzerland