|

시장보고서

상품코드

1895184

재생 테레프탈산 시장(-2035년) : 제품 유형별, 유도체별, 응용 분야별, 기업 유형별, 지역별, 업계 동향, 예측Recycled Terephthalic Acid Market, Till 2035: Distribution by Type of Product, Derivative, Application Area, Type of Enterprise, and Geographical Regions: Industry Trends and Forecasts |

||||||

재생 테레프탈산 시장 전망

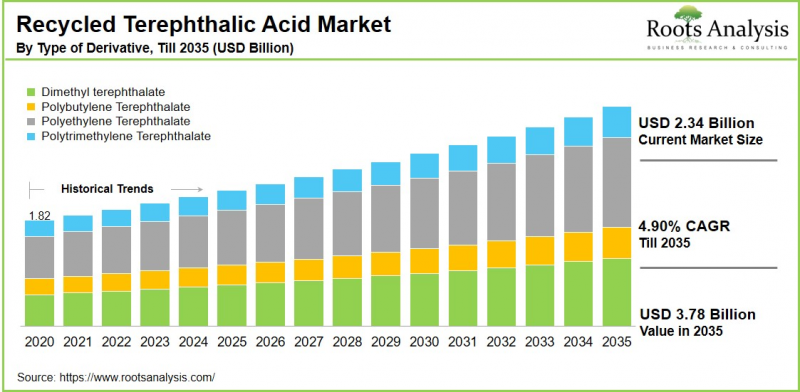

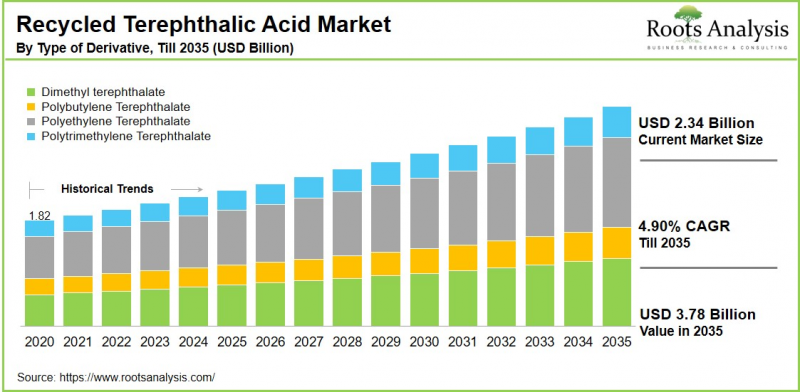

세계의 재생 테레프탈산 시장 규모는 현재 23억 4,000만 달러에서 2035년까지 37억 8,000만 달러에 달할 것으로 추정되며, 2035년까지의 예측 기간에 CAGR로 4.90%의 성장이 전망됩니다.

재생 테레프탈산(rTPA)은 주로 병이나 섬유에서 발생하는 폐플라스틱 폐기물을 화학적으로 재활용하여 생산되는 물질입니다. 화석연료에서 유래한 버진 테레프탈산을 대체할 수 있는 친환경적인 대안이 될 수 있습니다. rTPA는 포장재, 섬유, 기타 다양한 제품에 사용되는 재생 PET(rPET) 수지 등 새로운 폴리머 생산에 활용되어 플라스틱 폐기물을 최소화하고 탄소배출을 줄이는 데 기여하고 있습니다.

자동차 산업에서 지속가능성에 대한 관심이 높아지면서 rTPA에 대한 수요가 증가하고 있으며, Ford와 같은 제조업체는 차량 내-외장 부품에 재활용 플라스틱을 사용하고 있습니다. 이러한 전환은 환경 친화적인 제조 활동을 지원하고 지속가능한 제품에 대한 소비자 수요 증가와 일치합니다. 유럽과 인도 등 지역의 엄격한 환경 규제는 재활용 플라스틱 함량 향상을 의무화하고 플라스틱 폐기물을 줄이기 위해 rPTA의 사용을 촉진하고 있습니다. 이러한 규제는 인도 테레프탈산 시장 확대에 기여하는 중요한 요인이며, 제조업체들이 재생 테레프탈산 품질 기준과 지속가능성 목표를 달성하도록 촉구하고 있습니다.

재생 테레프탈산 시장 : 핵심 포인트

재생 테레프탈산의 주요 생산 기술

재생 테레프탈산(rTPA)을 생산하는 주요 기술로는 가수분해, 글리콜 분해, 메탄올 분해와 같은 화학적 재활용 기술이 있습니다. 이들은 PET(폴리에틸렌 테레프탈레이트) 폐기물을 기본 구성 요소로 분해합니다. 현재 고순도 rTPA의 생산은 가수분해가 주류를 이루고 있지만, 글리콜 분해와 메탄올 분해도 유용한 중간체 생산에 널리 활용되고 있습니다. 또한 효소를 이용한 재활용도 미래지향적이고 효과적인 접근법으로 인식되고 있습니다.

재생 테레프탈산(rTPA)이 순환형 경제를 지원하는 방법

재생 테레프탈산(rTPA)은 글리콜 분해, 메탄올 분해, 가수분해 등의 화학적 재활용 방법을 통해 사용한 PET 폐기물을 고품질 모노머로 전환함으로써 순환경제에서 중요한 역할을 합니다. 이를 통해 병, 섬유, 포장 등 재사용 가능한 PET 생산의 순환을 완성할 수 있습니다. 이러한 노력은 석유에서 추출한 새로운 PTA에 대한 의존도를 낮추고, 매립지와 해양에 플라스틱 폐기물이 쌓이는 것을 줄일 수 있습니다. 또한 1차 생산에 비해 에너지 소비를 50-80% 절감하고, 지속적인 재료 순환을 위한 다양한 재생 사이클을 가능하게 합니다. 재활용 재료 사용 촉진 정책, 지속가능한 포장을 위한 각 브랜드의 노력, 첨단 탈중합 기술에 대한 투자는 확장성을 더욱 높이고 섬유, 소비재(FMCG), 자동차 산업 전반에 걸쳐 환경 부하를 줄이고 자원 효율을 향상시키고 있습니다.

재생 테레프탈산 시장의 주요 성장 동인

재생 테레프탈산 시장의 주요 촉진요인으로는 환경 인식 증가, 플라스틱에 재생 소재의 높은 함량을 의무화하는 엄격한 규제, 섬유, 포장, 자동차 등의 분야에서 순환 경제로 전환하는 전 세계적인 추세 등이 있습니다. 유럽과 인도 등에서는 플라스틱 폐기물을 줄이고 화석연료 의존도를 낮추기 위한 정책이 시행되고 있으며, Ford와 같은 기업의 지속가능성 노력은 친환경 제품에서 재생 테레프탈산(rTPA)에 대한 수요를 촉진하고 있습니다.

또한 소비자의 지속가능한 제품에 대한 선호도, 화학적 탈중합과 같은 재활용 기술의 발전, 폐기물 관리에 대한 자금 투입은 재생 테레프탈산(rTPA)을 버진 소재의 실용적인 대체품으로 자리매김하면서 시장 성장을 더욱 촉진하고 있습니다.

세계의 재생 테레프탈산 시장에 대해 조사했으며, 시장 규모 추산과 기회의 분석, 경쟁 구도, 기업 개요 등의 정보를 제공하고 있습니다.

목차

제1장 프로젝트 개요

제2장 조사 방법

제3장 시장 역학

제4장 거시경제 지표

제5장 개요

제6장 서론

제7장 규제 시나리오

제8장 주요 기업의 종합적 데이터베이스

제9장 경쟁 구도

제10장 화이트 스페이스 분석

제11장 기업 경쟁력 분석

제12장 스타트업 에코시스템 분석

제13장 기업 개요

- 챕터 개요

- Indorama Ventures Public Company

- Alpek

- Biffa

- CARBIOS

- Loop

- Lotte

- Plastipak

- Reliance

- SABIC

- Zhejiang Haili Environmental Technology

제14장 메가트렌드 분석

제15장 미충족 요구 분석

제16장 특허 분석

제17장 최근 발전

제18장 세계의 재생 테레프탈산 시장

제19장 시장 기회 : 제품 유형별

제20장 시장 기회 : 유도체 유형별

제21장 시장 기회 : 응용 분야별

제22장 시장 기회 : 기업 유형별

제23장 북미의 재생 테레프탈산의 시장 기회

제24장 유럽의 재생 테레프탈산의 시장 기회

제25장 아시아의 재생 테레프탈산의 시장 기회

제26장 라틴아메리카의 재생 테레프탈산의 시장 기회

제27장 중동·북아프리카(MENA)의 재생 테레프탈산의 시장 기회

제28장 기타 지역의 재생 테레프탈산 시장의 시장 기회

제29장 시장 집중 분석 : 주요 기업별

제30장 인접 시장 분석

제31장 주요 성공 전략

제32장 Porter's Five Forces 분석

제33장 SWOT 분석

제34장 밸류체인 분석

제35장 Roots의 전략적 제안

제36장 1차 조사로부터의 인사이트

제37장 리포트 결론

제38장 표형식 데이터

제39장 기업·단체 리스트

KSA 26.01.08Recycled Terephthalic Acid Market Outlook

As per Roots Analysis, the global recycled terephthalic acid market size is estimated to grow from USD 2.34 billion in the current year to USD 3.78 billion by 2035, at a CAGR of 4.90% during the forecast period, till 2035.

Recycled terephthalic acid (rTPA) is a substance created through the chemical recycling of post-consumer plastic waste, mainly sourced from bottles and textiles. It serves as an eco-friendly substitute for virgin terephthalic acid, which is derived from fossil fuels. rTPA is utilized in the production of new polymers such as recycled PET (rPET) resins, which are employed in packaging, textiles, and various other products, contributing to the minimization of plastic waste and a reduction in carbon emissions.

The increasing focus on sustainability within the automotive industry is boosting the demand for r-PTA, with manufacturers like Ford utilizing recycled plastics in both the interior and exterior parts of vehicles. This transition supports environment friendly manufacturing practices and aligns with the growing consumer demand for sustainable products. Strict environmental regulations in areas such as Europe and India are promoting the use of r-PTA by requiring greater recycled content and aiming to decrease plastic waste. These regulations are significant factors contributing to the expansion of the Indian terephthalic acid market, motivating producers to meet quality standards for recycled terephthalic acid and sustainability objectives.

Recycled Terephthalic Acid Market: Key Takeaways

Key Technologies Producing Recycled Terephthalic Acid

The primary technologies for generating recycled terephthalic acid (rTPA) involve chemical recycling methods like hydrolysis, glycolysis, and methanolysis, which decompose PET (Polyethylene Terephthalate) waste into its basic building blocks. Although hydrolysis is presently the leading method for producing high-purity rTPA, glycolysis and methanolysis is also commonly employed to create valuable intermediates. Additionally, enzymatic recycling is gaining recognition as a potential effective approach.

How does r-PTA Support the Circular Economy?

Recycled terephthalic acid (r-PTA) plays a crucial role in the circular economy by converting post-consumer PET waste into high-quality monomers through chemical recycling methods such as glycolysis, methanolysis, and hydrolysis, thereby completing the loop for reusable PET production in bottles, fibers, and packaging. This effort decreases dependence on virgin petroleum-based PTA, reduces the accumulation of plastic waste in landfills and oceans, and cuts energy consumption by 50-80% in comparison to primary production, while enabling numerous recycling cycles for continuous material circulation. Policies encouraging recycled content, commitments from brands toward sustainable packaging, and investments in advanced depolymerization technologies further enhance scalability, reducing environmental impacts and promoting resource efficiency across the textiles, fast-moving consumer goods (FMCG), and automotive industries.

Key Drivers Propelling Growth of Recycled Terephthalic Acid Market

The primary factors propelling the recycled terephthalic acid market, include increasing environmental consciousness, strict regulations that require higher amounts of recycled material in plastics, and a worldwide shift towards circular economy practices in sectors such as textiles, packaging, and automotive. Authorities in areas like Europe and India are implementing policies aimed at decreasing plastic waste and reliance on fossil fuels, while corporate sustainability efforts from companies such as Ford boost the demand for rTPA in environmentally friendly products.

Furthermore, consumer inclination towards sustainable products, improvements in recycling technologies like chemical depolymerization, and funding in waste management are further fueling the growth of the market, establishing rTPA as a viable substitute for virgin materials.

Recycled Terephthalic Acid Market: Competitive Landscape of Companies in this Industry

The competitive landscape of the recycled terephthalic acid market is characterized by intense competition, featuring a combination of major global players, such as ALPLA, Alpek, Far Eastern New Century Corporation (FENC), Indorama Ventures and SK chemicals. These firms maintain their dominance through integrated production capabilities, investments in cutting-edge recycling technologies, and facility expansions across Asia-Pacific, Europe, and North America.

Key Market Challenges

The recycled terephthalic acid (rTPA) market faces significant financial and operational challenges due to the high costs associated with chemical recycling technologies, which require sophisticated equipment, considerable energy consumption, and continuous maintenance, making it difficult for small and medium-sized businesses to scale up. The ineffective collection, sorting, and processing of PET waste, especially for colored, blended, or contaminated plastics, restricts the availability and quality of feedstock. Additional challenges include strict environmental regulations that raise compliance costs, price fluctuations in comparison to virgin materials, supply shortages worsened by global supply chain disruptions, and competition from bio-based alternatives such as bio-PET.

Regional Analysis: Asia to Hold the Largest Share in the Market

According to our estimates Asia currently captures a significant share of the recycled terephthalic acid market. This is due to its swift industrial growth and vast manufacturing capabilities in countries like China, India, Indonesia, and Vietnam, which produce significant amounts of PET waste from their thriving textiles and packaging industries. The adoption of rPTA is further driven by stringent environmental regulations, government-led recycling programs, and increasing corporate commitments to sustainability.

Recycled Terephthalic Acid Market: Key Market Segmentation

Type of Product

- Clear

- Colored

Type of Derivative

- Dimethyl Terephthalate

- Polybutylene Terephthalate

- Polyethylene Terephthalate

- Polytrimethylene Terephthalate

Application Area

- Adhesives

- Chemical Intermediates

- Fibers

- Packaging

- Paints & Coatings

- Pharmaceuticals

Type of Enterprise

- Large Enterprises

- Small and Medium Enterprises

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Recycled Terephthalic Acid Market: Key Market Insights

Market Share by Type of Product

According to our estimates, currently, clear products capture majority share of the market. This growth is due to the ease of converting clear plastic waste into terephthalic acid, along with its promising applications in various industries. Additionally, clear materials are typically more economical to recycle since they do not necessitate extensive filtering processes, benefiting the PET recycling sector.

Market Share by Application Area

According to our estimates, currently, packaging captures majority share of the market. Packaging products made from recycled PET demonstrate excellent resistance to solvents, chemicals, and moisture, making them very suitable for food and beverage sectors that necessitate strict safety and quality standards.

Example Players in Recycled Terephthalic Acid Market

- ALPLA Group

- Alpek

- Biffa

- Carbios

- DePoly

- Evergreen Plastics

- Far Eastern New Century

- INTCO Recycling

- Krones

- Loop Industries

- SUEZ

- Unifi

Recycled Terephthalic Acid Market: Report Coverage

The report on the recycled terephthalic acid market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the recycled terephthalic acid market, focusing on key market segments, including [A] type of product, [B] derivative, application area, [C] type of enterprise, and [D] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the recycled terephthalic acid market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the recycled terephthalic acid market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] portfolio, [J] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the recycled terephthalic acid industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the recycled terephthalic acid domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the recycled terephthalic acid market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the recycled terephthalic acid market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the recycled terephthalic acid market.

Key Questions Answered in this Report

- What is the current and future market size?

- Who are the leading companies in this market?

- What are the growth drivers that are likely to influence the evolution of this market?

- What are the key partnership and funding trends shaping this industry?

- Which region is likely to grow at higher CAGR till 2035?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- Detailed Market Analysis: The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- In-depth Analysis of Trends: Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. Each report maps ecosystem activity across partnerships, funding, and patent landscapes to reveal growth hotspots and white spaces in the industry.

- Opinion of Industry Experts: The report features extensive interviews and surveys with key opinion leaders and industry experts to validate market trends mentioned in the report.

- Decision-ready Deliverables: The report offers stakeholders with strategic frameworks (Porter's Five Forces, value chain, SWOT), and complimentary Excel / slide packs with customization support.

Additional Benefits

- Complimentary Dynamic Excel Dashboards for Analytical Modules

- Exclusive 15% Free Content Customization

- Personalized Interactive Report Walkthrough with Our Expert Research Team

- Free Report Updates for Versions Older than 6-12 Months

TABLE OF CONTENTS

1. PROJECT OVERVIEW

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Concluding Remarks

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Recycled Terephthalic Acid Market

- 6.2.1. Type of Product

- 6.2.2. Type of Derivative

- 6.2.3. Area of Application

- 6.3. Future Perspective

7. REGULATORY SCENARIO

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Recycled Terephthalic Acid Market: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Type of Company

- 9.3. Key Findings

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM ANALYSIS

- 12.1. Recycled Terephthalic Acid Market: Startup Ecosystem Analysis

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Location of Headquarters

- 12.1.4. Analysis by Ownership Type

- 12.2. Key Findings

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. Indorama Ventures Public Company*

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- similar details are presented for other below mentioned companies based on information in the public domain

- 13.3. Alpek

- 13.4. Biffa

- 13.5. CARBIOS

- 13.6. Loop

- 13.7. Lotte

- 13.8. Plastipak

- 13.9. Reliance

- 13.10. SABIC

- 13.11. Zhejiang Haili Environmental Technology

14. MEGA TRENDS ANALYSIS

15. UNMET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

18. GLOBAL RECYCLED TEREPHTHALIC ACID MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global Recycled Terephthalic Acid Market, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF PRODUCT

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Recycled Terephthalic Acid Market for Clear: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.7. Recycled Terephthalic Acid Market for Colored: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

- 19.8.1. Secondary Sources

- 19.8.2. Primary Sources

- 19.8.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF DERIVATIVE

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Recycled Terephthalic Acid Market for Dimethyl Terephthalate: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.7. Recycled Terephthalic Acid Market for Polybutylene Terephthalate: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.8. Recycled Terephthalic Acid Market for Polyethylene Terephthalate: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.9. Recycled Terephthalic Acid Market for Polytrimethylene Terephthalate: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.10. Data Triangulation and Validation

- 20.10.1. Secondary Sources

- 20.10.2. Primary Sources

- 20.10.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON APPLICATION AREA

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Recycled Terephthalic Acid Market for Adhesives: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.7. Recycled Terephthalic Acid Market for Chemical Intermediates: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.8. Recycled Terephthalic Acid Market for Fibers: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.9. Recycled Terephthalic Acid Market for Packaging: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.10. Recycled Terephthalic Acid Market for Paints & Coatings: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.11. Recycled Terephthalic Acid Market for Pharmaceuticals: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.12. Data Triangulation and Validation

- 21.12.1. Secondary Sources

- 21.12.2. Primary Sources

- 21.12.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON TYPE OF ENTERPRISE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Podcasting Market for Large Enterprises: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.7. Podcasting Market for Small and Medium Enterprises (SMEs): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.8. Data Triangulation and Validation

- 22.8.1. Secondary Sources

- 22.8.2. Primary Sources

- 22.8.3. Statistical Modeling

23. MARKET OPPORTUNITIES FOR RECYCLED TEREPHTHALIC ACID IN NORTH AMERICA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Recycled Terephthalic Acid Market in North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.1. Recycled Terephthalic Acid Market in the US: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.2. Recycled Terephthalic Acid Market in Canada: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.3. Recycled Terephthalic Acid Market in Mexico: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.4. Recycled Terephthalic Acid Market in Other North American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR RECYCLED TEREPHTHALIC ACID IN EUROPE

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Recycled Terephthalic Acid Market in Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.1. Recycled Terephthalic Acid Market in Austria: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.2. Recycled Terephthalic Acid Market in Belgium: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.3. Recycled Terephthalic Acid Market in Denmark: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.4. Recycled Terephthalic Acid Market in France: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.5. Recycled Terephthalic Acid Market in Germany: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.6. Recycled Terephthalic Acid Market in Ireland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.7. Recycled Terephthalic Acid Market in Italy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.8. Recycled Terephthalic Acid Market in the Netherlands: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.9. Recycled Terephthalic Acid Market in Norway: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.10. Recycled Terephthalic Acid Market in Russia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.11. Recycled Terephthalic Acid Market in Spain: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.12. Recycled Terephthalic Acid Market in Sweden: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.13. Recycled Terephthalic Acid Market in Switzerland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.14. Recycled Terephthalic Acid Market in the UK: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.15. Recycled Terephthalic Acid Market in Other European Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR RECYCLED TEREPHTHALIC ACID IN ASIA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Recycled Terephthalic Acid Market in Asia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.1. Recycled Terephthalic Acid Market in China: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.2. Recycled Terephthalic Acid Market in India: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.3. Recycled Terephthalic Acid Market in Japan: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.4. Recycled Terephthalic Acid Market in Singapore: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.5. Recycled Terephthalic Acid Market in South Korea: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.6. Recycled Terephthalic Acid Market in Other Asian Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR RECYCLED TEREPHTHALIC ACID IN LATIN AMERICA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Recycled Terephthalic Acid Market in Latin America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.1. Recycled Terephthalic Acid Market in Argentina: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.2. Recycled Terephthalic Acid Market in Brazil: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.3. Recycled Terephthalic Acid Market in Chile: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.4. Recycled Terephthalic Acid Market in Colombia Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.5. Recycled Terephthalic Acid Market in Venezuela: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.6. Recycled Terephthalic Acid Market in Other Latin American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR RECYCLED TEREPHTHALIC ACID IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Recycled Terephthalic Acid Market in Middle East and North Africa (MENA): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.1. Recycled Terephthalic Acid Market in Egypt: Historical Trends (Since 2020) and Forecasted Estimates (Till 205)

- 27.6.2. Recycled Terephthalic Acid Market in Iran: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.3. Recycled Terephthalic Acid Market in Iraq: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.4. Recycled Terephthalic Acid Market in Israel: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.5. Recycled Terephthalic Acid Market in Kuwait: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.6. Recycled Terephthalic Acid Market in Saudi Arabia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.7. Recycled Terephthalic Acid Market in United Arab Emirates (UAE): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.8. Recycled Terephthalic Acid Market in Other MENA Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR RECYCLED TEREPHTHALIC ACID MARKET IN REST OF THE WORLD

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Recycled terephthalic acid Market in Rest of the World: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.1. Recycled terephthalic acid Market in Australia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.2. Recycled terephthalic acid Market in New Zealand: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.3. Recycled terephthalic acid Market in Other Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.7. Data Triangulation and Validation

29. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 29.1. Leading Player 1

- 29.2. Leading Player 2

- 29.3. Leading Player 3

- 29.4. Leading Player 4

- 29.5. Leading Player 5

- 29.6. Leading Player 6

30. ADJACENT MARKET ANALYSIS

31. KEY WINNING STRATEGIES

32. PORTER FIVE FORCES ANALYSIS

33. SWOT ANALYSIS

34. VALUE CHAIN ANALYSIS

35. ROOTS STRATEGIC RECOMMENDATIONS

- 35.1. Chapter Overview

- 35.2. Key Business-related Strategies

- 35.2.1. Research & Development

- 35.2.2. Product Manufacturing

- 35.2.3. Commercialization / Go-to-Market

- 35.2.4. Sales and Marketing

- 35.3. Key Operations-related Strategies

- 35.3.1. Risk Management

- 35.3.2. Workforce

- 35.3.3. Finance

- 35.3.4. Others